Vegan Meat Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Vegan Meat Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

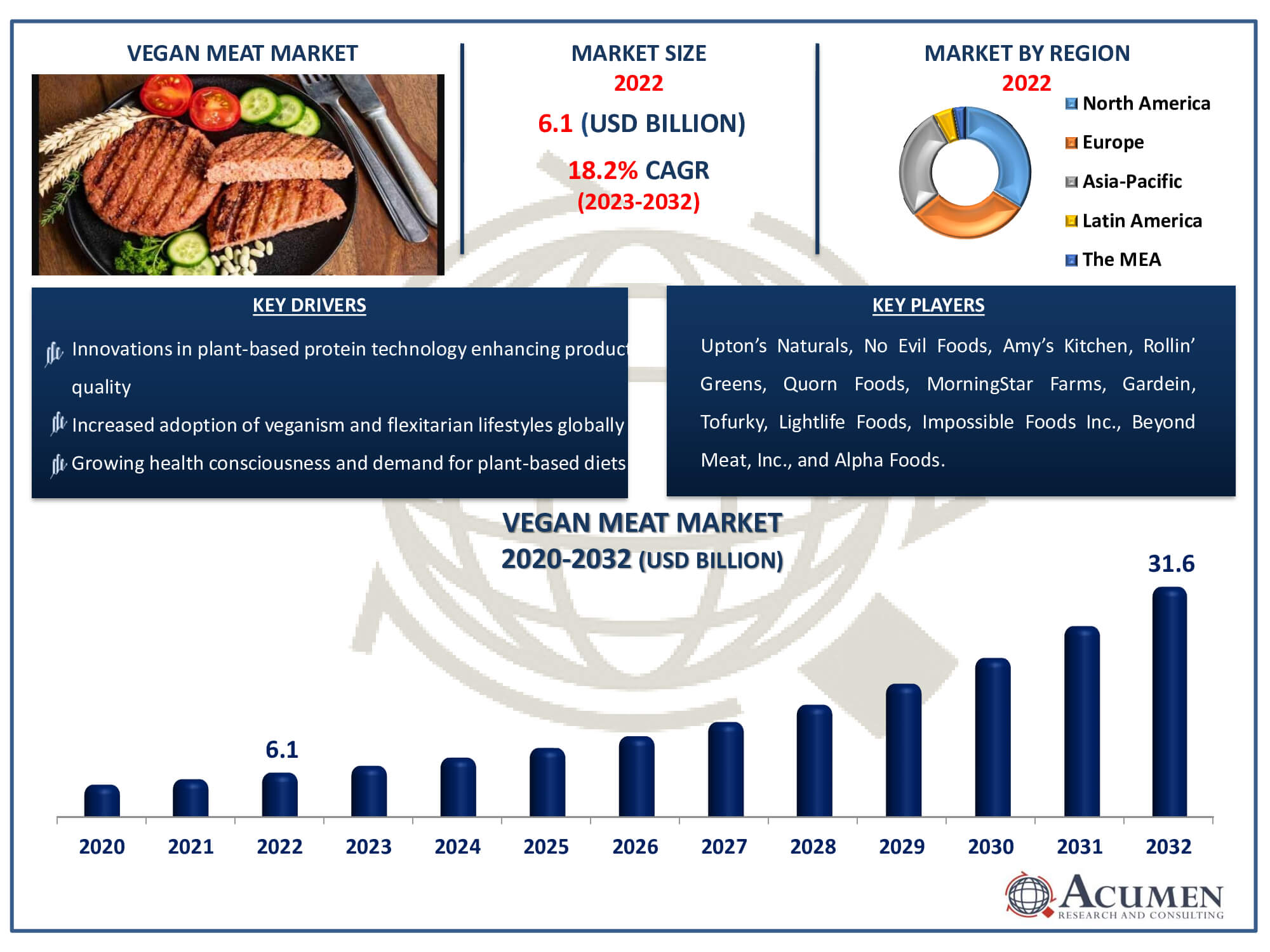

The Vegan Meat Market Size accounted for USD 6.1 Billion in 2022 and is estimated to achieve a market size of USD 31.6 Billion by 2032 growing at a CAGR of 18.2% from 2023 to 2032.

Vegan Meat Market Highlights

- Global vegan meat market revenue is poised to garner USD 31.6 billion by 2032 with a CAGR of 18.2% from 2023 to 2032

- North America vegan meat market value occupied around USD 2 billion in 2022

- Europe vegan meat market growth will record a CAGR of more than 20% from 2023 to 2032

- Among source, the soy sub-segment generated over US$ 2.4 billion revenue in 2022

- Based on product type, the chicken sub-segment generated around 31% share in 2022

- Growing market potential in emerging economies with rising vegan awareness is a popular vegan meat market trend that fuels the industry demand

Vegan meat is experiencing substantial growth not solely attributable to vegetarians and vegans but also because of heightened food consciousness and the perception of vegan meat as a healthier substitute. The International Agency for Research on Cancer (IARC) reports potential carcinoagenic effects associated with processed and red meat, leading to recommendations from the American Cancer Society. Their guidance advocates for a diet featuring reduced consumption of refined and red meat, emphasizing higher intake of vegetables, fruits, and whole grains. Additionally, they endorse selecting beans over red or refined meat for both dietary choices and physical exercise, signifying an evolving understanding of the adverse impacts of meat consumption on human well-being.

Global Vegan Meat Market Dynamics

Market Drivers

- Growing health consciousness and demand for plant-based diets

- Environmental concerns driving interest in sustainable and cruelty-free alternatives

- Innovations in plant-based protein technology enhancing product quality

- Increased adoption of veganism and flexitarian lifestyles globally

Market Restraints

- Higher production costs impacting pricing competitiveness

- Limited consumer acceptance due to taste and texture variations

- Challenges in establishing mainstream availability and distribution channels

Market Opportunities

- Expansion of product offerings and diversification in flavors and cuisines

- Collaborations with mainstream food chains for broader market penetration

- Government initiatives promoting sustainable and plant-based diets

Vegan Meat Market Report Coverage

| Market | Vegan Meat Market |

| Vegan Meat Market Size 2022 | USD 6.1 Billion |

| Vegan Meat Market Forecast 2032 | USD 64.8 Billion |

| Vegan Meat Market CAGR During 2023 - 2032 | 18.2% |

| Vegan Meat Market Analysis Period | 2020 - 2032 |

| Vegan Meat Market Base Year |

2022 |

| Vegan Meat Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Source, By Product Type, By Product Form, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Upton’s Naturals, No Evil Foods, Amy’s Kitchen, Rollin’ Greens, Quorn Foods, MorningStar Farms, Gardein, Tofurky, Lightlife Foods, Impossible Foods Inc., Beyond Meat, Inc., and Alpha Foods. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Vegan Meat Market Insights

Vegan meat is now growing not only thanks to vegetarians and vegans but also due to increased food consciousness and the expectation of vegan meat as a healthier substitute. According to the International Agency for Research on Cancer (IARC), processed meat and red meat may have a carcinogenic effect leading to cancer. Consequently, the American Cancer Society suggests a diet with less refined and red meat and higher in vegetables, fruits, and whole grains. Additionally, the American Cancer Society recommends choosing beans over red or refined meat for both diet and physical exercise. These various findings indicate a growing understanding of the negative effects of meat consumption on human well-being.

Vegan meat is increasingly demanded by customers, driven both by medicinal purposes and a desire for a healthier lifestyle, thereby continuing to elevate plant-based meat. Furthermore, ongoing research and development activities by vegan meat manufacturers are expected to contribute to the growth of the global vegan meat industry in the coming years, focusing on improving flavor, texture, shelf life, and nutritional profiles. The growing global preference for vegan diets is attracting businesses, start-ups, and existing players to enter this rapidly expanding industry. Noteworthy food companies, such as Cargill (US) and Tyson Foods (US), have invested in start-ups producing vegan meat products, indicating an anticipated further increase in the sales of products in the plant-based meat market forecast period.

Vegan Meat Market Segmentation

The worldwide market for vegan meat is split based on source, product type, product form, distribution channel, and geography.

Vegan Meat Sources

- Soy

- Wheat

- Mycoprotein

- Pea

- Legumes

- Others

According to vegan meat industry analysis, the market is dominated by the soy segment, which occupies a prominent position in this rapidly evolving sector. The increasing popularity of vegan meat products made from soy has been attributed to their adaptability, providing a variety of uses, including sausages, burgers, and meat alternatives. A great source of plant-based protein, soy helps products have the ideal meat-like flavour and texture for consumers. Furthermore, soy is known for having a nutritional profile that includes fibre and important amino acids. Consequently, the soy category has become a dominant force in the industry, propelling expansion and satisfying the growing need for cruelty-free, sustainable substitutes in the growing range of plant-based meat alternatives.

Vegan Meat Product Type

- Chicken

- Beef

- Pork

- Fish

- Turkey

- Others

As the biggest and most significant category in this developing market, the chicken segment holds a commanding position in the plant-based meat market. The extraordinary capacity of plant-based chicken substitutes to mimic the flavour, texture, and adaptability of conventional poultry products accounts for their widespread appeal. Plant-based alternatives to chicken have been developed thanks to advancements in production methods and plant-based protein sources. These products appeal to mainstream consumers who are looking for ethical and sustainable protein options, as well as vegetarians and vegans. Growing health consciousness, environmental sustainability, and consumer demand for cruelty-free food options all contribute to the success of the chicken segment, which is a major factor in the continuous change of the global food scene.

Vegan Meat Product Forms

- Patties

- Sausages

- Strips & Nuggets

- Strips & Nuggets

- Tenders & Cutlets

- Meatballs

- Others

In the product form category of the industry, the patties segment is currently the largest and is expected to continue dominating throughout the vegan meat market forecast period. The plant-based meat market has solidified around patties because of its adaptability, ease of use, and variety of uses. These plant-based patties are frequently used in burgers, sandwiches, and other culinary meals. They are frequently made to mimic the flavour and texture of regular meat. Their popularity is a result of the easy alternative they provide, which allows both non-vegans and vegans to enjoy them. The market is led by the patties category, which has shown significant growth as consumer preferences shift towards cruelty-free and sustainable solutions. This is because plant-based alternatives to classic meat-based patties are in high demand and provide a familiar and gratifying experience.

Vegan Meat Distribution Channels

- Supermarkets/Hypermarkets

- Convenience Stores

- HoReCa

- Online Retail

In terms of vegan meat market analysis, In the category of distribution channels for the industry, supermarkets/hypermarkets currently holds the biggest share. This dominance is explained by how widely accessible and convenient these retail locations are for customers looking for plant-based meat substitutes. Supermarkets and hypermarkets offer a wide range of plant-based meat alternatives to satisfy a wide range of consumer needs. The segment's popularity is partly due to the ease of one-stop shopping and the availability of in-person product inspection and purchasing. Supermarkets and hypermarkets are the main venues for the distribution and sale of vegan meat products because of the growing consumer demand for vegan meat and the crucial role these retail channels play in influencing market dynamics.

Vegan Meat Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

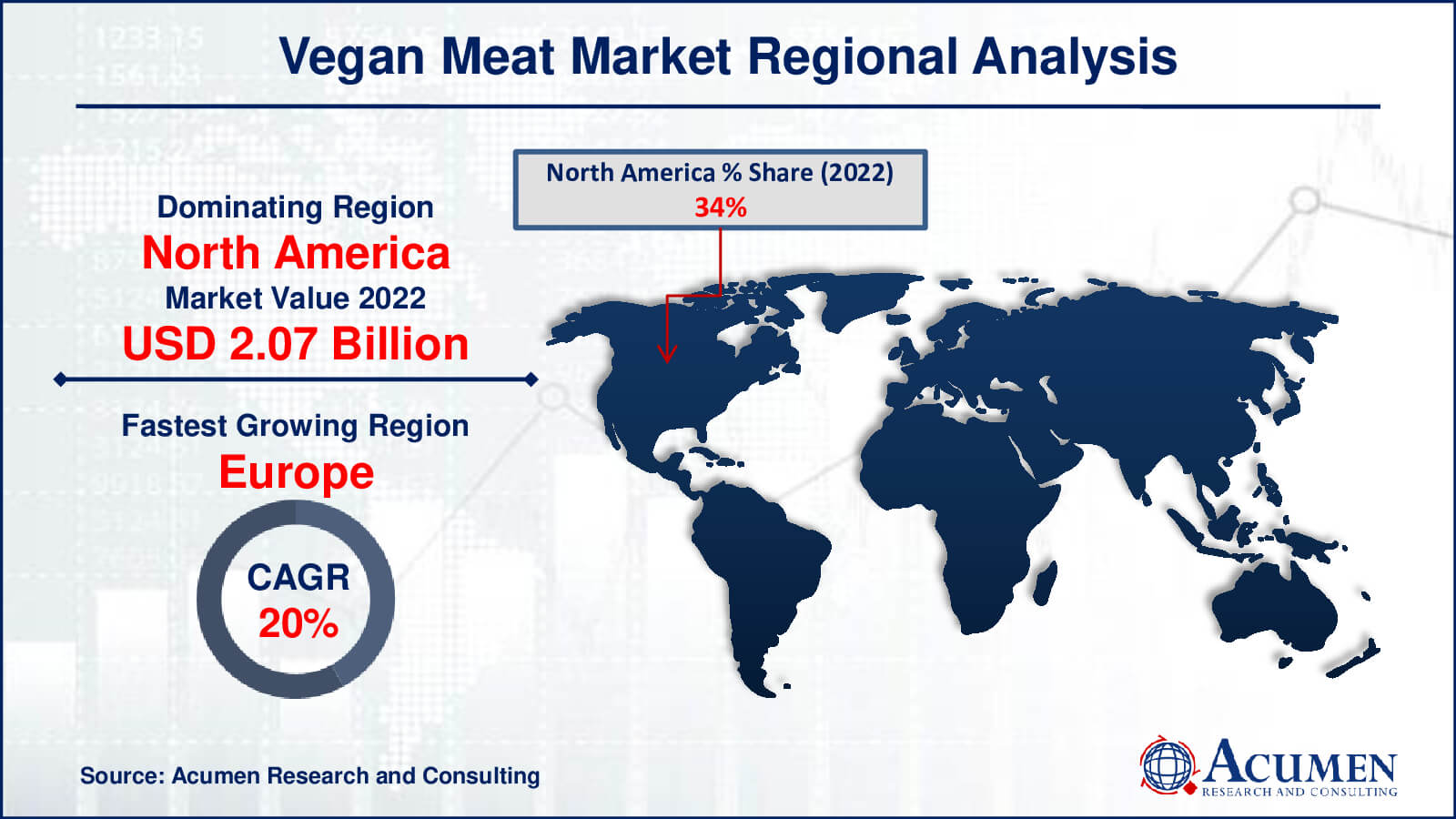

Vegan Meat Market Regional Analysis

North America is shown to be the largest market in the regional analysis of the plant-based meat market, indicating a strong demand for plant-based meat substitutes. This importance in North America can be ascribed to the region's increasing acceptance of vegan and flexitarian lifestyles, as well as its increased emphasis on sustainability and health-conscious consumer preferences. The market's expansion is further aided by the well-established presence of large food companies that provide a range of vegan meat products.

However, the vegan meat market is expanding at the quickest rate in Europe. Growing environmental consciousness and a trend towards plant-based diets for moral and health grounds are driving the industry's rapid rise in Europe. The region's acceleration of the acceptance of vegan meat products is also attributed to government measures that promote eco-friendly and sustainable dietary choices. Europe's thriving vegan meat business is fueled by the continent's dynamic culinary scene and an increasing number of creative start-ups, positioning it as a hub for breakthroughs and expansion in the worldwide vegan meat sector.

Vegan Meat Market Players

Some of the top vegan meat companies offered in our report include Upton’s Naturals, No Evil Foods, Amy’s Kitchen, Rollin’ Greens, Quorn Foods, MorningStar Farms, Gardein, Tofurky, Lightlife Foods, Impossible Foods Inc., Beyond Meat, Inc., and Alpha Foods.

Frequently Asked Questions

How big is the vegan meat market?

The market size of vegan meat size was valued at USD 6.1 billion in 2022.

What is the CAGR of the global vegan meat market from 2023 to 2032?

The CAGR of vegan meat is 18.2% during the analysis period of 2023 to 2032.

Which are the key players in the vegan meat market?

The key players operating in the global market are including Upton�s Naturals, No Evil Foods, Amy�s Kitchen, Rollin� Greens, Quorn Foods, MorningStar Farms, Gardein, Tofurky, Lightlife Foods, Impossible Foods Inc., Beyond Meat, Inc., and Alpha Foods.

Which region dominated the global vegan meat market share?

North America held the dominating position in plant-based meat industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of vegan meat during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global vegan meat industry?

The current trends and dynamics in the vegan meat industry include growing health consciousness and demand for plant-based diets, environmental concerns driving interest in sustainable and cruelty-free alternatives, innovations in plant-based protein technology enhancing product quality, and increased adoption of veganism and flexitarian lifestyles globally.

Which product type held the maximum share in 2022?

The chicken product type held the maximum share of the vegan meat industry.