Wound Dressing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Wound Dressing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

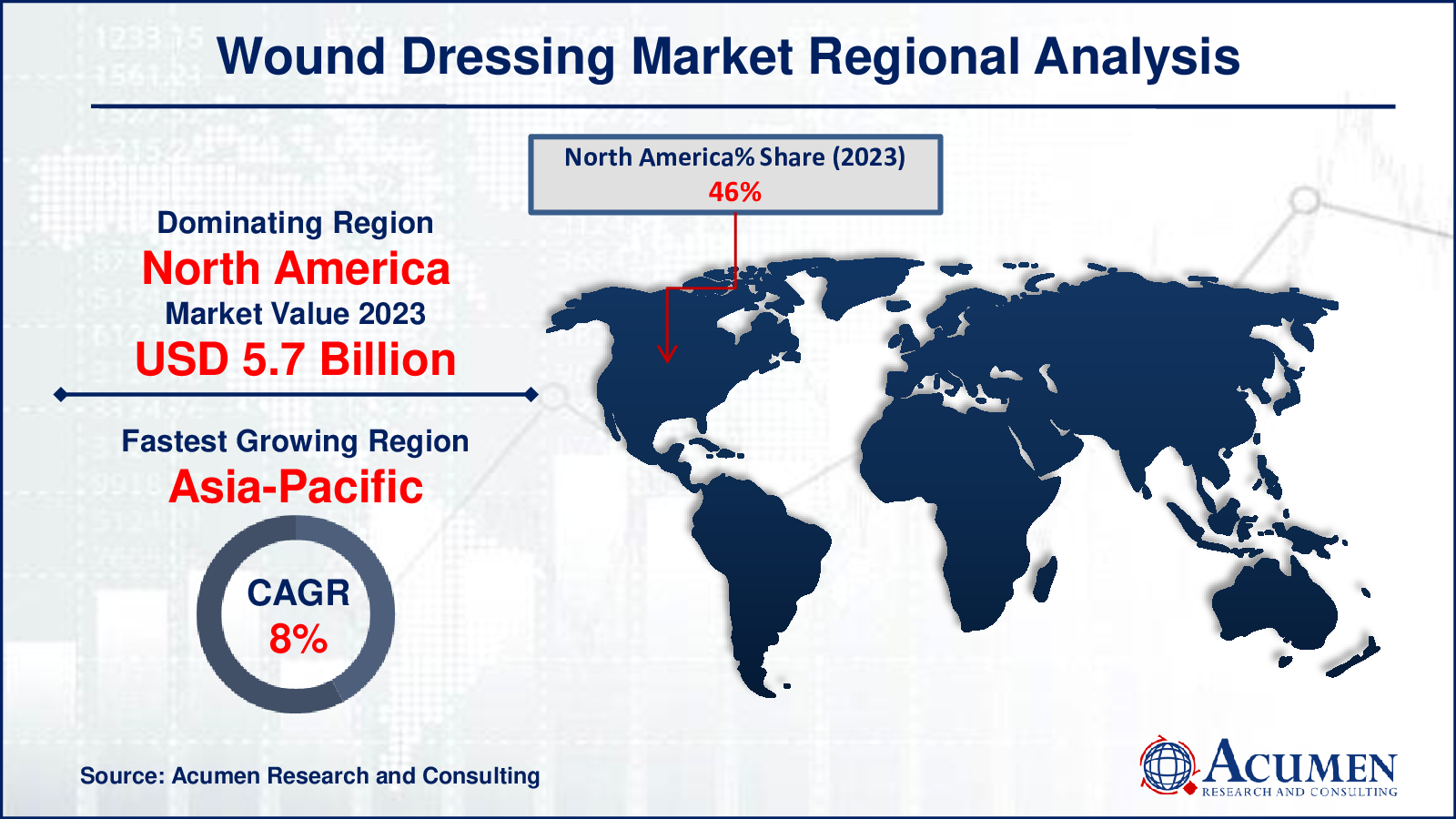

The Wound Dressing Market Size accounted for USD 12.4 Billion in 2023 and is estimated to achieve a market size of USD 22.7 Billion by 2032 growing at a CAGR of 7.1% from 2024 to 2032.

Wound Dressing Market Highlights

- The global wound dressing market is projected to reach USD 22.7 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2032

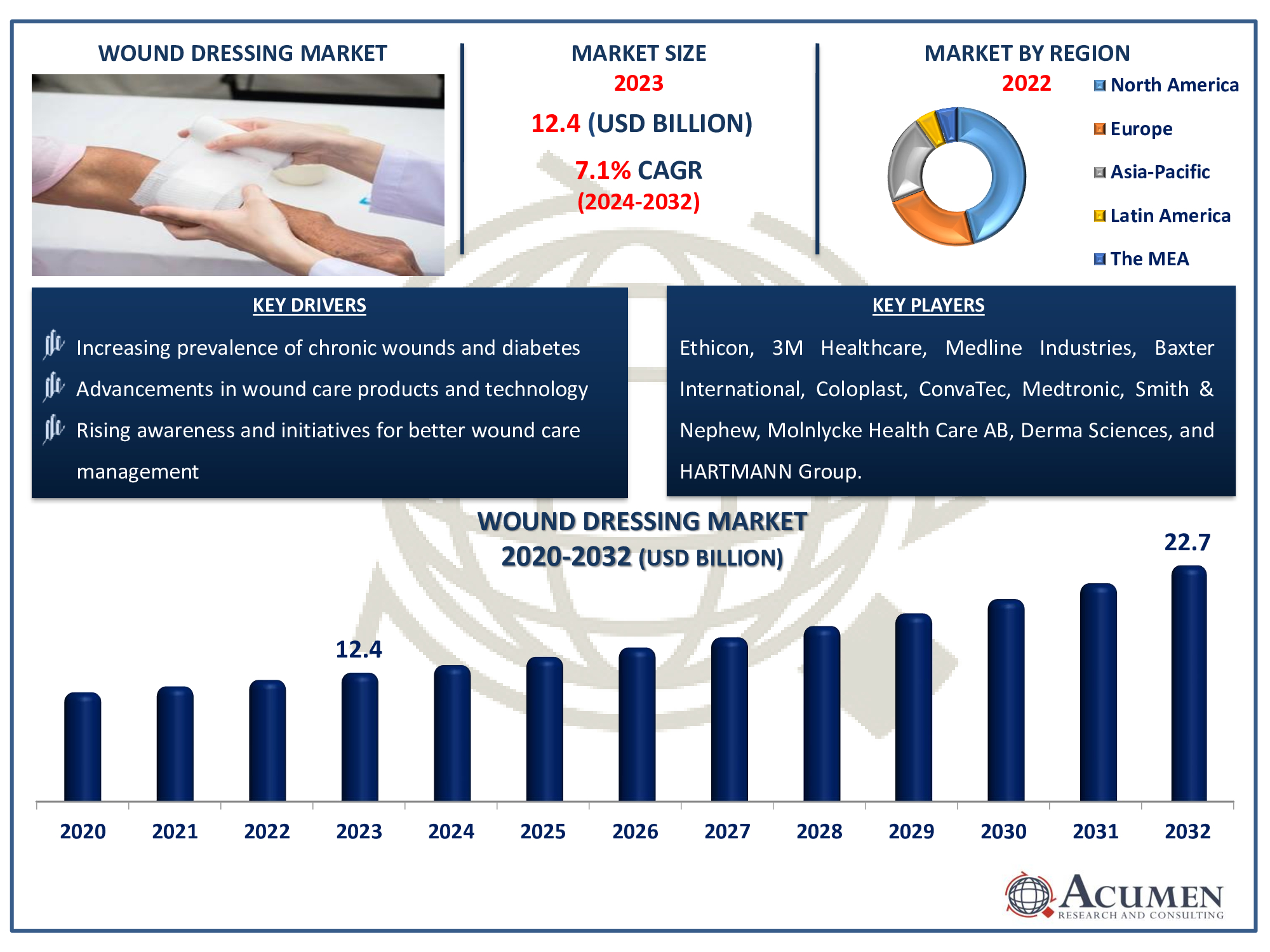

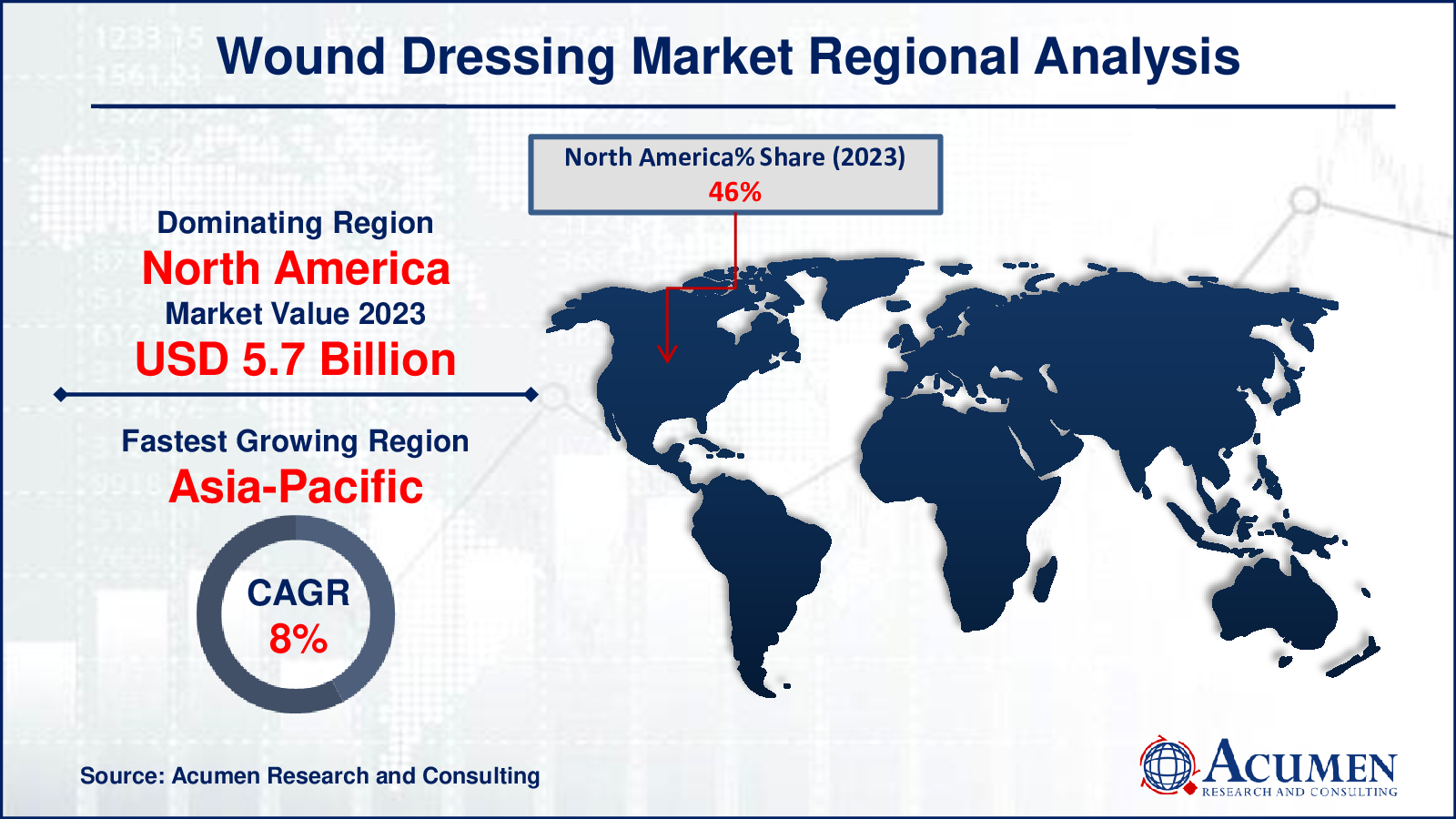

- In 2023, the North America wound dressing market was valued at approximately USD 5.7 billion

- The Asia Pacific wound dressing market is expected to achieve a CAGR of over 8% from 2024 to 2032

- The advanced dressing sub-segment accounted for 52% of the market share in 2023 among products

- Hospitals constituted 45% of the market share in 2023 based on end-use

- Increasing adoption of antimicrobial and biocompatible materials in wound dressings to enhance healing outcomes is the wound dressing market trend that fuels the industry demand

Wound dressing refers to materials and techniques used to cover and protect wounds, aiding in their healing process. These dressings serve several crucial functions: providing a barrier against infection, absorbing excess exudate (fluid from the wound), maintaining moisture balance for optimal healing, and promoting a conducive environment for tissue repair. They can range from simple gauze pads to advanced hydrocolloids, foams, or films, tailored to the specific needs of the wound type and stage. Wound dressings are essential in both acute and chronic wound management, including burns, ulcers, surgical incisions, and traumatic injuries. Their effectiveness is supported by continuous advancements in material science and medical technology, ensuring better outcomes and patient comfort.

Global Wound Dressing Market Dynamics

Market Drivers

- Increasing prevalence of chronic wounds and diabetes

- Advancements in wound care products and technology

- Rising awareness and initiatives for better wound care management

Market Restraints

- High cost of advanced wound care products

- Limited reimbursement policies in developing countries

- Risk of infections associated with wound dressing

Market Opportunities

- Growth in the aging population requiring wound care

- Expansion in emerging markets with rising healthcare expenditure

- Development of new and innovative wound care products

Wound Dressing Market Report Coverage

| Market | Wound Dressing Market |

| Wound Dressing Market Size 2022 | USD 12.4 Billion |

| Wound Dressing Market Forecast 2032 | USD 22.7 Billion |

| Wound Dressing Market CAGR During 2023 - 2032 | 7.1% |

| Wound Dressing Market Analysis Period | 2020 - 2032 |

| Wound Dressing Market Base Year |

2022 |

| Wound Dressing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Wound Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ethicon Inc., 3M Healthcare, Coloplast Corp., ConvaTec Group PLC, Medtronic Plc, Medline Industries, Derma Sciences, Baxter International, Smith & Nephew, Molnlycke Health Care AB, and HARTMANN Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wound Dressing Market Insights

The rising incidence of chronic wounds and diabetes significantly fuels the demand for the wound dressing market. For instance, chronic wounds, often referred to as a silent epidemic, in 2023 impact 6.5 million people in the United States, and this number is expected to rise, according to the U.S. National Institutes of Health. Chronic wounds, often resulting from conditions like diabetes, necessitate advanced and continuous care to prevent infections and promote healing. With diabetes prevalence increasing globally, more patients requires specialized wound dressings for effective management. Innovations in wound care technologies and materials further enhance the market's growth. Consequently, healthcare providers and patients increasingly seek advanced wound care solutions, propelling market expansion.

The wound dressing market faces constraints due to the risk of infections associated with their use. Improper or prolonged application of dressings can create a breeding ground for bacteria, leading to severe infections. This necessitates strict adherence to hygiene protocols, which can be challenging in resource-limited settings. Additionally, the increased prevalence of antibiotic-resistant bacteria complicates infection management, further deterring the adoption of certain wound dressings. Consequently, these infection risks drive the need for continuous innovation in safer, more effective wound care products.

The development of new and innovative wound care products represents a significant opportunity for the wound dressing market. For instance, in January 2023, Convatec Group PLC introduced Convafoam, an innovative foam dressing, in the U.S. This product caters to the diverse needs of patients and healthcare providers, offering versatile application for wounds at any stage. It serves as an uncomplicated option for both skin protection and effective wound management. These advancements often introduce improved materials, such as hydrocolloids, hydrogels, and antimicrobial dressings, which enhance healing outcomes and patient comfort. Innovations also focus on features like moisture management, adherence, and infection control, catering to diverse wound types and patient needs. Such developments not only drive market growth but also address critical healthcare challenges, fostering better wound management practices and outcomes globally.

Wound Dressing Market Segmentation

The worldwide market for wound dressing is split based on product, wound type, end use, and geography.

Wound Dressing Products

- Traditional Dressing

- Gauze

- Tape

- Bandages

- Cotton

- Others

- Advanced Dressing

- Moist Dressing

- Foam Dressing

- Hydrocolloid Dressing

- Film Dressing

- Alginate Dressing

- Hydrogel Dressing

- Collagen Dressing

- Other Advanced Dressing

- Antimicrobial Dressing

- Silver Dressing

- Non-silver Dressing

- Active Dressing

- Biomaterials

- Skin-substitute

According to the wound dressing industry analysis, the advanced dressing product type dominates the market due to its superior features and benefits. These dressings are designed to provide enhanced wound healing through technologies like hydrocolloids, hydrogels, and foam dressings. They offer advantages such as maintaining a moist wound environment, promoting faster healing, and reducing infection risk. Advanced dressings are versatile, catering to various wound types from minor cuts to chronic wounds, and are often preferred in healthcare settings for their effectiveness and ease of application. Their continuous innovation drives the market forward, meeting evolving patient needs and improving clinical outcomes.

Wound Dressing Wound Types

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

The chronic wounds segment is the largest wound type category in the wound dressing market and it is expected to increase over the industry, due to their complex and prolonged healing processes. These wounds often require specialized dressings that can provide a moist healing environment, manage exudates effectively, and promote tissue regeneration. The prevalence of conditions like diabetes and aging populations contributes significantly to the demand for advanced wound care products. For instance, according to a CDC report from November 2023, around 38.4 million people in the United States had been diagnosed with diabetes, with projections suggesting this number could triple by 2060, as reported by BMC Population Health Metrics. Overall, chronic wound segment driving innovation and market growth.

Wound Dressing End Uses

- Hospitals

- Outpatient Facilities

- Home Healthcare

- Research & Manufacturing

According to the wound dressing industry forecast, hospitals are predominant end users due to their critical role in acute and chronic wound management. For instance, according to Australian Institute of Health and Wellfare, in 2022–23, there were a total of 12.1 million hospitalizations. Same-day hospitalizations across all Australian hospitals rose by 5.6% compared to the previous year, 2021–22. Hospitals require a wide range of dressings to treat various types of wounds, from surgical incisions to diabetic ulcers. They demand high-quality products that promote healing, prevent infections, and offer ease of application and removal. The hospital segment's dominance stems from its need for reliable, sterile, and effective wound care solutions to ensure patient safety and recovery.

Wound Dressing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wound Dressing Market Regional Analysis

For several reasons, North America holds a dominant position in the wound dressing market due its advanced healthcare infrastructure and high healthcare spending foster widespread adoption of advanced wound care products. Secondly, the region's aging population contributes to a higher incidence of chronic wounds, driving demand for effective wound dressings. Additionally, strong research and development activities in the region continually innovate new products, enhancing market growth. For instance, in June 2023, Swift Medical, a company specializing in digital health technology aimed at improving clinical and economic outcomes in wound care, announced a partnership with Corstrata, a leading provider of virtual wound care services, to expand access to top-tier wound care services. Lastly, favorable reimbursement policies and increasing awareness about wound care management further bolster the market's expansion in North America.

Asia-Pacific region is experiencing rapid growth, driven by increasing healthcare investments, rising geriatric population, and improving healthcare infrastructure. This growth is further fueled by rising awareness about wound management and the adoption of advanced medical technologies across the region. For instance, in October 2022, Healthium Medtech launched a new series of wound dressings named "Theruptor Novo," designed specifically for treating stubborn conditions like diabetic foot ulcers and leg ulcers. Moreover, countries like China, Japan, and India are witnessing heightened demand for advanced wound care products due to a growing prevalence of chronic diseases and surgical procedures.

Wound Dressing Market Players

Some of the top wound dressing companies offered in our report includes Ethicon Inc., 3M Healthcare, Coloplast Corp., ConvaTec Group PLC, Medtronic Plc, Medline Industries, Derma Sciences, Baxter International, Smith & Nephew, Molnlycke Health Care AB, and HARTMANN Group.