Thermal Energy Storage Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Thermal Energy Storage Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

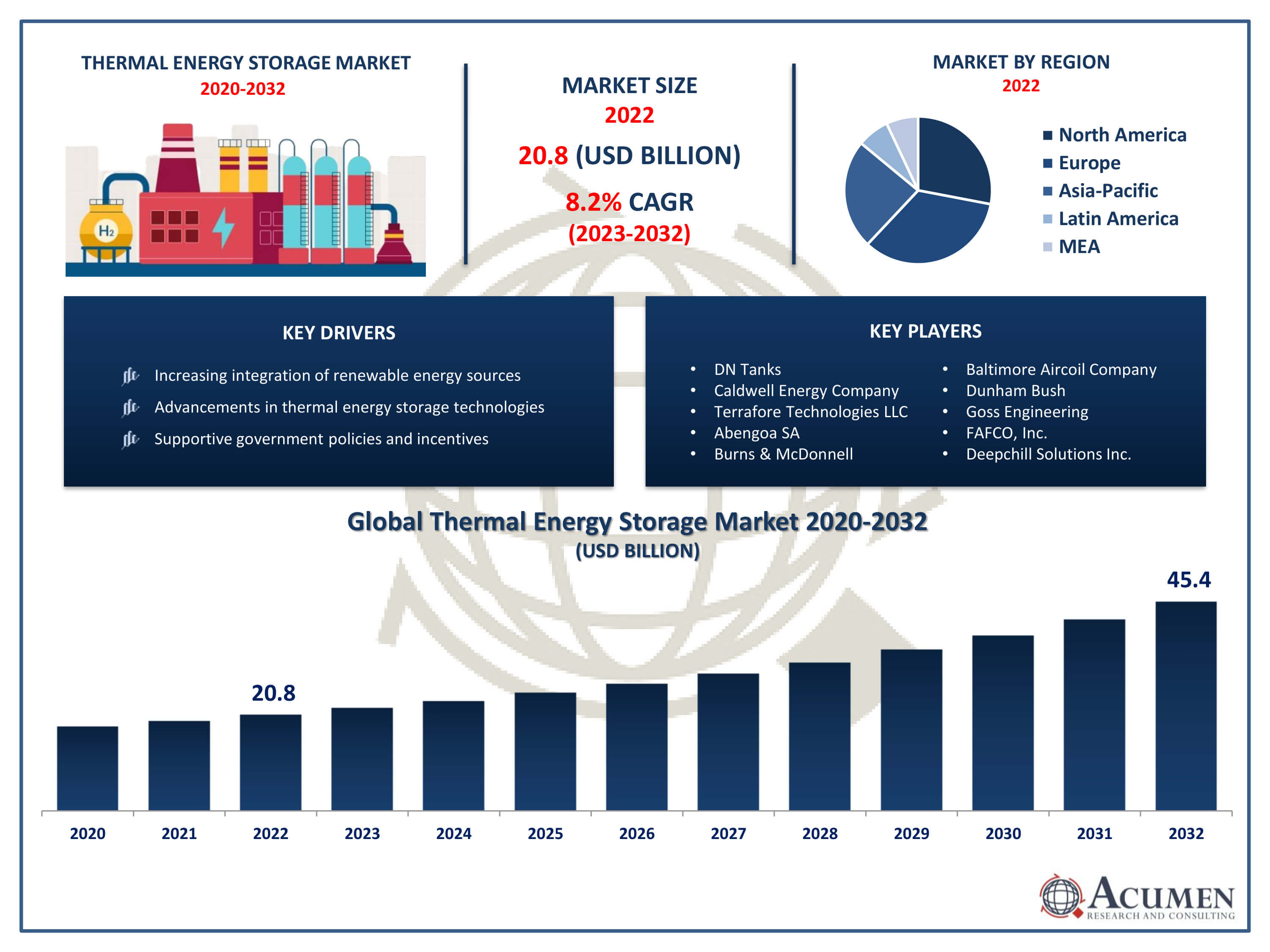

The Thermal Energy Storage Market Size accounted for USD 20.8 Billion in 2022 and is projected to achieve a market size of USD 45.4 Billion by 2032 growing at a CAGR of 8.2% from 2023 to 2032.

Thermal Energy Storage Market Highlights

- Global thermal energy storage market revenue is expected to increase by USD 45.4 Billion by 2032, with a 8.2% CAGR from 2023 to 2032

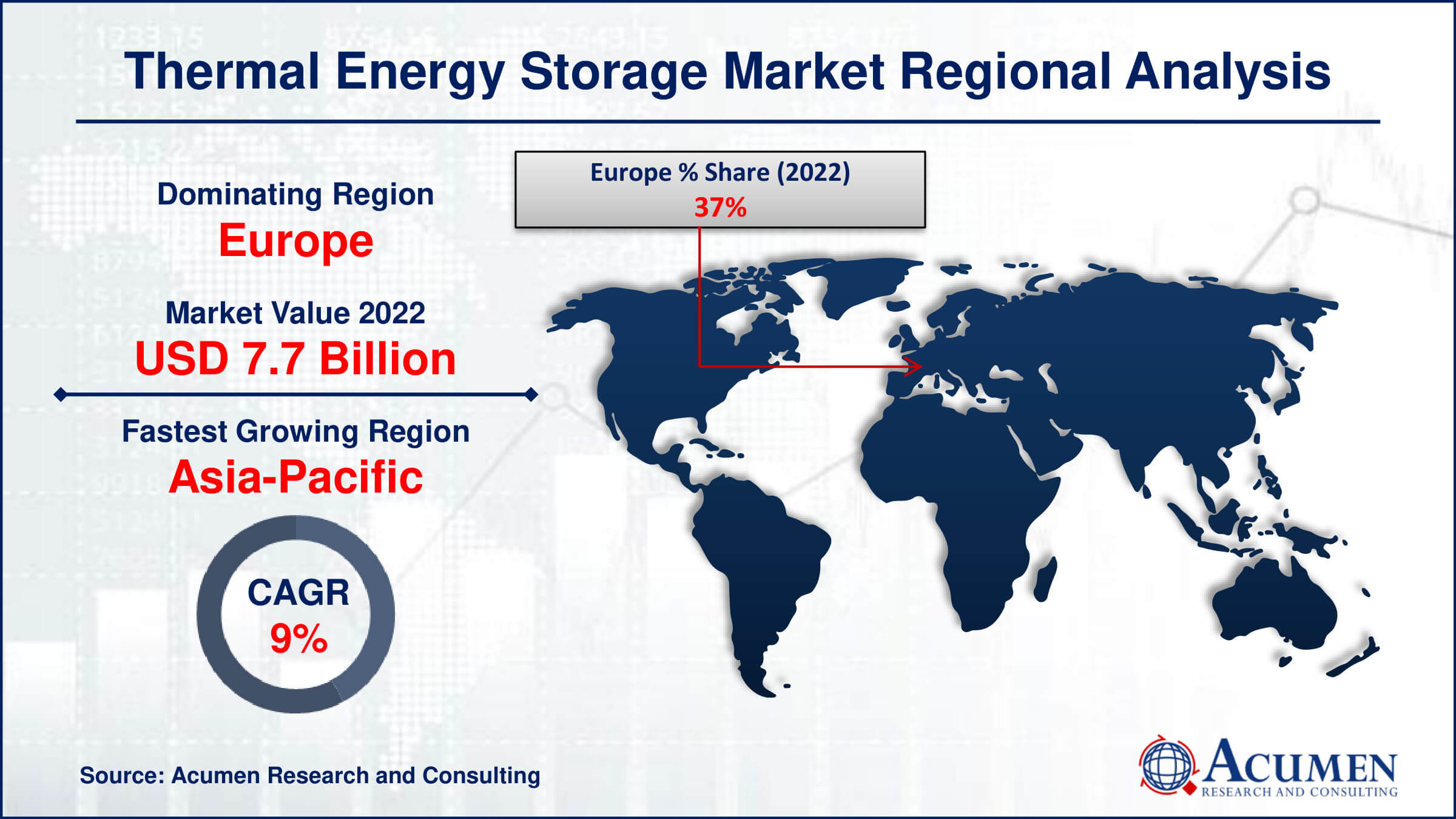

- Europe region led with more than 37% of thermal energy storage market share in 2022

- Asia-Pacific thermal energy storage market growth will record a CAGR of around 9.1% from 2023 to 2032

- By technology, the sensible segment is the largest segment in the market, accounting for over 45% of the market share in 2022

- By storage material, the molten salts segment has recorded more than 30% of the revenue share in 2022

- Growing deployment of concentrated solar power plants, drives the thermal energy storage market value

Thermal energy storage (TES) is a technology that allows for the storage of thermal energy (heat) during periods of low demand or low-cost electricity, and its subsequent use at a later time when demand or electricity prices are higher. This technology is crucial for balancing the intermittency of renewable energy sources like solar and wind, as it enables the capture and retention of excess energy produced during peak times for later use during periods of high demand. TES systems typically store energy in the form of sensible heat (raising the temperature of a material), latent heat (changing a material's phase, such as from solid to liquid), or thermochemical processes.

The market for thermal energy storage has been experiencing significant growth in recent years, driven primarily by the increasing integration of renewable energy sources into power grids worldwide. As the share of renewable energy generation continues to rise, the need for effective energy storage solutions becomes more pronounced to ensure grid stability and reliability. Additionally, advancements in TES technologies, such as improved materials and system designs, are enhancing the efficiency and scalability of these systems, further fueling market growth. Moreover, supportive government policies and incentives aimed at promoting clean energy adoption and reducing carbon emissions are also contributing to the expansion of the thermal energy storage market.

Global Thermal Energy Storage Market Trends

Market Drivers

- Increasing integration of renewable energy sources

- Advancements in thermal energy storage technologies

- Supportive government policies and incentives

- Growing demand for grid stability and reliability

- Diverse applications across residential, commercial, industrial, and utility sectors

Market Restraints

- High initial investment costs

- Technical challenges in scaling up TES systems

Market Opportunities

- Expansion of utility-scale TES projects

- Integration of TES with smart grid systems

Thermal Energy Storage Market Report Coverage

| Market | Thermal Energy Storage Market |

| Thermal Energy Storage Market Size 2022 | USD 20.8 Billion |

| Thermal Energy Storage Market Forecast 2032 |

USD 45.4 Billion |

| Thermal Energy Storage Market CAGR During 2023 - 2032 | 8.2% |

| Thermal Energy Storage Market Analysis Period | 2020 - 2032 |

| Thermal Energy Storage Market Base Year |

2022 |

| Thermal Energy Storage Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Storage Material, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DN Tanks, Caldwell Energy Company, Terrafore Technologies LLC, Abengoa SA, Siemens Gamesa Renewable Energy, S.A, Burns & McDonnell, Baltimore Aircoil Company, Dunham Bush, Goss Engineering, FAFCO, Inc., and Deepchill Solutions Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Thermal energy storage (TES) is a technology that enables the capture, storage, and subsequent release of thermal energy for later use. It involves storing heat energy in a variety of materials or mediums during periods of excess or low-cost energy, and then retrieving that energy when needed. TES systems typically operate through one of three main mechanisms: sensible heat storage (raising the temperature of a material), latent heat storage (changing the phase of a material, such as from solid to liquid), or thermochemical processes (chemical reactions that absorb or release heat). This technology is crucial for enhancing energy efficiency, managing peak demand, and integrating renewable energy sources into power grids by providing a means to store excess energy generated during peak production periods for use during times of high demand or when renewable sources are not available. The applications of thermal energy storage span across various sectors including residential, commercial, industrial, and utility-scale applications.

The thermal energy storage (TES) market has been experiencing robust growth in recent years, driven by several key factors. One of the primary drivers is the increasing adoption of renewable energy sources, such as solar and wind power, which are inherently intermittent. TES technologies play a crucial role in addressing the intermittency challenge by storing excess energy generated during peak production periods for use during periods of high demand or when renewable sources are not actively producing electricity. This integration of TES solutions helps enhance grid stability and reliability, thereby driving the demand for thermal energy storage systems. Additionally, advancements in TES technologies have led to improved efficiency, scalability, and cost-effectiveness, further fueling market growth. Innovations in materials, system designs, and thermal storage mediums have enabled TES systems to offer higher energy storage capacities, faster charging and discharging rates, and longer operational lifetimes.

Thermal Energy Storage Market Segmentation

The global thermal energy storage market segmentation is based on technology, storage material, application, end-user, and geography.

Thermal Energy Storage Market By Technology

- Latent

- Sensible

- Thermochemical

According to the thermal energy storage industry analysis, the sensible segment accounted for the largest market share in 2022. Sensible thermal energy storage involves storing heat by changing the temperature of a material without changing its state. This segment has garnered increasing attention because of its simplicity, reliability, and wide range of applications across various industries. Sensible TES systems typically use materials like water, molten salts, or rocks to store and release heat, making them versatile and cost-effective solutions for both heating and cooling purposes. One of the primary drivers for the growth of the sensible segment is the rising demand for energy-efficient heating and cooling solutions in buildings and industrial processes. Sensible thermal energy storage systems enable efficient utilization of excess heat generated from renewable energy sources or waste heat from industrial processes, thereby reducing energy consumption and operating costs.

Thermal Energy Storage Market By Storage Material

- Molten salts

- Phase change materials

- Water

- Others

In terms of storage materials, the molten salts segment is expected to witness significant growth in the coming years. Molten salt thermal energy storage systems utilize a mixture of salt compounds, typically sodium nitrate and potassium nitrate, which are heated to high temperatures and stored in insulated tanks. This segment has garnered attention due to its high energy density, excellent thermal stability, and ability to retain heat for extended periods, making it an ideal solution for large-scale energy storage applications, particularly in concentrated solar power (CSP) plants. One of the primary drivers for the growth of the molten salts segment is the increasing deployment of CSP plants worldwide. Molten salt TES systems play a critical role in CSP plants by storing excess thermal energy collected during the day and releasing it as needed to generate electricity during periods of low solar irradiance or at night. This enables CSP plants to provide continuous and reliable power output, thereby enhancing grid stability and supporting the integration of renewable energy into the electricity mix.

Thermal Energy Storage Market By Application

- Process Heating and Cooling

- District Heating and Cooling

- Power Generation

According to the thermal energy storage market forecast, the power generation segment is expected to witness significant growth in the coming years. Thermal energy storage systems are increasingly being integrated into power generation facilities to enhance grid stability, improve energy efficiency, and facilitate the integration of renewable energy sources. In particular, concentrated solar power (CSP) plants utilize TES technology to store excess thermal energy collected during the day and generate electricity during periods of high demand or when solar irradiance is low, enabling these plants to provide consistent and reliable power output. One of the primary drivers for the growth of the power generation segment is the expanding deployment of renewable energy sources, such as solar and wind power. As the share of renewable energy in the global energy mix continues to rise, there is a growing need for energy storage solutions to address the intermittency of these sources and ensure a stable and reliable supply of electricity.

Thermal Energy Storage Market By End-User

- Utilities

- Industrial

- Residential & Commercial

Based on the end-user, the residential & commercial segment is expected to continue its growth trajectory in the coming years. With increasing awareness of environmental sustainability and the rising costs of energy, there is a growing demand for energy-efficient heating, cooling, and power solutions in residential and commercial buildings. Thermal energy storage systems offer a viable solution by enabling users to store excess energy during off-peak hours and utilize it during peak demand periods, thereby reducing energy consumption and utility bills while also minimizing carbon emissions. One of the primary drivers for the growth of the residential and commercial segment is the emphasis on energy efficiency and sustainability in building design and operations. Additionally, advancements in TES technology, including the development of more compact and cost-effective systems, are making these solutions increasingly accessible to residential and commercial users, further driving market growth.

Thermal Energy Storage Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Europe is emerging as a significant growth region in the thermal energy storage (TES) market, fueled by several factors driving the adoption of sustainable energy solutions across the continent. One key driver is the European Union's ambitious renewable energy targets and climate change mitigation efforts. The EU's commitment to reducing greenhouse gas emissions and transitioning towards a low-carbon economy has spurred investments in renewable energy generation, including solar and wind power, which in turn has created a growing need for energy storage solutions like TES to address intermittency issues and ensure grid stability. Additionally, supportive policies and regulations at both the national and EU levels are incentivizing the deployment of TES systems in Europe. Initiatives such as the European Green Deal and the Clean Energy for All Europeans package provide funding, incentives, and regulatory frameworks to promote the adoption of renewable energy and energy storage technologies. Furthermore, financial instruments such as grants, subsidies, and feed-in tariffs encourage investments in TES projects, driving market growth across the region. Moreover, Europe's strong focus on energy efficiency and sustainability in various sectors, including residential, commercial, industrial, and utility-scale applications, is driving the demand for TES solutions.

Thermal Energy Storage Market Player

Some of the top thermal energy storage market companies offered in the professional report include DN Tanks, Caldwell Energy Company, Terrafore Technologies LLC, Abengoa SA, Siemens Gamesa Renewable Energy, S.A, Burns & McDonnell, Baltimore Aircoil Company, Dunham Bush, Goss Engineering, FAFCO, Inc., and Deepchill Solutions Inc.

Frequently Asked Questions

How big is the thermal energy storage market?

The thermal energy storage market size was USD 20.8 Billion in 2022.

What is the CAGR of the global thermal energy storage market from 2023 to 2032?

The CAGR of thermal energy storage is 8.2% during the analysis period of 2023 to 2032.

Which are the key players in the thermal energy storage market?

The key players operating in the global market are including DN Tanks, Caldwell Energy Company, Terrafore Technologies LLC, Abengoa SA, Siemens Gamesa Renewable Energy, S.A, Burns & McDonnell, Baltimore Aircoil Company, Dunham Bush, Goss Engineering, FAFCO, Inc., and Deepchill Solutions Inc.

Which region dominated the global thermal energy storage market share?

Europe held the dominating position in thermal energy storage industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of thermal energy storage during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global thermal energy storage industry?

The current trends and dynamics in the thermal energy storage industry include increasing integration of renewable energy sources, advancements in thermal energy storage technologies, and supportive government policies and incentives.

Which storage material held the maximum share in 2022?

The molten salt storage material held the maximum share of the thermal energy storage industry.