Turpentine Oil Market | Acumen Research and Consulting

Turpentine Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

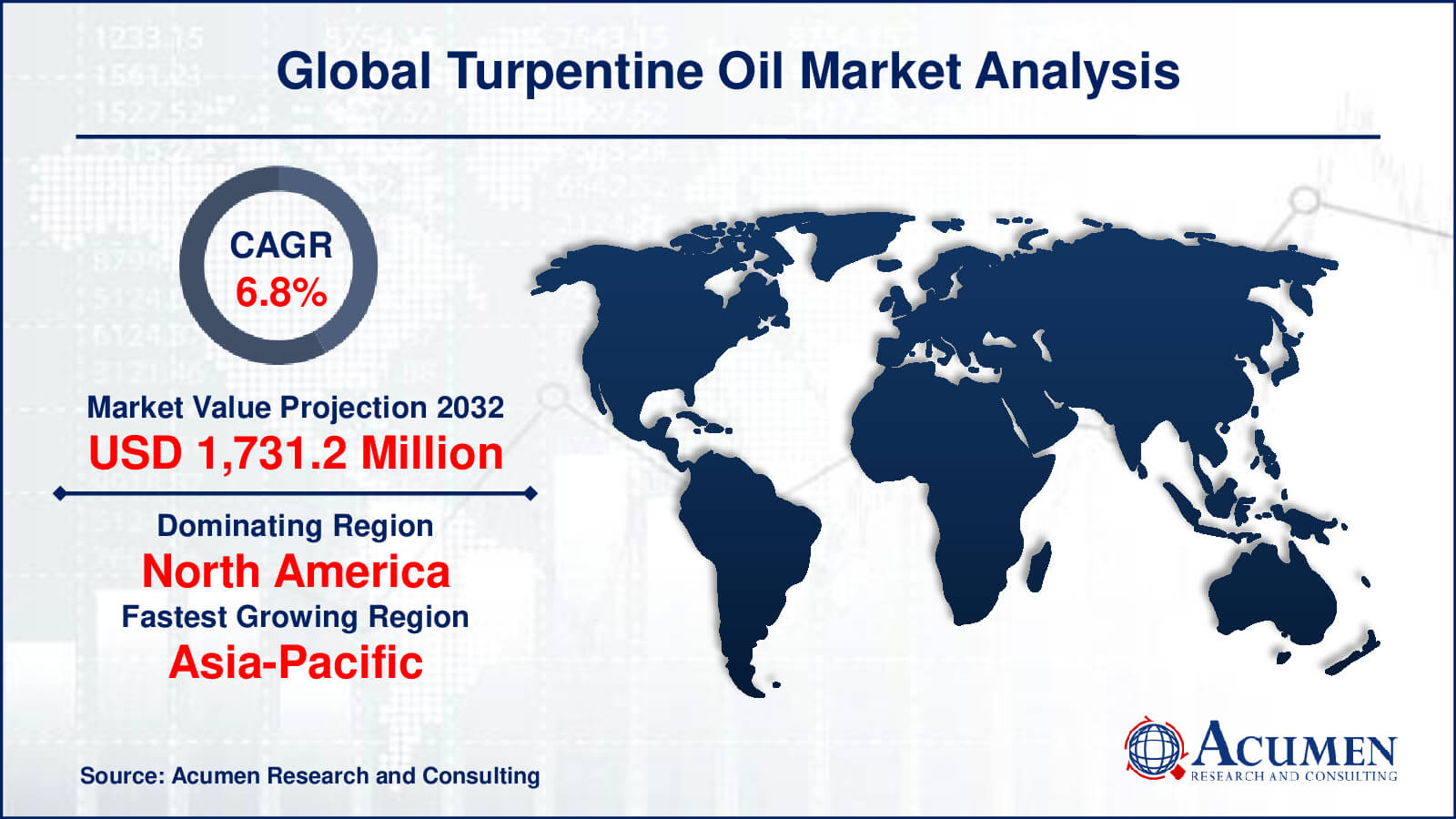

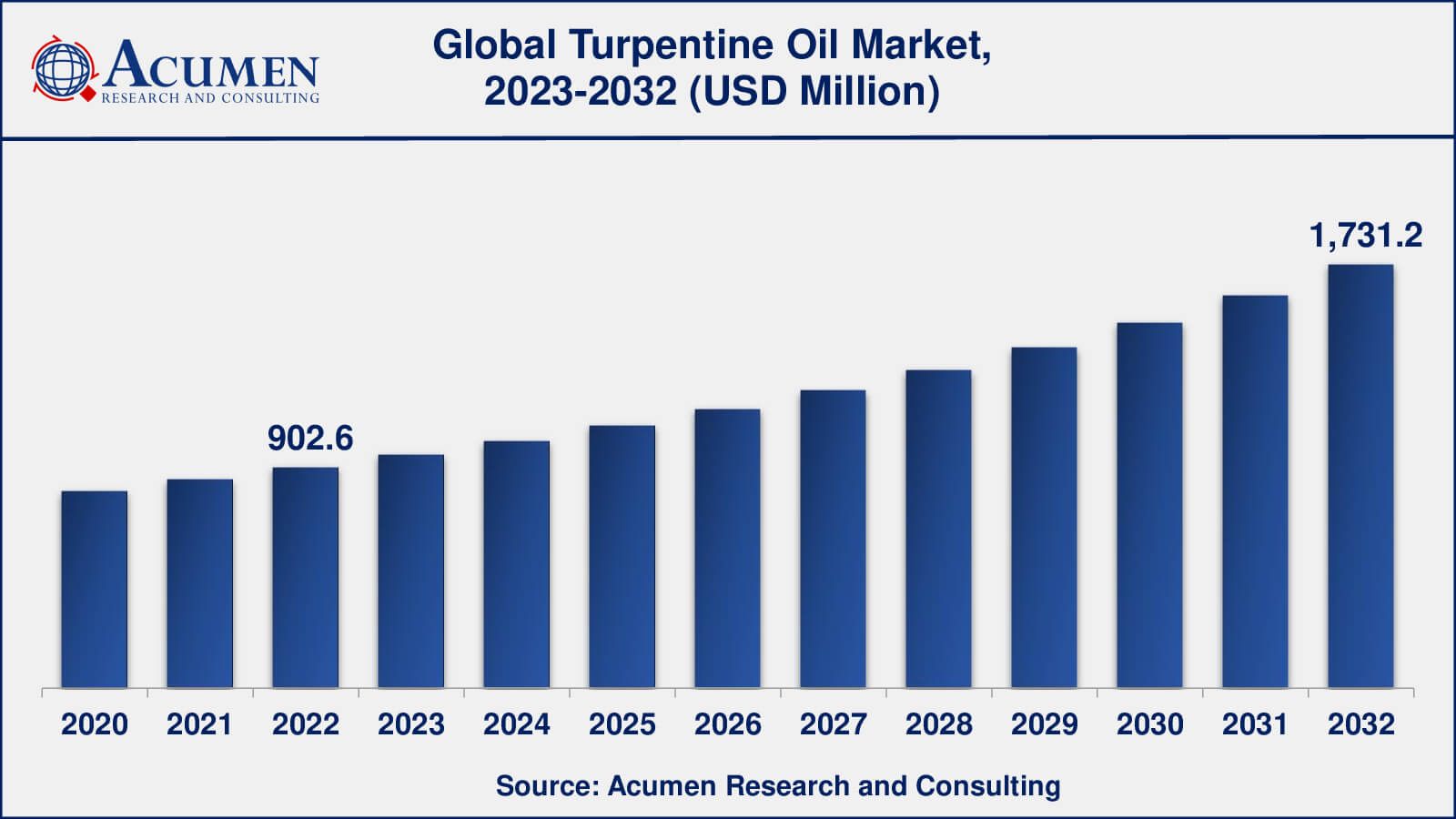

The Global Turpentine Oil Market Size accounted for USD 902.6 Million in 2022 and is estimated to achieve a market size of USD 1,731.2 Million by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Turpentine Oil Market Highlights

- Global turpentine oil market revenue is poised to garner USD 1,731.2 million by 2032 with a CAGR of 6.8% from 2023 to 2032

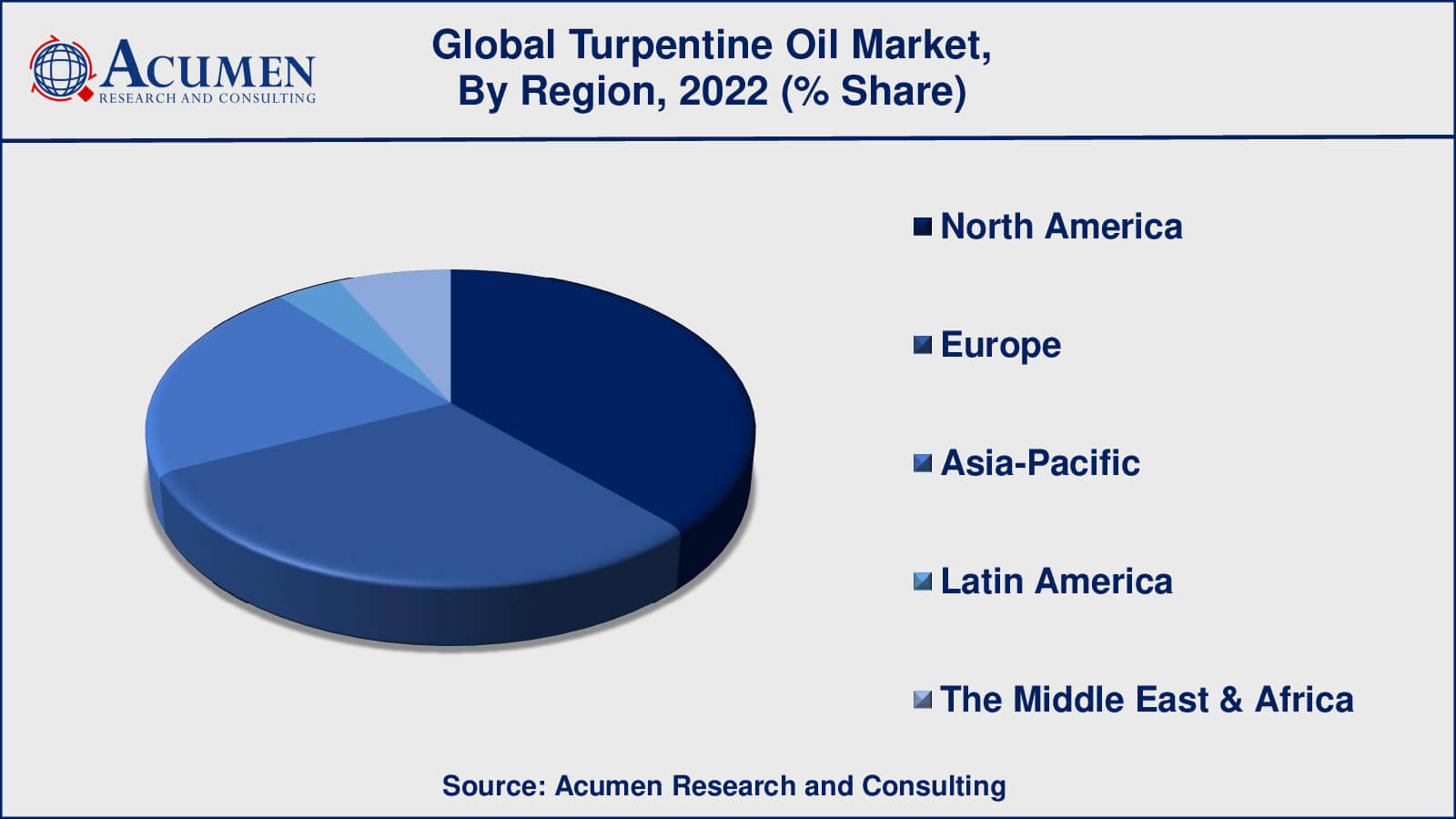

- North America turpentine oil market value occupied almost USD 343 million in 2022

- Asia-Pacific turpentine oil market growth will record a CAGR of over 7% from 2023 to 2032

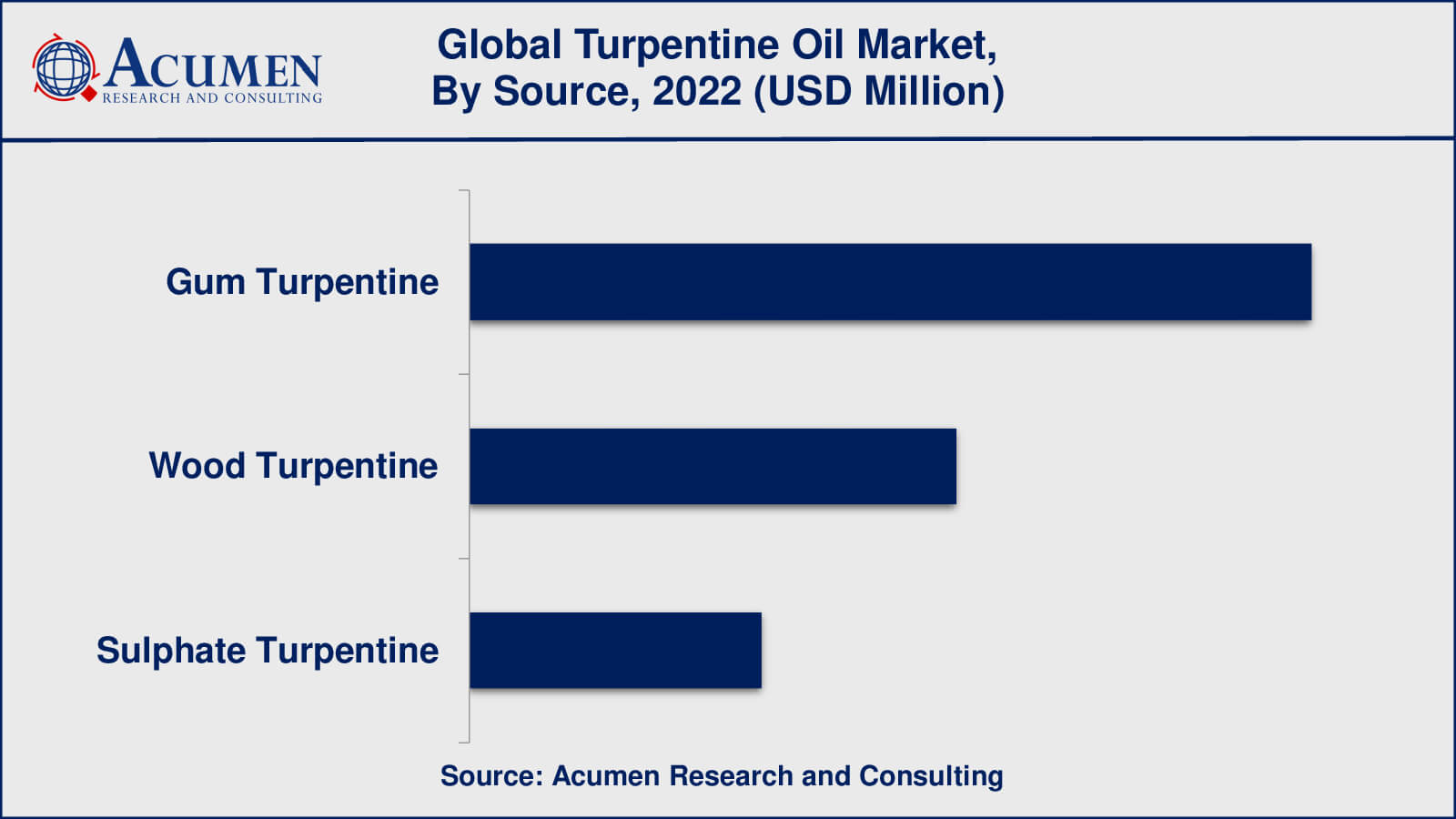

- Among source, the gum turpentine sub-segment generated over US$ 470 million revenue in 2022

- Based on application, the paints and coatings sub-segment generated around 40% share in 2022

- Advancements in production technology is a popular turpentine oil market trend that fuels the industry demand

Turpentine oil is a chemical that is combusted for energy recovery. Turpentine oil is derived during the process of kraft wood pulping and is widely sold as a commodity material. The process separates the cellulose fibers that are utilized in paper manufacturing. Turpentine oil is a fuel that contains several organic compounds such as beta-pinene, alpha-pinene, and certain terpenes. Turpentine oil works as a feedstock chemical in the manufacture of flavorings, pinenes, pine oil, polymer additives, and fragrances. It is also used as a commercial source of fuel and as an alternative to fossil fuels in a broad range of applications such as furnaces, rocket fuels, and industrial boilers. Turpentine oil has a low healing coefficient ranging between 16,000 & 18,000 Btu/lb as compared to other fossil fuels such as gasoline, diesel, butane, and propane.

Global Turpentine Oil Market Dynamics

Market Drivers

- Increasing demand from end-use industries

- Growing popularity of natural and organic products

- Rising awareness about the benefits of aromatherapy

- Technological advancements

Market Restraints

- Availability of substitutes

- Health and safety concerns

- Fluctuating prices

Market Opportunities

- Increasing use of turpentine oil in aromatherapy

- Growing popularity of bio-based solvents

- Rising trend towards using turpentine oil that promote health and wellness

Turpentine Oil Market Report Coverage

| Market | Turpentine Oil Market |

| Turpentine Oil Market Size 2022 | USD 902.6 Million |

| Turpentine Oil Market Forecast 2032 | USD 1,731.2 Million |

| Turpentine Oil Market CAGR During 2023 - 2032 | 6.8% |

| Turpentine Oil Market Analysis Period | 2020 - 2032 |

| Turpentine Oil Market Base Year | 2022 |

| Turpentine Oil Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arizona Chemical Company LLC, Dujodwala Paper Chemicals Ltd., Pine Chemical Group, International Flavors & Fragrances Inc., Lawter Inc., Les Derives Resiniques Et Terpeniqes SA, Harting Technology Group, Renessenz LLC., and Privi Organics Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Turpentine Oil Market Insights

The global turpentine oil market is foreseeing maximum growth potential due to a rapid increase in the demand for environment-friendly products coupled with an increase in consumption of household and personal care products. In addition, the rise in the manufacture of several chemical products which are widely used as fragrance agents, flavoring agents, and solvents are some other major factors driving the growth of the global turpentine oil market. However, factors such as the decrease in the production of paper, easy availability of cheaper petroleum products as well as low recovery of turpentine from the Kraft wood process are some of the major aspects hindering the growth of the turpentine oil market.

Turpentine Oil Market, By Segmentation

The worldwide market for turpentine oil is split based on source, application, and geography.

Turpentine Oil Market, By Source

- Gum Turpentine

- Wood Turpentine

- Sulphate Turpentine

According to turpentine oil industry analysis, gum turpentine has historically dominated the turpentine oil market. Gum turpentine is derived from pine trees and is a natural product. It's widely used as a solvent in a variety of industries, including paints and coatings, adhesives, and printing inks. Gum turpentine is also used in aromatherapy because of its numerous health benefits. However, there has been an increase in demand for wood turpentine, which is obtained through the distillation of pine wood, in recent years. Because it does not require the cutting of trees, wood turpentine is considered a more sustainable and environmentally friendly alternative to gum turpentine. Sulphate turpentine, on the other hand, is a byproduct of the paper manufacturing process and is used as a biofuel. While gum turpentine has traditionally dominated the turpentine oil market, rising demand for environmentally friendly and sustainable products is expected to drive the growth of wood turpentine in the coming years.

Turpentine Oil Market, By Application

- Paints and Coatings

- Adhesives

- Camphor Oil

- Aromatherapy

Paints and coatings have historically controlled the turpentine oil market because turpentine oil is frequently used as a solvent in the production of paints, varnishes, and lacquers. Turpentine oil is used as a solvent because it dissolves resins and other components of paint and coating formulations very well. Turpentine oil is also used as a thinner, which improves the flow and levelling of the paint.

Turpentine oil, on the other hand, is used in a variety of other applications, including adhesives, camphor oil, and aromatherapy. Turpentine oil is used as a solvent in the adhesive industry to make rubber and synthetic adhesives. Turpentine oil is used as a feedstock in the camphor oil industry to produce camphor oil, which is used in a variety of applications such as perfumes and insecticides. Turpentine oil is used as an essential oil in aromatherapy because of its numerous health benefits.

While coatings and paints have traditionally ruled the turpentine oil market, the use of turpentine oil in other applications is increasing due to its diverse applications and benefits.

Turpentine Oil Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Turpentine Oil Market Regional Analysis

North America and Europe are expected to be the largest markets for turpentine oil because of their well-established infrastructure and the presence of key players. The paints and coatings, adhesives, and printing inks industries are the primary drivers of turpentine oil demand in North America and Europe. Furthermore, rising demand for bio-based solvents in these regions is expected to propel the turpentine oil market forward.

As per the turpentine oil market forecast, Asia-Pacific region is expected to be the fastest-growing market for turpentine oil, owing to rising demand for paints and coatings, adhesives, and aromatherapy products in emerging economies such as China and India. These countries' rapid urbanization and industrialization are expected to drive regional demand for turpentine oil. Furthermore, the region's abundant raw materials and low labor costs are expected to propel the turpentine oil market forward.

Turpentine Oil Market Players

Some of the top turpentine oil companies offered in the professional report includes Arizona Chemical Company LLC, Dujodwala Paper Chemicals Ltd., Pine Chemical Group, International Flavors & Fragrances Inc., Lawter Inc., Les Derives Resiniques Et Terpeniqes SA, Harting Technology Group, Renessenz LLC., and Privi Organics Limited.

Frequently Asked Questions

What was the market size of the global turpentine oil in 2022?

The market size of turpentine oil was USD 902.6 million in 2022.

What is the CAGR of the global turpentine oil market from 2023 to 2032?

The CAGR of turpentine oil is 6.8% during the analysis period of 2023 to 2032.

Which are the key players in the turpentine oil market?

The key players operating in the global turpentine oil market are includes Arizona Chemical Company LLC, Dujodwala Paper Chemicals Ltd., Pine Chemical Group, International Flavors & Fragrances Inc., Lawter Inc., Les Derives Resiniques Et Terpeniqes SA, Harting Technology Group, Renessenz LLC., and Privi Organics Limited.

Which region dominated the global turpentine oil market share?

North America held the dominating position in turpentine oil industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of turpentine oil during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global turpentine oil industry?

The current trends and dynamics in the turpentine oil industry include increasing demand from end-use industries, growing popularity of natural and organic products, and rising awareness about the benefits of aromatherapy.

Which source held the maximum share in 2022?

The gum turpentine source held the maximum share of the turpentine oil industry.