Underwater Wireless Communication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Underwater Wireless Communication Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

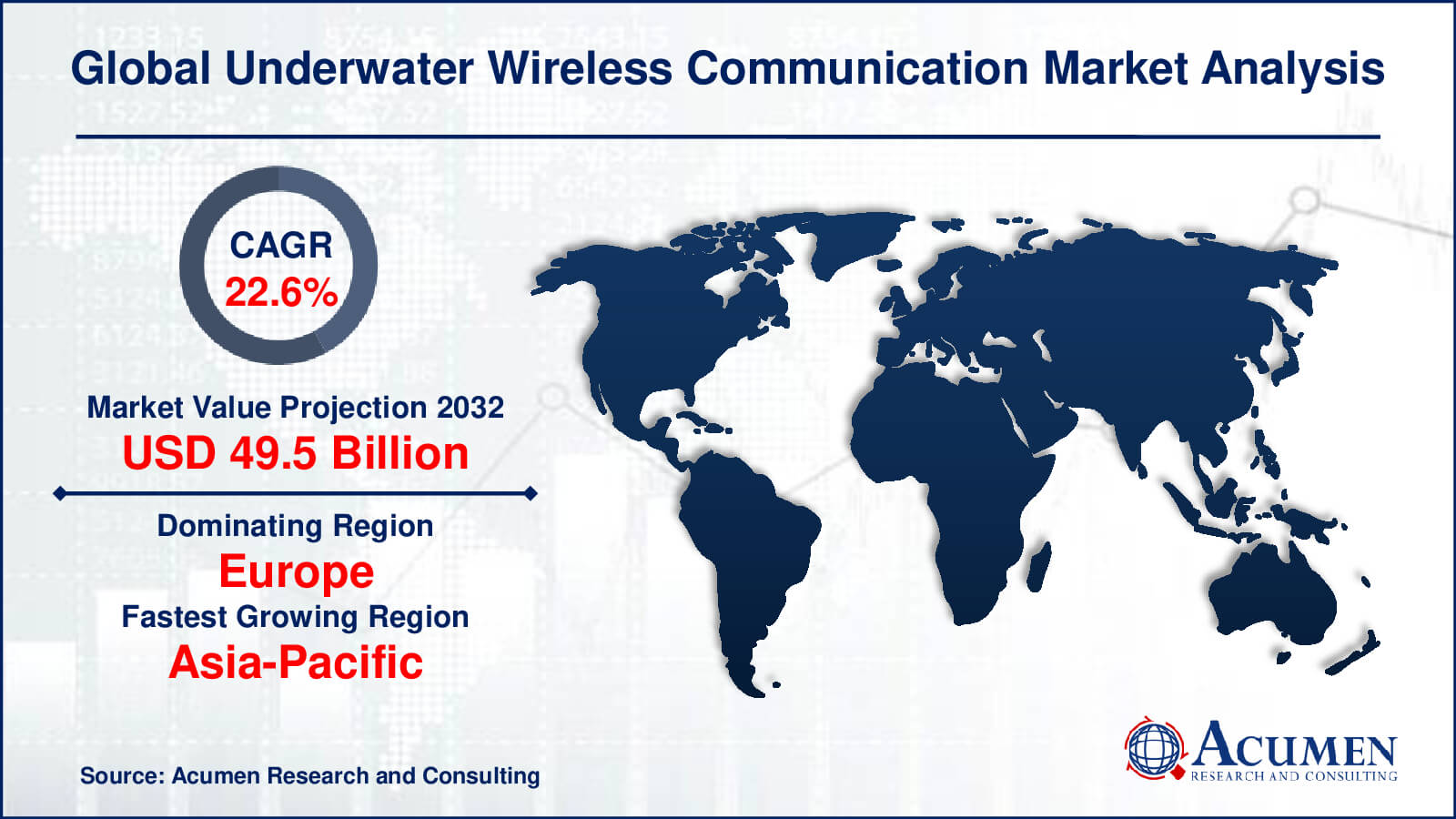

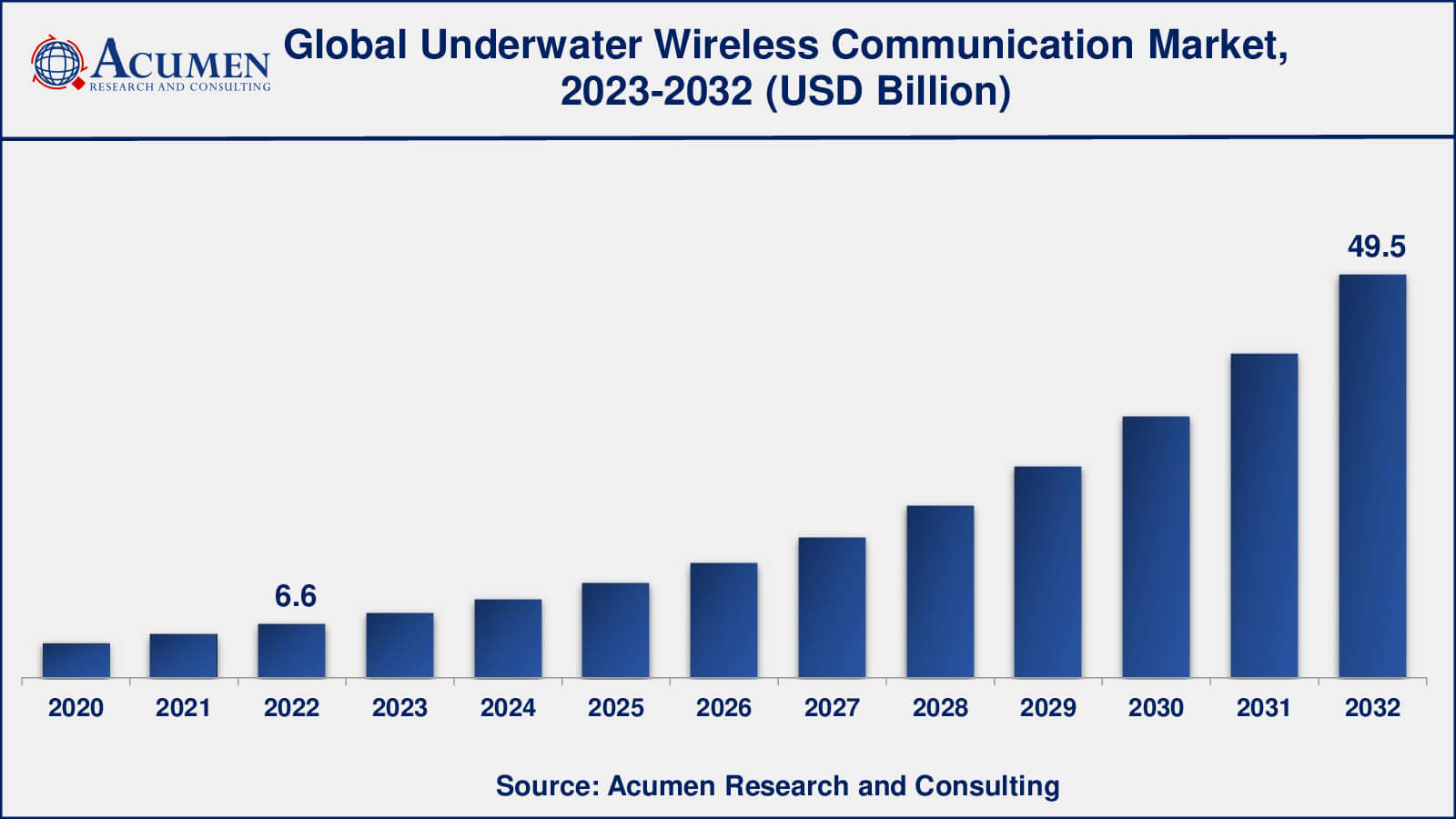

The global Underwater Wireless Communication Market size was valued at USD 6.6 Billion in 2022 and is projected to attain USD 49.5 Billion by 2032 mounting at a CAGR of 22.6% from 2023 to 2032.

Underwater Wireless Communication Market Highlights

- Global underwater wireless communication market revenue is poised to garner USD 49.5 Billion by 2032 with a CAGR of 22.6% from 2023 to 2032

- Europe underwater wireless communication market value occupied around USD 2.7 billion in 2022

- Asia-Pacific underwater wireless communication market growth will record a CAGR of more than 23% from 2023 to 2032

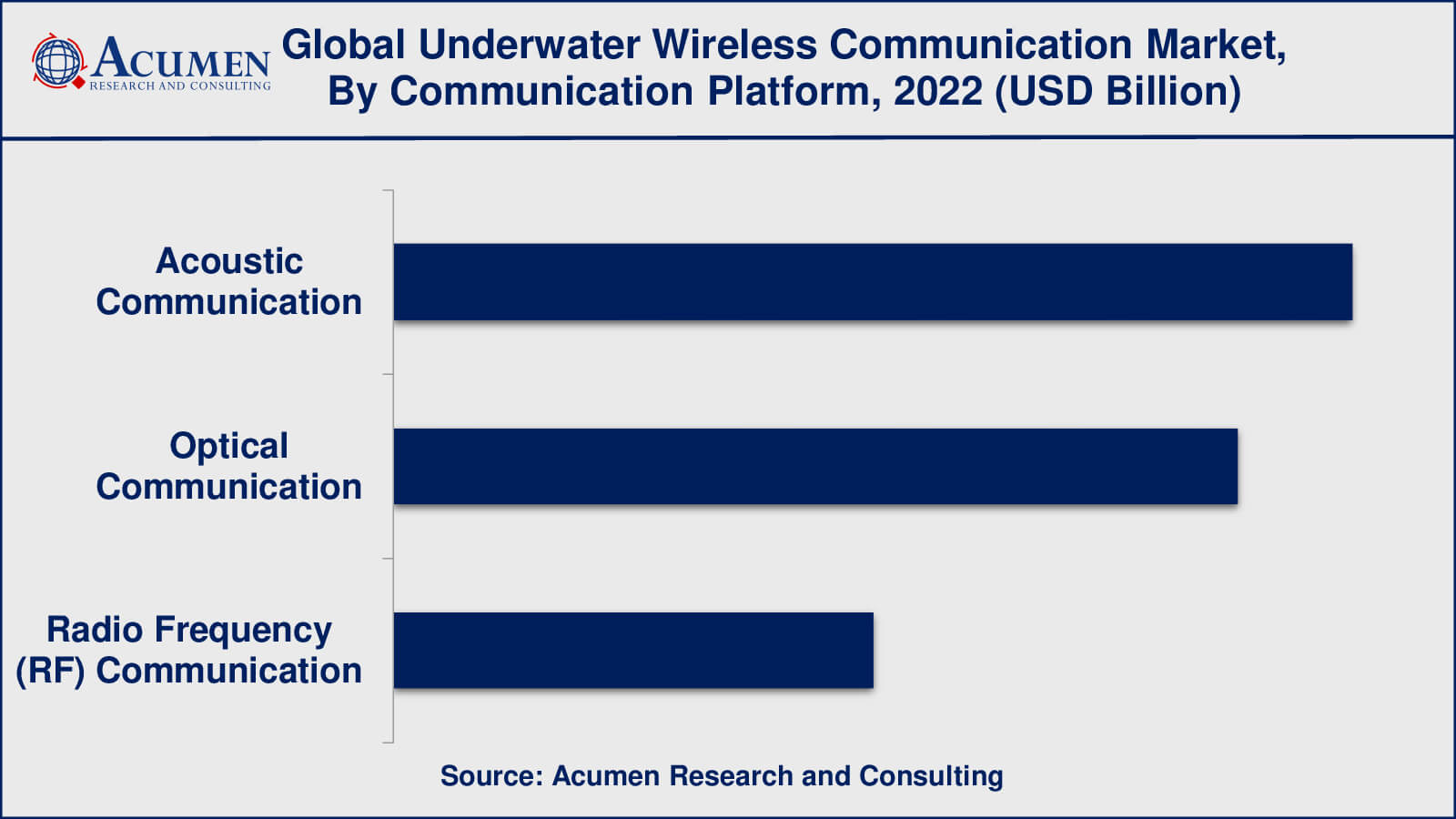

- Among communication platform, the acoustic communication sub-segment occupied over US$ 2.8 billion revenue in 2022

- Based on application, the oil & gas sub-segment gathered around 35% share in 2022

- Adoption of underwater autonomous vehicles and remotely operated vehicles is a popular underwater wireless communication market trend that drives the industry demand

Underwater wireless communication is the transfer of data, audio, and video signals across the water. It entails using specialised technology and protocols to provide dependable communication channels in underwater conditions. Unlike standard terrestrial communication systems, which depend on electromagnetic waves, underwater communication confronts unique obstacles due to water's features, such as significant attenuation and acoustic nature.

Underwater wireless communication is used in a variety of companies and areas. It is critical for offshore exploration, production, and monitoring activities in the oil and gas industry. Underwater communication enables real-time data transfer between subsea and surface installations, as well as communication with remotely operated vehicles (ROVs) and sensors. Underwater wireless communication is used by defense and security organizations for applications such as underwater surveillance, diver communication, mine countermeasures, and communication between autonomous underwater vehicles (AUVs).

Underwater wireless communication, in general, is a specialized discipline that solves the particular obstacles of transferring information across water. It includes diverse communication technologies including as acoustic, optical, and radio frequency (RF), and it serves industries and applications that demand dependable and efficient communication in underwater conditions. Continuous technological improvements strive to increase the performance, range, and data rates of underwater communication systems, hence expanding their possibilities and usefulness.

Global Underwater Wireless Communication Market Dynamics

Market Drivers

- Increasing demand for underwater communication in offshore oil and gas exploration and production

- Growing applications of underwater wireless communication in defense and security operations

- Rising need for environmental monitoring and underwater research activities

- Advancements in communication technologies, such as acoustic, optical, and RF systems

- Expansion of underwater infrastructure and subsea installations

Market Restraints

- Limited communication range and bandwidth in underwater environments

- Challenges related to signal attenuation, noise, and interference

- High deployment and maintenance costs of underwater wireless communication systems

- Technical complexities in designing robust and reliable underwater communication solutions

Market Opportunities

- Development of advanced signal processing techniques for improved underwater communication

- Integration of artificial intelligence and machine learning in underwater wireless communication systems

- Emerging applications in deep-sea exploration, underwater robotics, and underwater mining

Underwater Wireless Communication Market Report Coverage

| Market | Underwater Wireless Communication Market |

| Underwater Wireless Communication Market Size 2022 | USD 6.6 Billion |

| Underwater Wireless Communication Market Forecast 2032 | USD 49.5 Billion |

| Underwater Wireless Communication Market CAGR During 2023 - 2032 | 22.6% |

| Underwater Wireless Communication Market Analysis Period | 2020 - 2032 |

| Underwater Wireless Communication Market Base Year | 2022 |

| Underwater Wireless Communication Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Communication Platform, By Application, By Depth Range, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AquaSeNT, DSPComm, EvoLogics GmbH, Fugro, Kongsberg Gruppen, Nortek AS, SAAB AB, SONARDYNE, Subnero Pte Ltd, and Teledyne Technologies Incorporated. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Underwater Wireless Communication Market Insights

Technological innovations are critical in shaping market dynamics. Continuous advancements in acoustic, optical, and radio frequency communication technology result in higher data rates, longer communication ranges, and improved signal processing techniques. These developments allow for more dependable and effective undersea communication, which drives underwater wireless communication (UWC) market growth. In addition, industry demand is another underwater wireless communication UWC market driver. Underwater communication systems are required for operations in a variety of industries, including oil and gas, defense and security, environmental monitoring, and maritime research. In these industries, the necessity for real-time data transfer, remote monitoring, and control feeds the demand for modern underwater communication systems.

The growth of undersea infrastructure and subsea installations boosts the industry even more. For smooth operations, offshore oil rigs, underwater sensor networks, and other subsea facilities rely on effective communication systems. The expansion of these businesses, as well as the rising deployment of underwater infrastructure, opens up new prospects for underwater wireless communication providers. Despite recent advancements, the underwater communication sector confronts obstacles. Signal attenuation, ambient noise, interference, and restricted bandwidth are all challenges in underwater situations. Overcoming these obstacles and building strong, dependable communication solutions are critical for industry success. Companies are investing in R&D to overcome these challenges and increase the performance of underwater communication systems.

Cost and complexity are two further elements that influence UWC market dynamics. Underwater wireless communication systems might have high deployment and maintenance expenses. The complexity of building and executing these systems adds to the difficulties that market player’s encounter. However, technological developments, economies of scale, and the quest of cost-effective solutions are assisting in mitigating these concerns. The underwater wireless communication industry is also influenced by environmental variables. Signal transmission and quality can be affected by water turbidity, depth, temperature, and salt. Understanding these environmental parameters and modifying communication systems in response is critical for assuring dependable and efficient underwater communication in a variety of settings.

Government policies and standards influence market dynamics as well. The development, deployment, and acceptance of underwater wireless communication technologies need compliance with regulatory frameworks and adherence to industry standards. These rules and regulations have an impact on product creation, testing, and market entrance tactics.

Underwater Wireless Communication Market Segmentation

The worldwide market for underwater wireless communication is split based on communication platform, application, depth range, and geography.

Underwater Wireless Communication Platforms

- Acoustic Communication

- Optical Communication

- Radio Frequency (RF) Communication

According to the underwater wireless communication industry analysis, acoustic communication has traditionally dominated the underwater wireless communication market. Acoustic communication uses sound waves to send signals over water and has been widely utilised for underwater communication due to its capacity to propagate over great distances and through a variety of water conditions. In underwater applications, acoustic modems and hydrophones are extensively utilised for data transfer and communication between underwater entities.

However, advances in optical communication and radio frequency (RF) communication technologies have gained attention and demonstrated potential in the underwater wireless communication sector. Optical communication uses light-based technology such as lasers or LEDs to transfer data over water, providing more bandwidth than auditory communication. RF communication uses radio waves to send signals underwater and is best suited for short-distance communication. These alternative communication platforms are being researched and developed to address some of the shortcomings of acoustic communication.

Underwater Wireless Communication Applications

- Oil and Gas

- Defense and Security

- Environmental Monitoring

- Marine Research and Exploration

- Disaster Prevention and Response

As per the underwater wireless communication market forecast, the oil and gas sector is expected to dominate the underwater wireless communication business. Underwater communication systems are widely used in the business for a variety of tasks, including offshore exploration, production, and monitoring. undersea communication allows for real-time data transfer, remote control, and monitoring of oil and gas subsea facilities, pipelines, and undersea infrastructure.

Defence and security applications, environmental monitoring, maritime research and exploration, and disaster prevention and response have emerged as major drivers in the underwater wireless communication industry. Underwater surveillance, diver communication, mine countermeasures, and autonomous underwater vehicle (AUV) communication are all examples of defence and security uses. Underwater communication is used in environmental monitoring to collect data on oceanographic conditions, marine life, water quality, and climate change.

Underwater Wireless Communication Depth Ranges

- Shallow Water

- Deep Water

Shallow water and deep water are both important in the underwater wireless communication business. Shallow water communication often refers to depths between the coastline and a few hundred metres. It's frequently connected with coastal locations, nearshore operations, and shallow water research and monitoring. Environmental monitoring, marine research, underwater robots, and nearshore oil and gas activities all rely on shallow water communication.

Deep water communication, on the other hand, refers to communication in the ocean's deepest regions, often exceeding a few hundred metres and extending to the abyssal depths. Offshore oil and gas development and production, deep-sea research and exploration, submarine communication, and undersea cable networks all rely on deep water communication.

Underwater Wireless Communication Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

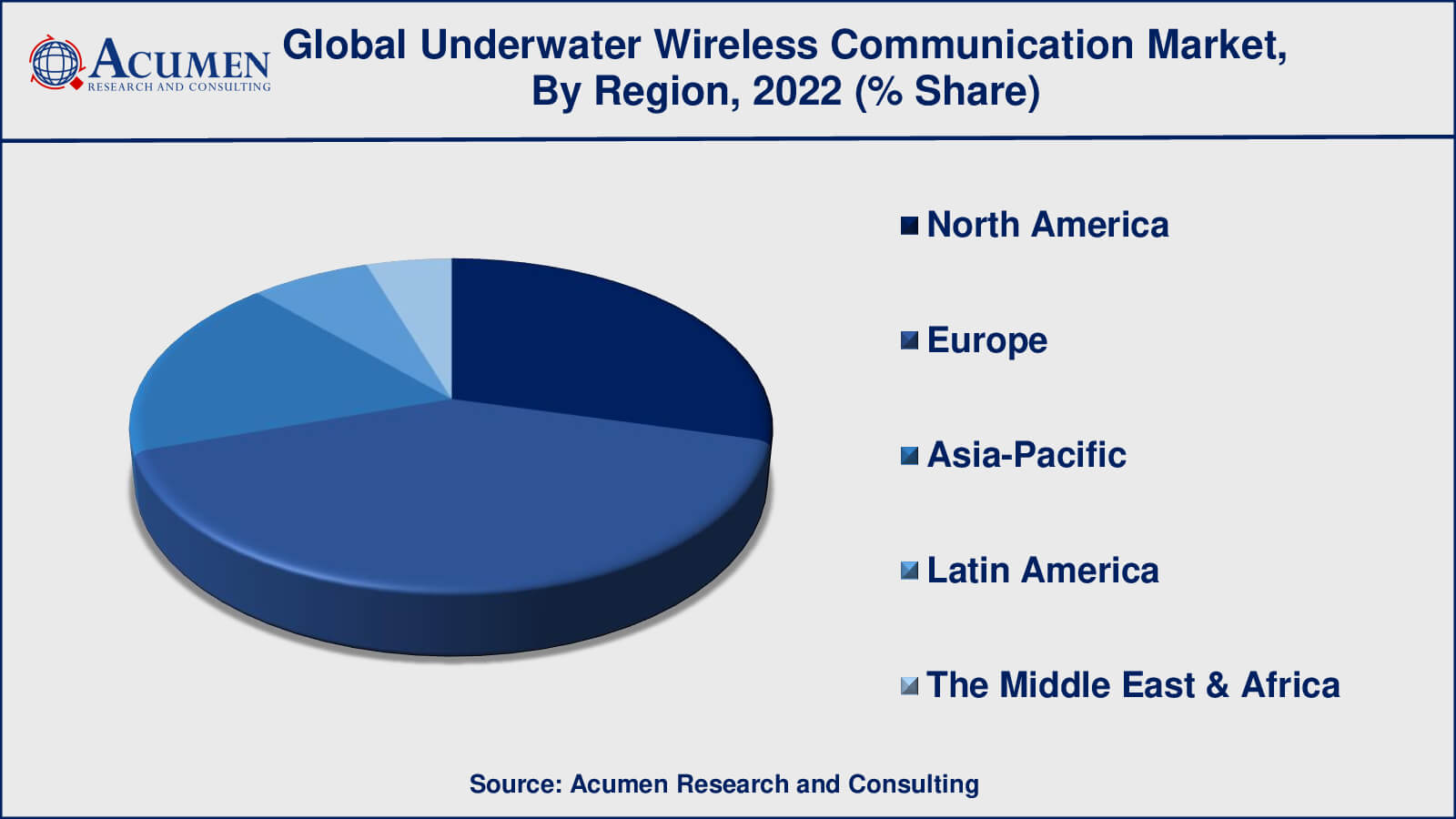

Underwater Wireless Communication UWC Market Regional Analysis

Europe has a substantial market share in underwater wireless communication. Norway, the United Kingdom, and Germany are at the forefront of technical advances in underwater communication systems. The market is being driven by the region's substantial presence in offshore industry, marine research institutes, and environmental monitoring. Increased investment in renewable energy projects, such as offshore wind farms, boosts demand for underwater communication networks.

North America also has a sizable market for underwater wireless communication, owing to the existence of established companies, technical improvements, and demand from a variety of sectors. Defense and security applications, offshore oil and gas activities, and maritime research are all important in the region. Government efforts and investments in undersea technology help to drive market expansion in this area.

Furthermore, the underwater wireless communication market in the Asia-Pacific region is expanding rapidly. China, Japan, and Australia have boosted their spending in offshore oil and gas exploration, marine research, and deep-sea mining. Because of the region's rising population and industrialization, there is a high demand for effective underwater communication systems for a variety of uses, including defense, environmental monitoring, and catastrophe avoidance.

Underwater Wireless Communication Market Players

Some of the top underwater wireless communication companies offered in our report include AquaSeNT, DSPComm, EvoLogics GmbH, Fugro, Kongsberg Gruppen, Nortek AS, SAAB AB, SONARDYNE, Subnero Pte Ltd, and Teledyne Technologies Incorporated.

Underwater Wireless Communication Industry Recent Developments

- AquaSeNT has teamed with the National University of Singapore to create AquaComm, a wireless underwater communication system. The system makes use of light-based communication technology to provide high-speed and long-distance underwater data transfer, with applications in underwater robots, environmental monitoring, and underwater infrastructure inspection.

- DSPComm unveiled the DSC 400, a new underwater acoustic modem designed for high-speed data transfer and dependable communication in demanding underwater conditions. The modem uses modern signal processing techniques and has increased bandwidth and range, making it appropriate for underwater surveillance, oil and gas operations, and maritime research.

Frequently Asked Questions

What was the market size of the global underwater wireless communication in 2022?

The market size of underwater wireless communication was USD 6.6 billion in 2022.

What is the CAGR of the global underwater wireless communication market from 2023 to 2032?

The CAGR of underwater wireless communication is 22.6% during the analysis period of 2023 to 2032.

Which are the key players in the underwater wireless communication market?

The key players operating in the global market are including AquaSeNT, DSPComm, EvoLogics GmbH, Fugro, Kongsberg Gruppen, Nortek AS, SAAB AB, SONARDYNE, Subnero Pte Ltd, and Teledyne Technologies Incorporated.

Which region dominated the global underwater wireless communication market share?

Europe held the dominating position in underwater wireless communication industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of underwater wireless communication during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global underwater wireless communication industry?

The current trends and dynamics in the underwater wireless communication industry include increasing demand for underwater communication in offshore oil and gas exploration and production, growing applications of underwater wireless communication in defense and security operations, and rising need for environmental monitoring and underwater research activities.

Which communication platform held the maximum share in 2022?

The acoustic communication held the maximum share of the underwater wireless communication industry.