Transcatheter Devices Market | Acumen Research and Consulting

Transcatheter Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

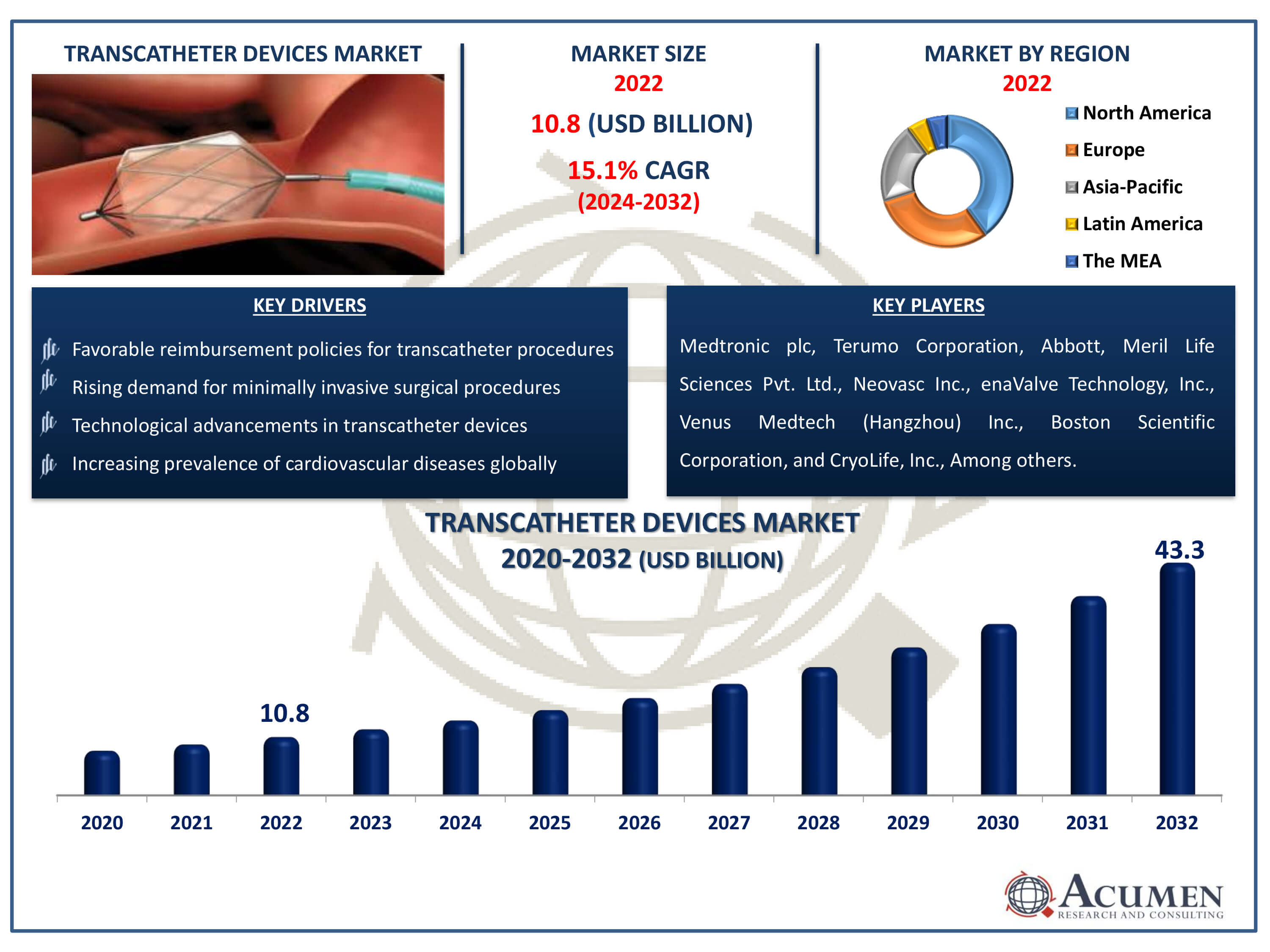

The Transcatheter Devices Market Size accounted for USD 10.8 Billion in 2022 and is estimated to achieve a market size of USD 43.3 Billion by 2032 growing at a CAGR of 15.1% from 2024 to 2032.

Transcatheter Devices Market Highlights

- Global transcatheter devices market revenue is poised to garner USD 43.3 billion by 2032 with a CAGR of 15.1% from 2024 to 2032

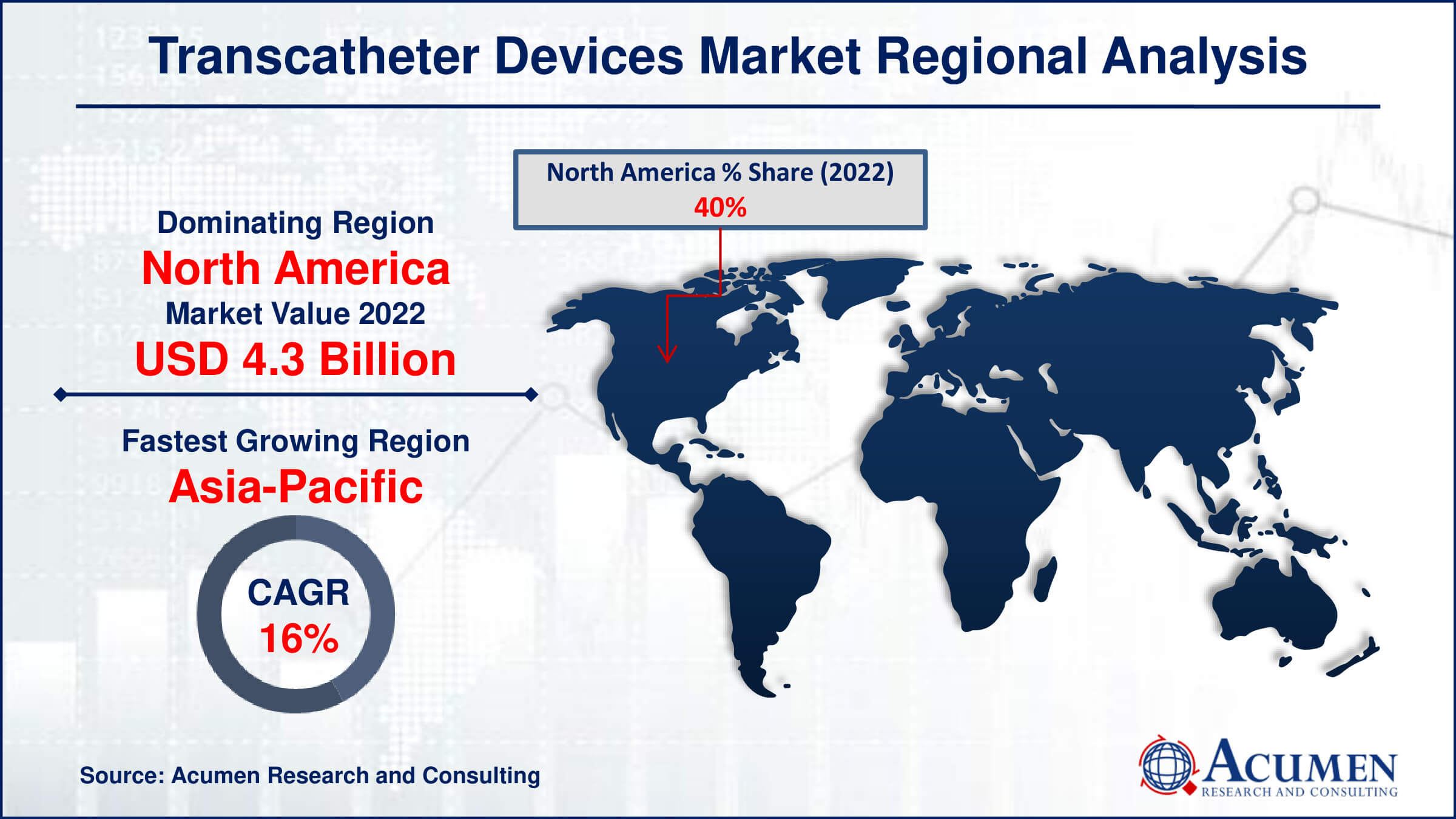

- North America transcatheter devices market value occupied around USD 4.3 billion in 2022

- Asia-Pacific transcatheter devices market growth will record a CAGR of more than 16% from 2024 to 2032

- Among product, the transcatheter replacement devices sub-segment generated noteworthy revenue in 2022

- Based on application, the cardiovascular sub-segment generated 58% transcatheter devices market share in 2022

- Potential for growth in outpatient and ambulatory care settings is a popular transcatheter devices market trend that fuels the industry demand

Transcatheter devices are used to perform minimally invasive procedures to treat cardiac, urological, and neurological disorders. These devices help minimize complications such as catheter entrapment, imprecise deployment, and balloon deflation associated with coiling. Transcatheter devices are primarily used for transcatheter aortic valve replacement (TAVR), also known as transcatheter aortic valve implantation (TAVI), which is a minimally invasive surgical procedure that repairs aortic valves without removing the old, damaged valve. This procedure is a new development in the market and has been FDA-approved for treating symptomatic aortic stenosis in high-risk patients who are not suitable candidates for standard valve replacement surgery. Cardiac surgeons in both developed and developing regions prefer TAVR over conventional aortic valve replacement surgery due to its benefits, such as lower risk, faster recovery, and shorter hospital stays.

Global Transcatheter Devices Market Dynamics

Market Drivers

- Increasing prevalence of cardiovascular diseases globally

- Rising demand for minimally invasive surgical procedures

- Technological advancements in transcatheter devices

- Favorable reimbursement policies for transcatheter procedures

Market Restraints

- High cost of transcatheter procedures

- Limited availability of skilled healthcare professionals

- Regulatory hurdles and approval challenges

Market Opportunities

- Expansion into emerging markets with growing healthcare infrastructure

- Development of innovative transcatheter devices for diverse applications

- Rising investment in research and development for advanced devices

Transcatheter Devices Market Report Coverage

| Market | Transcatheter Devices Market |

| Transcatheter Devices Market Size 2022 | USD 10.8 Billion |

| Transcatheter Devices Market Forecast 2032 |

USD 43.3 Billion |

| Transcatheter Devices Market CAGR During 2024 - 2032 | 15.1% |

| Transcatheter Devices Market Analysis Period | 2020 - 2032 |

| Transcatheter Devices Market Base Year |

2022 |

| Transcatheter Devices Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic plc, Terumo Corporation, Abbott, Meril Life Sciences Pvt. Ltd., Neovasc Inc., enaValve Technology, Inc., Venus Medtech (Hangzhou) Inc., Boston Scientific Corporation, CryoLife, Inc., W.L. Gore & Associates, Edwards Lifesciences Corporation, and Symetis SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Transcatheter Devices Market Insights

The constantly growing elderly population, along with the rising frequency of cardiac disorders globally, is a primary driving force in the growth of the transcatheter aortic valve replacement (TAVR) industry. Patients and healthcare professionals alike are increasingly opting for less invasive procedures like TAVR, which allows for faster recovery and has fewer dangers than standard open-heart surgery. This trend towards less intrusive solutions is a key driver of market growth. Another important factor contributing to the TAVR market's growing trend is the constant stream of technical improvements. Cutting-edge improvements in TAVR treatments and technologies improve their efficacy and safety, resulting in increased acceptance, particularly in developed nations. The healthcare industry's dedication to remaining at the forefront of technological advancement is unquestionably an important component of this trend.

Favourable reimbursement policies help to foster the expansion of the TAVR industry. The centres for Medicare and Medicaid Services (CMS), for example, has included TAVR in its Medicare National Coverage Determination policy. Such rules make the process more accessible to a broader portion of the population, resulting in market expansion. However, the market is not without obstacles. The expensive cost of transcatheter devices and the surgical operation itself may be a barrier to wider adoption, especially in emerging and undeveloped nations where disposable budgets are limited. Additionally, the availability of experienced doctors trained to administer TAVR operations is critical for the procedure's effectiveness. The paucity of such skills might stifle market growth. Furthermore, complex regulatory clearance processes might cause delays in the introduction of new and innovative TAVR devices to the market.

Transcatheter Devices Market Segmentation

The worldwide market for transcatheter devices is split based on product, application, and geography.

Transcatheter Device Products

- Transcatheter Embolization and Occlusion Devices

- Coil

- Non Coil

- Transcatheter Replacement Devices

- Transcatheter Aortic Valve Replacement Devices

- Transcatheter Pulmonary Valve Replacement

- Transcatheter Mitral Valve Replacement

- Transcatheter Repair Devices

- Transcatheter Mitral Valve Repair

- Transcatheter Tricuspid Valve Repair

The transcatheter replacement devices category is expected to be the most important in the transcatheter devices market due to its considerable advantages and expanding applications. Transcatheter replacement devices include heart valves, such as transcatheter aortic valve replacement (TAVR), which have transformed the treatment of valve-related cardiac diseases. The rising frequency of aortic stenosis, particularly in older populations, is boosting demand for TAVR operations, which provide a less invasive alternative to standard open-heart surgery. Patients having TAVR often have shorter hospital stays, faster recovery times, and a lower risk of problems, making it an appealing choice for both patients and healthcare professionals.

Continuous technical advances are another element driving growth in the transcatheter replacement devices industry. New generations of devices are intended to increase procedure efficiency and patient outcomes while also increasing durability and biocompatibility. As these devices advance, they become more accessible to a broader variety of patients, boosting the segment's market share. Furthermore, favourable payment rules for TAVR operations in North America and Europe are increasing the use of these devices. As a result, the transcatheter replacement devices category is likely to continue its market leadership position, aided by an ageing population and the ongoing development of novel technology.

Transcatheter Devices Applications

- Cardiovascular

- Oncology

- Neurology

- Urology

- Others

According to transcatheter devices industry analysis, the cardiovascular application held the highest market share in 2022 and was the dominant segment in the global transcatheter devices market. This segment accounted for 58% of the market and is projected to maintain its dominance over the transcatheter devices industry forecast period. The growth of this segment can be attributed to the increasing population with cardiovascular diseases such as mitral regurgitation, aortic stenosis, and tricuspid regurgitation. The adoption of technologically advanced devices such as the latest fourth-generation TAVR systems has helped reduce complications associated with cardiac diseases and the mortality rate. This is one of the key factors contributing to the growth of the cardiovascular segment. The oncology segment is expected to register the fastest-growing compound annual growth rate (CAGR) during the transcatheter devices market forecast period. This is due to the increasing adoption of embolization techniques to treat patients with kidney, pancreatic, breast, and liver cancer.

Transcatheter Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Transcatheter Devices Market Regional Analysis

In terms of transcatheter devices market analysis, North America has the largest market share in the industry and is likely to retain its dominance during the forecast period. The increased frequency of cardiovascular and neurological ailments, as well as an ageing population at risk of chronic illness, is driving this region's rise. According to one research, around 40 million individuals in the United States were over the age of 65 in 2011, and this figure is anticipated to rise to around 89 million by 2050. Following North America, Europe has the second highest share of the transcatheter device market.

Meanwhile, the Asia-Pacific area is rapidly expanding, making it the fastest-growing region in the market. This growth is being driven by an ageing population, improved healthcare infrastructure, and increased use of minimally invasive surgical techniques. Furthermore, rising awareness of modern medical treatments and higher healthcare spending are driving the market's growth in the area.

Transcatheter Devices Market Players

Some of the top transcatheter devices companies offered in our report includes Medtronic plc, Terumo Corporation, Abbott, Meril Life Sciences Pvt. Ltd., Neovasc Inc., enaValve Technology, Inc., Venus Medtech (Hangzhou) Inc., Boston Scientific Corporation, CryoLife, Inc., W.L. Gore & Associates, Edwards Lifesciences Corporation, and Symetis SA.

Frequently Asked Questions

How big is the transcatheter devices market?

The transcatheter devices market size was valued at USD 10.8 billion in 2022.

What is the CAGR of the global transcatheter devices market from 2024 to 2032?

The CAGR of transcatheter devices is 15.1% during the analysis period of 2024 to 2032.

Which are the key players in the transcatheter devices market?

The key players operating in the global market are including Medtronic plc, Terumo Corporation, Abbott, Meril Life Sciences Pvt. Ltd., Neovasc Inc., enaValve Technology, Inc., Venus Medtech (Hangzhou) Inc., Boston Scientific Corporation, CryoLife, Inc., W.L. Gore & Associates, Edwards Lifesciences Corporation, and Symetis SA.

Which region dominated the global transcatheter devices market share?

North America held the dominating position in transcatheter devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of transcatheter devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global transcatheter devices industry?

The current trends and dynamics in the transcatheter devices industry include increasing prevalence of cardiovascular diseases globally, rising demand for minimally invasive surgical procedures, technological advancements in transcatheter devices, and favorable reimbursement policies for transcatheter procedures.

Which application held the maximum share in 2022?

The cardiovascular application held the maximum share of the transcatheter devices industry.