Wheel Speed Sensor Market | Acumen Research and Consulting

Wheel Speed Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

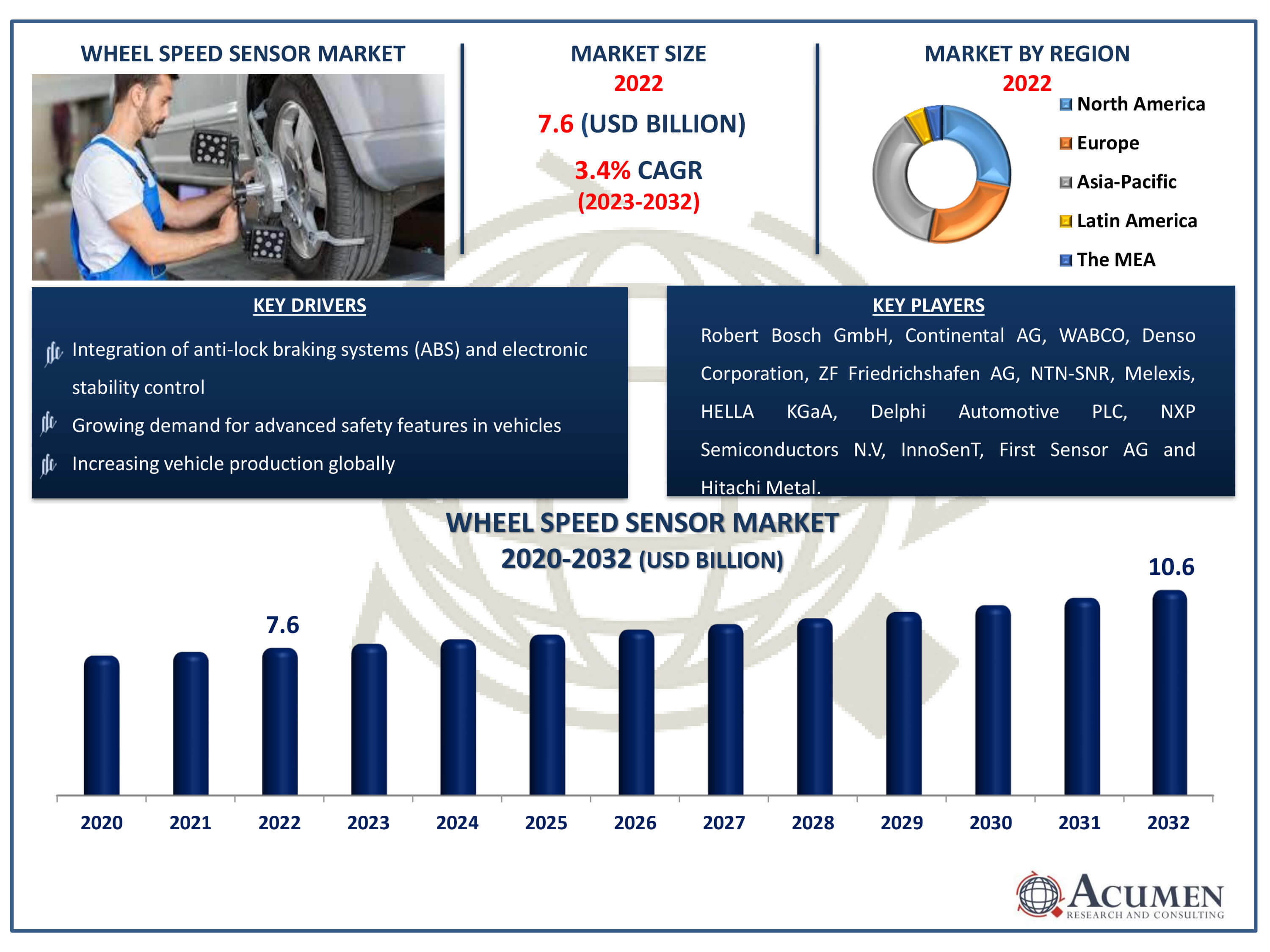

The Wheel Speed Sensor Market Size accounted for USD 7.6 Billion in 2022 and is estimated to achieve a market size of USD 10.6 Billion by 2032 growing at a CAGR of 3.4% from 2023 to 2032.

Wheel Speed Sensor Market Highlights

- Global wheel speed sensor market revenue is poised to garner USD 10.6 billion by 2032 with a CAGR of 3.4% from 2023 to 2032

- Asia-Pacific wheel speed sensor market value occupied around USD 2.9 billion in 2022

- Europe wheel speed sensor market growth will record a CAGR of more than 4% from 2023 to 2032

- Among sensor type, the passive sensor sub-segment generated more than USD 4.7 Billion revenue in 2022

- Based on vehicle type, the passenger car vehicles sub-segment generated around 70% share in 2022

- Collaborations and partnerships for technological advancements is a popular wheel speed sensor market trend that fuels the industry demand

A vital part of contemporary car safety systems, the wheel speed sensor (WSS) tracks a wheel's rotational speed. It helps systems like anti-lock braking systems (ABS) and traction control to maximize vehicle performance and stability by producing electrical impulses based on the speed of the wheel. Wheel speed sensor market is expanding significantly as a result of rising car demand for sophisticated safety features. The combination of electronic stability control and anti-lock brake systems in cars is a major factor in the market's growth. The market is expanding as a result of additional developments in sensor technology, such as the move towards more reliable and precise sensors. The global wheel speed sensor market is being driven by an increase in vehicle production as well as a focus on improving vehicle safety.

Global Wheel Speed Sensor Market Dynamics

Market Drivers

- Growing demand for advanced safety features in vehicles

- Integration of anti-lock braking systems (ABS) and electronic stability control

- Advancements in sensor technology, enhancing accuracy and durability

- Increasing vehicle production globally

Market Restraints

- High initial cost of advanced sensor technologies

- Complexity in integrating sensors into existing vehicle systems

- Limited awareness and adoption in certain regions

Market Opportunities

- Rising focus on electric and autonomous vehicles

- Emerging markets and increasing automotive aftermarket

- Continuous innovation and development of smart sensors

Wheel Speed Sensor Market Report Coverage

| Market | Wheel Speed Sensor Market |

| Wheel Speed Sensor Market Size 2022 | USD 7.6 Billion |

| Wheel Speed Sensor Market Forecast 2032 | USD 10.6 Billion |

| Wheel Speed Sensor Market CAGR During 2023 - 2032 | 3.4% |

| Wheel Speed Sensor Market Analysis Period | 2020 - 2032 |

| Wheel Speed Sensor Market Base Year |

2022 |

| Wheel Speed Sensor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Sensor Type, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Robert Bosch GmbH, Continental AG, WABCO, Denso Corporation, ZF Friedrichshafen AG, NTN-SNR, Melexis, HELLA KGaA, Delphi Automotive PLC, NXP Semiconductors N.V, InnoSenT, First Sensor AG, and Hitachi Metal. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wheel Speed Sensor Market Insights

The automotive sector is witnessing rapid advancements with the high penetration of electric vehicles in developed countries, and the demand for ABS systems, vehicle monitoring systems, etc., is gaining momentum. Manufacturers are focused on delivering technologically advanced products for a better driving experience and enhanced safety. Governments in developing countries are enforcing strict rules related to vehicle safety. According to the Union road transport ministry, starting from July 1, 2019, all vehicles are required to be equipped with airbags, seat-belt reminders, and alert systems for speeds beyond 80 km/h. This initiative aims to help reduce road accidents. Major players are concentrating on enhancing their business through the introduction of new products and partnerships, which is expected to augment the growth of the wheel speed sensor market.

In 2020, Carlson, an automotive product manufacturer, launched ABS wheel speed sensors, adding a new product to its existing brake product line, available for sale in North America. This move is expected to strengthen the company's position in North America.

In 2019, Allegro Microsystems, Inc., a global developer of advanced semiconductor devices, launched A19250 and A19350, their latest wheel speed sensor product line. This product launch is expected to help the company enhance its business and increase its customer base.

Players are highly focused on enhancing manufacturing capabilities to meet the rising demand for speed sensors. Changing vehicle safety norms in emerging economies are expected to increase demand for ABS and ESC systems. Manufacturers are investing heavily in plant expansion to deal with the changing automotive industry. In 2019, Continental AG, a global automotive player with a plant in Manesar, India, reached a milestone of producing one Billion speed sensor units a month. The company significantly increased its capacity to produce speed sensors at its plant to meet the growing demand caused by recent safety and emission legislations in India. Additionally, major players are focused on shifting manufacturing units to developing countries due to the easy availability of raw materials and low-cost labor, which is expected to augment the growth of the target market. Factors such as the high cost of the product and rising vehicle prices are expected to hamper the growth of the global wheel speed sensor market. Furthermore, fluctuating raw material prices are expected to challenge the growth of the wheel speed sensor market.

High investment by major players for delivering technologically advanced products and the increasing sale of electric vehicles in developing countries are factors expected to create new opportunities for players operating in the wheel speed sensor market. Additionally, the increasing focus on enhancing business through partnerships to strengthen the distribution channel is expected to support the revenue transactions of the target market.

Wheel Speed Sensor Market Segmentation

The worldwide market for Wheel Speed Sensor is split based on sensor type, vehicle type, and geography.

Wheel Speed Sensor Types

- Passive Sensor

- Active Sensor

According to wheel speed sensor industry analysis, the passive sensor segment leads because of its widely used and efficient functionality. Because of their affordability, dependability, and ease of use, passive wheel speed sensors are the standard option for many automotive applications. These sensors use the magnetic induction concept to generate electrical signals without the requirement for an external power source. They are perfect for wheel speed measurement in cars because of their simple construction and strong functionality. The reason for the supremacy of the passive sensor category is that it has a track record of meeting automotive regulatory criteria, guaranteeing vehicle safety, and delivering correct speed information. The effectiveness and robustness of passive wheel speed sensors are valued by both manufacturers and consumers, which helps explain their dominant position in the market.

Wheel Speed Sensor Vehicle Types

- Passenger Car

- Commercial Vehicles

With the biggest market share in this industry, the wheel speed sensor market is dominated by the passenger car segment. The main cause of this is the huge production and sales of passenger cars throughout the world. In passenger cars, wheel speed sensors are quite important, particularly when it comes to applying safety features like traction control and anti-lock brakes (ABS). Wheel speed sensors are becoming more and more popular in this market due in large part to consumer desire for sophisticated safety features in passenger cars. Wheel speed sensors are also in high demand due to developments in automotive technology and the addition of electronic safety systems to passenger cars. The passenger car segment is anticipated to hold onto its top spot in the wheel speed sensor market industry forecast period as long as the automotive industry keeps putting emphasis on raising safety standards.

Wheel Speed Sensor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wheel Speed Sensor Market Regional Analysis

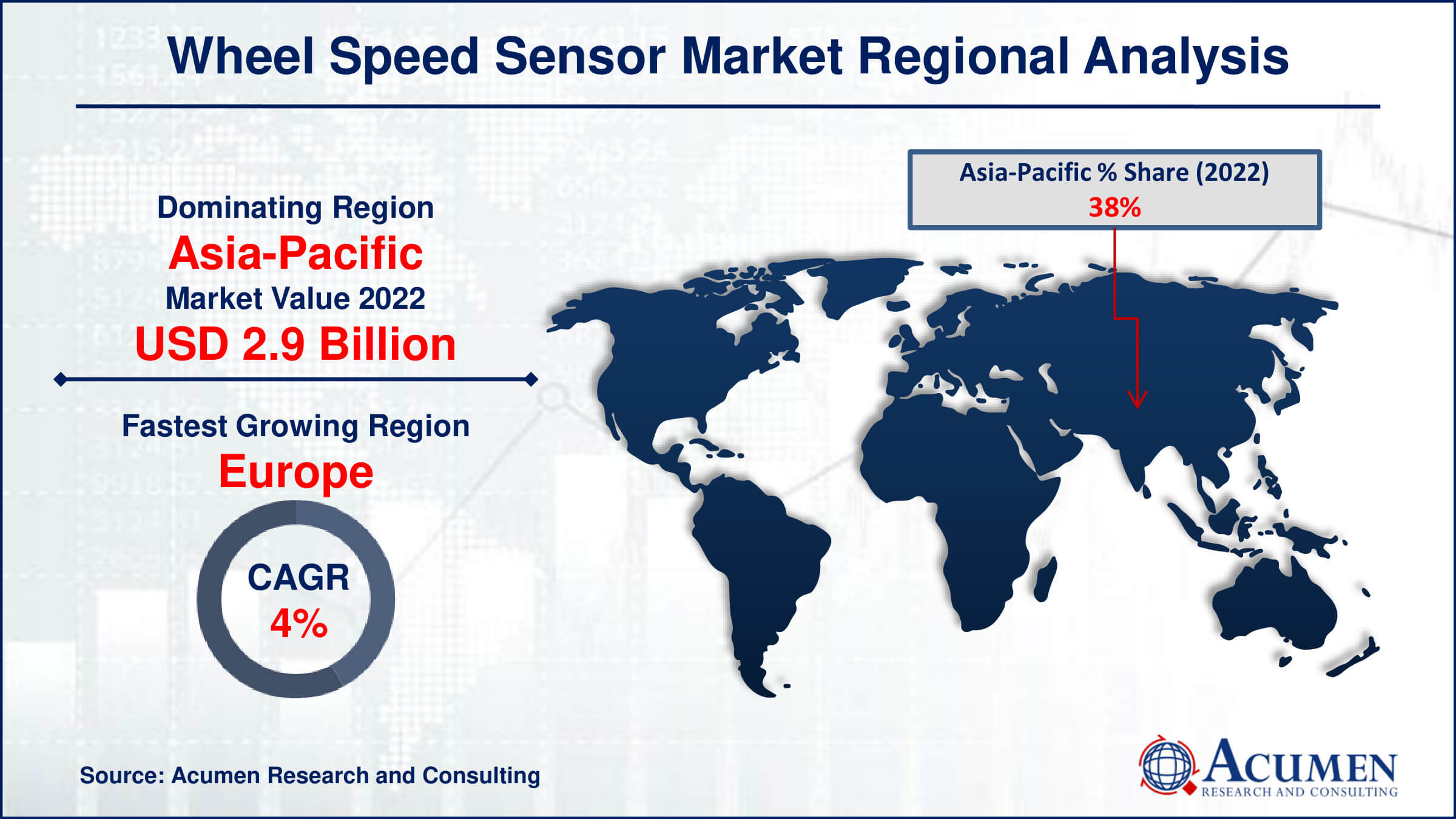

In terms of wheel speed sensor market analysis, Asia-Pacific is the dominating region, primarily due to the strong expansion of the automotive sector in nations like China and India. The region's supremacy is a result of growing car production, a growing emphasis on safety features, and the presence of significant automotive players. Technological developments and rising customer demand for sophisticated safety measures define the Asia-Pacific market.

The industry is expected to develop at the quickest rate in Europe over the wheel speed sensor market forecast period. Due to stricter rules and rising consumer awareness, the region is seeing a boom in demand for improved safety features in cars. Leading the way in implementing cutting-edge automotive technologies, such as sophisticated sensor systems, are European nations. Wheel speed sensors are becoming more and more in demand in the European market as a result of the growing popularity of electric vehicles and the increased focus on vehicle safety. Further driving the wheel speed sensor market's expansion in Europe is the auto industry's ongoing emphasis on raising safety and performance regulations for vehicles, which makes the continent a dynamic and quickly growing player in this market.

Wheel Speed Sensor Market Players

Some of the top wheel speed sensor companies offered in our report includes Robert Bosch GmbH, Continental AG, WABCO, Denso Corporation, ZF Friedrichshafen AG, NTN-SNR, Melexis, HELLA KGaA, Delphi Automotive PLC, NXP Semiconductors N.V, InnoSenT, First Sensor AG and Hitachi Metal.

Frequently Asked Questions

How big is the Wheel Speed Sensor market?

The wheel speed sensor market size was valued at USD 7.6 billion in 2022.

What is the CAGR of the global wheel speed sensor market from 2023 to 2032?

What is the CAGR of the global wheel speed sensor market from 2023 to 2032?

Which are the key players in the wheel speed sensor market?

The key players operating in the global market are including Robert Bosch GmbH, Continental AG, WABCO, Denso Corporation, ZF Friedrichshafen AG, NTN-SNR, Melexis, HELLA KGaA, Delphi Automotive PLC, NXP Semiconductors N.V, InnoSenT, First Sensor AG and Hitachi Metal.

Which region dominated the global wheel speed sensor market share?

Asia-Pacific held the dominating position in wheel speed sensor industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of wheel speed sensor during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Wheel Speed Sensor industry?

The current trends and dynamics in the wheel speed sensor industry include growing demand for advanced safety features in vehicles, integration of anti-lock braking systems (ABS) and electronic stability control, advancements in sensor technology, enhancing accuracy and durability, and increasing vehicle production globally.

Which sensor type held the maximum share in 2022?

The passive sensor type expected to hold the maximum share of the wheel speed sensor industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date