Vacuum Truck Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Vacuum Truck Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

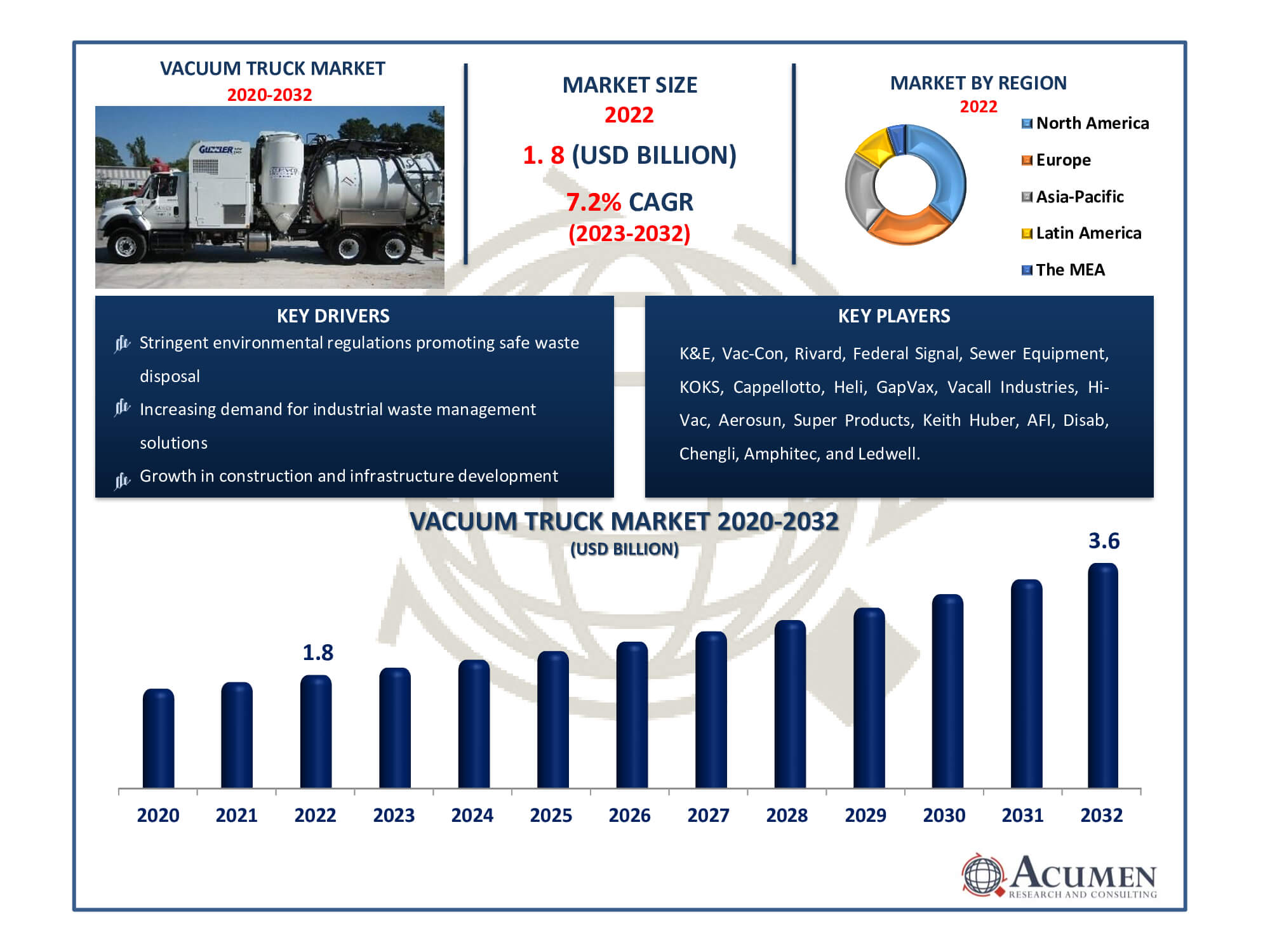

The Global Vacuum Truck Market Size accounted for USD 1.8 Billion in 2022 and is estimated to achieve a market size of USD 3.6 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

Vacuum Truck Market Highlights

- Global vacuum truck market revenue is poised to garner USD 3.6 billion by 2032 with a CAGR of 7.2% from 2023 to 2032

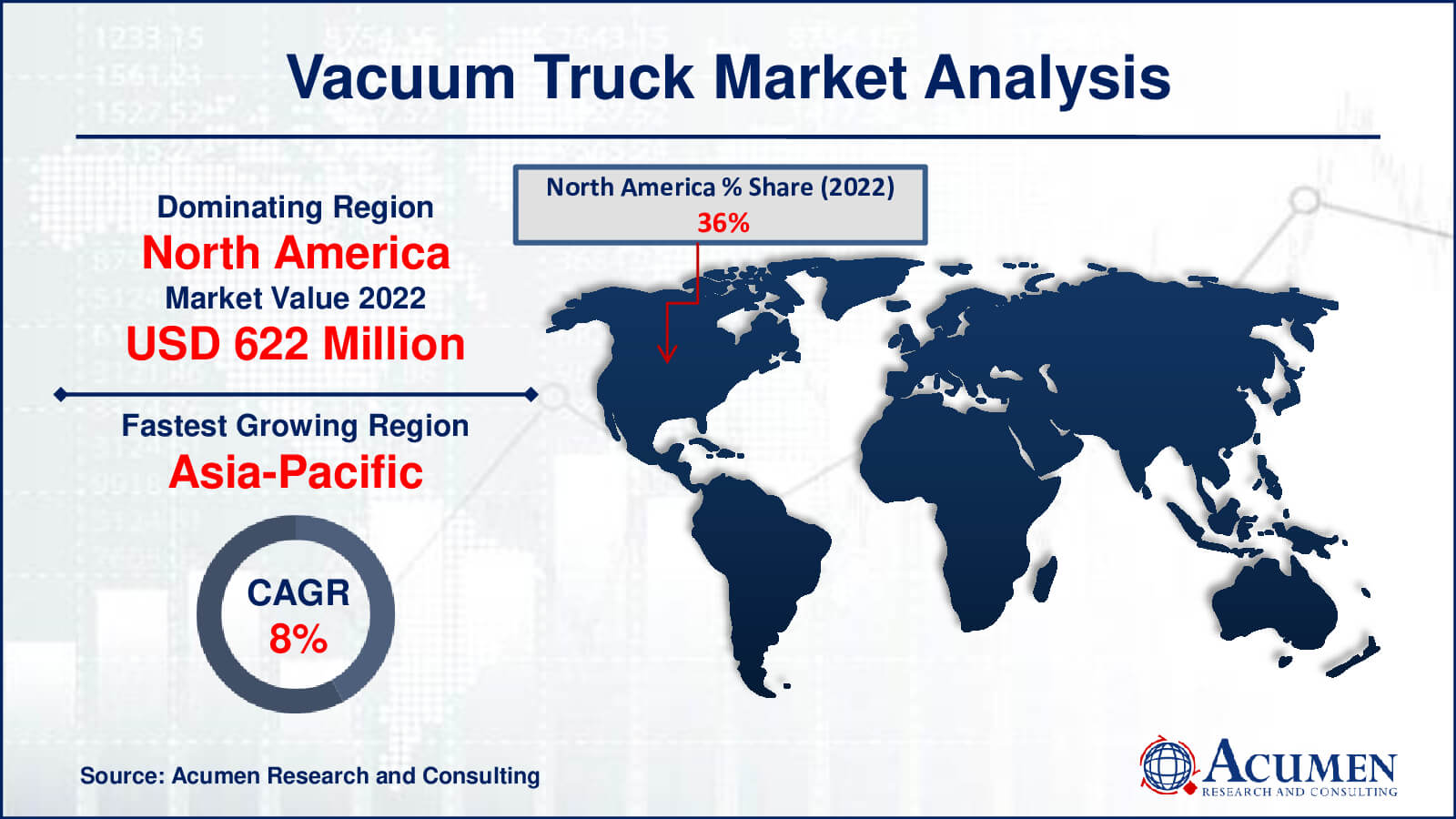

- North America vacuum truck market value occupied around USD 662.4 million in 2022

- Asia-Pacific vacuum truck market growth will record a CAGR of more than 8% from 2023 to 2032

- Among fuel type, the ICE sub-segment generated over US$ 1.3 billion revenue in 2022

- Based on application, the industrial sub-segment generated around 42% share in 2022

- Integration of digital technologies for fleet management and maintenance is a popular vacuum truck market trend that fuels the industry demand

In recent years, the vacuum truck market has seen substantial expansion and diversification. These adaptable trucks are often found in a variety of industries, including manufacturing facilities, where they serve numerous critical functions. They are used to clean gutters, sanitize sewers, capture stormwater, and contain debris efficiently during hydro excavation activities. These trucks assist the management of wet or humid products, including slurry, by utilizing a combination of vacuum, water, and clean tanks to transport compounds at variable flow rates. Because of their critical role in trash management, vacuum trucks are an essential component in a variety of industrial industries.

Global Vacuum Truck Market Dynamics

Market Drivers

- Increasing demand for industrial waste management solutions

- Stringent environmental regulations promoting safe waste disposal

- Growth in construction and infrastructure development

- Expansion of the oil and gas industry

Market Restraints

- High initial capital and maintenance costs

- Limited availability of skilled operators

- Fluctuations in fuel prices affecting operational expenses

Market Opportunities

- Rising adoption of vacuum trucks in municipal services

- Expansion into emerging markets with infrastructure development

- Development of eco-friendly and sustainable vacuum truck models

Vacuum Truck Market Report Coverage

| Market | Vacuum Truck Market |

| Vacuum Truck Market Size 2022 | USD 1.8 Billion |

| Vacuum Truck Market Forecast 2032 | USD 3.6 Billion |

| Vacuum Truck Market CAGR During 2023 - 2032 | 7.2% |

| Vacuum Truck Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Fuel Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | K&E, Vac-Con, Rivard, Federal Signal, Sewer Equipment, KOKS, Cappellotto, Heli, GapVax, Vacall Industries, Hi-Vac, Aerosun, Super Products, Keith Huber, AFI, Disab, Chengli, Amphitec, and Ledwell. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Vacuum Truck Market Insights

Currently, a significant challenge in the vacuum truck market is the constraint in downstream demand, which is impacting market growth. Many companies have entered the labor-efficient vacuum truck market, driven by strong demand for manufacturing vehicles in Germany and abroad. The widespread utilization of vacuum trucks is promoting advancements in consumer categories, and the rising demand for efficient work vehicles is leading to a profound transformation in the vacuum truck market. Products are now being tailored to meet customer requirements, reflecting the growing relationship between construction equipment suppliers and rental fleet operators. Rental companies constitute a broad client segment contributing to the demand for vacuum trucks. Despite facing competitive challenges, it is evident that investors remain optimistic about this region, driven by the global economic recovery cycle, and further investments are likely to emerge in the future.

The rising need for industrial cleaning applications is gaining traction. Industrial vacuum trucks are versatile vehicles designed to contain, retrieve, and transport various materials, including slurries, liquids, solids, dry bulk powders, and dense mud. These vacuum loaders have a long history of use in industrial settings. These trucks are purpose-built to handle even the most challenging dry or wet automotive liquids during washing and cleaning applications. Manufacturers offer a range of templates, options, and offload methods to ensure that the trucks are well-suited for cleaning applications. These factors are expected to drive market growth during the projected period.

COVID-19 Pandemic Impact on Market

Considering the slowdown of non-essential activities, the impact of the COVID-19 pandemic will be particularly pronounced in certain segments of the automotive industry. In 2020, COVID-19 had a widespread influence on the global vacuum truck market. Industrial growth was inevitably affected, leading to reduced opportunities for manufacturing heavy products, medium-sized products, and trailers.

Despite immediate practical setbacks, long-term aspirations remain largely unaffected, and businesses are expected to regain momentum in 2022. Across the globe, many countries temporarily closed their public safety manufacturing facilities, and due to the strain on medical resources, numerous countries shut down showrooms.

The COVID-19 pandemic significantly reduced the number of customer visits to showrooms worldwide

Vacuum Truck Market Segmentation

The worldwide market for vacuum truck is split based on type, fuel type, application, and geography.

Vacuum Truck Types

- Liquid Suctioning Only

- Liquid and Dry Suctioning

- High Velocity

According to the vacuum truck industry analysis, the liquid and dry suctioning category is typically the largest type due to its versatility. These trucks are capable of handling both liquid and dry materials, making them useful for a variety of applications such as waste collection, industrial clean-up, and hazardous material handling. This dual functionality saves businesses money by eliminating the need for numerous specialised vehicles. As a result, the liquid and dry suctioning section is the largest, addressing different industry needs more fully than the other segments due to its greater range of applications and cost-efficiency.

Vacuum Truck Fuel Types

- Electric

- ICE

The ICE (internal combustion engine) category currently accounts for the majority of the vacuum truck market. This is primarily due to the fact that ICE-powered vacuum trucks have long been a popular and well-established option in the business. They provide a dependable and powerful power supply for heavy-duty operations, which are frequently required in this sector. Although electric hoover trucks are gaining popularity owing to their environmental benefits, they are still evolving and face power and range constraints, making ICE-powered trucks the preferred choice due to their proven performance and versatility to a variety of demanding applications.

Vacuum Truck Applications

- Industrial

- Excavation

- Municipal

- General Cleaning

- Others

As per the vacuum truck market forecast, the Industrial sector is expected to be the largest in the vacuum truck market because it caters to several businesses that regularly generate rubbish and require maintenance. Vacuum trucks are in high demand because industrial processes frequently generate hazardous materials and requiring constant cleaning and trash collection.

The Municipal portion is the second-largest since municipalities rely on these trucks for critical services such as sewage repair, street cleaning, and rubbish collection. These municipal services are repeated, creating a constant demand for hoover trucks. While other segments, such as excavation, play essential roles, their demands are frequently project-specific, whereas municipal services remain continuing, securing its position as the second-largest section.

Vacuum Truck Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Vacuum Truck Market Regional Analysis

In 2022, North America held the largest market share in the global vacuum truck market. This prevalence can be attributed to the increasing number of rental fleet owners and the widespread industrial applications in the region. North America's dominance is also influenced by the presence of robust cleaning regulations in the US and Canada.

The European economy is expected to witness remarkable growth with a phenomenal compound annual growth rate (CAGR) as various sectors in the region are expanding rapidly. The strong sectoral growth in Europe is to blame for the economy's rising trend and impressive CAGR. This expansion suggests that the market for vacuum trucks has a lot of potential.

Meanwhile, the Asia-Pacific market is projected to experience healthy growth, primarily due to the increasing demand for municipal and industrial sludge removal. These factors are poised to drive business growth. The need for municipal and industrial sludge removal is on the rise in the Asia Pacific region as well, signaling significant opportunities for market expansion in this dynamic region.

Vacuum Truck Market Players

Some of the top vacuum truck companies offered in our report includes K&E, Vac-Con, Rivard, Federal Signal, Sewer Equipment, KOKS, Cappellotto, Heli, GapVax, Vacall Industries, Hi-Vac, Aerosun, Super Products, Keith Huber, AFI, Disab, Chengli, Amphitec, and Ledwell.

Frequently Asked Questions

How big is the vacuum truck market?

The market size of vacuum truck was USD 1.8 billion in 2022.

What is the CAGR of the global vacuum truck market from 2023 to 2032?

The CAGR of vacuum truck is 7.2% during the analysis period of 2023 to 2032.

Which are the key players in the vacuum truck market?

The key players operating in the global market are including K&E, Vac-Con, Rivard, Federal Signal, Sewer Equipment, KOKS, Cappellotto, Heli, GapVax, Vacall Industries, Hi-Vac, Aerosun, Super Products, Keith Huber, AFI, Disab, Chengli, Amphitec, and Ledwell.

Which region dominated the global vacuum truck market share?

North America held the dominating position in vacuum truck industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of vacuum truck during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global vacuum truck industry?

The current trends and dynamics in the vacuum truck industry include increasing demand for industrial waste management solutions, stringent environmental regulations promoting safe waste disposal, growth in construction and infrastructure development, and expansion of the oil and gas industry.

Which type held the maximum share in 2022?

The ICE fuel type held the maximum share of the vacuum truck industry.