Telecom Managed Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Telecom Managed Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

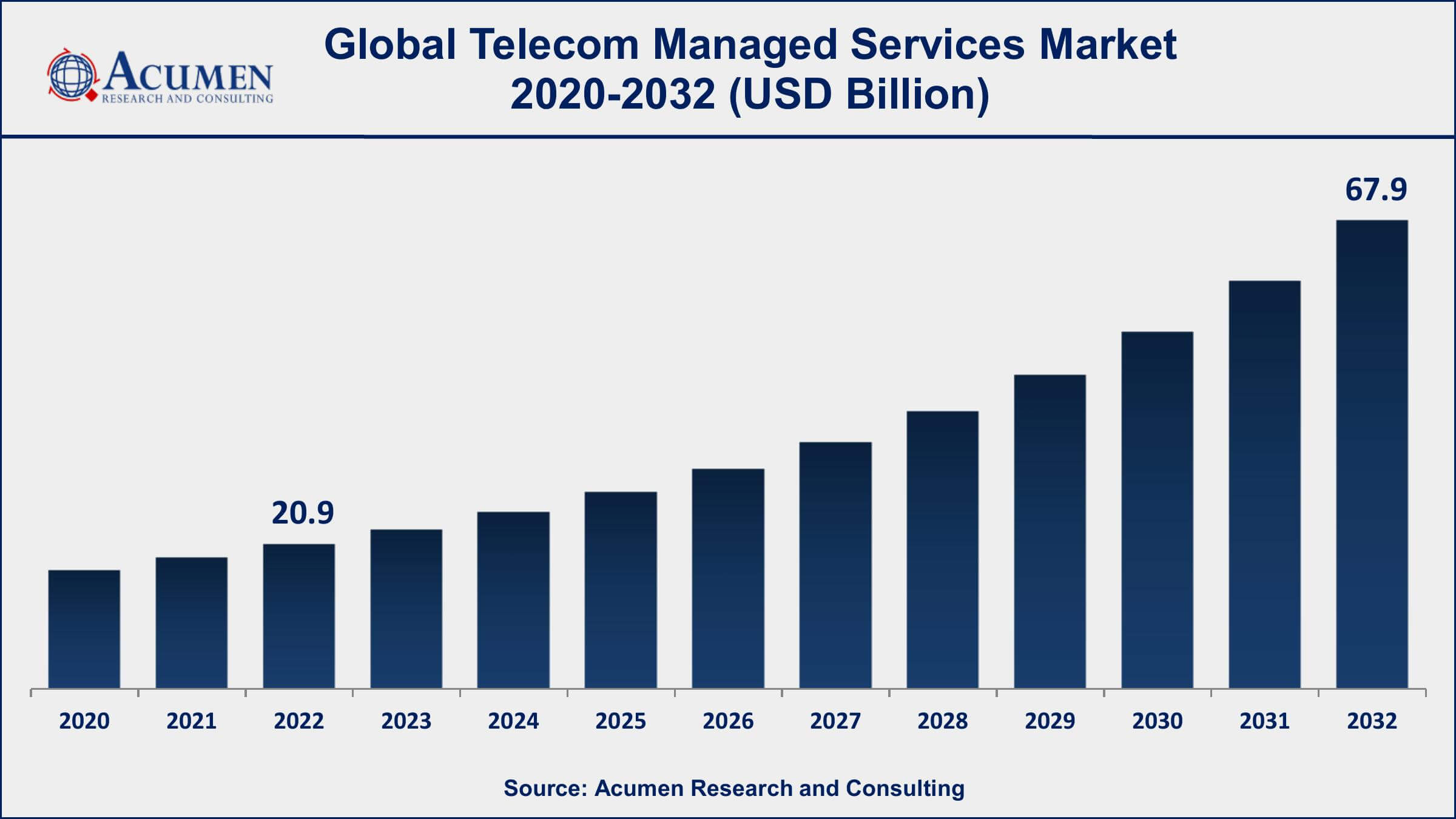

The Telecom Managed Services Market Size accounted for USD 20.9 Billion in 2022 and is projected to achieve a market size of USD 67.9 Billion by 2032 growing at a CAGR of 12.7% from 2023 to 2032.

Telecom Managed Services Market Highlights

- Global Telecom Managed Services Market revenue is expected to increase by USD 67.9 Billion by 2032, with a 12.7% CAGR from 2023 to 2032

- North America region led with more than 36% of Telecom Managed Services Market share in 2022

- Asia-Pacific Telecom Managed Services Market growth will record a CAGR of more than 13.5% from 2023 to 2032

- By deployment, the cloud segment captured the largest market share of 56% in 2022

- By product, the managed data center services segment registered the highest market share of 31% in 2022

- Growing demand for enhanced operational efficiency, security, and agility in telecom businesses, drives the Telecom Managed Services Market value

Telecom managed services refer to the outsourcing of specific telecommunications operations and responsibilities to a third-party service provider. These services can include network management, infrastructure maintenance, technical support, security management, and other related tasks. Telecom companies, in particular, often opt for managed services to streamline their operations, reduce costs, and enhance overall efficiency. By outsourcing these functions to specialized providers, telecom companies can focus on their core competencies, such as developing new services and expanding their customer base.

The market for telecom managed services has experienced significant growth in recent years, driven by the increasing complexity of telecom networks, advancements in technology, and the need for cost-effective solutions. With the rise of technologies like 5G, IoT (Internet of Things), and cloud computing, telecom companies are facing challenges in managing their networks efficiently. Managed services providers offer expertise in these areas, helping telecom companies navigate the complexities and ensure seamless operations. Additionally, the growing demand for enhanced customer experiences, coupled with the need for robust cybersecurity measures, has further fueled the market growth for telecom managed services. Businesses are recognizing the value of outsourcing these critical functions to experts, leading to a steady expansion of the market.

Global Telecom Managed Services Market Trends

Market Drivers

- Increasing complexity of telecom networks

- Advancements in 5G, IoT, and cloud technologies

- Focus on cost reduction and operational efficiency

- Growing demand for enhanced customer experiences

- Rising need for cybersecurity measures

Market Restraints

- Data security concerns and privacy issues

- Challenges in integration with legacy systems

Market Opportunities

- Expansion of 5G networks globally

- Rising adoption of IoT devices and applications

- Emergence of edge computing solutions

Telecom Managed Services Market Report Coverage

| Market | Telecom Managed Services Market |

| Telecom Managed Services Market Size 2022 | USD 20.9 Billion |

| Telecom Managed Services Market Forecast 2032 | USD 67.9 Billion |

| Telecom Managed Services Market CAGR During 2023 - 2032 | 12.7% |

| Telecom Managed Services Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Deployment, By Service Type, By Enterprise Size, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cisco Systems, Inc., International Business Machines Corporation, Huawei Technologies Co., Ltd., Verizon Communications Inc., Telefonaktiebolaget LM Ericsson, NTT DATA, Acuity Technologies, Nokia, AT&T Inc, Fujitsu Ltd., and Comarch SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Telecom managed services can include network monitoring, maintenance, technical support, security management, and even strategic planning. By outsourcing these tasks to specialized providers, telecom companies can focus on their core competencies, such as innovation, service development, and customer engagement, while leaving the operational intricacies to experts.

One of the primary applications of telecom managed services lies in network management. With the advent of technologies like 5G, IoT, and cloud computing, telecom networks have become highly intricate, requiring constant monitoring and maintenance to ensure seamless operations. Managed services providers offer expertise in these areas, managing network infrastructure, troubleshooting issues, and ensuring optimal performance. Another significant application is in customer support and service delivery. Telecom managed services providers often handle customer inquiries, technical support, and service activations, ensuring a smooth experience for subscribers.

The telecom managed services market has been experiencing significant growth in recent years and is expected to continue its upward trajectory in the foreseeable future. Several factors contribute to this expansion. One of the primary drivers is the increasing complexity of telecom networks. With the evolution of technologies like 5G, IoT, and cloud computing, telecom operators face challenges in managing these intricate networks. Outsourcing these tasks to specialized managed services providers allows telecom companies to leverage the expertise of professionals who can navigate the complexities efficiently. This trend is particularly evident as telecom operators seek to enhance their service quality and focus on delivering seamless, high-speed connectivity to consumers and businesses alike. Furthermore, the demand for managed services in the telecom sector is bolstered by the rapid adoption of IoT devices and applications. As more devices become interconnected, telecom operators require robust and scalable infrastructure to support these connections. Managed services providers offer tailored solutions, ensuring that networks can handle the increasing volume of data generated by IoT devices.

Telecom Managed Services Market Segmentation

The global Telecom Managed Services Market segmentation is based on deployment, service type, enterprise size, and geography.

Telecom Managed Services Market By Deployment

- Cloud

- On-premise

According to the telecom managed services industry analysis, the cloud segment accounted for the largest market share in 2022. One of the key drivers of this growth is the increasing adoption of cloud-based services and solutions by telecom operators. Cloud technology offers telecom companies the flexibility and scalability needed to handle the vast amounts of data generated by modern networks. It enables efficient storage, seamless data processing, and quick access to resources, which are vital for telecom operators dealing with the demands of high-speed connectivity, IoT, and 5G networks. The cloud segment provides telecom companies with the ability to enhance their operational efficiency, reduce capital expenditure, and accelerate the deployment of new services, making it a crucial component of managed services offerings.

Telecom Managed Services Market By Service Type

- Managed Data Center Services

- Managed Mobility Services

- Managed Network Services

- Managed Security Services

- Others

In terms of service types, the managed data center services segment is expected to witness significant growth in the coming years. One of the primary drivers of this growth is the increasing reliance on data-intensive applications and services by businesses and consumers. With the proliferation of digital content, cloud computing, and IoT devices, telecom operators are under pressure to efficiently manage and store vast amounts of data. Managed data center services provide telecom companies with scalable, secure, and reliable infrastructure solutions. By outsourcing their data center operations, telecom operators can focus on their core competencies while ensuring uninterrupted service delivery. This trend is especially crucial in the era of 5G networks, where low-latency data processing and storage are paramount for delivering high-quality services. Additionally, the growth of the managed data center services segment is closely linked to the rising trend of digital transformation across various industries.

Telecom Managed Services Market By Enterprise Size

- Large Enterprises

- SMEs

According to the telecom managed services market forecast, the SMEs segment is expected to witness significant growth in the coming years. This growth is driven by the increasing digitalization of businesses and the need for cost-effective, efficient, and scalable technology solutions. SMEs are recognizing the importance of robust telecommunication infrastructure to stay competitive in today's digital economy. Managed services tailored for SMEs offer a range of benefits, including reduced IT complexity, access to advanced technologies, and enhanced cybersecurity measures. As SMEs often lack the resources and expertise to manage their IT infrastructure internally, outsourcing to telecom managed services providers allows them to focus on core business activities while ensuring reliable and secure communication networks. This trend is especially prevalent in emerging markets where SMEs form the backbone of the economy, driving the demand for affordable and accessible managed services. Moreover, the growth in the SMEs segment is closely tied to the rising adoption of cloud-based services.

Telecom Managed Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Telecom Managed Services Market Regional Analysis

North America has emerged as a dominating region in the telecom managed services market due to several key factors. One of the primary reasons is the early and rapid adoption of advanced technologies in the region. North America, particularly the United States, has been at the forefront of technological innovation, with telecom operators quick to embrace services such as 5G, IoT, and cloud computing. As these technologies become more prevalent, the demand for specialized managed services to support them grows substantially. The region's tech-savvy population and business environment foster a culture of innovation, creating a conducive atmosphere for the telecom managed services market to thrive. Another significant factor contributing to North America's dominance is the presence of major telecom companies and managed services providers headquartered in the region. These companies have extensive resources, technical expertise, and experience in delivering high-quality managed services. Additionally, North America boasts a robust ecosystem of technology vendors, system integrators, and cloud service providers, which further supports the telecom managed services market. The established infrastructure, coupled with strategic partnerships and collaborations between telecom operators and managed services providers, ensures the seamless delivery of services to businesses and consumers, driving market growth.

Telecom Managed Services Market Player

Some of the top telecom managed services market companies offered in the professional report include Cisco Systems, Inc., International Business Machines Corporation, Huawei Technologies Co., Ltd., Verizon Communications Inc., Telefonaktiebolaget LM Ericsson, NTT DATA, Acuity Technologies, Nokia, AT&T Inc, Fujitsu Ltd., and Comarch SA.

Frequently Asked Questions

How big is telecom managed services market?

The market size of telecom managed services was USD 20.9 Billion in 2022.

What is the CAGR of the global telecom managed services market from 2023 to 2032?

The CAGR of telecom managed services is 12.7% during the analysis period of 2023 to 2032.

Which are the key players in the telecom managed services market?

The key players operating in the global market are including Cisco Systems, Inc., International Business Machines Corporation, Huawei Technologies Co., Ltd., Verizon Communications Inc., Telefonaktiebolaget LM Ericsson, NTT DATA, Acuity Technologies, Nokia, AT&T Inc, Fujitsu Ltd., and Comarch SA.

Which region dominated the global telecom managed services market share?

North America held the dominating position in telecom managed services industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of telecom managed services during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global telecom managed services industry?

The current trends and dynamics in the telecom managed services industry include increasing complexity of telecom networks, advancements in 5G, IoT, and cloud technologies, and focus on cost reduction and operational efficiency.

Which service type held the maximum share in 2022?

The managed data center services type held the maximum share of the telecom managed services industry.