Wireless Display Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Wireless Display Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

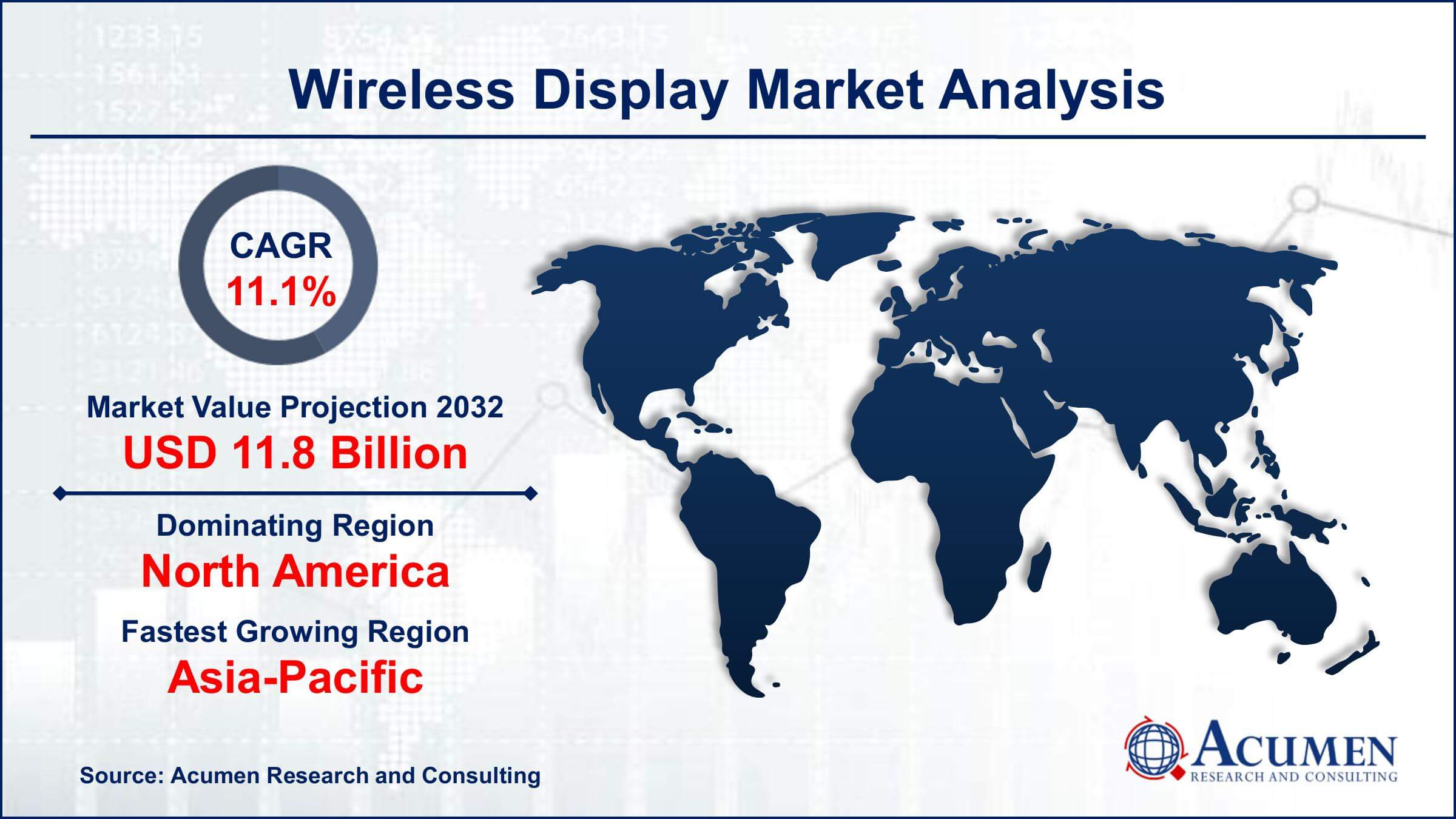

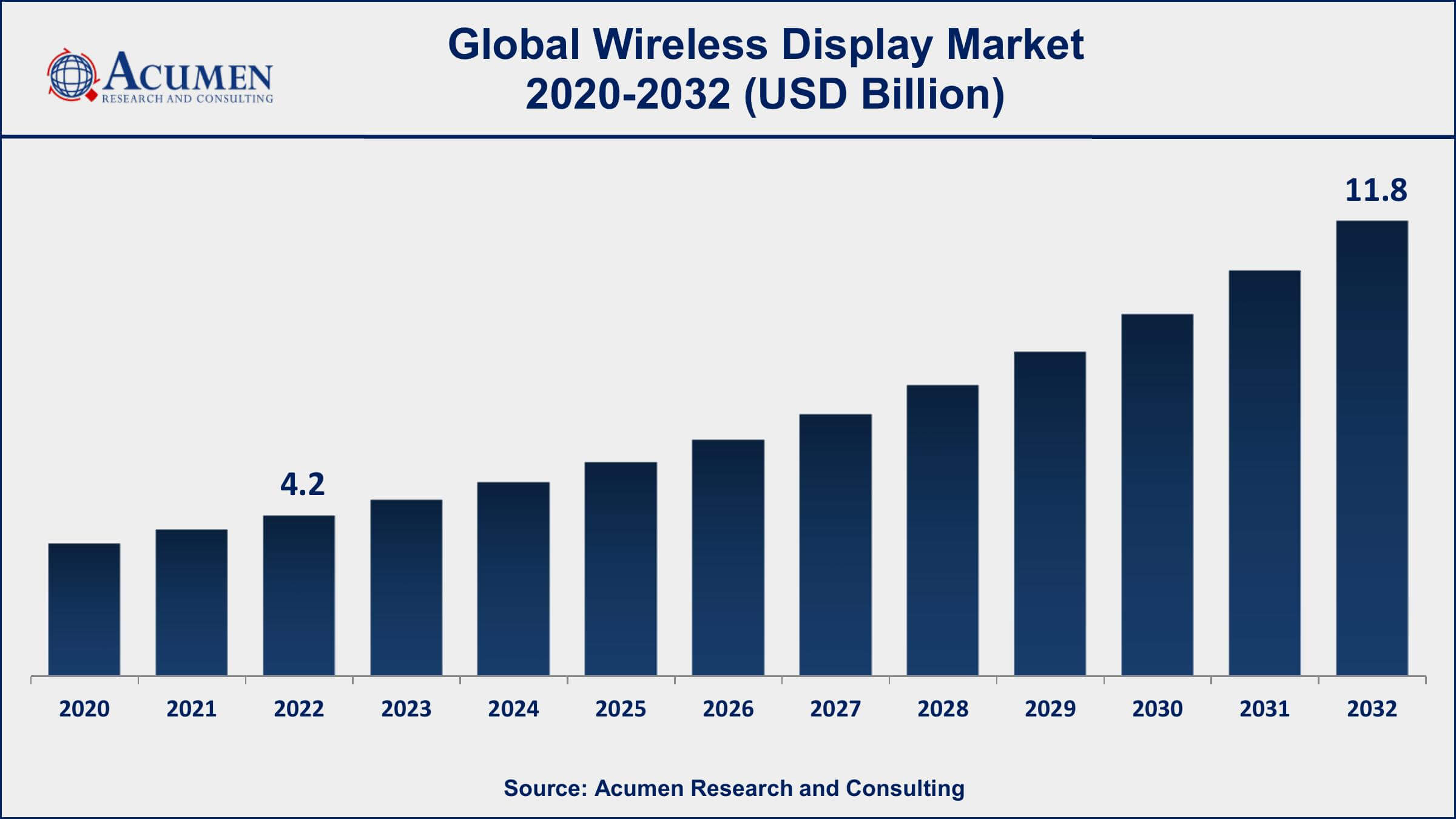

The Global Wireless Display Market Size accounted for USD 4.2 Billion in 2022 and is projected to achieve a market size of USD 11.8 Billion by 2032 growing at a CAGR of 11.1% from 2023 to 2032.

Wireless Display Market Highlights

- Global wireless display market revenue is expected to increase by USD 11.8 Billion by 2032, with a 11.1% CAGR from 2023 to 2032

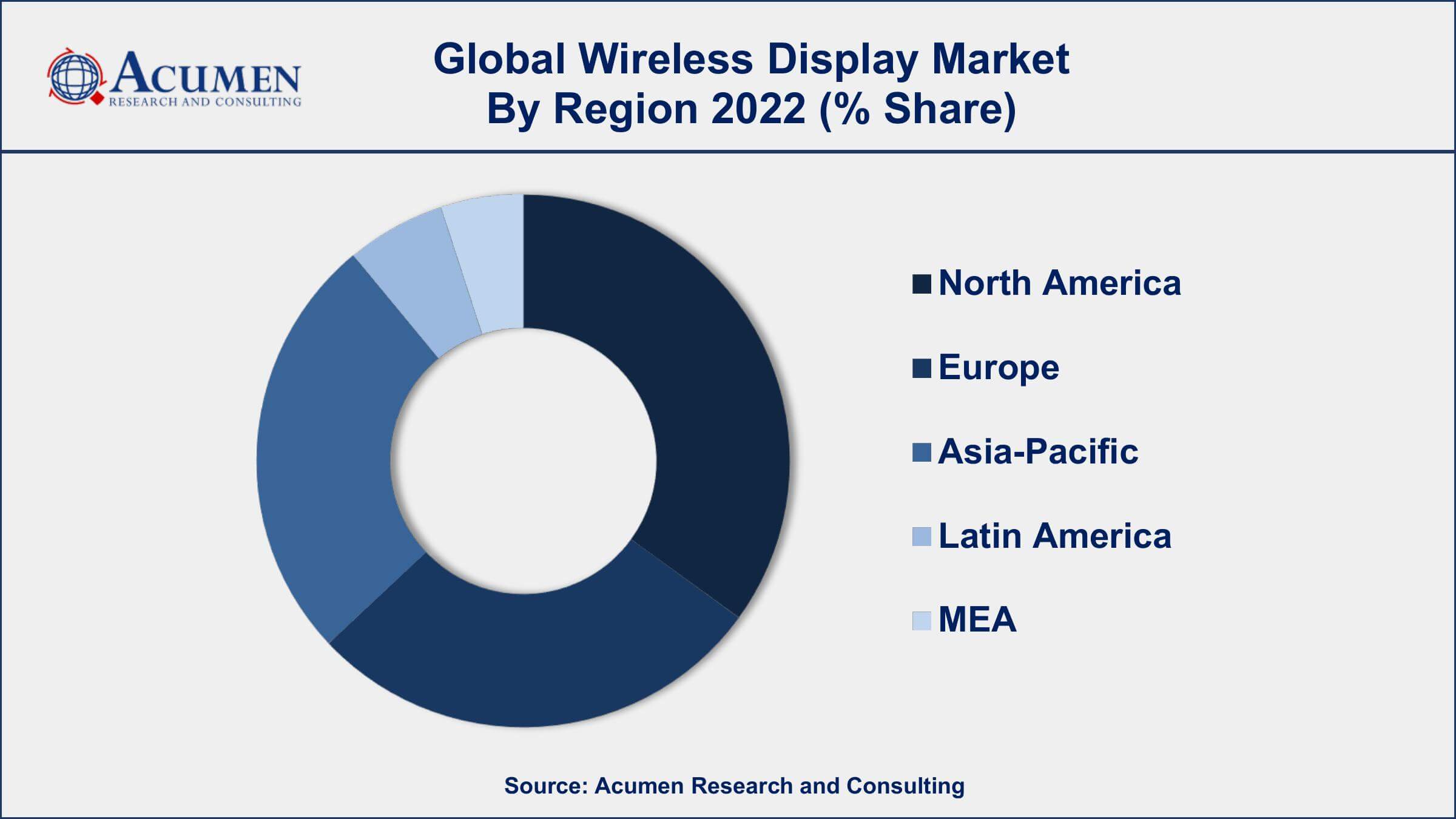

- North Americaregion led with more than 39% of wireless display market share in 2022

- Asia-Pacific wireless display market growth will record a CAGR of around 12% from 2023 to 2032

- According to a research survey, 49% of broadband households in the US own a streaming media player or a smart TV with built-in wireless display capabilities

- By application, the residential segment is predicted to grow at the fastest CAGR of 13.8% between 2023 and 2032

- Proliferation of mobile devices and increasing demand for screen mirroring capabilities, drives the wireless display market value

A wireless display, also known as wireless screen mirroring or wireless presentation, refers to the technology that enables users to wirelessly transmit audio, video, and other data from their devices to a larger display screen, such as a TV, monitor, or projector. It eliminates the need for physical cables and allows for seamless sharing and presentation of content from various sources. Wireless display solutions typically utilize Wi-Fi or Bluetooth connectivity to establish a connection between the transmitting device and the display screen.

The market for wireless display has witnessed significant growth in recent years. The increasing adoption of smartphones, tablets, and laptops, coupled with the rising demand for wireless connectivity and convenience, has been a key driver of this growth. Wireless display technology offers numerous advantages, including easy setup, flexibility, and the ability to collaborate and share content in real-time, making it ideal for businesses, educational institutions, and home entertainment. The market growth is also fueled by the proliferation of streaming services, online gaming, and digital content consumption. With the advent of 4K Ultra HD and high-definition displays, there is a growing need for wireless display solutions that can support high-quality video and audio transmission without latency or loss in quality. Furthermore, the integration of wireless display capabilities in smart TVs and the increasing popularity of smart homes have further contributed to the market expansion.

Global Wireless Display Market Trends

Market Drivers

- Proliferation of mobile devices and increasing demand for screen mirroring capabilities

- Growing adoption of streaming services and digital media consumption

- Increasing need for wireless collaboration and presentation solutions in the corporate sector

- Advancements in wireless connectivity standards, such as Wi-Fi 6 and 5G

Market Restraints

- Concerns over security and privacy risks associated with wireless transmission

- Compatibility issues between different wireless display technologies and devices

Market Opportunities

- Expansion of wireless display technology in education, healthcare, and hospitality sectors

- Integration of augmented reality (AR) and virtual reality (VR) capabilities with wireless display systems

Wireless Display Market Report Coverage

| Market | Wireless Display Market |

| Wireless Display Market Size 2022 | USD 4.2 Billion |

| Wireless Display Market Forecast 2032 | USD 11.8 Billion |

| Wireless Display Market CAGR During 2023 - 2032 | 11.1% |

| Wireless Display Market Analysis Period | 2020 - 2032 |

| Wireless Display Market Base Year | 2022 |

| Wireless Display Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Offering, By Technology Protocols, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Apple Inc., Google LLC, Microsoft Corporation, Amazon.com, Inc., Roku, Inc., Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Corporation, Intel Corporation, Cisco Systems, Inc., Barco NV, and Airtame A/S. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wireless display refers to the technology that allows users to transmit audio and video content from their devices, such as smartphones, tablets, or laptops, to a larger display screen without the need for physical cables. It enables seamless and convenient sharing of content, making it an increasingly popular choice in various applications. One of the primary applications of wireless display is in the consumer electronics sector. With the proliferation of mobile devices and streaming services, users often desire a larger screen experience. Wireless display technology allows them to mirror their device screens onto TVs or projectors, enabling them to enjoy movies, videos, games, and other multimedia content on a bigger display with enhanced visual and audio quality.

The wireless display also finds extensive applications in corporate and business environments. In meetings, presentations, and conferences, wireless display solutions enable participants to wirelessly connect their devices to a shared display. This facilitates real-time content sharing, collaboration, and interactive discussions. It eliminates the need for tangled cables and provides flexibility for presenters to move around the room while maintaining control over the displayed content, enhancing productivity and engagement in professional settings.

The wireless display market has experienced significant growth in recent years and is expected to continue its upward trajectory in the coming years. The proliferation of mobile devices, such as smartphones and tablets, coupled with the increasing demand for screen mirroring capabilities, has been a major driving force behind the market growth. Users seek seamless ways to mirror their device screens onto larger displays, such as TVs and projectors, for enhanced viewing experiences. This demand has led to the development of wireless display technologies that enable convenient content sharing. Additionally, the rising popularity of streaming services and digital media consumption has fueled the adoption of wireless display solutions.

Wireless Display Market Segmentation

The global wireless display market segmentation is based on offering, technology protocols, application, and geography.

Wireless Display Market By Offering

- Software

- Hardware

- Standalone

- Brand Product Integrated

According to the wireless display industry analysis, the hardware segment accounted for the largest market share in 2022. Hardware components play a crucial role in enabling wireless display functionality and ensuring seamless transmission of audio and video content. One of the key factors driving the growth of the hardware segment is the increasing demand for wireless display adapters and dongles. These small devices allow users to connect their devices, such as laptops or smartphones, to larger display screens wirelessly. With the growing popularity of streaming services, online content consumption, and remote work, there is a rising need for convenient and portable solutions to mirror device screens onto TVs or projectors. Wireless display adapters and dongles provide an easy-to-use and plug-and-play solution for users to achieve wireless screen mirroring. Another driver for the growth of the hardware segment is the integration of wireless display capabilities in consumer electronics devices.

Wireless Display Market By Technology Protocols

- AirPlay

- Google Cast

- Miracast

- WiDi

- DLNA

- WirelessHD

- Others

In terms of technology protocolss, the google cast segment is expected to witness significant growth in the coming years. Google Cast, also known as Chromecast, is a popular wireless display technology developed by Google. It allows users to stream audio and video content from their mobile devices or computers to a TV or display screen equipped with a Google Cast receiver. One of the key factors contributing to the growth of the Google Cast segment is the increasing adoption of streaming services and digital media consumption. Google Cast provides a convenient and user-friendly solution for users to cast their favorite content from streaming apps onto a larger screen. With the proliferation of streaming platforms such as Netflix, YouTube, and Disney+, users seek seamless ways to enjoy their content on a bigger display, and Google Cast fulfills this demand. Furthermore, the integration of Google Cast functionality in smart TVs and other consumer electronics devices has significantly expanded its market reach.

Wireless Display Market By Application

- Residential

- Commercial

According to the wireless display market forecast, the residential segment is expected to witness significant growth in the coming years. With the increasing prevalence of smart homes and connected devices, there is a growing demand for wireless display solutions in residential settings. Homeowners are seeking ways to seamlessly connect their mobile devices or laptops to larger screens, such as smart TVs, to enjoy streaming content, gaming, or video calls. One of the main factors fueling the growth of the residential segment is the rising popularity of streaming services and digital media consumption within households. Users want to stream movies, TV shows, and online videos from platforms like Netflix, Amazon Prime Video, and YouTube on their smart TVs. Wireless display technology provides an easy and convenient way to mirror content from their devices onto the larger screens in their homes, enhancing the viewing experience.

Wireless Display Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wireless Display Market Regional Analysis

Geographically, North America dominates the wireless display market in 2022. North America has a high level of technological advancement and infrastructure. The region is home to major tech giants, including Apple, Google, and Microsoft, which have played a pivotal role in developing and promoting wireless display technologies. These companies have introduced popular wireless display solutions, such as Apple AirPlay, Google Cast, and Microsoft Wireless Display Adapter, which have gained significant adoption in the market. The strong presence of these tech giants and their influence on consumer preferences have contributed to North America's dominance in the wireless display market. Moreover, North America has a large consumer base with a high level of digital media consumption. Streaming services like Netflix, Hulu, and Disney+ have gained tremendous popularity in the region, driving the demand for wireless display solutions.

Wireless Display Market Player

Some of the top wireless display market companies offered in the professional report include Apple Inc., Google LLC, Microsoft Corporation, Amazon.com, Inc., Roku, Inc., Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Corporation, Intel Corporation, Cisco Systems, Inc., Barco NV, and Airtame A/S.

Frequently Asked Questions

What was the market size of the global wireless display in 2022?

The market size of wireless display was USD 4.2 Billion in 2022.

What is the CAGR of the global wireless display market from 2023 to 2032?

The CAGR of wireless display is 11.1% during the analysis period of 2023 to 2032.

Which are the key players in the wireless display market?

The key players operating in the global market are including Apple Inc., Google LLC, Microsoft Corporation, Amazon.com, Inc., Roku, Inc., Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Corporation, Intel Corporation, Cisco Systems, Inc., Barco NV, and Airtame A/S.

Which region dominated the global wireless display market share?

North America held the dominating position in wireless display industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of wireless display during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global wireless display industry?

The current trends and dynamics in the wireless display industry include proliferation of mobile devices and increasing demand for screen mirroring capabilities, and growing adoption of streaming services and digital media consumption.

Which technology protocols held the maximum share in 2022?

The google cast technology protocols held the maximum share of the wireless display industry.