Virus Filtration Market | Acumen Research and Consulting

Virus Filtration Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

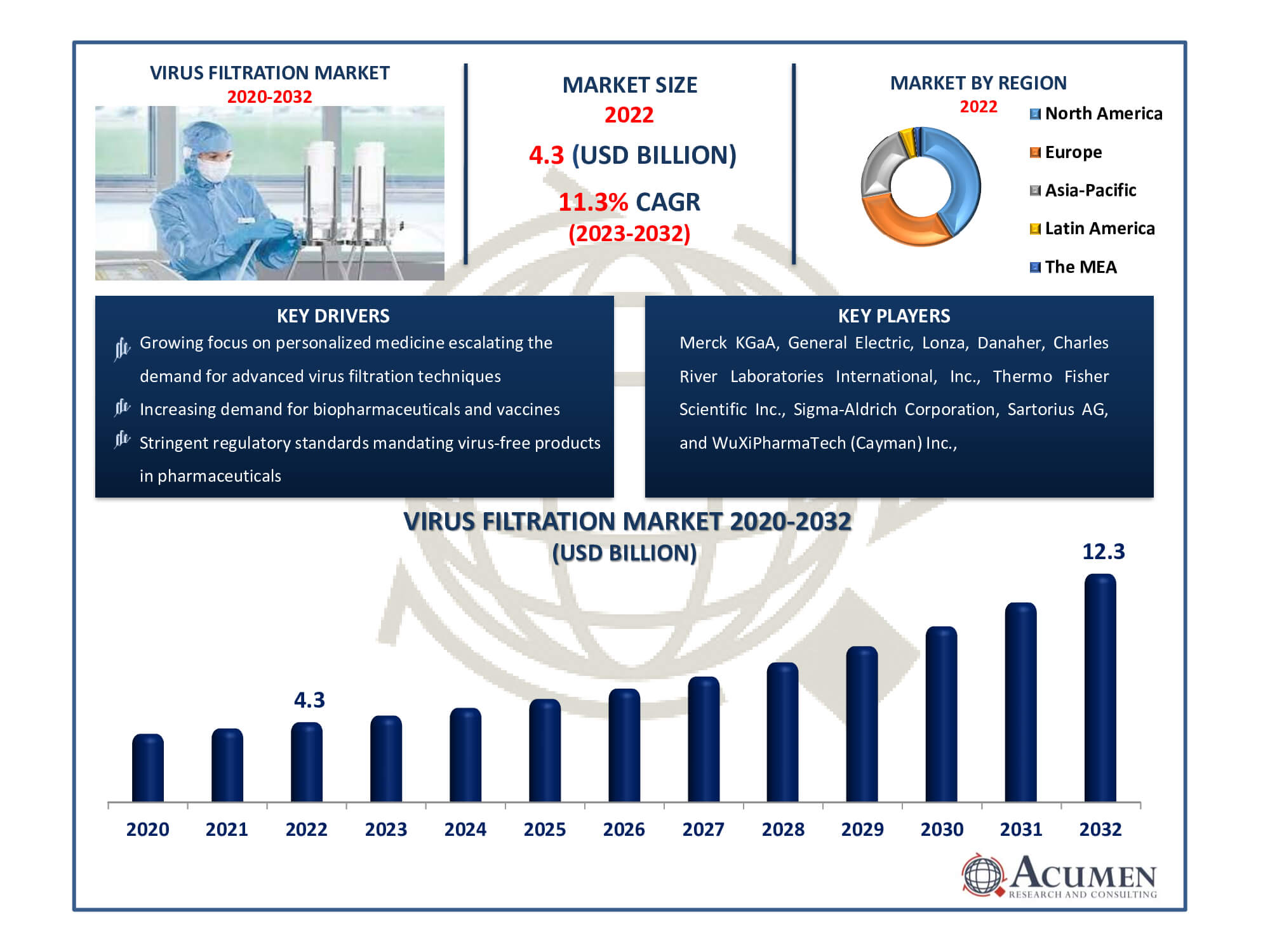

The Virus Filtration Market Size accounted for USD 4.3 Billion in 2022 and is estimated to achieve a market size of USD 12.3 Billion by 2032 growing at a CAGR of 11.3% from 2023 to 2032.

Virus Filtration Market Highlights

- Global virus filtration market revenue is poised to garner USD 12.3 billion by 2032 with a CAGR of 11.3% from 2023 to 2032

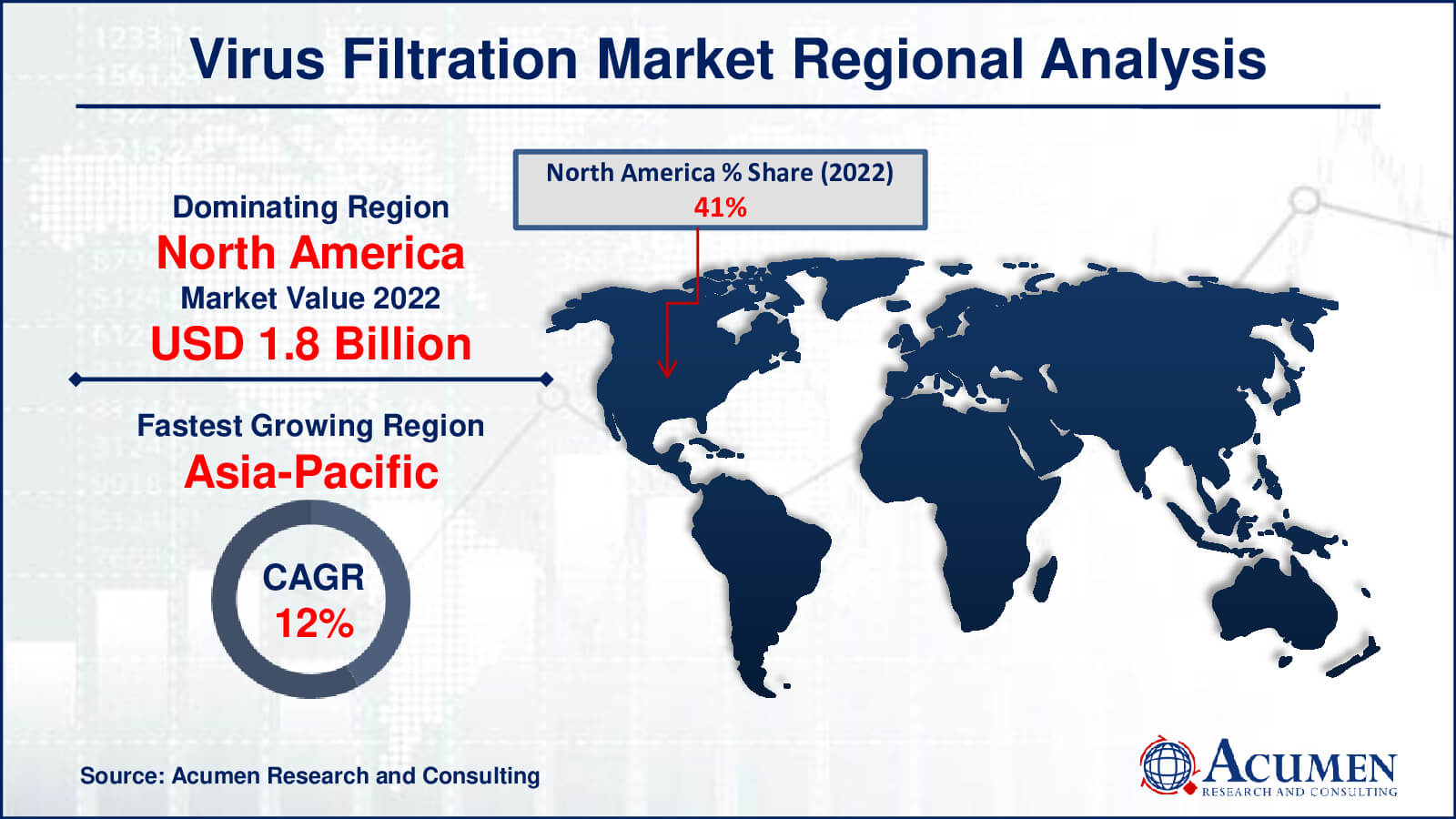

- North America virus filtration market value occupied around USD 1.8 billion in 2022

- Asia-Pacific virus filtration market growth will record a CAGR of more than 12% from 2023 to 2032

- Among product, the kits & reagents sub-segment generated over US$ 2.03 billion revenue in 2022

- Based on application, the biological sub-segment generated around 57% share in 2022

- Growing research focus on nanotechnology for developing more effective virus filtration methods is a popular virus filtration market trend that fuels the industry demand

Virus filtering technologies are used to eliminate viruses from biological products, medications, air, and water. These filtration procedures, which are essential in biopharmaceutical manufacturing, maintain product safety by removing viral contamination from vaccinations, antibodies, blood products, and other treatments. The demand for efficient viral filtration technologies is driven by stringent regulatory regulations and the vital need for virus-free products in the healthcare and pharmaceutical industries. The market includes filtering techniques such as nanofiltration, ultrafiltration, and chromatography, which serve to a wide range of applications in pharmaceuticals, biotechnology, food and beverages, and research laboratories. The growing emphasis on biologics and personalized medicine increases the importance of virus filtering technologies, propelling global market growth.

Global Virus Filtration Market Dynamics

Market Drivers

- Increasing demand for biopharmaceuticals and vaccines

- Stringent regulatory standards mandating virus-free products in pharmaceuticals

- Growing focus on personalized medicine escalating the demand for advanced virus filtration techniques

- Rising incidence of viral outbreaks emphasizing the necessity for efficient virus filtration across industries

Market Restraints

- High initial investment costs associated with implementing sophisticated virus filtration systems

- Technological complexities and the need for skilled personnel for operating advanced filtration technologies

- Challenges in maintaining the integrity and efficacy of sensitive biological products during filtration processes

Market Opportunities

- Expansion in emerging markets with increased healthcare investments

- Ongoing advancements in filtration technologies offering enhanced efficiency and broader applications

- Rising adoption of single-use systems in virus filtration

Virus Filtration Market Report Coverage

| Market | Virus Filtration Market |

| Virus Filtration Market Size 2022 | USD 4.3 Billion |

| Virus Filtration Market Forecast 2032 | USD 12.3 Billion |

| Virus Filtration Market CAGR During 2023 - 2032 | 11.3% |

| Virus Filtration Market Analysis Period | 2020 - 2032 |

| Virus Filtration Market Base Year |

2022 |

| Virus Filtration Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Merck KGaA, General Electric, Lonza, Danaher, WuXiPharmaTech (Cayman) Inc., Charles River Laboratories International, Inc., Thermo Fisher Scientific Inc., Sigma-Aldrich Corporation, Sartorius AG, and Asahi Kasei Medical Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Virus Filtration Market Insights

Several key aspects shape the virus filtration market. For starters, increased biopharmaceutical manufacturing and demand for virus-free products fuel market expansion. Stringent regulatory rules require virus eradication in pharmaceuticals, emphasizing the importance of effective filtration processes. Technological improvements are critical to market expansion. Continuous advancements in filtration technologies and materials improve filtration effectiveness, allowing for higher viral elimination rates and higher product quality, hence accelerating market expansion and adoption. Furthermore, the growing frequency of viral breakouts and pandemics, as shown during the COVID-19 crisis, heightens the importance of virus filtration across multiple industries. This increased awareness encourages expenditures in research and development, which leads to the creation of improved filtration systems capable of combating emerging viral dangers.

The increased demand for biologics and personalized medicine also has an impact on market dynamics. With the increased use of biopharmaceuticals and the requirement for personalized treatments, there is a corresponding increase in the demand for efficient virus filtering technologies to assure the safety and efficacy of these new therapies. Furthermore, the growth of the pharmaceutical and biotechnology industries in emerging economies drives market expansion. Pharmaceutical output is increasing in countries such as India, China, Brazil, and others, pushing the demand for high-quality viral filtration systems.

The market continues to face challenges, such as the high cost of filtration systems and the need for experienced experts to operate these technologies successfully. However, with ongoing developments and increased research investments, the Virus Filtration Market is poised for considerable growth, driven by the critical requirement for virus-free products across numerous industries globally.

Virus Filtration Market Segmentation

The worldwide market for virus filtration is split based on product, technology, application, end-user, and geography.

Virus Filtration Products

- Filtration Systems

- Kits & Reagents

- Services

- Other products

The kits & reagents segment leads the market due to its accessibility and extensive application across numerous sectors, substantiated by virus filtration industry analysis. These kits offer ease and rapid viral identification and removal in laboratories and production plants. Their standardized reagents and simple methodologies cater to diverse applications, making them integral in viral filtration processes across industries. Their adaptability and versatility across various contexts align with industry needs, solidifying their market dominance in providing effective virus filtering solutions.

Virus Filtration Technologies

- Filtration

- Consumables

- Instruments

- Services

- Chromatography

- Consumables

- Instruments

- Services

The filtration segment dominates the virus filtration market due to its broad applicability and efficacy in removing viruses from a variety of substances. Filtration technologies, which include methods such as nanofiltration and ultrafiltration, provide flexible viral eradication solutions in medicines, biotechnology, and water treatment. These techniques promise cost-effectiveness and scalability, as well as excellent purity and efficacy in virus eradication from various matrices. Their adaptability across industries, combined with demonstrated dependability, positions the filtration segment for ongoing expansion, reinforcing its greater market share in virus filtering technologies, as stated by the market forecast.

Virus Filtration Applications

- Biological

- Blood & Blood Products

- Tissue & Tissue Products

- Vaccines & Therapeutics

- Cellular & Gene Therapy Products

- Stem Cell Products

- Medical Devices

- Water Purification

- Air Purification

As per the virus filtration market forecast, the biological sector gathered utmost shares by its pivotal role in medicines, biotechnology, and research. This sector involves the meticulous removal of viruses from biological products like vaccines, antibodies, and blood components, ensuring compliance with stringent regulatory standards for product safety. Its prominence is propelled by the heightened demand for viral filtration in biologics and cell culture processes. With an increasing focus on biopharmaceuticals and novel therapeutics, the biological segment retains its criticality, underscoring its substantial market position in guaranteeing virus-free biological products across diverse healthcare and pharmaceutical applications.

Virus Filtration End-Users

- Pharmaceutical and Biotechnology Companies

- Contract Research Organization

- Medical Devices Companies

- Academic Institutes & Research Laboratories

The pharmaceutical and biotechnology sector is largest in the virus filtration market due to its dependency on viral filtering technologies in pharmaceutical manufacturing and biologics development. These firms use filtration methods to maintain viral safety in medicines, vaccines, and biopharmaceuticals while adhering to severe regulatory criteria. With the growing need for biologics and personalised treatment, pharmaceutical and biotech companies are investing extensively in virus filtration technologies. Their critical role in supplying safe and effective healthcare solutions reinforces their supremacy in this market area for viral filtering technologies.

Virus Filtration Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Virus Filtration Market Regional Analysis

North America holds a sizable market share, owing to its thriving pharmaceutical and biotechnology sectors. The region's strict regulatory structure assures high-quality requirements for healthcare items, which increases demand for viral filtering technology. Increased R&D efforts, as well as the existence of significant market players, all contribute to North America's sizable market position.

Europe is closely following, fueled by advances in biopharmaceuticals and vaccine research. The region's strong concentration on R&D, combined with favorable government measures, encourages the use of improved virus filtration techniques across the pharmaceutical and biotech sectors.

The Asia-Pacific area is seeing tremendous growth, owing to the expansion of pharmaceutical and biotechnology businesses in nations such as India, China, and Japan. Rising healthcare spending, along with a greater emphasis on biologics and biosimilars, boosts demand for virus filtering technologies.

Latin America and the Middle East and Africa (MEA) areas have consistent development potential, owing mostly to the expansion of pharmaceutical manufacturing and healthcare infrastructure. Despite some challenges, such as restricted access to innovative technologies, these regions are seeing increased usage of viral filtration systems as healthcare investments increase and consumer awareness about product safety grows.

Virus Filtration Market Players

Some of the top virus filtration companies offered in our report includes Merck KGaA, General Electric, Lonza, Danaher, WuXiPharmaTech (Cayman) Inc., Charles River Laboratories International, Inc., Thermo Fisher Scientific Inc., Sigma-Aldrich Corporation, Sartorius AG, and Asahi Kasei Medical Co., Ltd.

Frequently Asked Questions

How big is the virus filtration market?

The virus filtration market size was USD 4.3 Billion in 2022.

What is the CAGR of the global virus filtration market from 2023 to 2032?

The CAGR of virus filtration is 11.3% during the analysis period of 2023 to 2032.

Which are the key players in the virus filtration market?

The key players operating in the global market are including Merck KGaA, General Electric, Lonza, Danaher, WuXiPharmaTech (Cayman) Inc., Charles River Laboratories International, Inc., Thermo Fisher Scientific Inc., Sigma-Aldrich Corporation, Sartorius AG, and Asahi Kasei Medical Co., Ltd.

Which region dominated the global virus filtration market share?

North America held the dominating position in virus filtration industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of virus filtration during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global virus filtration industry?

The current trends and dynamics in the virus filtration industry include increasing demand for biopharmaceuticals and vaccines, stringent regulatory standards mandating virus-free products in pharmaceuticals, growing focus on personalized medicine escalating the demand for advanced virus filtration techniques, and rising incidence of viral outbreaks emphasizing the necessity for efficient virus filtration across industries.

Which product held the maximum share in 2022?

The kits & reagents product held the maximum share of the virus filtration industry.