Thermoforming Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Thermoforming Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

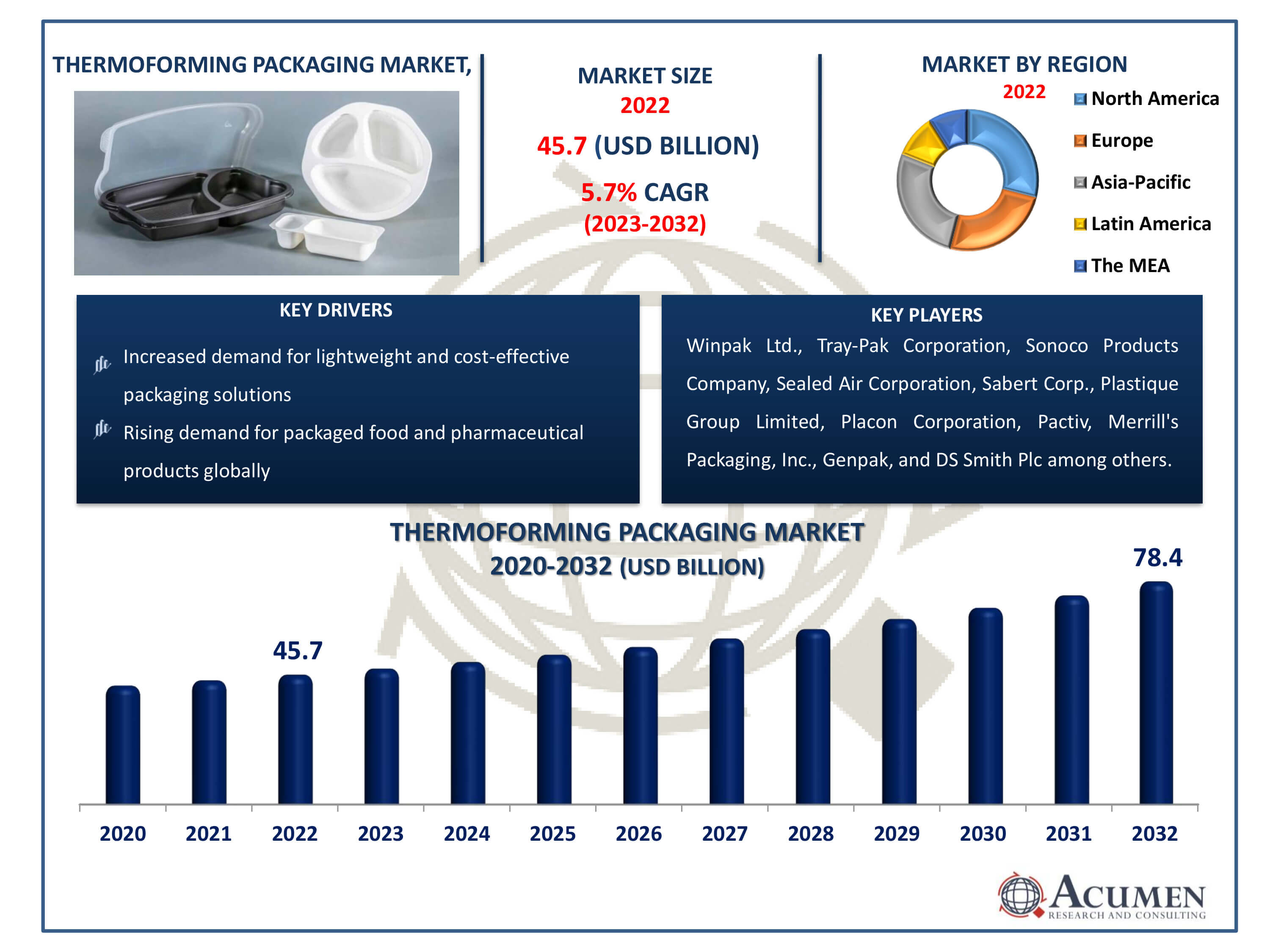

The Thermoforming Packaging Market Size accounted for USD 45.7 Billion in 2022 and is estimated to achieve a market size of USD 78.4 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Thermoforming Packaging Market Highlights

- Global thermoforming packaging market revenue is poised to garner USD 78.4 billion by 2032 with a CAGR of 5.7% from 2023 to 2032

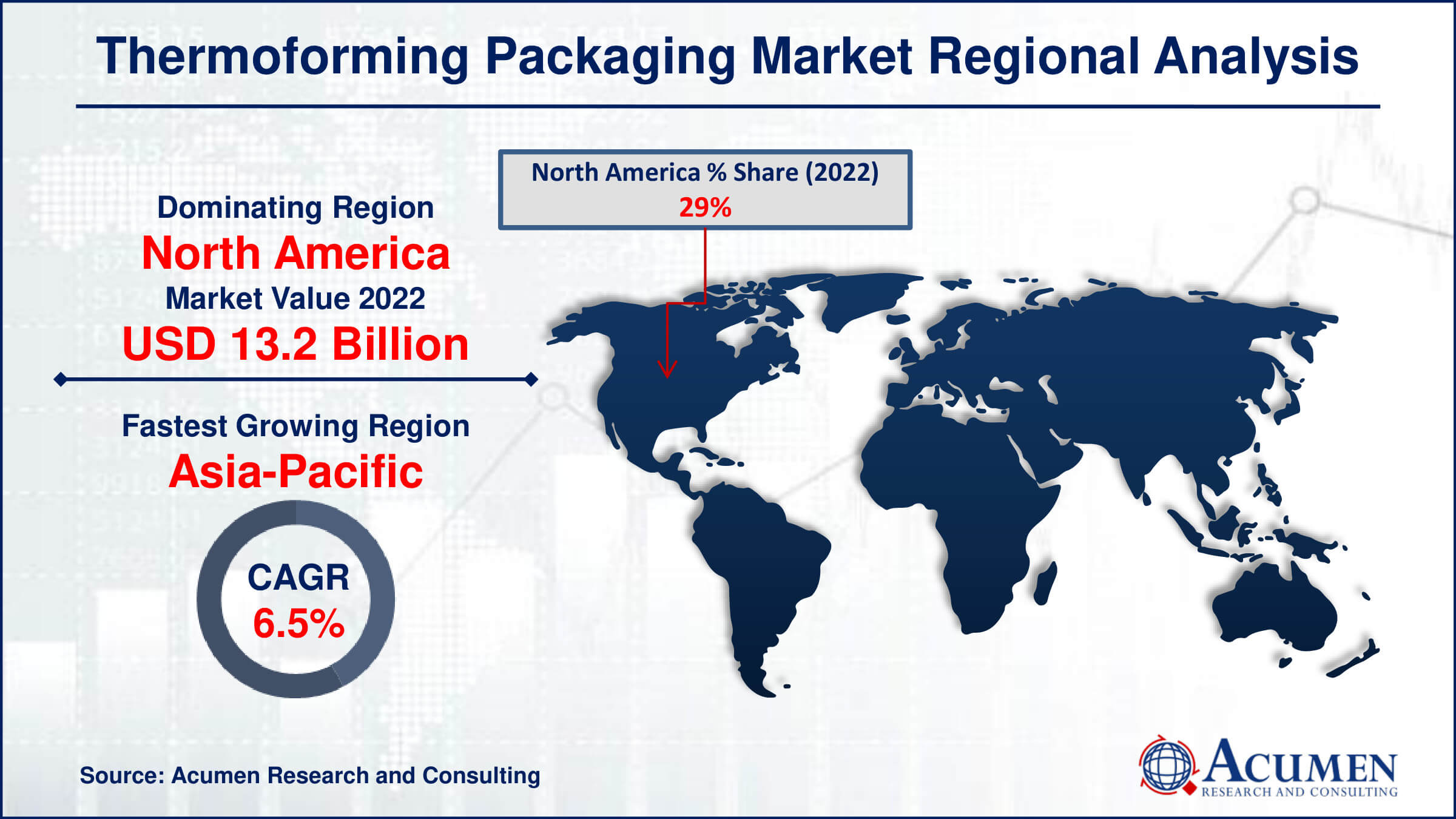

- North America thermoforming packaging market value occupied around USD 13.2 billion in 2022

- Asia-Pacific thermoforming packaging market growth will record a CAGR of more than 6.5% from 2023 to 2032

- Among type, the containers sub-segment generated over US$ 12.3 billion revenue in 2022

- Based on application, the food & beverage sub-segment generated around 52% share in 2022

- Market penetration in emerging economies for increased product demand is a popular thermoforming packaging market trend that fuels the industry demand

Thermoforming alludes to the way toward assembling plastic sheets utilizing warmth to frame explicit shapes in molds, subsequently making them usable. The assembling procedure includes extending a film or sheet to accomplish the ideal shape. A portion of the normal thermoformed things incorporate clamshells, rankles, plate, and covers. Thermoformed rankles and clamshells discover application in the hardware business retail packaging among others. Plate and covers offer as a perfect answer for a wide scope of a custom arrangement of things and instruments. The procedure of thermochromism offers advantages, for example, savvy customization, fast turnaround time, and the creation of minimal effort molds. Commonly, clear and inflexible shaped spreads fit the bill for a perfect bundle.

Global Thermoforming Packaging Market Dynamics

Market Drivers

- Increased demand for lightweight and cost-effective packaging solutions

- Growing preference for sustainable and recyclable packaging materials

- Advancements in technology improving thermoforming processes

- Rising demand for packaged food and pharmaceutical products globally

Market Restraints

- Concerns regarding environmental impact and waste disposal

- Challenges in meeting stringent quality standards and regulations

- Volatility in raw material prices affecting production costs

Market Opportunities

- Innovation in biodegradable and eco-friendly thermoforming materials

- Expansion in the food and beverage industry for convenient packaging

- Adoption of thermoformed packaging in the healthcare sector

Thermoforming Packaging Market Report Coverage

| Market | Thermoforming Packaging Market |

| Thermoforming Packaging Market Size 2022 | USD 45.7 Billion |

| Thermoforming Packaging Market Forecast 2032 | USD 78.4 Billion |

| Thermoforming Packaging Market CAGR During 2023 - 2032 | 5.7% |

| Thermoforming Packaging Market Analysis Period | 2020 - 2032 |

| Thermoforming Packaging Market Base Year |

2022 |

| Thermoforming Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Material, By Heat Sealing Coating, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Winpak Ltd., Tray-Pak Corporation, Sonoco Products Company, Sealed Air Corporation, Sabert Corp., Plastique Group Limited, Placon Corporation, Pactiv LLC, Merrill's Packaging, Inc., Genpak LLC, HUHTAMAKI GROUP, Fabri-Kal Corp., DS Smith Plc, Dordan Manufacturing Company, Inc., and Dart Container Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Thermoforming Packaging Market Insights

Thermoform packages, being scentless, light, moisture-resistant, and flexible, offer advantages over glass and wood, reducing waste and proving cost-effective. Consequently, the demand for thermoform packaging is projected to grow due to these superior properties. The increasing urbanization in developing economies and consumer preference for packaged and fresh food further accelerates the growth of the global thermoforming packaging market.

The rise in applications within the food and beverage industry drives global thermoforming packaging market growth. These packages, being odorless, flexible, and moisture-resistant, are preferred over wood and glass. As a result of these superior properties, the demand for thermoform packaging is expected to grow. Additionally, the increasing preference for packaged and fresh food is likely to boost the global thermoforming packaging market. Furthermore, macroeconomic factors such as lifestyle changes and improvements are expected to support the demand for thermoform packaging. Emerging trends like advancements in thermoform manufacturing technology, the shift towards lightweight packaging, and increased use of polylactic acid (PLA) films in thermoforming offer lucrative opportunities for the global thermoforming packaging market.

The rising demand for convenient packaging, emphasizing barrier properties to preserve food freshness and extend shelf life, has fueled the use of thermoform packaging in the food industry. However, factors like volatile raw material costs and governmental regulations on plastics, particularly PVC, are anticipated to hinder market growth.

The thermoforming packaging market is driven by increased usage in processed food and beverage packaging, as well as the environmental benefits it offers lower raw material consumption, reduced carbon emissions, and minimal waste compared to other packaging formats. However, the availability of alternative packaging solutions might impede market growth. Several factors propel the global thermoforming packaging market: cost-effectiveness, minimal packaging waste, steady growth in the food and beverage industry, and increased consumer spending on packaged goods. The pharmaceutical industry's growth and the demand for packaged products present significant opportunities for thermoforming packaging market expansion. However, limitations arise due to the unsuitability of thermoform packaging for heavy-duty items, fluctuations in raw material costs, and concerns regarding plastic disposal and recycling, potentially affecting thermoforming packaging market growth.

Thermoforming Packaging Market Segmentation

The worldwide market for thermoforming packaging is split based on type, material, heat sealing coating, application, and geography.

Thermoforming Packaging Types

- Blister Packs

- Clamshells

- Containers

- Cups & Bottles

- Trays & Lids

- Vacuum & Skin Packs

According to thermoforming packaging industry analysis, the containers sector leads the market because of its broad range of applications in many industries. From food items to consumer goods, containers provide versatile solutions for the storage, transportation, and display of a broad range of products. Their broad use is fueled by their robustness, adaptability, and compatibility with many items. Because they are a practical packaging solution that guarantees product safety and shelf appeal, containers are in great demand in a variety of markets. This has led to the expansion of the thermoforming packaging industry as the industry of choice for a wide range of packaging requirements.

Thermoforming Packaging Materials

- PET

- PVC

- PS

- PP

- PE

- Others

PET (polyethylene terephthalate) is the preferred material in the thermoforming packaging sector because to its exceptional properties. PET is the perfect material for a wide range of packaging applications in the food, beverage, and personal care industries because of its exceptional clarity, stiffness, and barrier qualities. Its durability to impact and chemicals, lightweight design, and recyclability all contribute to its allure. PET's adaptability and sustainability make it a standout option that meets customer demands, extends shelf life, and ensures product safety all of which help to cement its supremacy in the thermoforming packaging industry.

Thermoforming Packaging Heat Sealing Coatings

- Water-Based

- Solvent-Based

- Hot Melt-Based

Solvent-based heat sealing coatings are the most common type in the market and it will continue their dominance throughout the thermoforming packaging industry forecast period. Because of its strong sealing abilities and adaptability to a variety of packing materials, this type is the best. For packaging applications, solvent-based coatings provide dependable seals because of their quick cure time, great adherence, and versatility with different substrates. Because of its effectiveness, affordability, and proven performance in difficult packaging conditions, its broad acceptance continues despite environmental concerns. Solvent-based heat sealing coatings continue to rule the thermoforming packaging industry thanks to their solid seals and versatility.

Thermoforming Packaging Applications

- Food & Beverage

- Cosmetic & Personal Care

- Electrical & Electronics

- Homecare & Toiletries

- Industrial Goods

- Pharmaceutical

The food & beverage category of the thermoforming packaging market has the largest share because of its wide range of applications in a variety of items. Packaging that guarantees product safety, freshness, and shelf appeal is required by the industry, which calls for flexible packaging solutions for a range of food products and beverages. Convenience, robustness, and effective preservation are guaranteed by thermoforming packaging, which provides adaptable solutions to meet various packaging needs in this market. The food & beverage category holds a substantial market share, which contributes to the dominance of thermoforming packaging in this industry. This is due to the growing demand for packaged food and beverages as well as consumers preference for convenience.

Thermoforming Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Thermoforming Packaging Market Regional Analysis

In terms of thermoforming packaging market analysis, the North America is home to key players in the industry, primarily in the United States and Canada. The U.S. is estimated to hold noteworthy share of the global thermoforming packaging market share. Latin America's market includes Brazil, Mexico, Argentina, and the rest of the region. Brazil is expected to be the most attractive market due to increased consumer spending on retail products.

The growing food industry and the demand for sustainable packaging are major drivers for global thermoforming packaging market growth. The Asia-Pacific region is expected to be the fastest-growing region for thermoforming packaging. New entrants in manufacturing are benefiting end-users by providing cost-effective, high-quality thermoforming packaging products.

The Middle East and Africa are anticipated to experience sluggish growth, primarily due to slow retail and food industry growth in recent years. However, GCC Countries are expected to have an appealing thermoforming packaging market due to the presence of global food giants and retail chains.

Thermoforming Packaging Market Players

Some of the top thermoforming packaging companies offered in our report includes Winpak Ltd., Tray-Pak Corporation, Sonoco Products Company, Sealed Air Corporation, Sabert Corp., Plastique Group Limited, Placon Corporation, Pactiv LLC, Merrill's Packaging, Inc., Genpak LLC, HUHTAMAKI GROUP, Fabri-Kal Corp., DS Smith Plc, Dordan Manufacturing Company, Inc., and Dart Container Corp.

Frequently Asked Questions

How big is the thermoforming packaging market?

The thermoforming packaging market size was USD 45.7 Billion in 2022.

What is the CAGR of the global thermoforming packaging market from 2023 to 2032?

The CAGR of thermoforming packaging is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the thermoforming packaging market?

The key players operating in the global market are including Winpak Ltd., Tray-Pak Corporation, Sonoco Products Company, Sealed Air Corporation, Sabert Corp., Plastique Group Limited, Placon Corporation, Pactiv LLC, Merrill's Packaging, Inc., Genpak LLC, HUHTAMAKI GROUP, Fabri-Kal Corp., DS Smith Plc, Dordan Manufacturing Company, Inc., and Dart Container Corp.

Which region dominated the global thermoforming packaging market share?

North America held the dominating position in thermoforming packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of thermoforming packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global thermoforming packaging industry?

The current trends and dynamics in the thermoforming packaging industry include increasing security concerns, raising use of robots for observation and security, and growing criminal rate and territorial conflict.

Which type held the maximum share in 2022?

The containers type held the maximum share of the thermoforming packaging industry.