Wireless Telecom Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Wireless Telecom Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

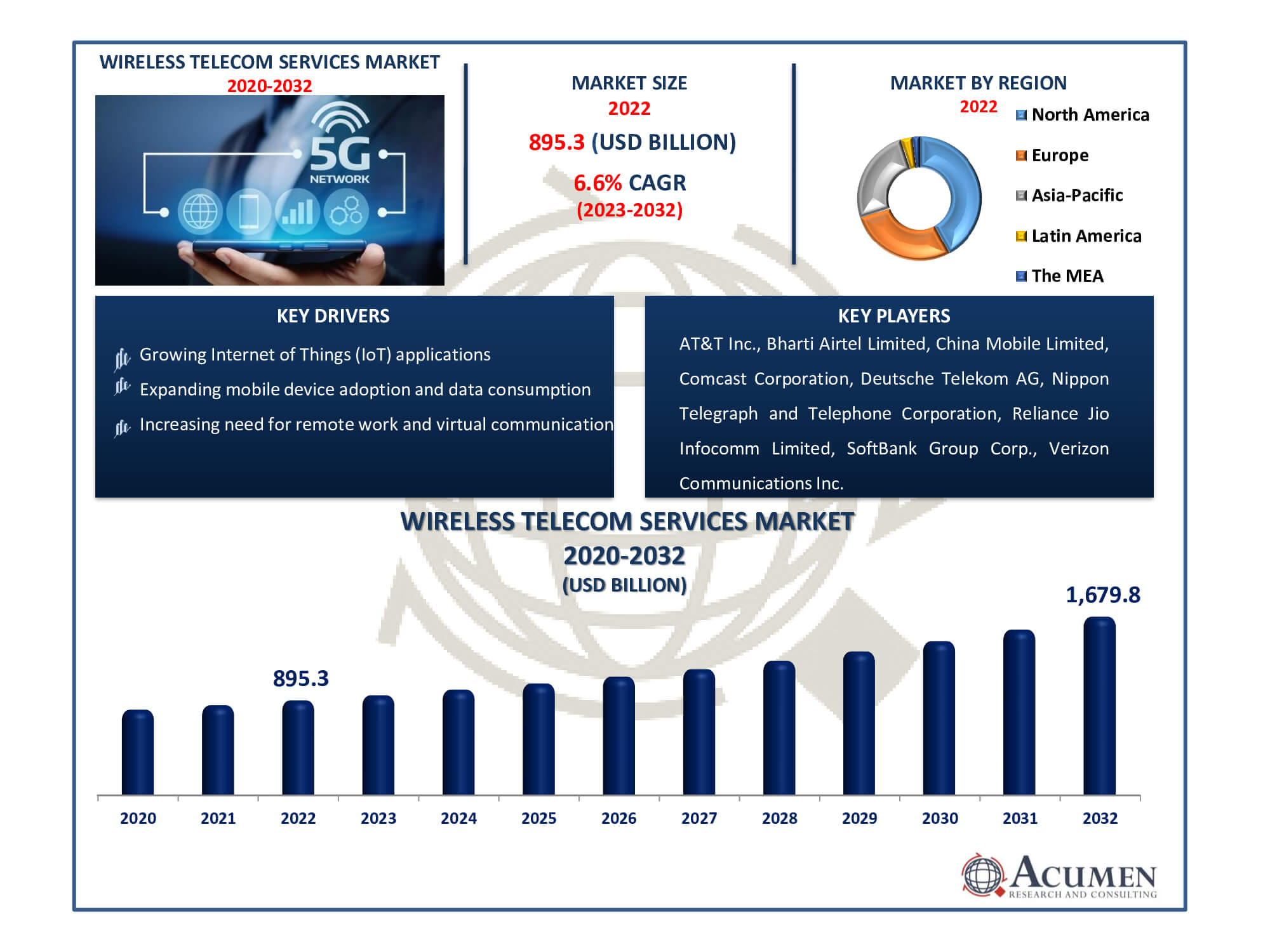

The Wireless Telecom Services Market Size accounted for USD 895.3 Billion in 2022 and is estimated to achieve a market size of USD 1,679.8 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Wireless Telecom Services Market Highlights

- Global wireless telecom services market revenue is poised to garner USD 1,679.8 billion by 2032 with a CAGR of 6.6% from 2023 to 2032

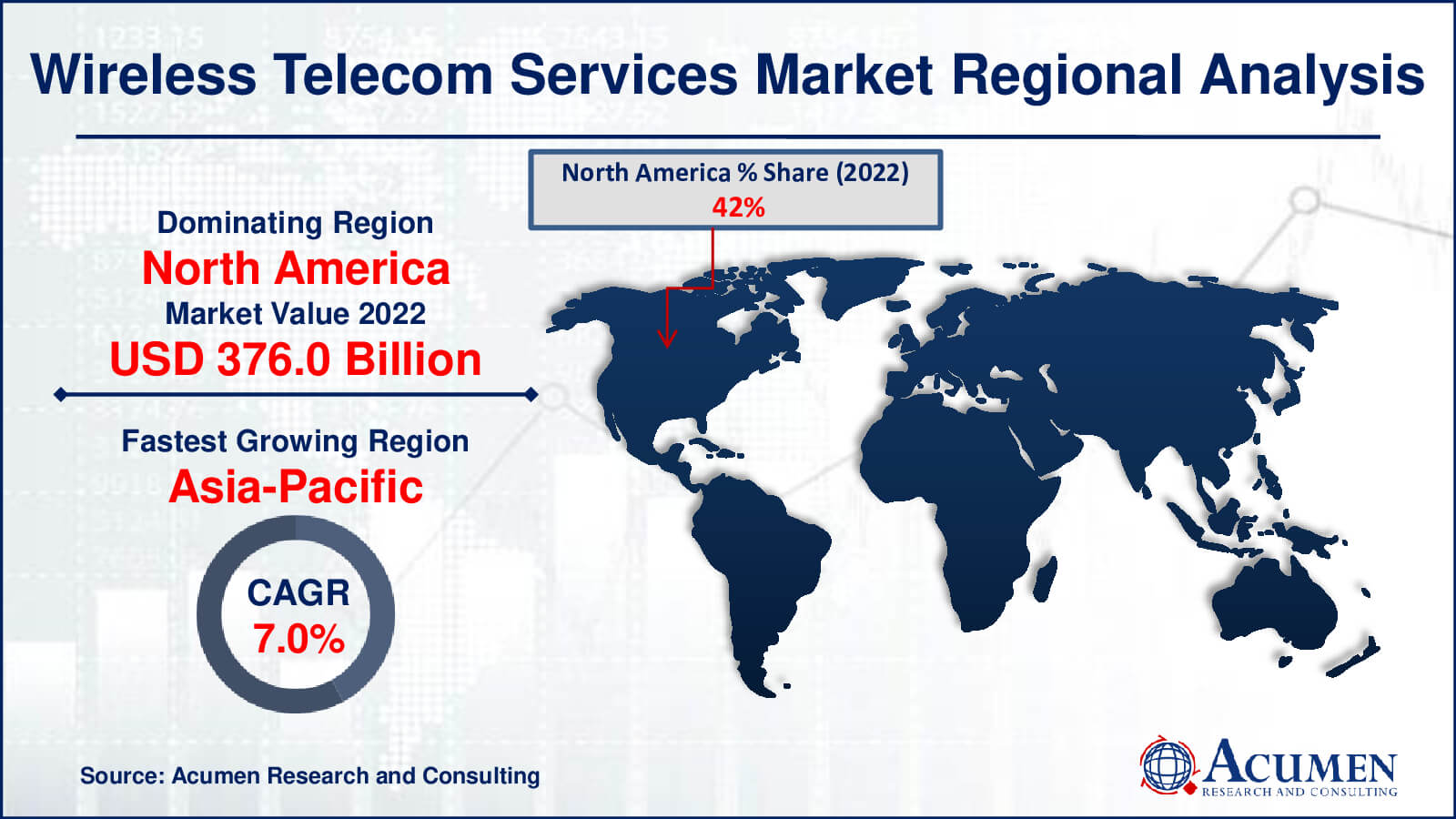

- North America wireless telecom services market value occupied around USD 376 billion in 2022

- Asia-Pacific wireless telecom services market growth will record a CAGR of more than 7% from 2023 to 2032

- Among type, the data service sub-segment generated over US$ 393.9 billion in revenue in 2022

- Based on end-user, the business sub-segment generated around 30% share in 2022

- Surging demand for 5G technology and high-speed data services is a popular market trend that fuels the industry demand

The telecommunication services industry is recognized as one of the fastest-growing sectors in the corporate world. Wireless telecom services, provided by telecom service providers, facilitate the sending and receiving of messages through electronic devices and wireless communication channels. These services encompass email, internet usage on smartphones, voice calls, texting, and various satellite wireless telecom services. Telecommunications services have a robust global market presence and are expected to witness substantial growth in the forecast period.

Wireless telecom services are highly beneficial for industries, enabling effective communication with customers and fostering strong relationships. These services also enhance communication for customers and employees, allowing seamless data transmission and improving overall efficiency. Smartphones are a key application of the rapidly expanding wireless telecommunication sector, offering a wide range of applications and functions.

Global Wireless Telecom Services Market Dynamics

Market Drivers

- Expanding mobile device adoption and data consumption

- Growing internet of things (IoT) applications

- Increasing need for remote work and virtual communication

- Advancements in wireless infrastructure and network technology

Market Restraints

- Security concerns and cyber threats in wireless networks

- Regulatory complexities and spectrum allocation challenges

- Intense market competition and price wars

Market Opportunities

- Rising demand for edge computing in wireless networks

- Expansion of IoT and smart city applications

- Enhanced wireless connectivity in rural and underserved areas

- 5G network deployment and associated services

Wireless Telecom Services Market Report Coverage

| Market | Wireless Telecom Services Market |

| Wireless Telecom Services Market Size 2022 | USD 895.3 Billion |

| Wireless Telecom Services Market Forecast 2032 | USD 1679.8 Billion |

| Wireless Telecom Services Market CAGR During 2023 - 2032 | 6.6% |

| Wireless Telecom Services Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Technology, By End user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AT&T Inc., Bharti Airtel Limited, China Mobile Limited, Comcast Corporation, Deutsche Telekom AG, Nippon Telegraph and Telephone Corporation, Reliance Jio Infocomm Limited, SoftBank Group Corp., Verizon Communications Inc., Vodafone Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wireless Telecom Services Market Insights

With the increasing acceptance of progressive technology-based services and solutions, organizations are adopting IoT to enhance efficiency and accessibility in their processes. Additionally, the rising adoption of smartphones and mobile applications offering a range of services contributes to the market's growth. Enterprises are increasingly deploying cost-effective digital solutions, further propelling market expansion. However, security concerns in wireless telecom services and the high cost of equipment pose challenges to market growth. Nevertheless, the preference for wireless connections over landlines, competitive pricing, and ongoing innovations by various companies across different sectors are expected to drive the overall growth of the wireless telecommunication services market in the coming years.

There are a lot of moving parts in the wireless telecom services market. The market environment is predicted to change as a result of the rapid improvements in wireless technology, especially the introduction of 5G networks. Wireless services are changing to satisfy the demands of consumers and companies for greater connectivity and data speeds. Furthermore, by connecting devices and facilitating real-time data interchange, the Internet of Things (IoT) is revolutionizing a number of industries, including manufacturing and healthcare. Due to the increasing number of devices and applications that require connectivity, this offers significant prospects for wireless telecom services.

The drawback is that network security is still a top priority. Data security and privacy become more important as wireless services become more ingrained in daily life. Industry standards and regulatory frameworks will be essential in tackling these security issues.

Wireless Telecom Services Market Segmentation

The worldwide market for wireless telecom services is split based on type, technology, end user, and geography.

Wireless Telecom Service Types

- Voice Service

- Data Service

- Texting Service

- Others

The voice service segment of the wireless telecom services industry is often the largest due to its historical significance and continued relevance. Voice services continue to be a vital component of mobile communication, even as data services have grown in popularity. In many areas, voice calls still make up a significant percentage of the utilisation of telecom services and are still commonly used for both personal and professional communication. phone communication is essential, even with the popularity of messaging and data apps. As a result, phone service is the largest category since it satisfies users' basic and persistent demand for cellular access.

Wireless Telecom Service Technologies

- 2G

- 3G

- 4G

- Others

In the market for wireless telecom services, the 4G (fourth generation) category is the biggest. It is in this position because 4G technology, which offers faster data rates and enhanced network capabilities, is a major improvement in wireless communication. Consumers and businesses choose 4G networks due to the increasing need for high-speed mobile data, video streaming, and the growth of data-intensive apps. For smooth and effective mobile connectivity, 4G has emerged as the industry standard. Although 2G and 3G technologies were important for mobile connectivity in the past, 4G's higher performance and data capacity have made it the industry leader for wireless telecom services.

Wireless Telecom Service End-Users

- Residential

- Education

- Healthcare

- Business

- Others

The education sector of the wireless telecom services market is usually the largest because of its particular connectivity requirements. Wireless connections are essential for online learning, research, and communication at educational institutions, ranging from schools to universities. There is a significant need for reliable wireless connections due to the growing usage of digital platforms in education. Initiatives for remote learning, which have grown in popularity, are also covered in this section. Widespread Wi-Fi coverage for employees and students is also necessary on educational campuses. As a result, the Education segment is the greatest because it meets the increasing technical requirements of educational institutions, enabling research, online learning, and efficient communication.

Wireless Telecom Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wireless Telecom Services Market Regional Analysis

The market for wireless telecom services is dominated by North America. There are multiple reasons for this supremacy. The need for cutting-edge cellular services is fueled by North America's robust economy and vast technology infrastructure. The area has a developed market for cellular services in addition to several significant corporations. Furthermore, network dependability, fast data rates, and adherence to data security laws are highly valued by North American businesses. North America is the market leader in wireless telecom services due to its emphasis on communication and technology.

In terms of wireless telecom services, Europe is the second-largest market. The robust economy and varied industrial sectors of Europe are major factors in the high demand for wireless services, especially in businesses like banking, manufacturing, and healthcare. Data privacy is highly valued in the region, which fuels demand for effective and safe wireless services. Additionally, the demand for wireless services has increased in Europe as a result of the development of cloud-based services and an increasing reliance on mobile connectivity.

The wireless telecom services market is expanding at the quickest rate in the Asia-Pacific area. This amazing rise is attributed to a number of important causes. First, growing economies in the Asia-Pacific area are adopting wireless technology, contributing to the region's rapid economic progress. Mobile service uptake has been fueled by the widespread use of smartphones and the accessibility of low-cost data plans. Wireless service growth has also been aided by the region's dynamic workforce and the rising demand for distant work and education.

In addition, the Asia-Pacific area is leading the way in the adoption and deployment of 5G technology, which improves connectivity and opens up a wide range of cutting-edge services and applications. Asia-Pacific is now the fastest-growing region in the market due to the huge increase in demand for cellular telecom services.

Wireless Telecom Services Market Players

Some of the top wireless telecom services companies offered in our report includes AT&T Inc., Bharti Airtel Limited, China Mobile Limited, Comcast Corporation, Deutsche Telekom AG, Nippon Telegraph and Telephone Corporation, Reliance Jio Infocomm Limited, SoftBank Group Corp., Verizon Communications Inc., Vodafone Group.

Frequently Asked Questions

How big is the wireless telecom services market?

The market size of wireless telecom services was USD 895.3 billion in 2022.

What is the CAGR of the global wireless telecom services market from 2023 to 2032?

The CAGR of wireless telecom services is 6.6% during the analysis period of 2023 to 2032.

Which are the key players in the wireless telecom services market?

The key players operating in the global market are including AT&T Inc., Bharti Airtel Limited, China Mobile Limited, Comcast Corporation, Deutsche Telekom AG, Nippon Telegraph and Telephone Corporation, Reliance Jio Infocomm Limited, SoftBank Group Corp., Verizon Communications Inc., Vodafone Group.

Which region dominated the global wireless telecom services market share?

North America held the dominating position in wireless telecom services industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of wireless telecom services during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global wireless telecom services industry?

The current trends and dynamics in the wireless telecom services industry include expanding mobile device adoption and data consumption, growing internet of things (IoT) applications, increasing need for remote work and virtual communication, and advancements in wireless infrastructure and network technology.

Which service held the maximum share in 2022?

The data service type held the maximum share of the wireless telecom services industry.