Wind Turbine Operations & Maintenance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Wind Turbine Operations & Maintenance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Wind Turbine Operations & Maintenance Market Size accounted for USD 17.2 Billion in 2023 and is estimated to achieve a market size of USD 33.1 Billion by 2032 growing at a CAGR of 7.6% from 2024 to 2032.

Wind Turbine Operations & Maintenance Market Highlights

- Global wind turbine operations & maintenance market revenue is poised to garner USD 33.1 billion by 2032 with a CAGR of 7.6% from 2024 to 2032

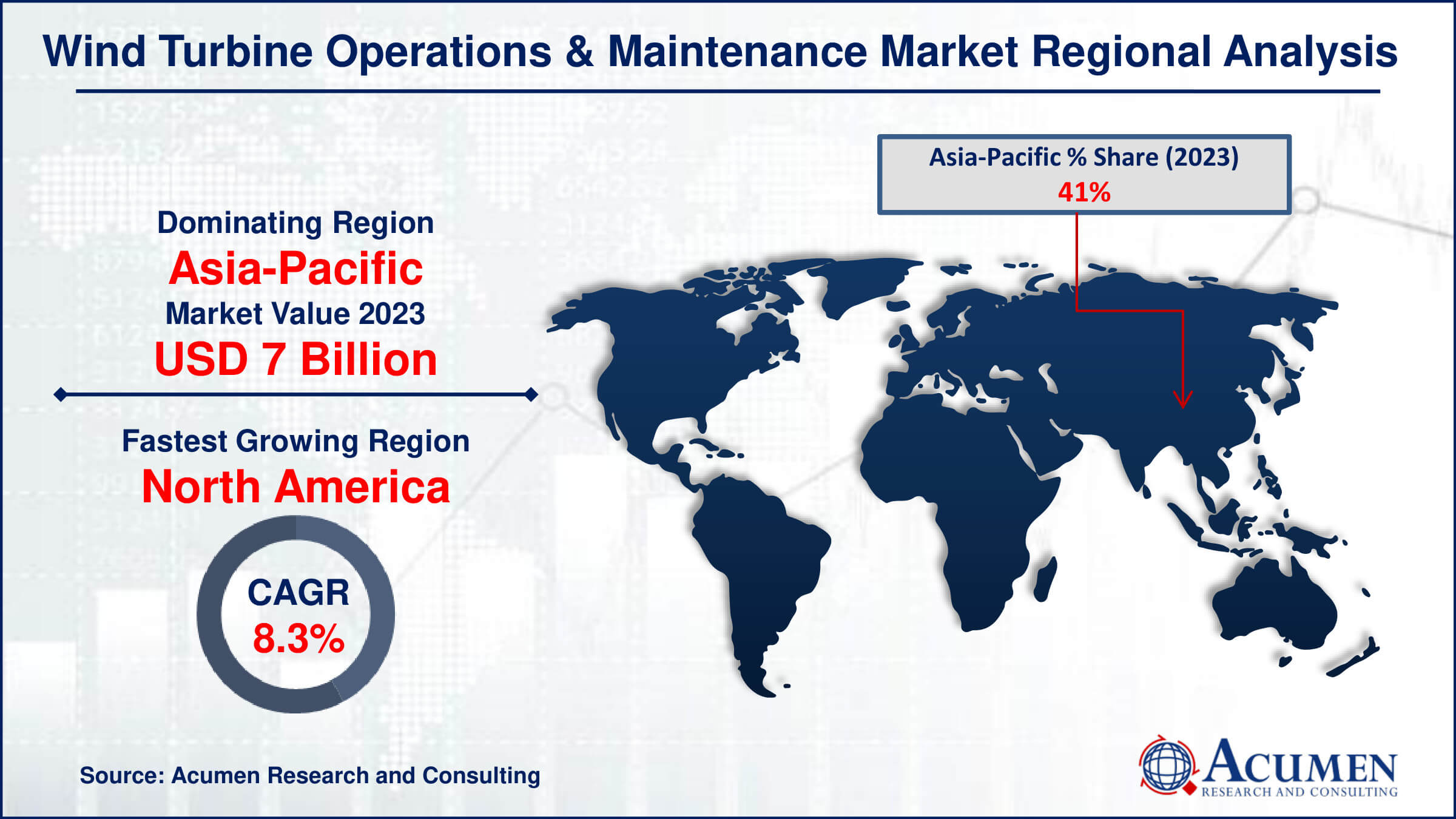

- Asia-Pacific wind turbine operations & maintenance market value occupied around USD 7 billion in 2023

- North America wind turbine operations & maintenance market growth will record a CAGR of more than 8.3% from 2024 to 2032

- Among type, the scheduled sub-segment generated around USD 12 billion revenue in 2023

- Based on application, the onshore sub-segment generated 91% wind turbine operations & maintenance market share in 2023

- Increasing collaborations and partnerships among industry players is a popular wind turbine operations & maintenance market trend that fuels the industry demand

Wind turbine operations and maintenance involve services aimed at ensuring the smooth functioning of wind turbines. This segment presents a significant business opportunity with promising growth prospects in the near future. In recent years, the increased focus on renewable and non-conventional energy sources has led to a surge in demand for various maintenance services. Wind turbines can generate substantial amounts of electricity at a lower cost compared to other sources. However, proper maintenance and operation are crucial to achieving this efficiency. As a result, the demand for these services is expected to increase significantly in the coming years, driven by technological advancements and expanding wind energy projects.

Global Wind Turbine Operations & Maintenance Market Dynamics

Market Drivers

- Increasing focus on renewable energy sources

- Technological advancements in wind turbine designs

- Government incentives and subsidies for renewable energy

- Rising global electricity demand

Market Restraints

- High initial investment and maintenance costs

- Limited availability of skilled workforce

- Environmental concerns and impact on wildlife

Market Opportunities

- Expansion of offshore wind projects

- Development of advanced maintenance technologies like predictive analytics

- Growing investments in green energy infrastructure

Wind Turbine Operations & Maintenance Market Report Coverage

| Market | Wind Turbine Operations & Maintenance Market |

| Wind Turbine Operations & Maintenance Market Size 2022 | USD 17.2 Billion |

| Wind Turbine Operations & Maintenance Market Forecast 2032 | USD 33.1 Billion |

| Wind Turbine Operations & Maintenance Market CAGR During 2023 - 2032 | 7.6% |

| Wind Turbine Operations & Maintenance Market Analysis Period | 2020 - 2032 |

| Wind Turbine Operations & Maintenance Market Base Year |

2022 |

| Wind Turbine Operations & Maintenance Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nordex SE, Siemens Gamesa Renewable Energy SA, Envision Energy Limited, General Electric Company, Enercon GmbH, Vestas Wind Systems A/S, NextEra Energy Resources, LLC, Orsted A/S, MHI Vestas Offshore Wind A/S, Xinjiang Goldwind Science & Technology Co., Ltd., and Suzlon Energy Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wind Turbine Operations & Maintenance Market Insights

The wind turbine operations and maintenance industry is expanding significantly due to a variety of causes. One of the key causes is increased investment in offshore wind turbines. Offshore wind farms are gaining popularity due to their higher energy output potential and the availability of extensive ocean areas compared to onshore places. This boom in investment has increased the demand for specialized maintenance services to guarantee that these offshore sites run smoothly. Another major driver is the increasing use of renewable energy sources. As countries attempt to decrease their carbon footprint and fulfill international climate commitments, there has been a significant movement toward renewable energy. Wind energy, as one of the most viable and mature renewable sources, has seen significant use. This transition has naturally increased demand for wind turbine maintenance services to keep these systems working well.

The rising global need for electricity is also boosting the industry. With rising populations and expanding industrial activity, the demand for dependable and sustainable electricity sources is greater than ever. Wind turbines, which can generate vast amounts of electricity for a low cost, are an appealing option. Regular maintenance is required to keep them efficient and long-lasting, which drives growth in the operations and maintenance industry. Moreover, the industry benefits from an increasing number of wind turbine installations and the aging of older turbines. As more turbines are installed worldwide and older turbines require more regular maintenance, the demand for specialized services has increased. This trend is also driven by the growing need to reduce carbon emissions. As governments and companies prioritize lowering greenhouse gas emissions, the reliance on wind power grows, increasing the demand for efficient maintenance services.

Government assistance is another critical factor. Many countries provide incentives, subsidies, and policies to support the development and maintenance of wind energy plants. These policies not only encourage the installation of new turbines, but also ensure that current ones are well-maintained, so contributing to the market's expansion. Furthermore, the growing number of maintenance service providers has fueled market expansion. As more companies enter the market to provide specialized maintenance services, competition increases, resulting in higher service quality and availability. However, the market faces hurdles. One of the primary constraints is the high cost of wind turbines and their upkeep. Wind turbines demand a significant initial investment, and upkeep can be costly, which may put off some potential investors. Furthermore, there is a shortage of experienced workers capable of conducting the specialized maintenance required for wind turbines. This lack of competence can restrict market expansion by limiting the ability to operate and repair turbines efficiently.

Wind Turbine Operations & Maintenance Market Segmentation

The worldwide market for wind turbine operations & maintenance market is split based on product, application, and geography.

Wind Turbine Operations and Maintenance Market By Types

- Scheduled

- Unscheduled

According to wind turbine operations & maintenance industry analysis, the market divides services into two categories: scheduled and unscheduled maintenance. Scheduled maintenance is the routine, planned servicing of wind turbines to ensure they run efficiently and effectively. This sector is the largest in the market because of its critical role in averting severe failures and increasing turbine lifespans. Scheduled maintenance often consists of frequent inspections, lubrication of moving parts, replacement of worn-out components, and software upgrades. These proactive approaches aid in recognizing and addressing possible problems before they result in costly and unexpected failures. The systematic approach to periodic maintenance improves wind turbine dependability and performance while also lowering long-term operational expenses.

Moreover, as the global number of wind turbine installations increases, so does the demand for planned maintenance services. Operators prioritize these services to maximize energy output while adhering to industry norms and regulations. Due to this emphasis on preventative care, scheduled maintenance is the largest and most important segment of the wind turbine operations and maintenance market.

Wind Turbine Operations and Maintenance Market By Applications

- Offshore

- Onshore

The wind turbine operations and maintenance market is divided into offshore and onshore divisions. The onshore category has the biggest market share. This dominance is attributable to a variety of variables. For starters, onshore wind farms are less expensive and easier to establish and manage than offshore wind farms. Onshore locations are easily accessible, allowing for regular and efficient maintenance, which is critical to wind turbine performance and longevity. Moreover, the infrastructure needed for onshore wind farms, such as roads and electricity lines, is often already in place or easy to build. This minimizes the total investment required for onshore wind installations.

Furthermore, onshore wind farms face less environmental and logistical obstacles than offshore sites, which may require specialized vessels and equipment to maintain. The greater proportion of onshore wind turbines in global wind energy capacity contributes to increased demand for onshore O&M services. This trend is projected to continue as many countries focus on increasing onshore wind generating capacity to achieve renewable energy requirements.

Wind Turbine Operations and Maintenance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wind Turbine Operations & Maintenance Market Regional Analysis

In terms of wind turbine operations & maintenance market analysis, geographically, the global industry is bifurcated into four regions: North America, Europe, Asia Pacific (APAC), and Latin America, Middle East & Africa (LAMEA). APAC is expected to be the largest market, driven by the increasing demand for energy to meet the needs of its large population, significant government support, and growing demand for wind turbines. North America is expected to be the fastest-growing region during the market wind turbine operations & maintenance forecast period, driven by increasing demand for various energy sources, rising spending on alternative energy sources, and heightened awareness of the benefits of proper wind turbine maintenance. The U.S. wind energy industry installed over 74,000 megawatts of wind projects, increasing the demand for maintenance services. Furthermore, in the next two decades, the U.S. will require more than 100,000 additional wind turbines to meet 20% of the nation’s electricity demand. Europe is expected to hold a major share during the forecast period due to growing investments in offshore wind farms, increasing installation of wind farms, and the aging of older wind farms. LAMEA is estimated to experience steady growth in the near future.

Wind Turbine Operations & Maintenance Market Players

Some of the top wind turbine operations & maintenance market companies offered in our report includes Nordex SE, Siemens Gamesa Renewable Energy SA, Envision Energy Limited, General Electric Company, Enercon GmbH, Vestas Wind Systems A/S, NextEra Energy Resources, LLC, Orsted A/S, MHI Vestas Offshore Wind A/S, Xinjiang Goldwind Science & Technology Co., Ltd., and Suzlon Energy Limited.

Frequently Asked Questions

How big is the wind turbine operations & maintenance market?

The wind turbine operations & maintenance market size was valued at USD 17.2 billion in 2023.

What is the CAGR of the global wind turbine operations & maintenance market from 2024 to 2032?

What is the CAGR of the global wind turbine operations & maintenance market from 2024 to 2032?

Which are the key players in the wind turbine operations & maintenance market?

The key players operating in the global market are including Nordex SE, Siemens Gamesa Renewable Energy SA, Envision Energy Limited, General Electric Company, Enercon GmbH, Vestas Wind Systems A/S, NextEra Energy Resources, LLC, Orsted A/S, MHI Vestas Offshore Wind A/S, Xinjiang Goldwind Science & Technology Co., Ltd., and Suzlon Energy Limited.

Which region dominated the global wind turbine operations & maintenance market share?

Asia-Pacific held the dominating position in wind turbine operations & maintenance industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of wind turbine operations & maintenance during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global wind turbine operations & maintenance industry?

The current trends and dynamics in the wind turbine operations & maintenance industry include increasing focus on renewable energy sources, technological advancements in wind turbine designs, government incentives and subsidies for renewable energy, and rising global electricity demand.

Which application held the maximum share in 2023?

The onshore application held the maximum share of the wind turbine operations & maintenance industry.