Synthetic Biology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Synthetic Biology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

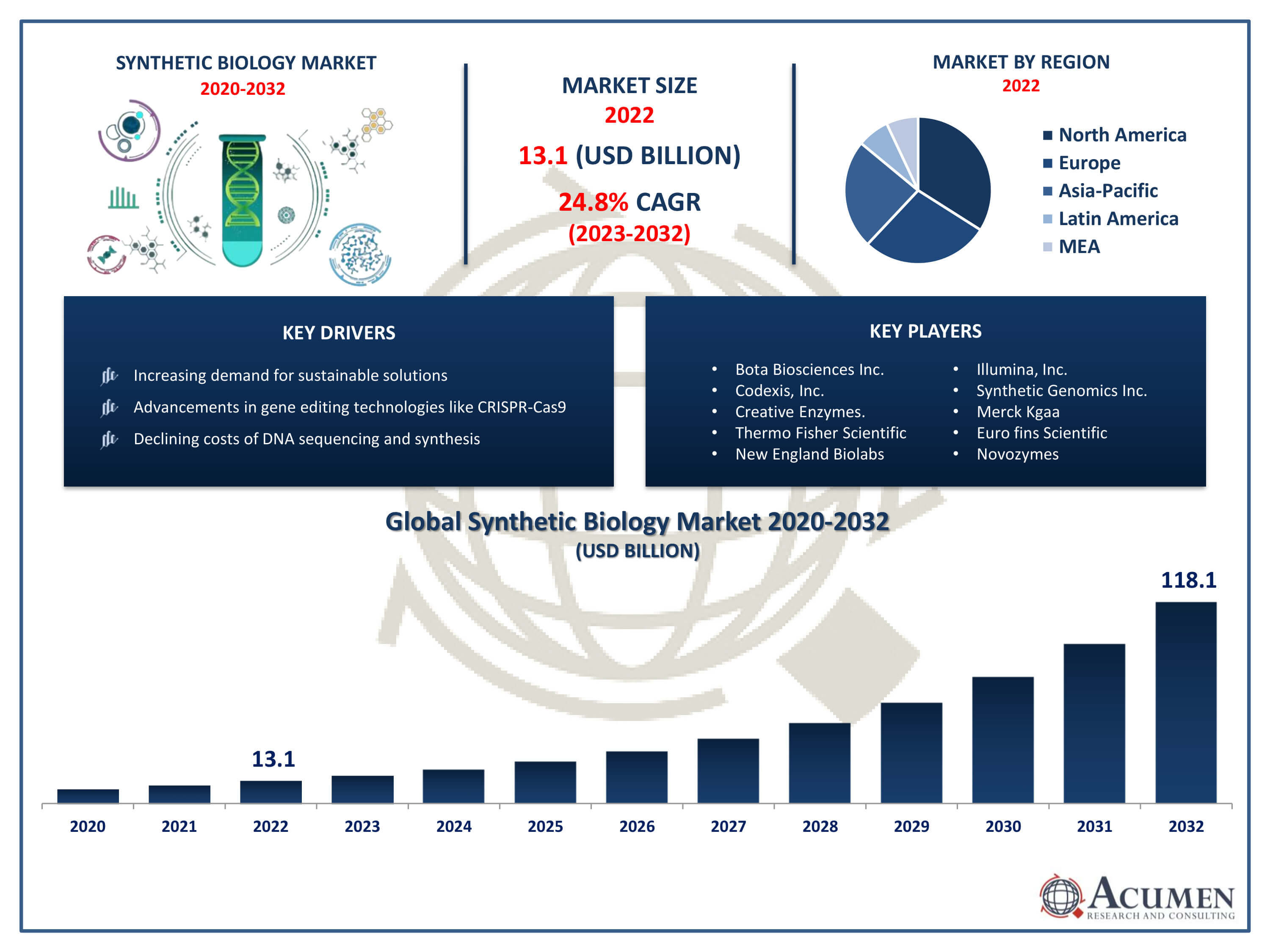

The Synthetic Biology Market Size accounted for USD 13.1 Billion in 2022 and is projected to achieve a market size of USD 118.1 Billion by 2032 growing at a CAGR of 24.8% from 2023 to 2032.

Synthetic Biology Market Highlights

- Global synthetic biology market revenue is expected to increase by USD 118.1 billion by 2032, with a 24.8% CAGR from 2023 to 2032

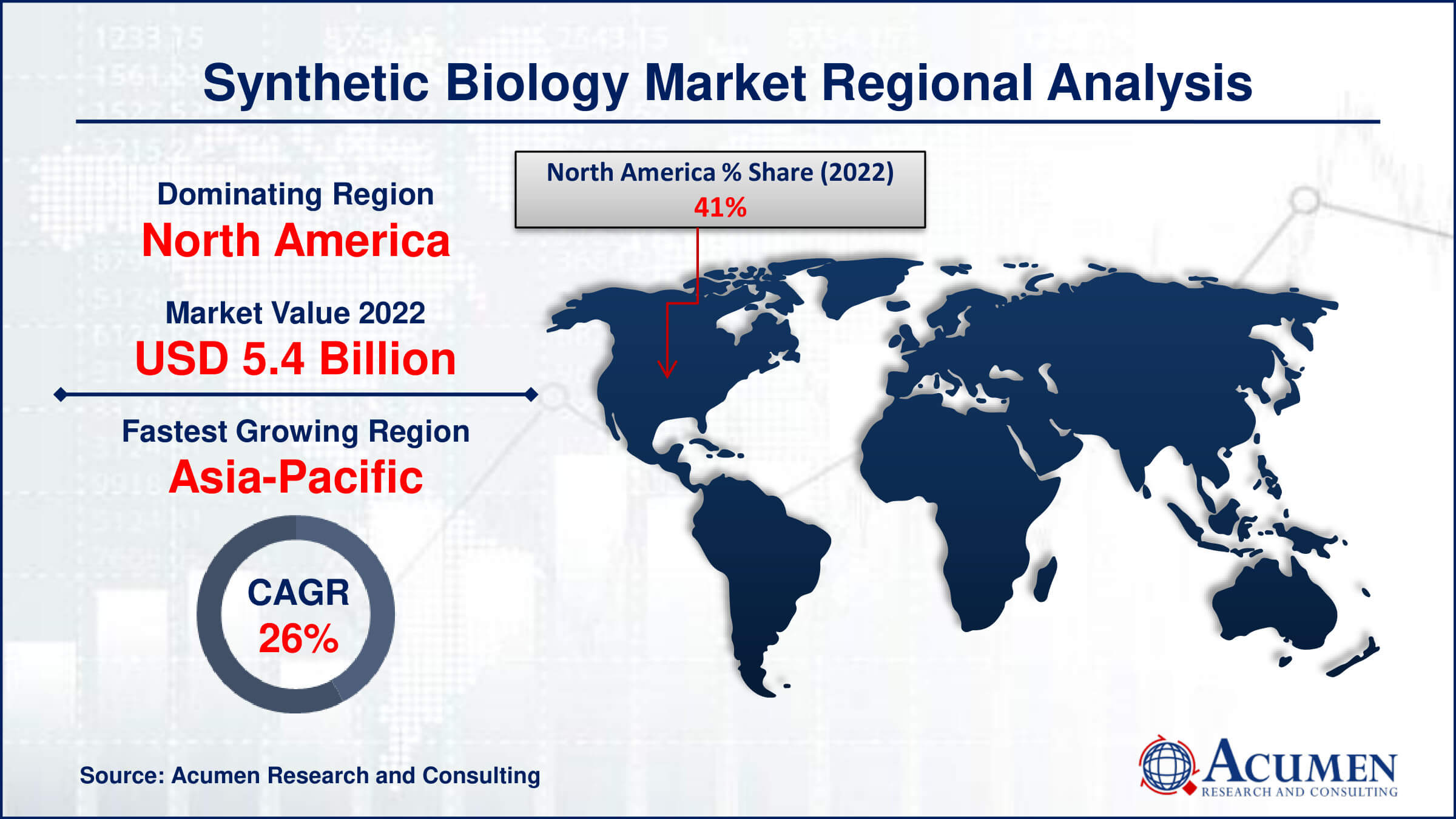

- North America region led with more than 41% of synthetic biology market share in 2022

- Asia-Pacific synthetic biology market growth will record a CAGR of around 26.1% from 2023 to 2032

- By technology, the PCR technology segment is the largest segment in the market, accounting for over 27% of the market share in 2022

- By end-use, the biotechnology & pharmaceutical companies segment has recorded more than 50% of the revenue share in 2022

- Increasing demand for sustainable solutions is one of the synthetic biology market trend that fuels the demand

Synthetic biology is a multidisciplinary area merging concepts from biology, engineering, chemistry, and computer science. Its aim is to develop and engineer novel biological components, structures, and systems, or to reconfigure existing biological systems for practical applications. This field entails manipulating DNA, RNA, proteins, and other biological entities to fabricate synthetic organisms, pathways, and functionalities, which find utility across diverse sectors like healthcare, agriculture, energy, and environmental preservation. Examples of synthetic biology applications encompass the synthesis of biofuels, pharmaceuticals, biodegradable plastics, and genetically modified organisms modified for enhanced crop productivity or ecological restoration.

In recent years, the synthetic biology industry has seen remarkable expansion, propelled by advancements in gene editing tools such as CRISPR-Cas9, decreasing expenses associated with DNA sequencing and synthesis, and escalating investments from both public and private entities. For instance, the advent of CRISPR/Cas9 as a tool for gene editing, along with advancements in nuclease technology, has opened up new avenues for precise genome correction. This breakthrough offers significant potential for treating cystic fibrosis and other genetic disorders. This growth is fueled by factors like increasing demand for sustainable solutions, a drive for pioneering healthcare remedies, and the widening utilization of synthetic biology in diverse industries. As the sector evolves and fresh breakthroughs surface, it is anticipated that the synthetic biology market will continue to broaden, paving the way for innovative products and technologies that hold substantial economic and societal implications.

Global Synthetic Biology Market Dynamics

Market Drivers

- Increasing demand for sustainable solutions

- Advancements in gene editing technologies like CRISPR-Cas9

- Declining costs of DNA sequencing and synthesis

- Growing investments from public and private sectors

- Expanding applications across industries such as healthcare, agriculture, and energy

Market Restraints

- Ethical and regulatory concerns surrounding genetic manipulation

- Limited understanding of complex biological systems

Market Opportunities

- Development of novel healthcare treatments and therapies

- Expansion of bio-based manufacturing for sustainable products

- Integration of synthetic biology in agriculture for improved crop traits

Synthetic Biology Market Report Coverage

| Market | Synthetic Biology Market |

| Synthetic Biology Market Size 2022 | USD 13.1 Billion |

| Synthetic Biology Market Forecast 2032 | USD 118.1 Billion |

| Synthetic Biology Market CAGR During 2023 - 2032 | 24.8% |

| Synthetic Biology Market Analysis Period | 2020 - 2032 |

| Synthetic Biology Market Base Year |

2022 |

| Synthetic Biology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bota Biosciences Inc., Codexis, Inc., Creative Enzymes., Thermo Fisher Scientific, Inc., New England Biolabs, Illumina, Inc., Synthetic Genomics Inc., Merck Kgaa (Sigma-Aldrich Co. Llc), Euro fins Scientific, Novozymes, Pareto Bio, Inc., and Scarab Genomics, Llc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Synthetic biology integrates principles from biology, engineering, computer science, and chemistry to create biological components, systems, and devices. It primarily involves manipulating genetic materials like DNA, RNA, and proteins to engineer new organisms or modify existing ones for specific purposes. Its applications are diverse, spanning across industries. In healthcare, synthetic biology could transform drug discovery, enabling the production of innovative therapeutics, vaccines, and diagnostics. It also holds potential for personalized medicine by engineering cells for targeted treatments. In agriculture, synthetic biology may boost crop yields, create disease-resistant plants, and produce sustainable products like biofuels and bioplastics.

The synthetic biology industry has experienced significant expansion recently, propelled by a combination of technological advancements, growing demand for sustainable solutions, and diverse applications across industries. Breakthroughs in gene editing tools like CRISPR-Cas9 and improvements in DNA sequencing and synthesis have propelled the field forward, enabling the creation of customized biological parts, organisms, and systems. These innovations are finding utility in healthcare, agriculture, energy, and the environment. Factors driving market growth include the increasing use of synthetic biology techniques in drug discovery, biomanufacturing, and agricultural biotechnology. For instance, according to National Institute of Health, synthetic cells serve not only as biofactories but also as screening platforms for both target-based and phenotypic-based approaches.

Synthetic Biology Market Segmentation

The global synthetic biology industry segmentation is based on technology, product, application, end-use, and geography.

Synthetic Biology Market By Technology

- NGS Technology

- PCR Technology

- Genome Editing Technology

- Bioprocessing Technology

- Others

According to the synthetic biology industry analysis, the polymerase chain reaction (PCR) technology segment accounted for the largest market share in 2022. PCR technology allows for rapid and precise replication of specific DNA sequences, supporting diverse applications in synthetic biology like gene cloning, DNA sequencing, and mutagenesis. For instance, according to National Institurte Of Health, PCR, a highly sensitive method, enables swift amplification of a targeted DNA segment. By generating billions of copies of a particular DNA fragment or gene, PCR facilitates the detection and identification of gene sequences through visual methods reliant on size and charge. Additionally, it's seeing strong growth due to innovations such as high-throughput systems, digital platforms, and isothermal amplification techniques. This segment in the synthetic biology market is expanding significantly, driven by demand from research labs, academia, pharmaceuticals, and biotech firms. PCR's versatility and scalability make it essential for applications from basic research to clinical diagnostics and biomanufacturing.

Synthetic Biology Market By Product

- Enzymes

- Xeno-Nucleic Acids

- Oligonucleotide/Oligo Pools and Synthetic DNA

- Chassis Organism

- Cloning Technologies Kits

In terms of products, the enzymes segment is expected to witness significant growth in the coming years. Enzymes play a crucial role in synthetic biology by catalyzing biochemical reactions involved in DNA manipulation, protein expression, metabolic engineering, and pathway optimization. With the advent of advanced enzyme engineering techniques, such as directed evolution and rational design, researchers can now design and modify enzymes to exhibit desired properties, such as increased specificity, stability, and efficiency, thus expanding their applicability across diverse industries. One of the key drivers of growth in the enzymes segment is the expanding applications of synthetic biology in biopharmaceuticals, biofuels, and specialty chemicals.

Synthetic Biology Market By Application

- Healthcare

- Non-Clinical

- Clinical

- Non-healthcare

- Bio-fuels

- Specialty Chemicals

- Biotech Crops

- Others

According to the synthetic biology industry forecast, the healthcare segment is expected to witness significant growth in the coming years. The rise in synthetic biology's prominence can be attributed to its inventive applications in drug discovery, personalized medicine, and regenerative therapies. Through synthetic biology, biological systems can be engineered to generate therapeutic molecules, devise innovative drugs, and craft modified treatments based on individual’s genetic characteristics. This has spurred the development of precision medicine strategies that utilize synthetic biology methods to attempt complex diseases more efficiently. A significant catalyst for growth in the healthcare sector is the escalating demand for new therapies to tackle unmet medical needs, including rare diseases, cancer, and genetic disorders.

Synthetic Biology Market By End-Use

- Academic & Government Research Institutes

- Biotechnology & Pharmaceutical Companies

- Others

Based on the end-use, the biotechnology & pharmaceutical companies segment is expected to continue its growth trajectory in the coming years. This growth is propelled by the increasing adoption of synthetic biology techniques to enhance drug discovery, biomanufacturing, and therapeutic development processes. Biotechnology and pharmaceutical firms are leveraging synthetic biology tools and platforms to engineer novel biologics, optimize production processes, and accelerate the development of next-generation therapies. This has led to a paradigm shift in drug development towards more efficient and targeted approaches, driving market expansion. One of the key drivers of growth in this segment is the demand for innovative therapies to address complex diseases and unmet medical needs. Synthetic biology enables the design and engineering of biological systems to produce biologics, gene therapies, and cell-based treatments with improved efficacy and specificity.

Synthetic Biology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Synthetic Biology Market Regional Analysis

North America dominates the synthetic biology industry due to several factors contributing to its leading position in research, development, and commercialization within the field. One significant factor is the region's robust infrastructure and ecosystem supporting biotechnology and life sciences industries. North America boasts world-renowned research institutions, universities, and biotech hubs such as Silicon Valley, Boston, and San Diego, which serve as centers of innovation and attract top talent and investment in synthetic biology. Furthermore, advancements by key players in North America encourage research and development in synthetic biology. For example, in July 2021, Codexis, Inc. and Kalsec, Inc. extended their research collaboration and signed a dedicated supply agreement for a novel enzyme aimed at producing Kalsec's latest natural hop acid. Additionally, on November 30, 2021, GenScript enhanced its gene synthesis production capabilities in the United States by incorporating fully automated sequencing and oligo synthesis platforms. Consequently, regulatory agencies like the FDA in the United States provide clear guidelines for the development and commercialization of synthetic biology products.

The Asia Pacific region is the fastest-growing region in the synthetic biology industry. Increasing investments in research and development, an expanding biotechnology sector, and rising demand for sustainable solutions across various industries are driving this growth. For instance, China's Ministry of Science and Technology (MST) announced an 8.1% increase in its R&D investment for 2023, bringing the total to over $458 billion. The region's burgeoning biopharmaceutical and healthcare sectors, along with growing awareness about environmental conservation, are further fueling the demand for synthetic biology applications. As a result, Asia Pacific emerges as a key region for the development and adoption of synthetic biology technologies.

Synthetic Biology Market Player

Some of the top synthetic biology market companies offered in the professional report include Bota Biosciences Inc., Codexis, Inc., Creative Enzymes., Thermo Fisher Scientific, Inc., New England Biolabs, Illumina, Inc., Synthetic Genomics Inc., Merck Kgaa (Sigma-Aldrich Co. Llc), Euro fins Scientific, Novozymes, Pareto Bio, Inc., and Scarab Genomics, Llc.

Frequently Asked Questions

How big is the synthetic biology market?

The synthetic biology market size was USD 13.1 Billion in 2022.

What is the CAGR of the global synthetic biology market from 2023 to 2032?

The CAGR of synthetic biology is 24.8% during the analysis period of 2023 to 2032.

Which are the key players in the synthetic biology market?

The key players operating in the global market are including Bota Biosciences Inc., Codexis, Inc., Creative Enzymes., Thermo Fisher Scientific, Inc., New England Biolabs, Illumina, Inc., Synthetic Genomics Inc., Merck Kgaa (Sigma-Aldrich Co. Llc), Euro fins Scientific, Novozymes, Pareto Bio, Inc., and Scarab Genomics, Llc.

Which region dominated the global synthetic biology market share?

North America held the dominating position in synthetic biology industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of synthetic biology during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global synthetic biology industry?

The current trends and dynamics in the synthetic biology industry include increasing demand for sustainable solutions, advancements in gene editing technologies like CRISPR-Cas9, and declining costs of DNA sequencing and synthesis.

Which product held the maximum share in 2022?

The oligonucleotide/oligo pools and synthetic DNA product held the maximum share of the synthetic biology industry.