Ultrasonic Sensors Market | Acumen Research and Consulting

Ultrasonic Sensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

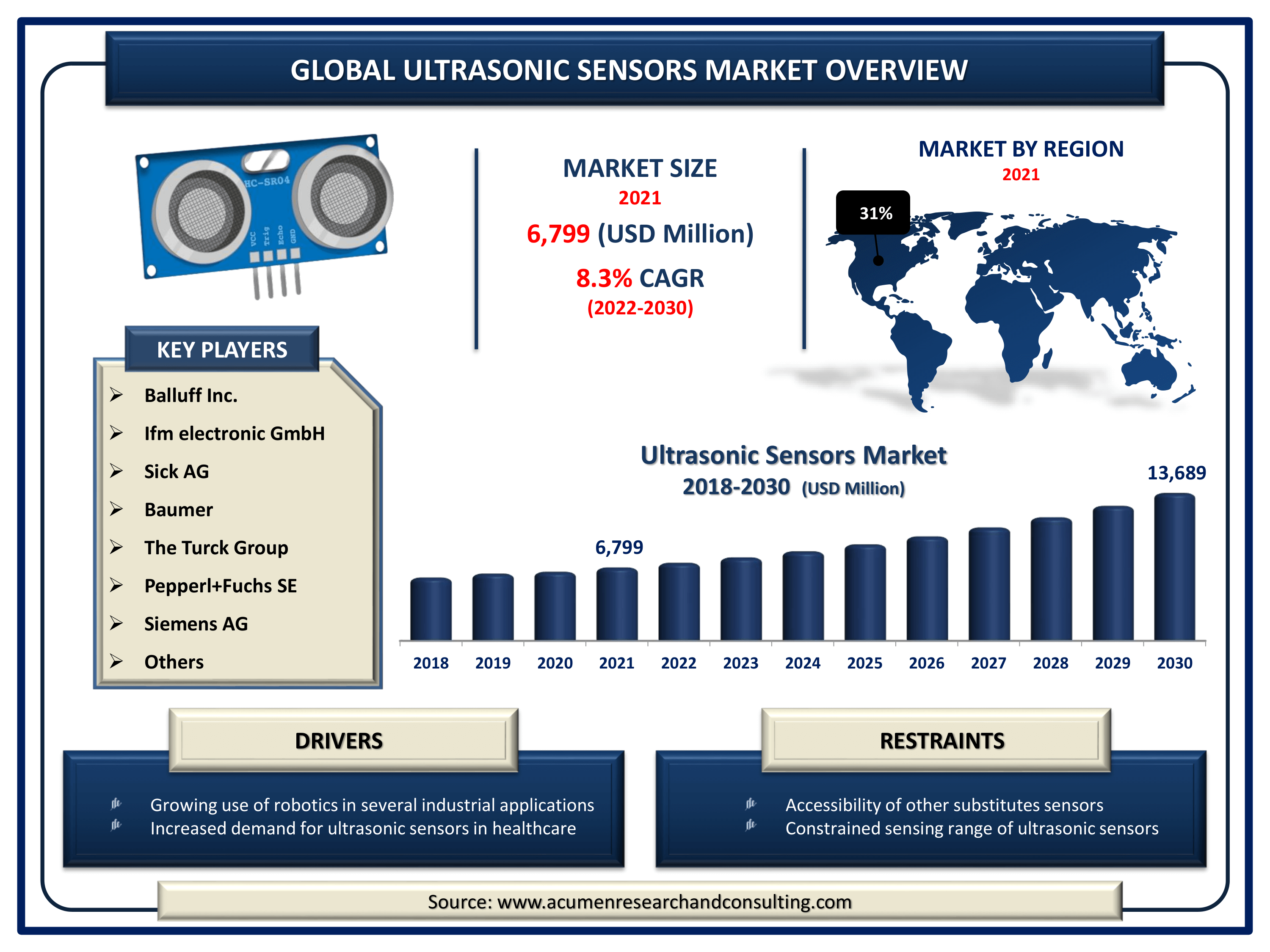

The Global Ultrasonic Sensors Market Size accounted for USD 6,799 Million in 2021 and is estimated to achieve a market size of USD 13,689 Million by 2030 growing at a CAGR of 8.3% from 2022 to 2030. The rising usage of ultrasonic sensors for distance measurement, object detection, as well as pallet detection, among other applications, is driving the ultrasonic sensors market growth. Additionally, due to the fact that these sensors satisfy a wide range of needs, including those for warehouse operations, processing, and hygiene monitoring in the food service industry, their demand has increased dramatically in recent years, propelling the ultrasonic sensors market value.

Ultrasonic Sensors Market Report Key Highlights

- Global ultrasonic sensors market revenue is expected to increase by USD 13,689 million by 2030, with an 8.3% CAGR from 2022 to 2030.

- North America region led with more than 31% Ultrasonic Sensors market share in 2021

- Asia-Pacific regional market is expected to grow at a CAGR of more than 9% during the forecast period

- By type, level measurement segment engaged more than 50% of the total market share in 2021

- Among end-use, healthcare sector is growing at a strongest CAGR over the forecast period

- Growing adoption for obstacle detection & parking assistance in automated vehicles, drives the ultrasonic sensors market size

Ultrasonic sensors are mostly used as proximity sensors. They can be found in self-parking technology and anti-collision safety systems in automobiles. In comparison to infrared (IR) sensors in proximity sensing applications, ultrasonic sensors are also used in robotic obstacle detection systems and manufacturing technology. Smoke, gas, and other airborne particles do not interfere with ultrasonic sensors as much (though the physical components are still affected by variables such as heat). Ultrasonic sensors are also used as level sensors in closed containers to detect, monitor, and regulate liquid levels (such as vats in chemical factories). Most notably, ultrasonic technology has allowed the medical industry to create images of internal organs, identify tumors, and monitor the health of babies in the womb.

Global Ultrasonic Sensors Market Dynamics

Market Drivers

- Growing use of robotics in several industrial applications

- Increased demand for ultrasonic sensors in healthcare

- Growing adoption for obstacle detection & parking assistance in automated vehicles

- Increasing usage in the food and beverage industry

Market Restraints

- Accessibility of other substitutes sensors

- Constrained sensing range of ultrasonic sensors

Market Opportunities

- Increasing application in factory automation

- High utilization in Smart applications

Ultrasonic Sensors Market Report Coverage

| Market | Ultrasonic Sensors Market |

| Ultrasonic Sensors Market Size 2021 | USD 6,799 Million |

| Ultrasonic Sensors Market Forecast 2030 | USD 13,689 Million |

| Ultrasonic Sensors Market CAGR During 2022 - 2030 | 8.3% |

| Ultrasonic Sensors Market Analysis Period | 2018 - 2030 |

| Ultrasonic Sensors Market Base Year | 2021 |

| Ultrasonic Sensors Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Technology, By Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Balluff Inc., Ifm electronic GmbH, Banner Engineering Corp., Sick AG, Baumer, Murata Manufacturing Co., Ltd., The Turck Group, Pepperl+Fuchs SE, and Siemens AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Significant Investment In Ultrasonic Sensors For The Agriculture Sector

The development of a sensing system that extracts information from an ultrasonic sensor is progressing, and this information would be used in a variety of sensing operations in precision agriculture. Furthermore, by detecting tree gaps, the ultrasonic sensor saves money on pesticides. When these sensors are detected, the spraying operation is temporarily halted. This is expected to provide significant benefits to the companies that provide this system, thereby positively influencing the ultrasonic sensor market share.

Ultrasonic Sensors Market Dynamics

The ultrasonic sensor industry is currently witnessing a surge in demand for autonomous mobile robots (AMRs). The adoption of AMRs is increasing year over year in the medical, oil and gas, electronics, and automotive industries, owing to rising technological developments and a growing emphasis on improving efficiency, operational capacity, and production output (YoY). Ultrasonic sensors are built into AMRs to detect obstacles and measure the distance between two objects. In 2019, Toposens GmbH, for example, developed an ultrasonic sensor for range perception in robotics and autonomous driving applications. Ultrasonic sensors are used in the manufacturing sector to measure water level in tanks, roll diameter, height, and distance, as well as loop control. The growing use of sensors in the manufacturing sector is a significant growth driver for the ultrasonic sensor market. Furthermore, rising industrial output in developing countries has increased demand for these sensors, particularly in level measurement applications. For example, industrial production in Turkey increased by nearly 3.4 percent year on year in September 2019. (YoY). The growing demand for industrial automation is a significant opportunity in the ultrasonic sensor market. Because of the Industry 4.0 initiative, there will be a significant demand for automation in a variety of industrial processes in the future. Furthermore, manufacturers are increasingly implementing automation solutions to improve efficiency and productivity while increasing revenue. Ultrasonic sensors are essential in industrial automation because they enable products to be automated and intelligent.

Ultrasonic Sensors Market Segmentation

The global ultrasonic sensors market segmentation is based on technology, type, end-use, and geography.

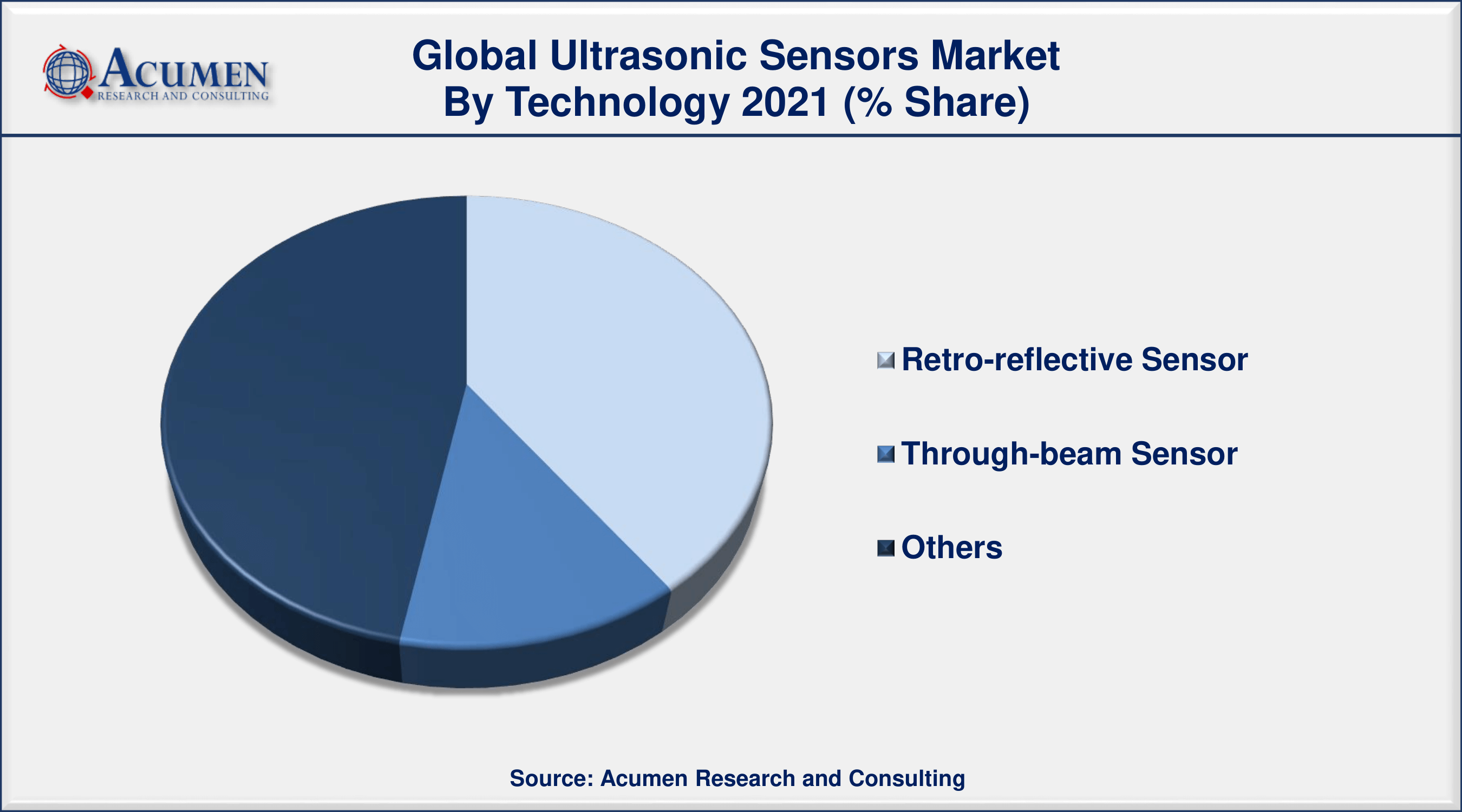

Ultrasonic Sensors Market By Technology

- Retro-reflective Sensor

- Through-beam Sensor

- Others

In terms of technology, the retro-reflective segment is expected to dominate the market in the coming years. Reduced maintenance costs, installation costs, and reliability in detecting transparent objects are the factors driving the segment's growth. Furthermore, retro-reflective sensors have simple optical axis adjustment and wiring, making them simple to deploy. Furthermore, the increasing use of retro-reflective systems in automobile throttle control and precision position measurement bodes well for segment growth.

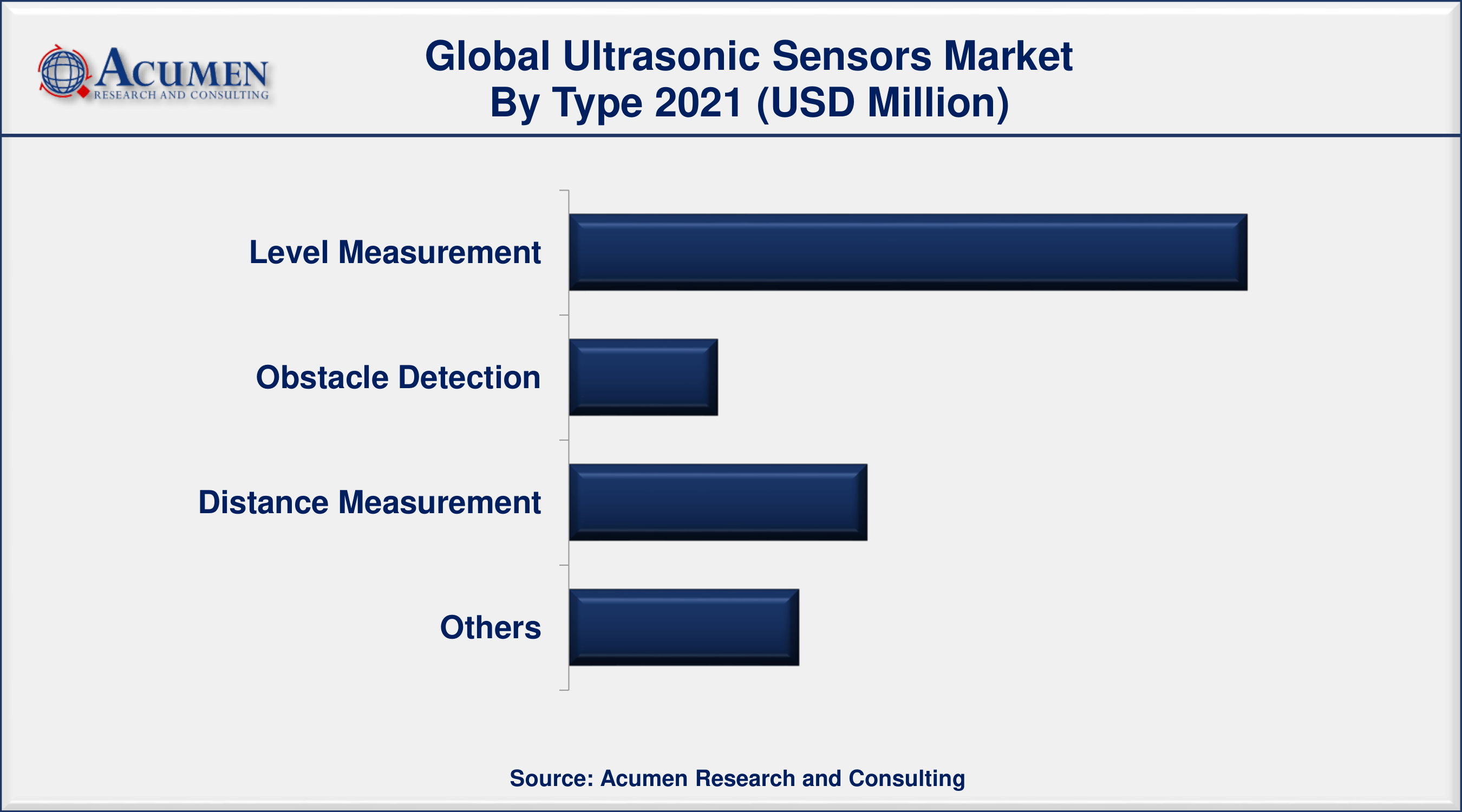

Ultrasonic Sensors Market By Type

- Level Measurement

- Obstacle Detection

- Distance Measurement

- Others

According to an ultrasonic sensors industry analysis, the obstacle detection segment is predicted to grow in the market over the next few years. This is due to the increasing use of these systems in automobile collision avoidance systems. Stringent government policies and regulations governing the installation of vehicle safety features such as collision avoidance systems and airbags have fueled the segment's growth prospects even further.

Ultrasonic Sensors Market By End-Use

- Consumer Electronics

- Healthcare

- Aerospace & Defense

- Automotive

- Industrial

- Others

According to the ultrasonic sensors market forecast, the automotive industry holds lucrative opportunities from the past and is expected to continue a similar trend till the forecast period. Ultrasonic devices have a wide range of applications in automotive sensors, including parking assistance, safety alarms, collision avoidance, object detection, and an automatic braking system. They have a significant impact on the future of next-generation driver assistance and self-driving systems.

In advanced cars, onboard sensing systems are available for a premium process. For measuring the relative distances of objects from the car, these systems rely on ultrasonic sensors. Long-range radar capabilities are being integrated with cruise control systems to prevent vehicle collisions. These sensors are also used to detect distances on the back end of vehicles for parking assistance and braking control. Furthermore, sensor vendors have been offering several variants of ultrasonic sensors with enhanced capabilities such as open structures, waterproofing, and external casing for damage reduction. As a result of the expected increase in ADAS systems in the future, ultrasonic sensors will see a proportional increase.

Ultrasonic Sensors Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America Holds The Dominant Market Share For The Global Ultrasonic Sensors Market

Due to a variety of factors, North America has traditionally been a market leader in ultrasonic sensors. This sector has a high market penetration, and the presence of several automotive and manufacturing behemoths is a critical growth factor. The United States has the largest market share in North America, but the Canadian market is expected to grow faster than the US market. Ultrasonic sensors are widely used in various medical inspections, including prenatal examinations, where radiography cannot be used because they can visualize the internal condition of the human body without causing damage.

Furthermore, the growing demand for better surgical procedures among health-conscious citizens is propelling the market for ultrasonic sensors in this region.

The Asia-Pacific, on the other hand, is expected to grow at a rapid pace in the coming years due to rising demand for factory automation in the region's manufacturing sector. The rapid expansion of the region's automotive manufacturing industry is expected to drive demand for these systems even further.

Ultrasonic Sensors Market Players

Some of the top ultrasonic sensors market companies offered in the professional report include Balluff Inc., Ifm electronic GmbH, Banner Engineering Corp., Sick AG, Baumer, Murata Manufacturing Co., Ltd., The Turck Group, Pepperl+Fuchs SE, and Siemens AG.

Frequently Asked Questions

What is the size of global ultrasonic sensors market in 2021?

The estimated value of global ultrasonic sensors market in 2021 was accounted to be USD 6,799 Million.

What is the CAGR of global ultrasonic sensors market during forecast period of 2022 to 2030?

The projected CAGR ultrasonic sensors market during the analysis period of 2022 to 2030 is 8.3%.

Which are the key players operating in the market?

The prominent players of the global ultrasonic sensors market are Balluff Inc., Ifm electronic GmbH, Banner Engineering Corp., Sick AG, Baumer, Murata Manufacturing Co., Ltd., The Turck Group, Pepperl+Fuchs SE, and Siemens AG.

Which region held the dominating position in the global ultrasonic sensors market?

North America held the dominating ultrasonic sensors during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for ultrasonic sensors during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global ultrasonic sensors market?

Increase in phlebotomy/venipuncture procedures, and growing numbers of obese, geriatric, dark-skinned, & Medicaid patients, drives the growth of global ultrasonic sensors market.

By type segment, which sub-segment held the maximum share?

Based on type, level measurement segment is expected to hold the maximum share ultrasonic sensors market.