Waste Recycling Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Waste Recycling Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

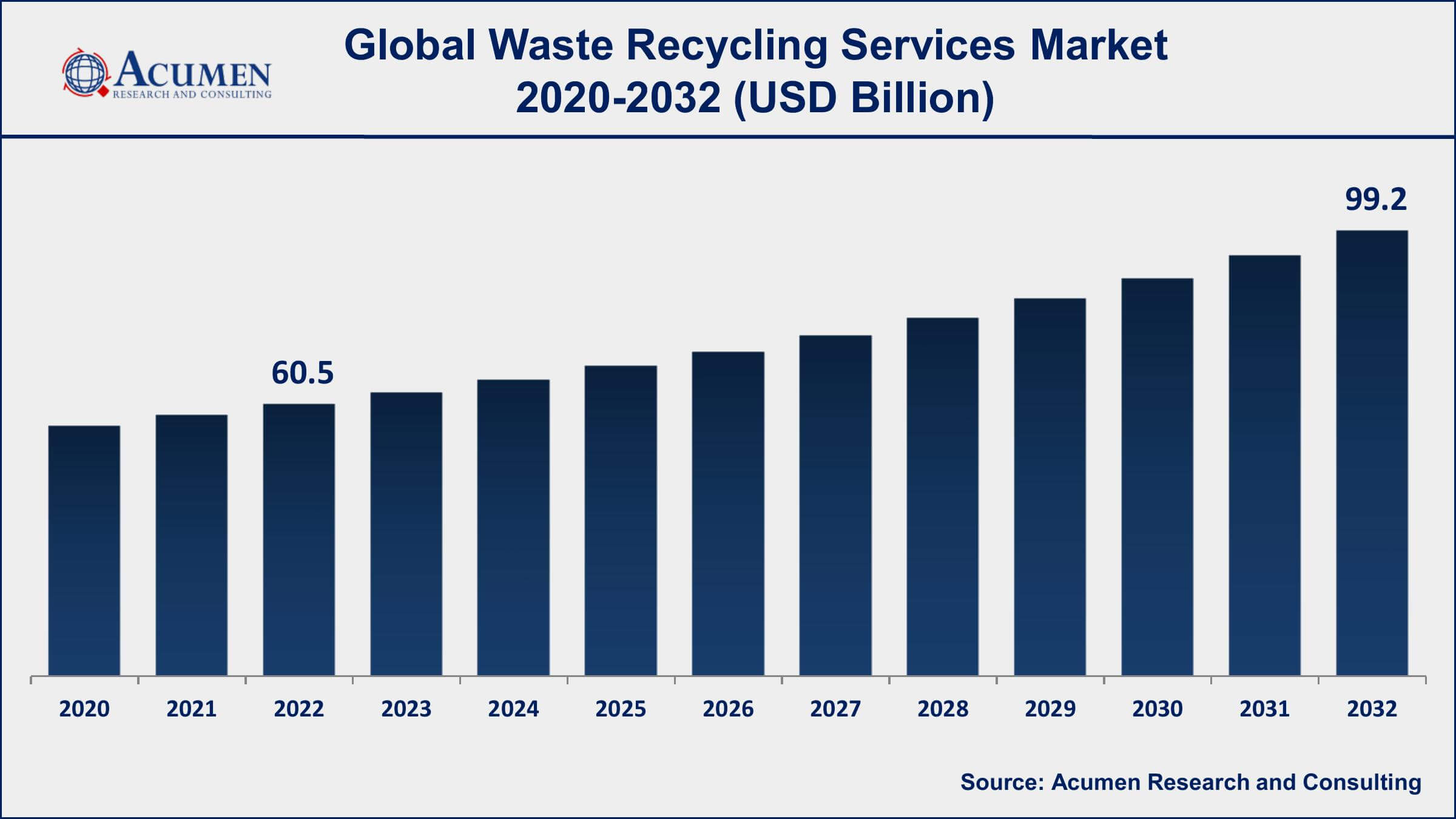

The Global Waste Recycling Services Market Size accounted for USD 60.5 Billion in 2022 and is projected to achieve a market size of USD 99.2 Billion by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Waste Recycling Services Market Key Highlights

- Global waste recycling services market revenue is expected to increase by USD 99.2 Billion by 2032, with a 5.1% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 40% of waste recycling services market share in 2022

- According to the EPA, the recycling industry in the US employs over 757,000 people and generates $36.6 billion in wages and benefits

- According to the analysis, only 17.4% of electronic waste was properly collected and recycled in 2020

- According to the EPA, the United States generated 292.4 million tons of municipal solid waste (MSW) in 2018, of which 69 million tonnes were recycled

- Increasing adoption of advanced technologies for waste recycling and processing, drives the waste recycling services market value

Waste recycling services refer to the collection, processing, and repurposing of waste materials to minimize the amount of waste sent to landfills. The goal of these services is to reduce the environmental impact of waste by diverting it from landfills, conserving resources, and reducing greenhouse gas emissions. Waste recycling services can include the recycling of paper, plastics, glass, metals, and organic materials such as food and yard waste.

The market for waste recycling services has experienced significant growth in recent years due to increasing concerns about the environment, as well as regulatory pressures to reduce waste and limit the use of landfills. Additionally, governments and private organizations around the world are implementing waste reduction and recycling initiatives, which are further fueling the waste recycling services market growth. For instance, the European Union has set a target of recycling 65% of municipal waste by 2035, while China has implemented a ban on the import of certain types of waste, which has spurred the development of domestic recycling facilities. Overall, the waste recycling services industry is expected to continue to grow in the coming years as governments and businesses focus on sustainability and reducing their environmental footprint.

Global Waste Recycling Services Market Trends

Market Drivers

- Growing concerns about the environment and the need for sustainable waste management practices

- Increasing adoption of advanced technologies for waste recycling and processing

- Government and private initiatives to reduce waste and increase recycling rates

- Rising urbanization and industrialization, lead to higher waste generation

Market Restraints

- High costs associated with waste recycling and processing

- Lack of infrastructure for waste management and recycling

Market Opportunities

- Integration of waste recycling and processing technologies with renewable energy generation

- Increasing demand for recycled materials in emerging industries such as electric vehicles and renewable energy

Waste Recycling Services Market Report Coverage

| Market | Waste Recycling Services Market |

| Waste Recycling Services Market Size 2022 | USD 60.5 Billion |

| Waste Recycling Services Market Forecast 2032 | USD 99.2 Billion |

| Waste Recycling Services Market CAGR During 2023 - 2032 | 5.1% |

| Waste Recycling Services Market Analysis Period | 2020 - 2032 |

| Waste Recycling Services Market Base Year | 2022 |

| Waste Recycling Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Waste Management, Inc., Republic Services, Inc., Veolia Environmental Services, SUEZ Environment, Clean Harbors, Inc., Stericycle, Inc., Waste Connections, Inc., Covanta Holding Corporation, Advanced Disposal Services, Inc., Casella Waste Systems, Inc., Recology Inc., and GFL Environmental Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rapid industrialization in developing countries, increasing solid waste generation from various end-use industries, and high government initiatives for proper waste management are major factors expected to drive the growth of the global market. In addition, high investment by major players for innovative solutions is another factor expected to further support the growth of the target market.

- In 2019, Waste Management, Inc a provider of waste management services including collection; transfer, recycling; resource recovery, and disposal services acquired Advanced Disposal Services. The acquisition is expected to generate more than US$100 million in savings and capital expenditures annually for the company. This is expected to help the company to enhance its profit share

- In 2019, SUEZ opened a packaging sorting plant in Germany that focuses on operations that include sorting lightweight packaging, with a capacity of 110,232 tons of waste. This is expected to help the company to enhance its business aspects are increase the profit ratio.

- In 2017, NTPC Limited invited national and international players in order to set up about 100 waste-to-energy pollution-free plants across India.

- The government of India allows 100% FDI under the automatic route for urban infrastructure areas including waste management subjects. This is expected to attract players across the globe to the country.

Above mentioned are some of the major factors expected to positively impact the growth of the global market.

However, factors such as the high cost of equipment and lack of required infrastructure for proper waste segregation are factors expected to hamper the growth of the global waste recycling services market. In addition, the lack of participation from sources in plastic waste management is another factor expected to challenge the growth of the target market.

The rising plastic waste problem in emerging economies, increasing government initiatives and players' inclination towards developing countries are factors expected to create new opportunities for players operating in the target market over the forecast period. In addition, increasing partnerships and agreements between regional and international players is another factor expected to support the revenue growth of the target market.

Waste Recycling Services Market Segmentation

The global waste recycling services market segmentation is based on product, application, and geography.

Waste Recycling Services Market By Product

- Metals

- Plastics

- Glass

- Paper and Paperboard

- Electronics, Bulbs & Batteries

- Food

- Yard Trimmings

- Others

In terms of products, the paper and paperboard segment has seen significant growth in the waste recycling services market in recent years. Paper and paperboard waste includes materials such as old newspapers, magazines, cardboard boxes, and other packaging materials. These materials are typically collected, processed, and converted into recycled paper and paperboard products, reducing the need for virgin materials and reducing the environmental impact of paper production. There is a growing demand for recycled paper products in various industries such as packaging, printing, and tissue manufacturing. The use of recycled paper products reduces the reliance on virgin materials, conserves resources, and reduces waste generation. Additionally, governments and private organizations are implementing policies and initiatives to promote the recycling of paper and paperboard waste. For example, the European Union has set a target of recycling 75% of paper and cardboard packaging waste by 2030. Similarly, the United States Environmental Protection Agency (EPA) has set a target of achieving a 70% recycling rate for paper and paperboard by 2030.

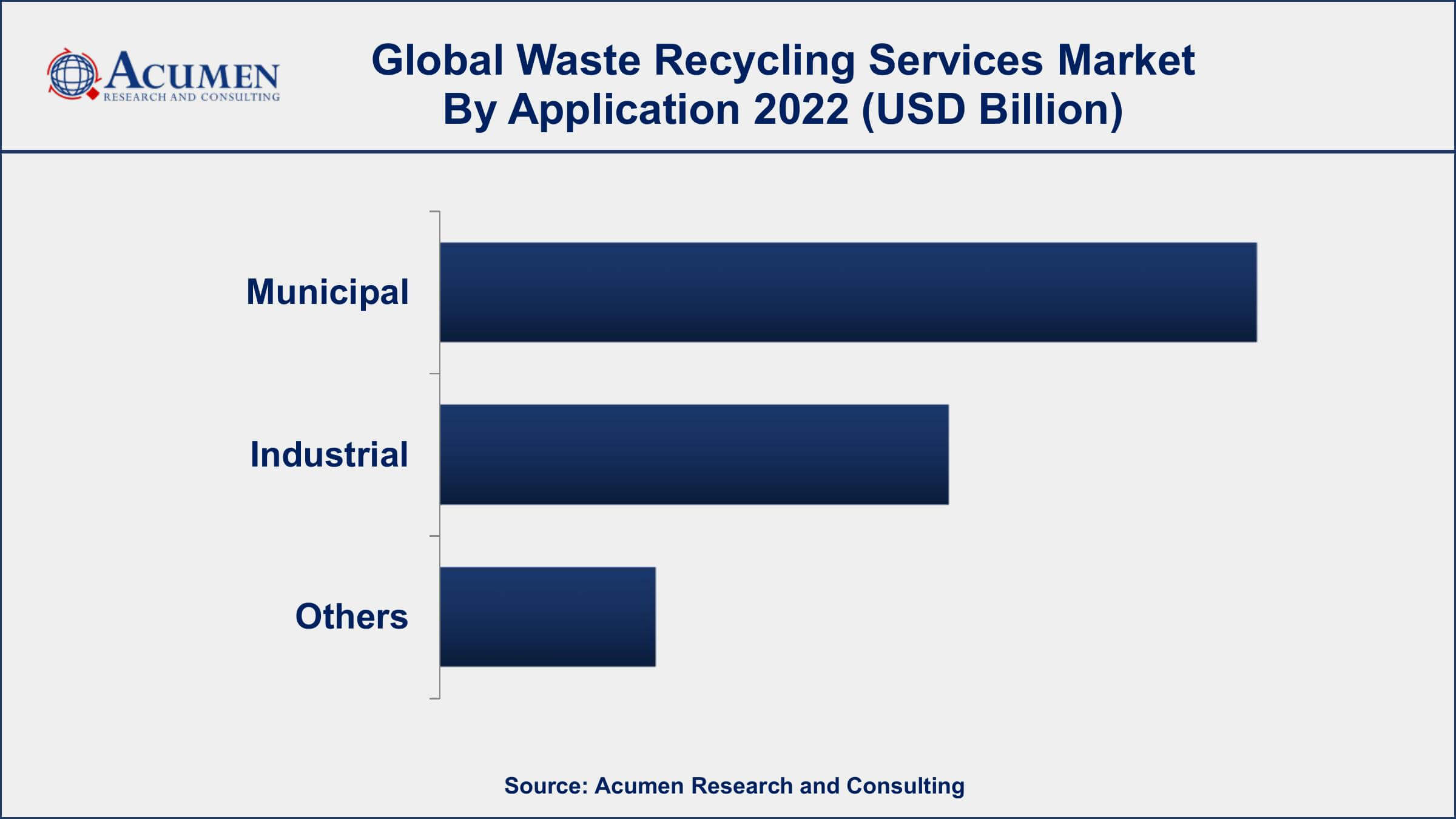

Waste Recycling Services Market By Application

- Municipal

- Industrial

- Others

According to the waste recycling services market forecast, the industrial segment is expected to witness significant growth in the coming years. The industrial waste includes various types of waste generated by manufacturing processes, such as scrap metal, plastics, glass, and other materials. Recycling industrial waste is important for reducing the environmental impact of industrial processes, conserving resources, and reducing waste generation. The growth of the industrial segment is driven by a growing demand for recycled materials in various industries, including construction, automotive, and electronics manufacturing. The use of recycled materials in these industries can reduce costs, conserve resources, and improve sustainability. Additionally, governments and private organizations are implementing policies and initiatives to promote the recycling of industrial waste.

Waste Recycling Services Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Waste Recycling Services Market Regional Analysis

The Asia-Pacific region is dominating the waste recycling services market due to several factors. First, the region has a large population, rapid urbanization, and industrialization, leading to high waste generation rates. This has created a significant demand for waste management and recycling services to reduce the environmental impact of waste and conserve resources. Moreover, the region has implemented various initiatives and policies to promote waste reduction and recycling. Many countries in the region have established regulatory frameworks for waste management, including recycling targets and incentives for waste reduction and recycling. For instance, Japan has implemented a "zero waste" policy, which aims to minimize waste generation and promote recycling, and China has set a target to recycle 35% of its municipal waste by 2020.

Waste Recycling Services Market Player

Some of the top waste recycling services market companies offered in the professional report include Waste Management, Inc., Republic Services, Inc., Veolia Environmental Services, SUEZ Environment, Clean Harbors, Inc., Stericycle, Inc., Waste Connections, Inc., Covanta Holding Corporation, Advanced Disposal Services, Inc., Casella Waste Systems, Inc., Recology Inc., and GFL Environmental Inc.

Frequently Asked Questions

What was the market size of the global waste recycling services in 2022?

The market size of waste recycling services was USD 60.5 Billion in 2022.

What is the CAGR of the global waste recycling services market from 2023 to 2032?

The CAGR of waste recycling services is 5.1% during the analysis period of 2023 to 2032.

Which are the key players in the waste recycling services market?

The key players operating in the global market are including Waste Management, Inc., Republic Services, Inc., Veolia Environmental Services, SUEZ Environment, Clean Harbors, Inc., Stericycle, Inc., Waste Connections, Inc., Covanta Holding Corporation, Advanced Disposal Services, Inc., Casella Waste Systems, Inc., Recology Inc., and GFL Environmental Inc.

Which region dominated the global waste recycling services market share?

Asia-Pacific held the dominating position in waste recycling services industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of waste recycling services during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global waste recycling services industry?

The current trends and dynamics in the waste recycling services industry include growing concerns about the environment and the need for sustainable waste management practices.

Which product held the maximum share in 2022?

The paper and paperboard product held the maximum share of the waste recycling services industry.