Wind Energy Cable Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Wind Energy Cable Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

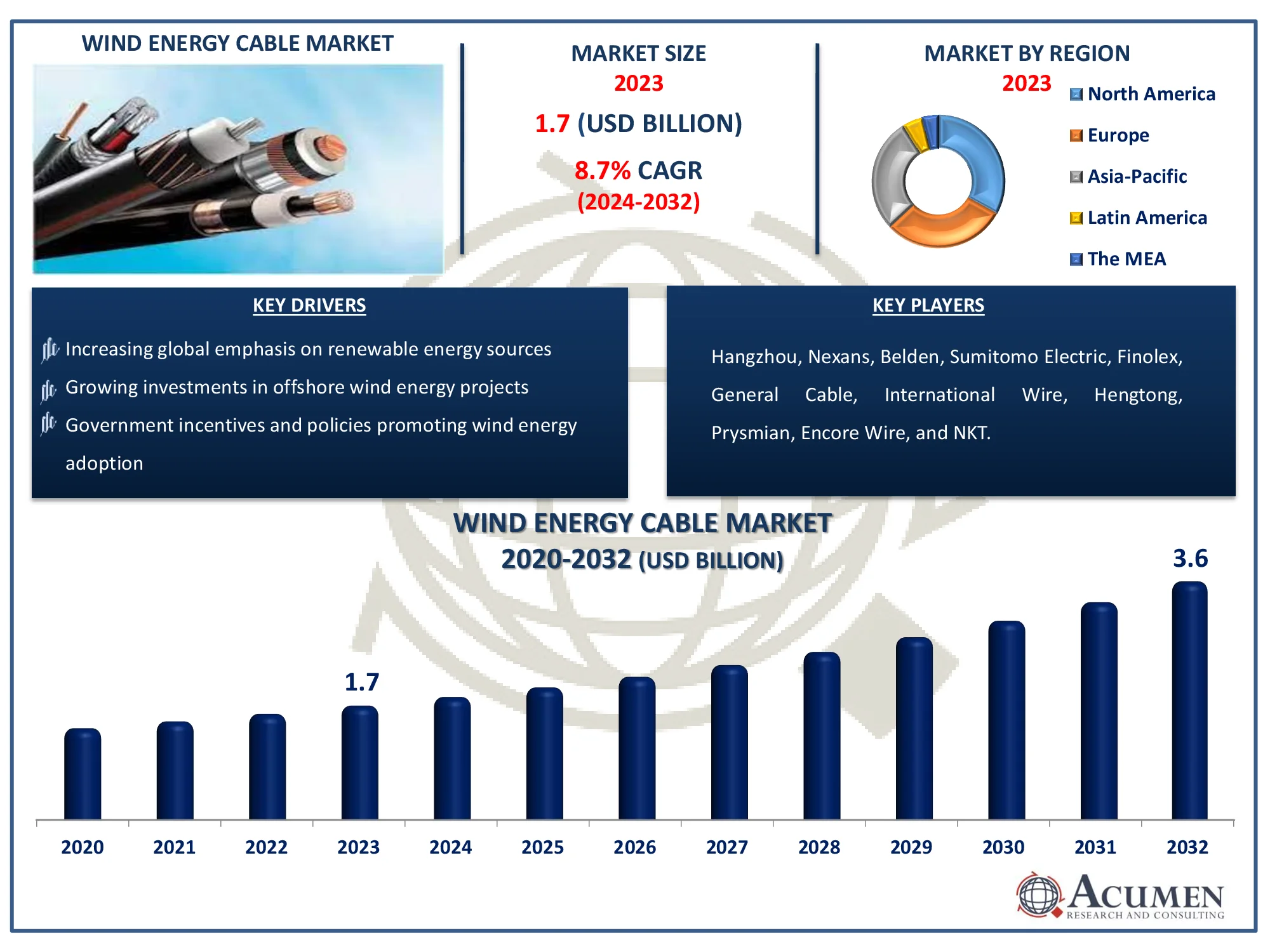

The Global Wind Energy Cable Market Size accounted for USD 1.7 Billion in 2023 and is estimated to achieve a market size of USD 3.6 Billion by 2032 growing at a CAGR of 8.7% from 2024 to 2032.

Wind Energy Cable Market Highlights

- Global wind energy cable market revenue is poised to garner USD 3.6 Billion by 2032 with a CAGR of 8.7% from 2024 to 2032

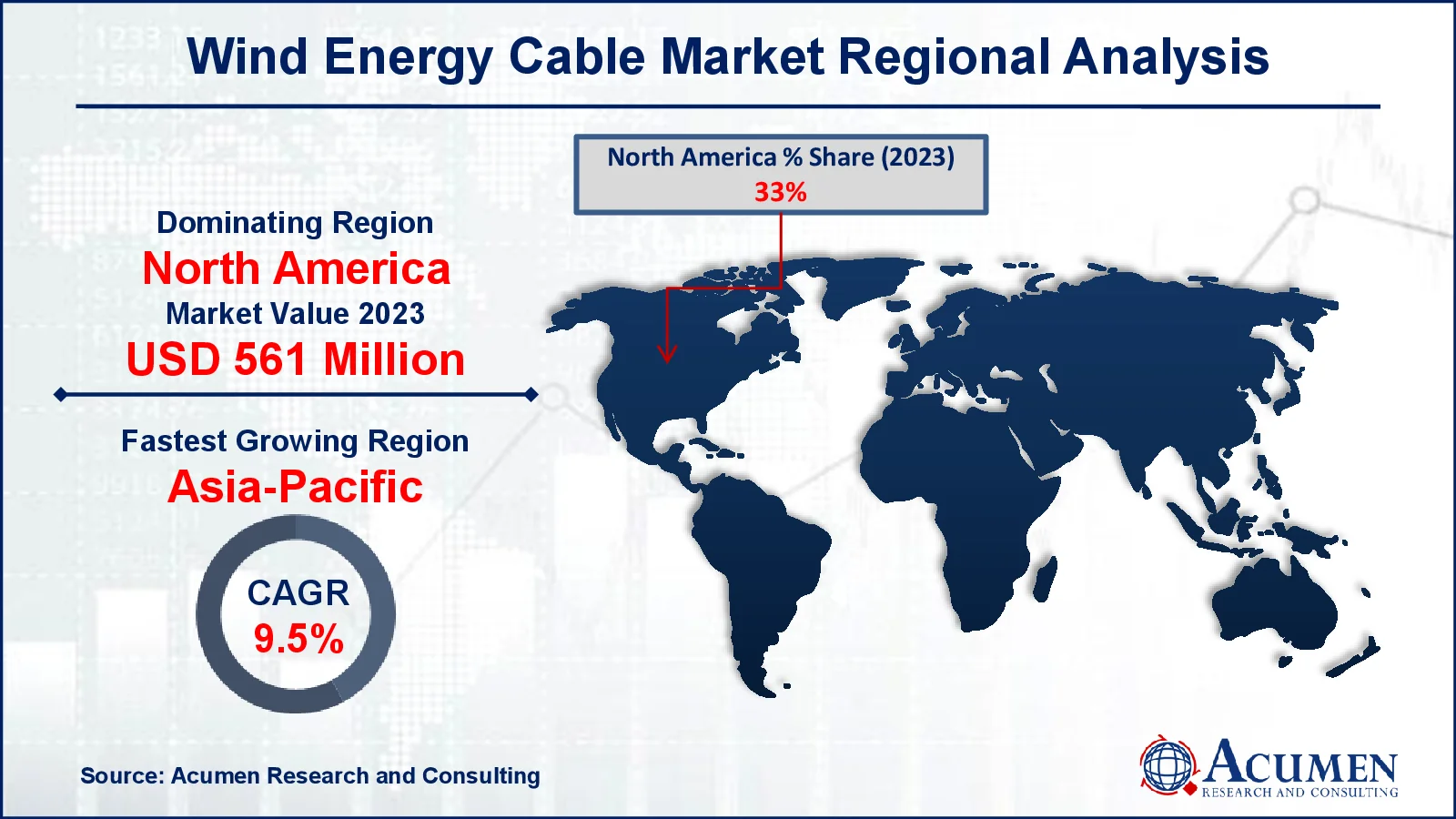

- North America wind energy cable market value occupied around USD 561 million in 2023

- Asia-Pacific wind energy cable market growth will record a CAGR of more than 9.5% from 2024 to 2032

- Among product type, the low-voltage power cables (600 V) sub-segment generated more than USD 901 million revenue in 2023

- Based on application, the Offshore sub-segment generated notable market wind energy cable market share in 2023

- Integration of digital technologies for enhanced monitoring and maintenance is a popular wind energy cable market trend that fuels the industry demand

Wind energy cables are typically composed of high-quality, thermosetting rubber for both insulation and sheathing. These cables must endure standard temperature ranges from -40°C to 90°C. The placement of wind farms, whether onshore or offshore, significantly influences the environmental challenges these cables face. Wind energy cables must withstand various weather conditions, including high winds, saltwater, and extreme temperatures. Within the nacelle and tower of a wind turbine, the cables are exposed to severe conditions such as flexing, vibration, electromagnetic interference, and high-torsion stress. Additionally, these cables need to be resistant to oil, ozone, fuel, coolant, corrosive chemicals, and abrasion to ensure long-term functionality and durability.

Global Wind Energy Cable Market Dynamics

Market Drivers

- Increasing global emphasis on renewable energy sources

- Growing investments in offshore wind energy projects

- Technological advancements in cable materials and design

- Government incentives and policies promoting wind energy adoption

Market Restraints

- High initial installation costs

- Challenges in grid integration of offshore wind farms

- Environmental concerns and regulatory hurdles

Market Opportunities

- Expansion of offshore wind energy installations

- Development of innovative cable solutions for harsh environments

- Emerging markets in Asia-Pacific and Latin America

Wind Energy Cable Market Report Coverage

|

Market |

Wind Energy Cable Market |

|

Wind Energy Cable Market Size 2023 |

USD 1.7 Billion |

|

Wind Energy Cable Market Forecast 2032 |

USD 3.6 Billion |

|

Wind Energy Cable Market CAGR During 2024 - 2032 |

8.7% |

|

Wind Energy Cable Market Analysis Period |

2020 - 2032 |

|

Wind Energy Cable Market Base Year |

2023 |

|

Wind Energy Cable Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Product Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Nexans, Sumitomo Electric, Hangzhou, Belden, Finolex, General Cable, International Wire, Hengtong, Prysmian, Encore Wire, and NKT. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wind Energy Cable Market Insights

The wind energy cable business is expanding rapidly, driven mostly by increased expenditures in offshore wind turbines. This is an important element since offshore installations often require extensive and strong cabling systems, resulting in a high market demand. The global desire for renewable energy sources is also driving market growth. As governments and businesses aim to reduce carbon emissions, wind energy as a clean and sustainable power source is gaining popularity. Furthermore, continual advancements in wire technology are a crucial trend leading to market growth. Wind energy cables are becoming increasingly appealing to investors and developers as their efficiency, durability, and performance improve due to innovations in cable materials and design.

Rising power demand, fueled by exponential population expansion, adds fuel to the industry. As the world's population continues to grow, so does the demand for reliable and sustainable energy sources. Wind energy, with its potential for large-scale power generation, is well positioned to satisfy this growing demand, bolstering the market for wind energy cables. However, the market confronts various constraints. High initial installation costs are a substantial barrier to entrance, especially for small businesses in underdeveloped regions. Furthermore, connecting offshore wind farms into existing power networks presents technological and logistical obstacles that may impede industry expansion. Environmental concerns and regulatory difficulties also place substantial constraints. Stringent environmental restrictions and the need to offset the impact of wind farms on local ecosystems can cause delays in project permits and implementation.

Despite these limitations, the wind energy cable market is full of opportunity. The expansion of offshore wind energy projects represents a significant global growth opportunity. As technology and infrastructure advance, more offshore projects are likely to emerge, increasing need for specialized cables. The development of innovative cable systems that can resist extreme weather conditions creates new opportunities for market growth. Emerging regions in Asia-Pacific and Latin America, where wind energy projects are gaining traction, also present major potential opportunities. Finally, the use of digital technologies for improved monitoring and maintenance of wind energy cables provides a potential to increase efficiency and lower operational costs, making wind energy even more competitive.

Wind Energy Cable Market Segmentation

The worldwide market for wind energy cable is split based on type, product type application, and geography.

Wind Energy Cable Types

- Standard Cable

- Premium Cable

- Servo Cable

- VFD Cable

- Others

According to wind energy cable industry analysis, the standard cable segment is predicted to be the largest. This dominance stems from its widespread utilization in wind turbine components such as nacelles, towers, and offshore platforms. Standard cables are required for basic power transmission and control systems, making them an important component in the design and management of wind farms. Their popularity stems from their dependability, low cost, and demonstrated ability to survive tough situations such as high winds, salinity, and extreme temperatures. Also, as the wind energy sector expands, so does the demand for standard cables, owing to the growing number of wind farms around the world. This trend presents standard cables as a vital element for meeting rising energy demand and facilitating the transition to renewable energy sources.

Wind Energy Cable Product Types

- Low-Voltage Power Cables (600 V)

- Medium-Voltage Power Cables (15 to 46 kv)

In the wind energy sector, low-voltage power cables (600 V) constitute the largest segment due to their critical role in connecting individual wind turbines to local substations. These cables are essential for transmitting power efficiently over shorter distances within wind farms. Their prevalence is driven by the widespread deployment of turbines in diverse geographical locations, where they form the backbone of the internal electrical infrastructure. Low-voltage cables ensure reliable power distribution, supporting the operational integrity and performance of turbines. They are designed to withstand environmental challenges such as varying weather conditions and mechanical stress, offering robustness and longevity. As wind energy continues to expand globally, the demand for these cables remains substantial, reflecting their indispensable role in facilitating renewable energy generation and distribution.

Wind Energy Cable Applications

- Offshore

- Onshore

Based on the wind energy cable market analysis, the offshore sector will lead the global industry due to the massive cabling required to connect turbines within these large-scale facilities and connect them to onshore power networks. Offshore wind farms generate enormous power thanks to stronger and more regular sea breezes, demanding durable cables for efficient long-distance transmission. These projects require more cables due to their size and complexity compared to onshore wind farms. Furthermore, significant investments in offshore wind projects are being made around the world, particularly in Europe, Asia, and North America, with the goal of harnessing the immense wind resources available in marine areas. This endeavor to increase renewable energy capacity ensures that the offshore segment will lead the market.

Wind Energy Cable Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wind Energy Cable Market Regional Analysis

The global wind energy cable market is divided into four major regions: North America, Europe, Asia Pacific (APAC), and Latin America, Middle East, and Africa (LAMEA). During the projected period, North America is expected to spend the most on upgrade programs and maintenance, repair, and operations (MRO). This is driven by rising urbanization and industrialization, which increases energy demand and, as a result, the regional wind energy cable market.

Europe is expected to have the biggest market share over the wind energy cable market forecast period. This is mostly due to the increasing number of wind farm installations, significant investments in offshore wind farm projects, and the need to replace or improve old wind energy infrastructure. This growth is further supported by the region's commitment to renewable energy and carbon reduction.

The Asia-Pacific region is expected to grow fastest throughout the wind energy cable industry forecast period. This increase is being driven by significant government backing in the form of subsidies, rising demand for wind turbines from current and proposed wind farms, and the availability of low-cost raw materials. China and India are driving this regional rise with ambitious renewable energy objectives and large-scale wind energy projects.

Wind Energy Cable Market Players

Some of the top wind energy cable companies offered in our report includes Nexans, Sumitomo Electric, Hangzhou, Belden, Finolex, General Cable, International Wire, Hengtong, Prysmian, Encore Wire, and NKT.

Frequently Asked Questions

How big is the wind energy cable market?

The wind energy cable market size was valued at USD 1.7 Billion in 2023.

What is the CAGR of the global wind energy cable market from 2024 to 2032?

The CAGR of wind energy cable is 8.7% during the analysis period of 2024 to 2032.

Which are the key players in the wind energy cable market?

The key players operating in the global market are Nexans, Sumitomo Electric, Hangzhou, Belden, Finolex, General Cable, International Wire, Hengtong, Prysmian, Encore Wire, and NKT.

Which region dominated the global wind energy cable market share?

North America held the dominating position in wind energy cable industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of wind energy cable during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global wind energy cable industry?

The current trends and dynamics in the wind energy cable industry include increasing global emphasis on renewable energy sources, growing investments in offshore wind energy projects, technological advancements in cable materials and design, and government incentives and policies promoting wind energy adoption.

Which product type held the maximum share in 2023?

The low-voltage power cables (600 v) product type held the notable share of the wind energy cable industry.