Sustainable Plastic Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Sustainable Plastic Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

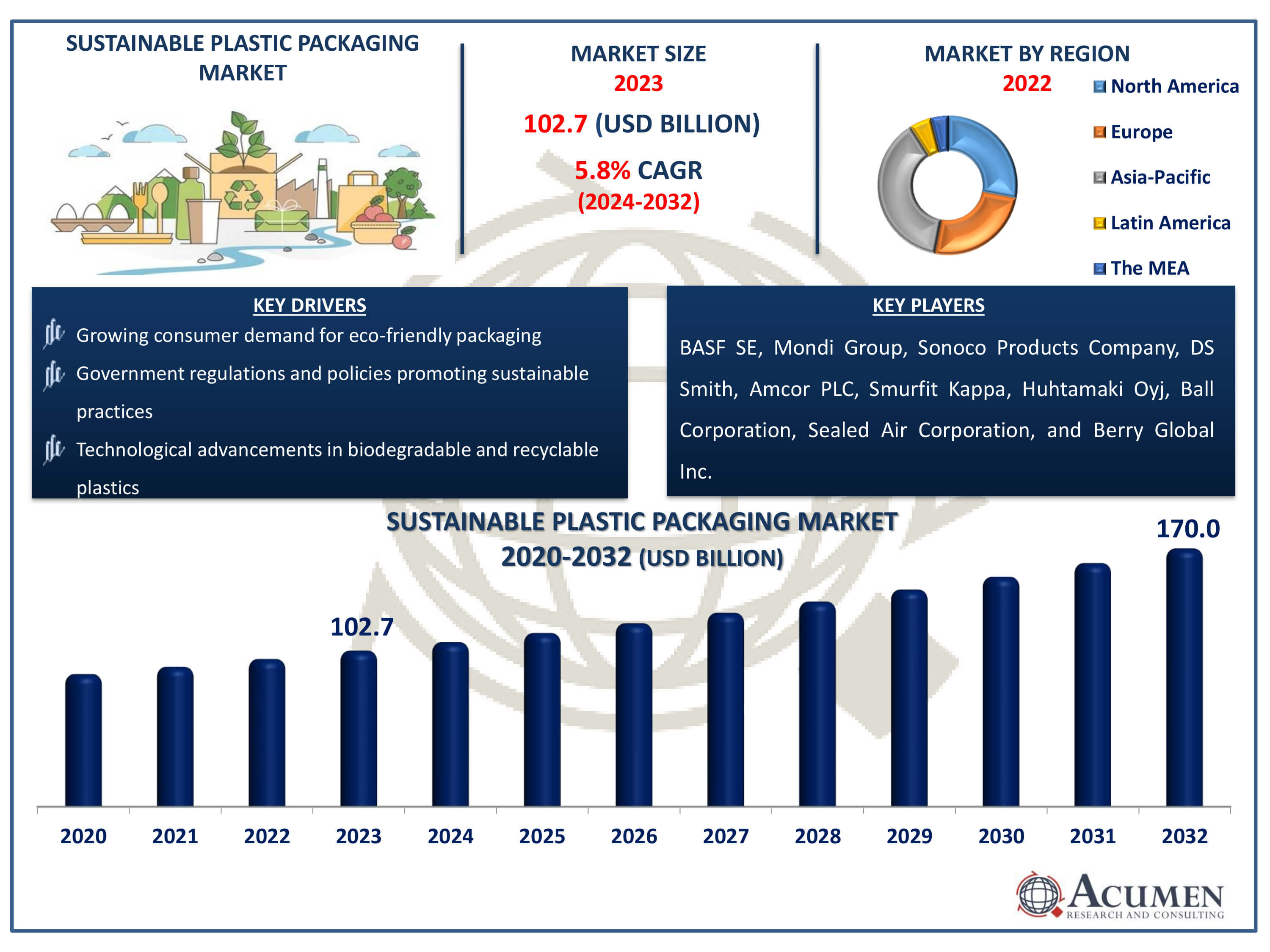

The Sustainable Plastic Packaging Market Size accounted for USD 102.7 Billion in 2023 and is estimated to achieve a market size of USD 170 Billion by 2032 growing at a CAGR of 5.8% from 2024 to 2032.

Sustainable Plastic Packaging Market Highlights

- Global sustainable plastic packaging market revenue is poised to garner USD 170 billion by 2032 with a CAGR of 5.8% from 2024 to 2032

- Asia-Pacific sustainable plastic packaging market value occupied around USD 39 billion in 2023

- North America sustainable plastic packaging market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among type, the rigid sub-segment generated significant of the market share in 2023

- Based on process, the biodegradable sub-segment generated notable market share in 2023

- Increasing demand for compostable and biodegradable plastics to reduce environmental impact is the sustainable plastic packaging market trend that fuels the industry demand

Sustainable plastic packaging refers to the development and use of plastic materials and designs that minimize environmental impact and enhance resource efficiency throughout the product lifecycle. This involves utilizing biodegradable, recyclable, or bio-based plastics, optimizing packaging design to reduce material usage, and improving the end-of-life recyclability of the packaging. Processs include food and beverage containers, medical packaging, and consumer goods, where the focus is on reducing carbon footprint, minimizing waste, and enhancing the circular economy. Innovations in this field aim to balance performance, cost, and sustainability, meeting consumer demand and regulatory requirements. These efforts contribute significantly to waste reduction and environmental preservation.

Global Sustainable Plastic Packaging Market Dynamics

Market Drivers

- Growing consumer demand for eco-friendly packaging solutions

- Government regulations and policies promoting sustainable practices

- Technological advancements in biodegradable and recyclable plastics

Market Restraints

- Higher costs associated with sustainable packaging materials

- Limited availability of raw materials for biodegradable plastics

- Challenges in establishing efficient recycling infrastructure

Market Opportunities

- Innovation in bioplastics and compostable materials

- Expansion of circular economy initiatives and closed-loop systems

- Increased corporate commitments to sustainability and environmental responsibility

Sustainable Plastic Packaging Market Report Coverage

| Market | Sustainable Plastic Packaging Market |

| Sustainable Plastic Packaging Market Size 2022 | USD 102.7 Billion |

| Sustainable Plastic Packaging Market Forecast 2032 |

USD 170 Billion |

| Sustainable Plastic Packaging Market CAGR During 2023 - 2032 | 5.8% |

| Sustainable Plastic Packaging Market Analysis Period | 2020 - 2032 |

| Sustainable Plastic Packaging Market Base Year |

2022 |

| Sustainable Plastic Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Process, By Packaging Format, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Mondi Group, Sonoco Products Company, DS Smith, Amcor PLC, Smurfit Kappa, Huhtamaki Oyj, Ball Corporation, Sealed Air Corporation, and Berry Global Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sustainable Plastic Packaging Market Insights

The rising consumer awareness and preference for environmentally responsible products are significantly boosting the sustainable plastic packaging market. Eco-friendly packaging solutions are increasingly favored due to their reduced environmental impact and potential for recyclability. This shift in consumer behavior is prompting manufacturers to innovate and adopt sustainable practices. Consequently, industries are investing in biodegradable, compostable, and reusable plastic materials to meet this growing demand. Overall, the drive for greener packaging options is reshaping the market landscape, developing a more sustainable future.

The growth of the sustainable plastic packaging market is hindered by the limited availability of raw materials needed for biodegradable plastics. These materials, often derived from renewable sources such as corn starch, sugarcane, and other biomass, are not produced in sufficient quantities to meet the rising demand. This scarcity drives up costs and makes it challenging for manufacturers to scale production. Additionally, the competition for these resources with other industries, like biofuels, further exacerbates the supply constraints. Consequently, the market expansion for eco-friendly packaging solutions remains restricted.

The surge in innovation within bioplastics and compostable materials is poised to transform the sustainable plastic packaging market in the coming years. For instance, in January 2020, Sealed Air Corporation introduced an updated version of their bubble wrap brand packaging, crafted from a minimum of 90% recycled materials. These recycled components are sourced from post-industrial sources, diverting them from landfills. These advancements offer eco-friendly alternatives to traditional plastics, reducing environmental impact and aligning with global sustainability goals. Enhanced biodegradability and the use of renewable resources address growing consumer and regulatory demands for greener products. Additionally, the development of efficient production processes and improved material properties boosts the market appeal of bioplastics. Consequently, these innovations are set to drive significant growth in the sustainable packaging sector.

Sustainable Plastic Packaging Market Segmentation

The worldwide market for sustainable plastic packaging is split based on type, process, packaging format, end-use, and geography.

Sustainable Plastic Packaging Types

- Flexible

- Rigid

- Industrial

According to the sustainable plastic packaging industry analysis, rigid type dominates sustainable plastic packaging market due to its durability, versatility, and recyclability. These attributes make it a preferred choice for manufacturers aiming to reduce environmental impact while maintaining product integrity. Additionally, advancements in bioplastics and recycling technologies have enhanced the sustainability of rigid packaging. This combination of strength and eco-friendliness continues to drive its market dominance.

Sustainable Plastic Packaging Processes

- Reusable

- Recyclable

- Biodegradable

According to the sustainable plastic packaging industry analysis, biodegradable processes, which offer an eco-friendly alternative to traditional plastics dominates industry. These processes involve materials that decompose naturally through the action of microorganisms, reducing environmental impact. Biodegradable plastics help mitigate pollution and waste accumulation, as they break down into non-toxic components. Innovations in this field are enhancing the performance and cost-effectiveness of biodegradable packaging, making it a viable option for businesses and consumers. For instance, XAMPLA, the manufacturer of biodegradable Morro packaging solutions, successfully obtained $7 million in funding in January 2024. Overall, as regulatory pressures and consumer awareness grow, the shift towards biodegradable solutions is becoming a crucial aspect of the sustainable packaging landscape.

Sustainable Plastic Packaging Formats

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

According to the sustainable plastic packaging industry forecast, primary packaging, expected to dominates sustainable plastic packaging market. This is driven by increasing consumer demand for eco-friendly options, stricter environmental regulations, and corporate commitments to sustainability. Innovations in biodegradable and recyclable materials are making primary packaging more sustainable. Companies are focusing on reducing the carbon footprint and environmental impact of their packaging solutions. This trend reflects a broader shift towards sustainability in the packaging industry, prioritizing both functionality and environmental responsibility.

Sustainable Plastic Packaging End Uses

- Healthcare

- Personal care

- Food & beverage

- Others

According to the sustainable plastic packaging industry, the food and beverage industry is a primary driver of the market, driven by the sector's substantial need for packaging solutions that balance functionality and environmental responsibility. For instance, the Indian food and beverage packaging sector, experiencing an annual growth rate of 14.8% in 2023, is anticipated to achieve a valuation of $86 billion by 2029. This industry's influence stems from its significant market size and the consumer demand for eco-friendly packaging options. As sustainability becomes a key purchasing reason, companies are increasingly adopting biodegradable, recyclable, and reusable packaging materials to meet both regulatory standards and consumer preferences. Innovations in sustainable plastics are modified to address the specific preservation and safety requirements of food and beverages, further maintaining their dominance in this market.

Sustainable Plastic Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sustainable Plastic Packaging Market Regional Analysis

For several reasons, the Asia-Pacific region leads the sustainable plastic packaging market due to rapid industrialization and urbanization, driving demand for eco-friendly solutions. Government regulations promoting environmental sustainability and a shift in consumer preferences toward green products also contribute to this dominance. Countries like China, India, and Japan invest heavily in sustainable technologies and infrastructure. Major Chinese e-commerce platforms and express delivery services have been proactively decreasing their reliance on packaging materials. For instance, SF Express utilized recyclable packaging boxes capable of being recycled approximately ten times on average. Additionally, the presence of numerous key market players in the region accelerates innovation and adoption of sustainable practices. Overall, the combination of regulatory support, market demand, and technological advancement underpins Asia-Pacific's leadership in this sector.

North America has emerged as the fastest-growing region in the sustainable plastic packaging market. This growth is propelled by stringent regulations, rising consumer awareness, and increasing demand for eco-friendly packaging solutions. Companies in the region are investing heavily in research and development to innovate sustainable packaging materials and technologies. For instance, in June 2023, New York and Maine initiated bans on food packaging containing harmful chemicals, particularly per- and poly-fluoroalkyl substances (PFAS), commonly referred to as "forever chemicals." Consequently, packaging manufacturers face the task of creating sustainable, chemical-free packaging that meets the demands of their food and beverage clientele. The trend towards sustainability is reshaping the packaging landscape, with North America at the forefront in this industry.

Sustainable Plastic Packaging Market Players

Some of the top sustainable plastic packaging companies offered in our report include BASF SE, Mondi Group, Sonoco Products Company, DS Smith, Amcor PLC, Smurfit Kappa, Huhtamaki Oyj, Ball Corporation, Sealed Air Corporation, and Berry Global Inc.

Frequently Asked Questions

How big is the sustainable plastic packaging market?

The sustainable plastic packaging market size was valued at USD 102.7 Billion in 2023.

What is the CAGR of the global sustainable plastic packaging market from 2024 to 2032?

The CAGR of sustainable plastic packaging is 5.8% during the analysis period of 2024 to 2032.

Which are the key players in the sustainable plastic packaging market?

The key players operating in the global market are including BASF SE, Mondi Group, Sonoco Products Company, DS Smith, Amcor PLC, Smurfit Kappa, Huhtamaki Oyj, Ball Corporation, Sealed Air Corporation, and Berry Global Inc.

Which region dominated the global sustainable plastic packaging market share?

Asia-Pacific held the dominating position in sustainable plastic packaging industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of sustainable plastic packaging during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global sustainable plastic packaging industry?

The current trends and dynamics in the sustainable plastic packaging industry include growing consumer demand for eco-friendly packaging solutions, government regulations and policies promoting sustainable practices, and technological advancements in biodegradable and recyclable plastics.

Which type held the maximum share in 2023?

The rigid type held the maximum share of the sustainable plastic packaging industry.