Video Surveillance Storage Market | Acumen Research and Consulting

Video Surveillance Storage Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

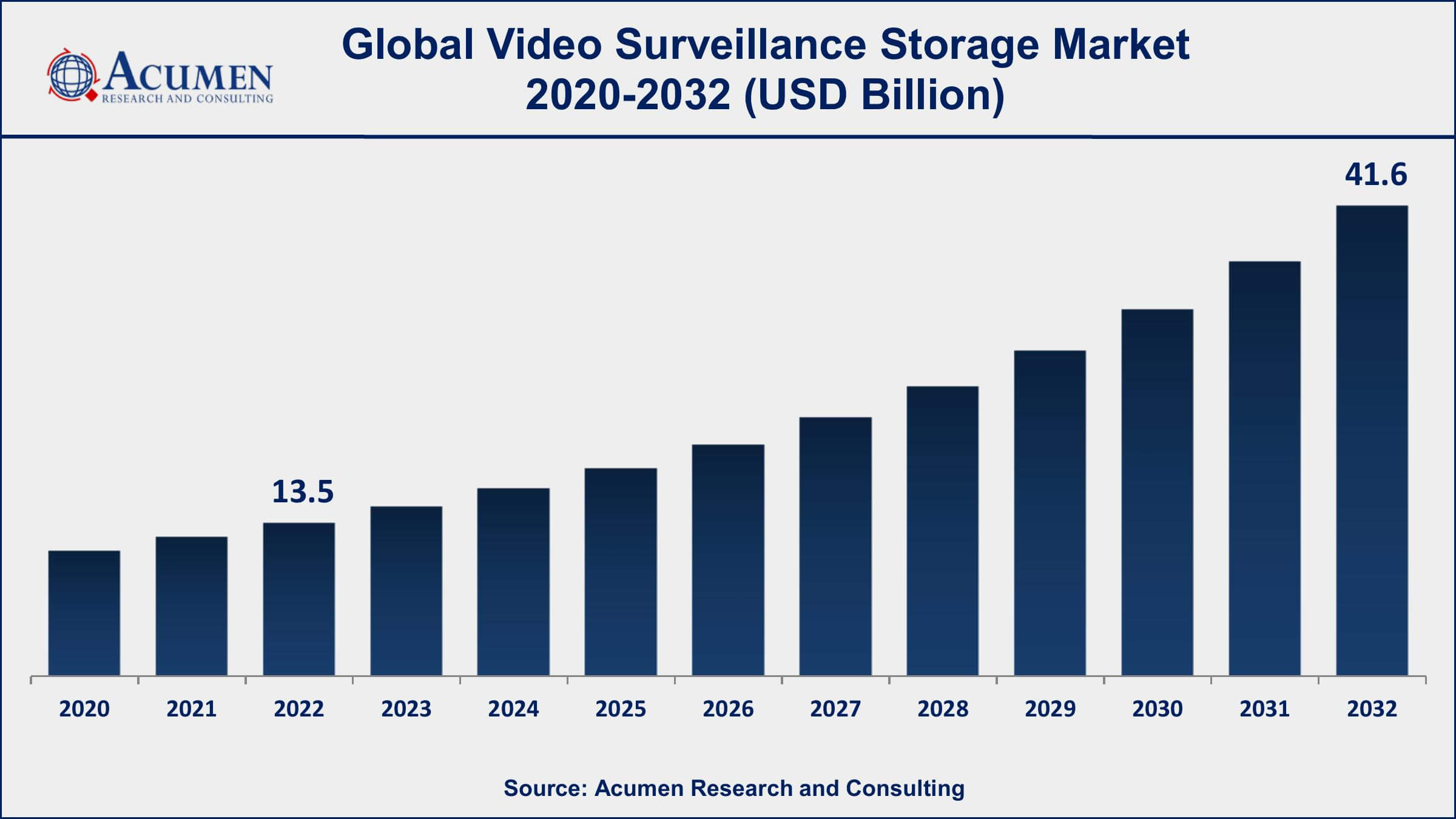

The Global Video Surveillance Storage Market Size accounted for USD 13.5 Billion in 2022 and is projected to achieve a market size of USD 41.6 Billion by 2032 growing at a CAGR of 12% from 2023 to 2032. The increasing demand for video surveillance systems, driven by growing security concerns and the need for monitoring and surveillance in various industries and applications, is one of the key factors driving the growth of the market. Additionally, the proliferation of high-definition (HD) and ultra-high-definition (UHD) cameras, which generate large volumes of data, is also contributing to the growth of the video surveillance storage market value, as storage solutions are needed to store and manage this data. Furthermore, the increasing adoption of cloud-based video surveillance storage solutions and the emergence of highly developed technologies, such as machine learning (ML) and artificial intelligence (AI), is expected to further drive the video surveillance storage market growth in the coming years.

Video Surveillance Storage Market Report Key Highlights

- Global video surveillance storage market revenue is expected to increase by USD 41.6 Billion by 2032, with a 12% CAGR from 2023 to 2032

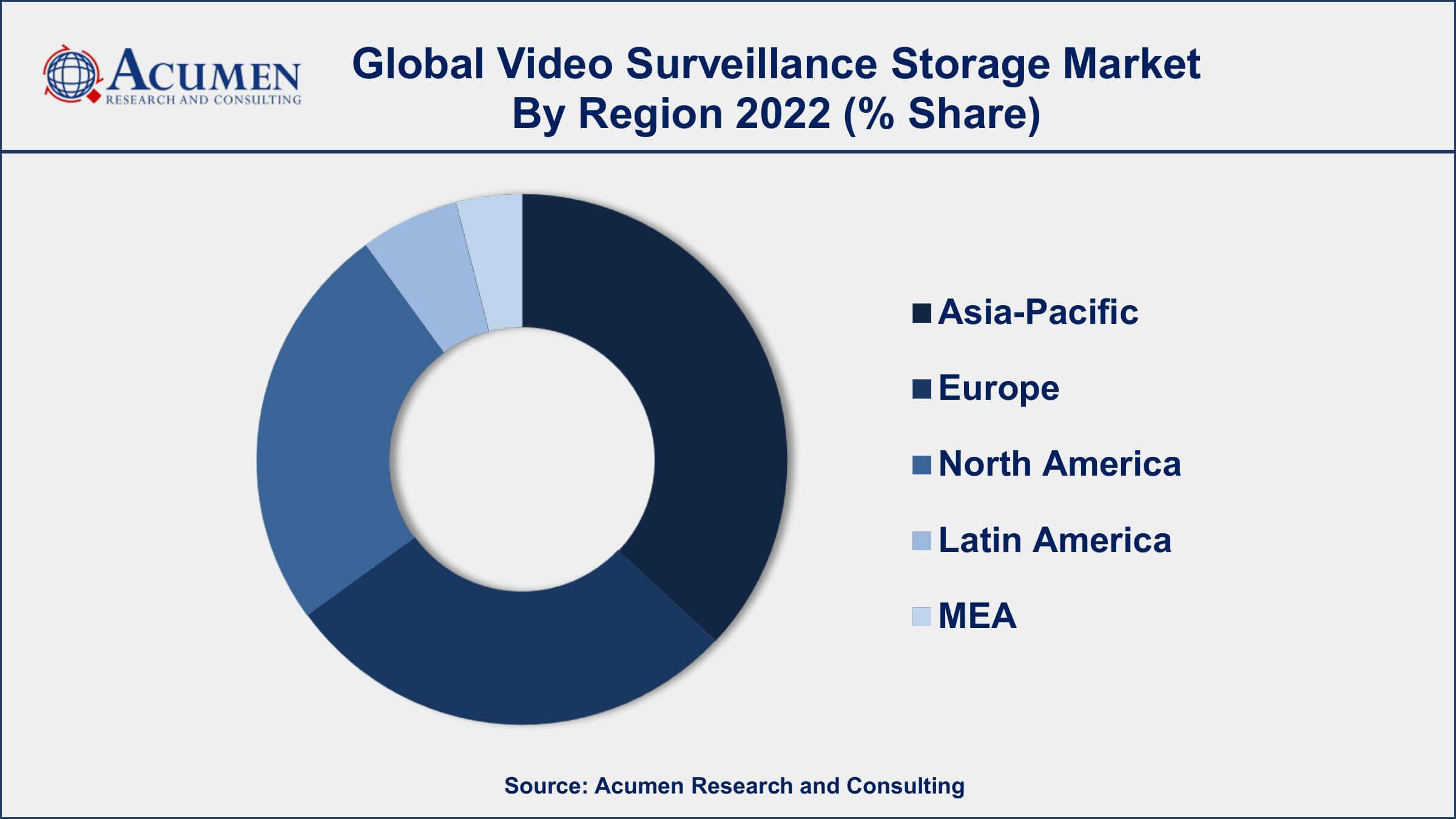

- Asia-Pacific region led with more than 35% of video surveillance storage market share in 2022

- By 2021, it is estimated that there will be 1 billion surveillance cameras in use worldwide

- The United States has the highest number of surveillance cameras per capita, with an estimated 15.28 cameras per 100 people

- The top three industries using video surveillance are government and public safety, retail, and transportation

- In 2018, the amount of data generated by surveillance cameras was 566 petabytes per day

- According to analysis, the amount of surveillance data created in 2019 will expand from 967 exabytes to 2,376 exabytes in 2022

- The video surveillance storage market is dominated by a few major players, including IBM, Dell EMC, Cisco, NetApp, and Hitachi

- Emergence of cloud-based video surveillance storage solutions, drives the video surveillance storage market size

The usage of video surveillance in various organizations across every vertical is rapidly growing, thereby building up new challenges related to storing the largely increasing volume of raw video footage and dealing with surveillance systems. Various large organizations on average use over 100 cameras, that functions 24*7 around the clock with no end in sight. The number of surveillance cameras and video analytics is expected to grow significantly and as a result our need for increased storage of video surveillance. Owing to commercial expansion, a large number of investments is witnessed in video surveillance; as higher capacity storage media is an essential requirement for such system upgrades. Over the last decade, there has been a significant advancement in storage technologies and with the emergence of IP cameras, the process of video surveillance became simplified and demand for video surveillance storage has significantly increased.

Global Video Surveillance Storage Market Trends

Market Drivers

- Increasing demand for video surveillance systems

- Proliferation of high-definition and ultra-high-definition cameras

- Emergence of cloud-based video surveillance storage solutions

- Advancements in AI and ML technologies

Market Restraints

- High cost of storage solutions

- Increasing prevalence of cyberattacks and data breaches

Market Opportunities

- Increasing adoption of video analytics

- Growing demand for hybrid storage solutions

Video Surveillance Storage Market Report Coverage

| Market | Video Surveillance Storage Market |

| Video Surveillance Storage Market Size 2022 | USD 13.5 Billion |

| Video Surveillance Storage Market Forecast 2032 | USD 41.6 Billion |

| Video Surveillance Storage Market CAGR During 2023 - 2032 | 12% |

| Video Surveillance Storage Market Analysis Period | 2020 - 2032 |

| Video Surveillance Storage Market Base Year | 2022 |

| Video Surveillance Storage Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Storage Media, By Enterprise Size, By Industry Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Western Digital Corporation, Seagate Technology PLC, Dell Technologies Inc., Hewlett Packard Enterprise Development LP, NetApp, Inc., IBM Corporation, Bosch Security Systems, Honeywell International Inc., Hitachi, Ltd., and Quantum Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The video surveillance storage market is a rapidly growing industry that is driven by the increasing demand for advanced security solutions. The market dynamics of video surveillance storage are influenced by several factors, including the growth in the use of IP cameras, the development of cloud-based storage solutions, and the increasing adoption of artificial intelligence (AI) and deep learning technologies.

The use of IP cameras has revolutionized the video surveillance storage market, as these cameras offer high-resolution video and can be easily integrated into the existing IT infrastructure. Additionally, cloud-based storage solutions have gained popularity due to their scalability, flexibility, and cost-effectiveness. With the increasing adoption of AI and deep learning technologies, video surveillance systems can now detect and respond to potential security threats in real time, leading to increased demand for storage solutions with higher processing capabilities.

However, the video surveillance storage market also faces several challenges, such as data security concerns and the need for large storage capacities to accommodate high-resolution video feeds. In response to these challenges, manufacturers are investing in research and development to develop more secure and efficient storage solutions, which is expected to drive further growth in the market.

Video Surveillance Storage Market Segmentation

The global video surveillance storage market segmentation is based on component, storage media, enterprise size, industry vertical, and geography.

Video Surveillance Storage Market By Component

- Hardware

- Network Attached Storage

- Storage Area Network

- Direct Attached Storage

- Others

- Software

- Video Analytics

- Video Management Software

- Service

- Managed Services

- Professional Services

According to the video surveillance storage industry analysis, the hardware segment is dominating the market in 2022. The video surveillance storage market in the hardware segment refers to the physical equipment used to store video footage captured by surveillance cameras. This includes devices such as Network Video Recorders (NVRs), Digital Video Recorders (DVRs), and storage servers. The demand for video surveillance storage in the hardware segment has been increasing due to the growing need for reliable and high-capacity storage solutions to store video footage from surveillance cameras. This is driven by various factors such as increasing security concerns, the need for real-time monitoring, and the growth of smart cities.

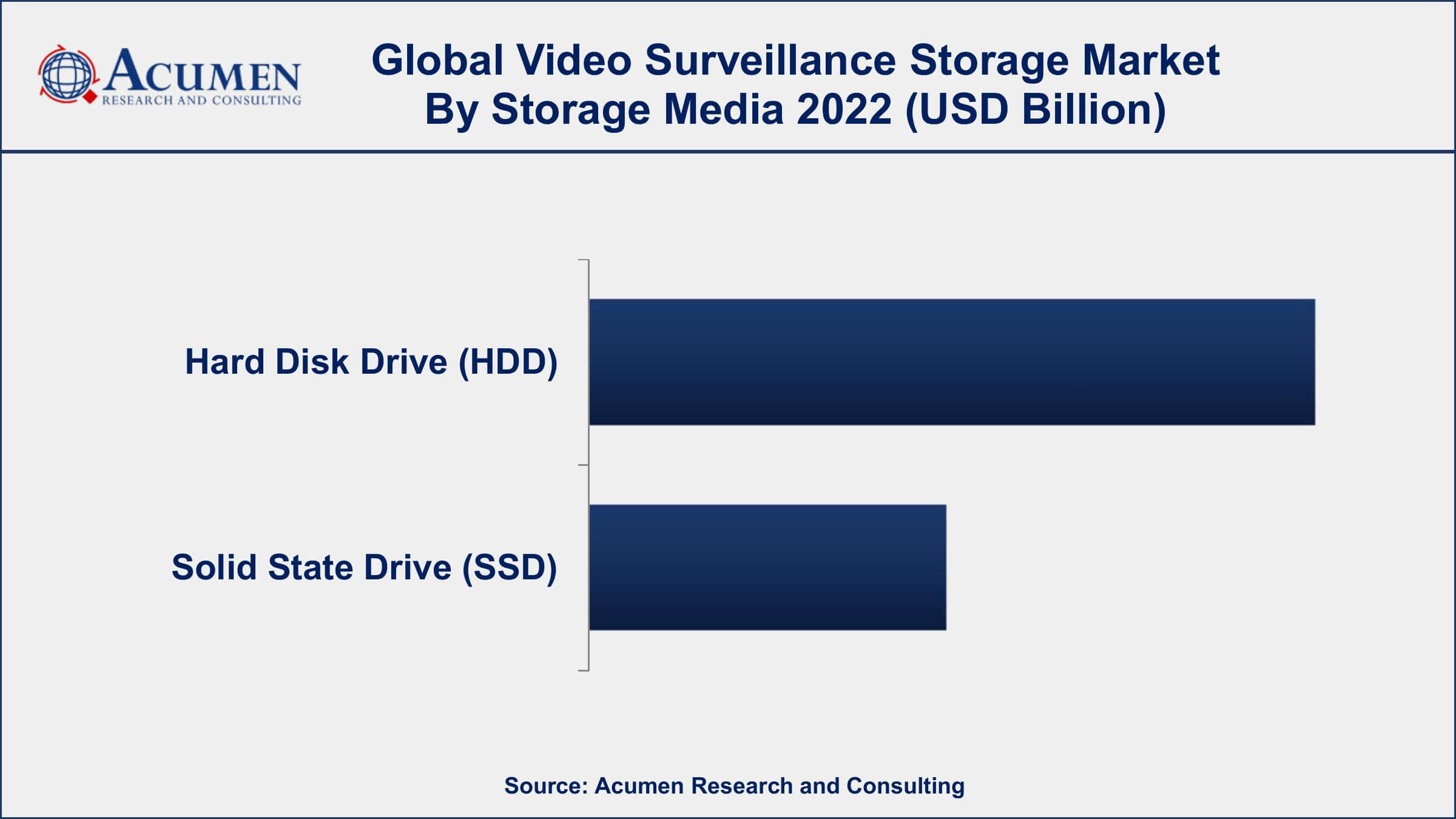

Video Surveillance Storage Market By Storage Media

- Hard Disk Drive (HDD)

- Solid State Drive (SSD)

In terms of storage media, the hard disk drive (HDD) segment accounted for the largest market share in 2022. HDDs are the most commonly used storage technology for video surveillance, as they offer a balance of high capacity and affordability. The demand for video surveillance storage in HDDs has been growing due to the increasing need for high-capacity storage solutions that can handle the large amounts of video footage generated by surveillance cameras. In addition, the decreasing cost of HDDs and the increasing demand for higher-resolution cameras that generate larger video files have also contributed to the growth of this market segment.

Video Surveillance Storage Market By Enterprise Size

- Large Enterprises

- SMEs

According to the video surveillance storage market forecast, the SME segment is predicted to increase significantly in the market during the predicted years. SMEs are increasingly adopting video surveillance systems to improve security, monitor employee productivity, and prevent theft and vandalism. The video surveillance storage market in SMEs is driven by factors such as the increasing need for cost-effective storage solutions, the growth of cloud-based storage solutions, and the increasing adoption of IP-based surveillance cameras. These factors have led to the emergence of various storage solutions such as Network Video Recorders (NVRs), Digital Video Recorders (DVRs), and cloud-based storage solutions.

Video Surveillance Storage Market By Industry Vertical

- Media and Entertainment

- Education

- Transportation and Logistics

- BFSI

- Retail

- Manufacturing

- Government and Defense

- Healthcare and Pharmaceutical

- Others

In terms of industry verticals, the government and defense segment is expected to grow rapidly in the market over the next several years. The government and defense sector is one of the biggest users of video surveillance storage systems. In this sector, video surveillance storage systems are used to store and analyze large amounts of video footage captured by surveillance cameras in critical locations such as borders, government buildings, military bases, and public spaces. Video surveillance storage solutions offer advanced features such as real-time video analytics, facial recognition, and object tracking, which help government agencies and defense organizations to detect and respond to security threats effectively. With the rising threat of terrorism and cross-border crime, government and defense agencies are increasingly investing in video surveillance storage solutions. The increasing adoption of highly developed technologies such as the cloud computing, Internet of Things (IoT), and AI is projected to drive the growth of the video surveillance storage market in the government and defense sectors in the coming years.

Video Surveillance Storage Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Video Surveillance Storage Market Regional Analysis

The Asia-Pacific region is dominating the video surveillance storage market due to the increasing demand for advanced surveillance solutions for security and monitoring purposes. The growing concerns for safety and security across industries such as banking, healthcare, and government have propelled the demand for high-resolution video surveillance systems. Additionally, the region has a high adoption rate of advanced technologies, such as the Internet of Things (IoT) and artificial intelligence, which have further driven the growth of the video surveillance storage market.

Another factor contributing to the domination of the Asia-Pacific region in the video surveillance storage market is the increasing government initiatives for public safety and security. Countries such as China and India have initiated large-scale surveillance projects, which require high-capacity and reliable storage solutions to store and analyze the massive amounts of data generated. Furthermore, the increasing urbanization and smart city initiatives in the region have also fueled the demand for video surveillance storage solutions to manage and analyze the vast amount of video data generated from smart city infrastructure.

Video Surveillance Storage Market Player

Some of the top video surveillance storage market companies offered in the professional report include Western Digital Corporation, Seagate Technology PLC, Dell Technologies Inc., Hewlett Packard Enterprise Development LP, NetApp, Inc., IBM Corporation, Bosch Security Systems, Honeywell International Inc., Hitachi, Ltd., and Quantum Corporation.

Frequently Asked Questions

How big is the video surveillance storage market?

The video surveillance storage market size was USD 13.5 Billion in 2022.

What is the CAGR of the global video surveillance storage market during forecast period of 2023 to 2032?

The CAGR of video surveillance storage market is 12% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global video surveillance storage market are Western Digital Corporation, Seagate Technology PLC, Dell Technologies Inc., Hewlett Packard Enterprise Development LP, NetApp, Inc., IBM Corporation, Bosch Security Systems, Honeywell International Inc., Hitachi, Ltd., and Quantum Corporation.

Which region held the dominating position in the global video surveillance storage market?

Asia-Pacific held the dominating position in video surveillance storage market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for video surveillance storage market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global video surveillance storage market?

The current trends and dynamics in the video surveillance storage industry include the increasing demand for video surveillance systems, and proliferation of high-definition and ultra-high-definition cameras.

Which component held the maximum share in 2022?

The hardware component held the maximum share of the video surveillance storage market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date