Ultrafiltration Market | Acumen Research and Consulting

Ultrafiltration Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

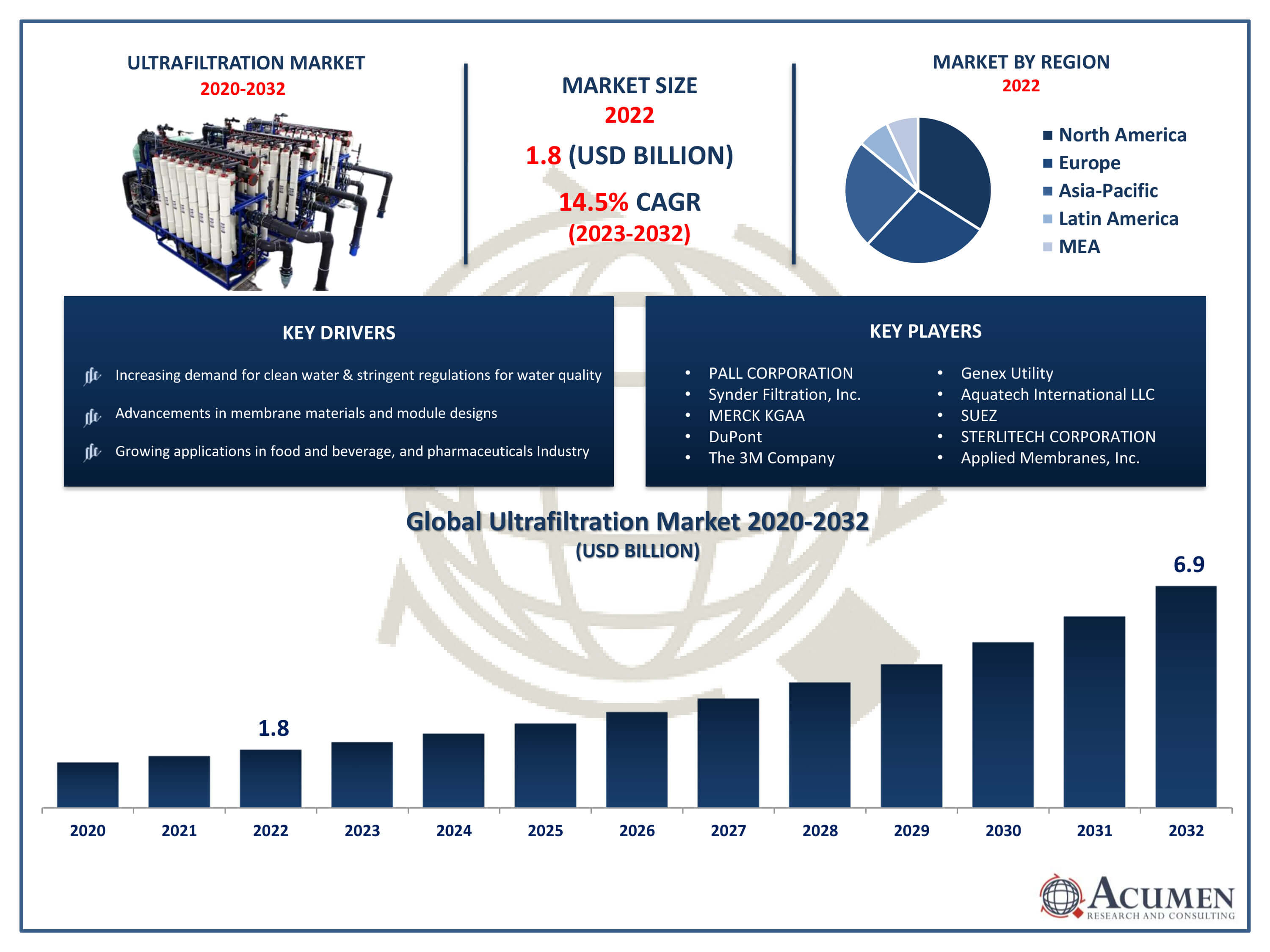

The Ultrafiltration Market Size accounted for USD 1.8 Billion in 2022 and is projected to achieve a market size of USD 6.9 Billion by 2032 growing at a CAGR of 14.5% from 2023 to 2032.

Ultrafiltration Market Highlights

- Global ultrafiltration market revenue is expected to increase by USD 6.9 billion by 2032, with a 14.5% CAGR from 2023 to 2032

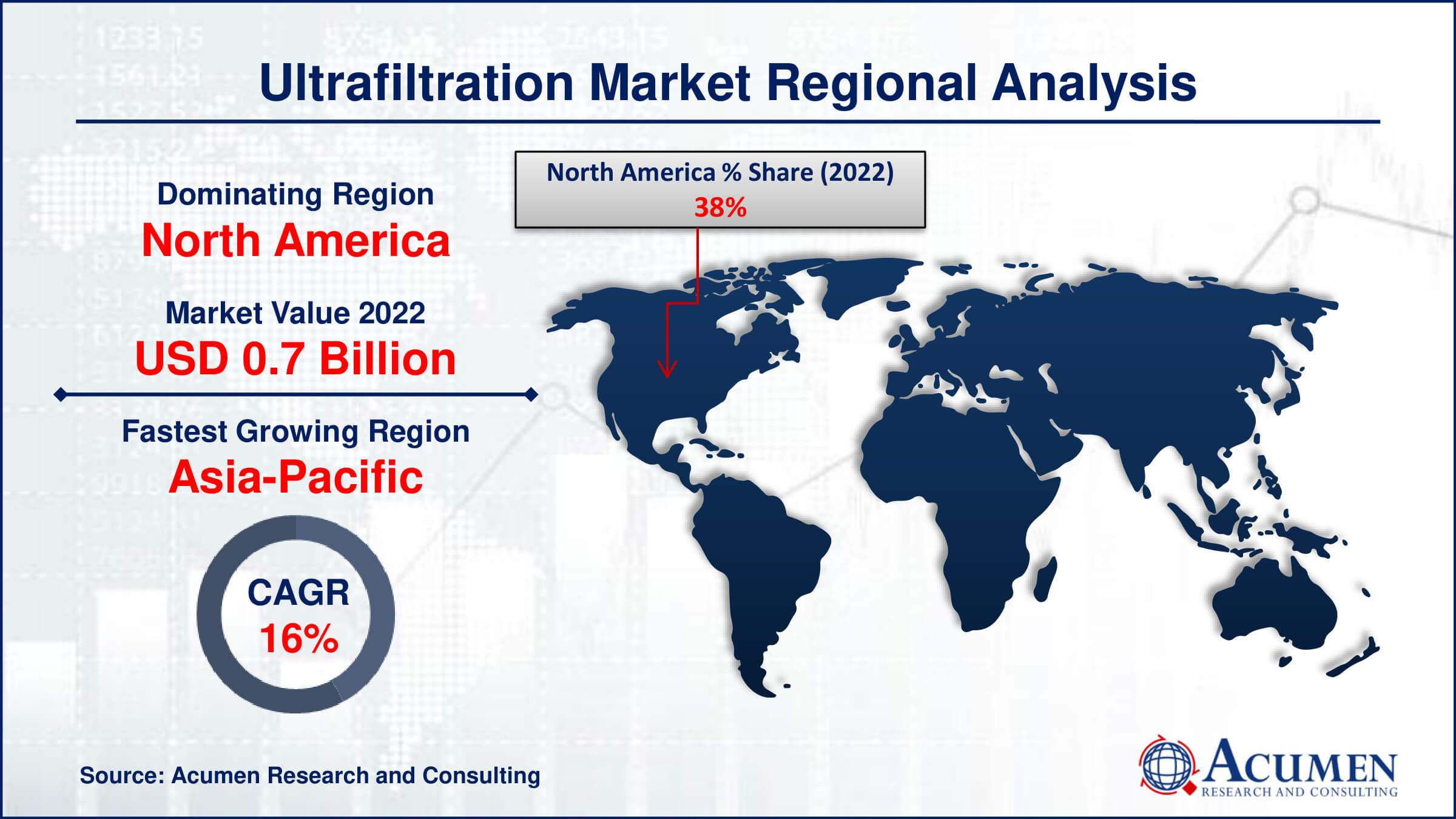

- North America region led with more than 38% of ultrafiltration market share in 2022

- Asia-Pacific ultrafiltration market growth will record a CAGR of more than 16.1% from 2023 to 2032

- By type, the polymeric segment captured more than 52% of revenue share in 2022.

- By application, the industrial treatment segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for clean water and stringent regulations for water quality, drives the ultrafiltration market value

Ultrafiltration is a membrane-based separation process that utilizes pressure to separate particles and solutes from a liquid stream based on their size. It is widely used in various industries including water treatment, food and beverage processing, pharmaceutical manufacturing, and biotechnology. The ultrafiltration process involves forcing a liquid through a semi-permeable membrane with pores typically ranging from 0.001 to 0.1 micrometers in diameter. These pores are small enough to effectively remove suspended solids, colloids, bacteria, viruses, and other contaminants from the liquid while allowing water and smaller molecules to pass through, resulting in a purified product.

Ultrafiltration is a membrane-based separation process that utilizes pressure to separate particles and solutes from a liquid stream based on their size. It is widely used in various industries including water treatment, food and beverage processing, pharmaceutical manufacturing, and biotechnology. The ultrafiltration process involves forcing a liquid through a semi-permeable membrane with pores typically ranging from 0.001 to 0.1 micrometers in diameter. These pores are small enough to effectively remove suspended solids, colloids, bacteria, viruses, and other contaminants from the liquid while allowing water and smaller molecules to pass through, resulting in a purified product.

The market for ultrafiltration has been experiencing significant growth driven by several factors. Increasing global population, urbanization, and industrialization have led to a rising demand for clean water, which has propelled the adoption of ultrafiltration systems for water and wastewater treatment applications. For instance, according to the US Census Bureau, the global population increased by 75 million in 2023 and is projected to exceed 8 billion by New Year's Day. Additionally, stringent government regulations pertaining to water quality standards and environmental protection have further boosted the demand for ultrafiltration technologies. For instance, the 2022 version of China's SDWQ has coordinated assessment standards for both urban and rural water supplies, enhanced the scientific approach and safety of disinfection, and refined management criteria for the sensory aspects of drinking water, aligning more closely with China's current standards for drinking water quality. Moreover, advancements in membrane materials and module designs, along with improvements in energy efficiency and operational costs, have made ultrafiltration systems more attractive to end-users across various industries.

Global Ultrafiltration Market Trends

Market Drivers

- Increasing demand for clean water and stringent regulations for water quality

- Advancements in membrane materials and module designs

- Growing population and industrialization driving demand for water and wastewater treatment

- Rising awareness about the importance of water conservation and environmental protection

- Technological innovations improving energy efficiency and operational costs of ultrafiltration systems

Market Restraints

- High initial investment and maintenance costs

- Challenges related to membrane fouling and lifespan

Market Opportunities

- Expansion of applications in pharmaceutical and biotechnology industries

- Integration of ultrafiltration with other treatment processes for enhanced efficiency

Ultrafiltration Market Report Coverage

| Market | Ultrafiltration Market |

| Ultrafiltration Market Size 2022 | USD 1.8 Billion |

| Ultrafiltration Market Forecast 2032 |

USD 6.9 Billion |

| Ultrafiltration Market CAGR During 2023 - 2032 | 14.5% |

| Ultrafiltration Market Analysis Period | 2020 - 2032 |

| Ultrafiltration Market Base Year |

2022 |

| Ultrafiltration Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Module, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PALL CORPORATION, Synder Filtration, Inc., MERCK KGAA, Berghof Membrane Technology GmbH (BMT), DuPont, The 3M Company, Genex Utility, Aquatech International LLC, SUEZ, STERLITECH CORPORATION, Applied Membranes, Inc., Pentair plc, and FUMATECH BWT GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ultrafiltration is a membrane-based separation process used to purify and separate substances in a liquid by size exclusion. It operates on the principle of passing a liquid through a semi-permeable membrane with pore sizes. This process effectively removes particles, colloids, bacteria, viruses, and macromolecules from the liquid while allowing smaller molecules and solvents to pass through. Ultrafiltration is widely employed in various industries such as water treatment, food and beverage processing, pharmaceutical manufacturing, biotechnology, and wastewater treatment. In water treatment, ultrafiltration is utilized for the purification of drinking water, desalination, and the removal of contaminants and pollutants from industrial wastewater. In the food and beverage industry, it is employed for the clarification and concentration of juices, dairy products, and other liquid foodstuffs. Moreover, in pharmaceutical manufacturing, ultrafiltration plays a crucial role in protein purification, virus removal, and the concentration of pharmaceutical compounds.

The ultrafiltration market has been experiencing robust growth in recent years, driven by several factors. One of the primary drivers is the increasing demand for clean water worldwide, spurred by population growth, urbanization, and industrial expansion. For instance, approximately 70% of India's water is polluted, and by 2030, the projected water demand for India is expected to be twice the available supply, as emphasized in the Interconnected Disaster Risks Report in October 2023. Stricter regulations regarding water quality and environmental protection have further propelled the adoption of ultrafiltration systems for water and wastewater treatment applications. This heightened awareness about the importance of water conservation and sustainability has led industries and municipalities to invest in advanced filtration technologies like ultrafiltration to ensure access to safe and clean water resources. Technological innovations have led to improvements in energy efficiency, operational costs, and overall system performance, making ultrafiltration systems more attractive to a wide range of end-users across various industries. For instance, on September 27, 2022, PPG announced the launch of filter components and a high-performance ultrafiltration (UF) membrane for use in wastewater and industrial process applications. Moreover, advancements in membrane materials, module designs, and process efficiency have contributed to the growth of the ultrafiltration market.

Ultrafiltration Market Segmentation

The global ultrafiltration market segmentation is based on type, module, application, and geography.

Ultrafiltration Market By Type

- Ceramic

- Polymeric

According to the ultrafiltration industry analysis, the polymeric segment accounted for the largest market share in 2022. This growth is primarily driven by advancements in polymer science and membrane technology. Polymeric membranes, which are typically made from materials like polysulfone, polyethersulfone, and polyvinylidene fluoride (PVDF), offer several advantages such as excellent chemical resistance, mechanical strength, and durability, making them ideal for various filtration applications. One significant factor contributing to the growth of the polymeric segment is the increasing demand for cost-effective and efficient filtration solutions across industries such as water treatment, food and beverage processing, pharmaceuticals, and biotechnology. Polymeric membranes provide a reliable and scalable solution for removing contaminants, particles, and microorganisms from liquids, thereby ensuring product quality and safety.

Ultrafiltration Market By Module

- Hollow Fiber

- Tubular

- Plate and Frame

- Others

In terms of modules, the hollow fiber segment is expected to witness significant growth in the coming years. Hollow fiber membranes offer significant advantages such as high surface area-to-volume ratio, compact design, and efficient mass transfer properties, making them well-suited for a wide range of ultrafiltration applications. These membranes are commonly used in industries such as water and wastewater treatment, pharmaceuticals, biotechnology, and food and beverage processing. One key driver behind the growth of the hollow fiber segment is the increasing demand for compact and modular filtration systems, particularly in decentralized and mobile applications. Hollow fiber membranes allow for the construction of space-efficient and scalable filtration modules, making them ideal for installations in constrained spaces or remote locations. Additionally, advancements in membrane manufacturing technologies have led to improvements in membrane performance, including higher flux rates, better fouling resistance, and enhanced durability, further driving the adoption of hollow fiber ultrafiltration systems. Additionally, the innovative contributions of key players continue to drive growth. For example, Toray Industries, Inc. revealed that its hollow fiber ultrafiltration membrane modules are being utilized in a cutting-edge facility, which commenced operations at the Yindingzhuang Wastewater Treatment Plant in July 2022. Such advancements sustain the segment's leadership position within this industry.

Ultrafiltration Market By Application

- Municipal Treatment

- Industrial Treatment

- Chemical & Petrochemical Processing

- Pharmaceutical Processing

- Food & Beverage Processing

- Others

According to the ultrafiltration industry forecast, the industrial treatment segment is expected to witness significant growth in the coming years. Industries such as manufacturing, mining, power generation, and oil and gas production generate large volumes of wastewater and process streams containing contaminants that require treatment before discharge or reuse. Ultrafiltration technology offers an effective solution for removing suspended solids, colloids, oil, grease, heavy metals, and other pollutants from industrial wastewater, thereby ensuring compliance with environmental regulations and reducing the environmental impact of industrial operations. One of the key drivers behind the growth of the industrial treatment segment is the growing emphasis on water conservation and sustainability in industrial processes. As water resources become scarcer and water quality regulations become more stringent, industries are increasingly turning to advanced filtration technologies like ultrafiltration to treat and recycle wastewater for reuse in their operations. Ultrafiltration systems help industries reduce their reliance on freshwater sources, minimize discharge volumes, and mitigate the environmental footprint associated with their water-intensive processes.

Ultrafiltration Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ultrafiltration Market Regional Analysis

North America has emerged as a dominating region in the ultrafiltration industry due to several key factors that contribute to its prominence in this industry. One significant factor is the region's robust industrial infrastructure across various sectors such as pharmaceuticals, food and beverage, chemicals, and manufacturing. These industries generate significant volumes of wastewater and process streams that require treatment, driving the demand for ultrafiltration systems. Additionally, North America has stringent environmental regulations governing water quality and discharge standards, necessitating the adoption of advanced filtration technologies like ultrafiltration to ensure compliance. Moreover, the region benefits from a strong research and development ecosystem and technological expertise in membrane science and engineering. North American companies and research institutions are at the forefront of developing innovative membrane materials, module designs, and process optimization techniques for ultrafiltration applications. For instance, DuPont is rebranding and streamlining its extensive array of ultrafiltration (UF) membranes, utilized for water conservation, sustainable purification, and recycling, to better cater to its municipal and industrial customers. Furthermore, Dupont unveiled a collaboration with Water.org on December 20, 2021, aiming to enhance worldwide access to clean water. This technological leadership allows North American manufacturers to offer high-performance and cost-effective ultrafiltration solutions that meet the diverse needs of industrial and municipal customers worldwide.

The Asia Pacific region emerges as the fastest-growing market for ultrafiltration technology, driven by increasing industrialization and water scarcity concerns. Rapid urbanization, coupled with stringent environmental regulations, propels the demand for efficient water treatment solutions across various sectors. Investments in infrastructure development and advancements in filtration technology further bolster the market growth in this dynamic region. Moreover, presence of robust key players further boosts market’s growth. For instance, on June 5, 2023, Veolia Water Technologies, a prominent provider of water and wastewater treatment solutions, bolstered its range of mobile water services in China by unveiling advanced molecular trailer-mounted Reverse Osmosis (RO) units. As industries and municipalities seek sustainable water management solutions, ultrafiltration emerges as a pivotal technology addressing purification needs with its effectiveness and versatility.

Ultrafiltration Market Player

Some of the top ultrafiltration market companies offered in the professional report include PALL CORPORATION, Synder Filtration, Inc., MERCK KGAA, Berghof Membrane Technology GmbH (BMT), DuPont, The 3M Company, Genex Utility, Aquatech International LLC, SUEZ, STERLITECH CORPORATION, Applied Membranes, Inc., Pentair plc, and FUMATECH BWT GmbH.

Frequently Asked Questions

How big is the ultrafiltration market?

The ultrafiltration market size was USD 1.8 Billion in 2022.

What is the CAGR of the global Ultrafiltration Market from 2023 to 2032?

The CAGR of ultrafiltration is 14.5% during the analysis period of 2023 to 2032.

Which are the key players in the Ultrafiltration Market?

The key players operating in the global market are including PALL CORPORATION, Synder Filtration, Inc., MERCK KGAA, Berghof Membrane Technology GmbH (BMT), DuPont, The 3M Company, Genex Utility, Aquatech International LLC, SUEZ, STERLITECH CORPORATION, Applied Membranes, Inc., Pentair plc, and FUMATECH BWT GmbH.

Which region dominated the global Ultrafiltration Market share?

North America held the dominating position in ultrafiltration industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ultrafiltration during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ultrafiltration industry?

The current trends and dynamics in the ultrafiltration industry include increasing demand for clean water and stringent regulations for water quality, advancements in membrane materials and module designs, and growing population and industrialization driving demand for water and wastewater treatment.

Which module held the maximum share in 2022?

The hollow fiber module held the maximum share of the ultrafiltration industry.