Textile Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Textile Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

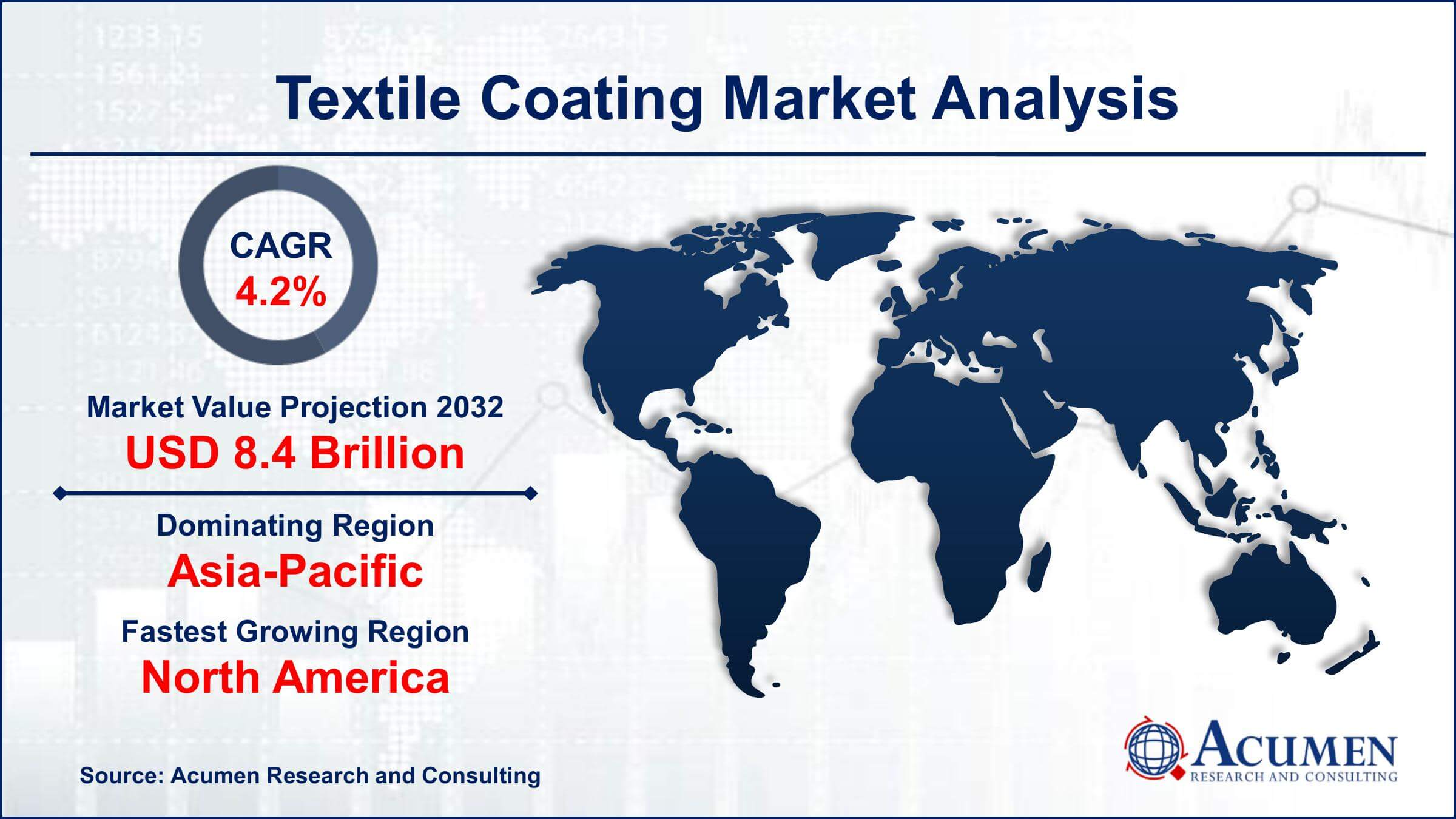

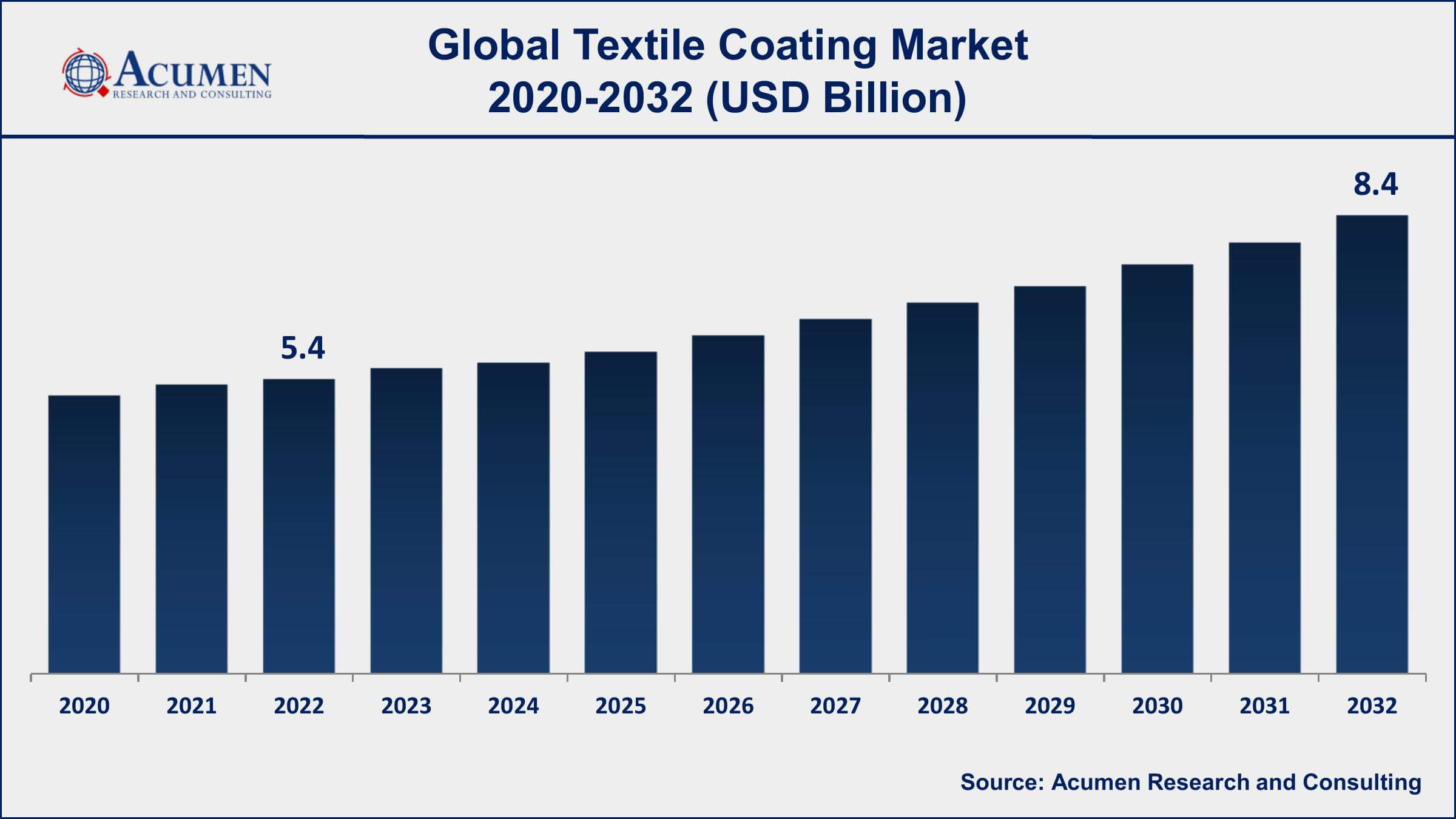

The Global Textile Coating Market Size accounted for USD 5.4 Billion in 2022 and is projected to achieve a market size of USD 8.4 Billion by 2032 growing at a CAGR of 4.2% from 2023 to 2032.

Textile Coating Market Key Highlights

- Global textile coating market revenue is expected to increase by USD 8.4 Billion by 2032, with a 4.2% CAGR from 2023 to 2032

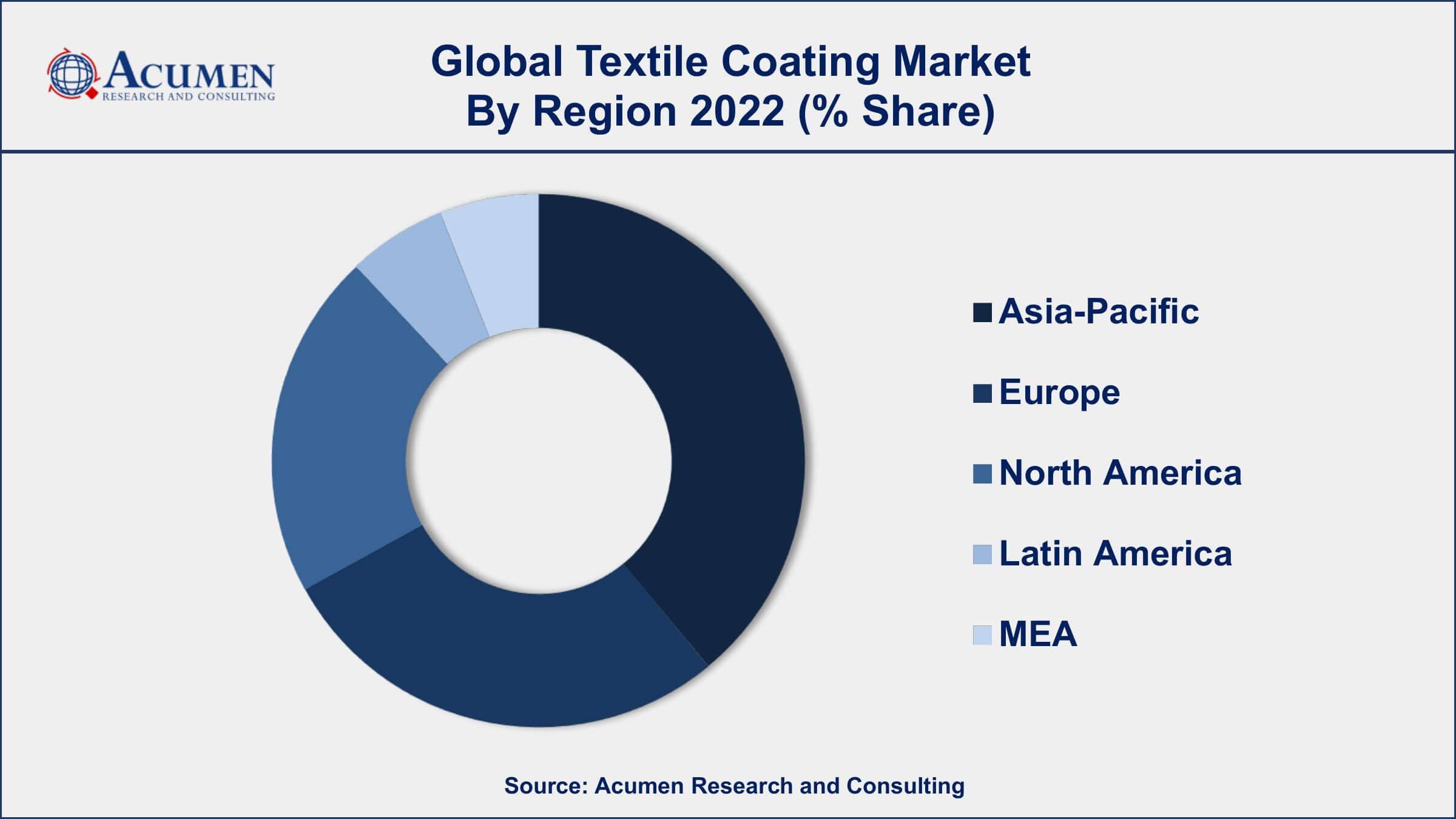

- Asia-Pacific region led with more than 40% of textile coating market share in 2022

- The automotive industry is one of the major end-users of coated textiles, particularly for upholstery and airbags. The automobile industry will account for around 28% of global market share in 2022

- Among end-user industries, home furnishing segment accounts for almost 18% of the global market in 2022

- The textile coating industry is highly competitive, with major players including BASF SE, Covestro AG, Huntsman International LLC, and Lubrizol Corporation

- Increasing adoption of smart textiles and wearable technology, drives the textile coating market size

The textile coating is the process of applying a layer of polymer or other coating materials to a piece of fabric to enhance its properties such as durability, water resistance, and flame retardancy. The coating material can be applied through various methods including spraying, padding, or roller coating. The textile coating is widely used in various industries such as automotive, construction, and medical, as it offers improved functional and aesthetic properties to the fabrics.

In recent years, the textile coating market value has experienced significant growth, driven by increasing demand for coated fabrics in various end-use industries. The growing construction industry, especially in emerging economies, is one of the major factors contributing to the growth of the market. Textile coated materials are increasingly used in construction applications such as roofing, insulation, and waterproofing, as they offer superior performance and durability compared to traditional materials. Additionally, the increasing demand for protective clothing, such as fire-resistant and high-visibility garments, is also driving the growth of the market.

Global Textile Coating Market Trends

Market Drivers

- Increasing demand for coated fabrics in various end-use industries

- Growing construction industry, especially in emerging economies

- Rising demand for protective clothing and other technical textiles

- Growing awareness about the benefits of textile coating

Market Restraints

- Volatility in raw material prices

- Stringent regulations regarding the use of certain chemicals in coating materials

Market Opportunities

- Growing demand for high-performance fabrics in the sports and leisure industry

- Increasing adoption of smart textiles and wearable technology

Textile Coating Market Report Coverage

| Market | Textile Coating Market |

| Textile Coating Market Size 2022 | USD 5.4 Billion |

| Textile Coating Market Forecast 2032 | USD 8.4 Billion |

| Textile Coating Market CAGR During 2023 - 2032 | 4.2% |

| Textile Coating Market Analysis Period | 2020 - 2032 |

| Textile Coating Market Base Year | 2022 |

| Textile Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Archroma, BASF SE, Covestro AG, DowDupont Inc., Huntsman Corporation, Kansai Nerolac Paints Ltd., Lubrizol Corporation, PPG Industries, Inc., Sika AG, Sumitomo Chemical Co., Ltd., The Chemours Company, and The Dow Chemical Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Textile chemicals are used to enhance and improve the manufacturing process and give the final product an exactly needed appearance or offer a specific function like flameproof furniture fabrics, greenhouse material that reflects the sun, and durable airbags for vehicles. The growth of the global attire industry is expected to drive the demand for textile coatings over the forecast period. The global clothing industry was worth over $1.2 trillion in 2015 and is anticipated to witness significant growth over the estimated period. Around 75% of this market value is prominent in the US, Japan, EU-27, and China. These areas account for less than 35% of the global population. This signifies higher expenditure on clothing and attire in these countries. Growing demand for textiles across different end-use applications is also anticipated to drive market growth.

Rising environmental concerns about the adverse effect of these chemicals may pose a challenge to market growth. Water scarcity and contamination of water caused by the use of chemicals in the fabric industry may have widespread local consequences in manufacturing nations. Severe environmental regulation such as IPPC (Integrated Pollution Prevention and Control) along with ETS (Emission Trading System) and regulation on Registration, Authorization Restriction, and Evaluation is anticipated to hamper the growth of this industry. Sizing and coating dominated the product segment, accounting for over one-third of the total market in 2015. Sizing chemicals are mainly used for improving the abrasion strength and resistance of yarn during weaving. The auxiliaries and colorants segment is estimated to witness sluggish development over the next few years. The market for this product is expected to witness a decline in sales on account of the availability of substitute products such as pigments. Rising concerns over factors affecting the finishing of yarn into the textile are anticipated to drive the demand for concluding agents over the following years. The demand for finishing agents is hence anticipated to rise over the period.

Textile Coating Market Segmentation

The global textile coating market segmentation is based on type, end-use industry, and geography.

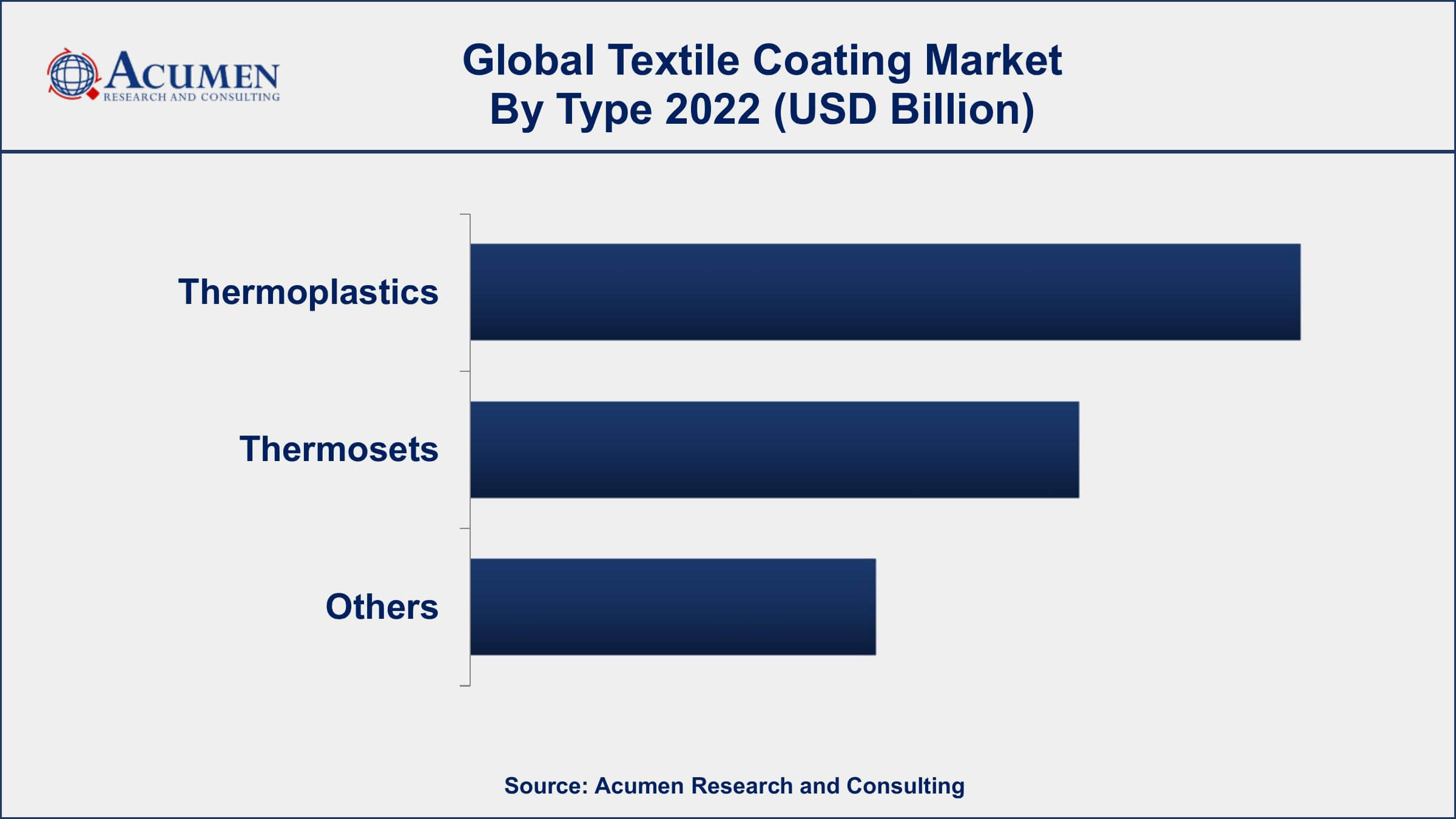

Textile Coating Market By Type

- Thermoplastics

- Acrylics

- Polyurethane

- Polyvinyl chloride

- Others

- Thermosets

- Natural rubber

- Styrenebutadiene rubber

- Others

- Others

In terms of types, the thermoplastics segment has seen significant growth in the textile coating market in recent years. Thermoplastic coatings offer superior performance compared to traditional coatings, including improved flexibility, durability, and resistance to abrasion and chemicals. Thermoplastic coatings can be applied to a wide range of fabrics, including natural and synthetic fibers, and they can be used in various end-use applications such as automotive interiors, outdoor furniture, and protective clothing. Additionally, thermoplastic coatings can be applied through a variety of methods, including hot melt, calendering, and lamination, making them a popular choice for manufacturers. The growth of the thermoplastics segment is also driven by the increasing demand for eco-friendly and sustainable coatings.

Textile Coating Market By End-use Industry

- Chemical & Petrochemical

- Transportation

- Agriculture

- Building & Construction

- Healthcare

- Home Furnishing

- Others

According to the textile coating market forecast, the home furnishing segment is expected to witness significant growth in the coming years. Textile coating can be applied to various fabrics used in home furnishings, including upholstery, curtains, and carpets, to provide improved durability, stain resistance, and water repellency. In recent years, the home furnishing segment has witnessed significant growth, driven by factors such as increasing urbanization, rising disposable income, and changing consumer preferences. Consumers are increasingly seeking home furnishings that are aesthetically pleasing, durable, and easy to maintain, which has led to the adoption of coated fabrics in various home furnishing applications.

Textile Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Textile Coating Market Regional Analysis

The Asia-Pacific region is dominating the textile coating market due to several factors. The region has a large textile industry that produces a vast range of fabrics for various end-use applications, including automotive, construction, and industrial applications. As a result, the demand for textile coating materials in the Asia-Pacific region is high. Additionally, the region has a large population with a growing middle class, which has led to an increase in disposable income and consumer spending. This, in turn, has driven the demand for high-performance coated fabrics in various end-use applications. Another factor contributing to the dominance of the Asia-Pacific region is the availability of raw materials at a lower cost. The region is home to several countries that produce raw materials such as polyester, nylon, and polypropylene, which are widely used in the production of coated fabrics. Additionally, the lower labor costs in the region have made it an attractive destination for textile manufacturing, which has further boosted the demand for textile coating materials.

Textile Coating Market Player

Some of the top textile coating market companies offered in the professional report include Archroma, BASF SE, Covestro AG, DowDupont Inc., Huntsman Corporation, Kansai Nerolac Paints Ltd., Lubrizol Corporation, PPG Industries, Inc., Sika AG, Sumitomo Chemical Co., Ltd., The Chemours Company, and The Dow Chemical Company.

Frequently Asked Questions

What was the market size of the global textile coating in 2022?

The market size of textile coating was USD 5.4 Billion in 2022.

What is the CAGR of the global textile coating market from 2023 to 2032?

The CAGR of textile coating is 4.2% during the analysis period of 2023 to 2032.

Which are the key players in the textile coating market?

The key players operating in the global market are including Archroma, BASF SE, Covestro AG, DowDupont Inc., Huntsman Corporation, Kansai Nerolac Paints Ltd., Lubrizol Corporation, PPG Industries, Inc., Sika AG, Sumitomo Chemical Co., Ltd., The Chemours Company, and The Dow Chemical Company.

Which region dominated the global textile coating market share?

Asia-Pacific held the dominating position in textile coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of textile coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global textile coating industry?

The current trends and dynamics in the textile coating industry include increasing demand for coated fabrics and rising demand for protective clothing and other technical textiles.

Which type held the maximum share in 2022?

The thermoplastics type held the maximum share of the textile coating industry.