Transcatheter Embolization and Occlusion Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Transcatheter Embolization and Occlusion Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

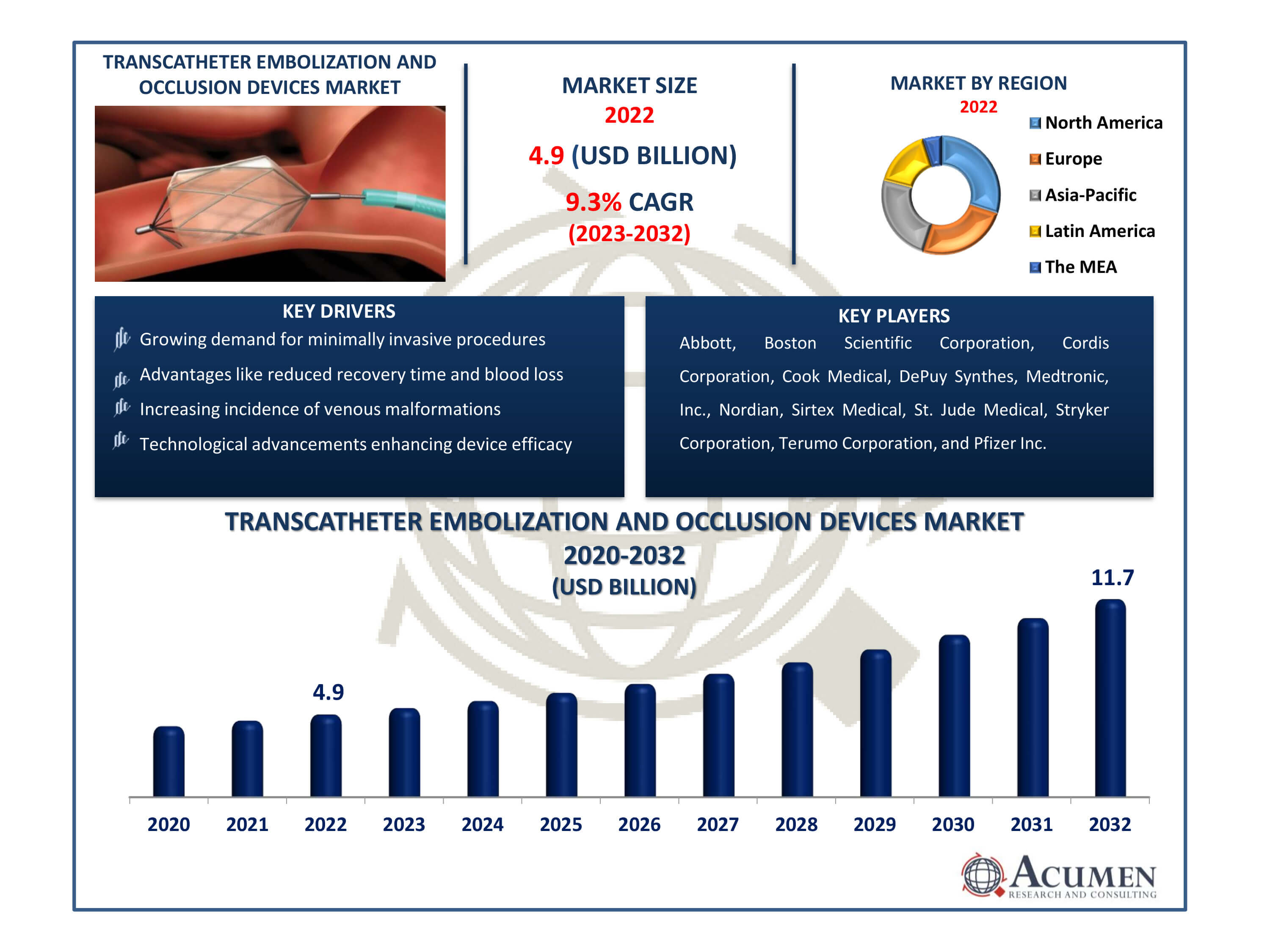

The Transcatheter Embolization and Occlusion Devices Market Size accounted for USD 4.9 Billion in 2022 and is estimated to achieve a market size of USD 11.7 Billion by 2032 growing at a CAGR of 9.3% from 2023 to 2032.

Transcatheter Embolization and Occlusion Devices Market Highlights

- Global transcatheter embolization and occlusion devices market revenue is poised to garner USD 11.7 billion by 2032 with a CAGR of 9.3% from 2023 to 2032

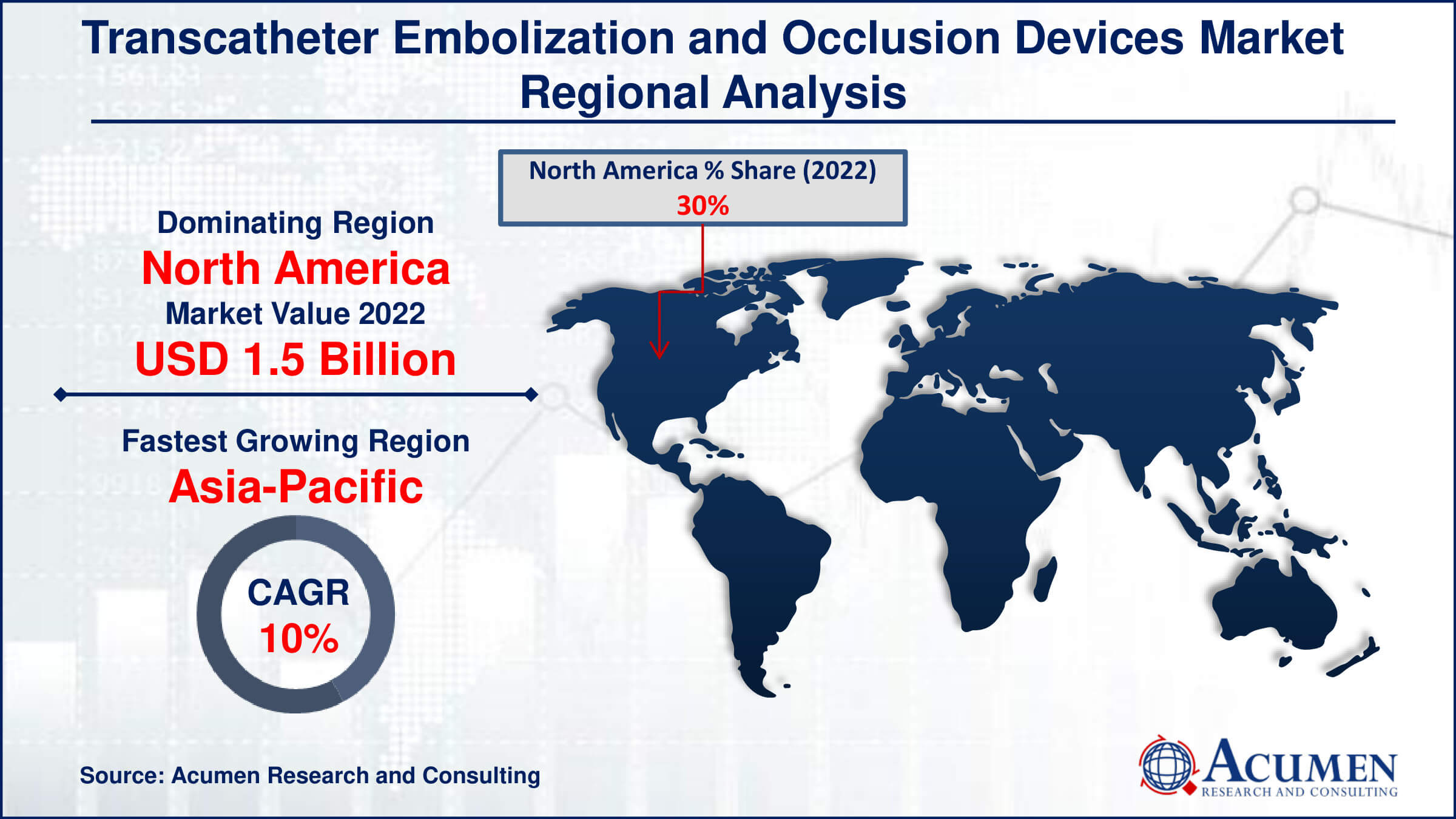

- North America transcatheter embolization and occlusion devices market value occupied around USD 1.5 billion in 2022

- Asia-Pacific transcatheter embolization and occlusion devices market growth will record a CAGR of more than 10% from 2023 to 2032

- Among type, the non coil sub-segment generated over US$ 2.6 billion revenue in 2022

- Based on end-user, the hospitals & clinics sub-segment generated around 58% share in 2022

- Rising awareness and education about minimally invasive options is a popular transcatheter embolization and occlusion devices

Transcatheter embolism and occlusion devices involve the passage or insertion of a synthetic embolus into a blood vessel using a fine catheter to block blood flow in a specific area of the body. This embolization is a minimally invasive procedure performed in interventional radiology to reduce tumor blood circulation. Sometimes, embolic synthetic materials are coated with chemotherapeutic products, serving a dual purpose: blocking blood supply and inducing cytotoxic effects on tumors in various ways.

Furthermore, this technique can be used to control or prevent aneurysms bulging or sack-like formations in weakened artery walls and eliminate abnormal connections between arteries and veins, or to treat aneurysms. Transcatheter embolization is significantly less invasive and highly effective in controlling bleeding compared to open surgical procedures. For gastrointestinal bleeding, it is considered the primary treatment option, either alone or in combination with other therapies such as surgery or radiation. The procedure begins with radiography to visualize the blood vessel. Then, guided by an interventional radiologist, a cutaneous catheter is inserted into the desired vessel and advanced to the treatment site. Among females, this method offers an excellent means of shrinking and controlling heavy menstrual bleeding caused by uterine fibroid tumors.

Global Transcatheter Embolization and Occlusion Devices Market Dynamics

Market Drivers

- Growing demand for minimally invasive procedures

- Advantages like reduced recovery time and blood loss

- Increasing incidence of venous malformations

- Technological advancements enhancing device efficacy

Market Restraints

- Lack of adherence to FDA guidelines leading to complications

- Requirement for specialized expertise hindering adoption

- Potential increase in hospital readmissions

Market Opportunities

- Expanding applications in various medical fields

- Emerging markets with untapped potential

- Research and development for enhanced device efficiency

Transcatheter Embolization and Occlusion Devices Market Report Coverage

| Market | Transcatheter Embolization and Occlusion Devices Market |

| Transcatheter Embolization and Occlusion Devices Market Size 2022 | USD 4.9 Billion |

| Transcatheter Embolization and Occlusion Devices Market Forecast 2032 | USD 11.7 Billion |

| Transcatheter Embolization and Occlusion Devices Market CAGR During 2023 - 2032 | 9.3% |

| Transcatheter Embolization and Occlusion Devices Market Analysis Period | 2020 - 2032 |

| Transcatheter Embolization and Occlusion Devices Market Base Year |

2022 |

| Transcatheter Embolization and Occlusion Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, Boston Scientific Corporation, Cordis Corporation, Cook Medical, DePuy Synthes, Medtronic, Inc., Nordian, Sirtex Medical, St. Jude Medical, Stryker Corporation, Terumo Corporation, and Pfizer Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Transcatheter Embolization and Occlusion Devices Market Insights

Growing demand is expected to drive the transcatheter embolization and occlusion device market for minimally invasive surgical procedures compared to standard open surgeries. This shift arises from the advantages of minimally invasive procedures, including significantly reduced blood loss, shorter recovery times, decreased surgical duration, and a lower likelihood of errors. For instance, a retrospective survey by John Hopkins' Department of Surgery revealed lower complication and error rates of 4.69% in catheter embolism compared to 6.64% in open surgical procedures, demonstrating the benefits. Another significant factor contributing to market growth is the increasing incidence of venous malformations leading to vascular issues. Studies have indicated a global incidence of vein malformations ranging from 1-4% with no specific gender bias.

However, the practice of transcatheter embolization without adherence to FDA guidelines, resulting in increased hospital readmissions and necessitating specific expertise, is anticipated to impede market growth. Studies have shown the increase in major post-operative complications among patients who underwent catheter embolization for fibroid tumors.

In the past decade, according to the transcatheter embolization and occlusion devices industry analysis the market has witnessed remarkable growth. Paradigm shifts from clipping to bending have spurred the demand for transcatheter embolization devices. However, factors such as expensive products, stringent regulatory approval procedures, and the need for expert personnel to perform these procedures can hinder global growth. Additionally, the adoption of transcatheter embolization and occlusion (TEO) devices is increasing. This minimally invasive surgical approach supports non-coil products, such as embolization particles or liquid embolics. Using these instruments helps prevent complications like inaccurate deployment, catheter occlusions, and deflation related to coiling. As a result, surgeons are increasingly transitioning to non-coiling devices, which is expected to further drive the demand for TEO devices.

Transcatheter Embolization and Occlusion Devices Market Segmentation

The worldwide market for transcatheter embolization and occlusion devices is split based on type, application, end-user, and geography.

Transcatheter Embolization and Occlusion Devices Types

- Coil

- Pushable Coils

- Detachable Coils

- Non Coil

- Flow Diverting Devices

- Embolization Particles

- Liquid Embolics

- Others

According to transcatheter embolization and occlusion devices industry analysis, The non-coil subsegment emerges as the leading force in the market, with the greatest share. This area includes a variety of novel technologies that go beyond typical coil-based approaches. Flow diversion devices, embolising particles, liquid embolics, and other non-coil alternatives are included.

The transition to non-coil devices represents a paradigm shift in interventional procedures. These sophisticated instruments meet the growing demand for minimally invasive methods by improving precision, lowering procedural risks, and expanding applicability across multiple medical sectors. Their success in treating problems such as aneurysms, vascular malformations, and tumours has greatly contributed to their market dominance. The non-coil subsegment's dominance shows healthcare practitioners' growing trust in these alternative technologies. This trend highlights a market strategic development, highlighting a path where innovation and efficacy in minimally invasive therapies generate significant market growth and set new norms in interventional radiology.

Transcatheter Embolization and Occlusion Devices Applications

- Peripheral Vascular Disease

- Arterial Blockage

- Venous Blood Clot

- Others

- Oncology

- Liver Cancer

- Pancreatic Cancer

- Breast Cancer

- Kidney Cancer

- Others

- Neurology

- Brain Aneurysm

- Cerebral Arteriovenous Malformations

- Others

- Urology

- Benign Prostatic Hyperplasia/Urinary Retention

- Others (Varicocele)

- Others

The market is segmented into peripheral vascular diseases, oncology, neurology, and others based on application. Growth within these segments is expected to be driven by the increasing incidence of fatal neurologic diseases such as brain aneurysms and brain arteriovenous malformations. According to the Society of Neurointerventional Surgery, there are currently more than 140 detachable Guglielmi coils available in various sizes, which have treated over 125,000 patients worldwide. Consequently, the market for brain aneurysms is anticipated to witness significant growth during the transcatheter embolization and occlusion devices market forecast period.

Within the oncology segment, embolization techniques are expected to offer highly efficient treatments for liver and kidney cancers. Embolization has emerged as one of the most common treatment modalities for various cancers, including those affecting the liver, kidney, breast, pancreas, and more. Specifically, hepatocellular carcinoma, the most common type of liver cancer treated through embolism, ranks as the third leading cause of cancer-related deaths worldwide according to the National Center for Biotechnology Information.

Transcatheter Embolization and Occlusion Devices End-Users

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

In terms of transcatheter embolization and occlusion devices market analysis, Several factors contribute to the Hospitals & Clinics subsegment's dominance in the industry. Hospitals & Clinics and clinics are often the principal sites for advanced medical interventions such as interventional radiology procedures such as transcatheter embolisation. These facilities feature a well-established infrastructure, a large patient base, and a wide spectrum of specialised personnel capable of executing complex treatments. Furthermore, Hospitals & Clinics frequently serve as referral centres for difficult situations, thus enhancing their use of transcatheter embolisation and occlusion devices. Their ability to handle a wide range of medical ailments and provide specialised care establishes the Hospitals & Clinics subsegment as the market leader in adopting and deploying these cutting-edge gadgets.

Transcatheter Embolization and Occlusion Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Transcatheter Embolization and Occlusion Devices Market Regional Analysis

The majority of revenues in 2022 were primarily represented by North America, followed by Europe. Some of the factors contributing to demand for TEO devices in these regions are the presence of advanced healthcare infrastructure, a well-defined regulatory framework and experienced health professionals to carry out procedures. During the transcatheter embolization and occlusion devices market forecast period, both regions are expected to maintain their dominance.

This growth has to do with a large population base, increased capacity for expenditure and the widespread use of state of the art healthcare. In the forecast period, Asia Pacific will be registering the quickest CAGR of 10.0%. In emerging economies, such as India, China and Malaysia, the rapidly growing medical tourism industry attracts cancer patients around the world. This is expected to rapidly increase the demand for TEO treatments in these countries and drive the regional market.

Transcatheter Embolization and Occlusion Devices Market Players

Some of the top transcatheter embolization and occlusion devices companies offered in our report includes Abbott, Boston Scientific Corporation, Cordis Corporation, Cook Medical, DePuy Synthes, Medtronic, Inc., Nordian, Sirtex Medical, St. Jude Medical, Stryker Corporation, Terumo Corporation, and Pfizer Inc.

Frequently Asked Questions

How big is the transcatheter embolization and occlusion devices market?

The market size of transcatheter embolization and occlusion devices was USD 4.9 Billion in 2022.

What is the CAGR of the global transcatheter embolization and occlusion devices market from 2023 to 2032?

The CAGR of transcatheter embolization and occlusion devices is 9.3% during the analysis period of 2023 to 2032.

Which are the key players in the transcatheter embolization and occlusion devices market?

The key players operating in the global market are including Abbott, Boston Scientific Corporation, Cordis Corporation, Cook Medical, DePuy Synthes, Medtronic, Inc., Nordian, Sirtex Medical, St. Jude Medical, Stryker Corporation, Terumo Corporation, and Pfizer Inc.

Which region dominated the global transcatheter embolization and occlusion devices market share?

North America held the dominating position in transcatheter embolization and occlusion devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of transcatheter embolization and occlusion devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global transcatheter embolization and occlusion devices industry?

The current trends and dynamics in the transcatheter embolization and occlusion devices industry include growing demand for minimally invasive procedures, advantages like reduced recovery time and blood loss, increasing incidence of venous malformations, and technological advancements enhancing device efficacy.

Which type held the maximum share in 2022?

The non coil type held the maximum share of the transcatheter embolization and occlusion devices industry.?