Transplant Diagnostics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

The Global Transplant Diagnostics Market Size accounted for USD 4.94 Billion in 2024 and is estimated to achieve a market size of USD 9.21 Billion by 2033 growing at a CAGR of 7.3% from 2025 to 2033.

Transplant Diagnostics Market Highlights

- Global transplant diagnostics market revenue is poised to garner USD 9.21 billion by 2033 with a CAGR of 7.3% from 2025 to 2033

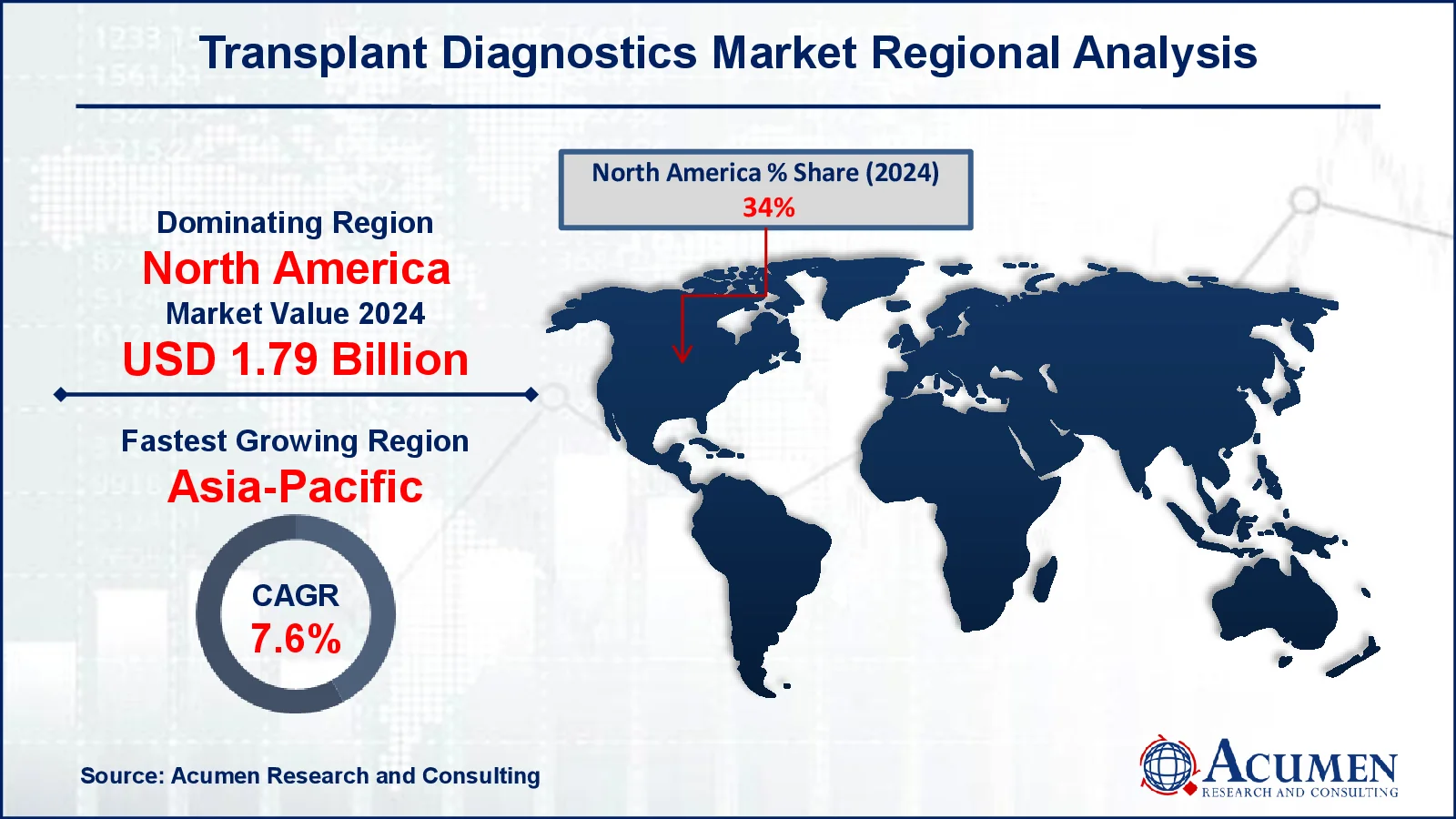

- North America transplant diagnostics market value occupied around USD 1.7 billion in 2024

- Asia-Pacific transplant diagnostics market growth will record a CAGR of more than 7.8% from 2025 to 2033

- Among technology, the molecular assay sub-segment generated around USD 1.97 billion revenue in 2024

- Based on application, the diagnostic sub-segment generated 72% transplant diagnostics market share in 2024

- Development of non-invasive diagnostic techniques that improves patient outcomes is a popular transplant diagnostics market trend that fuels the industry demand

Transplant diagnostics is an integral procedure in organ transplantation. This is performed to check the compatibility between donor and the recipient and it plays a crucial role at every stage of organ transplantation. Additionally, assist physician and surgeons during the overall procedure of transplantation to control the risk of organ failure or transplant rejection. Moreover, organ transplantation is performed in order to replace the non-functioning organ with functioning one to provide a normal life to the patient.

Transplant diagnostics is an integral procedure in organ transplantation. This is performed to check the compatibility between donor and the recipient and it plays a crucial role at every stage of organ transplantation. Additionally, assist physician and surgeons during the overall procedure of transplantation to control the risk of organ failure or transplant rejection. Moreover, organ transplantation is performed in order to replace the non-functioning organ with functioning one to provide a normal life to the patient.

Global Transplant Diagnostics Market Dynamics

Market Drivers

- Rising prevalence of organ failure increases demand for transplant procedures

- Technological advancements enhance accuracy and efficiency in transplant diagnostics

- Growing adoption of molecular and NGS-based diagnostic techniques

- Increasing government initiatives and funding for organ transplantation

Market Restraints

- High costs of advanced transplant diagnostic tests limit accessibility

- Shortage of compatible organ donors impacts transplant volumes

- Stringent regulatory frameworks delay product approvals and market entry

Market Opportunities

- Expansion of precision medicine boosts demand for personalized transplant diagnostics

- Integration of AI and big data enhances predictive transplant compatibility

- Rising awareness and investments in transplant research

Transplant Diagnostics Market Report Coverage

|

Market |

Transplant Diagnostics Market |

|

Transplant Diagnostics Market Size 2024 |

USD 4.94 Billion |

|

Transplant Diagnostics Market Forecast 2033 |

USD 9.21 Billion |

|

Transplant Diagnostics Market CAGR During 2025 - 2033 |

7.3% |

|

Transplant Diagnostics Market Analysis Period |

2021 - 2033 |

|

Transplant Diagnostics Market Base Year |

2024 |

|

Transplant Diagnostics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product & Service, By Technology, By Transplant Type, By Application, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Abbott, Illumina, Inc., BD (Becton, Dickinson and Company), Bio-Rad Laboratories, Inc., QIAGEN, Thermo Fisher Scientific, Inc., Omixon Inc., Bruker, F. Hoffmann-La Roche Ltd, and Werfen (Immucor, Inc.). |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Transplant Diagnostics Market Insights

The increasing number of transplant procedures along with the increasing awareness leads to increased number of organ donors is primarily driving the market value. Technological advancements associated with the transplant diagnostics coupled with the increasing public-private funding for target research activities are supporting the market value. The rising prevalence of infectious diseases is further accelerating the market value. Moreover, the rising adoption of cross-matching and chimerism testing during pre & post-transplantation is anticipated to create potential demand during the estimated period from 2025 to 2033.

On the other side, lack of favorable reimbursement policies, high cost of organ transplant, social and ethical issues related to organ transplantation are some of the factors projected to hamper the growth over the forecast period. Moreover, the transplant diagnostics market is driven by dynamic factors such as the increased emphasis on precision medicine, which increases demand for advanced molecular tests and sequencing technologies. The use of artificial intelligence (AI) and machine learning (ML) in diagnostic tools improves accuracy and efficiency in transplant compatibility testing.

Furthermore, collaborations among healthcare providers, diagnostic firms, and research institutes are promoting innovation and creating market potential. However, regulatory complexity and the necessity for consistent standards across locations remain important factors. Despite these challenges, the market is primed for expansion, aided by increased R&D spending and a growing emphasis on improving transplant outcomes worldwide.

Transplant Diagnostics Market Segmentation

Transplant Diagnostics Market Segmentation

The worldwide market for transplant diagnostics is split based on product & service, technology, transplant type, application, end user, and geography.

Transplant Diagnostics Product & Service

- Reagents & Consumables

- Instruments

- Software & Services

According to transplant diagnostics industry analysis, by product & service, the reagents & consumables segment is leading the global market due to its importance in numerous diagnostic processes. These items are essential for tissue typing, antibody screening, and crossmatching, which are all important phases in transplant compatibility testing. The high demand for reagents and consumables is due to their frequent use in diagnostics, where they are required for each test performed. Furthermore, advances in molecular diagnostics, as well as an increase in the number of transplant surgeries conducted worldwide, are propelling growth in this category. The need for precise and trustworthy diagnostic results drives a continual need for high-quality reagents and consumables, making them an important and vital component of the transplant diagnostics industry.

Transplant Diagnostics Technology

- Molecular Assay

- PCR-Based

- Sequencing-Based

- Others

- Sequencing-Based Molecular Assays

- Sanger Sequencing

- Next Generation Sequencing

- Other

- Non-Molecular Assay

- Serological Assay

- Mixed Lymphocyte Culture Assay

The molecular assay category is a key driver in the transplant diagnostics market because of its accuracy and efficiency in identifying genetic markers and transplant compatibility. These assays, particularly PCR- and sequencing-based methods, allow for very accurate characterization of human leukocyte antigen (HLA) genes, which is necessary for successful organ and tissue matching. The increasing use of advanced techniques like next-generation sequencing (NGS) has boosted the segment's importance by generating faster and more comprehensive results. With rising demand for tailored medication and an increase in the number of transplant surgeries, molecular diagnostics has become important to assuring better patient outcomes and preserving their position as industry leaders.

Transplant Diagnostics Transplant Type

- Solid Organ Transplantation

- Kidney Transplantation

- Liver Transplantation

- Heart Transplantation

- Lung Transplantation

- Pancreas Transplantation

- Other Organ Transplantations

- Stem Cell Transplantation

- Soft Tissue Transplantation

- Bone Marrow Transplantation

Solid organ transplantation dominates the transplant diagnostics market, owing to rising demand for organ replacements and advances in diagnostic technology. Key surgeries include kidney, liver, heart, lung, and pancreas transplants, with kidney transplants being the most common worldwide. This category is driven by an increase in the prevalence of chronic diseases, organ failure, and an aging population. Furthermore, advances in HLA typing, crossmatch testing, and molecular diagnostics improve transplant outcomes. While stem cell, soft tissue, and bone marrow transplants all contribute to the industry, solid organ transplants remain the primary emphasis due to their life-saving nature and increasing availability of donor organs and diagnostic technologies.

Transplant Diagnostics Application

- Diagnostic Application

- Histocompatibility Testing

- Infectious Disease Testing

- Blood Profiling

- Research Application

Diagnostic applications lead the transplant diagnostics market, accounting for 72% of the total market share. This part contains crucial tests such as histocompatibility testing, which ensures donor-recipient compatibility, infectious disease testing, which prevents post-transplant infections, and blood profiling, which assesses patient and organ health. The dominance of diagnostic apps stems from their critical role in increasing transplant success rates, decreasing complications, and assuring patient safety. With the increasing number of transplants worldwide, the requirement for reliable and effective diagnostic tools grows. While research applications help to progress transplant science, diagnostic applications continue to be the market's foundation, addressing immediate clinical demands and improving transplant outcomes.

Transplant Diagnostics End User

- Independent Reference Laboratories

- Hospitals & Transplant Centers

- Research Laboratories & Academic Institutes

Hospitals and transplant centres are a prominent end user in the transplant diagnostics market, accounting for USD 2.3 billion in revenue. These facilities are essential for transplant procedures, including extensive diagnostic services such histocompatibility testing, infectious disease screening, and post-transplant monitoring. Their dominance is due to the growing number of transplant surgeries, advances in diagnostic technologies, and the requirement for integrated care under one roof. Collaborations with organ procurement groups, as well as access to cutting-edge techniques, help hospitals and transplant centers ensure accurate diagnoses and better patient outcomes. This segment's considerable revenue underscores its vital role in providing efficient, life-saving transplant services, making it a key player in the transplant diagnostics market.

Transplant Diagnostics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Transplant Diagnostics Market Regional Analysis

Transplant Diagnostics Market Regional Analysis

North America is leading the market with a major share in terms of value. The region is also projected to maintain its dominance over the estimated period. The well-established healthcare infrastructure with the highly developed healthcare system is primarily driving the regional market value. High adoption of personalized medicines, availability of skilled professionals, high adoption of innovative transplant diagnostic technologies, the large volume of organ transplantation procedures performed, technological advancements coupled with the higher healthcare expenditure are other important factors supporting the regional market value.

On other hand, the Asia-Pacific region is the fastest growing region throughout the transplant diagnostics market forecast period i.e. 2025-2033. This growth is fueled by increasing healthcare investments, awareness about organ transplantation is rising, and improving healthcare infrastructure within the region. Also, countries like China, India, and Japan are witnessing a surge in demand for advanced diagnostic technologies and advanced equipment due to the growing prevalence of chronic diseases and the increasing number of transplant procedures. Additionally, government initiatives to promote organ donation and the expansion of healthcare facilities are contributing to the region's rapid growth. The rising adoption of molecular diagnostics and the presence of a large patient pool further position Asia-Pacific as a key growth hub in the global transplant diagnostics market.

Transplant Diagnostics Market Players

Some of the top transplant diagnostics companies offered in our report includes Abbott, Illumina, Inc., BD (Becton, Dickinson and Company), Bio-Rad Laboratories, Inc., QIAGEN, Thermo Fisher Scientific, Inc., Omixon Inc., Bruker, F. Hoffmann-La Roche Ltd, and Werfen (Immucor, Inc.)

Frequently Asked Questions

How big is the transplant diagnostics market?

The transplant diagnostics market size was valued at USD 4.94 Billion in 2024.

What is the CAGR of the global transplant diagnostics market from 2025 to 2033?

The CAGR of transplant diagnostics is 7.3% during the analysis period of 2025 to 2033.

Which are the key players in the Transplant Diagnostics market?

The key players operating in the global market are including Abbott, Illumina, Inc., BD (Becton, Dickinson and Company), Bio-Rad Laboratories, Inc., QIAGEN, Thermo Fisher Scientific, Inc., Omixon Inc., Bruker, F. Hoffmann-La Roche Ltd, and Werfen (Immucor, Inc.)

Which region dominated the global transplant diagnostics market share?

North America held the dominating position in transplant diagnostics industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of transplant diagnostics during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global transplant diagnostics industry?

The current trends and dynamics in the transplant diagnostics industry include growing adoption of molecular and NGS-based diagnostic techniques, and increasing government initiatives and funding for organ transplantation.

Which transplant type held the maximum share in 2024?

The solid organ transplant type held the maximum share of the transplant diagnostics industry.