Truck And Bus Tire Market | Acumen Research and Consulting

Truck and Bus Tire Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

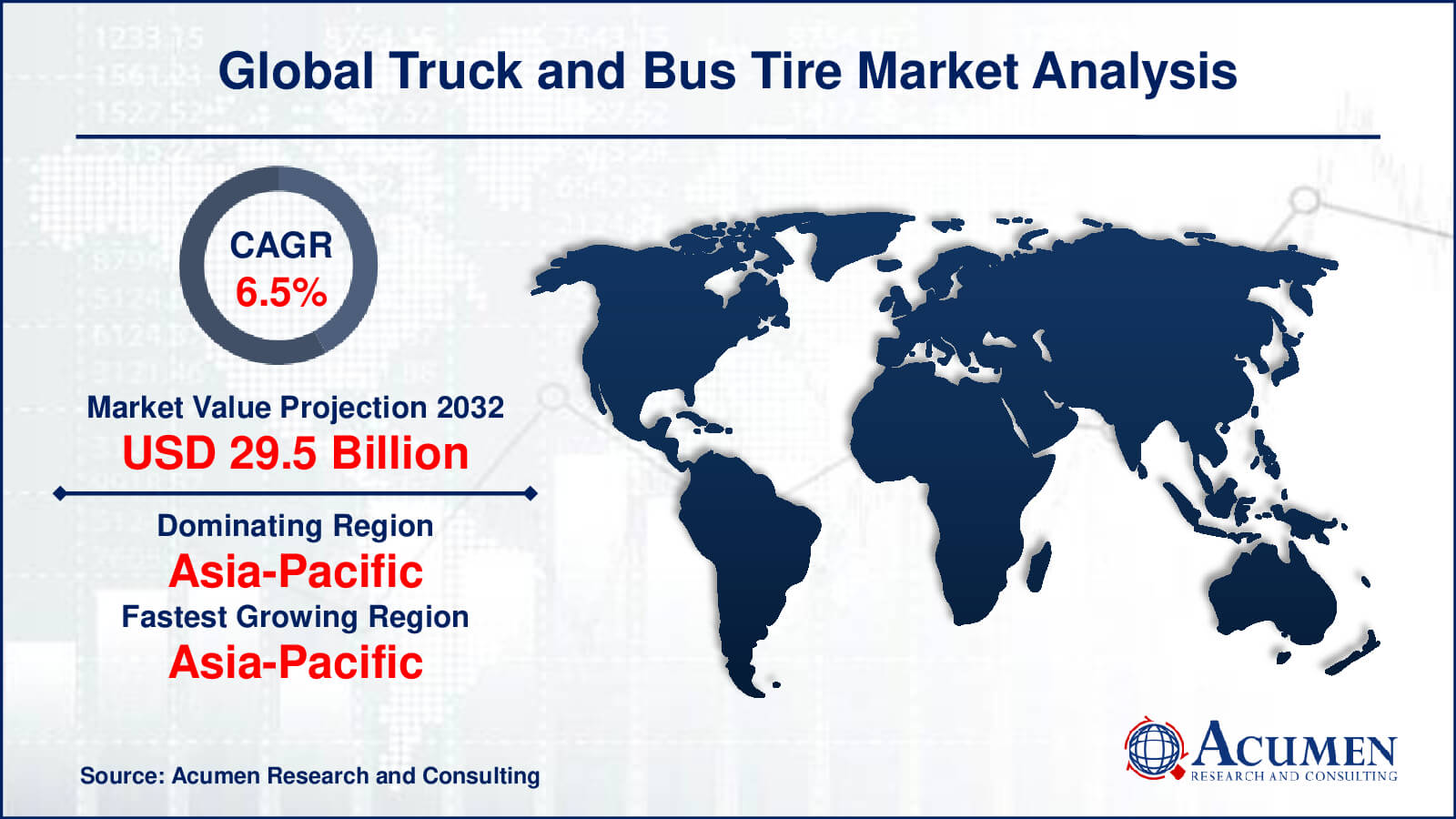

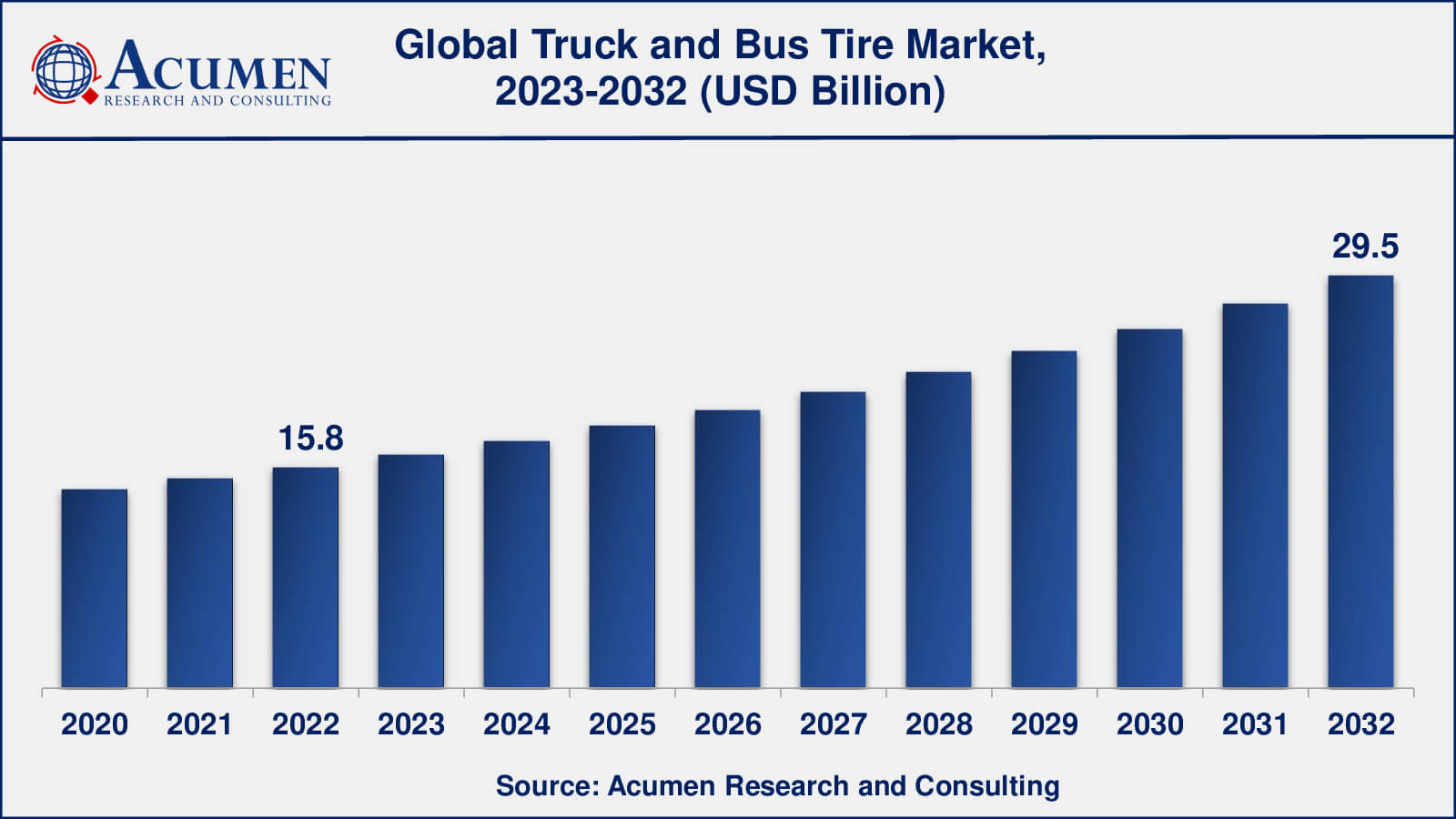

The Global Truck and Bus Tire Market Size accounted for USD 15.8 Billion in 2022 and is estimated to achieve a market size of USD 29.5 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Truck and Bus Tire Market Highlights

- Global truck and bus tire market revenue is poised to garner USD 29.5 billion by 2032 with a CAGR of 6.5% from 2023 to 2032

- Asia-Pacific truck and bus tire market value occupied more than USD 7.7 billion in 2022

- Asia-Pacific truck and bus tire market growth will record a CAGR of more than 7% from 2023 to 2032

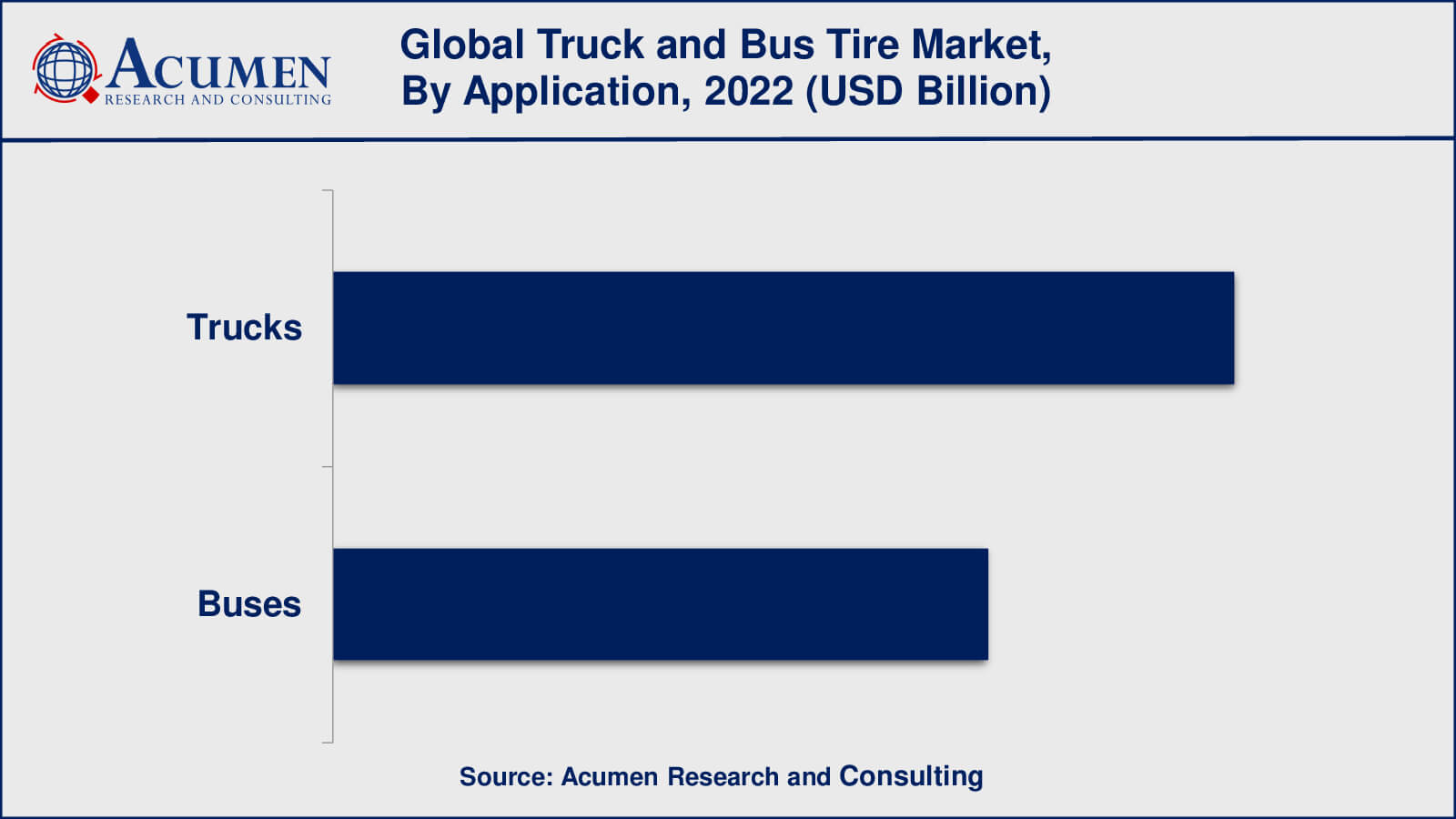

- Among application, the trucks sub-segment generated over US$ 9.2 billion revenue in 2022

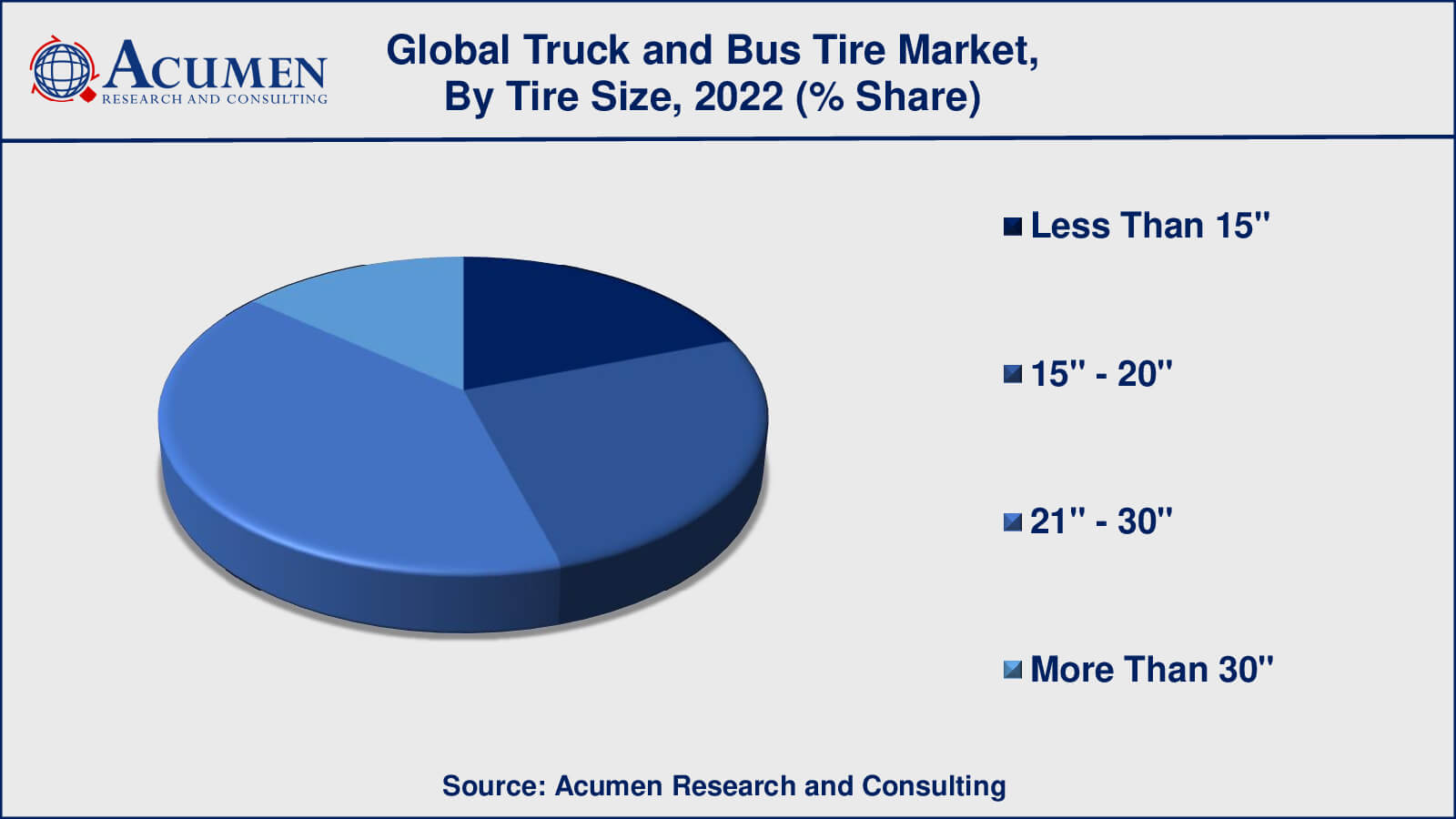

- Based tire size, the 21” – 30” sub-segment generated around 41% share in 2022

- Development of intelligent tires is a popular truck and bus tire market trend that fuels the industry demand

Trucks and buses are the widely used mode of transportation for freight and public, globally and the tires are the most essential part of such vehicles. Vehicle tires offer a higher level of safety, dependability, and cost-effectiveness for city, highway, road, and off-road and winter driving conditions. Players involved in the manufacturing of tires are continually engaged in new innovations in truck and bus tire technology.

Global Truck and Bus Tire Market Dynamics

Market Drivers

- Increasing demand for commercial vehicles

- Rising adoption of radial tires

- Growing investment in infrastructure

- Technological advancements in tire manufacturing

Market Restraints

- Fluctuating raw material prices

- Competition from alternative modes of transportation

- Limited availability of natural resources

Market Opportunities

- Increasing demand for retreaded tires

- Growing popularity of all-season tires

- Rising demand for energy-efficient tires

- Growth in e-commerce and logistics industries

Truck and Bus Tire Market Report Coverage

| Market | Truck And Bus Tire Market |

| Truck And Bus Tire Market Size 2022 | USD 15.8 Billion |

| Truck And Bus Tire Market Forecast 2032 | USD 29.5 Billion |

| Truck And Bus Tire Market CAGR During 2023 - 2032 | 6.5% |

| Truck And Bus Tire Market Analysis Period | 2020 - 2032 |

| Truck And Bus Tire Market Base Year | 2022 |

| Truck And Bus Tire Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Tire Type, By Tire Size, By Application, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Apollo Tyres, Bridgestone, Continental, Sumitomo, Michelin, Goodyear, Cooper Tire, Triangle Group, Yokohama, Maxxis, Hengfeng Rubber, GITI Tire, Kumho Tire, Toyo Tire, Nexen Tire, Zhongce, Nokian Tyres, and Hankook. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Truck and Bus Tire Market Insights

The increasing need for passenger and freight transportation vehicles and innovations in tire manufacturing technology are directly benefiting the overall sale of truck and bus tires. Manufacturers of tires are constantly making innovations in the material used such as non-pneumatic tires, firmer tiring nanomaterial, and technologies for overcoming present wear and rolling resistance and tire grip in truck tires. Likewise, more focus has been given to the quest for alternatives, sustainability, and abating the use of volatile raw materials such as oil-derived products or organic rubber for the quality advancement of tires. The increase in pubic and freight transportation due to growing mobility and urbanization has increased the need for vehicle ownership and in due course has up-surged the demand for quality tires and is leading to market growth.

Truck and Bus Tire Market Segmentation

The worldwide market for truck and bus tire is split based on tire type, tire size, application, sales channel, and geography.

Truck and Bus Tires Market Tire Types

- Tube-Type

- Tubeless

- Non-Radial

- Radial

According to our truck and bus tire industry analysis, radial tires have dominated the truck and bus tire market. Radial tyres outperform non-radial tyres in terms of performance, safety, and fuel efficiency. They provide a smoother ride, longer tyre life, and lower rolling resistance, all of which contribute to increased fuel efficiency. Radial tyres have become the preferred choice for commercial vehicle owners and fleet operators as a result of these advantages. As a result, in recent years, radial tyres have accounted for a sizable portion of the truck and bus tyre market. Non-radial tyres, on the other hand, are still in demand, particularly in certain regions where they are recommended due to their durability and resistance to harsh road conditions. The preference between radial and non-radial tyres is also determined by the commercial vehicle's specific needs and operating conditions.

Truck and Bus Tires Market Tire Sizes

- Less Than 15”

- 15” - 20”

- 21” - 30”

- More Than 30"

According to the oil and gas data management market forecast, the tire size that dominates the truck and bus tire market is the 21”-30” category. This category includes tyres for medium- and heavy-duty trucks and buses, that are among the most common types of commercial vehicles on the road. The 21"-30" category includes a wide range of tyre sizes suitable for various commercial vehicles such as delivery trucks, dump trucks, and long-haul trucks. These tyres are engineered to provide long-term durability, performance, and safety under extreme operating conditions. However, there is also a demand for tyres in the 15"-20" and less than 15" categories, particularly for smaller commercial vehicles like vans and minibuses. Tires for specialised heavy-duty vehicles such as mining trucks and construction vehicles, which have specific tyre size and performance requirements, are included in the more than 30" category.

Truck and Bus Tires Market Applications

- Trucks

- Buses

According to truck & bus radial tire TBR market analysis, the trucks application is leading the market in 2022. Heavy-duty trucks account for the lion's share of the truck and bus tyre market. This is because heavy-duty trucks are used for long-distance transportation, construction, and other heavy-duty applications that require long-lasting, high-performance tyres. Heavy-duty trucks are also the most common type of commercial vehicle used globally, which drives demand for truck and bus tyres in this segment even further.

Aside from heavy-duty trucks, the sub-segment of light commercial vehicles (LCVs) contributes significantly to the truck and bus tyre market. LCVs are commonly used for goods and services to be transported in urban and semi-urban areas, and their popularity is growing as e-commerce and last-mile delivery services expand.

Truck and Bus Tires Market Sales Channels

- OEMs

- Aftermarket

OEMs are expected to lead the trucks and buses radial tire TBR market from 2023 to 2032. This is due to the fact that a large portion of truck and bus tyres are sold directly to commercial vehicle manufacturers for use in new vehicles. OEMs typically have long-term contracts with tyre manufacturers and purchase large quantities of tyres to meet their production needs. Furthermore, OEMs have stringent quality and performance standards for the tyres they use in their vehicles, which can limit the number of tyre suppliers with whom they work.

While the aftermarket is an important sales channel for truck and bus tyres, it is often more fragmented than the OEM channel. The aftermarket also comprises tyre replacement sales to fleet operators and private vehicle owners for vehicles whose original equipment manufacturer warranties have expired.

Truck and Bus Tire Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Truck and Bus Tire Market Regional Analysis

The Asia-Pacific region has the largest and fastest-growing truck and bus tire market, owing to rapidly expanding commercial vehicle fleets in countries such as China and India. The region's demand for truck and bus tires is also supported by infrastructure development and construction activities, which necessitate the use of heavy-duty commercial vehicles.

The North American truck and bus tire market is fueled by the region's large and mature commercial vehicle fleet, which necessitates frequent tire replacements. The growth of e-commerce and online shopping has also boosted demand for last-mile delivery vehicles.

The European market for truck and bus tires is being driven by the region's growing transportation and logistics industry, which necessitates efficient and dependable commercial vehicles. Strict regulations on tire safety and fuel efficiency also help the market.

Truck and Bus Tire Market Players

Some of the top truck and bus tire companies offered in the professional report include Apollo Tyres, Bridgestone, Continental, Sumitomo, Michelin, Goodyear, Cooper Tire, Triangle Group, Yokohama, Maxxis, Hengfeng Rubber, GITI Tire, Kumho Tire, Toyo Tire, Nexen Tire, Zhongce, Nokian Tyres, and Hankook.

Frequently Asked Questions

What was the market size of the global truck and bus tire in 2022?

The market size of truck and bus tire was USD 15.8 billion in 2022.

What is the CAGR of the global truck and bus tire market from 2023 to 2032?

The CAGR of truck and bus tire is 6.5% during the analysis period of 2023 to 2032.

Which are the key players in the truck and bus tire market?

The key players operating in the global market are including Apollo Tyres, Bridgestone, Continental, Sumitomo, Michelin, Goodyear, Cooper Tire, Triangle Group, Yokohama, Maxxis, Hengfeng Rubber, GITI Tire, Kumho Tire, Toyo Tire, Nexen Tire, Zhongce, Nokian Tyres, and Hankook.

Which region dominated the global truck and bus tire market share?

Asia-Pacific held the dominating position in truck and bus tire industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of truck and bus tire during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global truck and bus tire industry?

The current trends and dynamics in the truck and bus tire industry include increasing demand for oil and gas, advancements in technology, and rising operational efficiency.

Which tire type held the maximum share in 2022?

The radial tire type held the maximum share of the truck and bus tire industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date