Transfusion Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Transfusion Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

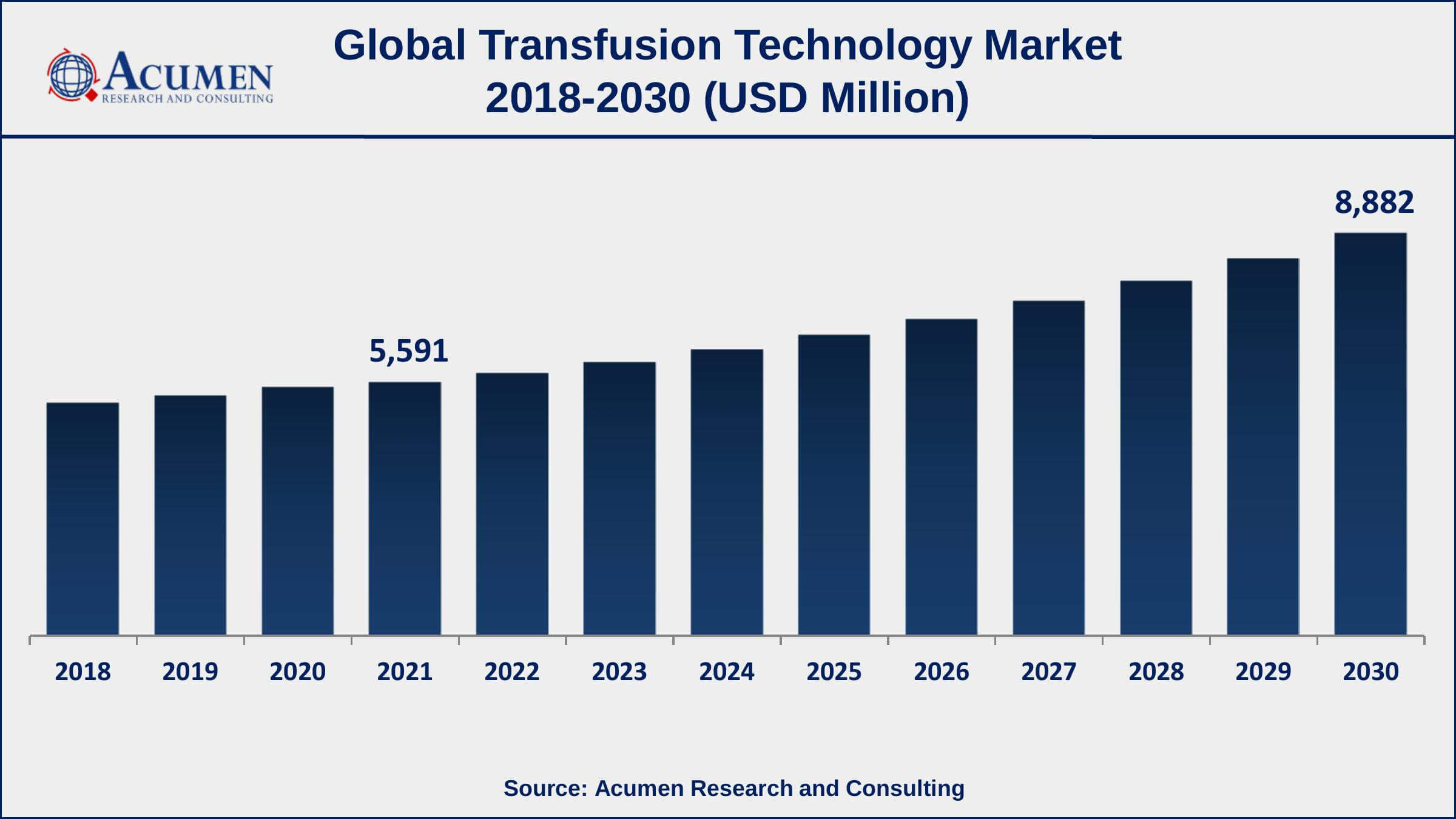

The Global Transfusion Technology Market Size accounted for USD 5,591 Million in 2021 and is estimated to achieve a market size of USD 8,882 Million by 2030 growing at a CAGR of 5.5% from 2022 to 2030. The rising prevalence of chronic diseases among the senior population is propelling the transfusion technology market growth. Furthermore, increased investments in transfusion technology innovation, as well as collaborations for the co-development and commercialization of such devices, are likely to propel the worldwide transfusion technology market value in the coming years.

Transfusion Technology Market Report Key Highlights

- Global transfusion technology market revenue is estimated to expand by USD 8,882 million by 2030, with a 5.5% CAGR from 2022 to 2030.

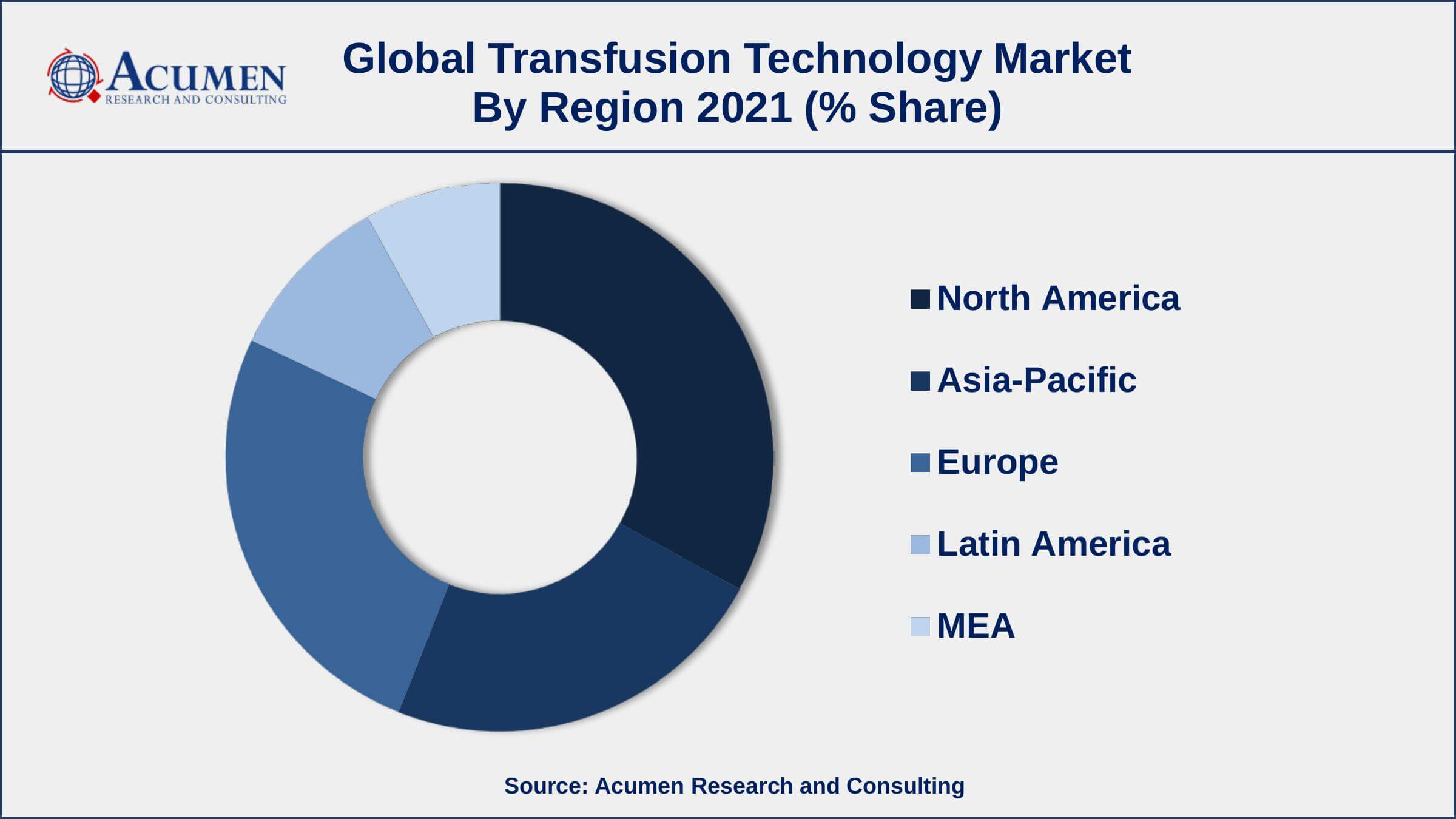

- North America transfusion technology market share accounted for over 33% of total market shares in 2021

- Asia-Pacific transfusion technology market growth will observe highest CAGR from 2022 to 2030

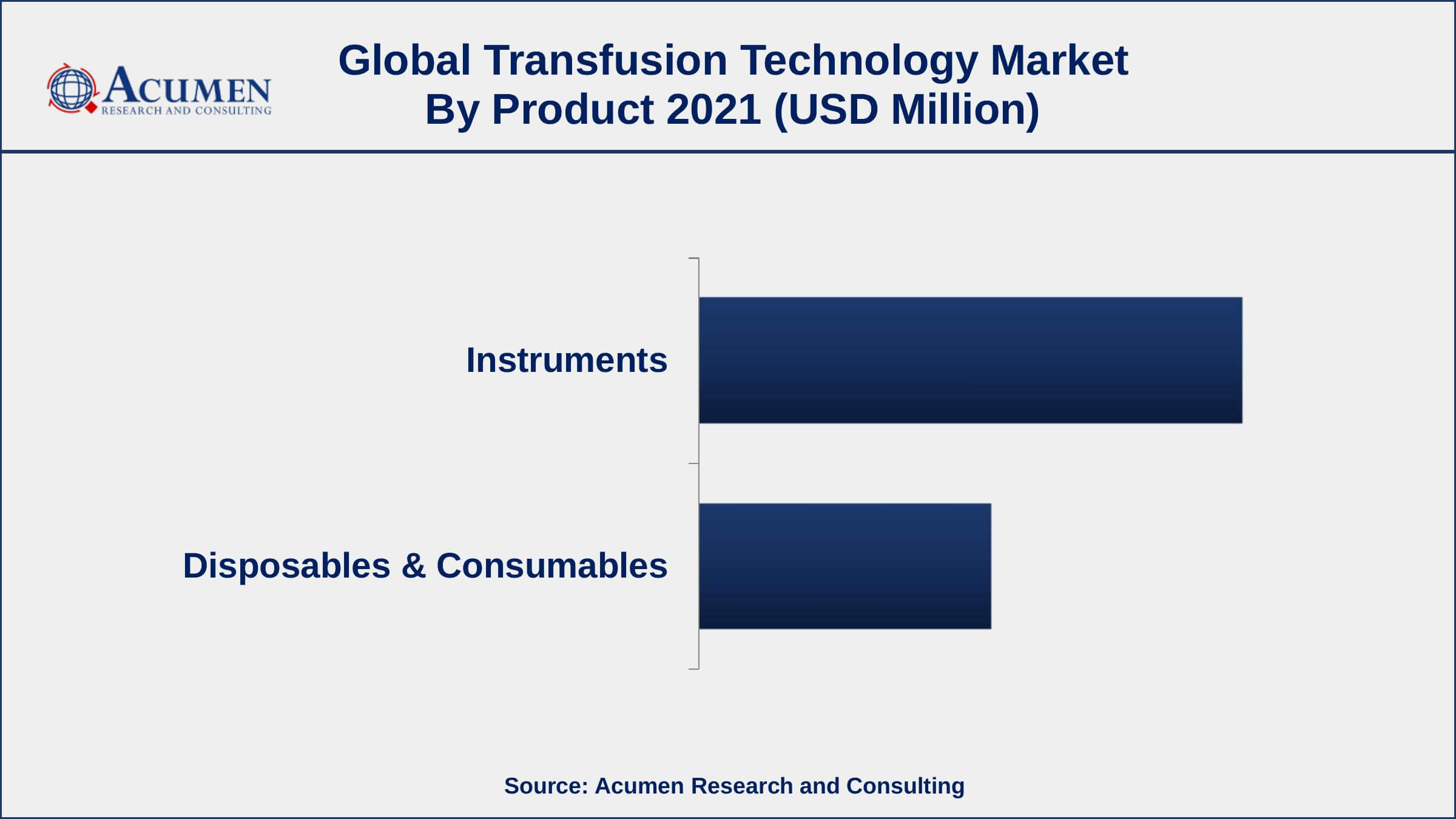

- Based on product, instruments segment accounted for over 65% of the overall market share in 2021

- Among end-user, blood bank segment engaged more than 39% of the total market share

- Increasing number of accidents and trauma cases, drives the transfusion technology market size

A transfusion technology device is an electro-mechanical system used to assure safety and quality of care during blood transfusion & donation. Transfusion technology devices are categorized as cell expansion systems, blood component separators, apheresis systems, as well as autotransfusion devices. Apheresis is a method used to either donate a blood element or cure diseases by removing the sick or disease-causing blood constituent.

Global Transfusion Technology Market Trends

Market Drivers

- Rise in the prevalence of chronic diseases

- Increased number of surgical procedures

- Increase in the number of accidents and trauma cases

- Significant rise in the geriatric population

Market Restraints

- Prolonged regulatory approval procedure

- Required significant investments in transfusion technology innovation

Market Opportunities

- Rising investments in transfusion technology innovation

- Increasing collaboration for the co-development and commercialization of such technologies

Transfusion Technology Market Report Coverage

| Market | Transfusion Technology Market |

| Transfusion Technology Market Size 2021 | USD 5,591 Million |

| Transfusion Technology Market Forecast 2030 | USD 8,882 Million |

| Transfusion Technology Market CAGR During 2022 - 2030 | 5.5% |

| Transfusion Technology Market Analysis Period | 2018 - 2030 |

| Transfusion Technology Market Base Year | 2021 |

| Transfusion Technology Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LivaNova PLC., Medtronic plc, Haemonetics Corporation, Inc., Asahi Kasei Medical Co., Ltd., TERUMO BCT, B. Braun Melsungen AG, MiltenyiBiotec, Cerus Corporation, GE Healthcare, and Fresenius Kabi AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The worldwide transfusion technology market is described by an expansion in the occurrence of incessant sicknesses over the world. The market is growing at a fast pace, because of the execution of government rules about the security of transfusion. The worldwide transfusion technology market is anticipated to extend at a fast pace from 2022 to 2030.

Expanding the number of clinical medical procedures, and creating a medicinal services foundation are required to fuel the worldwide transfusion technology market amid the figure time frame. North America is probably going to represent a noteworthy offer of the worldwide market amid the conjecture time frame, inferable from the strong nearness of real players with set up dissemination arranges in the area. The transfusion technology market in Asia Pacific is anticipated to extend at a high CAGR from 2022 to 2030.

Transfusion Technology Market Insights

Increment in the geriatric populace, which is inclined to chronic diseases, expansive patient pool in developing nations requiring better health care facilities, and ventures by open and private players in R&D on transfusion innovation to guarantee the end of transfusion-related diseases and diminish the danger of transfusion responses are key factors that are probably going to drive the worldwide transfusion innovation market amid the figure time frame. In any case, the lengthy process of obtaining regulatory approval, huge ventures required in the development of transfusion innovation, and increment in the negligibly obtrusive system that prompts low blood loss are probably going to limit the worldwide market amid the conjecture time frame. Transfusion technology devices are picking up notoriety among healthcare professionals, as these have ended up being viable in decreasing transfusion response. Rising investment for advancement in transfusion innovation and organizations for co-improvement and commercialization of these gadgets are relied upon to fuel the worldwide transfusion technology market sooner rather than later.

Transfusion Technology Market Segmentation

The worldwide transfusion technology market segmentation is based on the product, end-user, and geography.

Transfusion Technology Market By Product

- Instruments

- Apheresis System & Multicomponent Collection Systems

- Auto Transfusion Devices

- Cell Processing Systems & Cell Expansion Systems

- Others

- Disposables & Consumables

According to transfusion technology industry research, the disposable & consumables category is predicted to increase at a faster-than-average rate throughout the projection period. This growth is due to end-users significant utilization of these transfusion technology devices. This is owing to the introduction of severe rules by government agencies to limit the incidence of transfusion-associated illness. Apheresis equipment is mostly used for blood donation in health facilities and governmental and commercial blood banks. Due to the increased demand for therapeutic apheresis, end-users are gradually choosing apheresis equipment as well as multi-component treatment facilities.

Transfusion Technology Market By End-user

- Hospitals

- Blood Banks

- Biotechnology & Pharmaceutical Companies

- Others

According to the transfusion technology market forecast, the blood banks sector is anticipated to lead the global market during the forecast period. One of the important reasons driving the market is the increasing frequency of hematological diseases such as rare genetic abnormalities, anemia, and sickle cell disorders caused by problems of the blood and plasma organs. Furthermore, the increasing incidence of sports-related injuries caused by poor training techniques, structural abnormalities, as well as unsafe training conditions is growing at a significant rate for packed red blood cells (RBCs) during blood transfusions.

Transfusion Technology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

North America Holds The Largest Share Of The Global Transfusion Technology Market

North America and Europe represented a huge offer of the worldwide transfusion technology market in 2021. This can be credited to high health care expenditure, high rate of apheresis for treatment of chronic diseases, for example, chronic kidney disease, driven by increment in the commonness of way of life-related infections, rise in mindfulness about the importance of careful blood, high market penetration of recently created transfusion technology gadgets, favorable reimbursement policies guaranteeing business development for new market contestants, and nearness of real players in the two areas. Notwithstanding, changes in repayment and protection approaches in 2017 and the stringent administrative system for the generation of medical gadgets in the U.S. are probably going to hamper the transfusion technology market in North America in the following couple of years.

Asia-Pacific is probably going to offer noteworthy chances to the transfusion technology market amid the figure time frame, attributable to an expansion in the geriatric populace, ascend in the appropriation of transfusion technology gadgets driven by mindfulness about their focal points, and flood in the occurrence of transfusion- acquired infections in the area.

Transfusion Technology Market Players

Some of the top transfusion technology market companies offered in the professional report include LivaNova PLC., Medtronic plc, Haemonetics Corporation, Inc., Asahi Kasei Medical Co., Ltd., TERUMO BCT, B. Braun Melsungen AG, MiltenyiBiotec, Cerus Corporation, GE Healthcare, and Fresenius Kabi AG.

Frequently Asked Questions

What is the size of global transfusion technology market in 2021?

The estimated value of global transfusion technology market in 2021 was accounted to be USD 5,591 Million.

What is the CAGR of global transfusion technology market during forecast period of 2022 to 2030?

The projected CAGR transfusion technology market during the analysis period of 2022 to 2030 is 5.5%.

Which are the key players operating in the market?

The prominent players of the global transfusion technology market are LivaNova PLC., Medtronic plc, Haemonetics Corporation, Inc., Asahi Kasei Medical Co., Ltd., TERUMO BCT, B. Braun Melsungen AG, MiltenyiBiotec, Cerus Corporation, GE Healthcare, and Fresenius Kabi AG.

Which region held the dominating position in the global transfusion technology market?

North America held the dominating transfusion technology during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for transfusion technology during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global transfusion technology market?

Rise in the prevalence of chronic diseases and increased number of surgical procedures drives the growth of global transfusion technology market.

By product segment, which sub-segment held the maximum share?

Based on product, instruments segment is expected to hold the maximum share of the transfusion technology market.