Wind Turbine Composite Materials Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Wind Turbine Composite Materials Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

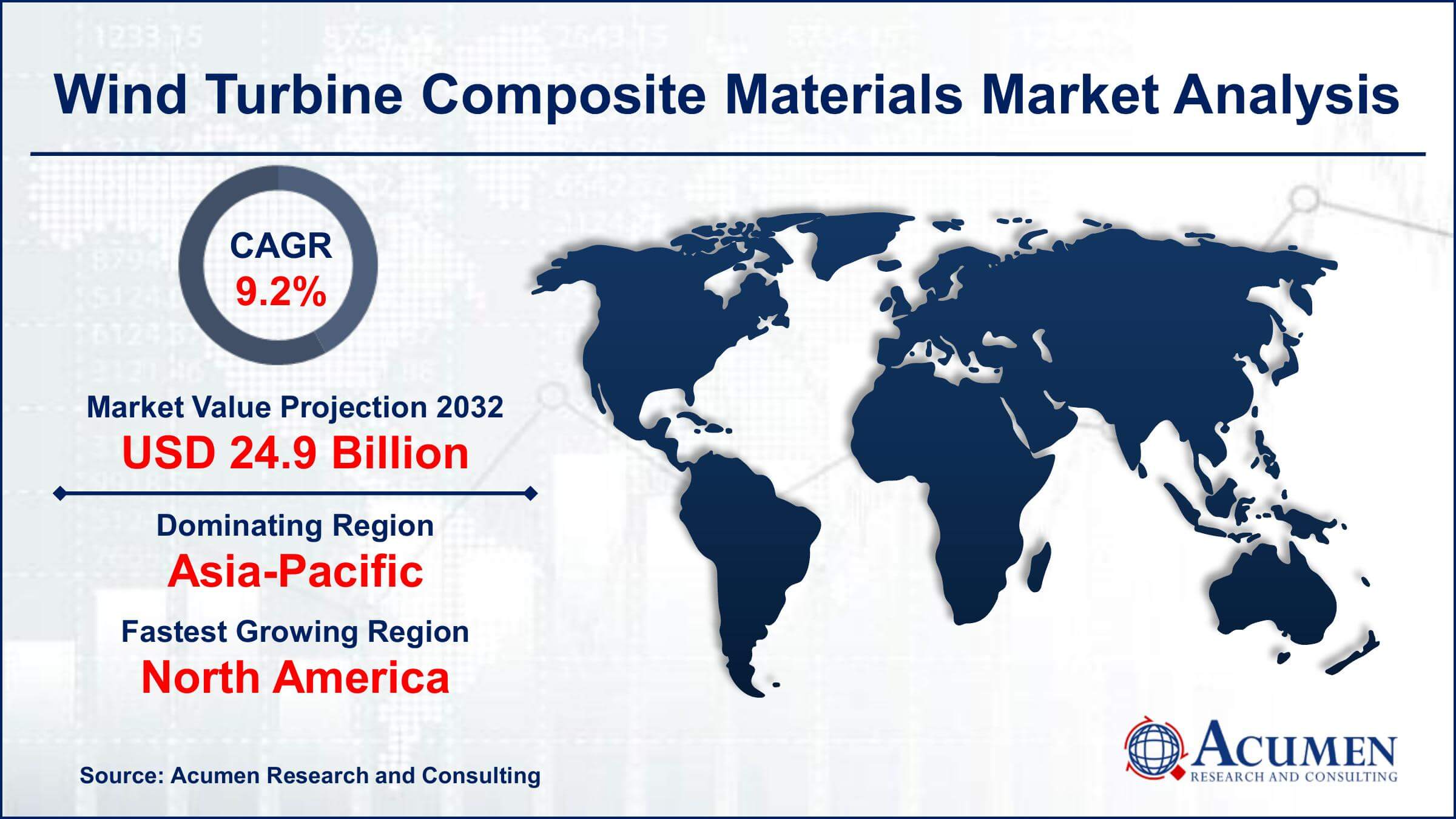

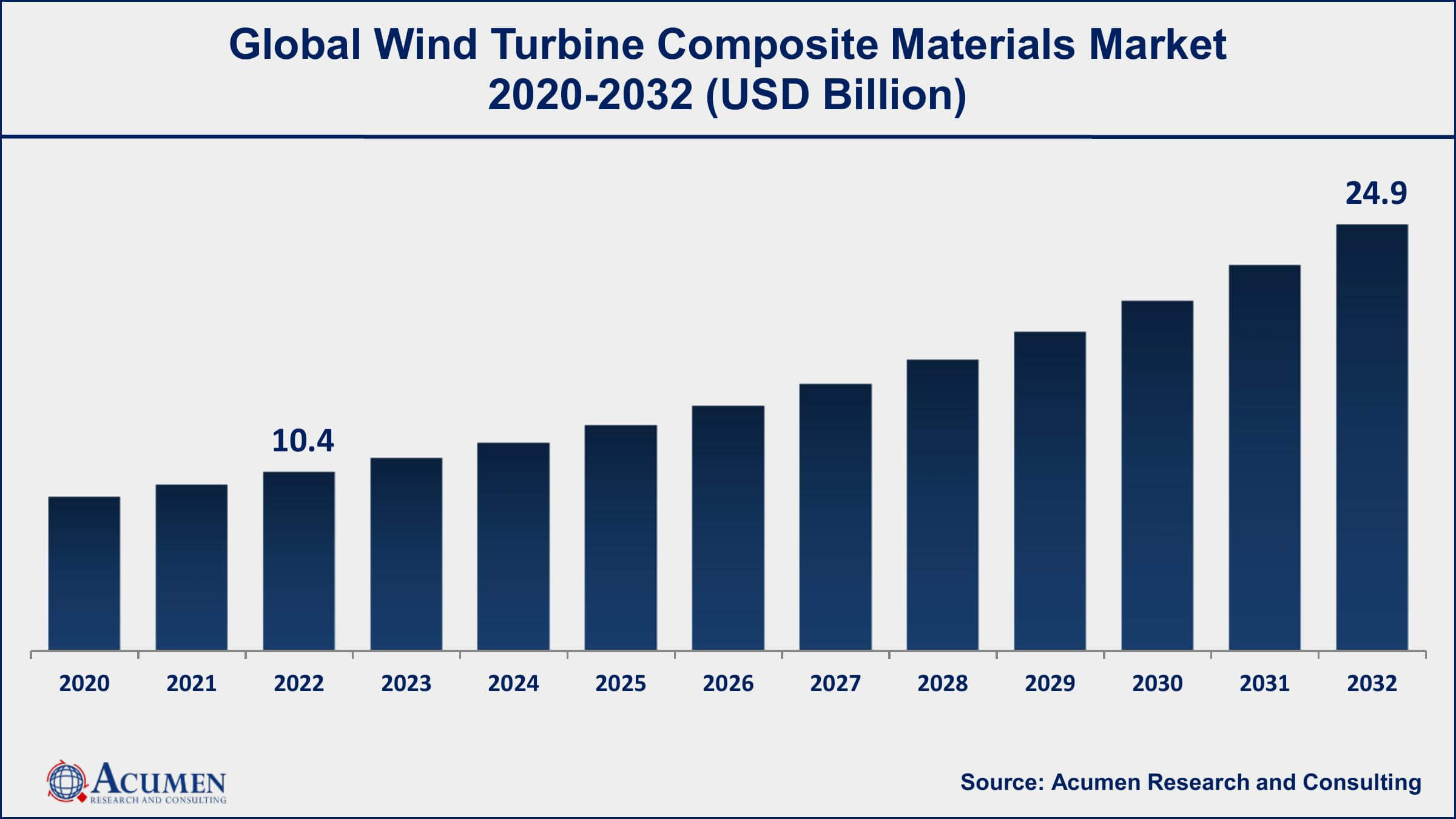

The Global Wind Turbine Composite Materials Market Size accounted for USD 10.4 Billion in 2022 and is projected to achieve a market size of USD 24.9 Billion by 2032 growing at a CAGR of 9.2% from 2023 to 2032.

Wind Turbine Composite Materials Market Highlights

- Global wind turbine composite materials market revenue is expected to increase by USD 24.9 Billion by 2032, with a 9.2% CAGR from 2023 to 2032

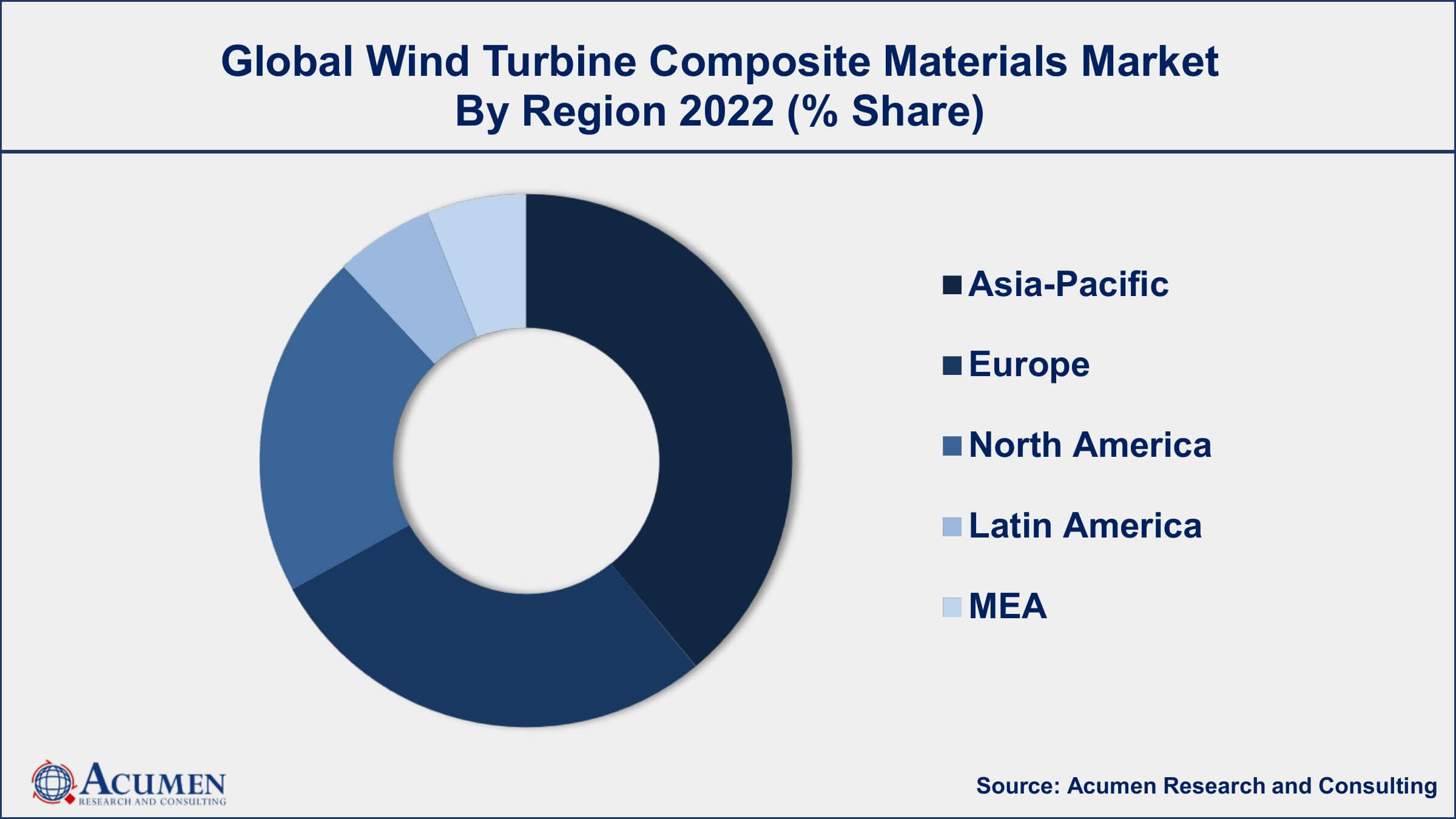

- Asia-Pacific region led with more than 45% of wind turbine composite materials market share in 2022

- According to the International Renewable Energy Agency, global wind energy capacity increased by an average of 17% per year between 2010 and 2019, with China, the United States, and Germany producing the most wind energy

- The Global Wind Energy Council estimates that by 2030, the wind energy sector would supply more than 20% of the world's electricity needs, with wind energy capacity predicted to reach 1,200 GW

- In terms of fiber type, the glass fiber sub-segment accounted for more than 55% of the market in 2022

- Growing focus on improving the efficiency and durability of wind turbines, drives the wind turbine composite materials market value

Wind turbine composite materials are used in the manufacturing of wind turbine blades, nacelles, and other structural components. These materials are lightweight, strong, and durable, making them an ideal choice for the harsh environmental conditions faced by wind turbines. The most common types of composites used in wind turbines include glass fiber-reinforced polymer (GFRP), carbon fiber-reinforced polymer (CFRP), and hybrid composites.

The wind turbine composite materials market has seen significant growth in recent years, and this trend is expected to continue in the coming years. One of the key drivers of this growth is the increasing demand for renewable energy sources, particularly wind energy. As the global shift towards a low-carbon economy accelerates, governments and businesses are investing heavily in wind energy projects, leading to an increase in the production of wind turbines and, consequently, the demand for wind turbine composite materials. Another factor contributing to the growth of the wind turbine composite materials market is the increasing focus on improving the efficiency and durability of wind turbines.

Global Wind Turbine Composite Materials Market Trends

Market Drivers

- Increasing demand for renewable energy sources

- Growing focus on improving the efficiency and durability of wind turbines

- Advancements in composite manufacturing technologies

- Favorable government policies and incentives

- Rising global energy demand and increasing electricity prices

Market Restraints

- High initial investment cost

- Challenges in recycling and disposing of composite materials

- Dependence on government subsidies and incentives

Market Opportunities

- Adoption of new composite materials and manufacturing technologies

- Demand for lightweight and durable composite materials in other industries such as aerospace and automotive

Wind Turbine Composite Materials Market Report Coverage

| Market | Wind Turbine Composite Materials Market |

| Wind Turbine Composite Materials Market Size 2022 | USD 10.4 Billion |

| Wind Turbine Composite Materials Market Forecast 2032 | USD 24.9 Billion |

| Wind Turbine Composite Materials Market CAGR During 2023 - 2032 | 9.2% |

| Wind Turbine Composite Materials Market Analysis Period | 2020 - 2032 |

| Wind Turbine Composite Materials Market Base Year | 2022 |

| Wind Turbine Composite Materials Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Fiber Type, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Vestas Wind Systems A/S, General Electric Company, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Limited, Enercon GmbH, Nordex SE, LM Wind Power A/S, TPI Composites, Inc., Mitsubishi Power, Ltd., Senvion S.A., ENERCON GmbH, and Goldwind Science & Technology Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wind Turbine Composite Materials Market Dynamics

Wind turbine composite material forms a vital component of wind turbines for the production of the turbine rotor blade. Composite material is made up of matrix and fiber to offer physical strength and distributes loads in the composite. The matrix material used acts as a binder and maintains the spacing of the fiber material, thus protecting the fiber from environmental and abrasion damage. The composite material manufactured from the fortification of matrix and fiber is far superior to conventional metals such as aluminum and steel.

Increasing wind power generation capacity and increasing demand for larger blades are majorly driving the growth of this market. In addition, stringent environmental regulations related to emissions from burning conventional fuel coupled with government support for wind power projects are driving the growth of this market. The high cost of composite materials and uncertain global economic condition is restraining the growth of this market to some extent. Technological advancements in advanced composites and growing compliance for carbon fiber reinforcement are the key trends in this market. Untapped markets in the Middle East and Africa and research and development for low-cost advanced composites are anticipated to boost the growth of this market in near future.

In North America, the wind turbine composite materials market growth is anticipated to rise at a noteworthy rate throughout the forecast period. The governments of Canada and the US are subtle to environmental destruction produced by fuel burnt for power. High power consumption in North America has led the government to incentivize substitute sources of energy. This has given rise to the wind turbine composite materials industry in this region.

Wind Turbine Composite Materials Market Segmentation

The global wind turbine composite materials market segmentation is based on fiber type, technology, application, and geography.

Wind Turbine Composite Materials Market By Fiber Type

- Carbon Fiber

- Glass Fiber

- Others

According to the wind turbine composite materials industry analysis, the glass fiber segment accounted for the largest market share in 2022. Glass fiber reinforced polymer (GFRP) composites are widely used in wind turbine blades due to their high strength-to-weight ratio, durability, and cost-effectiveness. These composites are made by combining glass fibers with a thermosetting resin, typically polyester or epoxy, to create a strong and lightweight material that can withstand the harsh environmental conditions faced by wind turbines. The growth of the glass fiber segment is driven by several factors including, the increasing demand for renewable energy sources has led to a surge in wind energy projects, resulting in a higher demand for wind turbine blades. Moreover, advancements in glass fiber manufacturing technologies, such as continuous filament winding and pultrusion, have made the production of GFRP composites more cost-effective and efficient, further driving the growth of the market.

Wind Turbine Composite Materials Market By Technology

- Vacuum Injection Molding

- Hand Lay-Up

- Prepreg

- Others

In terms of technologies, the vacuum injection molding (VIM) segment is expected to witness significant growth in the coming years. VIM is a manufacturing process used to produce high-quality composite parts with minimal voids and defects. In this process, a dry fiber preform is placed into a mold cavity, and resin is injected under a vacuum, allowing the resin to fully impregnate the fiber and cure into a solid part. The growth of the VIM segment is driven by several factors including, the increasing demand for wind energy has led to a surge in the production of wind turbine blades, which require large and complex composite structures. Moreover, the VIM process allows for the production of large and thick composite parts, making it well-suited for wind turbine blades that can be over 80 meters in length.

Wind Turbine Composite Materials Market By Application

- Wind Blade

- Nacelle

- Tower

- Base

- Others

According to the wind turbine composite materials market forecast, the wind blade segment is expected to witness significant growth in the coming years. Wind blades are the largest and most critical component of a wind turbine, and their performance has a significant impact on the overall efficiency and output of the turbine. Composite materials such as glass fiber reinforced polymer (GFRP) and carbon fiber reinforced polymer (CFRP) are widely used in wind blade manufacturing due to their high strength-to-weight ratio, durability, and corrosion resistance. The growth of the wind blade segment is driven by several factors including, the increasing demand for wind energy has led to a surge in wind turbine installations, resulting in a higher demand for wind blades. Moreover, the use of composite materials in wind blade manufacturing offers several advantages, including lower weight, higher stiffness, and improved fatigue resistance, resulting in improved turbine performance and longer service life.

Wind Turbine Composite Materials Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wind Turbine Composite Materials Market Regional Analysis

Asia-Pacific dominates the wind turbine composite materials market and is expected to continue to do so in the coming years. The region is a major hub for wind energy production and has witnessed significant growth in the installation of wind turbines in recent years. China, India, and Japan are the major countries driving the growth of the wind energy sector in the region. One of the key factors driving the dominance of Asia-Pacific in the wind turbine composite materials market is the growing demand for renewable energy sources. Governments in the region are promoting the use of renewable energy sources to reduce their reliance on fossil fuels and mitigate climate change. This has led to an increase in wind energy projects and a higher demand for wind turbine components, including composite materials. Furthermore, the availability of low-cost labor and raw materials in the region has also contributed to the growth of the wind turbine composite materials market.

Wind Turbine Composite Materials Market Player

Some of the top wind turbine composite materials market companies offered in the professional report include Vestas Wind Systems A/S, General Electric Company, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Limited, Enercon GmbH, Nordex SE, LM Wind Power A/S, TPI Composites, Inc., Mitsubishi Power, Ltd., Senvion S.A., ENERCON GmbH, and Goldwind Science & Technology Co., Ltd.

Frequently Asked Questions

What was the market size of the global wind turbine composite materials in 2022?

The market size of wind turbine composite materials was USD 10.4 Billion in 2022.

What is the CAGR of the global wind turbine composite materials market from 2023 to 2032?

The CAGR of wind turbine composite materials is 9.2% during the analysis period of 2023 to 2032.

Which are the key players in the wind turbine composite materials market?

The key players operating in the global market are including Vestas Wind Systems A/S, General Electric Company, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Limited, Enercon GmbH, Nordex SE, LM Wind Power A/S, TPI Composites, Inc., Mitsubishi Power, Ltd., Senvion S.A., ENERCON GmbH, and Goldwind Science & Technology Co., Ltd.

Which region dominated the global wind turbine composite materials market share?

Asia-Pacific held the dominating position in wind turbine composite materials industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of wind turbine composite materials during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global wind turbine composite materials industry?

The current trends and dynamics in the wind turbine composite materials industry include increasing demand for renewable energy sources, growing focus on improving the efficiency and durability of wind turbines, and advancements in composite manufacturing technologies.

Which application held the maximum share in 2022?

The wind blade application held the maximum share of the wind turbine composite materials industry.