Unified Communication and Business Headsets Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Unified Communication and Business Headsets Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

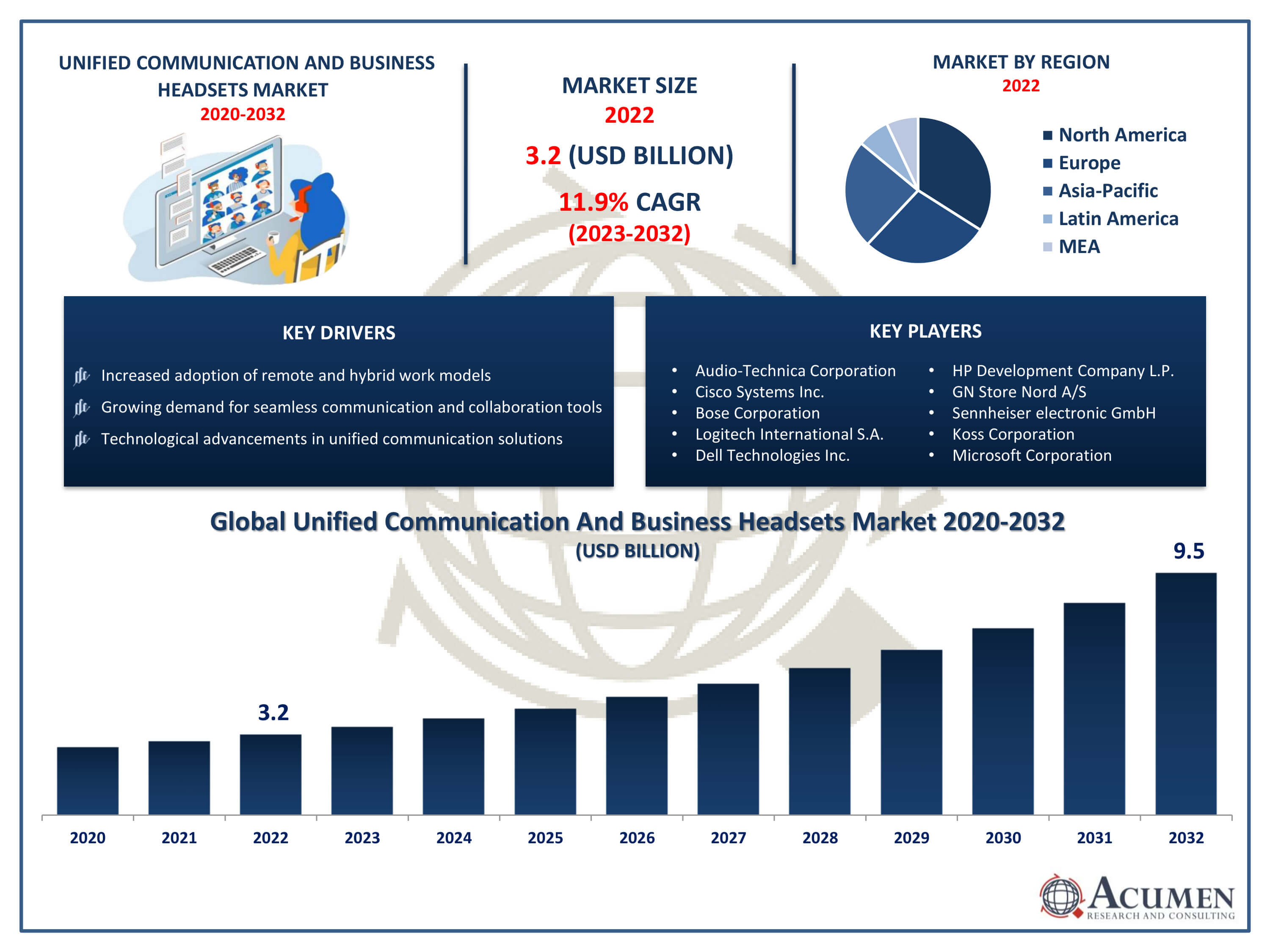

The Unified Communication and Business Headsets Market Size accounted for USD 3.2 Billion in 2022 and is projected to achieve a market size of USD 9.5 Billion by 2032 growing at a CAGR of 11.9% from 2023 to 2032.

Unified Communication and Business Headsets Market Key Highlights

- Global Unified Communication and Business Headsets Market revenue is expected to increase by USD 9.5 Billion by 2032, with an 11.9% CAGR from 2023 to 2032

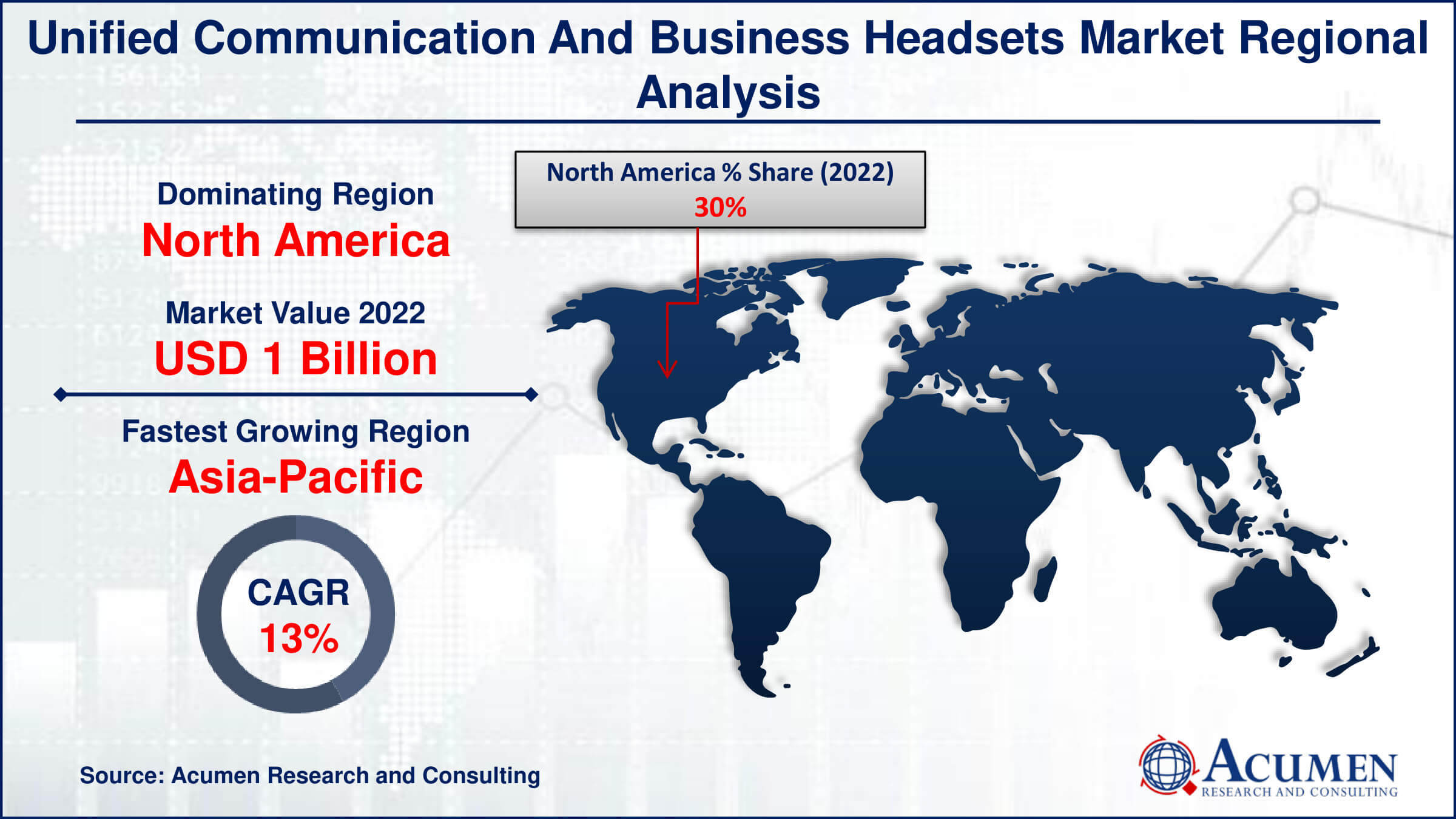

- North America region led with more than 30% of Unified Communication and Business Headsets Market share in 2022

- Asia-Pacific Unified Communication and Business Headsets Market growth will record a CAGR of more than 12.6% from 2023 to 2032

- By type, the wired segment contributed over 56% of revenue share in 2022

- By product, the headphones segment captured more than 68% of revenue share in 2022

- Increased adoption of remote and hybrid work models, drives the Unified Communication and Business Headsets Market value

Unified Communications (UC) refers to the integration of various communication tools and platforms to streamline and enhance business communication. This includes combining services such as voice and video calling, instant messaging, email, and collaboration tools into a unified platform. Business headsets play a crucial role in the UC landscape by providing users with a high-quality audio experience, whether they are engaging in voice or video calls or participating in virtual meetings. These headsets are designed to offer noise cancellation, comfort, and reliable connectivity to ensure clear and effective communication. With the increasing adoption of remote and hybrid work models, the demand for business headsets has witnessed substantial growth.

In recent years, the UC and business headset market has seen significant expansion due to the global shift towards remote work and the increasing need for reliable communication solutions. The COVID-19 pandemic has accelerated the adoption of UC technologies, as businesses strive to maintain connectivity and collaboration among remote teams. As the market continues to mature, innovations in headset technology, such as advancements in wireless connectivity, smart features, and integration capabilities, are likely to further drive growth. Additionally, the rising awareness of the importance of clear communication for business success is expected to contribute to sustained demand for unified communication solutions and high-quality business headsets in the foreseeable future.

Global Unified Communication and Business Headsets Market Trends

Market Drivers

- Increased adoption of remote and hybrid work models

- Growing demand for seamless communication and collaboration tools

- Technological advancements in unified communication solutions

- Rising emphasis on digital transformation in organizations

Market Restraints

- Security and privacy concerns in unified communication

- Initial implementation costs and integration challenges

Market Opportunities

- Expansion of AI and IoT integration in communication solutions

- Continuous innovation in headset technology for enhanced user experience

Unified Communication And Business Headsets Market Report Coverage

| Market | Unified Communication and Business Headsets Market |

| Unified Communication and Business Headsets Market Size 2022 | USD 3.2 Billion |

| Unified Communication and Business Headsets Market Forecast 2032 | USD 9.5 Billion |

| Unified Communication and Business Headsets Market CAGR During 2023 - 2032 | 11.9% |

| Unified Communication and Business Headsets Market Analysis Period | 2020 - 2032 |

| Unified Communication and Business Headsets Market Base Year |

2022 |

| Unified Communication and Business Headsets Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Type, By Price, By Distribution Channel, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Audio-Technica Corporation, Cisco Systems Inc., Bose Corporation, Logitech International S.A., Dell Technologies Inc., HP Development Company L.P., GN Store Nord A/S, Sennheiser electronic GmbH & Co. KG., Koss Corporation, and Microsoft Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Unified Communication (UC) is a comprehensive communication approach that integrates various communication channels and tools within a unified platform. It combines real-time communication services, such as instant messaging, video conferencing, and voice calls, with non-real-time communication services like email and voicemail. Business headsets play a crucial role in supporting UC applications by providing a hands-free and high-quality audio experience. These headsets are equipped with features like noise cancellation, comfortable designs, and superior sound quality, making them ideal for voice and video communication. The applications of business headsets in a unified communication environment are diverse and include virtual meetings, conference calls, customer support, and general day-to-day communication. As organizations increasingly rely on video conferencing and voice calls for remote collaboration, business headsets become essential tools for enhancing communication clarity and maintaining productivity.

The unified communication and business headsets market has experienced robust growth in recent years, driven by a confluence of factors shaping the modern workplace. The accelerated adoption of remote and hybrid work models, especially in the wake of global events impacting the way we work, has been a primary driver. Organizations are increasingly recognizing the need for seamless communication and collaboration tools to connect geographically dispersed teams, fostering productivity and maintaining a cohesive work environment. As a result, the demand for unified communication solutions, encompassing features like video conferencing, instant messaging, and integrated voice communication, has surged. Business headsets, an integral component of unified communication, have seen a parallel rise in demand. The shift towards virtual meetings and the emphasis on clear, high-quality audio experiences during remote collaborations have led to a surge in headset adoption.

Unified Communication and Business Headsets Market Segmentation

The global Unified Communication and Business Headsets Market segmentation is based on product, type, price, distribution channel, end-use, and geography.

Unified Communication And Business Headsets Market By Product

- Headphones

- Earphones

According to unified communication and business headsets industry analysis, the headphones segment held the largest market share in 2022. With the increasing adoption of remote work and virtual collaboration, individuals and businesses alike are placing greater emphasis on high-quality audio experiences during online meetings, presentations, and discussions. As a result, headphones have become essential tools for professionals seeking clear and uninterrupted communication, while also ensuring privacy and reducing background noise. Technological advancements in headphone design, such as noise-cancellation features and integration with unified communication platforms, have contributed to the growth of this segment.

Unified Communication and Business Headsets Market By Type

- Wired

- Wireless

- Wi-Fi

- Bluetooth

- NFC

- Others

In terms of type, the wired segment dominates the market in 2022. Wired headsets offer a stable and consistent connection, ensuring uninterrupted audio quality during critical business communications, virtual meetings, and collaborative sessions. This reliability makes wired headsets a preferred choice for professionals in various industries who prioritize clear and high-fidelity audio experiences. One key factor driving the growth of the wired segment is the demand for enhanced security. Wired connections are less susceptible to interference and eavesdropping, making them a preferred choice for businesses with stringent security and privacy requirements. Additionally, wired headsets often feature easy plug-and-play functionality, eliminating the need for complex setups and reducing potential connectivity issues.

Unified Communication And Business Headsets Market By Distribution Channel

- Online Sales Channel

- Exclusive Showrooms

- Others

Based on the price, the 50 to 100 USD segment is expected to witness significant growth in the coming years. As organizations prioritize cost-effective solutions without compromising on quality, headsets within this price range have gained popularity among businesses of various sizes. Professionals seeking reliable unified communication tools find these headsets to be a sweet spot, providing a balance between budget considerations and essential features required for effective remote collaboration and communication. The growth of the 50 to 100 USD segment is also attributed to the increasing demand for remote work solutions. With a significant portion of the global workforce adopting flexible work arrangements, businesses are equipping their employees with affordable yet functional headsets to facilitate seamless communication.

Unified Communication And Business Headsets Market By Distribution Channel

- Online Sales Channel

- Exclusive Showrooms

- Others

According to the unified communication and business headsets market forecast, the online sales channel segment is expected to witness significant growth in the coming years. This growth is spurred by the increasing trend of digital commerce and the convenience it offers to businesses and consumers alike. The shift towards online purchasing is driven by the ease of browsing, comparing products, and making informed decisions without the need for physical visits to brick-and-mortar stores. As organizations embrace remote work and global supply chains, the online sales channel becomes a pivotal avenue for businesses to efficiently procure unified communication and business headsets, streamline their purchasing processes, and access a wide range of products from different manufacturers. The rise of e-commerce platforms and dedicated online marketplaces has further fueled the growth of this sales channel segment.

Unified Communication And Business Headsets Market By End-use

- Business Enterprises

- Contact Center

In terms of end-use, the business enterprises segment has been experiencing significant growth in recent years. As businesses undergo digital transformation and adapt to evolving work models, there is a growing recognition of the crucial role played by unified communication solutions and high-quality headsets in fostering effective collaboration. Large and medium-sized enterprises, in particular, are investing in comprehensive communication infrastructure to enhance productivity, streamline operations, and support the communication needs of their geographically dispersed teams. The growth in the business enterprises segment can be attributed to the rising demand for unified communication platforms that integrate various communication channels, such as video conferencing, instant messaging, and voice calls.

Unified Communication And Business Headsets Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Unified Communication And Business Headsets Market Regional Analysis

North America stands out as a dominating region in the unified communication and business headsets market, owing to a combination of technological advancements, widespread adoption of remote work, and the presence of leading market players. The region has been at the forefront of embracing digital transformation, with businesses recognizing the importance of robust communication infrastructure for seamless collaboration. As companies in North America continue to invest heavily in unified communication solutions, the demand for high-quality business headsets has surged, driving the market's growth. The strong presence of major technology hubs, corporate enterprises, and innovation centers in North America contributes significantly to the region's dominance in the unified communication and business headsets market. Key players in the industry, including both established corporations and agile startups, are often headquartered or have a substantial presence in North America. This concentration of industry leaders facilitates the rapid adoption and integration of cutting-edge technologies into unified communication systems and business headsets, further solidifying the region's position as a leader in the global market.

Unified Communication And Business Headsets Market Player

Some of the top unified communication and business headsets market companies offered in the professional report include Audio-Technica Corporation, Cisco Systems Inc., Bose Corporation, Logitech International S.A., Dell Technologies Inc., HP Development Company L.P., GN Store Nord A/S, Sennheiser electronic GmbH & Co. KG., Koss Corporation, and Microsoft Corporation.

Frequently Asked Questions

How big is the unified communication and business headsets market?

The unified communication and business headsets market size was USD 3.2 Billion in 2022.

What is the CAGR of the global unified communication and business headsets market from 2023 to 2032?

The CAGR of unified communication and business headsets is 11.9% during the analysis period of 2023 to 2032.

Which are the key players in the unified communication and business headsets market?

The key players operating in the global market are including Audio-Technica Corporation, Cisco Systems Inc., Bose Corporation, Logitech International S.A., Dell Technologies Inc., HP Development Company L.P., GN Store Nord A/S, Sennheiser electronic GmbH & Co. KG., Koss Corporation, and Microsoft Corporation.

Which region dominated the global unified communication and business headsets market share?

North America held the dominating position in unified communication and business headsets industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of unified communication and business headsets during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global unified communication and business headsets industry?

The current trends and dynamics in the unified communication and business headsets industry include increased adoption of remote and hybrid work models, growing demand for seamless communication and collaboration tools, and technological advancements in unified communication solutions.

Which product held the maximum share in 2022?

The headphones product held the maximum share of the unified communication and business headsets industry.