Wave And Tidal Energy Market | Acumen Research and Consulting

Wave and Tidal Energy Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

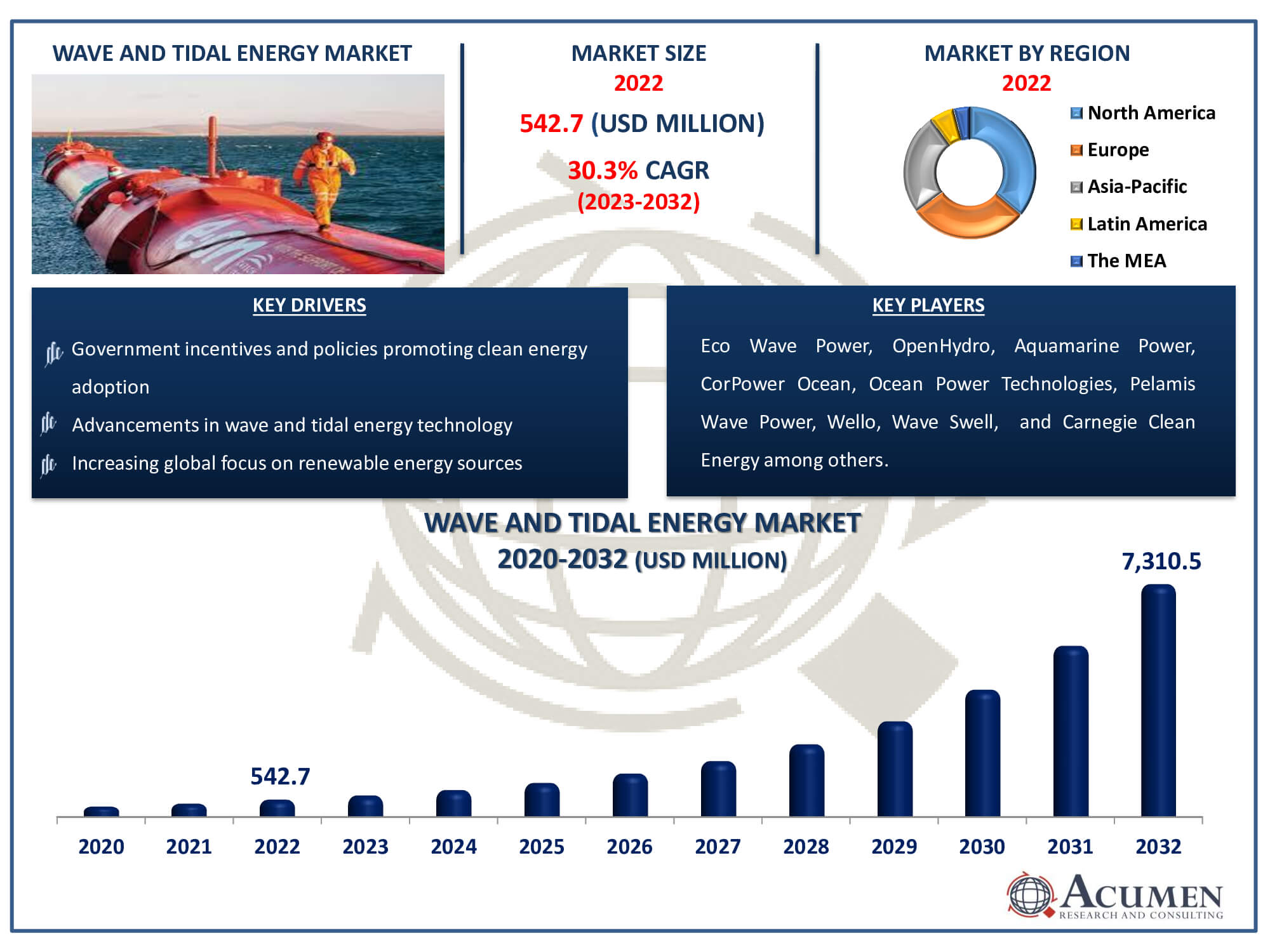

The Wave and Tidal Energy Market Size accounted for USD 542.7 Million in 2022 and is estimated to achieve a market size of USD 7,310.5 Million by 2032 growing at a CAGR of 30.3% from 2023 to 2032.

Wave and Tidal Energy Market Highlights

- Global wave and tidal energy market revenue is poised to garner USD 7,310.5 million by 2032 with a CAGR of 30.3% from 2023 to 2032

- North America wave and tidal energy market value occupied around USD 195.4 million in 2022

- Europe wave and tidal energy market growth will record a CAGR of more than 33% from 2023 to 2032

- Among technology, the wave stream generator sub-segment generated more than USD 260.5 million revenue in 2022

- Based on application, the power generation sub-segment generated around 72% market share in 2022

- Potential for hybrid systems combining wave and tidal energy with other renewable sources is a popular wave and tidal energy market trend that fuels the industry demand

Modern technologies that capture the energy of waves on the surface of water and store it in reservoirs to produce electricity, desalinate water, and aid in water pumping are included in the wave and tidal energy industry. These cutting-edge technologies, which draw energy from the limitless renewable resources of the oceans, are one of the most concentrated sources of renewable electricity. The most effective way to use ocean resources for power generation is to process wave and tidal energy from ocean surfaces. In particular, wave energy presents a bright future for the production of sustainable electricity. Similar to this, tidal energy offers a plentiful and dependable source of renewable energy since it is produced by the moon and sun's gravitational pull on ocean waters. When combined, these technologies open the door to a more sustainable energy future while also helping to lower carbon emissions.

Global Wave and Tidal Energy Market Dynamics

Market Drivers

- Increasing global focus on renewable energy sources

- Advancements in wave and tidal energy technology

- Growing concerns about climate change and carbon emissions

- Government incentives and policies promoting clean energy adoption

Market Restraints

- High initial capital costs for wave and tidal energy projects

- Technical challenges and uncertainties in marine environment

- Limited infrastructure and grid integration capabilities

Market Opportunities

- Expansion of research and development efforts to enhance efficiency and reliability

- Rising demand for sustainable energy solutions in remote coastal areas

- Collaboration between governments, industry, and research institutions

Wave and Tidal Energy Market Report Coverage

| Market | Wave and Tidal Energy Market |

| Wave and Tidal Energy Market Size 2022 | USD 542.7 Million |

| Wave and Tidal Energy Market Forecast 2032 | USD 7,310.5 Million |

| Wave and Tidal Energy Market CAGR During 2023 - 2032 | 30.3% |

| Wave and Tidal Energy Market Analysis Period | 2020 - 2032 |

| Wave and Tidal Energy Market Base Year |

2022 |

| Wave and Tidal Energy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eco Wave Power, OpenHydro, Aquamarine Power, CorPower Ocean, Ocean Power Technologies, Pelamis Wave Power, Wello, Wave Swell, Carnegie Clean Energy, Ocean Renewable Power Company, SIMEC Atlantis Energy, and Orbital Marine Power. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wave and Tidal Energy Market Insights

The increased investment in wave and tidal power projects is a significant factor driving the global renewable wave and tidal energy markets. With the limited supply of fossil fuels such as oil, gas, and coal, major countries are increasingly investing in renewable energy sources, including wave and tidal energies, due to their abundance and environmental friendliness. Consequently, investment in related projects has seen considerable growth.

Numerous ventures focusing on wave and tidal energies have been undertaken worldwide and are expected to steadily contribute to the global energy mix in the coming years. Many national and regional governments actively promote ocean resource development through various initiatives, including funding for research and development projects, capital grants for equipment developers, and incentives for energy production.

However, the high upfront costs of project development and implementation present a major barrier to the wave and tidal energy sector. For many prospective investors and developers, the capital-intensive nature of these projects, involving infrastructure installation such as tidal turbines and wave energy converters, poses a barrier to market access. Long payback times and uncertainty regarding return on investment can further discourage new investment.

To address environmental issues and increase the sustainability of energy production, technical innovation presents a significant opportunity in the wave and tidal energy sector. Developments in tidal and wave energy technology, such as more effective tidal turbines and wave energy converters, have the potential to increase energy output while reducing environmental impact. Advancements in designs, materials, and deployment methods can also help reduce costs and make wave and tidal energy systems more competitive compared to other forms of energy. Additionally, improvements in grid interconnection and storage options can enhance the scalability and reliability of wave and tidal energy projects. Seizing these opportunities through investments in research and development can propel market expansion and contribute to a more sustainable energy future.

Wave and Tidal Energy Market Segmentation

The worldwide market for wave and tidal energy is split based on type, technology, application, and geography.

Wave and Tidal Energy Types

- Tidal Energy

- Wave Energy

According to wave and tidal energy industry analysis, the wave energy segment is the market leader. Wave energy technology uses the force of the ocean's waves to create electricity, and it has a lot of potential to produce renewable energy. Wave energy systems are getting more dependable and efficient with improvements in wave energy converters and deployment techniques. Wave energy's dominant position in the market is fueled by the quantity of wave energy resources, growing worries about climate change, and the demand for sustainable energy solutions. Wave energy is positioned as a prominent participant in the renewable energy landscape.

Wave and Tidal Energy Technologies

- Tidal Stream Generator

- Oscillating Water Columns

- Tidal Turbines

- Tidal Barrages

- Tidal Fences

The tidal stream generator segment is the largest technology category in the wave and tidal energy market and it is expected to increase over the industry wave and tidal energy forecast period. In order to transform the kinetic energy of tidal currents into electrical energy, tidal stream producers use underwater turbines. This technology is the best option for tidal energy harvesting because it has major benefits in terms of scalability and reliability. This category continues to dominate the wave and tidal energy industry due to continuous improvements in the design and implementation of tidal stream generators, as well as advantageous regulatory frameworks and rising investments.

Wave and Tidal Energy Applications

- Power generation

- Desalination

The power generating category maintains the highest proportion in the wave and tidal energy industry. The main goal of wave and tidal energy technologies is to use the kinetic and potential energy of tidal currents and ocean waves to create electricity. An environmentally friendly and renewable substitute for conventional fossil fuels is power generation from wave and tidal energy sources. The power generating segment of the market remains dominant due to technological improvements and the growing global need for clean energy solutions. This has resulted in substantial growth and development within the wave and tidal energy industry.

Wave and Tidal Energy Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Wave and Tidal Energy Market Regional Analysis

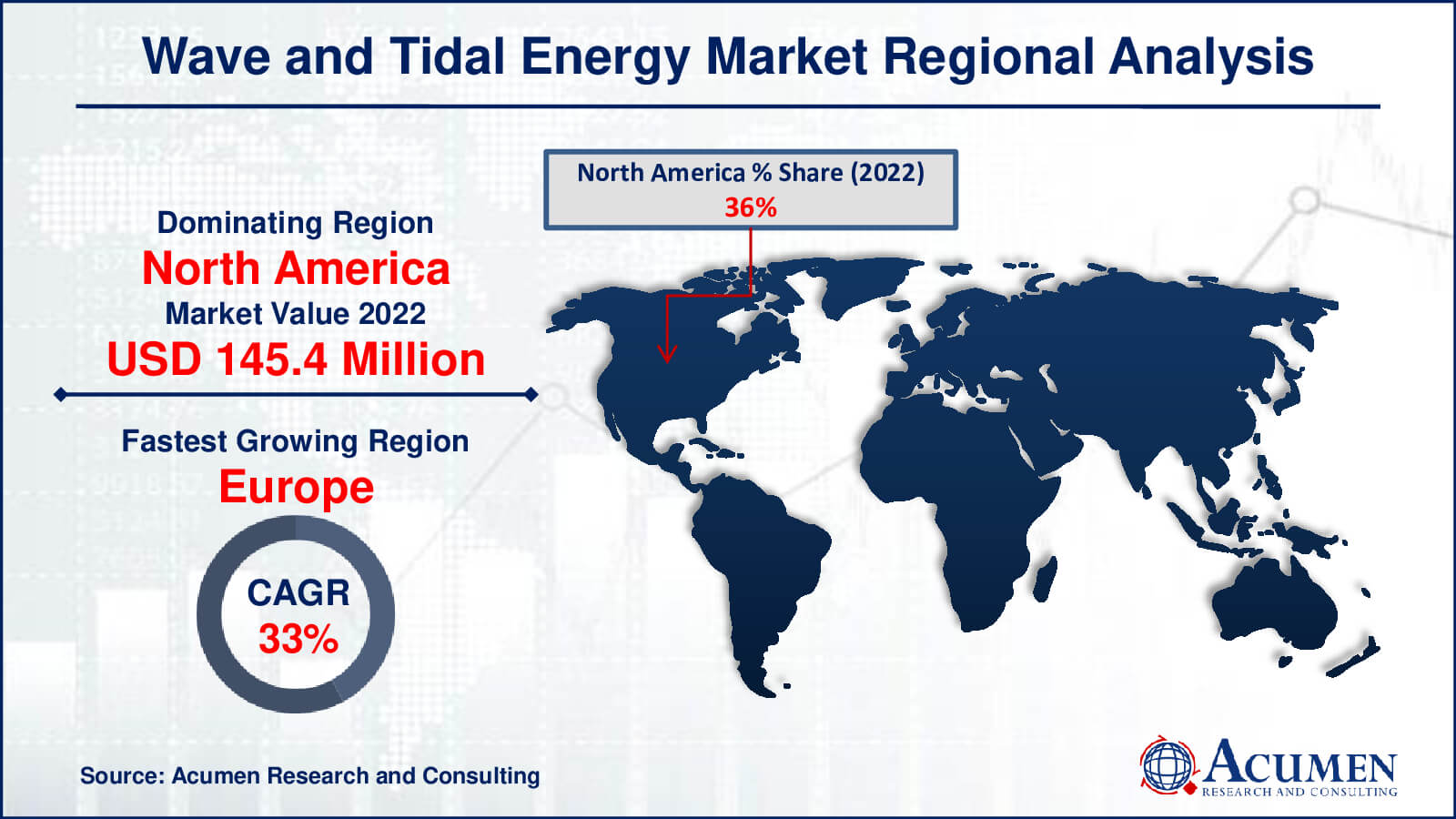

For a number of reasons, North America is the largest region in the wave and tidal energy market. The area has made great technological strides and has a strong infrastructure for renewable energy sources. The industry is growing in part because of supportive government policies and incentives that encourage the use of renewable energy. Furthermore, there are lots of prospects for wave and tidal energy projects due to North America's extensive coastline and wealth of marine resources. Furthermore, the need for renewable energy solutions is driven by growing awareness of environmental sustainability and the need to lessen reliance on fossil fuels, which further solidifies North America's position as a major participant in the wave and tidal energy market.

Europe is expected to grow fastest during the wave and tidal energy market forecast period due to its existing infrastructure and the involvement of major players in wave, tidal energy, and renewable energy in the region. On the other hand, the North American industry has experienced various changes. In 2022, renewable energy accounted for approximately 15% of gross power production. Canada's demand for ocean technology in the region is significant. The province of Nova Scotia, which has allocated approximately US$50 million to maritime resources since 2010, is expected to be a major market in Canada.

Wave and Tidal Energy Market Players

Some of the top wave and tidal energy companies offered in our report include Eco Wave Power, OpenHydro, Aquamarine Power, CorPower Ocean, Ocean Power Technologies, Pelamis Wave Power, Wello, Wave Swell, Carnegie Clean Energy, Ocean Renewable Power Company, SIMEC Atlantis Energy, and Orbital Marine Power.

Frequently Asked Questions

How big is the wave and tidal energy market?

The wave and tidal energy market size was valued at USD 542.7 million in 2022.

What is the CAGR of the global wave and tidal energy market from 2023 to 2032?

The CAGR of wave and tidal energy is 30.3% during the analysis period of 2023 to 2032.

Which are the key players in the wave and tidal energy market?

The key players operating in the global market are including Eco Wave Power, OpenHydro, Aquamarine Power, CorPower Ocean, Ocean Power Technologies, Pelamis Wave Power, Wello, Wave Swell, Carnegie Clean Energy, Ocean Renewable Power Company, SIMEC Atlantis Energy, and Orbital Marine Power.

Which region dominated the global wave and tidal energy market share?

North America held the dominating position in wave and tidal energy industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of wave and tidal energy during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global wave and tidal energy industry?

The current trends and dynamics in the wave and tidal energy industry include increasing global focus on renewable energy sources, advancements in wave and tidal energy technology, growing concerns about climate change and carbon emissions, and government incentives and policies promoting clean energy adoption.

Which technology held the maximum share in 2022?

The tidal stream generator technology held the maximum share of the wave and tidal energy industry.