VCI Shrink Film Market | Acumen Research and Consulting

VCI Shrink Film Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

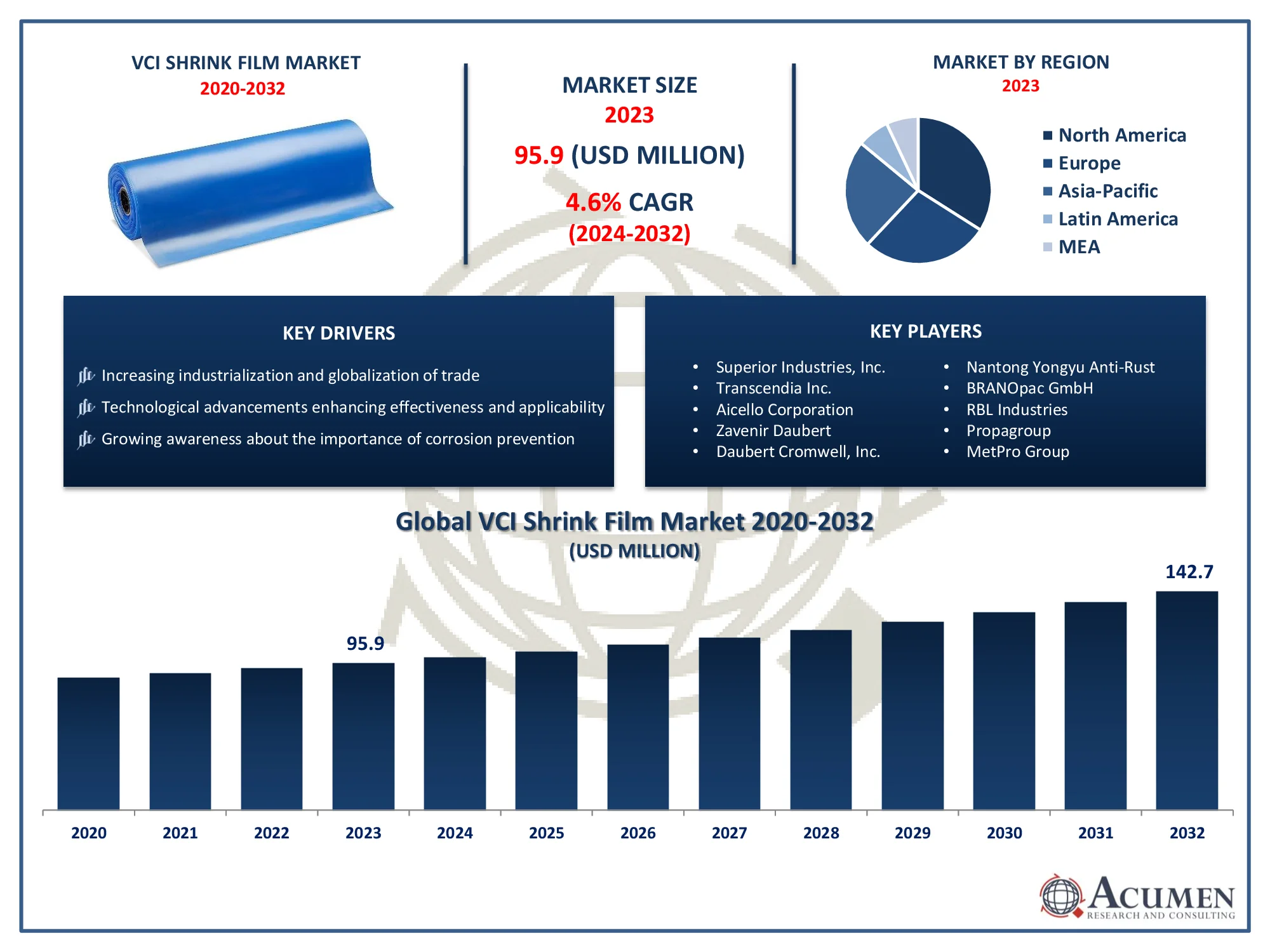

The Global VCI Shrink Film Market Size accounted for USD 95.9 Million in 2023 and is projected to achieve a market size of USD 142.7 Million by 2032 growing at a CAGR of 4.6% from 2024 to 2032.

VCI Shrink Film Market Highlights

- Global VCI shrink film market revenue is expected to increase by USD 142.7 Million by 2032, with a 4.6% CAGR from 2024 to 2032

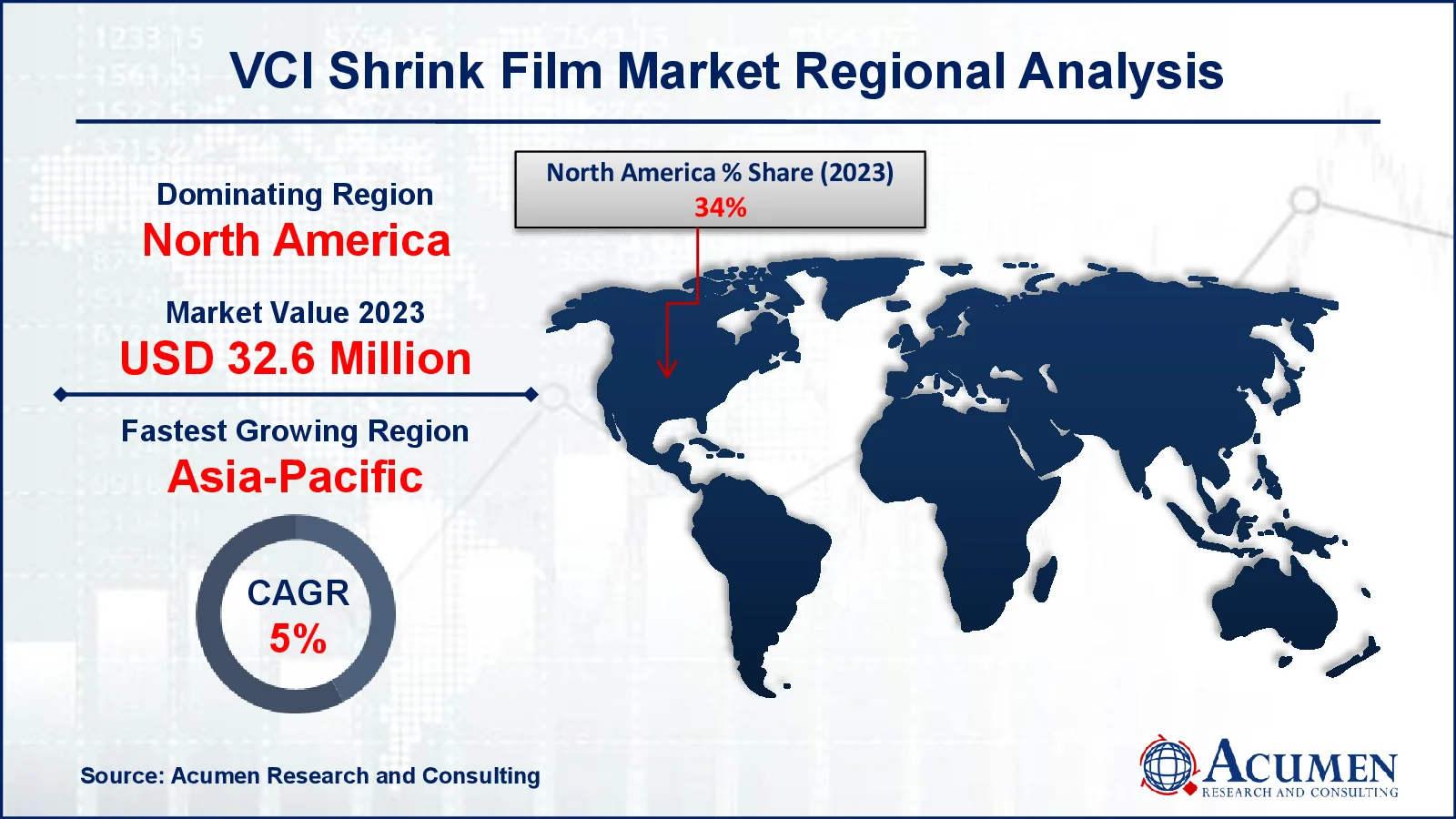

- North America region led with more than 34% of VCI shrink film market share in 2023

- Asia-Pacific VCI shrink film market growth will record a CAGR of more than 5.3% from 2024 to 2032

- By material, the PE are the largest segment of the market, accounting for over 65% of the global market share

- By end use, the primary metal is one of the largest and fastest-growing segments of the VCI shrink film industry

- Increasing demand for corrosion protection solutions across industries, drives the VCI shrink film market value

VCI shrink film, or Volatile Corrosion Inhibitor shrink film, is a specialized packaging material used to protect metal components from corrosion during storage or transportation. It incorporates volatile corrosion inhibitors into the film's structure, which vaporize and form a protective layer on the metal surface, preventing oxidation and corrosion. This technology is particularly valuable in industries where metal parts are susceptible to rust and corrosion, such as automotive, aerospace, and manufacturing.

The market for VCI shrink film has been experiencing steady growth in recent years, driven by increasing demand for corrosion protection solutions across various industries. Factors such as globalization of supply chains, stringent quality standards, and the need for extended shelf life of metal products have propelled the adoption of VCI shrink film. Additionally, innovations in VCI formulations and film manufacturing processes have led to enhanced performance and cost-effectiveness, further driving market growth. With a growing emphasis on sustainable packaging solutions, VCI shrink film manufacturers are also exploring eco-friendly alternatives to meet the evolving needs of customers and regulatory requirements.

Global VCI Shrink Film Market Trends

Market Drivers

- Increasing industrialization and globalization of trade

- Stringent quality standards driving demand for corrosion protection solutions

- Technological advancements enhancing effectiveness and applicability

- Growing awareness about the importance of corrosion prevention

- Expansion of end-user industries such as automotive and manufacturing

Market Restraints

- Fluctuating raw material prices

- Regulatory compliance challenges

Market Opportunities

- Adoption of eco-friendly alternatives

- Expansion of applications into new industries

VCI Shrink Film Market Report Coverage

| Market | VCI Shrink Film Market |

| VCI Shrink Film Market Size 2022 |

USD 95.9 Billion |

| VCI Shrink Film Market Forecast 2032 | USD 142.7 Billion |

| VCI Shrink Film Market CAGR During 2023 - 2032 | 4.6% |

| VCI Shrink Film Market Analysis Period | 2020 - 2032 |

| VCI Shrink Film Market Base Year |

2022 |

| VCI Shrink Film Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Superior Industries, Inc., Transcendia Inc., Aicello Corporation, Zavenir Daubert, Daubert Cromwell, Inc., Nantong Yongyu Anti-Rust, BRANOpac GmbH, RBL Industries, Propagroup, MetPro Group, Intertape Polymer Group, and Harita-NTI Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

VCI Shrink Film Market Dynamics

VCI shrink film is a specialized packaging material designed to protect metal components from corrosion during storage and transportation. It incorporates volatile corrosion inhibitors into its structure, which vaporize and form a protective layer on the metal surface. This layer acts as a barrier, preventing moisture and other corrosive elements from reaching the metal, thus effectively inhibiting oxidation and rust formation. VCI shrink film is commonly made from polyethylene or polypropylene and can be applied through various packaging methods such as wrapping, bagging, or heat shrinking. The applications of VCI shrink film span across a wide range of industries where metal products are vulnerable to corrosion. In the automotive sector, it is extensively used to protect engine parts, brake components, and other metal assemblies during shipment and storage. Similarly, in the aerospace industry, VCI shrink film safeguards critical aircraft parts and equipment from corrosion damage caused by humidity and environmental factors.

The VCI (Volatile Corrosion Inhibitor) shrink film market has witnessed robust growth in recent years, driven by the increasing need for effective corrosion protection solutions across various industries. With globalization amplifying supply chain complexities and stringent quality standards, the demand for packaging materials that safeguard metal components from rust and corrosion during storage and transportation has surged. VCI shrink film, with its ability to form a protective layer on metal surfaces, has emerged as a preferred choice for manufacturers seeking reliable corrosion prevention methods. Technological advancements and innovations in VCI formulations have further propelled market growth, leading to enhanced performance and cost-effectiveness. Manufacturers are continuously refining their products to meet evolving industry requirements, resulting in a wider adoption of VCI shrink film across different sectors such as automotive, aerospace, and manufacturing.

VCI Shrink Film Market Segmentation

The global VCI shrink film market segmentation is based on material, end use, and geography.

VCI Shrink Film Market By Material

- PE

- PP

- PET

In terms of materials, the Polyethylene (PE) segment accounted for the largest market share in 2023. PE-based VCI shrink films offer effective corrosion protection while also providing superior mechanical strength and durability, making them suitable for a wide range of applications across industries. Industries such as automotive, electronics, and aerospace rely on PE VCI shrink films to safeguard their metal components during storage, transportation, and export. Moreover, advancements in PE film manufacturing technologies have led to the development of high-performance VCI shrink films with enhanced barrier properties and corrosion protection capabilities. These films not only offer superior protection against rust and corrosion but also provide added benefits such as puncture resistance, clarity, and ease of handling. As a result, manufacturers are increasingly adopting PE-based VCI shrink films as a cost-effective and reliable solution to protect their valuable metal assets.

VCI Shrink Film Market By End Use

- Aerospace & Defence

- Automotive

- Electricals & Electronics

- Primary Metal

- Others

According to the VCI shrink film market forecast, the primary metal segment is expected to witness significant growth in the coming years. This growth is due to its crucial role in protecting raw materials, semi-finished, and finished metal products from corrosion. Industries involved in the production and processing of primary metals such as steel, aluminum, and copper rely heavily on VCI shrink films to ensure the integrity and quality of their metal assets during storage, shipping, and handling. The primary metal segment accounts for a substantial portion of the overall VCI shrink film market, driven by the widespread adoption of corrosion prevention measures to mitigate financial losses and maintain product quality. Furthermore, the primary metal segment's growth is propelled by increasing industrialization, infrastructure development, and construction activities worldwide. As demand for primary metals continues to rise across various sectors, the need for effective corrosion protection solutions becomes paramount to safeguard investments and maintain operational efficiency. VCI shrink films offer a cost-effective and reliable method to prevent corrosion-related damage, thereby prolonging the lifespan of primary metal products and reducing maintenance costs.

VCI Shrink Film Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

VCI Shrink Film Market Regional Analysis

North America dominates the VCI shrink film market due to several key factors that contribute to its strong position in the industry. The North America region boasts a mature industrial landscape, particularly in sectors such as automotive, aerospace, and manufacturing, which are significant consumers of VCI shrink films for corrosion protection purposes. The presence of established players with advanced manufacturing capabilities and robust distribution networks further strengthens North America's position as a leading market for VCI shrink films. Moreover, stringent regulatory standards and quality requirements in North America drive the adoption of high-performance corrosion protection solutions like VCI shrink films. Industries in the region prioritize product quality and reliability, necessitating the use of advanced packaging materials to safeguard metal components from corrosion during storage and transportation. As a result, manufacturers and end-users in North America exhibit a strong preference for VCI shrink films, contributing to the region's dominance in the market. Furthermore, ongoing technological advancements and innovations in VCI formulations and film manufacturing processes in North America bolster market growth and competitiveness.

VCI Shrink Film Market Player

Some of the top VCI shrink film market companies offered in the professional report include Superior Industries, Inc., Transcendia Inc., Aicello Corporation, Zavenir Daubert, Daubert Cromwell, Inc., Nantong Yongyu Anti-Rust, BRANOpac GmbH, RBL Industries, Propagroup, MetPro Group, Intertape Polymer Group, and Harita-NTI Ltd.

Frequently Asked Questions

What was the market size of the global VCI shrink film in 2023?

The market size of VCI shrink film was USD 95.9 Million in 2023.

What is the CAGR of the global VCI shrink film market from 2024 to 2032?

The CAGR of VCI shrink film is 4.6% during the analysis period of 2024 to 2032.

Which are the key players in the VCI shrink film market?

The key players operating in the global market are including Superior Industries, Inc., Transcendia Inc., Aicello Corporation, Zavenir Daubert, Daubert Cromwell, Inc., Nantong Yongyu Anti-Rust, BRANOpac GmbH, RBL Industries, Propagroup, MetPro Group, Intertape Polymer Group, and Harita-NTI Ltd.

Which region dominated the global VCI shrink film market share?

North America held the dominating position in VCI shrink film industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of VCI shrink film during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global VCI shrink film industry?

The current trends and dynamics in the VCI shrink film market growth include increasing demand for corrosion protection solutions across industries, and globalization of supply chains driving the need for extended shelf life of metal products.

Which material held the maximum share in 2023?

The PE material held the maximum share of the VCI shrink film industry.