Thermally Conductive Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Thermally Conductive Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

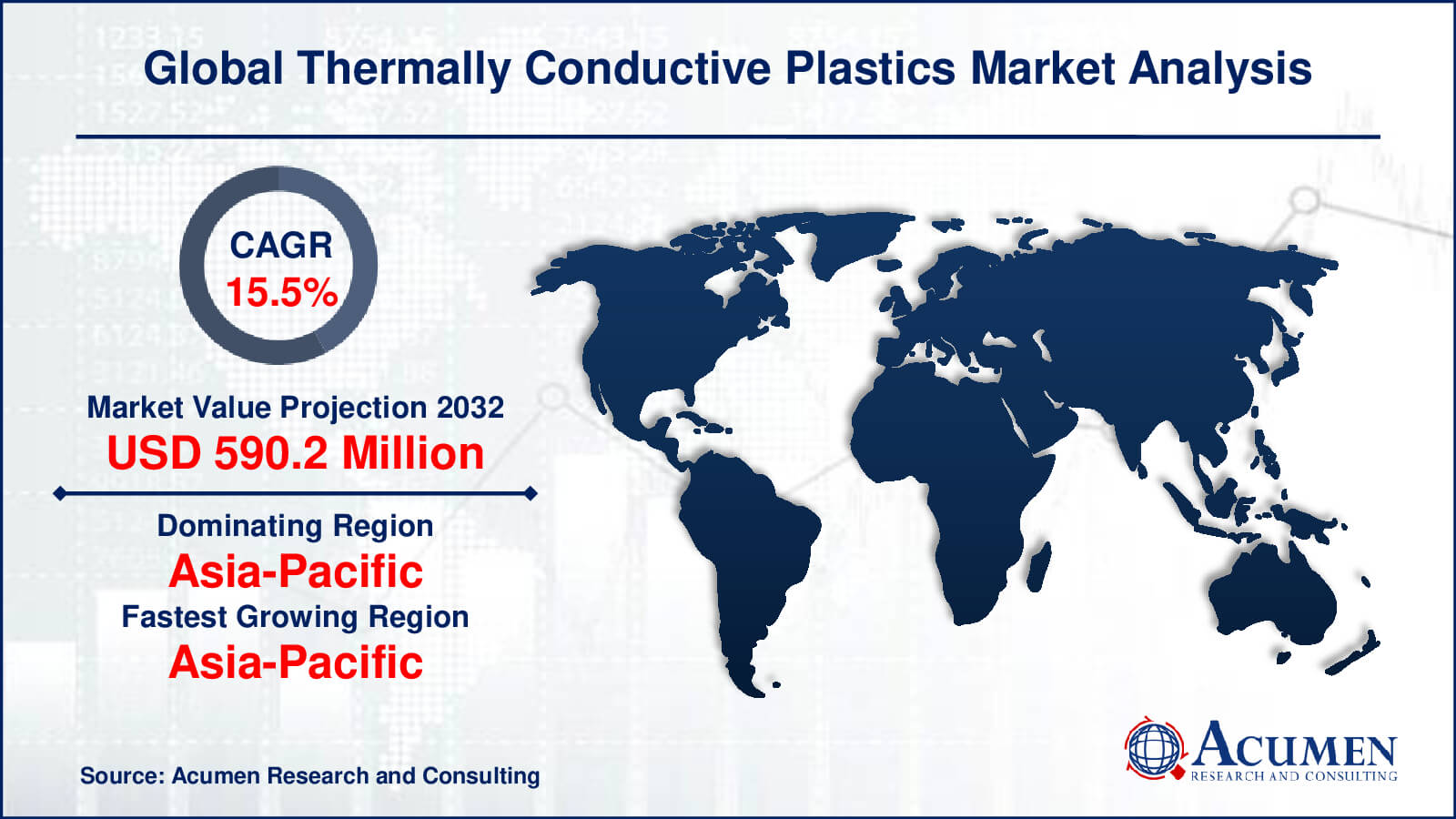

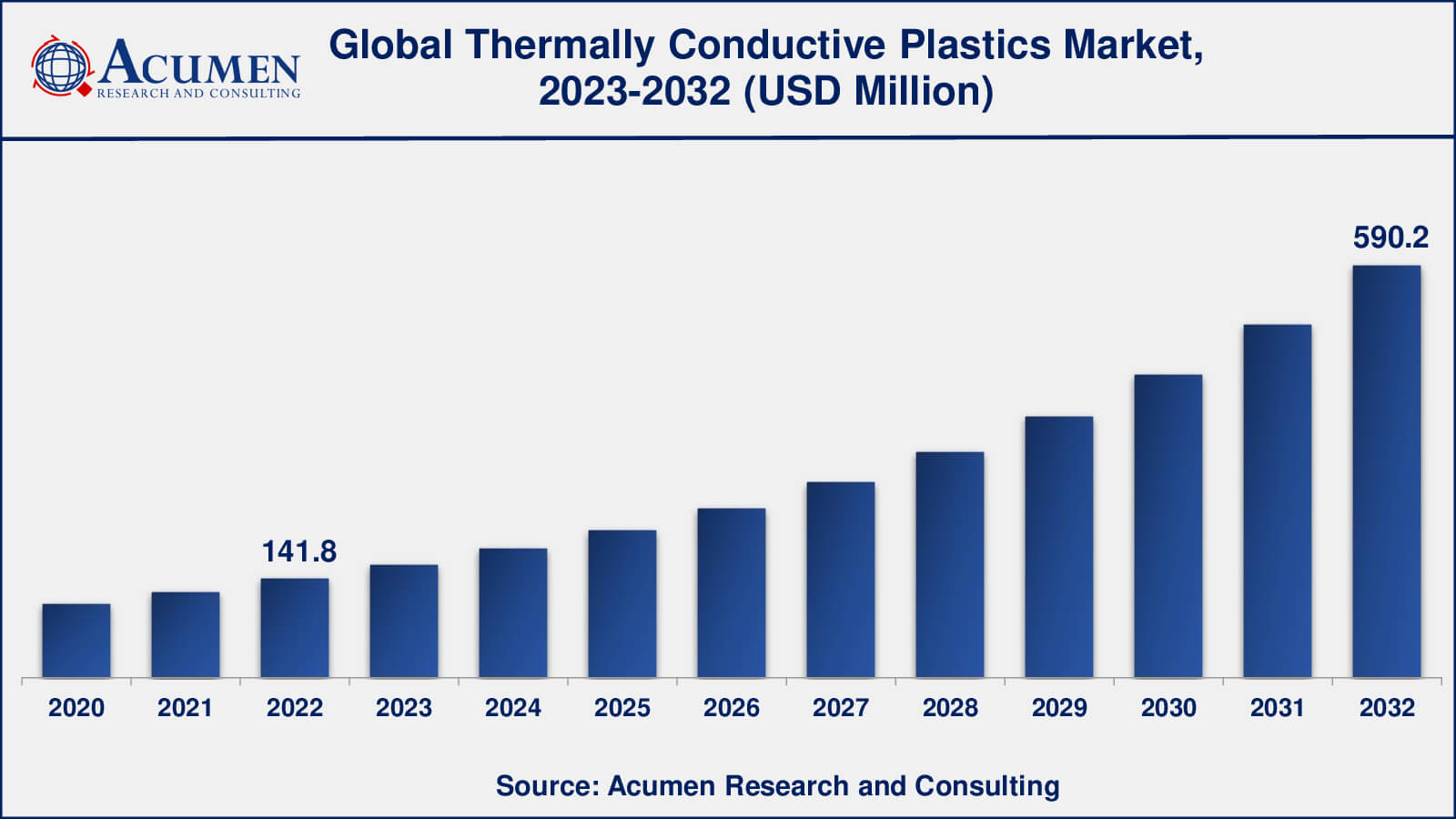

The global Thermally Conductive Plastics Market size was valued at USD 141.8 Million in 2022 and is projected to attain USD 590.2 Million by 2032 mounting at a CAGR of 15.5% from 2023 to 2032.

Thermally Conductive Plastics Market Highlights

- Global thermally conductive plastics market revenue is poised to garner USD 590.2 Million by 2032 with a CAGR of 15.5% from 2023 to 2032

- Asia-Pacific thermally conductive plastics market value occupied around USD 69.5 million in 2022

- Asia-Pacific thermally conductive plastics market growth will record a CAGR of more than 16% from 2023 to 2032

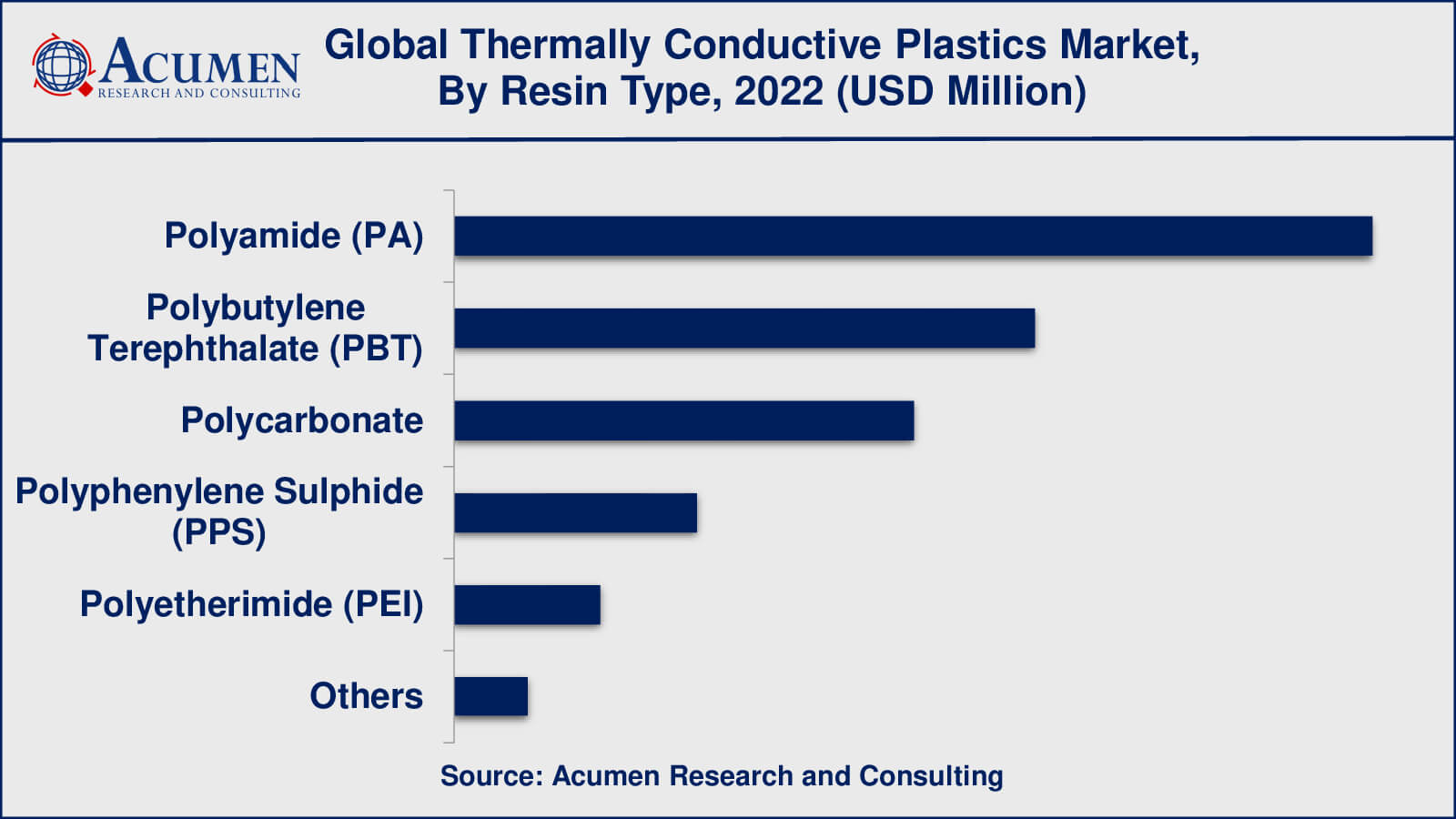

- Among resin type, the polyamide (PA) sub-segment occupied over US$ 54 million revenue in 2022

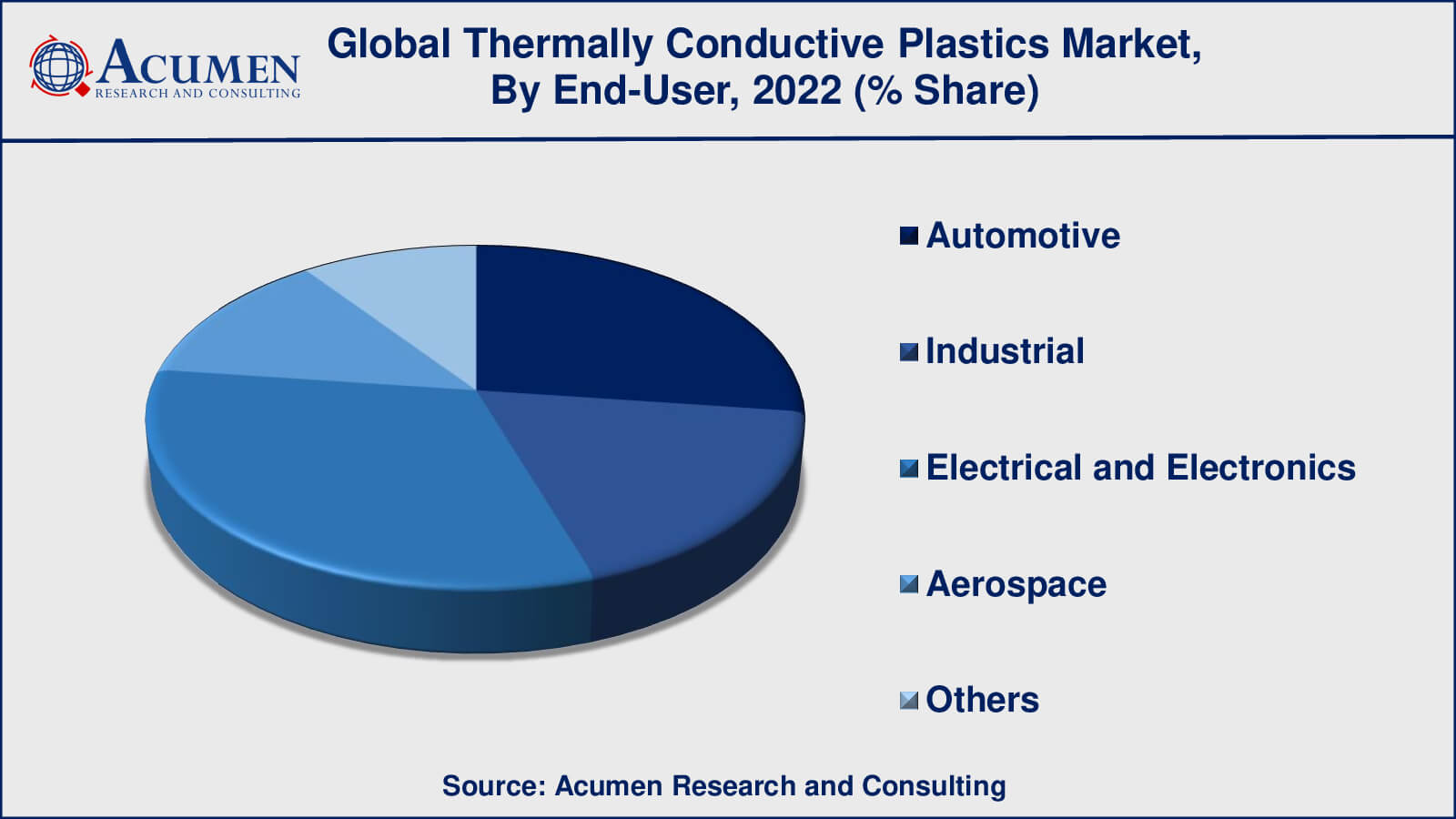

- Based on end-user, the electrical and electronics sub-segment gathered around 32% share in 2022

- Increasing demand for thermally conductive plastics in electric vehicle (EV) battery packs is a popular thermally conductive plastics market trend that drives the industry demand

Thermally conductive plastics, also known as thermal plastics or thermally conductive polymers, are a type of material that combines plastic's mechanical features with improved heat transmission capabilities. These materials are intended to transmit heat effectively while retaining desired plastic properties such as low weight, flexibility, and simplicity of processing.

Thermally conductive polymers are distinguished by their ability to disperse heat. Traditional plastics are often poor heat conductors, which mean that heat is trapped within the material. Thermally conductive polymers, on the other hand, are made with additives that increase thermal conductivity, allowing them to transport heat more effectively. Thermally conductive fillers, such as ceramics or metal particles, can be used as additives that are evenly spread inside the plastic matrix.

The resultant composite material gets higher thermal conductivity without compromising the benefits of employing plastics by integrating thermally conductive fillers. This makes them appropriate for a variety of End-Users requiring effective heat dissipation.

Thermally conductive polymers are used in a variety of sectors. In the electronics sector, for example, they are utilised in electronic enclosures, heat sinks, LED lights, and power modules. These materials assist avoid overheating and maintain maximum performance and reliability by efficiently dispersing heat generated by electronic components.

Global Thermally Conductive Plastics Market Dynamics

Market Drivers

- Increasing demand for heat management in electronic devices

- Growing automotive industry

- Surging need for lightweight and efficient thermal solutions

Market Restraints

- High cost compared to traditional plastics

- Limited thermal conductivity compared to metals

- Challenges in achieving consistent dispersion of fillers

Market Opportunities

- Development of advanced thermally conductive additives

- Expanding applications in emerging industries like 5G and electric vehicles

- Rising focus on sustainable and eco-friendly thermally conductive plastics for improved heat management

Thermally Conductive Plastics Market Report Coverage

| Market | Thermally Conductive Plastics Market |

| Thermally Conductive Plastics Market Size 2022 | USD 141.8 Million |

| Thermally Conductive Plastics Market Forecast 2032 | USD 590.2 Million |

| Thermally Conductive Plastics Market CAGR During 2023 - 2032 | 15.5% |

| Thermally Conductive Plastics Market Analysis Period | 2020 - 2032 |

| Thermally Conductive Plastics Market Base Year | 2022 |

| Thermally Conductive Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arkema Group, BASF SE, Celanese Corporation, Covestro AG, Kaneka Corporation, PolyOne Corporation, RTP Company, Royal DSM, SABIC Group, and Saint-Gobain. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Thermally Conductive Plastics Market Insights

The rising requirement for heat control in electronic equipment is one of the key factors. The heat created by electrical gadgets' components grows as they become smaller and more powerful. Thermally conductive polymers provide an excellent option for heat dissipation, overheating prevention, and guaranteeing maximum performance and dependability of electronic systems.

Another key driver of the thermally conductive polymers market is the expanding automobile industry. The growth of electric cars and innovative driver-assistance systems has increased the demand for effective thermal management in numerous automotive components. Thermally conductive polymers enhance heat dissipation in battery packs, cooling systems, LED headlights, and other essential automotive applications, resulting in increased energy economy, component longevity, and overall vehicle performance.

Furthermore, the popularity of thermally conductive polymers is being driven by the desire for lightweight and efficient thermal solutions. These materials combine the advantages of plastics, such as light weight, flexibility, and simplicity of manufacturing, with improved heat conductivity. Aerospace, renewable energy, consumer electronics, and telecommunications industries benefit from thermally conductive polymers' ability to enable efficient heat transmission while lowering weight and boosting design flexibility.

However, there are several constraints in the market for thermally conductive polymers. The increased cost compared to typical plastics is one of the key problems. Thermally conductive fillers and additions raise the material cost, making them more costly than traditional plastics. Furthermore, while thermally conductive polymers outperform ordinary plastics in terms of heat conductivity, they fall short of the thermal conductivity levels attained by metals. This constraint may limit their utility in situations requiring greater heat dissipation.

Despite these obstacles, the thermally conductive polymers industry offers several prospects. The development of improved thermally conductive additives and fillers has the potential to boost thermal conductivity even further. Emerging sectors such as 5G communication networks and electric cars open up new markets for thermally conductive polymers. Furthermore, there is an increasing need for environmentally friendly and recyclable materials, which creates potential for thermally conductive polymers with higher sustainability profiles.

Thermally Conductive Plastics Market Segmentation

The worldwide market for thermally conductive plastics is split based on resin type, end-user, and geography.

Thermally Conductive Plastic Resin Types

- Polyamide (PA)

- Polybutylene Terephthalate (PBT)

- Polycarbonate

- Polyphenylene Sulphide (PPS)

- Polyetherimide (PEI)

- Others

According to the thermally conductive plastics industry analysis, polyamide (PA) is the dominant resin type in the thermally conductive plastics market. Polyamide, sometimes known as nylon, has a number of benefits that make it a flexible and frequently used material. Polyamide's remarkable strength and durability is one of its key features. It has a high tensile strength, allowing it to endure heavy loads and resist impact, making it ideal for applications requiring robustness and endurance.

In addition, polycarbonate is another significant resin type that is gathering noteworthy market share. Because of its exceptional mix of thermal conductivity, mechanical characteristics, and simplicity of manufacturing, polycarbonate resins are widely employed in a variety of sectors. They have high impact strength, strong thermal stability, and outstanding electrical insulating qualities, making them appropriate for applications requiring efficient heat dissipation, such as electronic enclosures, LED lighting, and automotive components.

While other resin types, such as polyamide (PA), polybutylene terephthalate (PBT), polyphenylene sulphide (PPS), and polyetherimide (PEI), are used in thermally conductive plastics, polycarbonate is the dominant resin type due to its versatility and broad range of properties that align well with the demands of heat management applications.

Thermally Conductive Plastic End-Users

- Automotive

- Industrial

- Electrical and Electronics

- Aerospace

- Others

According to the thermally conductive plastics market forecast, the electrical and electronics industry will dominate the industry from 2023 to 2032. The requirement for effective heat management in electronic devices such as smartphones, laptops, tablets, and household appliances drives demand for thermally conductive polymers in this area. Thermally conductive polymers provide for excellent heat dissipation generated by electronic components, reducing overheating and maintaining maximum device performance and reliability.

While other end-users such as automotive, industrial, aerospace, and others contribute to the thermally conductive plastics market, the Electrical and Electronics industry's dominance is primarily due to the widespread use of electronic devices in a variety of applications and the growing demand for compact, lightweight, and thermally efficient solutions in this sector.

Thermally Conductive Plastics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Thermally Conductive Plastics Market Regional Analysis

Asia-Pacific is the dominating region in the thermally conductive polymers market. Major electronics manufacturers, a thriving automobile sector, and rising industrialization in nations such as China, Japan, South Korea, and Taiwan all contribute to this region's supremacy. The Asia-Pacific market is driven by the rising demand for thermally conductive polymers in electronic gadgets, electric cars, and numerous industrial applications.

Moreover, Asia-Pacific area is predicted to be the fastest expanding region in the thermally conductive plastics market as well. The need for thermally conductive polymers in this region is expected to grow significantly as the electronics industry expands, the automotive sector expands, and investments in electric cars increase. The growing consumer base, along with the requirement for effective heat management solutions, generates favorable conditions for Asia-Pacific market advancement.

Thermally Conductive Plastics Market Players

Some of the top thermally conductive plastics companies offered in our report include Arkema Group, BASF SE, Celanese Corporation, Covestro AG, Kaneka Corporation, PolyOne Corporation, RTP Company, Royal DSM, SABIC Group, and Saint-Gobain.

Thermally Conductive Plastics Industry Recent Developments

- In June 2023, Arkema has introduced Rilsan THERMOVEIL, a novel thermally conductive polyamide-based polymer suited for the automobile sector. Because of its excellent thermal conductivity, this material allows for effective heat dissipation in electric car battery packs and other automotive applications.

- In April 2023, BASF has introduced Ultradur® TC, a novel thermally conductive polymer based on polybutylene terephthalate (PBT). Ultradur® TC is appropriate for applications in the electrical and electronics industries because to its high thermal conductivity, outstanding dimensional stability, and exceptional electrical insulation qualities.

Frequently Asked Questions

What was the size of the global thermally conductive plastics market in 2022?

The size of thermally conductive plastics market was USD 141.8 Million in 2022.

What is the thermally conductive plastics market CAGR from 2023 to 2032?

The thermally conductive plastics market CAGR during the analysis period of 2023 to 2032 is 15.5%.

Which are the key players in the thermally conductive plastics market?

The key players operating in the global market are including Arkema Group, BASF SE, Celanese Corporation, Covestro AG, Kaneka Corporation, PolyOne Corporation, RTP Company, Royal DSM, SABIC Group, and Saint-Gobain.

Which region dominated the global thermally conductive plastics market share?

Asia-Pacific region held the dominating position in thermally conductive plastics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of thermally conductive plastics during the analysis period of 2023 to 2032.

What are the current trends in the global thermally conductive plastics industry?

The current trends and dynamics in the thermally conductive plastics industry include increasing demand for heat management in electronic devices, growing automotive industry, and surging need for lightweight and efficient thermal solutions

Which resin type held the maximum share in 2022?

The polycarbonate held the maximum share of the thermally conductive plastics industry.