Veterinary Diagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Veterinary Diagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

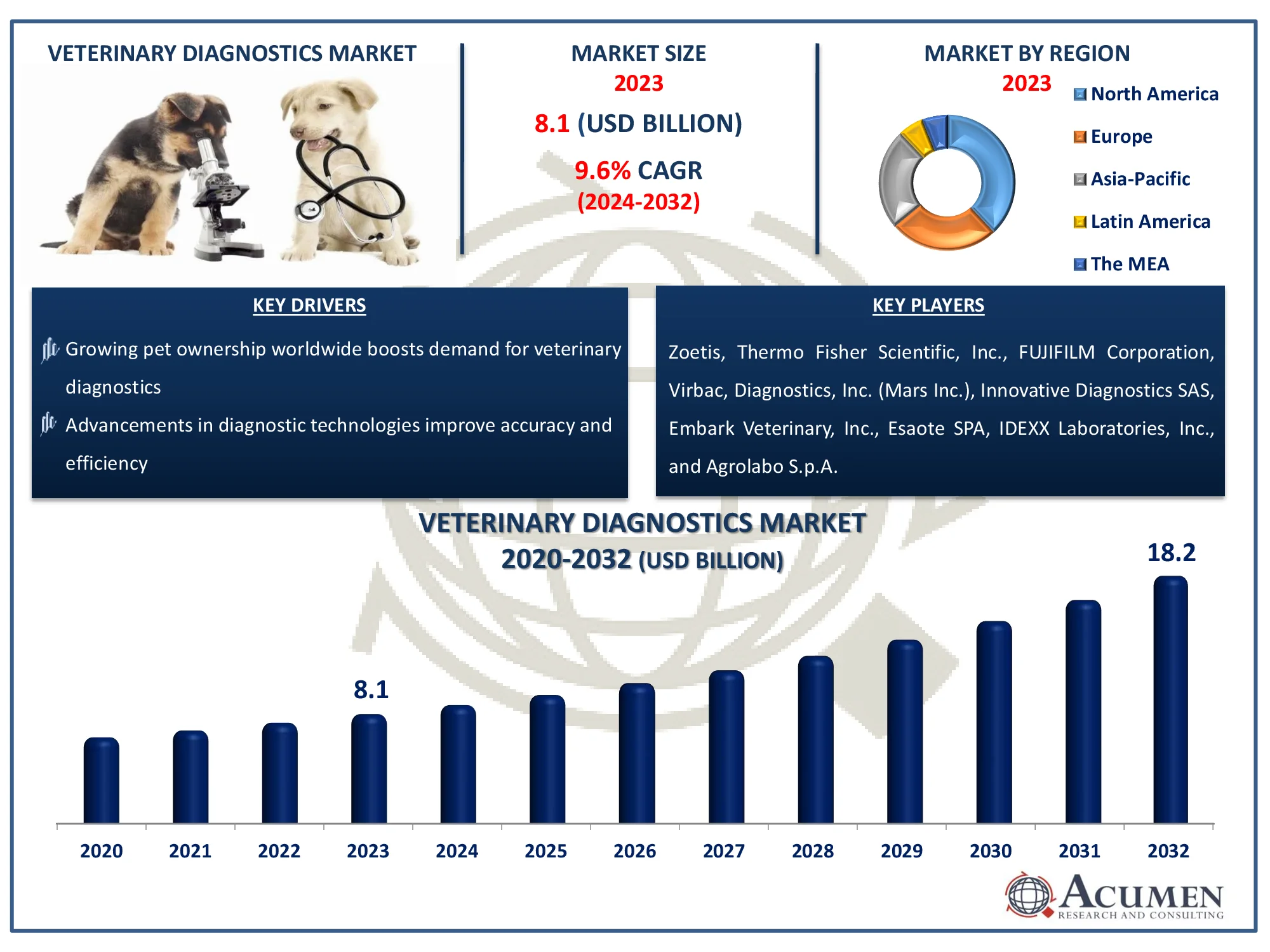

The Global Veterinary Diagnostics Market Size accounted for USD 8.1 Billion in 2023 and is estimated to achieve a market size of USD 18.2 Billion by 2032 growing at a CAGR of 9.6% from 2024 to 2032.

Veterinary Diagnostics Market Highlights

- Global veterinary diagnostics market revenue is poised to garner USD 18.2 billion by 2032 with a CAGR of 9.6% from 2024 to 2032

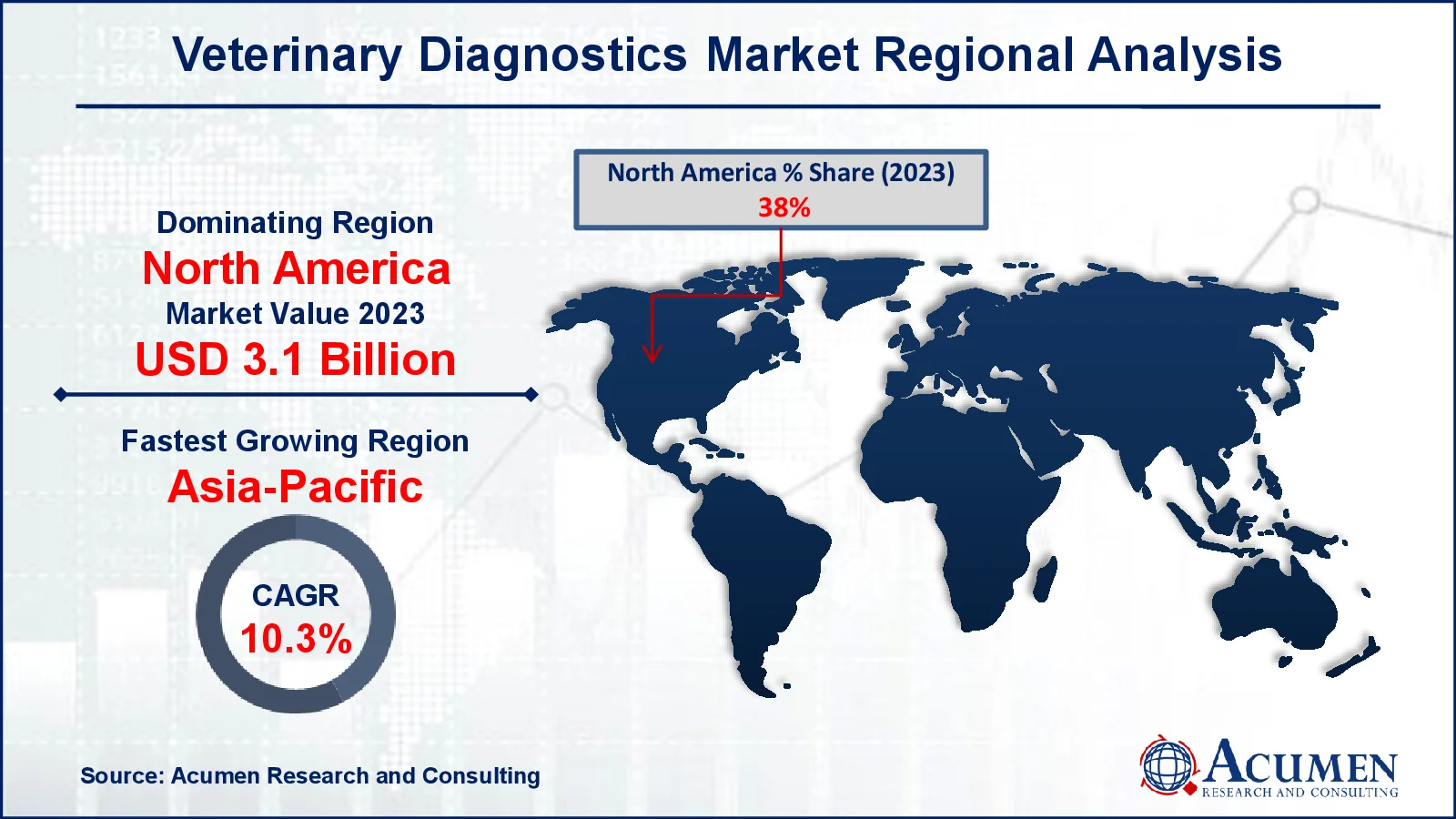

- North America veterinary diagnostics market value occupied around USD 3.1 billion in 2023

- Asia-Pacific veterinary diagnostics market growth will record a CAGR of more than 10.3% from 2024 to 2032

- Among product, the consumables, reagents & kits sub-segment generated noteworthy revenue in 2023

- Based on species, the ovine sub-segment generated significant veterinary diagnostics market share in 2023

- Expanding telemedicine in veterinary care offers diagnostic innovations is a popular veterinary diagnostics market trend that fuels the industry demand

Veterinary diagnostics are tests that aid in the identification and determination of various animal diseases. These tests use a variety of methodologies involving samples of feces, blood, and tissue. Veterinary diagnostics makes full use of the most recent tools and methods designed for human diagnostics. Furthermore, the industry's development has been expedited by the increased usage of IVD testing and new techniques such as nanotechnology and fluorometric diagnostics. Furthermore, there has been an increase in demand for internal diagnostic devices and technology at research facilities and laboratories. These elements help to drive revenue growth in this industry.

Global Veterinary Diagnostics Market Dynamics

Market Drivers

- Growing pet ownership worldwide boosts demand for veterinary diagnostics

- Advancements in diagnostic technologies improve accuracy and efficiency

- Rising prevalence of zoonotic diseases drives veterinary testing

- Increased awareness of animal healthcare fuels market growth

Market Restraints

- High cost of veterinary diagnostic procedures limits market adoption

- Lack of skilled professionals in emerging regions hampers growth

- Stringent regulatory requirements slow product approvals

Market Opportunities

- Growing demand for point-of-care diagnostic devices presents market potential

- Rising adoption of pet insurance supports increased diagnostic testing

- Emerging markets offer untapped growth opportunities for veterinary diagnostics

Veterinary Diagnostics Market Report Coverage

| Market | Veterinary Diagnostics Market |

| Veterinary Diagnostics Market Size 2022 |

USD 8.1 Billion |

| Veterinary Diagnostics Market Forecast 2032 | USD 18.2 Billion |

| Veterinary Diagnostics Market CAGR During 2023 - 2032 | 9.6% |

| Veterinary Diagnostics Market Analysis Period | 2020 - 2032 |

| Veterinary Diagnostics Market Base Year |

2022 |

| Veterinary Diagnostics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Species, By Testing Category, By Disease Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Zoetis, Thermo Fisher Scientific, Inc., FUJIFILM Corporation, Virbac, Antech Diagnostics, Inc. (Mars Inc.), Innovative Diagnostics SAS, Embark Veterinary, Inc., Esaote SPA, IDEXX Laboratories, Inc., and Agrolabo S.p.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Veterinary Diagnostics Market Insights

Growth has been ascribed to several variables including an increase in the spending on animal health, incidence of zoonotic disease and the amount in developing and developing areas of veterinarian professionals and their incomes. The veterinary diagnostics market is generally divided into two classifications: cattle and pets. In the following years, sophisticated diagnostic techniques, such as analytical services, molecular testing, immunodiagnostics and clinical chemistry are projected to grow considerably in the industry, and are now widely used in the veterinary diagnostics market.

The firms are expected to invest more in the development of their production installations, which, in turn, should affect demand and veterinary diagnostics worldwide. Most of these trials are biological tests, such as quick trials needing, among other things, enzymes and antibodies, tissue samples and blood and cell culture. These experiments are extremely vulnerable and require knowledge for analysis and performance. There are often false results or incorrect evaluations made while conducting the experiments which could prove fatal to the pets. This makes the diagnostic element of animal health and well-being extremely important.

Increased incidences of zoonotic and food-borne diseases around the globe have motivated firms to create effective diagnostic alternatives for both animals and animals. In addition, increasing livestock ownership, expenses in animal care and less expensive regulation dynamics for diagnostic approvals support the development of accompanying animal diagnostics.

Veterinary Diagnostics Market Segmentation

The worldwide market for veterinary diagnostics is split based on product, species, testing category, disease type, end use, and geography.

Veterinary Diagnostics Market By Product

- Instruments & Devices

- Consumables, Reagents & Kits

According to veterinary diagnostics industry analysis, the greatest development for consumables is anticipated in the forecast era with a notable CAGR. A profound understanding of the demand of such goods in veterinary clinics, hospitals, laboratories, etc. determines the general market for veterinary diagnostics. In addition, demand for point diagnostics of animal animals on the market is on the rise. Few of the diagnoses of care for accompanying pets are blood glucose monitors, pregnancy kits, strips of urinalysis, etc. While most diagnostic tests for livestock continue to be limited to laboratories because of the elevated sensitivity demands and the efficacy of their disease tests. Tonometer, laryngoscopes, centrifuges and analyzers are amongst those diagnostic tools and tools used for animal disease testing. It is projected that the future revenues of this segment will rise significantly owing to its greater consumption, utilization and disposal rates. Therefore, in the coming years, this segment will develop significantly.

Veterinary Diagnostics Market By Species

- Camelid

- Bovine

- Canine and Feline

- Caprine

- Avian

- Ovine

- Equine

- Porcine

- Others

The ovine segment is expected to dominate the veterinary diagnostics market due to the high frequency of diseases affecting sheep and goats, combined with the growing emphasis on livestock health management. Sheep are an important element of the worldwide agriculture economy for meat, wool, and dairy products, therefore keeping them healthy is a responsibility. Advanced diagnostic methods are increasingly being utilized to treat diseases like bluetongue, foot rot, and gastrointestinal infections, all of which have an influence on herd productivity and sustainability. Furthermore, government attempts to encourage sheep husbandry and disease prevention in developing countries stimulate demand for ovine diagnostics. Innovations in point-of-care testing and molecular diagnostics for ovine species are also increasing the need for advanced diagnostic solutions.

Veterinary Diagnostics Market By Testing Category

- Bacteriology

- Analytical Services

- Diagnostic Imaging

- Immunoassays

- Pathology

- Molecular Diagnostics

- Parasitology

- Virology

- Serology

- Others

Immunoassays are predicted to lead the veterinary diagnostics market in terms of testing category due to their broad applicability, accuracy, and reliability in identifying infectious infections, hormone imbalances, and other animal health issues. These assays are especially useful for identifying infections, evaluating immune responses, and assuring effective disease control in companion and livestock animals. The rising prevalence of zoonotic illnesses has increased the demand for immunoassays to protect both animal and human health. Furthermore, technological improvements have resulted in the creation of quick, user-friendly kits, making immunoassays the favored choice among veterinarians. Their capacity to give precise and rapid results has cemented their place as a cornerstone of diagnostic methods in veterinary healthcare worldwide.

Veterinary Diagnostics Market By Disease Type

- Non-Infectious

- Infectious

- General Ailments

- Hereditary, Congenital and Acquired

- Structural and Functional

Animal diseases have a significant impact on both human and animal populations, especially during epidemics or when infections spread across animals or from animals to humans. Common animal illnesses include brucellosis, influenza, foot-and-mouth disease, respiratory and reproductive diseases, herpes, and tuberculosis.

Non-infectious presently account notable of the market and are expected to grow steadily over the veterinary diagnostics market forecast period. This increase is being fueled by advanced technology that improve animal disease diagnosis. For example, the Lab-on-a-Chip may check human fluids such as blood, urine, and milk for electrical anomalies, allowing for early diagnosis and treatment. These advancements help to improve animal health management and disease prevention efforts.

Veterinary Diagnostics Market By End Use

- Veterinary Hospitals and Clinics

- Research Institutes and Universities

- Laboratories

- Point-Of-Care/In-House Testing

Nowadays, advanced hospital analysts are utilized in veterinary hospitals and clinics, which contributes to the market's revenue growth. End users, such as pet owners, benefit greatly from modern technological tools like in-house analyzers and point-of-service diagnostics for their convenience and quick results.

Point-of-care/in-house testing is also expected to grow over the next few years, with a notable CAGR of the market. Today, technology improves on a daily basis, providing medical professionals and veterinarians with huge opportunities to improve animal health.

Veterinary Diagnostics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Veterinary Diagnostics Market Regional Analysis

In the veterinary diagnostics market, US has the biggest market share in the North American market. This may be because accompanying pets in this region are increasingly adopting, as animal healthcare expenditure has risen. In addition, many business players and well-established infrastructures exist in these areas. In addition, the resulting greater share is also attributed to the assistance provided by government organizations combining greater R&D investment. There are also anticipated to be strong growth opportunities on this market from emerging markets, like China, India and LA. Asian economies in this sector are thought to have the greatest development veterinary diagnostics industry forecast period.

Veterinary Diagnostics Market Players

Some of the top veterinary diagnostics companies offered in our report includes Zoetis, Thermo Fisher Scientific, Inc., FUJIFILM Corporation, Virbac, Antech Diagnostics, Inc. (Mars Inc.), Innovative Diagnostics SAS, Embark Veterinary, Inc., Esaote SPA, IDEXX Laboratories, Inc., and Agrolabo S.p.A.

Frequently Asked Questions

How big is the veterinary diagnostics market?

The veterinary diagnostics market size was valued at USD 8.1 billion in 2023.

What is the CAGR of the global veterinary diagnostics market from 2024 to 2032?

The CAGR of veterinary diagnostics is 9.6% during the analysis period of 2024 to 2032.

Which are the key players in the veterinary diagnostics market?

The key players operating in the global market are including Zoetis, Thermo Fisher Scientific, Inc., FUJIFILM Corporation, Virbac, Antech Diagnostics, Inc. (Mars Inc.), Innovative Diagnostics SAS, Embark Veterinary, Inc., Esaote SPA, IDEXX Laboratories, Inc., and Agrolabo S.p.A.

Which region dominated the global veterinary diagnostics market share?

North America held the dominating position in veterinary diagnostics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of veterinary diagnostics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global veterinary diagnostics industry?

The current trends and dynamics in the veterinary diagnostics industry include growing pet ownership worldwide boosts demand for veterinary diagnostics, advancements in diagnostic technologies improve accuracy and efficiency, rising prevalence of zoonotic diseases drives veterinary testing, and increased awareness of animal healthcare fuels market growth.

Which product held the maximum share in 2023?

The consumables, reagents & kits held the maximum share of the veterinary diagnostics industry.