Vegetal Natural Fiber Market | Acumen Research and Consulting

Vegetal Natural Fiber Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

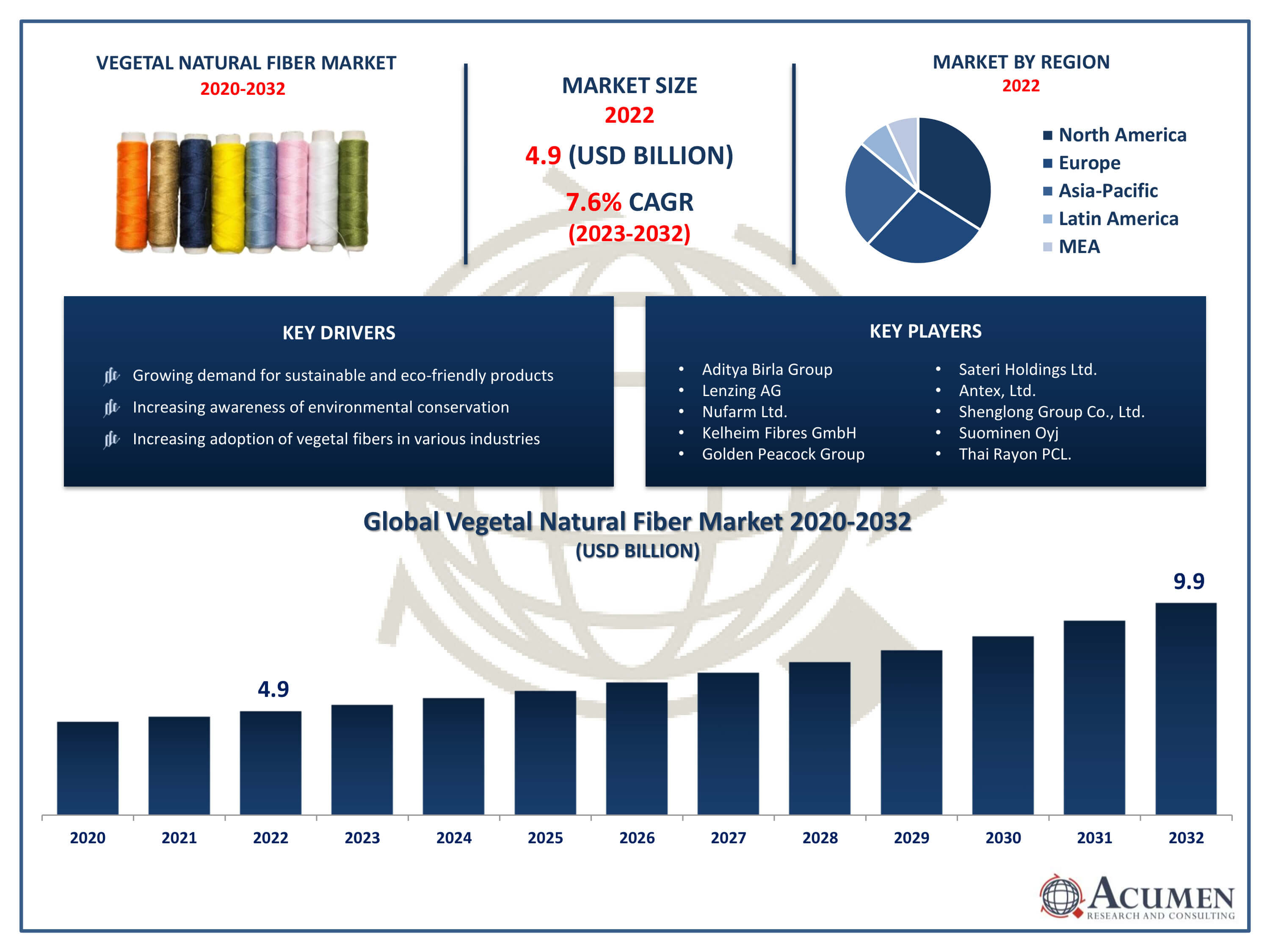

The Global Vegetal Natural Fiber Market Size accounted for USD 4.9 Billion in 2022 and is projected to achieve a market size of USD 9.9 Billion by 2032 growing at a CAGR of 7.6% from 2023 to 2032.

Vegetal Natural Fiber Market Highlights

- Global Vegetal Natural Fiber Market revenue is expected to increase by USD 9.9 Billion by 2032, with a 7.6% CAGR from 2023 to 2032

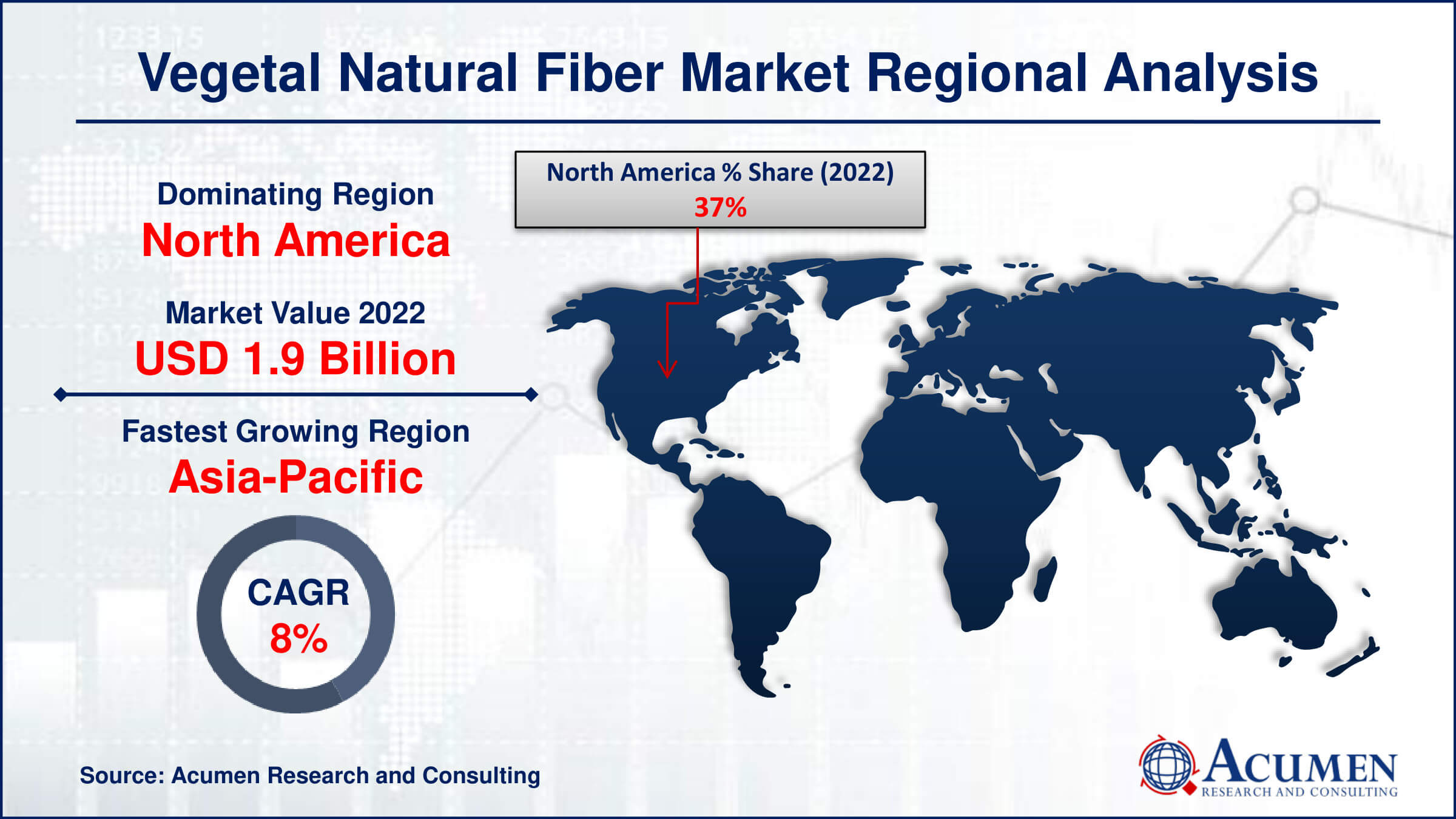

- North America region led with more than 37% of Vegetal Natural Fiber Market share in 2022

- Asia-Pacific Vegetal Natural Fiber Market growth will record a CAGR of more than 8.3% from 2023 to 2032

- By product, the cotton fibers segment captured more than 31% of revenue share in 2022.

- By application, the textiles segment generated over 34% of revenue share in 2022

- Growing demand for sustainable and eco-friendly products, drives the Vegetal Natural Fiber Market value

Vegetal natural fibers are derived from plant sources and have been utilized by humans for various applications for centuries. These fibers are extracted from plants like cotton, jute, flax, hemp, and sisal, among others. Each type of vegetal fiber possesses unique properties that make them suitable for specific uses. For example, cotton is known for its softness and breathability, making it a popular choice for textiles, while jute is valued for its strength and durability, often used in packaging materials and textiles. The eco-friendly and biodegradable nature of vegetal natural fibers aligns with the growing global emphasis on sustainable and environmentally friendly products.

In recent years, the market for vegetal natural fibers has experienced significant growth, primarily driven by increased awareness of environmental issues and a shift towards sustainable practices. Consumers are becoming more conscious of the environmental impact of their purchasing decisions, leading to a surge in demand for products made from natural and renewable resources. Additionally, industries such as fashion, automotive, and construction are increasingly adopting vegetal natural fibers as a substitute for synthetic materials to reduce their carbon footprint. Government regulations and initiatives promoting sustainable practices further contribute to the expansion of the vegetal natural fiber market.

Global Vegetal Natural Fiber Market Trends

Market Drivers

- Growing demand for sustainable and eco-friendly products

- Increasing awareness of environmental conservation

- Adoption of vegetal fibers in various industries for reduced carbon footprint

- Government regulations favoring sustainable practices

- Shift in consumer preferences towards natural and renewable resources

Market Restraints

- Limited scalability and production challenges

- Price competitiveness with synthetic alternatives

Market Opportunities

- Innovations in processing technologies for improved efficiency

- Development of new plant-based fiber varieties with enhanced properties

Vegetal Natural Fiber Market Report Coverage

| Market | Vegetal Natural Fiber Market |

| Vegetal Natural Fiber Market Size 2022 | USD 4.9 Billion |

| Vegetal Natural Fiber Market Forecast 2032 | USD 9.9 Billion |

| Vegetal Natural Fiber Market CAGR During 2023 - 2032 | 7.6% |

| Vegetal Natural Fiber Market Analysis Period | 2020 - 2032 |

| Vegetal Natural Fiber Market Base Year |

2022 |

| Vegetal Natural Fiber Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By Processing Methods, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aditya Birla Group, Lenzing AG, Shandong Ruyi Textile Group Co., Ltd., Nufarm Ltd., Kelheim Fibres GmbH, Golden Peacock Group, Shanghai Chemical Industries Co., Ltd., Sateri Holdings Ltd., Antex, Ltd., Shenglong Group Co., Ltd., Suominen Oyj, and Thai Rayon PCL. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Vegetal natural fibers are fibers derived from plant sources, encompassing a diverse range of materials obtained from plants such as cotton, jute, flax, hemp, and sisal. The extraction process involves harvesting, separating, and processing plant fibers to create versatile materials with distinct properties. These fibers are characterized by their natural origin, biodegradability, and sustainability, making them an environmentally friendly alternative to synthetic materials. The applications of vegetal natural fibers are extensive and span various industries. In the textile industry, cotton is widely used for clothing and home textiles due to its softness and breathability. Jute, known for its strength and durability, finds applications in packaging materials, floor coverings, and textiles. Flax and hemp fibers are utilized in the production of high-quality linen fabrics, while sisal is employed in rope and twine manufacturing.

The vegetal natural fiber market has witnessed robust growth in recent years, fueled by the increasing global emphasis on sustainability and eco-friendly practices. As consumers become more environmentally conscious, there has been a notable shift towards products made from renewable resources, driving the demand for vegetal fibers derived from plants like cotton, jute, and hemp. The fashion industry, in particular, has played a significant role in propelling this market forward, with many apparel brands and manufacturers opting for vegetal natural fibers to meet the rising demand for sustainable and ethically produced clothing. Moreover, the market growth is supported by a surge in government initiatives and regulations promoting sustainable practices across various industries. Policies favoring the use of eco-friendly materials have encouraged businesses to integrate vegetal natural fibers into their products, contributing to reduced environmental impact. Additionally, technological advancements in processing methods and innovations in developing new varieties of plant-based fibers with enhanced properties further propel the market forward.

Vegetal Natural Fiber Market Segmentation

The global Vegetal Natural Fiber Market segmentation is based on product, application, processing methods, and geography.

Vegetal Natural Fiber Market By Product

- Cotton Fibers

- Hemp Fibers

- Jute Fibers

- Sisal Fibers

- Flax Fibers (Linens)

- Coconut Fibers (Coir)

According to the vegetal natural fiber industry analysis, the cotton fibers segment accounted for the largest market share in 2022. Cotton is a widely cultivated plant, and its fibers are valued for their softness, breathability, and absorbency, making them ideal for a range of products, including textiles, apparel, and home furnishings. The fashion industry, in particular, has been a major contributor to the growth of the cotton fibers segment, with many consumers opting for cotton clothing due to its comfort and natural feel. The market growth of cotton fibers is also supported by the increasing awareness of sustainable and organic practices. As consumers prioritize environmentally friendly products, there is a growing demand for organic cotton, which is cultivated without synthetic pesticides and fertilizers. This trend aligns with the broader movement towards sustainable and ethical fashion, further boosting the market for cotton fibers.

Vegetal Natural Fiber Market By Application

- Textiles

- Construction Materials

- Automotive Industry

- Agricultural and Horticultural

- Packaging

- Geotextiles

In terms of applications, the textiles segment is expected to witness significant growth in the coming years. Consumers are increasingly seeking clothing and textiles made from plant-derived fibers like cotton, flax, and hemp due to their natural properties and minimal environmental impact. These fibers are prized for their breathability, comfort, and biodegradability, aligning with the growing awareness of environmental issues and a preference for eco-conscious products. The adoption of vegetal natural fibers in the textiles segment is also influenced by the fashion industry's commitment to sustainability. Many clothing brands and manufacturers are incorporating these fibers into their collections to meet the demand for environmentally friendly and ethically produced garments. Furthermore, the use of vegetal fibers is not limited to traditional textiles but extends to innovative applications, such as eco-friendly packaging materials and non-woven fabrics.

Vegetal Natural Fiber Market By Processing Methods

- Retting

- Spinning

- Decortication

- Composite Manufacturing

- Weaving and Knitting

According to the vegetal natural fiber market forecast, the retting segment is expected to witness significant growth in the coming years. Retting is the process of separating fibers from the inner woody core of the plant through microbial or enzymatic action. This method is vital in enhancing the quality and characteristics of the fibers, making them suitable for various end-use applications. The demand for retting services has witnessed growth parallel to the increasing adoption of plant-based fibers in industries such as textiles, automotive, and construction. As the emphasis on sustainable and eco-friendly practices continues to rise, the retting segment has become a focal point for innovation. Efforts are being directed toward developing environmentally friendly retting methods that minimize water usage and reduce the environmental impact associated with traditional retting processes.

Vegetal Natural Fiber Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Vegetal Natural Fiber Market Regional Analysis

North America has emerged as a dominating region in the vegetal natural fiber market, propelled by several factors contributing to the growth and prominence of the industry. One key factor is the region's strong emphasis on sustainable practices and environmental awareness. Consumers in North America are increasingly seeking products that align with eco-friendly values, driving the demand for vegetal natural fibers. This trend is particularly evident in the fashion and textile industries, where there is a growing preference for clothing made from plant-derived fibers like cotton and hemp. Moreover, the agricultural landscape in North America is conducive to the cultivation of various plants that serve as sources for vegetal natural fibers. The United States, for instance, is a major producer of cotton, one of the most widely used plant fibers in the world. The region's advanced agricultural practices and infrastructure contribute to the efficient cultivation and processing of vegetal fibers. Additionally, the North American market benefits from ongoing research and development efforts aimed at improving the sustainability and productivity of fiber crops, ensuring the region's continued dominance in the vegetal natural fiber market.

Vegetal Natural Fiber Market Player

Some of the top vegetal natural fiber market companies offered in the professional report include Aditya Birla Group, Lenzing AG, Shandong Ruyi Textile Group Co., Ltd., Nufarm Ltd., Kelheim Fibres GmbH, Golden Peacock Group, Shanghai Chemical Industries Co., Ltd., Sateri Holdings Ltd., Antex, Ltd., Shenglong Group Co., Ltd., Suominen Oyj, and Thai Rayon PCL.

Frequently Asked Questions

How big is the vegetal natural fiber market?

The vegetal natural fiber market size was USD 4.9 Billion in 2022.

What is the CAGR of the global vegetal natural fiber market from 2023 to 2032?

The CAGR of vegetal natural fiber is 7.6% during the analysis period of 2023 to 2032.

Which are the key players in the vegetal natural fiber market?

The key players operating in the global market are including Aditya Birla Group, Lenzing AG, Shandong Ruyi Textile Group Co., Ltd., Nufarm Ltd., Kelheim Fibres GmbH, Golden Peacock Group, Shanghai Chemical Industries Co., Ltd., Sateri Holdings Ltd., Antex, Ltd., Shenglong Group Co., Ltd., Suominen Oyj, and Thai Rayon PCL.

Which region dominated the global vegetal natural fiber market share?

North America held the dominating position in vegetal natural fiber industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of vegetal natural fiber during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global vegetal natural fiber industry?

The current trends and dynamics in the vegetal natural fiber industry include growing demand for sustainable and eco-friendly products, increasing awareness of environmental conservation, and adoption of vegetal fibers in various industries for reduced carbon footprint.

Which application held the maximum share in 2022?

The textiles application held the maximum share of the vegetal natural fiber industry.