Warehouse Automation Market

Published :

Report ID:

Pages :

Format :

Warehouse Automation Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

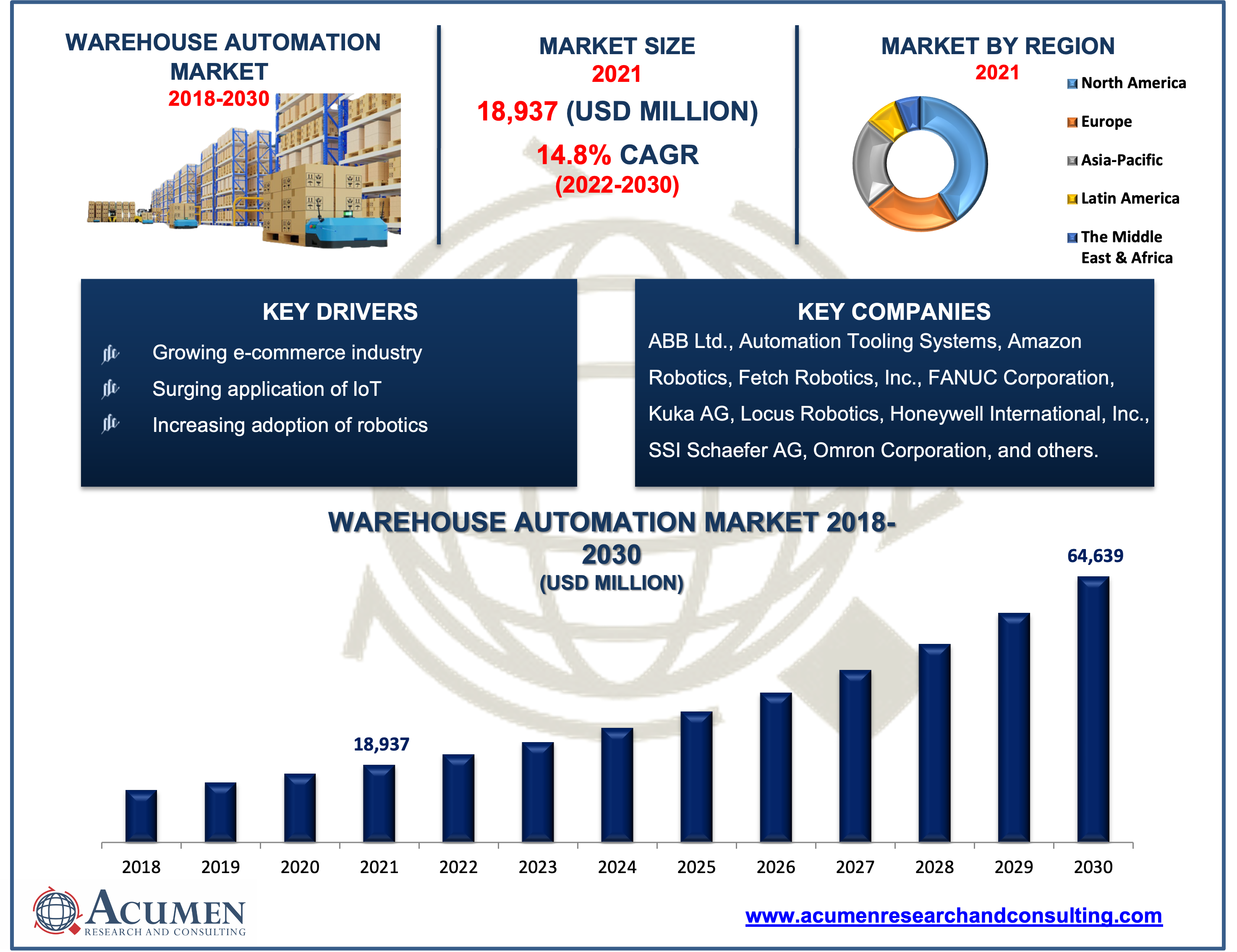

Request Sample Report

The Global Warehouse Automation Market accounted for US$ 18,937 Mn in 2021 and is estimated to reach US$ 64,639 Mn by 2030, with a significant CAGR of 14.8% from 2022 to 2030.

Warehouse automation is a broad term that encompasses most modern warehouse modifications. Warehouse automation employs technology and equipment to automate repetitive warehouse tasks and make them less labor-intensive in order to increase efficiency. Warehouse automation covers all of the hardware, software, people, and processes needed to automate warehouse tasks for greater efficiency and accuracy. This could include everything from labeling inventory items to capturing warehouse data, automating storage and retrieval of items, and creating back-office reports. Automation can help with any task that involves repetitive labor. Modern technology, such as drones and machine learning, provides the door for warehouse automation systems to perform more complicated, non-repetitive work and complete many tasks.

Market Growth Drivers:

· Growing e-commerce industry

· Surging application of IoT

· Rising urbanization

· Rising adoption of robotics in warehousing

Market Restraints:

- Lack of skilled workforce

- Mechanical challenges associated with warehouse automation

Market Opportunities:

· Growing R&D activities

· Increasing adoption of technologies such as AI, big data, ML, and others

Report Coverage

| Market | Warehouse Automation Market |

| Market Size 2021 | US$ 18,937 Mn |

| Market Forecast 2030 | US$ 64,639 Mn |

| CAGR | 14.8% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Technology, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Ltd., Automation Tooling Systems, Amazon Robotics, Fetch Robotics, Inc., FANUC Corporation, Kuka AG, Locus Robotics, Honeywell International, Inc., SSI Schaefer AG, Omron Corporation, and Yaskawa Electric Corporation, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Market Dynamics

The warehouse automation market is expected to witness outstanding growth in the coming years due to the rise in the e-commerce industry and increasing warehousing labor costs. The increase in adoption of IoT, AI, machine learning, and big data analytics which are successfully running the automation business are also creating a buzz for the industry. In addition, the rising adoption of robotics in warehouse processes has also opened new business opportunities for the market. However, the lack of skilled labor and mechanical challenges linked with warehouse automation are some of the factors that are limiting the market growth. Nevertheless, the growing benefits of automation and surge in the number of R&D activities are likely to drive the market growth further in the coming years.

Warehouse automation is on the rise as corporations and warehouse managers seek to streamline operations, boost efficiency and production, and cut costs. Many warehouse processes are becoming more efficient as technology augments the work of humans or, in some cases, manual tasks, automates tedious, freeing up associates to focus on more complex tasks. It is impossible to deny the impact of technology on human’s everyday lives and in the workplace in today's increasingly automated society. In light of the COVID-19 pandemic's disruption, it's important to look into prospective approaches for increased efficiency, process improvements, and easy supply chain evolution. Warehouse automation is one of these approaches.

Damage and miscount mistakes are reduced as a result of more efficient warehousing, resulting in more precise order fulfillment. Automated warehousing improves the predictability of fulfillment processes, making it easier to schedule an increasingly expensive resource, transportation. Automation can save money by reducing warehouse labor and expenses, allowing to invest in and maintain the automated facility.

Market Segmentation

The global warehouse automation market is segregated by technology, industrial vertical, and region.

Market by Technology

· Automatic Identification and Data Capture

· Automated Storage and Retrieval Systems (ASRS)

· Overhead Systems

· Conveyors

· AGV/AMR

· MRO Outbounds

· Order Picking

· Palletizing & Depalletizing

· Gantry Robots

· Sortation

· WMS/WES/WCS

Based on our analysis the maintenance, repair, and operations (MRO) segment is expected to achieve a considerable market share in 2021. However, the AGV/AMR segment is anticipated to witness a noteworthy market share throughout the forecast period 2022 – 2030. Automatic guided vehicles (AGV) is a type of mechanized automation that has a little amount of processing capacity onboard. To navigate a defined path across the warehouse, these vehicles use magnetic strips, wires, or sensors. AGVs can only be used in big, straightforward warehouse locations with this navigation scheme. On the other hand, autonomous mobile robots (AMRs), which are more adaptable than AGVs, employ GPS systems to plan efficient paths within a warehouse. AMRs can safely navigate dynamic situations with a lot of human traffic because they employ modern laser guiding systems to detect impediments.

Market by Industry Vertical

- E-commerce

- 3PL

- Apparel

- Pharma

- Grocery

- Food & Beverage

- General Merchandise

The e-commerce industry has triggered the automation sector to a greater extent. The adoption of automation has proven to be a real backbone for the online fashion distributor, customer satisfaction, improving workflow, and delivery time. The retail industry's gradual march toward warehouse automation has recently accelerated, owing to the coronavirus pandemic and the resulting acceleration of online ordering for nearly everything. Warehouse automation is increasingly becoming the trump card for companies trying to get a leg up on the competition, especially in the fast-paced and competitive e-grocery sector, as retailers struggle to keep up with an ever-increasing volume of orders and mounting last-mile delivery needs.

Warehouse Automation Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· Japan

· China

· Australia

· South Korea

· Rest of Asia-Pacific

The Middle East & Africa

· GCC

· South Africa

· Rest of the Middle East & Africa

Thepresence of well-established e-commerce industry fuels the North America market

Based on the regional segmentation, the North America region held the majority of the share in 2021. The region's dominance is credited to the presence of a well-established e-commerce industry, retail companies, and numerous other industry verticals. In addition, the favorable government support and growing emphasis of warehouse players to automate their processes due to multifold benefits propel the North America warehouse automation market. However, the Asia-Pacific region is likely to accomplish the fastest growth rate throughout the forecast period 2022 – 2030. Some of the factors such as increasing population, rising number of manufacturing facilities, and growing e-commerce and packaging industry in countries such as China and India are contributing to an impressive growth of the Asia-Pacific warehouse automation market.

Major Companies

Some of the top vendors offered in the professional report include ABB Ltd., Automation Tooling Systems, Amazon Robotics, Fetch Robotics, Inc., FANUC Corporation, Kuka AG, Locus Robotics, Honeywell International, Inc., SSI Schaefer AG, Omron Corporation, and Yaskawa Electric Corporation, Inc.

Frequently Asked Questions

How much was the estimated value of the global warehouse automation market in 2021?

The estimated value of global warehouse automation market in 2021 was accounted to be US$18,937 Mn.

What will be the projected CAGR for global warehouse automation market during forecast period of 2022 to 2030?

The projected CAGR of warehouse automation market during the analysis period of 2022 to 2030is 14.8%.

Which are the prominent competitors operating in the market?

The prominent players of the global warehouse automation market involve ABB Ltd., Automation Tooling Systems, Amazon Robotics, Fetch Robotics, Inc., FANUC Corporation, Kuka AG, Locus Robotics, Honeywell International, Inc., SSI Schaefer AG, Omron Corporation, and Yaskawa Electric Corporation, Inc.

Which region held the dominating position in the global warehouse automation market?

North America held the dominating share for warehouse automation during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for warehouse automation during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global warehouse automation market?

Growing e-commerce industry, surging application of IoT, and rising adoption of robotics in warehousing drives the growth of global warehouse automation market.

By segment technology, which sub-segment held the maximum share?

Based on technology, MRO segment held the maximum share for warehouse automation market in 2021.