Transformer Ferrite Core Market | Acumen Research and Consulting

Transformer Ferrite Core Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

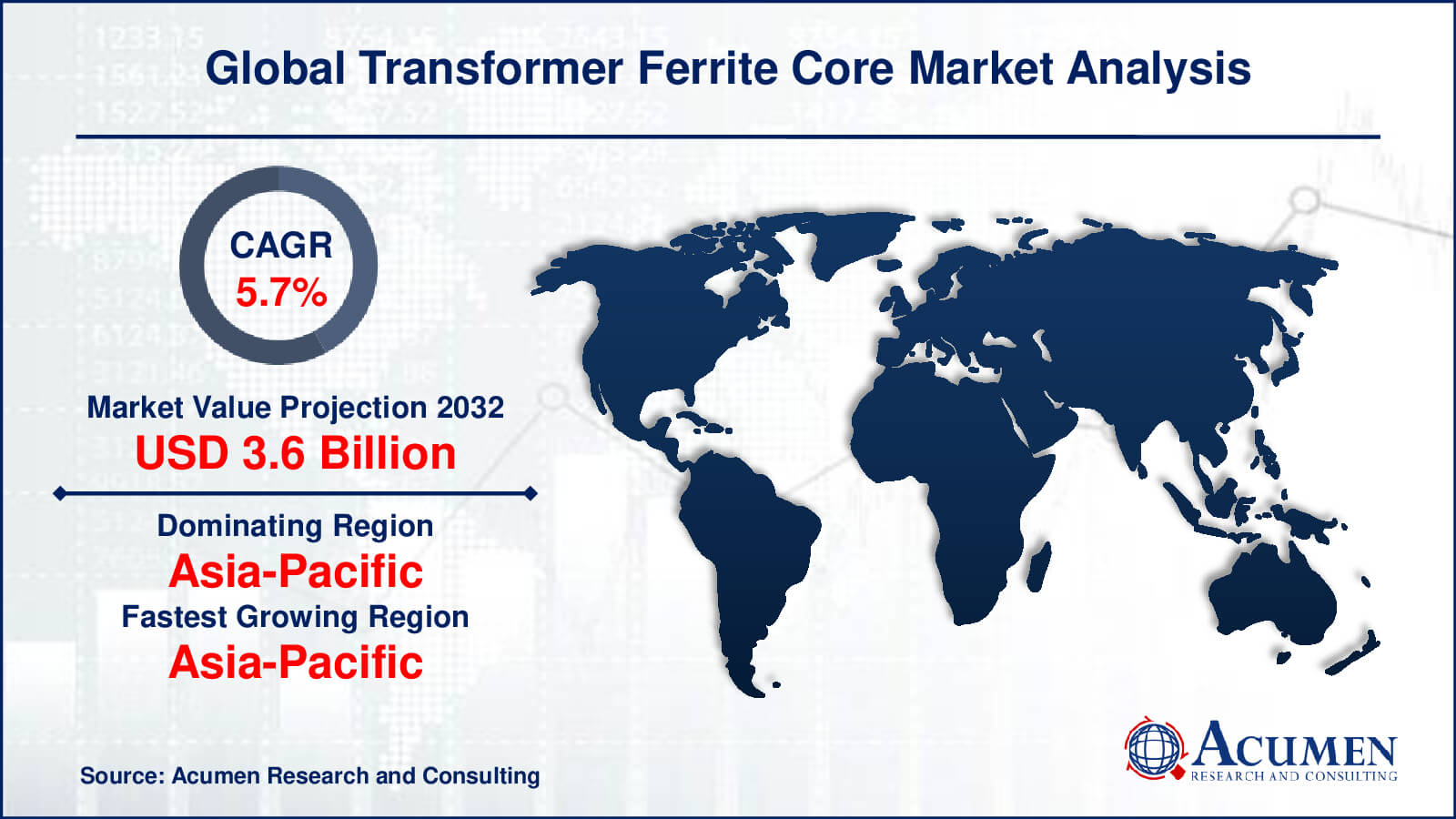

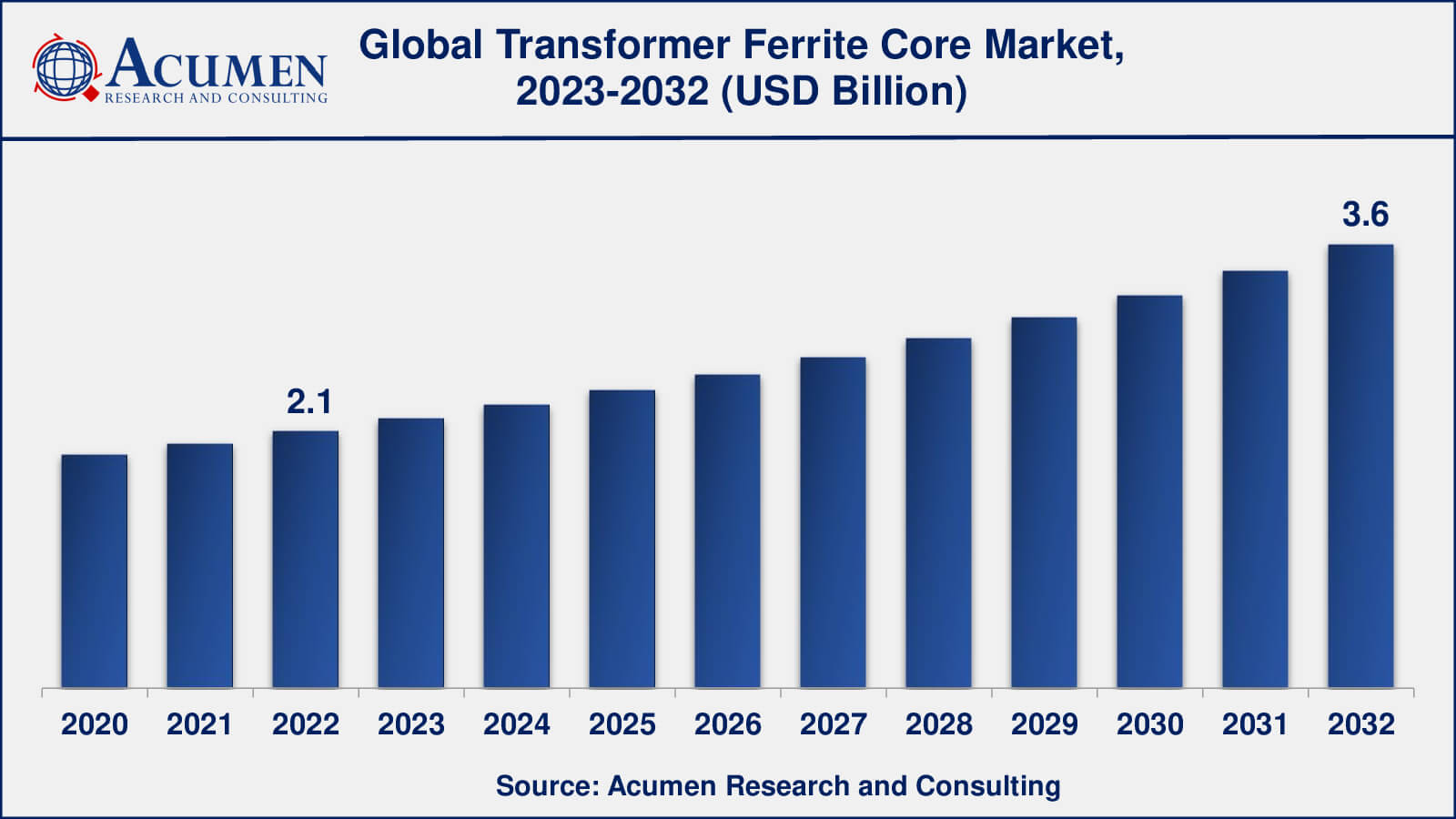

The Global Transformer Ferrite Core Market Size accounted for USD 2.1 Billion in 2022 and is estimated to achieve a market size of USD 3.6 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Transformer Ferrite Core Market Highlights

- Global transformer ferrite core market revenue is poised to garner USD 3.6 billion by 2032 with a CAGR of 5.7% from 2023 to 2032

- Asia-Pacific transformer ferrite core market value occupied more than USD 840 million in 2022

- Asia-Pacific transformer ferrite core market growth will record a CAGR of around 6% from 2023 to 2032

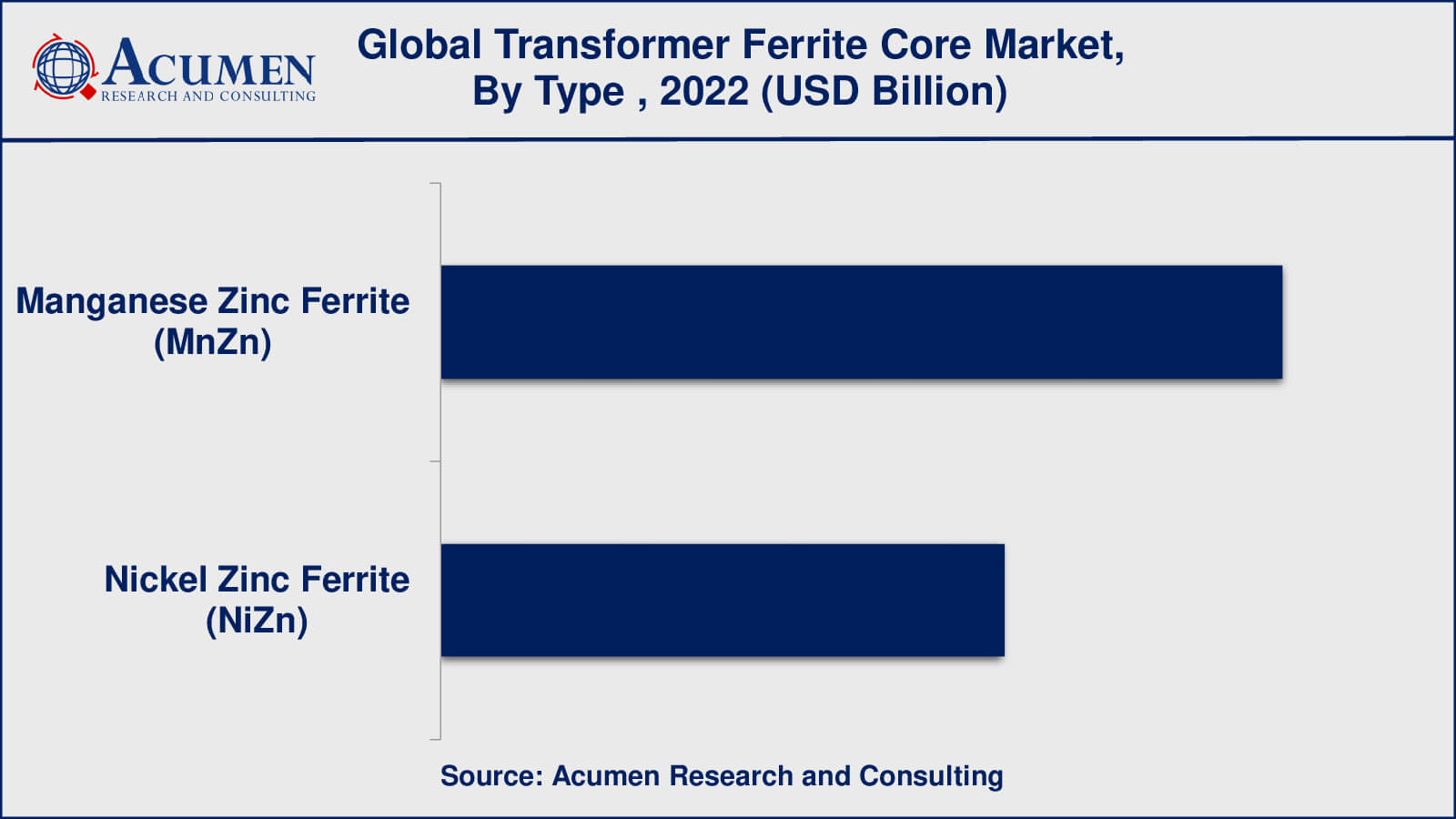

- Among type, the manganese zinc ferrite (MnZn) sub-segment generated around US$ 1.3 billion revenue in 2022

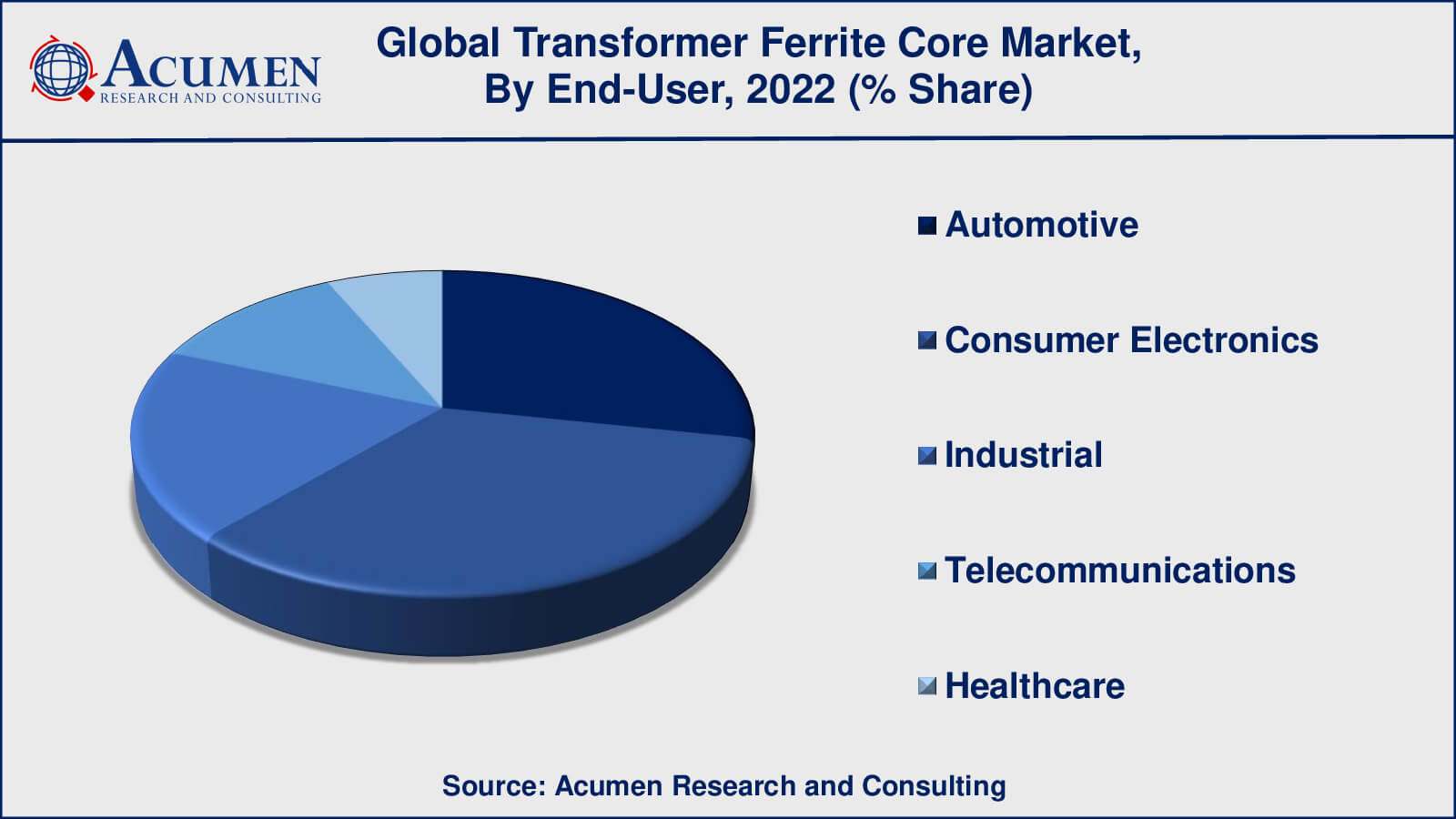

- Based on end-user industry, the consumer electronics sub-segment generated over 34% share in 2022

- Technological advancements in the design and manufacturing of transformer ferrite cores is a popular transformer ferrite core market trend that fuels the industry demand

Ferrites, also known as soft ferrites are non-conductive ceramic compounds that offer ferromagnetic properties and are commonly used in transformers. Transformer ferrite cores are made from iron oxides with a combination of compounds that offer low coercivity such as zinc, nickel, and manganese compounds. The ability to provide high current resistivity and high permeability with effective mechanical and electrical properties makes ferrite cores a preferred alternative to magnetic core transformers in applications such as high-frequency transformers, adjustable inductors, and wide-band transformers among others. The major factors driving the growth of the market include an increase in government initiatives to integrate renewable resources of energy to produce electricity across sectors, globally.

Global Transformer Ferrite Core Market Dynamics

Market Drivers

- Growing demand for electricity and energy-efficient solutions

- Increasing adoption of renewable energy sources

- Rising demand for consumer electronics and other electronic devices

- High demand for power transformers in the transmission and distribution of electricity

Market Restraints

- Fluctuations in the prices of raw materials

- Stringent regulations regarding the production and use of transformer ferrite cores

- High initial investment required for the setup of manufacturing facilities

Market Opportunities

- Growing demand for ferrite cores in automotive and aerospace industries

- Increasing adoption of electric vehicles and hybrid electric vehicles

- Emergence of new applications such as wireless charging and power transmission

Transformer Ferrite Core Market Report Coverage

| Market | Transformer Ferrite Core Market |

| Transformer Ferrite Core Market Size 2022 | USD 2.1 Billion |

| Transformer Ferrite Core Market Forecast 2032 | USD 3.6 Billion |

| Transformer Ferrite Core Market CAGR During 2023 - 2032 | 5.7% |

| Transformer Ferrite Core Market Analysis Period | 2020 - 2032 |

| Transformer Ferrite Core Market Base Year | 2022 |

| Transformer Ferrite Core Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Shape, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | TDK Corporation, Hitachi Metals Ltd., Ferroxcube International Holding B.V., Vishay Intertechnology, Inc., EPCOS AG, MAGNETICS® (a division of Spang & Company), Shinohara Electric Co., Ltd., DMEGC Magnetics Co., Ltd., Neosid GmbH, and Sumida Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Transformer Ferrite Core Market Insights

The increase in the use of high-performance manganese zinc ferrite cores in transformers across domestic and industrial applications as well as increasing technological investments by leading players have led to the growth of the transformer ferrite cores market, globally. An increase in demand for electricity from emerging economies such as Asia-Pacific and Middle East & Africa, growth of the power sector, growth in adoption of ferrite cores over magnetic cores in transformers, and technological advancements by key players are the major opportunity areas for the market. The major challenges can be attributed to fluctuation in raw material prices and change in the regulatory environment.

Transformer Ferrite Core Market Segmentation

The worldwide market for transformer ferrite core is split based on type, shape, application, end-use industry, and geography.

Transformer Ferrite Core Types

- Manganese Zinc Ferrite (MnZn)

- Nickel Zinc Ferrite (NiZn)

According to a transformer ferrite core industry analysis, manganese zinc ferrite (MnZn) will have the highest market share in 2022. Manganese zinc ferrite (MnZn) is the most common ferrite material used in transformer cores, accounting for a sizable market share. It is preferred for high-frequency applications because of its high magnetic permeability and low magnetic loss, making it suitable for power transformers, switching power supplies, and inductors. Another important ferrite material used in transformer cores is nickel zinc ferrite (NiZn). It is preferred for low-frequency applications and has a high resistivity and magnetic saturation, making it suitable for filter, choke, and noise suppressor applications.

Transformer Ferrite Core Shapes

- E-Shaped

- U-Shaped

- Toroidal

- Pot Core

Toroidal cores are one of the most widely used shapes in transformer ferrite cores because of their excellent magnetic properties, low leakage inductance, and high efficiency. They're common in high-frequency applications like switch-mode power supplies and audio transformers. Furthermore, pot cores are another popular shape for transformer ferrite cores, particularly in low power applications. They are preferred because of their high permeability and low magnetic leakage, making them suitable for inductors and filters. In addition, U-shaped and E-shaped cores are used in transformer ferrite cores, particularly in lower frequency applications. They have excellent magnetic properties and are widely used in power transformers and chokes.

Transformer Ferrite Core Applications

- Power Transformers

- High-Frequency Transformers

- Pulse Transformers

As per the transformer ferrite core market forecast, power transformers, which are used in electrical power transmission and distribution systems, are one of the largest applications for transformer ferrite cores. They typically operate at low to medium frequencies and must be highly efficient with minimal losses. Ferrite cores are used in power transformers to improve performance by increasing magnetic coupling and decreasing leakage inductance.

Another important application for transformer ferrite cores is high-frequency transformers. They're found in a variety of electronic devices and applications, including switch-mode power supplies, RF filters, and audio transformers. Because of their low magnetic losses and high permeability, ferrite cores are preferred in high-frequency applications, resulting in improved efficiency and performance.

Another important application for transformer ferrite cores is pulse transformers, which are used to transmit signals in electronic circuits. They can be found in a variety of applications, including pulse generators, radar systems, and telecommunications. Because of their high magnetic permeability, ferrite cores are preferred in pulse transformers, which helps to reduce signal distortion and improve performance.

Transformer Ferrite Core End-Use Industries

- Automotive

- Consumer Electronics

- Industrial

- Telecommunications

- Healthcare

The consumer electronics industry is a major end-user of transformer ferrite cores, accounting for a sizable market share. Transformers with ferrite cores are used in consumer electronics devices such as smartphones, tablets, laptops, and other electronic devices. The consumer electronics industry's growth, driven by factors such as increasing demand for connected devices, is expected to drive demand for transformer ferrite cores in the future. Furthermore, the automotive industry is a major end-user of transformer ferrite cores. They are used in a variety of applications, including sensors, power supplies, and electric vehicle charging systems. Electric vehicle market growth is expected to drive demand for transformer ferrite cores in the automotive industry.

Another growing end-user of transformer ferrite cores is the healthcare industry. They're found in medical devices like MRI scanners, CT scanners, and X-ray machines. The healthcare industry's expansion, fueled by factors such as an ageing population and rising healthcare spending, is expected to drive demand for transformer ferrite cores.

Transformer Ferrite Core Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Transformer Ferrite Core Market Regional Analysis

Asia-Pacific is the largest market for transformer ferrite cores, owing to rapid growth in the consumer electronics and automotive industries in China, Japan, and South Korea. The region is expected to maintain its market dominance in the coming years, owing to rapid industrialization and urbanization in emerging economies.

Transformer ferrite cores are also popular in North America and Europe. The demand for transformer ferrite cores in these regions is being driven by the demand for energy-efficient solutions and the expansion of the renewable energy sector. Furthermore, the growing demand for electric vehicles in North America and Europe is expected to drive demand for transformer ferrite cores. The Middle East and Africa, as well as Latin America, are expected to see significant growth in demand for transformer ferrite cores, owing to the increasing adoption of renewable energy solutions and the expansion of the automotive industry in these regions.

Transformer Ferrite Core Market Players

Some of the top transformer ferrite core companies offered in the professional report include TDK Corporation, Hitachi Metals Ltd., Ferroxcube International Holding B.V., Vishay Intertechnology, Inc., EPCOS AG, MAGNETICS® (a division of Spang & Company), Shinohara Electric Co., Ltd., DMEGC Magnetics Co., Ltd., Neosid GmbH, and Sumida Corporation.

Frequently Asked Questions

What was the market size of the global transformer ferrite core in 2022?

The market size of transformer ferrite core was USD 2.1 billion in 2022.

What is the CAGR of the global transformer ferrite core from 2023 to 2032?

The CAGR of transformer ferrite core is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the transformer ferrite core market?

The key players operating in the global transformer ferrite core market is includes TDK Corporation, Hitachi Metals Ltd., Ferroxcube International Holding B.V., Vishay Intertechnology, Inc., EPCOS AG, MAGNETICS® (a division of Spang & Company), Shinohara Electric Co., Ltd., DMEGC Magnetics Co., Ltd., Neosid GmbH, and Sumida Corporation.

Which region dominated the global transformer ferrite core market share?

Asia-Pacific held the dominating position in transformer ferrite core industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of transformer ferrite core during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global transformer ferrite core industry?

The current trends and dynamics in the transformer ferrite core industry include growing demand for electricity and energy-efficient solutions, increasing adoption of renewable energy sources, and rising demand for consumer electronics and other electronic devices.

Which type held the maximum share in 2022?

The manganese zinc ferrite (MnZn) held the maximum share of the transformer ferrite core industry.