Wind Turbine Blade Repair Material Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Wind Turbine Blade Repair Material Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

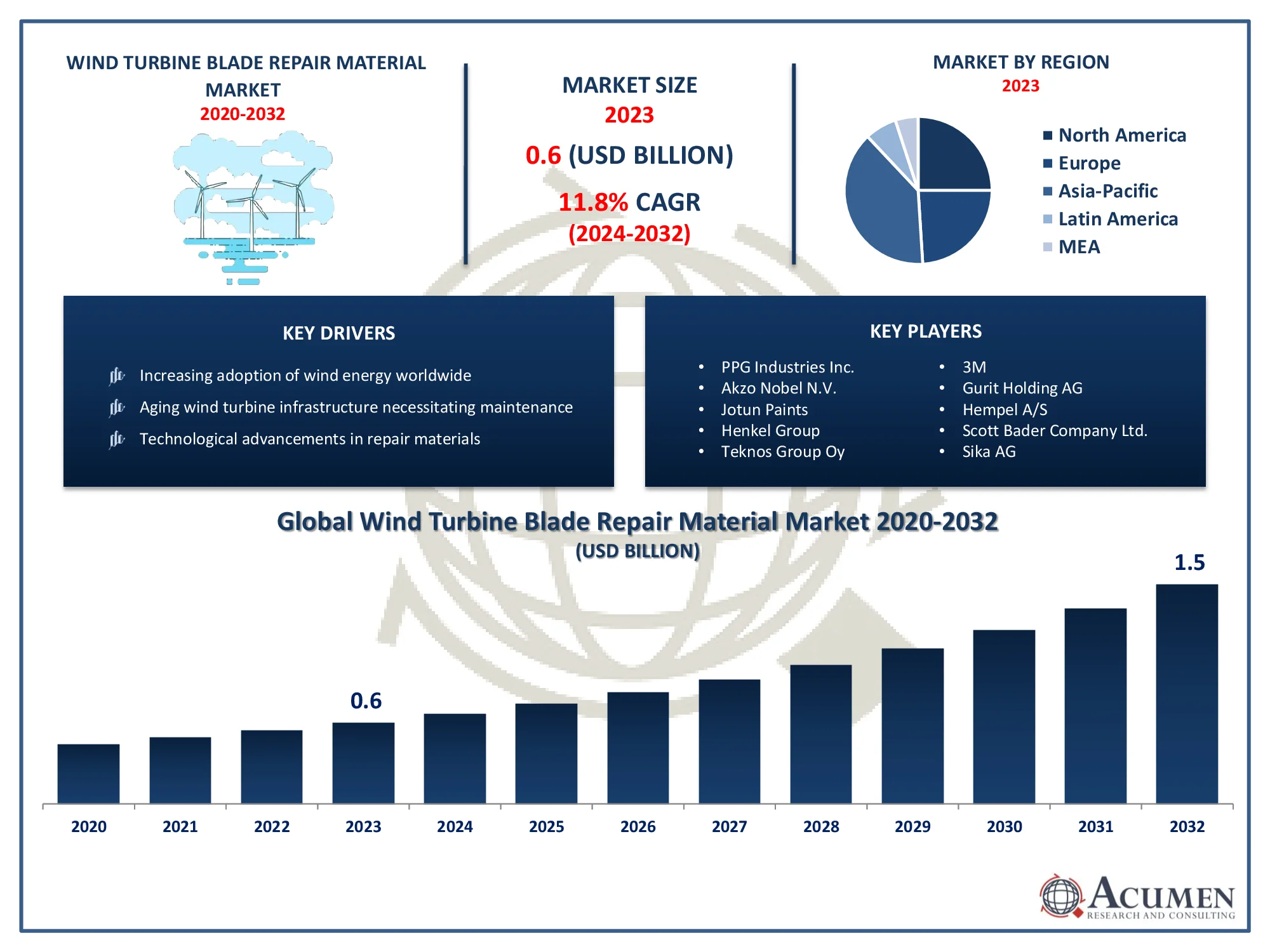

The Global Wind Turbine Blade Repair Material Market Size accounted for USD 0.6 Billion in 2023 and is projected to achieve a market size of USD 1.5 Billion by 2032 growing at a CAGR of 11.8% from 2024 to 2032.

Wind Turbine Blade Repair Material Market Highlights

- Global wind turbine blade repair material market revenue is expected to increase by USD 1.5 Billion by 2032, with a 11.8% CAGR from 2024 to 2032

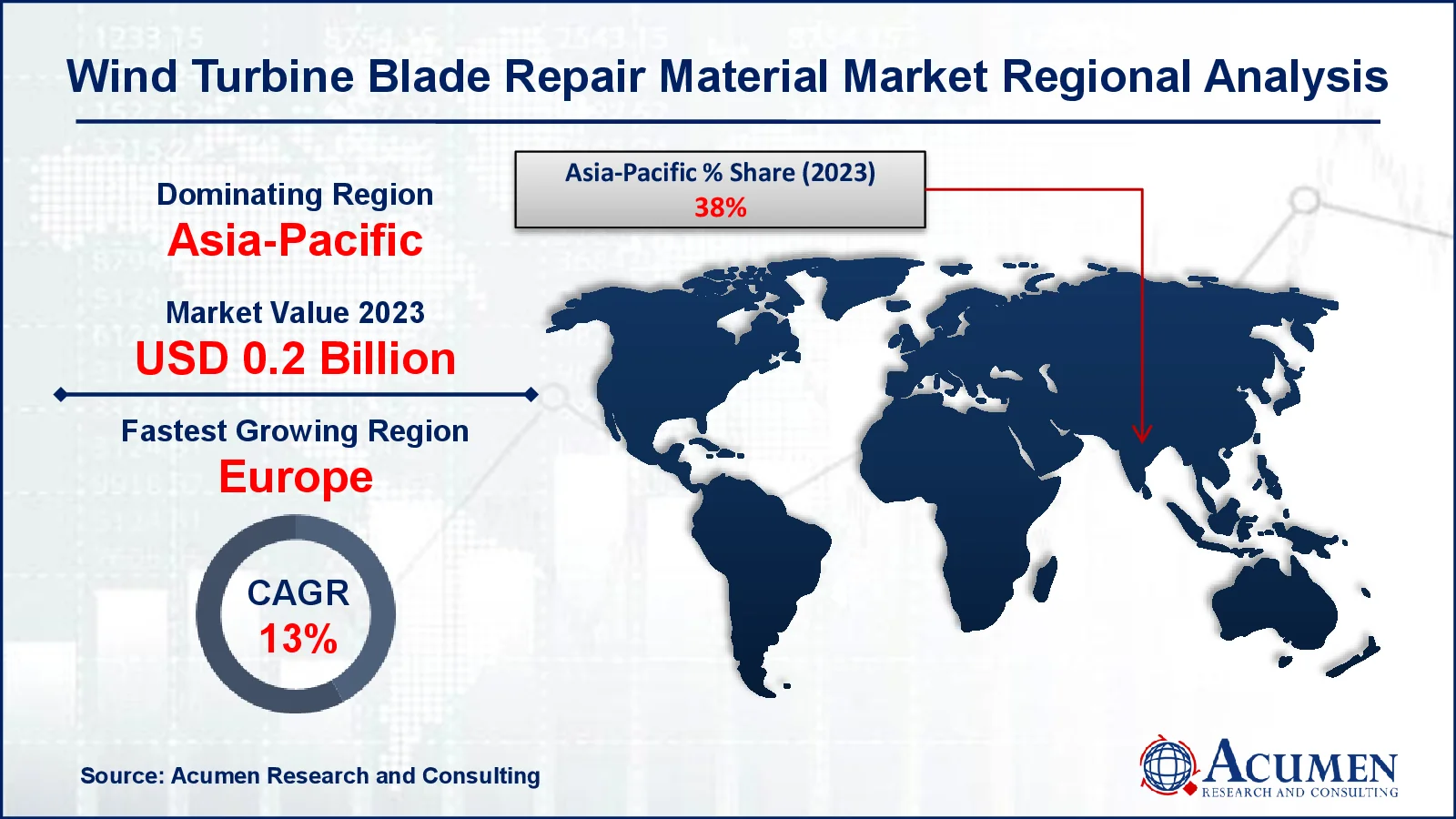

- Asia-Pacific region led with more than 38% of wind turbine blade repair material market share in 2023

- Europe wind turbine blade repair material market growth will record a CAGR of more than 12.6% from 2024 to 2032

- By product type, the coatings are the largest segment of the market, accounting for over 44% of the global market share

- By application, the onshore is one of the largest and fastest-growing segments of the wind turbine blade repair material industry

- Increasing adoption of wind energy worldwide, drives the wind turbine blade repair material market value

Wind turbine blade repair materials typically include composite materials such as epoxy resins, fiberglass, carbon fiber, and various fillers and adhesives. These materials are used to repair damage to wind turbine blades caused by factors like erosion, lightning strikes, or wear and tear over time. Repairing these blades is crucial for maintaining the efficiency and lifespan of wind turbines, as damaged blades can significantly reduce energy output and increase maintenance costs.

The market for wind turbine blade repair materials has seen substantial growth in recent years, driven by the increasing adoption of wind energy worldwide and the need to maintain existing wind turbine infrastructure. As more wind farms are established and existing ones age, the demand for repair and maintenance services has grown accordingly. Additionally, advancements in materials science and engineering have led to the development of more durable and efficient repair materials, further fueling market growth. Factors such as government initiatives to promote renewable energy and the growing awareness of environmental sustainability are also contributing to the expansion of the wind turbine blade repair materials market.

Global Wind Turbine Blade Repair Material Market Trends

Market Drivers

- Increasing adoption of wind energy worldwide

- Aging wind turbine infrastructure necessitating maintenance

- Technological advancements in repair materials

- Government initiatives promoting renewable energy

- Growing awareness of environmental sustainability

Market Restraints

- High initial investment costs

- Limited accessibility to remote wind farm locations

Market Opportunities

- Rising demand for specialized repair and maintenance services

- Development of innovative repair technologies and materials

Wind Turbine Blade Repair Material Market Report Coverage

| Market | Wind Turbine Blade Repair Material Market |

| Wind Turbine Blade Repair Material Market Size 2022 |

USD 0.6 Billion |

| Wind Turbine Blade Repair Material Market Forecast 2032 | USD 1.5 Billion |

| Wind Turbine Blade Repair Material Market CAGR During 2023 - 2032 | 11.8% |

| Wind Turbine Blade Repair Material Market Analysis Period | 2020 - 2032 |

| Wind Turbine Blade Repair Material Market Base Year |

2022 |

| Wind Turbine Blade Repair Material Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PPG Industries Inc., Akzo Nobel N.V., The Sherwin-Williams Company, Jotun Paints, Henkel Group, Teknos Group Oy, 3M, Gurit Holding AG, Hempel A/S, Scott Bader Company Ltd., Sika AG, and Mankiewicz Gebr. and Co. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wind Turbine Blade Repair Material Market Dynamics

Wind turbine blade repair materials are specialized composite materials designed to restore and reinforce damaged wind turbine blades. These materials typically consist of resins, such as epoxy or polyester, combined with reinforcing fibers like fiberglass, carbon fiber, or other synthetic materials. Additionally, fillers and adhesives are often used to fill in cracks, gaps, or surface imperfections. The choice of materials depends on factors such as the severity of the damage, environmental conditions, and the specific requirements of the repair. The applications of wind turbine blade repair materials are primarily focused on maintaining the structural integrity and performance of wind turbine blades. These materials are used to repair various types of damage, including erosion, cracks, delamination, and impact damage caused by factors such as lightning strikes or bird strikes.

The wind turbine blade repair material market has been experiencing robust growth driven by several key factors. With the increasing global focus on renewable energy, there has been a significant expansion in wind energy capacity, leading to a higher demand for wind turbine maintenance and repair. As wind farms age, the need for repairing and refurbishing turbine blades becomes more pronounced, propelling the market forward. Moreover, advancements in repair material technologies have enhanced the durability and longevity of wind turbine blades, further stimulating market growth. Another significant driver of the wind turbine blade repair material market is the growing awareness of the importance of sustainable energy sources. Governments and organizations worldwide are increasingly investing in wind energy as part of their efforts to reduce carbon emissions and combat climate change. This heightened environmental consciousness has led to greater investments in wind turbine maintenance and repair, driving the demand for repair materials.

Wind Turbine Blade Repair Material Market Segmentation

The global wind turbine blade repair material market segmentation is based on product type, application, and geography.

Wind Turbine Blade Repair Material Market By Product Type

- Putties

- Coatings

- Adhesives and Sealants

In terms of product types, the coatings segment accounted for the largest market share in 2023. Coatings play a crucial role in protecting wind turbine blades from environmental factors such as moisture, UV radiation, and abrasion, thereby extending their lifespan and enhancing performance. As the number of wind turbines continues to rise globally, the demand for coatings for repair and maintenance purposes has increased significantly. One of the key drivers of growth in the coatings segment is the development of advanced coating technologies that offer superior protection and durability. Manufacturers are continuously innovating to create coatings that can withstand harsh operating conditions and provide long-lasting performance. Additionally, there is a growing trend towards the use of environmentally friendly coatings that minimize the environmental impact of wind turbine maintenance activities, further driving market growth.

Wind Turbine Blade Repair Material Market By Application

- Onshore

- Offshore

According to the wind turbine blade repair material market forecast, the onshore segment is expected to witness significant growth in the coming years. Onshore wind farms remain the dominant form of wind energy generation globally, accounting for the majority of installed capacity. As these onshore wind turbines age, the need for repair and maintenance services, including the use of specialized repair materials, becomes more pronounced, driving the growth of the market segment. One of the primary drivers of growth in the onshore segment is the increasing capacity of onshore wind farms worldwide. Governments and energy companies are continually investing in onshore wind projects as a cost-effective means of meeting renewable energy targets and reducing carbon emissions. This expanding onshore wind capacity translates into a growing market for repair materials, as the maintenance of these turbines becomes essential to ensure optimal performance and longevity. Additionally, the onshore segment benefits from its relatively lower operational costs compared to offshore wind farms.

Wind Turbine Blade Repair Material Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wind Turbine Blade Repair Material Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the wind turbine blade repair material market, primarily due to the rapid expansion of wind energy infrastructure in countries like China, India, and South Korea. These nations have made significant investments in renewable energy, including wind power, to meet their growing electricity demands while reducing carbon emissions. As a result, there is a substantial installed base of wind turbines in the Asia-Pacific region, driving the demand for repair and maintenance services, including the necessary materials. Furthermore, the Asia-Pacific region benefits from favorable government policies and incentives aimed at promoting renewable energy development. Many countries in the region have implemented supportive regulatory frameworks, feed-in tariffs, and subsidies to encourage investment in wind energy projects. This policy support has created a conducive environment for wind energy expansion, driving the demand for wind turbine blade repair materials. Additionally, the availability of skilled labor and manufacturing capabilities in countries like China further contributes to the region's dominance in the wind turbine blade repair material market.

Wind Turbine Blade Repair Material Market Player

Some of the top wind turbine blade repair material market companies offered in the professional report include PPG Industries Inc., Akzo Nobel N.V., The Sherwin-Williams Company, Jotun Paints, Henkel Group, Teknos Group Oy, 3M, Gurit Holding AG, Hempel A/S, Scott Bader Company Ltd., Sika AG, and Mankiewicz Gebr. and Co.

Frequently Asked Questions

What was the market size of the global wind turbine blade repair material in 2023?

The market size of wind turbine blade repair material was USD 2.5 Billion in 2023.

What is the CAGR of the global wind turbine blade repair material market from 2024 to 2032?

The CAGR of wind turbine blade repair material is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the wind turbine blade repair material market?

The key players operating in the global market are including PPG Industries Inc., Akzo Nobel N.V., The Sherwin-Williams Company, Jotun Paints, Henkel Group, Teknos Group Oy, 3M, Gurit Holding AG, Hempel A/S, Scott Bader Company Ltd., Sika AG, and Mankiewicz Gebr. and Co.

Which region dominated the global wind turbine blade repair material market share?

Asia-Pacific held the dominating position in wind turbine blade repair material industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of wind turbine blade repair material during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global wind turbine blade repair material industry?

The current trends and dynamics in the wind turbine blade repair material market growth include increasing adoption of wind energy worldwide, aging wind turbine infrastructure necessitating maintenance, and technological advancements in repair materials.

Which product type held the maximum share in 2023?

The coatings product type held the maximum share of the wind turbine blade repair material industry.