Usage-Based Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Usage-Based Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Usage-based Insurance Market Size accounted for USD 25.3 Billion in 2022 and is estimated to achieve a market size of USD 261.7 Billion by 2032 growing at a CAGR of 26.7% from 2023 to 2032.

Usage-Based Insurance Market Highlights

- Global usage-based insurance market revenue is poised to garner USD 261.7 billion by 2032 with a CAGR of 26.7% from 2023 to 2032

- North America usage-based insurance market value occupied around USD 9.6 billion in 2022

- Asia-Pacific usage-based insurance market growth will record a CAGR of more than 28% from 2023 to 2032

- Among policy type, the pay-as-you-drive (PAYD) sub-segment generated over US$ 14.7 billion revenue in 2022

- Based on vehicle type, the passenger sub-segment generated around 65% share in 2022

- Customization of insurance offerings to attract a broader consumer base is a popular usage-based insurance market trend that fuels the industry demand

.jpg)

Usage-based insurance (UBI) is a type of insurance that determines vehicle premiums based on the vehicle's behavior. An insurance company is provided with a wireless device to collect data from the vehicle, which is then used to calculate the premium. Usage-based insurance is a service in the telecommunications sector that determines premiums based on consumer driving behavior. Factors such as road type, braking, and driving patterns are used to calculate these premiums. Usage-based insurance includes various services such as pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and MHYD. Due to increasing demand in the U.S. and Canada, North America is expected to experience the fastest expansion during the usage-based insurance industry forecast period.

Global Usage-Based Insurance Market Dynamics

Usage-Based Insurance UBI Market Drivers

- Advancements in telematics technology

- Increasing consumer demand for personalized insurance solutions

- Regulatory support and encouragement for usage-based insurance adoption

- Cost-saving incentives for safer driving behaviors

Usage-Based Insurance UBI Market Restraints

- Privacy concerns regarding data collection and usage

- Initial infrastructure and implementation costs

- Challenges in accurately assessing driving behavior and risk

Usage-Based Insurance UBI Market Opportunities

- Market expansion in emerging economies

- Integration of UBI with smart city initiatives

- Collaboration with automakers for embedded UBI solutions

Usage-Based Insurance (UBI) Market Report Coverage

| Market | Usage-based Insurance (UBI) Market |

| Usage-based Insurance (UBI) Market Size 2022 | USD 25.3 Billion |

| Usage-based Insurance (UBI) Market Forecast 2032 | USD 261.7 Billion |

| Usage-based Insurance (UBI) Market CAGR During 2023 - 2032 | 26.7% |

| Usage-based Insurance (UBI) Market Analysis Period | 2020 - 2032 |

| Usage-based Insurance (UBI) Market Base Year |

2022 |

| Usage-based Insurance (UBI) Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Policy Type, By Vehicle Age, By Device Type, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Progressive, AllState Insurance Company, Axa, The AA, Allianz, Uniqa, Generali, MAIF, Groupama, Aviva, Uniposai, Insure the Box, State Farm, and Liberty Mutual. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Usage-Based Insurance Market Insights

The competitive landscape among insurance firms, striving to offer competitive pricing and effective underwriting, propels the UBI market. Precise vehicle tracking aids in assessing risks accurately, enabling insurance companies to determine compensation and maintain actuarial reserves. The growing interest in connected vehicles among consumers drives increased insurance usage. Additional services like vehicle diagnostics, theft tracking, and breakdown notifications, provided to insurance companies, further mitigate potential fraud and enhance corporate profitability.

Encouraging safe driving habits by offering reduced premium rates provides a boost to the UBI market. Consumption-based insurance reduces costs for both insurers and the insured, thereby driving the projected rise in UBI demand. Notably, in Italy and South Africa, high rates of fraud and theft contribute to elevated insurance premiums, incentivizing consumers to opt for discounted UBI schemes in these regions.

UBI is a complex insurance model that necessitates interoperability across various industries, including insurance, IT, telecoms, and hardware. The market encounters several challenges, such as legal hurdles and the extensive development of IT infrastructure. Many consumers remain uncertain about the sharing of their data, making data privacy maintenance a key challenge for UBI providers. The adoption of UBI is propelled by the decreasing prices of connected devices and mobility technology. Consumer demand for fair pricing is raising as traditional insurance charges both safe and rash drivers equally. In the UBI insurance model, variable charges based on drivers' safe driving behavior are introduced, leading to anticipated growth in demand for this model in the usage-based insurance market forecast period.

Escalating competition and rising claim costs have led to losses in the automotive insurance industry. UBI insurance facilitates improved risk assessment and helps maintain profitability.

Usage-Based Insurance Market Impacting Factors

Telematics-based insurance reduces the opportunities for accidents and car theft by monitoring driving behavior, thereby complementing market growth. Vehicles lost or stolen can be detected through GPS in the vehicle's telematics device. These factors are expected to drive the demand for telematics insurance in the short term.

Usage-based insurance relies entirely on telematics devices. Installing telematics is a high-tech process, and its costs are expected to rise in the next few years. This increase in cost may raise operating expenses for UBI service providers and restrict market growth, as anticipated. However, telecom services based on smartphones are expected to gain popularity due to their relatively lower costs.

Technological progress is projected to fuel the growth of the usage-based insurance industry during the forecast period, streamlining processes with lower service rates. Market growth is further stimulated by smartphones and hybrid technology-based solutions. According to market studies, household participation in UBI policies has notably increased in the U.S.

Usage-based Insurance Market Segmentation

The worldwide market for usage-based insurance is split based on policy type, vehicle age, device type, vehicle type, and geography.

Usage-Based Insurance Policy Types

- Manage-How-You-Drive (MHYD)

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

According to usage-based insurance industry analysis, the global market can be categorized into pay-how-you-drive (PHYD), pay-as-you-drive (PAYD), and manage-how-you-drive (MHYD) based on policy types. Among these, PAYD has emerged as a highly favored type of UBI policy. PAYD, the fundamental UBI policy, determines premiums based on miles driven, tracked either by the odometer or an installed device. During the forecast period, there is an expected increase in demand for the PHYD type of UBI. PHYD reduces premiums by monitoring driving behaviors such as acceleration, braking, location, and driving time. MHYD not only monitors driving behavior but also provides drivers with feedback to promote safe driving practices.

Usage-Based Insurance Vehicle Ages

- Used Vehicles

- New Vehicles

Within the vehicle age segment, several reasons contribute to the new vehicles segment's dominance in the usage-based insurance (UBI) market. New automobiles, in particular, are frequently outfitted with modern telematics and connected technology, allowing for easy integration of UBI systems. Manufacturers are progressively offering inbuilt telematics solutions, encouraging new car owners to use UBI. Furthermore, insurers may offer cheaper premiums to new car owners to encourage adoption. Furthermore, the increased need for new insurance models, combined with consumers' preference for harnessing the latest car technologies for personalised insurance solutions, strengthens the New Vehicles segment's significance within the UBI market landscape.

Usage-Based Insurance Device Types

- OBD (On-Board Diagnostics)-II

- Black Box

- Smartphone

- Hybrid

- Others

The black box category emerges as the largest in the landscape of usage-based insurance (UBI) device types. These Black Boxes are dedicated hardware devices that are specifically designed to gather and communicate complex driving data to insurance providers. Despite the changing technological landscape, black boxes continue to be a popular choice because to their specialised capabilities in recording detailed driving behaviours with high precision. They provide insurers with precise information about driving habits and risk assessment with a dedicated methodology completely focused on UBI. The demonstrated dependability and precision of Black Box data collecting cement its position as the industry leader, resulting in significant market dominance within the UBI device types.

Usage-Based Insurance Vehicle Types

- Commercial

- Passenger

In terms of usage-based insurance market analysis, the passenger segment leads the industry for various reasons. The sheer volume of passenger vehicles on the road versus commercial vehicles, in particular, adds greatly to this segment's supremacy. Furthermore, individual vehicle owners have a higher level of consumer awareness and acceptability of UBI. Passenger automobiles are frequently used as a focus point for insurance innovation, with manufacturers and insurers actively promoting UBI solutions suited to this market. Furthermore, the personal aspect of passenger vehicles combines well with the customisation and flexibility provided by UBI rules, cementing the passenger segment's prominence in the UBI market landscape.

Usage-Based Insurance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Usage-Based Insurance Market Regional Analysis

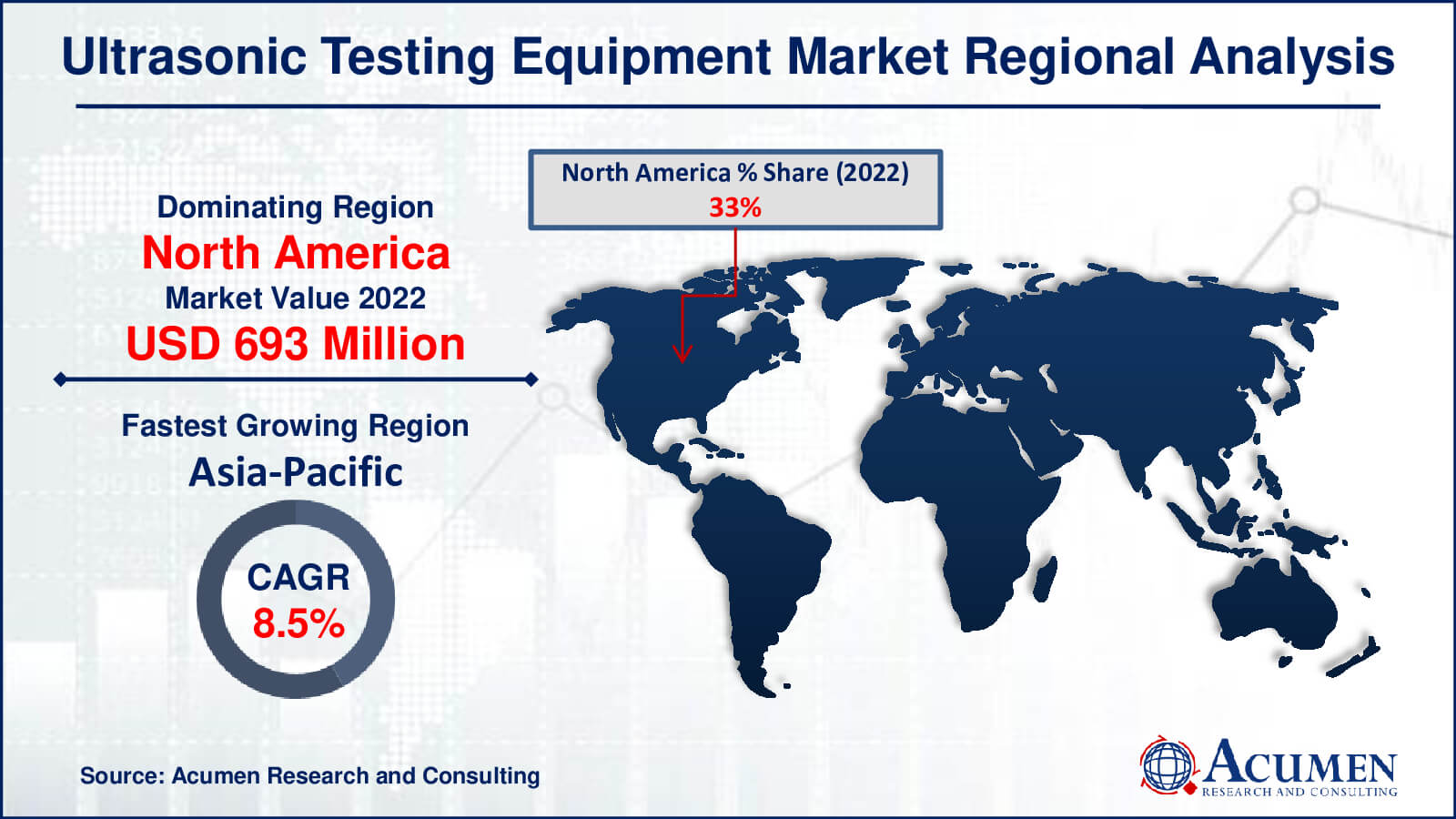

North America has emerged as the largest region in the usage-based insurance (UBI) market in recent years, owing to its superior technology infrastructure, broad telematics adoption, and a healthy car insurance sector. The region's high consumer knowledge of UBI benefits, combined with legislative support and insurance companies' proactive approach to supplying UBI solutions, has contributed greatly to its market domination. Furthermore, the presence of important businesses investing in UBI technology and services, as well as a culture of innovation, has driven North America to the forefront of this market.

In contrast, the Asia-Pacific region is the fastest-growing market for usage-based insurance. Several causes are driving this rise, including the rapid expansion of the automobile sector, rising disposable incomes, and a growing middle class. As the region's vehicle ownership increases, so does the demand for innovative insurance solutions. Furthermore, technical advances, like as the proliferation of smartphones and connected gadgets, have aided in the adoption of UBI across Asia-Pacific.

Furthermore, encouraging government actions, together with shifting consumer tastes towards more personalized and cost-effective insurance choices, have hastened the region's adoption of UBI. The dynamic regulatory landscape and relationships between insurance providers and technology firms fuel the Asia-Pacific region's high development trajectory of usage-based insurance.

Usage-based Insurance Market Players

Some of the top Usage-based Insurance companies offered in our report includes Progressive, AllState Insurance Company, Axa, The AA, Allianz, Uniqa, Generali, MAIF, Groupama, Aviva, Uniposai, Insure the Box, State Farm, and Liberty Mutual.

Frequently Asked Questions

How big is the usage-based insurance market?

The market size of usage-based insurance was USD 25.3 Billion in 2022.

What is the CAGR of the global usage-based insurance market from 2023 to 2032?

The CAGR of usage-based insurance is 26.7% during the analysis period of 2023 to 2032.

Which are the key players in the usage-based insurance market?

The key players operating in the global market are including Progressive, AllState Insurance Company, Axa, The AA, Allianz, Uniqa, Generali, MAIF, Groupama, Aviva, Uniposai, Insure the Box, State Farm, and Liberty Mutual.

Which region dominated the global usage-based insurance market share?

North America held the dominating position in usage-based insurance industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of usage-based insurance during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Usage-based Insurance industry?

The current trends and dynamics in the usage-based insurance industry include advancements in telematics technology, increasing consumer demand for personalized insurance solutions, regulatory support and encouragement for usage-based insurance adoption, and cost-saving incentives for safer driving behaviors.

Which vehicle type held the maximum share in 2022?

The passenger vehicle type held the maximum share of the usage-based insurance industry.