Viral Vector & Plasmid DNA Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Viral Vector & Plasmid DNA Manufacturing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

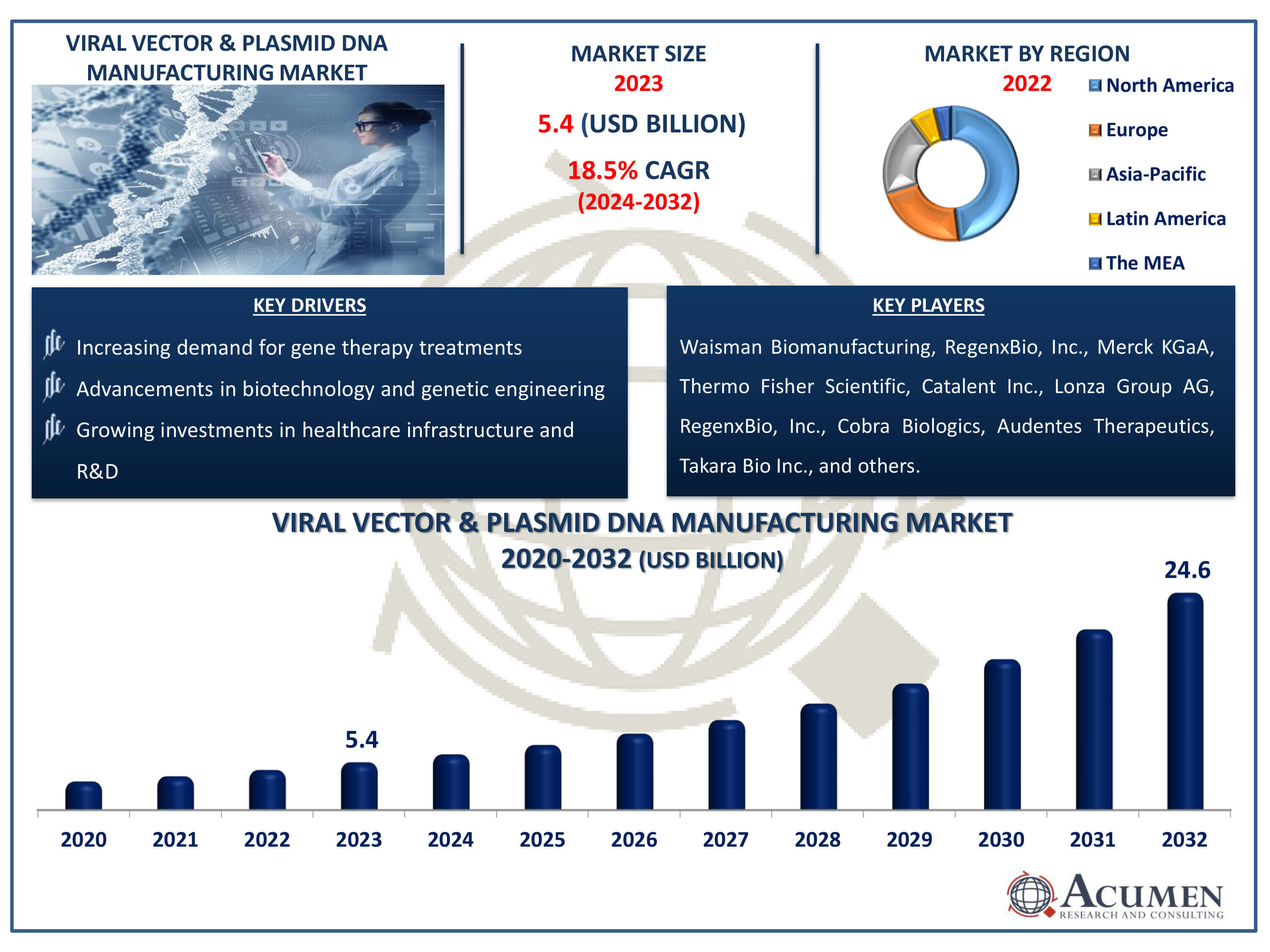

The Viral Vector & Plasmid DNA Manufacturing Market Size accounted for USD 5.4 Billion in 2023 and is estimated to achieve a market size of USD 24.6 Billion by 2032 growing at a CAGR of 18.5% from 2024 to 2032.

Viral Vector & Plasmid DNA Manufacturing Market Highlights

- Global viral vector & plasmid DNA manufacturing market revenue is poised to garner USD 24.6 billion by 2032 with a CAGR of 18.5% from 2024 to 2032

- North America viral vector & plasmid DNA manufacturing market value occupied around USD 2.6 billion in 2023

- Asia-Pacific viral vector & plasmid DNA manufacturing market growth will record a CAGR of more than 19% from 2024 to 2032

- Among workflow, the downstream manufacturing sub-segment generated 54% of share in 2023

- Based on application, the vaccinology sub-segment generated 24% of viral vector & plasmid DNA manufacturing market share in 2023

- Surge in gene therapy research and development. is a popular viral vector & plasmid DNA manufacturing market trend that fuels the industry demand

Viral vector and plasmid DNA manufacturing refer to the processes of producing genetic material used for gene therapy, vaccine development, and research. Viral vectors, derived from viruses, deliver therapeutic genes into host cells, while plasmid DNA serves as a template for gene expression. These biotechnologies enable precise genetic modifications, playing a crucial role in treating genetic disorders, cancers, and infectious diseases. Applications include gene therapy for inherited diseases, CAR-T cell therapy for cancer, and the production of mRNA vaccines. Advances in this field are driving the development of personalized medicine and innovative treatments.

Global Viral Vector & Plasmid DNA Manufacturing Market Dynamics

Market Drivers

- Increasing demand for gene therapy treatments

- Advancements in biotechnology and genetic engineering

- Growing investments in healthcare infrastructure and R&D

Market Restraints

- Regulatory challenges and safety concerns

- High production costs and complex manufacturing processes

- Limited scalability of current production methods

Market Opportunities

- Development of novel viral vector and plasmid DNA manufacturing technologies

- Expansion into emerging markets with unmet medical needs

- Collaborations and partnerships to accelerate innovation and streamline production processes

Viral Vector & Plasmid DNA Manufacturing Market Report Coverage

| Market | Viral Vector & Plasmid DNA Manufacturing Market |

| Viral Vector & Plasmid DNA Manufacturing Market Size 2023 | USD 5.4 Billion |

| Viral Vector & Plasmid DNA Manufacturing Market Forecast 2032 |

USD 24.6 Billion |

| Viral Vector & Plasmid DNA Manufacturing Market CAGR During 2024 - 2032 | 18.5% |

| Viral Vector & Plasmid DNA Manufacturing Market Analysis Period | 2020 - 2032 |

| Viral Vector & Plasmid DNA Manufacturing Market Base Year |

2023 |

| Viral Vector & Plasmid DNA Manufacturing Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Vector Type, By Workflow, By Application, By Disease, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Waisman Biomanufacturing, Merck KGaA, RegenxBio, Inc., Thermo Fisher Scientific, Catalent Inc., Lonza Group AG, RegenxBio, Inc., Cobra Biologics, Audentes Therapeutics, Takara Bio Inc., BioNTech IMFS GmbH, FUJIFILM Diosynth Biotechnologies, Virovek Incorporation, SIRION Biotech GmbH, Genezen laboratories, and Miltenyi Biotec GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Viral Vector & Plasmid DNA Manufacturing Market Insights

The burgeoning demand for gene therapy treatments is significantly propelling the growth of the viral vector and plasmid DNA manufacturing market. For instance, gene therapy represents a novel medical approach aimed at modifying a patient's genetic makeup by substituting, removing, or adding genetic material to address a specific illness. As of December 2022, the United States Food and Drug Administration (FDA) had granted approval for four gene therapy treatments for commercial distribution in the United States. Gene therapies rely on viral vectors and plasmid DNA to deliver genetic material into patient’s cells, necessitating robust production capabilities. This surge is fueled by advancements in medical research, increasing approvals of gene therapy products, and a growing channel of clinical trials. Consequently, manufacturers are scaling up operations and investing in new technologies to meet the escalating requirements. As the gene therapy sector continues to expand, the demand for high-quality viral vectors and plasmid DNA is expected to rise correspondingly.

The viral vector and plasmid DNA manufacturing market faces significant growth challenges due to high production costs and complex manufacturing processes. Producing these biological materials requires specialized equipment, stringent quality control, and skilled labor, which drive up costs. Additionally, the intricate processes involved in scaling up production without compromising product efficacy and safety further complicate manufacturing. Regulatory requirements for compliance and validation add another layer of complexity and expense. As a result, these factors collectively hinder the market's expansion and limit the accessibility of these crucial gene therapy components.

Expansion into emerging markets with unmet medical needs presents a significant growth opportunity for the vector and plasmid DNA manufacturing market. These regions often face a shortage of advanced medical treatments and technologies, creating high demand for innovative therapies and vaccines that utilize genetic engineering. By addressing these needs, companies can tap into new revenue streams while improving global health outcomes. Additionally, establishing a presence in these markets can foster local partnerships and enhance distribution networks. For instance, AGC Biologics revealed plans in October 2023 to enhance their pDNA manufacturing facility located in Germany through expansion. Overall, this strategy not only drives market growth but also contributes to addressing critical healthcare gaps in under-served areas.

Viral Vector & Plasmid DNA Manufacturing Market Segmentation

The worldwide market for viral vector & plasmid DNA manufacturing is split based on vector type, workflow, application, disease, end use, and geography.

Viral Vector & Plasmid DNA Manufacturing Vector Types

- Viral Vectors

- Adenovirus

- Retrovirus

- Adeno-Associated Virus (AAV)

- Lentivirus

- Others

- Plasmid DNA

According to viral vector & plasmid DNA manufacturing industry analysis, the viral vectors market is led by adeno-associated virus (AAV) vectors in 2023. For instance, MERCK KGaA unveiled the VirusExpress 293 Adeno-Associated Virus (AAV) Production Platform in August 2022, providing a comprehensive viral vector manufacturing solution encompassing AAV and Lentiviral vectors. AAV's prominence is driven by its safety profile, efficient gene delivery, and minimal immunogenicity, making it a preferred choice in gene therapy and medical research. This dominance reflects the growing demand for effective and reliable vectors in the development of novel therapies. AAV's versatility in targeting various tissues and its ability to achieve long-term expression further bolster its market position.

Viral Vector & Plasmid DNA Manufacturing Workflows

- Upstream Manufacturing

- Vector Amplification & Expansion

- Vector Recovery/Harvesting

- Downstream Manufacturing

- Purification

- Fill Finish

Downstream manufacturing has long been a market leader in the viral vector & plasmid DNA manufacturing industry through its advanced purification processes and cutting-edge technologies. By ensuring high purity and yield of the final products, it supports the development of innovative gene therapies and vaccines. Its commitment to quality and scalability has made it a preferred partner for biotech and pharmaceutical companies. Continuous investment in research and development keeps it at the forefront of industry advancements.

Viral Vector & Plasmid DNA Manufacturing Applications

- Antisense & RNAi Therapy

- Gene Therapy

- Cell Therapy

- Vaccinology

- Research Applications

In the viral vector & plasmid DNA manufacturing market, vaccinology dominates market due to its critical role in developing vaccines for various infectious diseases. The rise of mRNA and DNA vaccines, especially highlighted by the rapid development of COVID-19 vaccines, has significantly boosted demand. Viral vectors and plasmid DNA are essential components in vaccine production, providing the necessary genetic material for generating immune responses. This technology's adaptability and effectiveness in creating vaccines against emerging pathogens have solidified its market dominance. Additionally, ongoing research and advancements in gene therapy and personalized medicine continue to drive growth and innovation within this sector.

Viral Vector & Plasmid DNA Manufacturing Diseases

- Infectious Disease

- Genetic Disorders

- Cancer

- Others

Historically, cancer disease dominated the viral vector & plasmid DNA manufacturing business. The viral vector and plasmid DNA manufacturing sector is primarily driven by the demand for innovative cancer therapies. As cancer remains a leading cause of mortality worldwide, there is a significant focus on developing gene and cell-based treatments. These advanced therapies require viral vectors and plasmid DNA for delivering genetic material into cells, thus propelling the market. Consequently, cancer research and treatment advancements dominate this specialized manufacturing industry.

Viral Vector & Plasmid DNA Manufacturing End Uses

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

In the viral vector & plasmid DNA manufacturing market, research institutes segment dominates viral vector & plasmid DNA manufacturing market due to their extensive involvement in basic and clinical research, which drives demand for high-quality vectors and DNA products. These institutes are pivotal in the development of gene therapies, vaccines, and advanced biological studies, requiring consistent supply and innovation in viral vector and plasmid DNA technologies. Government funding and academic collaborations further bolster their capabilities and market dominance. Additionally, their focus on translational research bridges the gap between laboratory discoveries and clinical applications, reinforcing their central role in this market.

Viral Vector & Plasmid DNA Manufacturing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Viral Vector & Plasmid DNA Manufacturing Market Regional Analysis

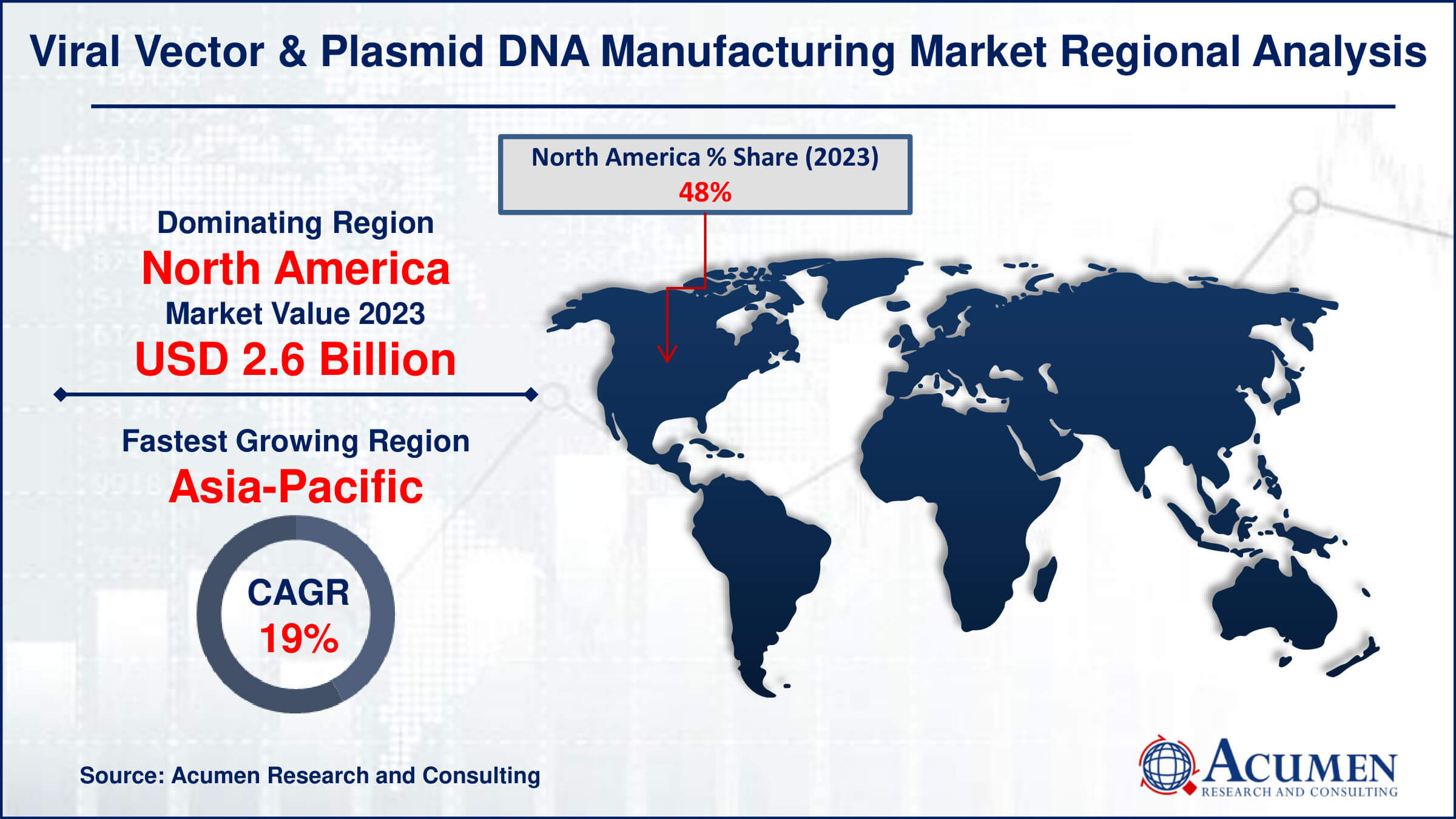

The market in North America dominates viral vector & plasmid DNA manufacturing market. North America's dominance in the viral vector and plasmid DNA manufacturing market is attributed to its robust biotechnology sector, significant investments in research and development, and a well-established regulatory framework. The region benefits from a concentration of leading biopharmaceutical companies and academic institutions driving innovation. Additionally, favorable government policies and substantial funding for gene therapy research further bolster its market leadership. This strong infrastructure supports high production capabilities and advanced technological advancements in the field.

Asia-Pacific is fastest-growing region in viral vector & plasmid DNA manufacturing market due to significant investments in biotechnology, a robust pipeline of gene therapy and vaccine development, and increasing collaborations between pharmaceutical companies and research institutions. For instance, Advaccine Biopharmaceuticals Suzhou Co., Ltd and INOVIO entered into a licensing agreement in January 2021 to distribute INO-800, a COVID-19 DNA vaccine, across greater China, encompassing Taiwan, Hong Kong, Macao, and Mainland China. Additionally, favorable government policies and the region's advanced manufacturing capabilities further drive this rapid growth.

Viral Vector & Plasmid DNA Manufacturing Market Players

Some of the top viral vector & plasmid DNA manufacturing companies offered in our report includes Waisman Biomanufacturing, Merck KGaA, RegenxBio, Inc., Thermo Fisher Scientific, Catalent Inc., Lonza Group AG, RegenxBio, Inc., Cobra Biologics, Audentes Therapeutics, Takara Bio Inc., BioNTech IMFS GmbH, FUJIFILM Diosynth Biotechnologies, Virovek Incorporation, SIRION Biotech GmbH, Genezen laboratories, and Miltenyi Biotec GmbH.

Frequently Asked Questions

How big is the vector & plasmid DNA manufacturing market?

The viral vector & plasmid DNA manufacturing market size was valued at USD 5.4 billion in 2023.

What is the CAGR of the global vector & plasmid DNA manufacturing market from 2024 to 2032?

The CAGR of viral vector & plasmid DNA manufacturing is 18.5% during the analysis period of 2024 to 2032.

Which are the key players in the vector & plasmid DNA manufacturing market?

The key players operating in the global market are including Waisman Biomanufacturing, Merck KGaA, RegenxBio, Inc., Thermo Fisher Scientific, Catalent Inc., Lonza Group AG, RegenxBio, Inc., Cobra Biologics, Audentes Therapeutics, Takara Bio Inc., BioNTech IMFS GmbH, FUJIFILM Diosynth Biotechnologies, Virovek Incorporation, SIRION Biotech GmbH, Genezen laboratories, and Miltenyi Biotec GmbH.

Which region dominated the global vector & plasmid DNA manufacturing market share?

North America held the dominating position in viral vector & plasmid DNA manufacturing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of viral vector & plasmid DNA manufacturing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global vector & plasmid DNA manufacturing industry?

The current trends and dynamics in the viral vector & plasmid DNA manufacturing industry include increasing demand for gene therapy treatments, advancements in biotechnology and genetic engineering, and growing investments in healthcare infrastructure and R&D.

Which Workflow held the maximum share in 2023?

The downstream manufacturing held the maximum share of the viral vector & plasmid DNA manufacturing industry.