Trifluoromethanesulfonic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Trifluoromethanesulfonic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

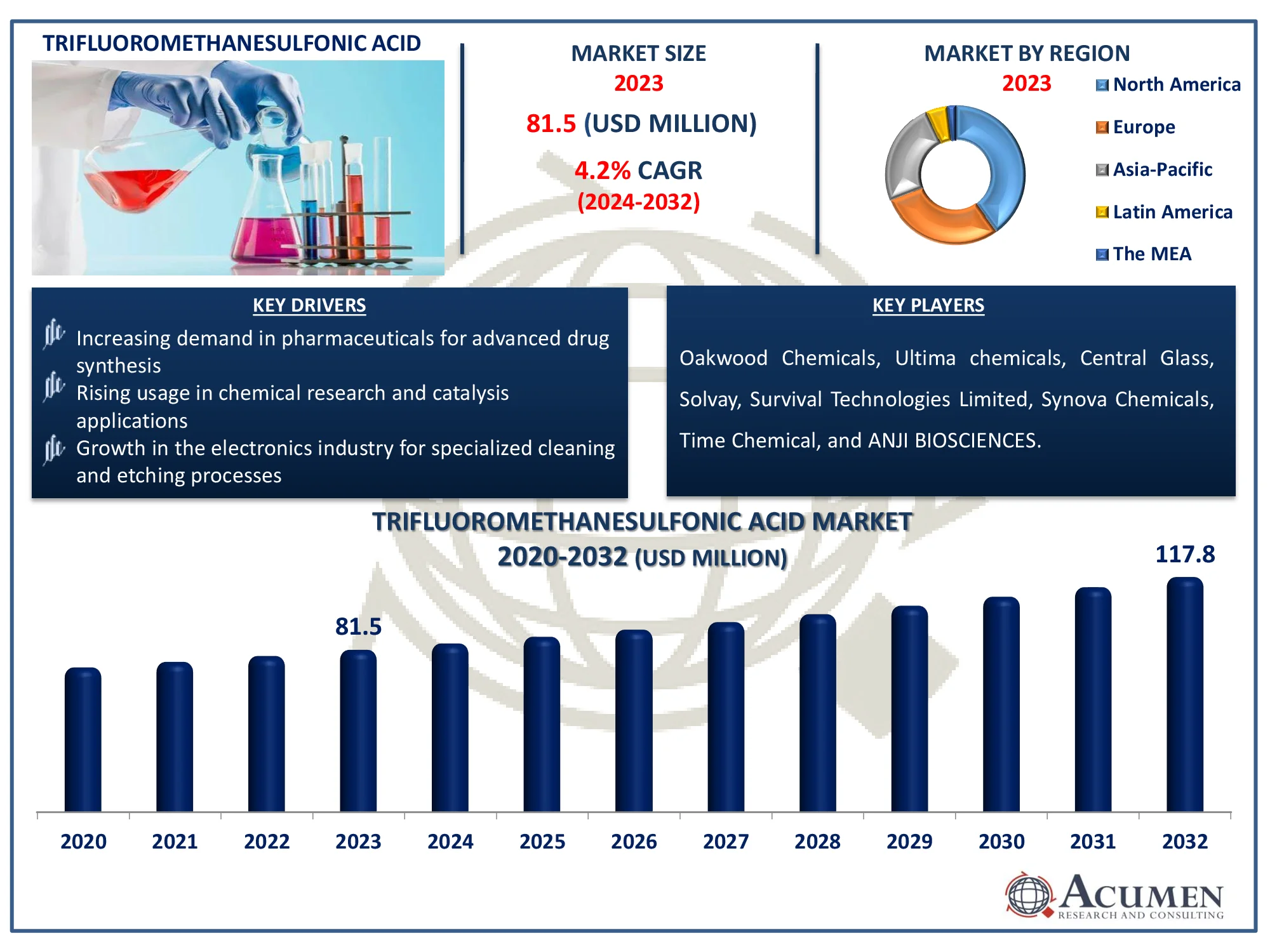

The Global Trifluoromethanesulfonic Acid Market Size accounted for USD 81.5 Million in 2023 and is estimated to achieve a market size of USD 117.8 Million by 2032 growing at a CAGR of 4.2% from 2024 to 2032.

Trifluoromethanesulfonic Acid Market Highlights

- Global trifluoromethanesulfonic acid market revenue is poised to garner USD 117.8 million by 2032 with a CAGR of 4.2% from 2024 to 2032

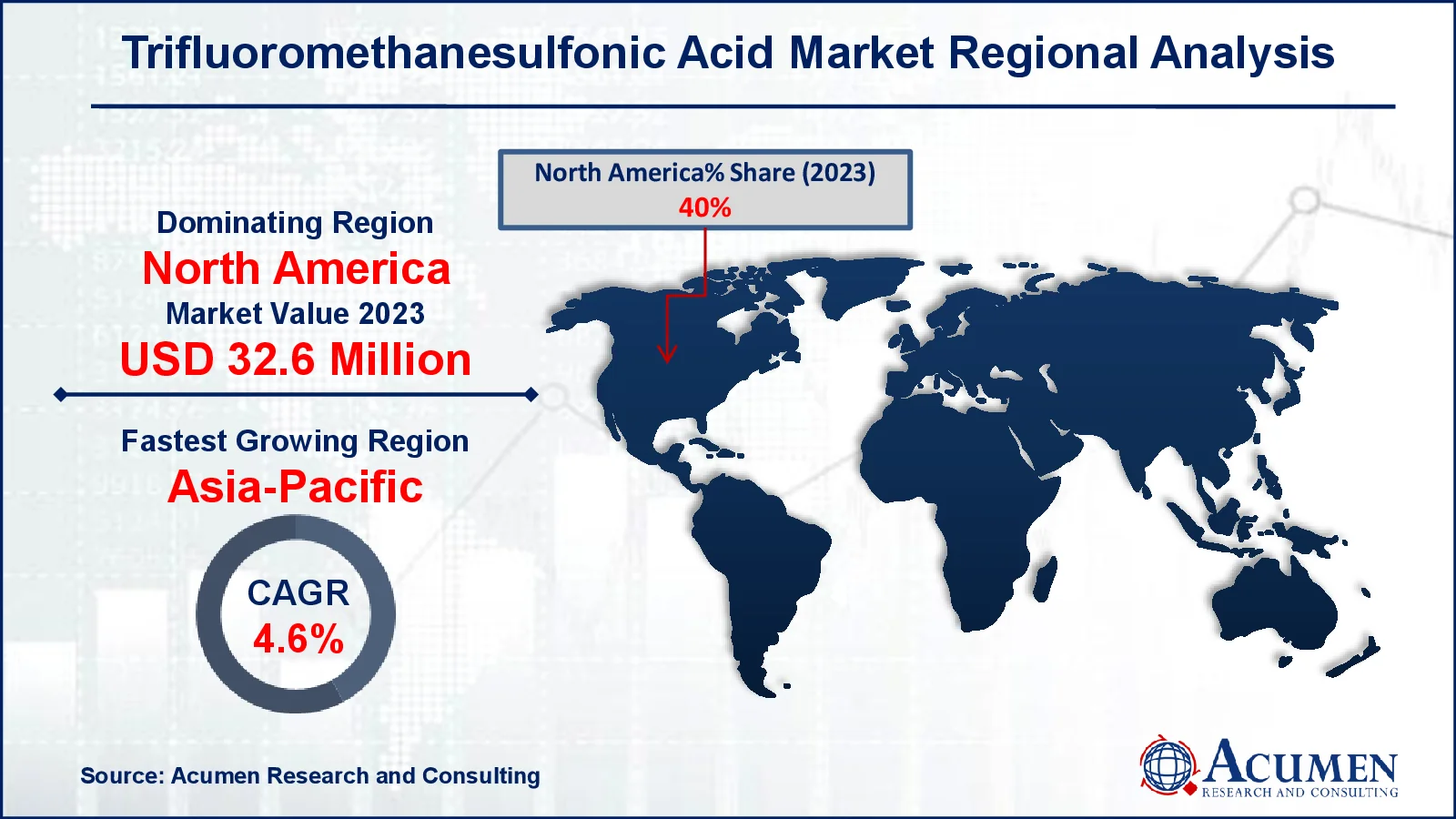

- North America trifluoromethanesulfonic acid market value occupied around USD 32.6 million in 2023

- Asia-Pacific trifluoromethanesulfonic acid market growth will record a CAGR of more than 4.6% from 2024 to 2032

- Based on method, the ≥ 99.5% purity sub-segment expected to generated 75% market share in 2023

- Trifluoromethanesulfonic acid is gaining popularity in pharmaceutical synthesis due to its effectiveness as a strong acid catalyst and as a

- reagent in the synthesis of various pharmaceutical intermediates is the trifluoromethanesulfonic acid market trend that fuels the industry demand

TFSA, or triflic acid, is a powerful organic acid having the chemical formula CF₃SO₃H. The conjugate base is stabilized by the trifluoromethylsulfonyl (CF₃SO₂) group, resulting in a high acidity. TFSA is widely used as a catalyst and super acid in organic synthesis, particularly in processes that require strong acid conditions but are ineffective with mineral acids such as sulfuric acid. Its applications are many, including medicines, where it aids in the synthesis of complicated compounds, and electrochemistry for electrolytes in batteries due to its high stability. TFSA is also used in polymerization to improve polymer characteristics, as well as in material science to create specialty materials. Its distinctive features make it indispensable in research and industrial applications needing robust acid catalysis and chemical modification.

Global Trifluoromethanesulfonic Acid Market Dynamics

Market Drivers

- Increasing demand in pharmaceuticals for advanced drug synthesis

- Rising usage in chemical research and catalysis applications

- Growth in the electronics industry for specialized cleaning and etching processes

Market Restraints

- High production costs due to complex manufacturing processes

- Stringent regulatory requirements for handling and usage

- Environmental concerns regarding disposal and potential hazards

Market Opportunities

- Expanding applications in green chemistry and sustainable processes

- Innovations in battery technology increasing demand for high-purity acids

- Growing markets in emerging economies for advanced industrial applications

Trifluoromethanesulfonic Acid Market Report Coverage

|

Market |

Trifluoromethanesulfonic Acid Market |

|

Trifluoromethanesulfonic Acid Market Size 2023 |

USD 81.5 Million |

|

Trifluoromethanesulfonic Acid Market Forecast 2032 |

USD 117.8 Million |

|

Trifluoromethanesulfonic Acid Market CAGR During 2024 - 2032 |

4.2% |

|

Trifluoromethanesulfonic Acid Market Analysis Period |

2020 - 2032 |

|

Trifluoromethanesulfonic Acid Market Base Year |

2023 |

|

Trifluoromethanesulfonic Acid Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Purity, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Oakwood Chemicals, Ultima chemicals, Central Glass, Solvay, Survival Technologies Limited, Synova Chemicals, Time Chemical, and ANJI BIOSCIENCES. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Trifluoromethanesulfonic Acid Market Insights

The growing demand in pharmaceuticals for advanced drug synthesis is significantly boosting the trifluoromethanesulfonic acid market. This acid is essential in catalyzing various complex reactions, enhancing efficiency and yield in drug production. Its robustness and effectiveness in synthesizing high-purity compounds make it invaluable in developing innovative pharmaceuticals. As the pharmaceutical industry continues to expand and innovate, the demand for trifluoromethanesulfonic acid is expected to rise correspondingly.

Environmental concerns about the disposal and potential hazards of trifluoromethanesulfonic acid (TFMSA) pose significant restraints on its market growth. The acid is highly corrosive and poses risks to human health and the environment if not handled and disposed of properly. Regulatory pressures and the need for stringent safety measures increase operational costs for manufacturers. Additionally, the search for greener alternatives further limits the expansion of the TFMSA market.

Emerging economies are undergoing significant industrial growth, which increases demand for advanced industrial chemicals such as trifluoromethanesulfonic acid. For example, the US economy outperformed expectations with a faster-than-expected growth rate in both the fourth quarter and the entire year of 2023, according to the most recent data from the US Commerce Department's Bureau of Economic Analysis. Because of its high acidity and stability, this molecule is used in a variety of applications, including medicines, agrochemicals, and electronics. The developing industrial sectors in these regions present considerable market potential, as enterprises seek efficient and dependable chemical solutions to improve production processes. As a result, the market for trifluoromethanesulfonic acid is expected to increase significantly in these emerging markets.

Trifluoromethanesulfonic Acid Market Segmentation

Trifluoromethanesulfonic Acid Market Segmentation

The worldwide market for trifluoromethanesulfonic acid is split based on purity, application, and geography.

Trifluoromethanesulfonic Acid (TFMSA) Market By Purity

- ≥ 99.5% Purity

- < 99.5% Purity

According to the trifluoromethanesulfonic acid industry analysis, the segment with ≥ 99.5% purity dominates due its high demand in advanced chemical processes, pharmaceutical applications, and precision synthesis where high purity is essential. This high-purity grade is preferred for its reliability and effectiveness in reactions requiring minimal impurities. The < 99.5% purity segment, while smaller, still finds use in less demanding applications, such as industrial processes where minor impurities are permissible.

Trifluoromethanesulfonic Acid (TFMSA) Market By Application

- Chemical & Petrochemical

- Pharmaceutical & Biotechnology

- Electronics & Semiconductor

- Polymers & Plastics

- Energy & Power

- Others (Agrochemicals, Research, Specialty Coatings)

According to the trifluoromethanesulfonic acid market forecast, pharmaceutical and biotechnology industries are plays crucial role in drug discovery, synthesis, and formulation, where high purity is required. Following that, the chemical and petrochemical industries make substantial contributions, using TFMSA in catalysis and specialized chemical manufacturing. It is used in etching and cleaning in the electronics and semiconductor industries, as well as polymerization processes in the polymers and plastics sector. TFMSA is also used in energy storage systems by the energy & power industry.

Trifluoromethanesulfonic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Trifluoromethanesulfonic Acid Market Regional Analysis

Trifluoromethanesulfonic Acid Market Regional Analysis

For several reasons, North America dominates has a well-developed healthcare infrastructure and an advanced medical sector. As a result, vitamin synthesis activities contribute to meeting healthcare needs on a regular basis. As a result, demand for trifluoromethanesulponic acid is increasing by the day. The United States is one of the most promising countries in terms of healthcare, and it is predicted to emerge as an investment-driven economy for the trifluoromethanesulphonic acid industry

The Asia-Pacific region growing significantly in trifluoromethanesulfonic acid market. The region has the biggest market share, both in terms of value and volume. China and India have thriving pharmaceutical industries, and due to population growth, both countries offer a diverse range of basic chemicals and medications. For example, India's pharmaceutical industry for fiscal year 2023-24 is estimated at USD 50 billion, with domestic consumption at USD 23.5 billion and exports at USD 26.5 billion. India's pharmaceutical sector is ranked third in the world by volume and fourteenth in terms of production value. As a result, the demand for trifluoromethanesulphonic acid is rapidly increasing. The region is predicted to expand at the highest CAGR during the projection period.

The European region is increasing at a slow rate due to the presence of regulatory agencies that prohibit the use of synthetic chemicals. However, factors such as rising demand for silicon rubber and the need for silicon rubber modification are driving up demand for tryfluoromethanesulponic acid.

Latin America, the Middle East, and Africa are poor-growth regions. Both of these regions have gained the fewest market shares as a result of poor economic performance across the main economies. However, increased industrialization is projected to provide some individuals with enormous growth prospects throughout the course of the year.

Trifluoromethanesulfonic Acid Market Players

Some of the top trifluoromethanesulfonic acid companies offered in our report include Oakwood Chemicals, Ultima chemicals, Central Glass, Solvay, Survival Technologies Limited, Synova Chemicals, Time Chemical, and ANJI BIOSCIENCES.

Frequently Asked Questions

How big is the trifluoromethanesulfonic acid market?

The trifluoromethanesulfonic acid market size was valued at USD 81.5 million in 2023.

What is the CAGR of the global trifluoromethanesulfonic acid market from 2024 to 2032?

The CAGR of trifluoromethanesulfonic acid is 4.2% during the analysis period of 2024 to 2032.

Which are the key players in the trifluoromethanesulfonic acid market?

The key players operating in the global market are including Oakwood Chemicals, Ultima chemicals, Central Glass, Solvay, Survival Technologies Limited, Synova Chemicals, Time Chemical, and ANJI BIOSCIENCES.

Which region dominated the global trifluoromethanesulfonic acid market share?

North America held the dominating position in trifluoromethanesulfonic acid industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of trifluoromethanesulfonic acid during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global trifluoromethanesulfonic acid industry?

The current trends and dynamics in the trifluoromethanesulfonic acid industry include increasing demand in pharmaceuticals for advanced drug synthesis, rising usage in chemical research and catalysis applications, and growth in the electronics industry for specialized cleaning and etching processes.

Which method held the maximum share in 2023?

The ≥ 99.5% purity expected to hold the maximum share of the trifluoromethanesulfonic acid industry.