Welding Wires Market | Acumen Research and Consulting

Welding Wires Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

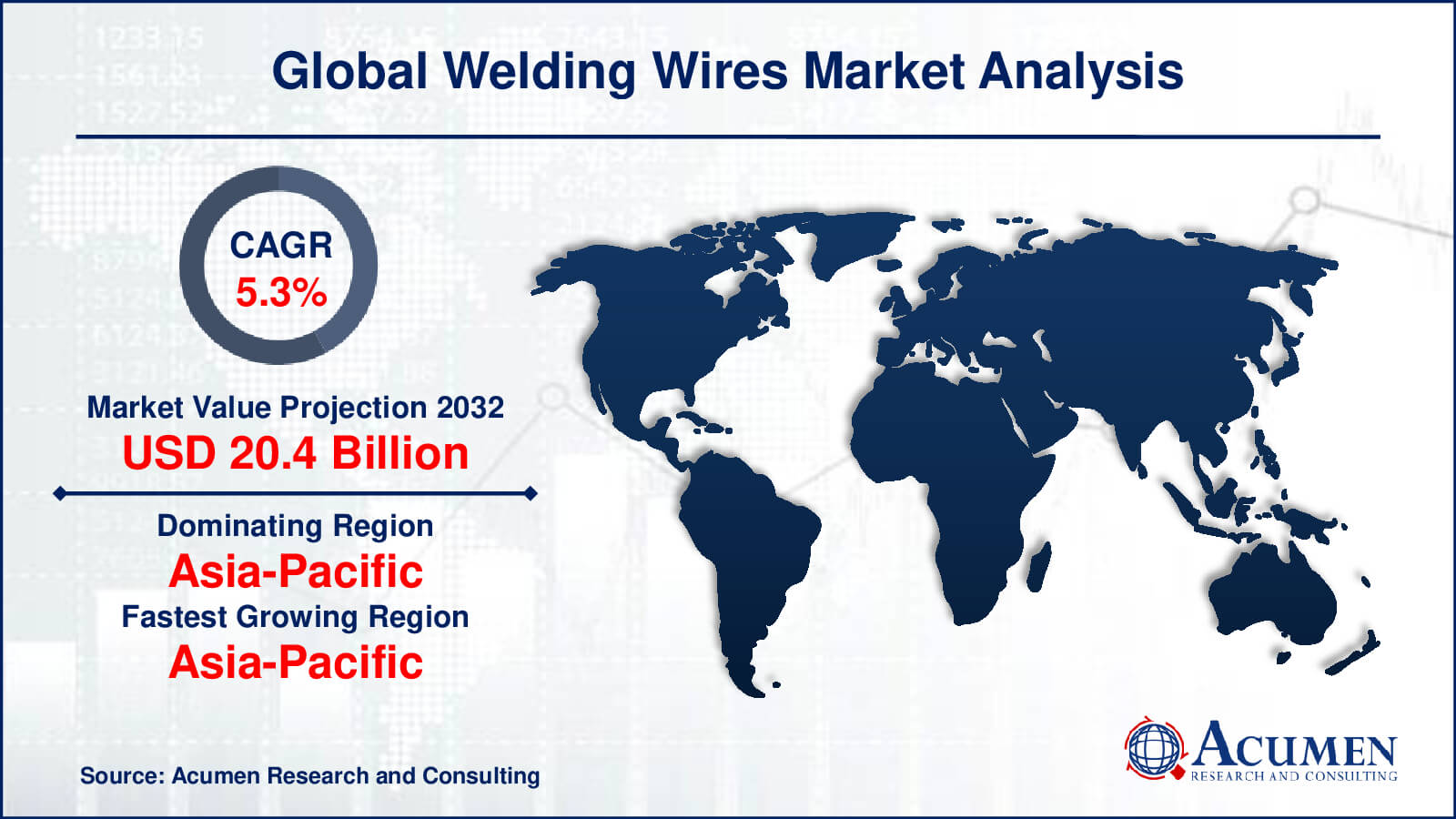

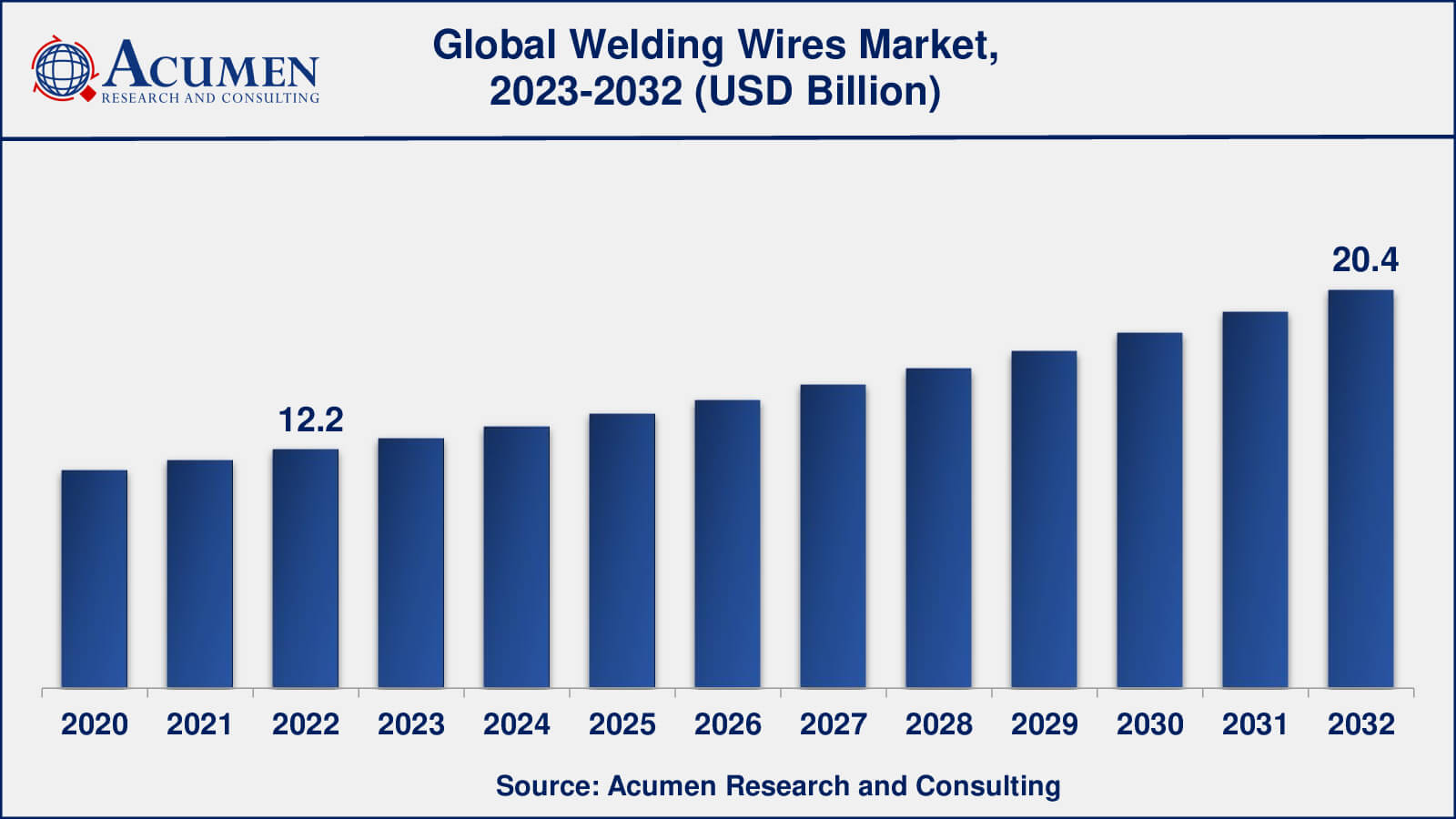

The Global Welding Wires Market Size accounted for USD 12.2 Billion in 2022 and is estimated to achieve a market size of USD 20.4 Billion by 2032 growing at a CAGR of 5.3% from 2023 to 2032.

Welding Wires Market Highlights

- Global welding wires market revenue is poised to garner USD 20.4 billion by 2032 with a CAGR of 5.3% from 2023 to 2032

- Asia-Pacific Welding Wires market value occupied almost USD 4.4 billion in 2022

- Asia-Pacific welding wires market growth will record a CAGR of over 6% from 2023 to 2032

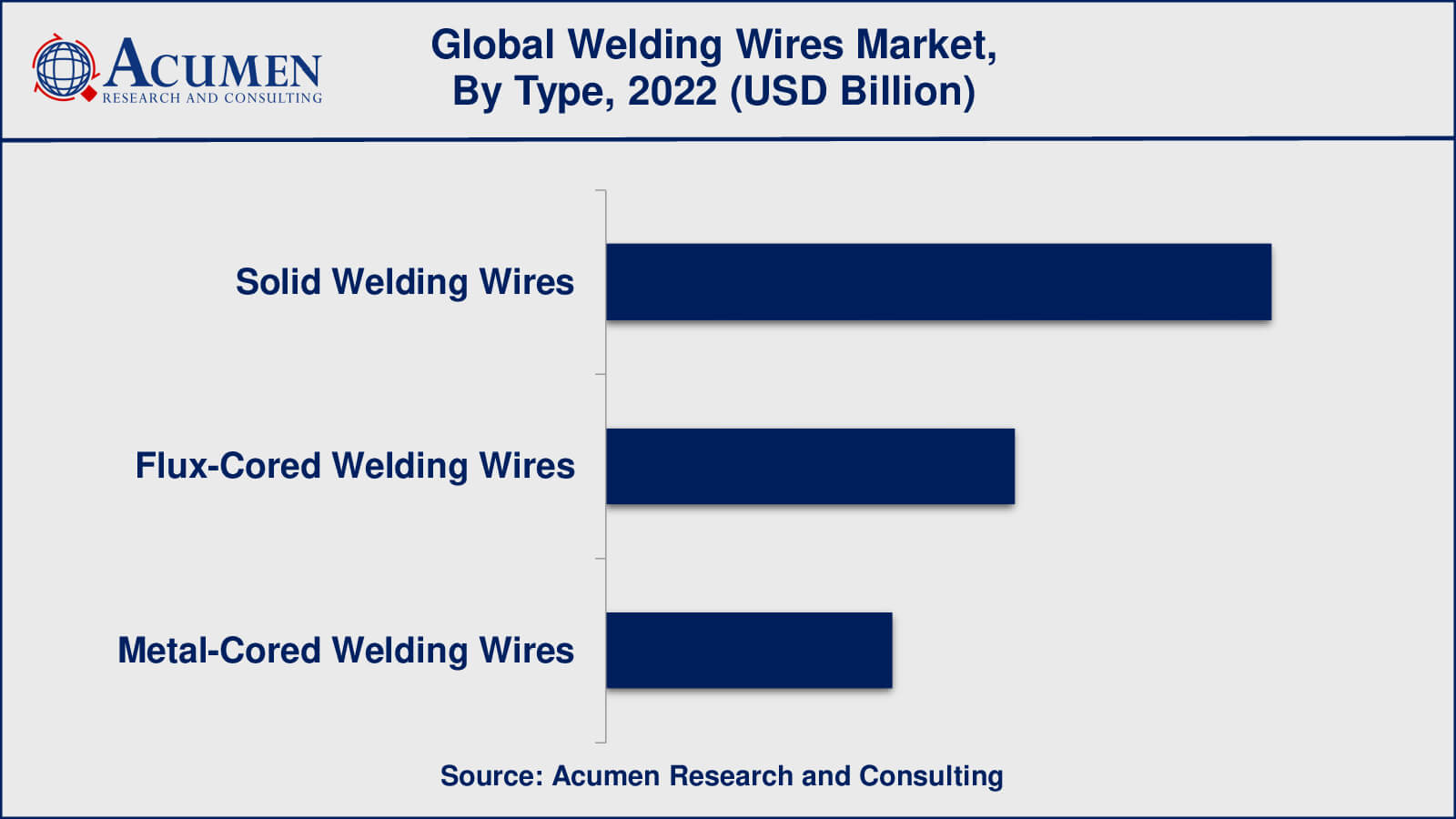

- Among type, the solid welding wires sub-segment generated over US$ 6 billion revenue in 2022

- Based on application, the automotive sub-segment generated around 30% share in 2022

- Rise of e-commerce platforms is a popular welding wires market trend that fuels the industry demand

Wired flux and metal wire fillers are called welding consumables. These welding wires get melted while welding two metals to aid in forming a robust joint and safeguard the molten weld from several atmospheric containments. Welding wires are primarily employed in oxyfuel welding and arc welding processes. In the arc welding process, welding wires are broadly utilized in shielded metal arc welding, gas metal arc welding, flux-cored arc welding, and submerged arc welding among others. Welding wires have come out as an integral part of the building & construction industry. Welding plays an essential role in the construction of bridges, buildings, huge offshore oil and gas plants, and pipelines. Governments especially in developed and developing economies are trying to enlarge their national infrastructure such as bridges, dams, and roads, which entail a large number of welding wires. Thus, the aforementioned developments are fueling the overall demand for welding wires, especially from the construction industry.

Global Welding Wires Market Dynamics

Market Drivers

- Increasing demand from end-use industries

- Growing infrastructure development

- Surging demand for automotive

- Rising demand for energy and power

Market Restraints

- Volatility in raw material prices

- Stringent government regulations

- Availability of substitutes

Market Opportunities

- Increasing demand for high-quality welding wires

- Growing adoption of automation in welding

- Growing trend for environmentally sustainable products

Welding Wires Market Report Coverage

| Market | Welding Wires Market |

| Welding Wires Market Size 2022 | USD 12.2 Billion |

| Welding Wires Market Forecast 2032 | USD 20.4 Billion |

| Welding Wires Market CAGR During 2023 - 2032 | 5.3% |

| Welding Wires Market Analysis Period | 2020 - 2032 |

| Welding Wires Market Base Year | 2022 |

| Welding Wires Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Heico Wire Group, Sandvik Materials Technology, Jiangsu Zhongjiang Welding Wire Co. Ltd., Hobart Brothers Company, Sumitomo Electric Industries, Saarstahl AG, Haynes International, Luvata Oy, Harris Products Group and LaserStar Technologies. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Welding Wires Market Insights

The rapid growth of the construction industry mainly in emerging markets such as India and China is anticipated to be one of the key factors augmenting the growth of the global welding wires market. In addition, rapid industrialization and urbanization, especially in emerging economies such as Indonesia, Thailand, and Korea are some major aspects resulting in the growth of construction projects which is further projected to result in huge demand for welding wires. The demand for these welding wires can be attributed to the increasing requirement from major end-use applications such as transportation, building and construction, automobiles, and marine. Furthermore, an increasing number of infrastructural projects coupled with technological advancements in the automotive industry are projected to bring impetus to the demand for welding wires over the forecast period. However, the increasing availability of alternatives such as fluxes and cores is expected to hamper the growth.

Welding Wires Market, By Segmentation

The worldwide market for welding wires is split based on type, application, and geography.

Welding Wire Market Types

- Solid Welding Wires

- Flux-Cored Welding Wires

- Metal-Cored Welding Wires

According to welding wires industry analysis, solid welding wires dominated the largest share in the welding wires market in recent years. Solid welding wires are widely used in a variety of welding applications due to their ease of use, superior weld quality, and lower cost when compared to other types of welding wires. They work with a variety of welding processes, including gas tungsten arc welding (GTAW), gas metal arc welding (GMAW), and flux-cored arc welding (FCAW). Because of their superior properties such as high tensile strength, better corrosion resistance, and excellent weldability, solid welding wires are widely used in end-use industries such as automotive, construction, and shipbuilding. However, due to their improved efficiency, productivity, and advanced properties, flux-cored and metal-cored welding wires are expected to gain market share in the coming years.

Welding Wire Market Applications

- Automotive

- Building & Construction

- Aerospace & Defense

- Shipbuilding

- Oil & Gas

- Others

In recent years, the automotive industry has dominated the welding wires market. The increasing demand for lightweight and fuel-efficient vehicles, which necessitate precision welding applications, is driving the use of welding wires in the automotive industry. Welding wires are frequently used in automotive applications like body-in-white, exhaust systems, and suspension systems because of their superior qualities like high tensile strength, excellent corrosion resistance, and better weldability. Additionally, the building and construction industry is a significant application segment in the welding wires market, driven by rising demand for infrastructure development and construction activities. Because of their superior properties such as high durability, better weld quality, and excellent corrosion resistance, welding wires are widely used in building and construction applications such as bridges, buildings, and pipelines. The aerospace and defence, shipbuilding, oil and gas, and other industries all contribute to the growth of the welding wires market, owing to their specific needs for precision welding applications and advanced properties such as high strength, better fatigue resistance, and improved weld quality.

Welding Wires Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Welding Wires Market Regional Analysis

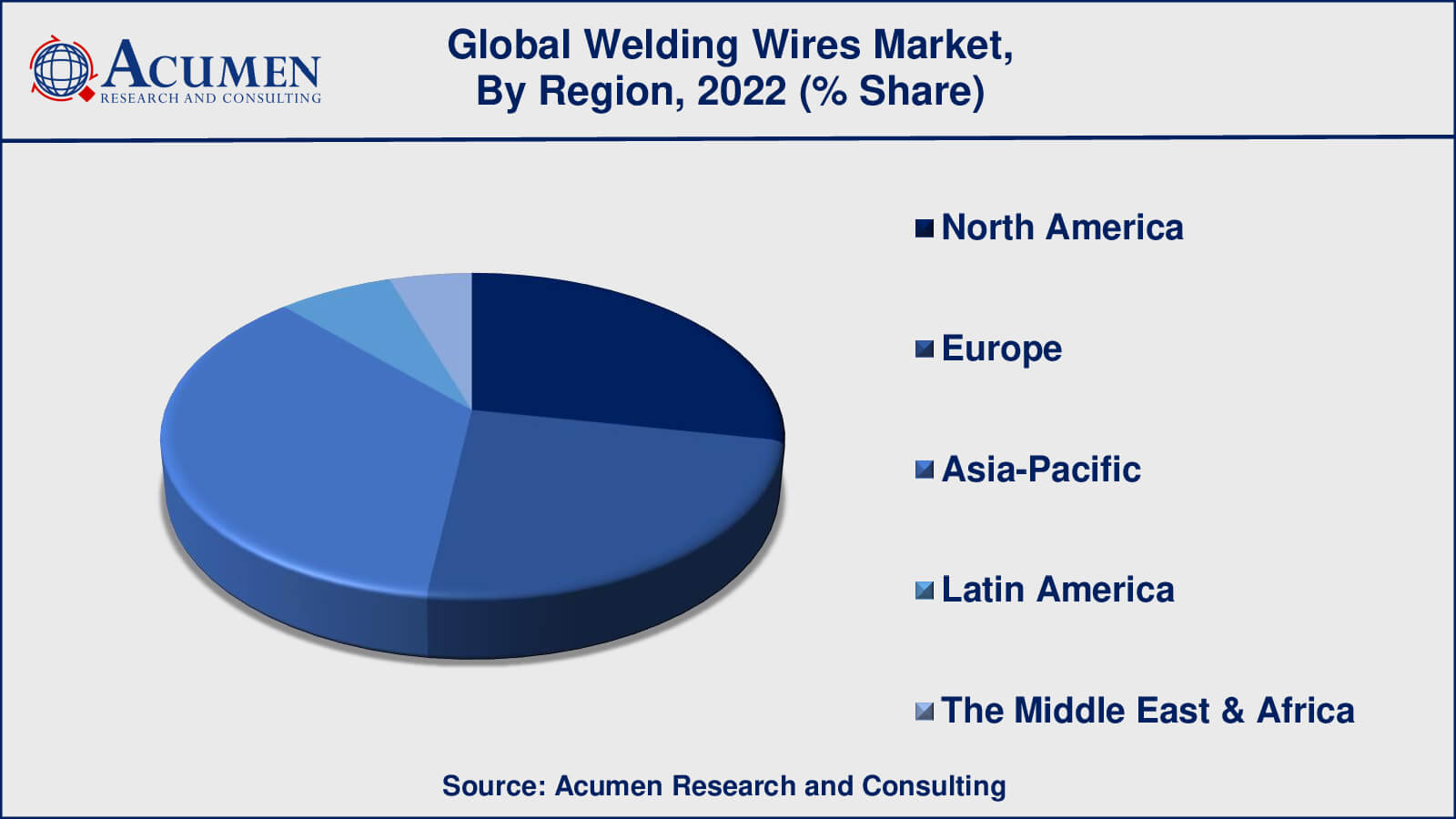

The Asia-Pacific region has the largest and fastest-growing welding wire market, owing to rising infrastructure development and rapid industrialization in developing nations like China, India, and Japan. The expanding automotive industry and rising construction activity all help to drive the growth of the welding wires market in this region.

The presence of established end-use sectors like automotive, construction, and aerospace & defense has resulted in a mature market for welding wires in North America. Because of the growing demand for lightweight and fuel-efficient vehicles, the United States is the region's largest market for welding wires.

The European region is another mature welding wire market, owing to the presence of established end-use industries such as automotive, shipbuilding, and construction. Germany is the region's largest market for welding wires, followed by France and the United Kingdom.

Welding Wires Market Players

Some of the top welding wires companies offered in the professional report include Harris Products Group, Haynes International, Heico Wire Group, Hobart Brothers Company, Jiangsu Zhongjiang Welding Wire Co. Ltd., LaserStar Technologies, Luvata Oy, Saarstahl AG, Sandvik Materials Technology, and Sumitomo Electric Industries.

Frequently Asked Questions

What was the market size of the global welding wires in 2022?

The market size of welding wires was USD 12.2 billion in 2022.

What is the CAGR of the global welding wires market from 2023 to 2032?

The CAGR of welding wires is 5.3% during the analysis period of 2023 to 2032.

Which are the key players in the welding wires market?

The key players operating in the global welding wires market are includes Harris Products Group, Haynes International, Heico Wire Group, Hobart Brothers Company, Jiangsu Zhongjiang Welding Wire Co. Ltd., LaserStar Technologies, Luvata Oy, Saarstahl AG, Sandvik Materials Technology, and Sumitomo Electric Industries.

Which region dominated the global welding wires market share?

Asia-Pacific held the dominating position in welding wires industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of welding wires during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global welding wires industry?

The current trends and dynamics in the welding wires industry include increasing demand from end-use industries, growing infrastructure development, and surging demand for automotive.

Which type held the maximum share in 2022?

The solid welding wires type held the maximum share of the welding wires industry.