Ultrasonic Testing Equipment Market | Acumen Research and Consulting

Ultrasonic Testing Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

The Ultrasonic Testing Equipment Market Size accounted for USD 2.1 Billion in 2022 and is estimated to achieve a market size of USD 4.4 Billion by 2032 growing at a CAGR of 7.8% from 2023 to 2032.

Ultrasonic Testing Equipment Market Highlights

- Global ultrasonic testing equipment market revenue is poised to garner USD 4.4 billion by 2032 with a CAGR of 7.8% from 2023 to 2032

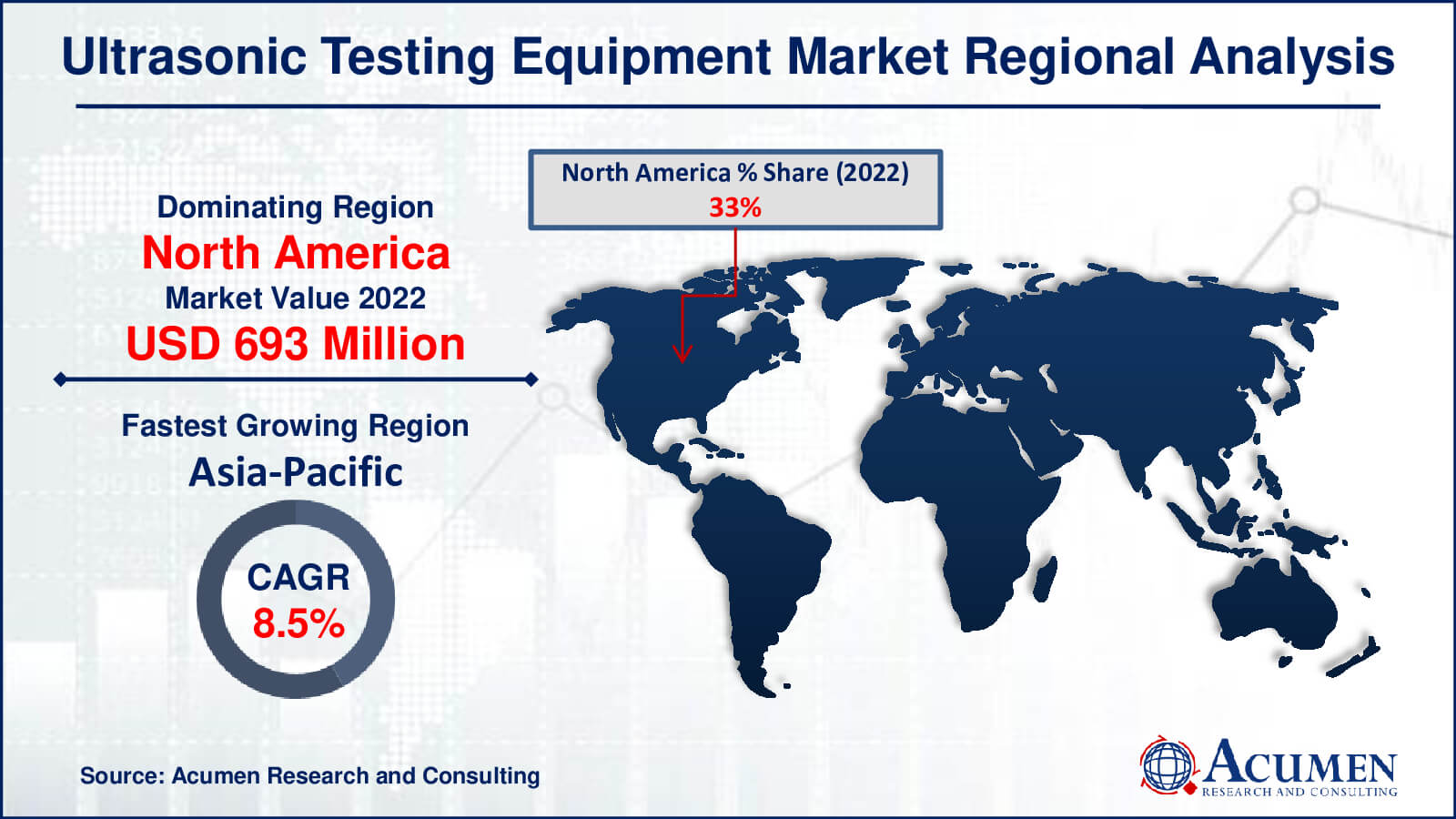

- North America ultrasonic testing equipment market value occupied around USD 693 million in 2022

- Asia-Pacific ultrasonic testing equipment market growth will record a CAGR of more than 8.5% from 2023 to 2032

- Among product, the flaw detectors sub-segment generated noteworthy revenue in 2022

- Based on component, the hardware sub-segment generated considerable share in 2022

- Integration of AI and data analytics for more precise and efficient testing processes is a popular ultrasonic testing equipment market trend that fuels the industry demand

.jpg)

Ultrasonic testing equipment is a non-destructive testing tool that examines materials for faults or irregularities. It works by injecting high-frequency sound waves into a material, which bounce back to form images or identify flaws in the material. Because of its precision in recognizing structural integrity and detecting faults without causing harm to the tested object, this equipment is widely utilized in a variety of industries, including manufacturing, aerospace, and construction. Ultrasound tests are a non-destructive test procedure that uses high-frequency sound energy for testing and measuring. It is based on the capture and quantification of waves reflected (pulse-echo) or on the transmission of waves. In particular testing applications, each of these two types of waves is used. Pulse-echo systems, however, are usually more useful because they need unilateral access to the object under examination. The increased adoption of ultrasonic pipeline test techniques is expected to drive the global market for ultrasonic testing equipment over the predicted timeframe.

Global Ultrasonic Testing Equipment Market Dynamics

Market Drivers

- Technological advancements enhancing equipment accuracy and efficiency

- Growing demand for non-destructive testing across industries like aerospace and automotive

- Stricter safety regulations driving the need for reliable inspection methods

- Increased infrastructure development projects worldwide

Market Restraints

- High initial setup costs and equipment investment

- Lack of skilled professionals proficient in operating advanced testing equipment

- Challenges in testing complex structures or materials

Market Opportunities

- Rising adoption of automated and robotic inspection systems

- Expansion into emerging markets with increasing industrialization

- Development of portable and user-friendly testing solutions

Ultrasonic Testing Equipment Market Report Coverage

| Market | Ultrasonic Testing Equipment Market |

| Ultrasonic Testing Equipment Market Size 2022 | USD 2.1 Billion |

| Ultrasonic Testing Equipment Market Forecast 2032 | USD 4.4 Billion |

| Ultrasonic Testing Equipment Market CAGR During 2023 - 2032 | 7.8% |

| Ultrasonic Testing Equipment Market Analysis Period | 2020 - 2032 |

| Ultrasonic Testing Equipment Market Base Year |

2022 |

| Ultrasonic Testing Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Component, By Technique, By End-use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ashtead Technology, Eddyfi Technologies, General Electric, Karl Deutsch Pruef- und Messgeraetebau GmbH + Co KG, Mistras Group, Nikon Corporation, Olympus Corporation, Panametrics, SONOTEC GmbH, SONOTRONIC Nagel GmbH, TÜV Rheinland, and Zetec Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ultrasonic Testing Equipment Market Insights

The growing adoption of ULT in the oil and gas industry is driving an increased demand for non-destructive pipeline testing. Oil and gas transportation occurs through rail, truck, ships, and pipelines globally. Pipelines are the exclusive means for natural gas due to its inherent structure and cost. They also handle around 70% of crude oil and related products in the United States. This heightened reliance on pipelines, coupled with significant government investments in pipeline infrastructure, amplifies the need for testing. For instance, projects like the Trans Anatolian Pipeline (TANAP) started to transport Azerbaijani gas to Turkey and Europe, boasting a substantial initial capacity. Another ongoing project is the transmission of gas via the EUGAL Pipeline in Germany, with significant investments. These developments underscore the escalating demand for non-destructive testing in the oil and gas sector.

Non-Destructive Stance

Non-destructive testing equipment plays a critical role in ensuring precise welds, minimizing girth solder defects, and guaranteeing pipeline quality before deployment. For instance, a significant gas pipeline explosion in Shelby County, Alabama, highlighted the necessity of non-destructive testing to prevent such incidents, mandated by standard organizations.

Ultrasonic non-destructive tests are instrumental in detecting faults such as leakage, porosity, cracking, and incomplete penetration, critical for maintaining weld strength. This drives a substantial global demand for ultrasound testing equipment. Additionally, stringent government safety regulations and quality control standards further bolster the global need for ultrasonic testing tools.

The US government has made regular inspection activities compulsory for manufacturers of non-destructive testing machinery. Across all economic sectors, excluding electrical and telecommunications fields, the European Standardization Committee (CEN) holds responsibility for formulating and adopting European Standards. These rigorous security regulations propel the growth of the global NDT equipment market.

Ultrasonic Testing Equipment Market Segmentation

The worldwide market for ultrasonic testing equipment is split based on product, component, technique, end-use industry, and geography.

Ultrasonic Testing Equipment Products

- Flaw Detectors

- Ultrasonic Scanners

- Thickness Gauges

- Others

According to ultrasonic testing equipment industry analysis, the market segments include flaw detectors, thickness gauges, ultrasonic scanners, etc., based on product types. Notably, the flaw detectors segment holds a significant market share due to the portability and usability offered by defect detectors. Ultrasonic fault detectors, small and portable with microprocessor-based functionalities for both shop and field use, constitute this segment. These instruments generate and display ultrasonic waveforms, enabling trained operators to identify and classify defects in test pieces, often with the assistance of analysis software. The fault detector sector is projected to witness a 7.9% increase in the ultrasonic testing equipment industry forecast period, growing at a compound annual growth rate (CAGR).

Ultrasonic Testing Equipment Components

- Services

- Hardware

The hardware category dominates the ultrasonic testing equipment market, accounting for the majority of market share. This category includes the physical gear and machinery required for ultrasonic testing, such as transducers, defect detectors, scanners, and imaging systems. The importance of hardware may be found in its important role in providing precise and efficient testing processes in industries such as manufacturing, aerospace, and healthcare. Its popularity can be due to continuous technical breakthroughs, which have fueled the creation of complex and precise equipment. As companies prioritise quality assurance and nondestructive testing, the hardware segment remains critical, preserving its market leadership in ultrasonic testing equipment.

Ultrasonic Testing Equipment Techniques

- Conventional

- Advanced

In terms of ultrasonic testing equipment market analysis, the advanced technique category is at the forefront of the industry due to its novel methodology and expanded capabilities. It incorporates cutting-edge technologies such as phased array ultrasonics and guided wave testing to provide improved precision, adaptability, and efficiency in detecting faults or anomalies in materials. Advanced approaches enable more control over beam angles, improved imaging resolution, and the inspection of complicated geometries. Industries seeking higher precision and faster inspection rates, particularly in crucial industries such as oil and gas, aerospace, and automotive, prefer these sophisticated techniques, fueling their prevalence and leadership in the ultrasonic testing equipment market.

Ultrasonic Testing Equipment End-Use Industries

- Oil & Gas

- Power Generation

- Aerospace & Defense

- Manufacturing

- Automotive

- Others

The oil and gas industry dominates the market due to severe safety standards and the importance of assuring asset integrity and its expected to consistently lead over the ultrasonic testing equipment market forecast period. Ultrasonic testing is critical in evaluating pipelines, storage tanks, and offshore infrastructure, where slight defects can have disastrous implications. The industry's ongoing emphasis on preventative maintenance, combined with the rising use of non-destructive testing to save downtime, increases demand for ultrasonic equipment. The oil and gas sector is the leading driver, controlling a significant part of the global ultrasonic testing equipment market, with a dedication to improving operational efficiency and safety measures.

Ultrasonic Testing Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ultrasonic Testing Equipment Market Regional Analysis

North America leads the ultrasonic testing equipment market due to strict safety requirements and a robust industrial infrastructure. Ultrasonic testing is significantly used in industries such as oil and gas, aerospace, and manufacturing in the United States and Canada for quality control and asset integrity, boosting market expansion. Europe closely follows, heavily utilizing ultrasonic testing in industries such as automotive, power generation, and aerospace. The region's large market share is driven by stringent quality requirements and a strong focus on technical improvements.

Due to significant industrialization and infrastructure development in nations like as China, India, and Japan, the Asia-Pacific region emerges as the fastest-growing market. Increased investment in industries such as industrial, automotive, and infrastructure necessitates dependable non-destructive testing methods, which drives the development of ultrasonic testing equipment. Furthermore, high safety standards established by regulatory agencies hasten the adoption of these technologies throughout businesses in the region.

Ultrasonic Testing Equipment Market Players

Some of the top ultrasonic testing equipment companies offered in our report includes Ashtead Technology, Eddyfi Technologies, General Electric, Karl Deutsch Pruef- und Messgeraetebau GmbH + Co KG, Mistras Group, Nikon Corporation, Olympus Corporation, Panametrics, SONOTEC GmbH, SONOTRONIC Nagel GmbH, TÜV Rheinland, and Zetec Inc.

Frequently Asked Questions

How big is the ultrasonic testing equipment market?

The ultrasonic testing equipment market size was USD 2.1 billion in 2022.

What is the CAGR of the global ultrasonic testing equipment market from 2023 to 2032?

The CAGR of ultrasonic testing equipment is 7.8% during the analysis period of 2023 to 2032.

Which are the key players in the ultrasonic testing equipment market?

The key players operating in the global market are including Ashtead Technology, Eddyfi Technologies, General Electric, Karl Deutsch Pruef- und Messgeraetebau GmbH + Co KG, Mistras Group, Nikon Corporation, Olympus Corporation, Panametrics, SONOTEC GmbH, SONOTRONIC Nagel GmbH, TÜV Rheinland, and Zetec Inc.

Which region dominated the global ultrasonic testing equipment market share?

North America held the dominating position in ultrasonic testing equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ultrasonic testing equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ultrasonic testing equipment industry?

The current trends and dynamics in the ultrasonic testing equipment industry include technological advancements enhancing equipment accuracy and efficiency, growing demand for non-destructive testing across industries like aerospace and automotive, stricter safety regulations driving the need for reliable inspection methods, and increased infrastructure development projects worldwide.

Which product held the maximum share in 2022?

The flaw detectors product held the maximum share of the ultrasonic testing equipment industry.