Zero Emission Vehicle Market | Acumen Research and Consulting

Zero Emission Vehicle Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

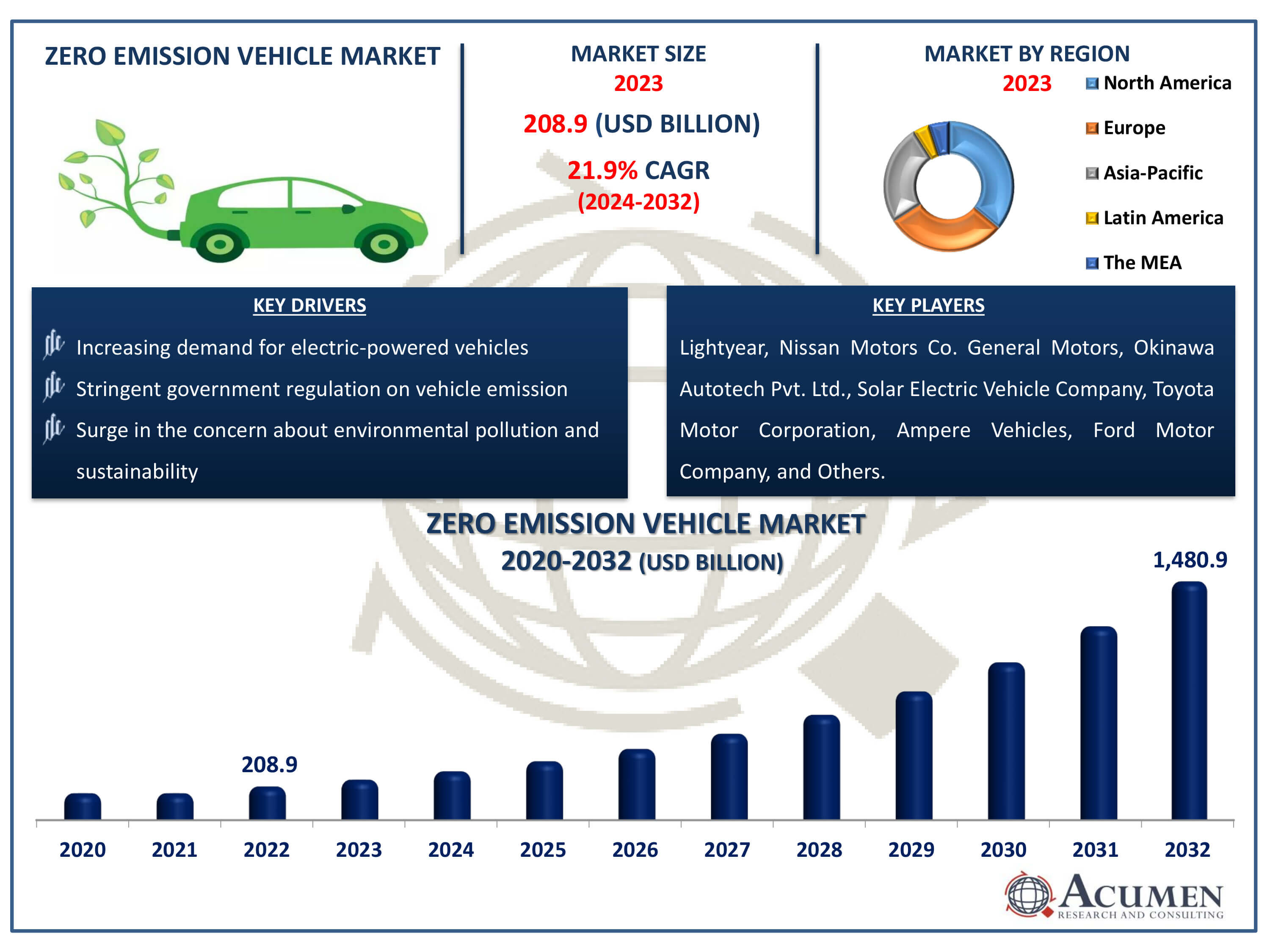

The Zero Emission Vehicle Market Size accounted for USD 208.9 Billion in 2022 and is estimated to achieve a market size of USD 1480.9 Billion by 2032 growing at a CAGR of 21.9% from 2024 to 2032.

Zero Emission Vehicle Market Highlights

- Global zero emission vehicle market revenue is poised to garner USD 1480.9 billion by 2032 with a CAGR of 21.9% from 2024 to 2032

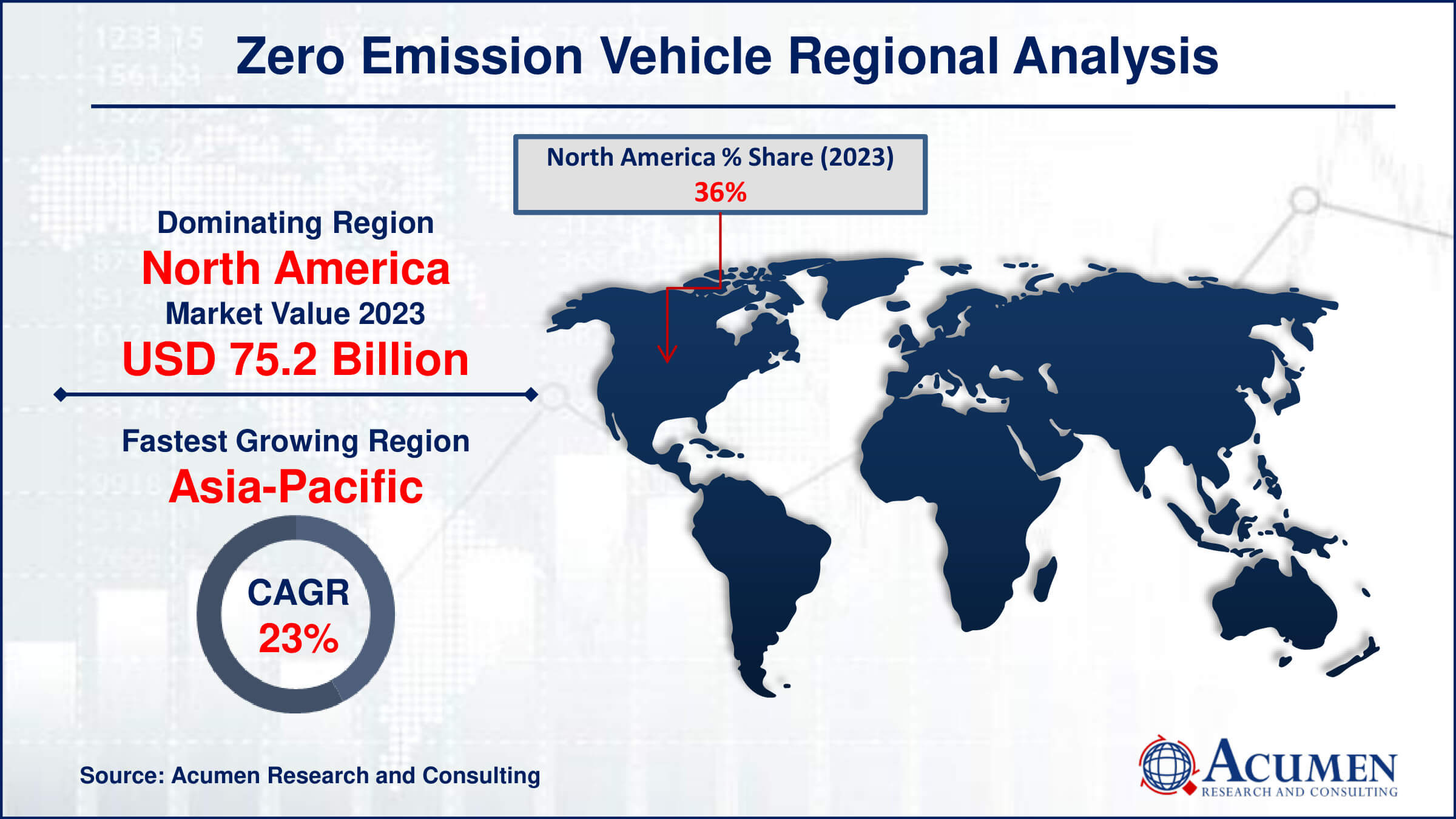

- North America zero emission vehicle market value occupied around USD 75.2 million in 2022

- Asia-Pacific zero emission vehicle market growth will record a CAGR of more than 23% from 2024 to 2032

- Among vehicle class, the passenger class sub-segment generated 60% of share 2022

- Based on vehicle type, the battery electric vehicle sub-segment generated 65% of share in zero emission vehicle market share in 2022

- Growing concern about climate change and air pollution is a zero emission vehicle market trend that fuels the industry demand

A zero emission vehicle (ZEV) refers to any vehicle that emits no tailpipe pollutants from its source of power. This includes electric vehicles powered solely by batteries, hydrogen fuel cell vehicles, and some plug-in hybrid electric vehicles that can operate exclusively on electricity for a significant distance. ZEVs play a crucial role in reducing greenhouse gas emissions and combating climate change by eliminating or significantly reducing the release of pollutants associated with traditional internal combustion engine vehicles. They also contribute to improved air quality, decreased dependence on fossil fuels, and increased energy security. ZEVs including personal transportation, public transit, commercial fleets, and even heavy-duty vehicles like trucks and buses. Their versatility and environmental benefits make them a key component of sustainable transportation systems worldwide.

Global Zero Emission Vehicle Market Dynamics

Market Drivers

- Increasing demand for electric-powered vehicles

- Stringent government regulation on vehicle emission

- Surge in the concern about environmental pollution and sustainability

Market Restraints

- High manufacturing cost

- Lack of charging facilities

- Environmental concerns about disposal of electrical

Market Opportunities

- Technological advancements

- Favorable governmental policies

- Growing preference for eco-friendly transportation

Zero Emission Vehicle Market Report Coverage

| Market | Zero Emission Vehicle Market |

| Zero Emission Vehicle Market Size 2022 | USD 208.9 Billion |

| Zero Emission Vehicle Market Forecast 2032 |

USD 1480.9 Billion |

| Zero Emission Vehicle Market CAGR During 2024 - 2032 | 21.9% |

| Zero Emission Vehicle Market Analysis Period | 2020 - 2032 |

| Zero Emission Vehicle Market Base Year |

2022 |

| Zero Emission Vehicle Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Vehicle Class, By Vehicle Type, By Drive Type, By Top Speed, By Source Of Power, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lightyear, Nissan Motors Co., General Motors, Okinawa Autotech Pvt. Ltd., Solar Electric Vehicle Company, Toyota Motor Corporation, Ampere Vehicles, Ford Motor Company, Hanergy Thin Film Power Group, Tesla Inc., BMW AG, Volkswagen AG, Chevrolet Motor Company, Hyundai Motor Company, Benling India Energy and Technology Pvt Ltd, Kia Corporation, Daimler AG, Energica Motor Company S.p.A., Mahindra Electric Mobility Limited, Lucid Group, Inc., BYD Company Limited, Xiaopeng Motors, Tata Motors, Sono Motors, and WM Motor |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Zero Emission Vehicle Market Insights

Increasing demand for electric-powered vehicles is driving the growth of the zero-emission vehicle market. As consumers and governments prioritize sustainability, this surge in demand is reshaping the automotive industry. Manufacturers are investing heavily in electric vehicle technology and infrastructure, further contributing to market growth. With advancements in battery technology and increasing awareness of environmental concerns, the zero-emission vehicle market is projected to grow significantly in the forecasted year. Additionally, stringent government regulations on vehicle emissions are also becoming a growing factor for the market. For instance, in an effort to decrease emissions of nitrogen oxide and other pollutants from heavy-duty trucks, the U.S. Environmental Protection Agency (EPA) announced new rules.

However, the high manufacturing cost of zero-emission vehicles impedes market growth. Despite increasing demand for environmentally friendly transportation options, the expense of producing these vehicles remains a challenge. Factors such as specialized components, advanced battery technology, and limited economies of scale contribute to elevated manufacturing expenses. As a result, consumers often face higher purchase prices for zero-emission vehicles compared to traditional internal combustion engine vehicles. Overcoming cost challenges through technological innovation, supply chain optimization, and supportive government policies will be essential to accelerate the adoption of zero-emission vehicles and drive sustainable growth in the market.

Technological advancements create opportunities for the zero-emission vehicle market in the forecasted year. Advancements in battery technology offer increased energy density, extended range, and reduced charging times. Moreover, the adoption of renewable energy integration and infrastructure development facilitate the widespread adoption of ZEVs, making them more accessible and convenient for consumers. For instance, in November 2020, Hyundai Group collaborated with IONITY to establish a network of high-power charging stations for EVs across Europe. Innovations in autonomous driving and connectivity further enhance the appeal of ZEVs, offering safer, more efficient transportation solutions. With growing environmental consciousness and stringent emissions regulations, these advancements position ZEVs as the driving force of the future.

Zero Emission Vehicle Market Segmentation

The worldwide market for zero emission vehicles is split based on vehicle class, vehicle type, drive type, top speed, source of power, and geography.

Zero Emission Vehicle (ZEV) Market By Class

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

According to zero-emission vehicle industry analysis, passenger cars dominate the zero-emission vehicle market. This prominence stems from various factors, including significant consumer demand, advancing technology, supportive government incentives, and expanding charging infrastructure. As a result, electric passenger cars have become a cornerstone of sustainable transportation, capturing the attention of consumers. Overall, passenger cars hold a central position in the ZEV market for reducing emissions.

Zero Emission Vehicle (ZEV) Market By Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

Battery electric vehicles (BEVs) have long been market leaders in the zero-emission vehicle industry. Offering clean and sustainable transportation solutions, BEVs derive their power solely from rechargeable batteries, thereby eliminating tailpipe emissions and reducing environmental impact. With advancements in battery technology, range, and charging infrastructure, BEVs have gained popularity among consumers. Lower operating costs and decreasing upfront prices further contribute to their widespread adoption.

Zero Emission Vehicle (ZEV) Market By Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

In the zero-emission vehicle market, the all-wheel drive (AWD) segment is experiencing significant growth in the coming years. With advancements in automotive technology and shifting consumer preferences towards vehicles offering enhanced stability, AWD systems are gaining popularity across various vehicle categories. Key players are integrating AWD into a wider range of models, offering more choice and versatility. This trend is expected to continue driving the growth of the AWD segment in the forecasted future.

Zero Emission Vehicle (ZEV) Market By Top Speed

- Less Than 100 MPH

- 100 to 125 MPH

- More Than 125 MPH

Historically, speeds exceeding 125 mph have been expected to dominate in the zero-emission vehicle business. The surge in demand for high-speed EVs underscores a growing consumer desire for sustainable transportation options without compromising on power or thrill. This trend not only reflects advancements in battery technology and motor efficiency but also the evolving preferences of a market increasingly prioritizing eco-awareness. As manufacturers continue to innovate in EVs, the demand for high-speed zero-emission vehicles is expected to grow significantly.

Zero Emission Vehicle (ZEV) Market By Source of Power

- Gasoline

- Diesel

- CNG

- Others

According to the zero-emission vehicle industry forecast, gasoline is not a source of power used in zero-emission vehicles. Gasoline is a flammable liquid produced by blending products from petroleum and natural gas, but it is not compatible with zero-emission vehicles due to its emissions. Gasoline and diesel engines are known for their higher CO2 emissions. However, new and exciting engines are utilizing low-carbon renewable biofuels, offering lower emissions compared to traditional fossil fuels.

Zero Emission Vehicle Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Zero Emission Vehicle Market Regional Analysis

According to the zero-emission vehicle industry analysis, North America dominates the zero-emission vehicle market, maintaining its position through technological innovation, government incentives, and growing consumer demand. For instance, in May 2022, BYD Company Limited joined with Link Transit to deliver eight additional BYD battery-electric buses. The growing focus on sustainability and reducing carbon emissions in countries like the United States and Canada has led to a surge in electric vehicle adoption. Robust infrastructure development and favorable policies promoting electric vehicle manufacturing have propelled North America to the forefront of ZEV adoption. Additionally, rising awareness of environmental concerns and the need for cleaner transportation solutions further boost the demand for zero-emission vehicles in this region. For example, in December 2022, the California Energy Commission (CEC) approved USD 2.9 billion in funding for zero-emission transportation initiatives in California.

The Asia-Pacific region is the fastest-growing region in the zero-emission vehicle market due to increasing demand for electric-powered vehicles and stringent government regulations on vehicle emissions. There is a surge in concern about environmental pollution and sustainability in countries like India, Japan, China, and South Korea. Furthermore, key players are focusing on innovations and infrastructure development, contributing to market growth in this region. For instance, in December 2023, Japanese automakers Nissan and Mitsubishi committed to investing in Renault’s electric vehicle division, Ampere. As a result, the region is experiencing steady growth in the zero-emission vehicle market.

Zero Emission Vehicle Market Players

Some of the top zero emission vehicle companies offered in our report include Lightyear, Nissan Motors Co. General Motors, Okinawa Autotech Pvt. Ltd., Solar Electric Vehicle Company, Toyota Motor Corporation, Ampere Vehicles, Ford Motor Company, Hanergy Thin Film Power Group, Tesla Inc., BMW AG, Volkswagen AG, Chevrolet Motor Company, Hyundai Motor Company, Benling India Energy and Technology Pvt Ltd, Kia Corporation, Daimler AG, Energica Motor Company S.p.A., Mahindra Electric Mobility Limited, Lucid Group, Inc., BYD Company Limited, Xiaopeng Motors, Tata Motors, Sono Motors, and WM Motor.

Frequently Asked Questions

How big is the zero emission vehicle market?

The zero emission vehicle market size was valued at USD 208.9 billion in 2022.

What is the CAGR of the global zero emission vehicle market from 2024 to 2032?

The CAGR of zero emission vehicle is 21.9% during the analysis period of 2024 to 2032.

Which are the key players in the zero emission vehicle market?

The key players operating in the global market are including Lightyear, Nissan Motors Co. General Motors, Okinawa Autotech Pvt. Ltd., Solar Electric Vehicle Company, Toyota Motor Corporation, Ampere Vehicles, Ford Motor Company, Hanergy Thin Film Power Group, Tesla Inc., BMW AG, Volkswagen AG, Chevrolet Motor Company, Hyundai Motor Company, Benling India Energy and Technology Pvt Ltd, Kia Corporation, Daimler AG, Energica Motor Company S.p.A., Mahindra Electric Mobility Limited, Lucid Group, Inc., BYD Company Limited, Xiaopeng Motors, Tata Motors, Sono Motors, and WM Motor

Which region dominated the global zero emission vehicle market share?

North America held the dominating position in zero emission vehicle industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of zero emission vehicles during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global zero emission vehicle industry?

The current trends and dynamics in the zero emission vehicle industry include increasing demand for electric-powered vehicles, stringent government regulation on vehicle emission, and surge in the concern about environmental pollution and sustainability.

Which vehicle class held the maximum share in 2022?

The passenger class held the maximum share of the zero emission vehicle industry.