Thermoplastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Thermoplastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

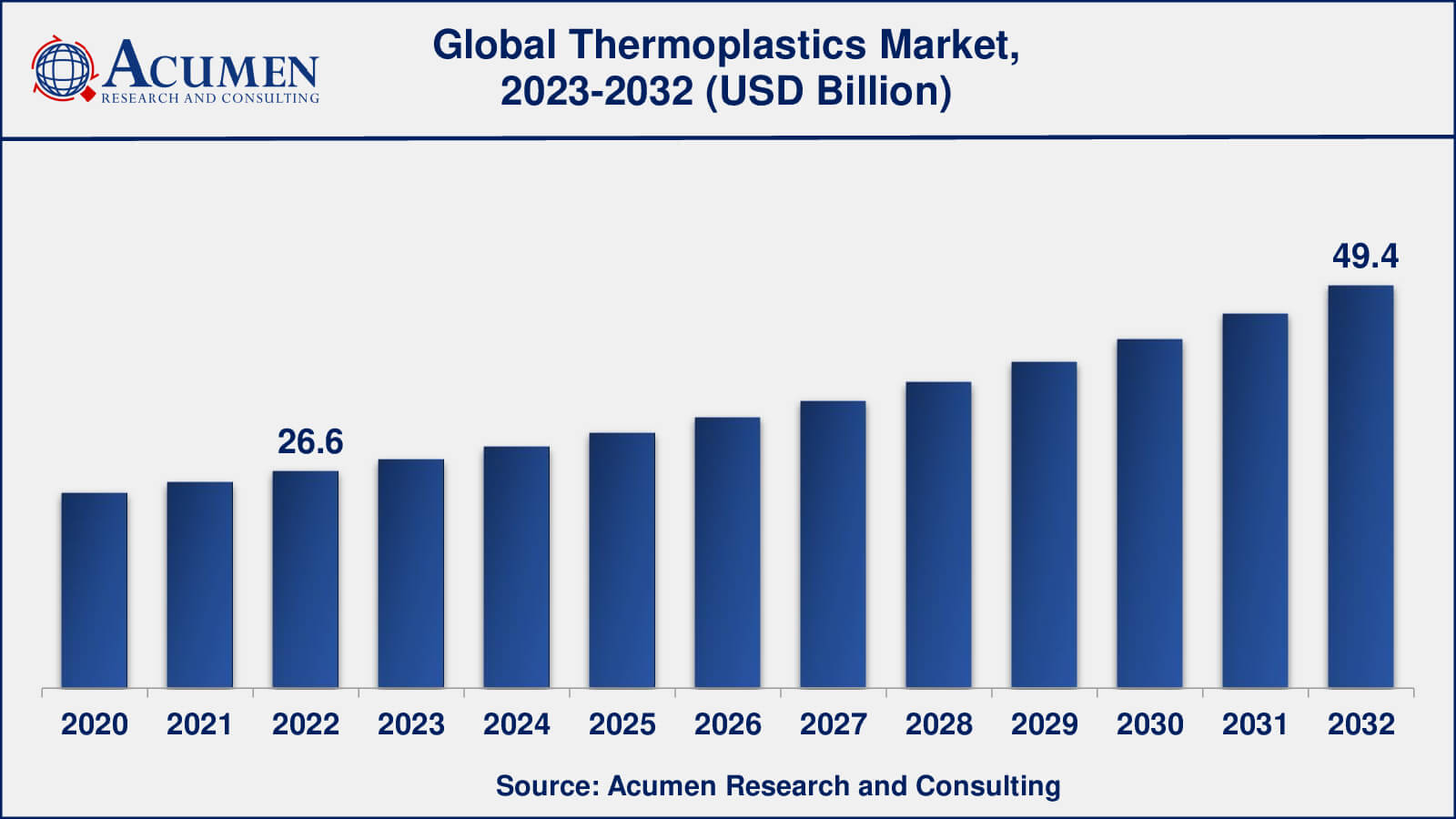

The Global Thermoplastics Market Size accounted for USD 26.6 Billion in 2022 and is estimated to achieve a market size of USD 49.4 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Thermoplastics Market Highlights

- Global thermoplastics market revenue is poised to garner USD 49.4 billion by 2032 with a CAGR of 6.5% from 2023 to 2032

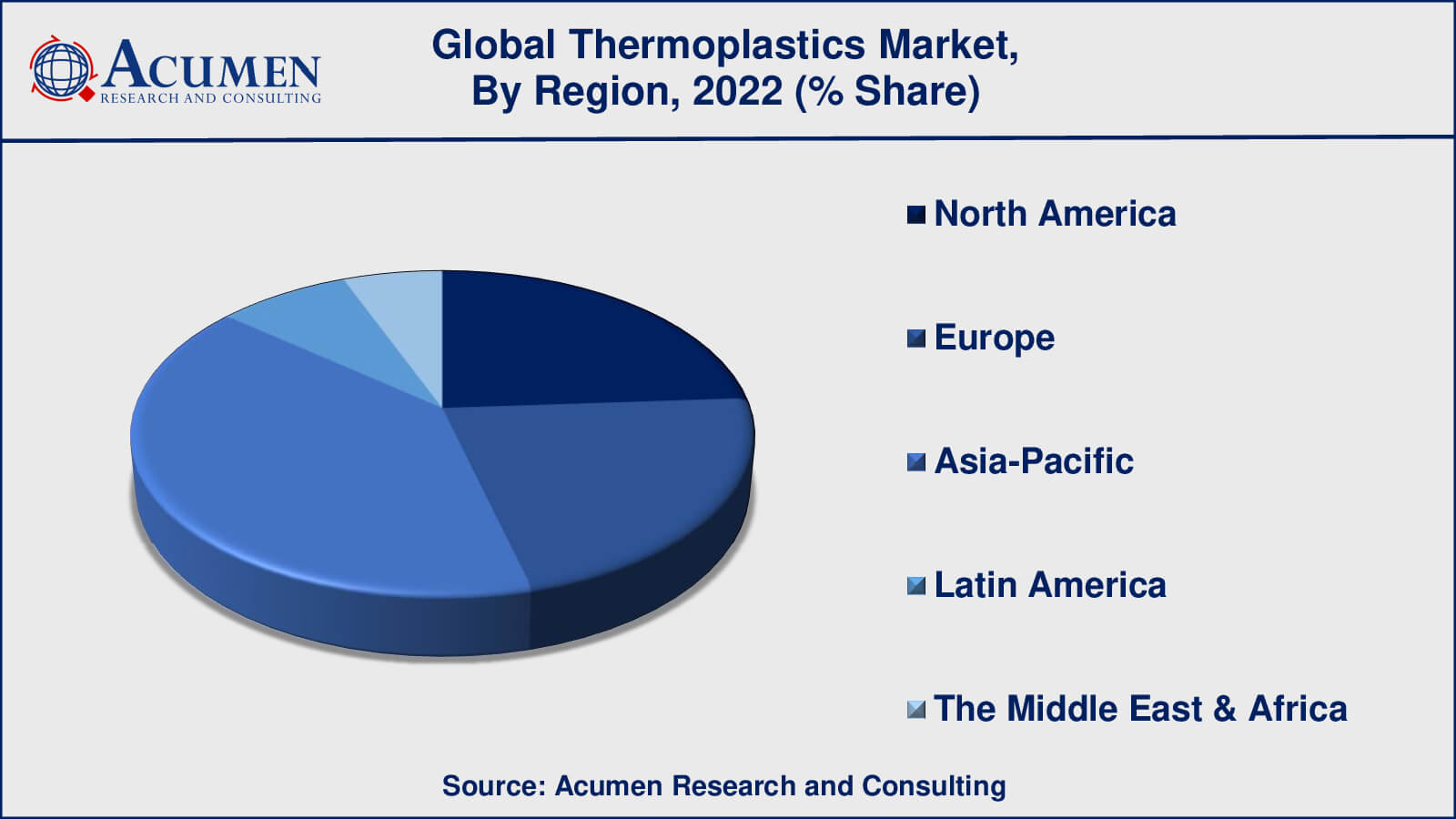

- Asia-Pacific thermoplastics market value occupied almost USD 10 billion in 2022

- Asia-Pacific thermoplastics market growth will record a CAGR of over 7% from 2023 to 2032

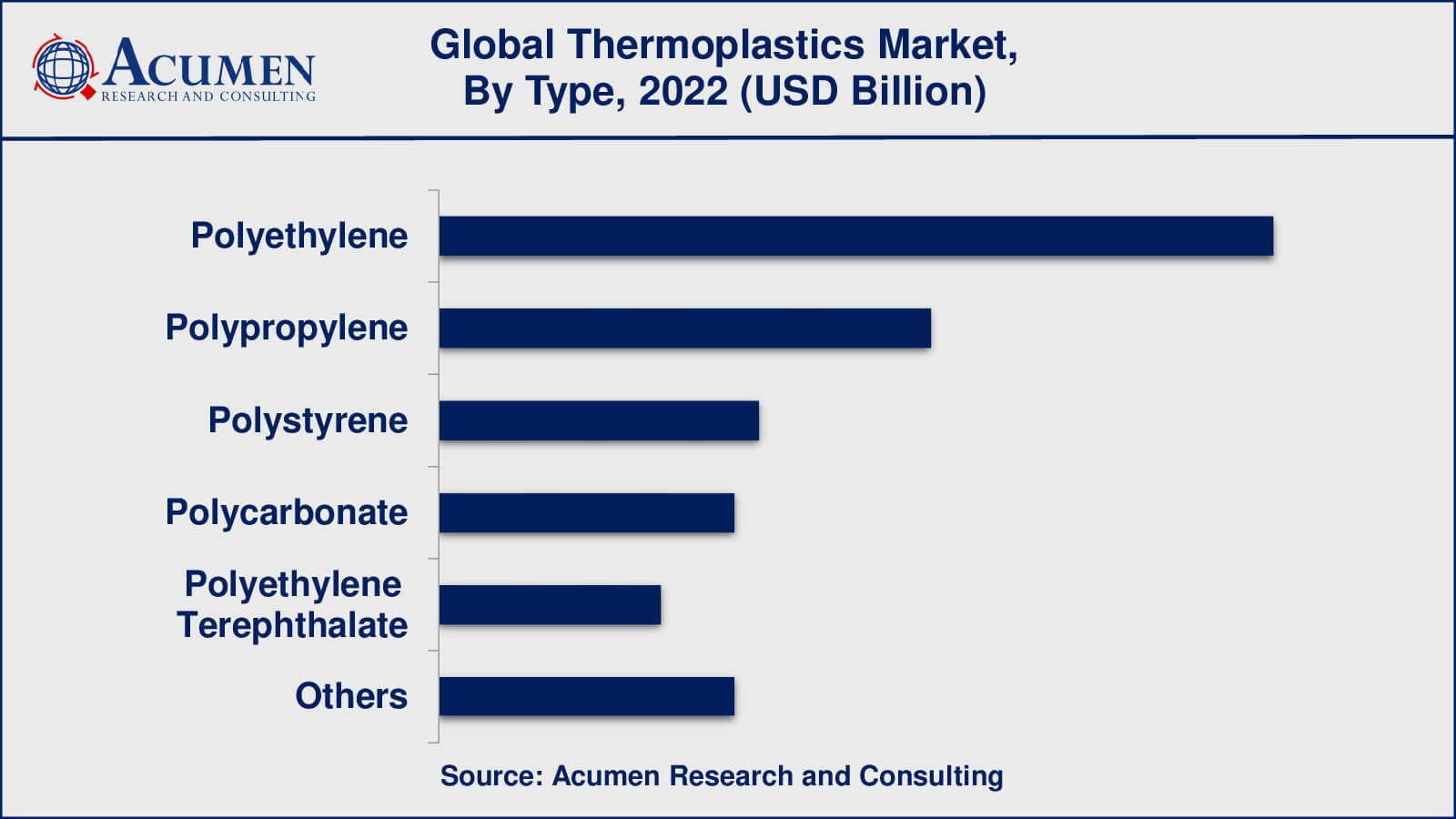

- Among type, the polyethylene sub-segment generated over US$ 9 billion revenue in 2022

- Based on end-use industry, the packaging sub-segment generated around 20% share in 2022

- Rising focus on sustainability and the use of biodegradable thermoplastics is a popular thermoplastics market trend that fuels the industry demand

A thermoplastic is a polymer material that changes its shape and becomes moldable above a specific range of temperatures and solidifies upon cooling. Most thermoplastics possess higher molecular weight and their brittleness is reduced by the addition of plasticizers. Thermoplastics witness numerous applications in different industries. For example, it serves as a substitute for glass for aquariums, helmets, lenses of exterior lights of vehicles, etc. These are also used to make fabrics, rope, carpets, and musical strings.

Global Thermoplastics Market Dynamics

Market Drivers

- Growing demand for lightweight and durable materials in various industries

- Increasing awareness about the benefits of using thermoplastics over traditional materials

- Advancements in technology leading to the development of new and innovative thermoplastics

Market Restraints

- Fluctuating prices of raw materials used in the production of thermoplastics

- Strict regulatory requirements for the use of thermoplastics in certain applications such as medical devices

- Lack of awareness and knowledge about the properties and benefits of thermoplastics among end-users

Market Opportunities

- Increasing demand for thermoplastics in emerging markets such as Asia-Pacific and Latin America

- Development of new and innovative applications for thermoplastics in industries such as aerospace and defense

- Growing focus on recycling and reuse of thermoplastics leading to the development of new business models and opportunities

Thermoplastics Market Report Coverage

| Market | Thermoplastics Market |

| Thermoplastics Market Size 2022 | USD 26.6 Billion |

| Thermoplastics Market Forecast 2032 | USD 49.4 Billion |

| Thermoplastics Market CAGR During 2023 - 2032 | 6.5% |

| Thermoplastics Market Analysis Period | 2020 - 2032 |

| Thermoplastics Market Base Year | 2022 |

| Thermoplastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arkema SA, Asahi Kasei Corporation, BASF SE, Covestro, Celanese Corporation, Chevron Phillips Chemical Company LP, Daicel Corporation, DuPont, Eastman Chemical Company, and Evonik Industries AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Thermoplastics Market Insights

The market is witnessing significant growth owing to the ongoing production of ultra-high molecular weight thermoplastic coupled with sugarcane-based thermoplastics. These trends are expected to drive the market over the forecast years. The market is poised to rise further and this growth is projected to remain intact in the coming years. High-temperature thermoplastics (HTTs), due to their special characteristics such as higher chemical resistance, thermal stability, high dielectric strength, less shrinkage, and increased flexibility, are utilized in various end-use industries such as agriculture, automotive, medical, electronics, industrial, and others.

Thermoplastics Market, By Segmentation

The worldwide market for thermoplastics is split based on type, application, end-use industry, and geography.

Thermoplastic Types

- Polyethylene

- Polypropylene

- Polystyrene

- Polycarbonate

- Polyethylene Terephthalate

- Others

Our analysis of the thermoplastics market shows that polyethylene, which makes up about 34% of the global plastic market, is the thermoplastic that is most commonly used. It's used in a variety of applications, including packaging, consumer goods, and construction. Polypropylene is the second most common thermoplastic, accounting for about a quarter of the global plastic market. It is used in a wide range of applications, including automotive parts, packaging, and consumer goods. Polystyrene is the third most common thermoplastic, accounting for about 11% of the global plastic market. It is used in a variety of applications including packaging, insulation, and consumer goods. Polycarbonate and polyethylene terephthalate (PET) are also common thermoplastics, accounting for 3% and 7% of the global plastic market, respectively. Polycarbonate is used in applications such as automotive parts, electronics, and building, whereas PET is used in packaging and textiles.

Thermoplastic Applications

- Packaging

- Automotive

- Construction

- Electrical And Electronics

- Medical

- Others

Thermoplastics are extensively used in the packaging industry because of their outstanding characteristics such as flexibility, durability, lightweight, and low cost. They are used in a variety of packaging applications, including bottles, containers, bags, films, and other materials. The two most common thermoplastics, polyethylene and polypropylene, are widely used in the packaging industry.

The automotive industry is the second-largest application for thermoplastics, with bumpers, dashboards, door panels, and other interior and exterior parts being the most common. Because of their superior mechanical and thermal properties, engineering thermoplastics are preferred for these applications.

Another major application for thermoplastics is in the construction industry, where they are used in a variety of applications such as pipes, insulation, roofing, and other building materials. Polycarbonate, polyvinyl chloride (PVC), and polyethylene are common building materials.

Thermoplastic End-Use Industries

- Consumer Goods

- Healthcare

- Construction

- Automotive

- Others

According to thermoplastics market forecasts, the consumer goods industry will dominate the thermoplastic market. Toys, kitchenware, food packaging, bottles, and containers are all made from thermoplastics, which are widely used in the consumer goods industry. Because of their low cost and versatility, polyethylene and polypropylene are the most commonly used thermoplastics in this industry.

The healthcare industry, where thermoplastics are used in medical devices such as syringes, IV bags, and catheters, is the second-largest end-use industry for thermoplastics. Thermoplastics used in medical applications must meet stringent regulatory standards.

Another major end-use industry for thermoplastics is construction, where they are used in a variety of applications such as pipes, insulation, roofing, and other building materials. Polycarbonate, PVC, and polyethylene are all common building materials.

Thermoplastics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Thermoplastics Market Regional Analysis

The Asia-Pacific thermoplastics market is the largest and fastest-growing region, with China being the largest contributor to the region's growth. The high demand for thermoplastics in industries such as automotive, construction, and packaging drives the region. The region's growing population, rising disposable income, and increasing industrialization are driving market growth.

North America is a major region in the thermoplastics market, with the United States contributing the most to the region's growth. The high demand for thermoplastics in industries such as automotive, construction, and packaging drives the region. The region's demand for thermoplastics is also being driven by the growing trend of lightweight vehicles.

Europe is another important region in the thermoplastics market, with Germany being the region's largest contributor to growth. The region is being propelled by rising thermoplastics demand in industries such as automotive, construction, and packaging. The growing emphasis on sustainability and the use of biodegradable thermoplastics is also driving market growth in the region.

Thermoplastics Market Players

Some of the top thermoplastics companies offered in the professional report include Arkema SA, Asahi Kasei Corporation, BASF SE, Covestro, Celanese Corporation, Chevron Phillips Chemical Company LP, Daicel Corporation, DuPont, Eastman Chemical Company, and Evonik Industries AG.

Frequently Asked Questions

What was the market size of the global thermoplastics in 2022?

The market size of thermoplastics was USD 26.6 billion in 2022.

What is the CAGR of the global thermoplastics market from 2023 to 2032?

The CAGR of thermoplastics is 6.5% during the analysis period of 2023 to 2032.

Which are the key players in the thermoplastics market?

The key players operating in the global thermoplastics market is includes Arkema SA, Asahi Kasei Corporation, BASF SE, Covestro, Celanese Corporation, Chevron Phillips Chemical Company LP, Daicel Corporation, DuPont, Eastman Chemical Company, and Evonik Industries AG.

Which region dominated the global thermoplastics market share?

Asia-Pacific held the dominating position in thermoplastics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of thermoplastics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global thermoplastics industry?

The current trends and dynamics in the thermoplastics industry include growing demand for lightweight and durable materials in various industries, increasing awareness about the benefits of using thermoplastics over traditional materials, and advancements in technology leading to the development of new and innovative thermoplastics.

Which type held the maximum share in 2022?

The polyethylene type held the maximum share of the thermoplastics industry.?