Waterproofing Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Waterproofing Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

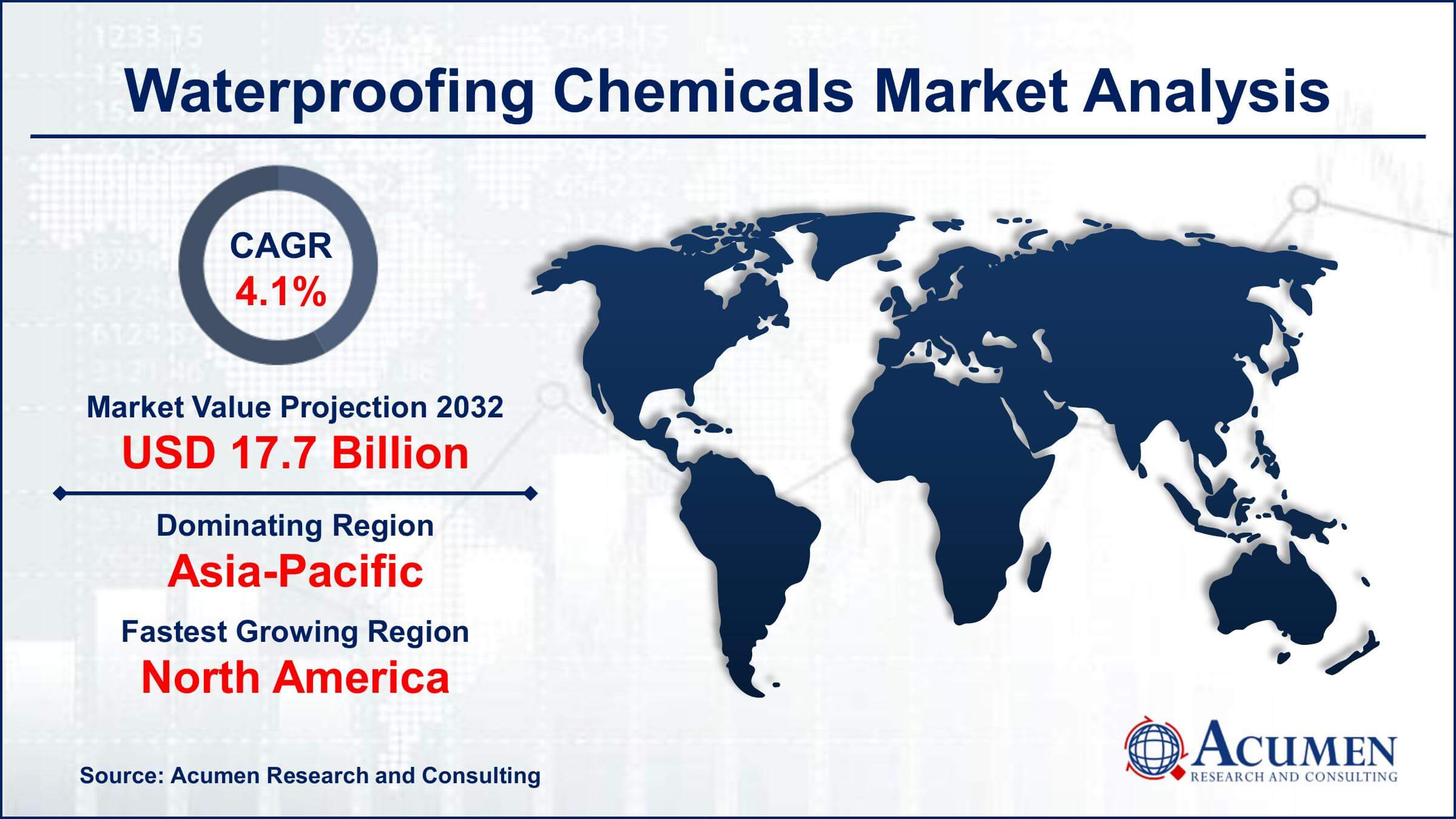

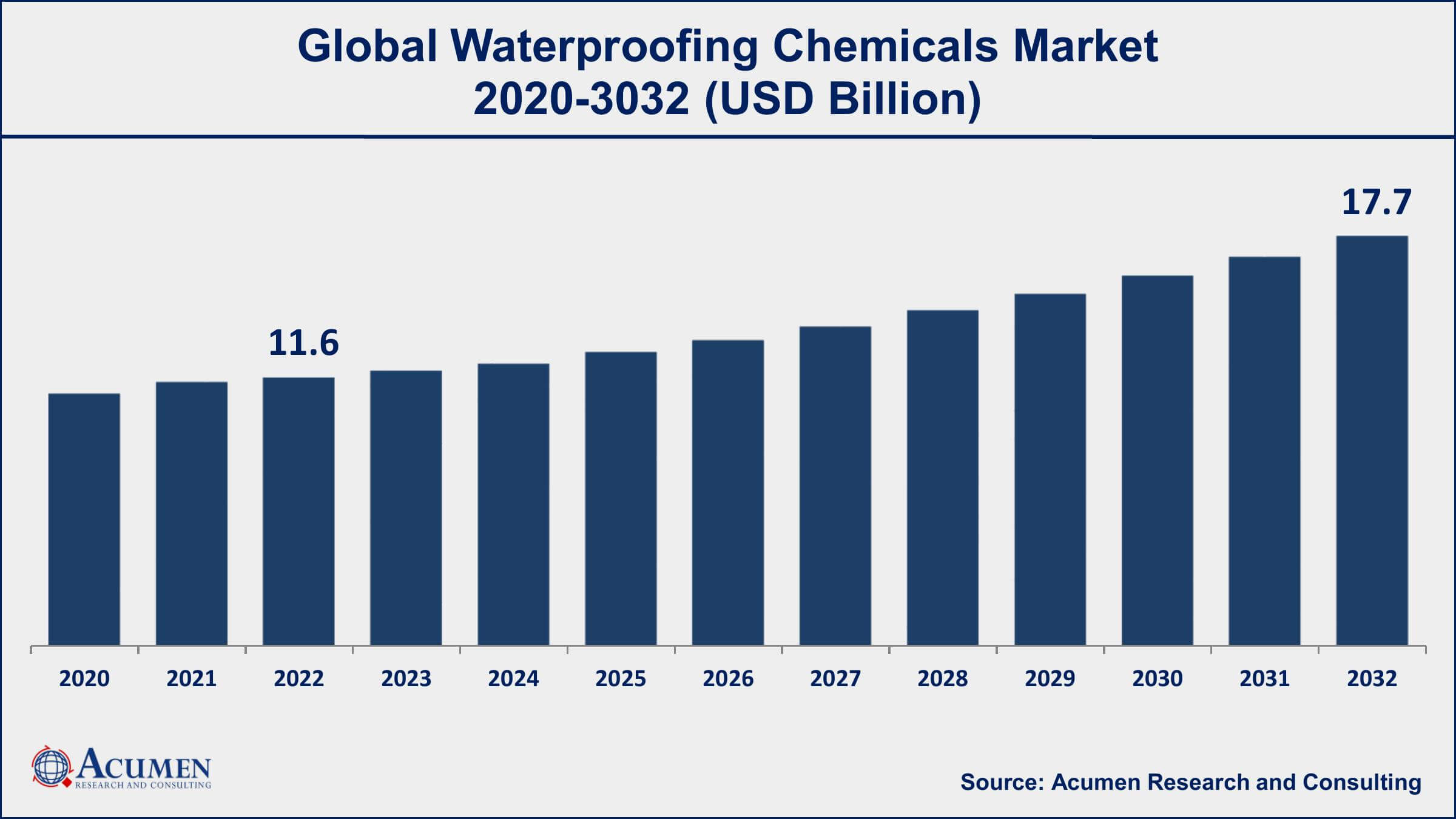

The Global Waterproofing Chemicals Market Size accounted for USD 11.6 Billion in 2022 and is projected to achieve a market size of USD 17.7 Billion by 2032 growing at a CAGR of 4.1% from 2023 to 2032. The increasing demand for waterproofing chemicals in various end-use industries, such as construction, automotive, and infrastructure, is a key driver for the waterproofing chemicals market growth. With the rise in urbanization and construction activities, the need for water-resistant infrastructure is increasing, which is further driving the demand for waterproofing chemicals. Additionally, the growing awareness about the benefits of waterproofing, such as protection against water damage and the prevention of mold and mildew growth, is further boosting the waterproofing chemicals market value in the coming years.

Waterproofing Chemicals Market Report Key Highlights

- Global waterproofing chemicals market revenue is expected to increase by USD 17.7 Billion by 2032, with a 4.1% CAGR from 2023 to 2032

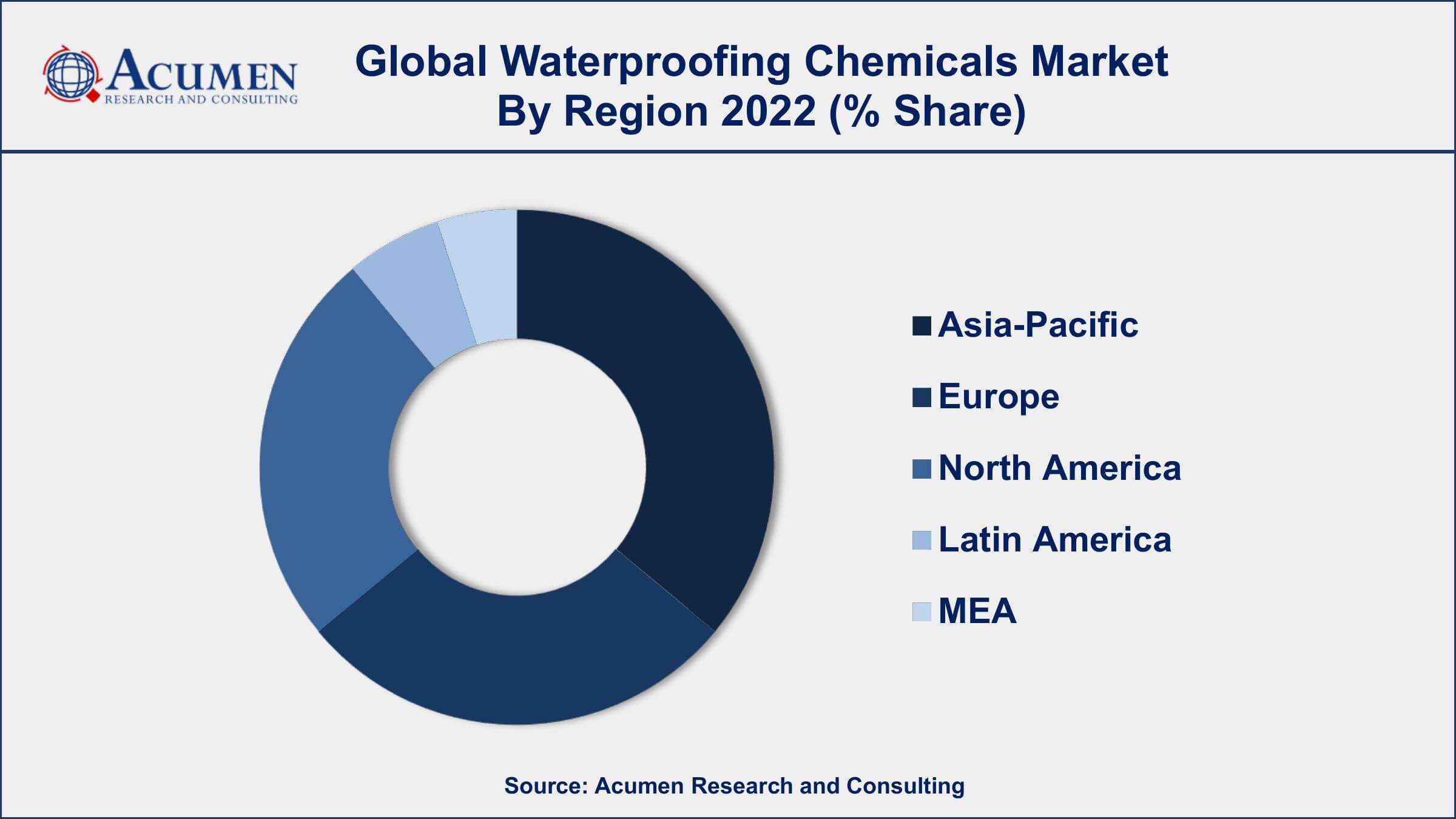

- Asia-Pacific region led with more than 38% of waterproofing chemicals market share in 2022

- The construction industry is the major end-user of waterproofing chemicals, accounting for over 55% of the market share

- Global construction industry is expected to reach USD 8 trillion by 2030, which will boost the demand for waterproofing chemicals

- Some major companies operating in market include BASF SE, Dow Chemical Company, Sika AG, and W.R. Grace & Co.

- Growing need for water-resistant infrastructure, drives the waterproofing chemicals market size

Waterproofing chemicals are high-quality materials used on large scale in the building and construction industry to protect buildings and infrastructures against water penetration. Waterproofing chemicals have high sturdiness intended to lessen the maintenance cost and increase the life of the built structure. Various types of waterproofing chemicals are available worldwide, among which the majorly used include acrylic polymer, elastomeric coatings, polyurethane, expanded polyethylene, and many others. These can be used in slurry, liquid as well as in solid form.

Global Waterproofing Chemicals Market Trends

Market Drivers

- Growing demand from the construction industry

- Rising awareness about the benefits of waterproofing

- Growing need for water-resistant infrastructure

- Technological advancements and innovations in the manufacturing process of waterproofing chemicals

Market Restraints

- Fluctuating raw material prices

- Stringent government regulations

Market Opportunities

- Growing demand for eco-friendly products

- Increasing demand for bio-based waterproofing chemicals

Waterproofing Chemicals Market Report Coverage

| Market | Waterproofing Chemicals Market |

| Waterproofing Chemicals Market Size 2022 | USD 11.6 Billion |

| Waterproofing Chemicals Market Forecast 2032 | USD 17.7 Billion |

| Waterproofing Chemicals Market CAGR During 2023 - 2032 | 4.1% |

| Waterproofing Chemicals Market Analysis Period | 2020 - 2032 |

| Waterproofing Chemicals Market Base Year | 2022 |

| Waterproofing Chemicals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, The Dow Chemical Company, Sika AG, Pidilite Industries Limited, RPM International Inc., Carlisle Companies Inc., GCP Applied Technologies Inc., Fosroc International Limited, Mapei S.p.A, and AkzoNobel N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

As roofing was the largest application for waterproofing chemicals and the trend is expected to grow on account of increased government expenditure on infrastructure enhancement, speedy urbanization coupled with increasing income of the middle-class population, it is expected to fuel the growth of the waterproofing chemicals market in coming years. Increasing product awareness among consumers is expected to have an optimistic impact on the waterproofing chemicals market over the forecast period. Broadening of niche applications for waterproofing chemicals such as subsoil waterproofing, bitumen bonding, and expansion joints are likely to mark positive growth of this sector. The waterproofing chemical market has immense future growth potential as it is developing new composites with enhanced self-adhesion and durability.

However, the global market may be restrained due to volatile raw material costs which are mainly reliant on the demand and supply of petrochemicals. Besides, owing to their flexible and water-resilient ability, these chemicals have massive applications in water management, tunnel liners, and geomembranes. There are various other areas that are expected to open new market opportunities for waterproofing chemicals during the forecast period. Waterproofing chemicals are mostly used in the fabric and textile industry for the enormous production of breathable and waterproof fabrics. Market contributors have been constantly concentrating on commercializing organic routes for developing eco-friendly waterproofing chemicals.

Waterproofing Chemicals Market Segmentation

The global waterproofing chemicals market segmentation is based on product, technology, end-user, and geography.

Waterproofing Chemicals Market By Product

- Bitumen

- Elastomers

- Polyurethane

- Acrylic

- Others

According to the waterproofing chemicals industry analysis, the bitumen segment accounted for the largest market share in 2022. Bitumen waterproofing chemicals are a type of waterproofing chemical used for waterproofing roofs, basements, and other structures. Bitumen waterproofing chemicals are derived from crude oil and are primarily used as a coating material to protect structures from water damage. Bitumen-type waterproofing chemicals are widely used due to their excellent waterproofing properties, durability, and low cost compared to other waterproofing materials. The increasing demand for bitumen-based waterproofing chemicals in emerging economies, such as India and China, is a major driver of the market's growth. The demand for bitumen-based waterproofing chemicals is also increasing due to the growing construction activities and infrastructure development globally.

Waterproofing Chemicals Market By Technology

- Sheet membrane

- Liquid coated membrane

- Cementitious waterproofing

- Others

In terms of technology, sheet membrane technology is a widely used waterproofing technology that involves the use of waterproofing membranes in the form of pre-formed sheets. The waterproofing sheets are made of materials such as modified bitumen, PVC, EPDM, TPO, and others, and are laid on the surface of structures to protect them from water damage. The sheet membrane technology is extensively used in various end-use industries, such as construction, infrastructure, and automotive, driving the growth of the waterproofing chemicals market. The demand for sheet membrane technology is growing due to its excellent waterproofing properties, durability, and ease of application. The increasing demand for waterproofing in the construction industry and the growing construction activities globally are major drivers for the market's growth.

Waterproofing Chemicals Market By End-user

- Construction

- Automobile

- Textile

- Others

According to the waterproofing chemicals market forecast, the construction segment will be the fastest-expanding end-user in the market in the coming years. The construction industry is one of the major end-users of waterproofing chemicals, driving the growth of the waterproofing chemicals market. Waterproofing chemicals are widely used in construction to protect buildings and other structures from water damage caused by rain, moisture, and groundwater. The waterproofing chemicals used in construction include bitumen, polyurethane, acrylic, cementitious, and other chemical formulations. Additionally, the growing awareness about the benefits of waterproofing, such as the prevention of mold and mildew growth and the protection against water damage, is driving the market's growth.

Waterproofing Chemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Waterproofing Chemicals Market Regional Analysis

The Asia-Pacific region is the largest market for waterproofing chemicals, accounting for the majority of the market share. The increasing construction activities in the region, particularly in countries such as China and India, are driving the growth of the market. The region is also witnessing a growing trend towards eco-friendly and sustainable products, creating new growth opportunities for market players to develop and manufacture bio-based waterproofing chemicals.

North America and Europe are mature markets for waterproofing chemicals, with significant demand for waterproofing chemicals in the construction and infrastructure industries. The market in these regions is expected to witness steady growth in the coming years, driven by the need for infrastructure maintenance and renovation.

Waterproofing Chemicals Market Player

Some of the top waterproofing chemicals market companies offered in the professional report include BASF SE, The Dow Chemical Company, Sika AG, Pidilite Industries Limited, RPM International Inc., Carlisle Companies Inc., GCP Applied Technologies Inc., Fosroc International Limited, Mapei S.p.A, and AkzoNobel N.V.

Frequently Asked Questions

What was the market size of the global waterproofing chemicals in 2022?

The market size of waterproofing chemicals was USD 11.6 Billion in 2022.

What is the CAGR of the global waterproofing chemicals market during forecast period of 2023 to 2032?

The CAGR of waterproofing chemicals market is 4.1% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global waterproofing chemicals market are BASF SE, The Dow Chemical Company, Sika AG, Pidilite Industries Limited, RPM International Inc., Carlisle Companies Inc., GCP Applied Technologies Inc., Fosroc International Limited, Mapei S.p.A, and AkzoNobel N.V.

Which region held the dominating position in the global waterproofing chemicals market?

Asia-Pacific held the dominating position in waterproofing chemicals market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for waterproofing chemicals market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global waterproofing chemicals market?

The current trends and dynamics in the waterproofing chemicals industry include the growing demand from the construction industry, and rising awareness about the benefits of waterproofing.

Which Product held the maximum share in 2022?

The bitumen product held the maximum share of the waterproofing chemicals market.