Surgical Stapling Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Surgical Stapling Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

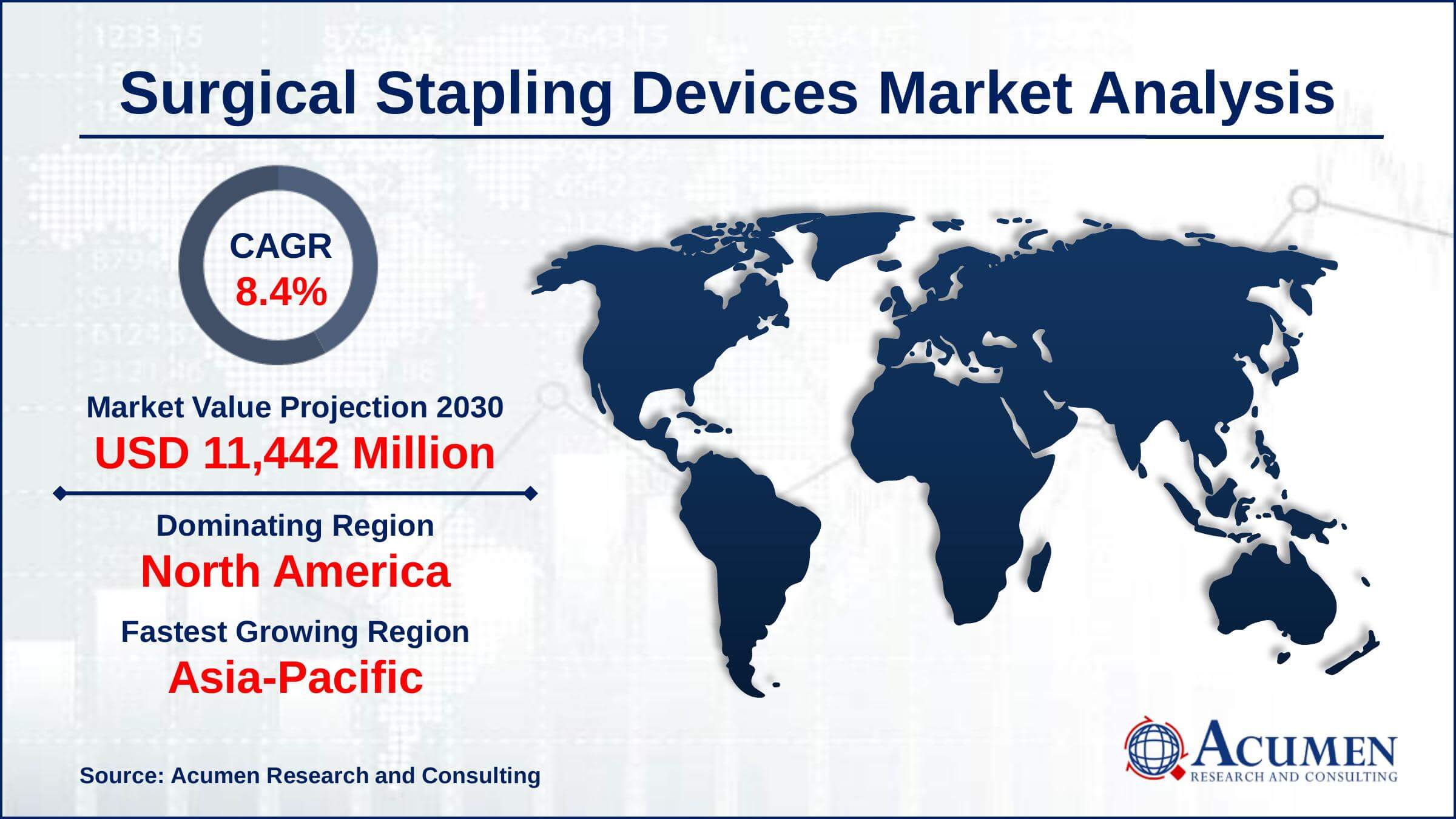

Request Sample Report

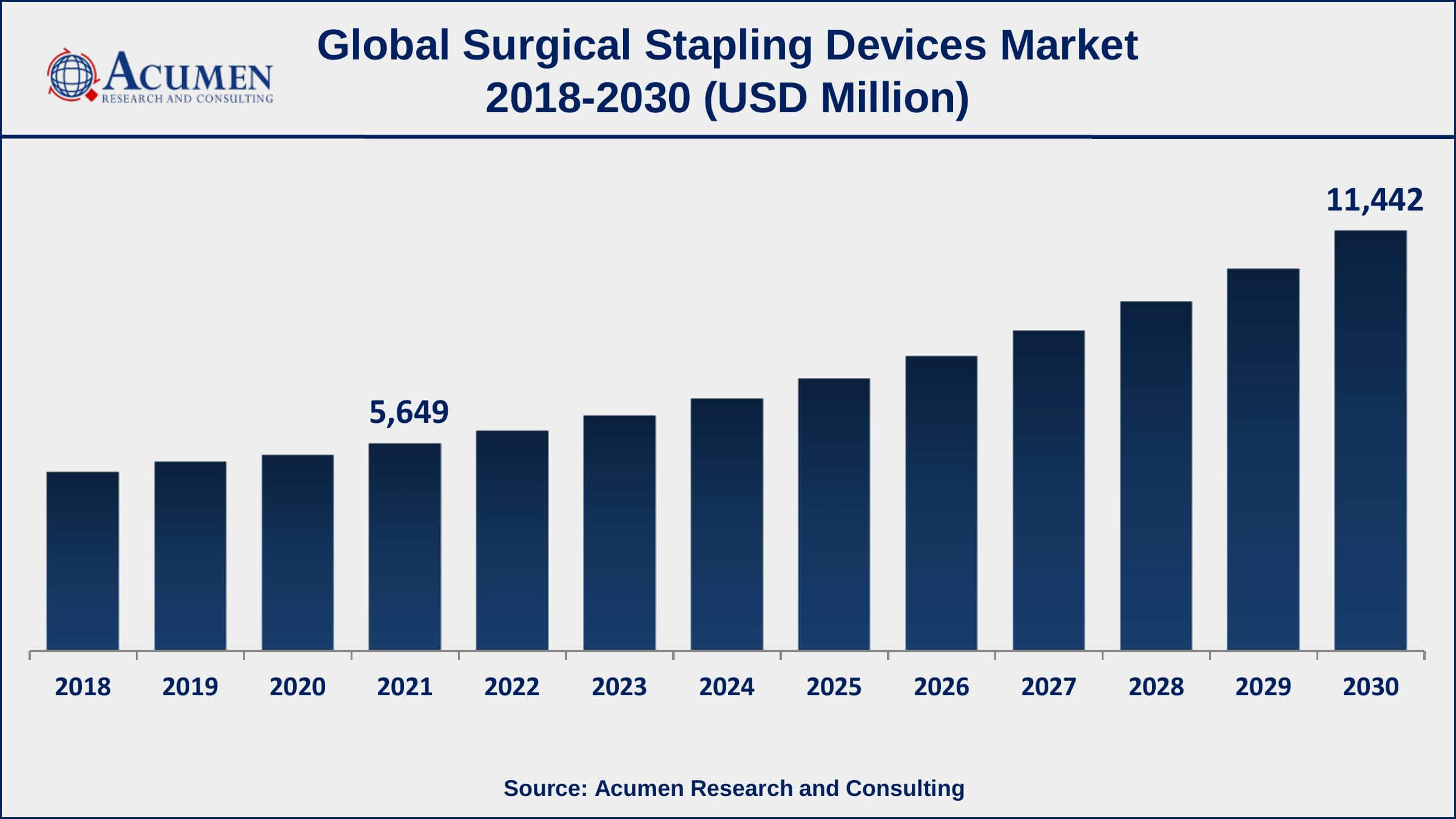

The Global Surgical Stapling Devices Market Size accounted for USD 5,649 Million in 2021 and is estimated to achieve a market size of USD 11,442 Million by 2030 growing at a CAGR of 8.4% from 2022 to 2030. The growing preferences for staples over sutures, as well as the increasing number of surgical procedures, have been the key growth drivers for the surgical stapling devices market value. Furthermore, the rising desire for minimally invasive treatments and the increasing use of surgical stapling devices in bariatric operations are some of the major factors expected to drive the surgical stapling devices market growth in the coming years.

Surgical Stapling Devices Market Report Key Highlights

- Global surgical stapling devices market revenue is expected to increase by USD 11,442 million by 2030, with a 8.4% CAGR from 2022 to 2030

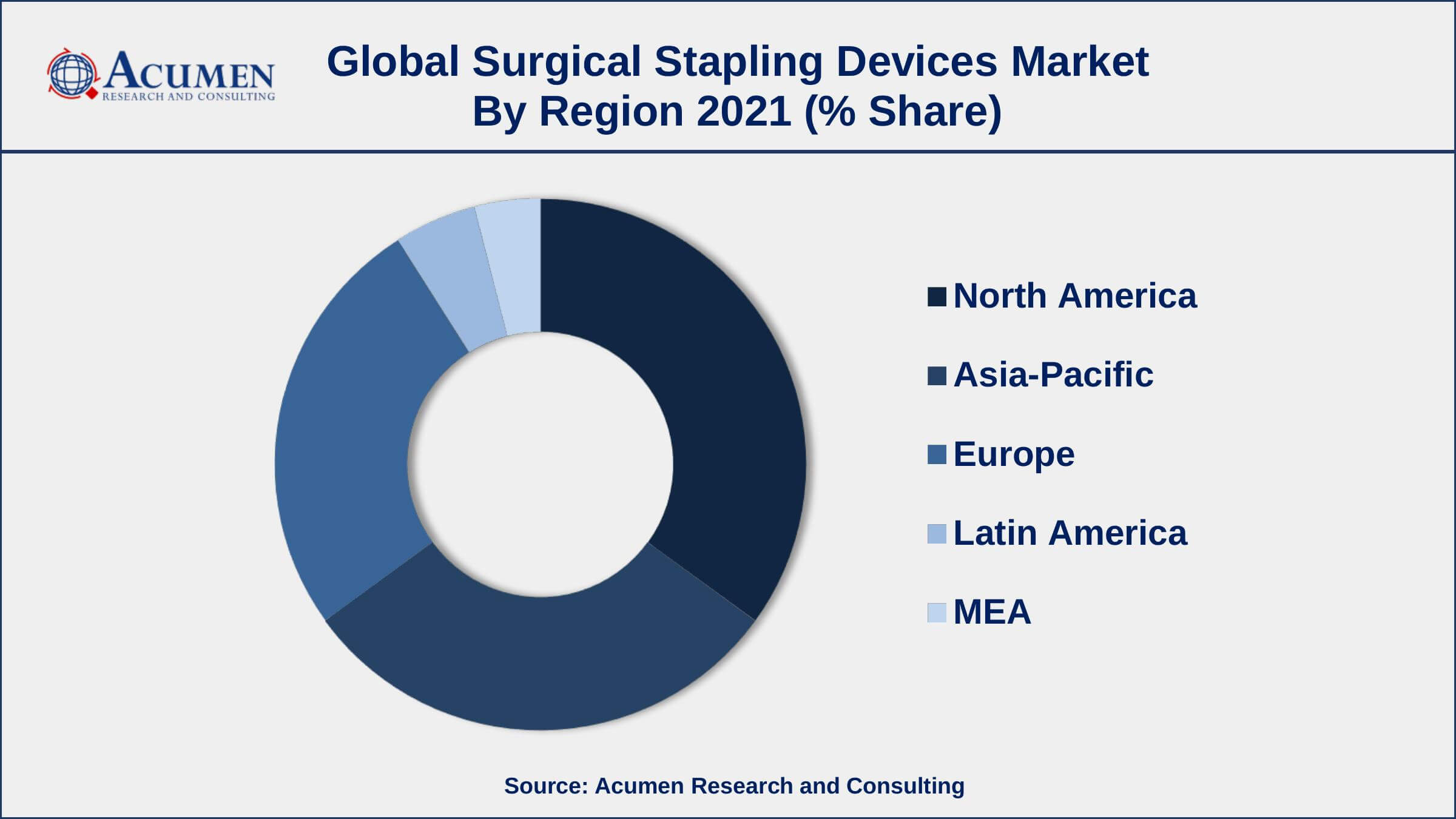

- North America region led with more than 48% of surgical stapling devices market share in 2021

- Asia-Pacific surgical stapling devices market growth will observe strongest CAGR from 2022 to 2030

- By type, the reusable segment has accounted market share of over 62% in 2021

- By product, manual devices segment engaged more than 59% of the total market share in 2021

- Increasing demand for minimally invasive surgery, drives the surgical stapling devices market size

Surgical staplers are surgical tools that can be utilized to replace sutures both externally and internally during surgeries or other diagnostic interventions. Surgical staplers are employed to close surgeries wounds or injuries that are too large or intricate for ordinary stitches to close. These are specialist instruments for sealing and/or closing both interior and exterior wounds. Surgical staplers are now favored over sutures globally because they are simpler, faster, highly accurate, and more reliable to utilize than hand stitches.

Global Surgical Stapling Devices Market Trends

Market Drivers

- Growing number of surgical procedures globally

- Increased demand for wound and tissue management devices

- Technological improvements in surgical staplers

- Rising obesity and awareness about bariatric surgeries

Market Restraints

- Increased risk of infections and other adverse effects

- Stringent safety regulations

Market Opportunities

- Increasing desire for minimally invasive surgery

- Growing adoption of robotic surgery

Surgical Stapling Devices Market Report Coverage

| Market | Surgical Stapling Devices Market |

| Surgical Stapling Devices Market Size 2021 | USD 5,649 Million |

| Surgical Stapling Devices Market Forecast 2030 | USD 11,442 Million |

| Surgical Stapling Devices Market CAGR During 2022 - 2030 | 8.4% |

| Surgical Stapling Devices Market Analysis Period | 2018 - 2030 |

| Surgical Stapling Devices Market Base Year | 2021 |

| Surgical Stapling Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Product, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ethicon, Inc., Stryker Corporation, Covidien plc (Medtronic plc), Zimmer Holdings, Inc., Conmed Corporation, Smith & Nephew plc, Cardica, Inc., CareFusion Corporation, and Alcon Laboratories Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The factors such as increasing awareness about surgical stapling devices and their applications are anticipated to boost the market growth. Also, the introduction of powered surgical devices and the increasing need for tissue & wound management is expected to further drive the market.

Over the past few years, the operational shift in the healthcare industry with technological integrations is creating an immense opportunity for the industry solution providers. The surgical stapling devices are one such devices with the more improved version of stitching used for internal as well as external wounds during surgeries. The manufacturers of surgical stapling devices are currently facing an increasing demand for these devices. The factors such as rising awareness about the availability of advanced medical solutions such as surgical stapling devices and their usage is expected to drive the market growth over the forecast period. Also, increasing healthcare expenditure in emerging economies in Asia Pacific, the Middle East, and others is likely to boost the surgical stapling devices market. Other factors such as the implementation of advanced technologies to perform endoscopic procedures and the rise in bariatric procedures are expected to boost the demand for these stapling devices from hospitals and other healthcare services providing organizations.

Surgical Stapling Devices Market Segmentation

The global surgical stapling devices market segmentation is based on type, product, end use, and geography.

Surgical Stapling Devices Market By Type

- Reusable

- Disposable

In terms of type, the disposable segment is projected to experience solid growth in the market during the forecast years, owing to the rising concerns about contagious diseases. Disposable staplers are widely used because they prevent surgical procedure-related infections, resulting in higher technical quality. Eliminating surgical staplers also aids in the prevention of infection transfer from the consumer to the medical professionals. Furthermore, the advantages of disposable staplers have included a lesser infection risk, and greater product offerings are expected to drive demand for the segment.

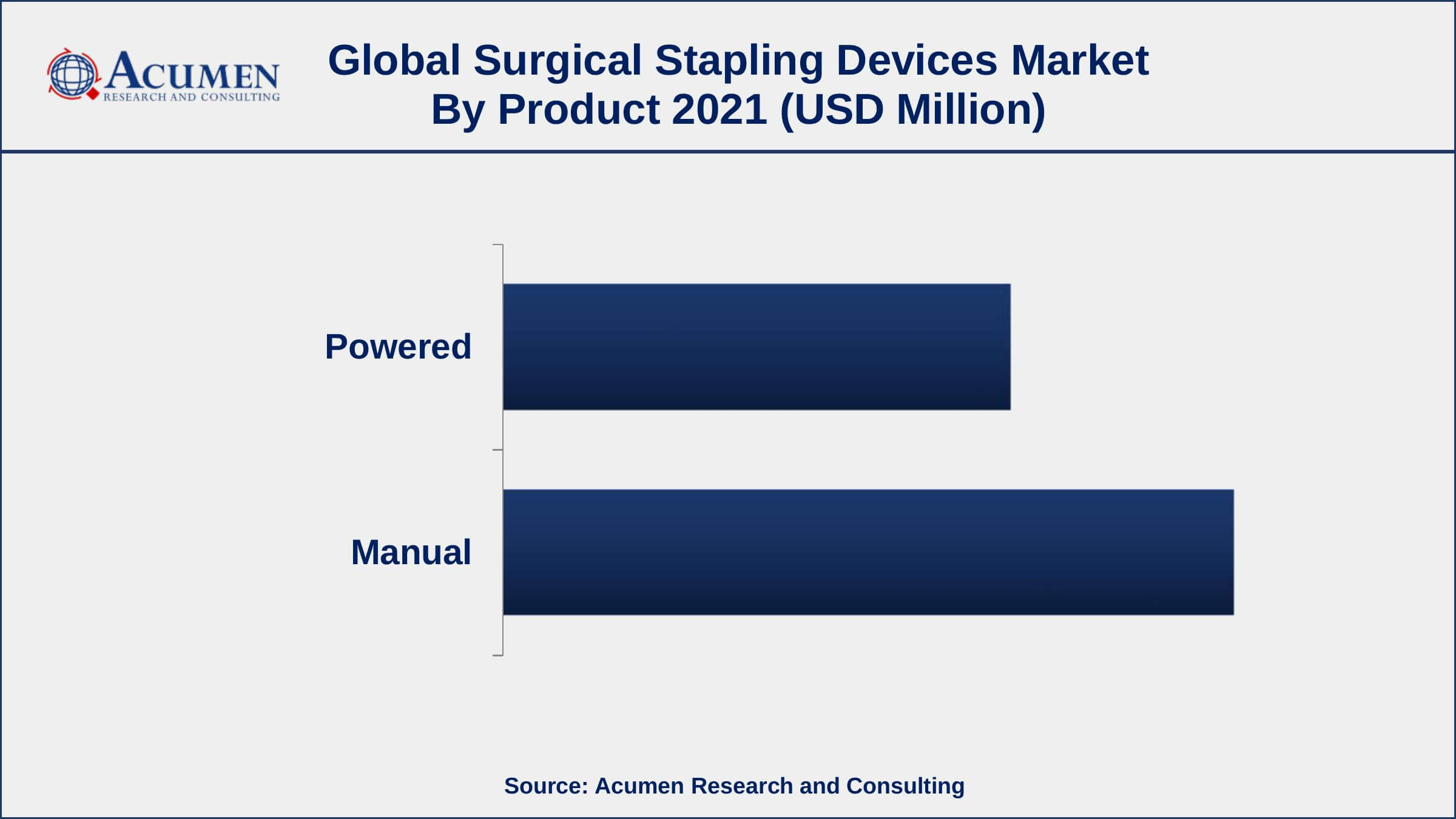

Surgical Stapling Devices Market By Product

- Powered

- Manual

According to the surgical stapling devices market forecast, powered stapling devices are predicted to grow at a higher rate throughout the projected timeline. The attractive features powered staplers get about manual staplers, such as the convenience of use, the minimal danger of issues like loss of blood or spillages, quicker surgical guides, and reduced hospital costs, is driving the expansion of this industry. The powered segment of the surgery staple demand is determined by many benefits such as exact wound contraction, stability, less leaks, and decreased compressive force. Increased research activities to improve the functionality of motorized surgical staplers will open up new potential for the sector's growth.

Surgical Stapling Devices Market By End Use

- Hospitals

- Ambulatory Centers

According to a surgical stapling devices industry analysis, the hospital segment dominates the market in 2021. Healthcare systems are increasingly scarce, particularly in low and middle-income countries, which may be related to the continued growth of outpatient commercial centers. Trends such as the increasing use of automated processes in surgery, which improves the results of minimally invasive treatments, are also expected to drive the industry. Advantageous bariatric surgery reimbursement regulations will also help hospitals maintain their dominance.

Surgical Stapling Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

North America Dominates The Global Surgical Stapling Devices Market

The North America and Europe region are dominating the global surgical stapling devices and are likely to retain their position over the forecast period. Being the quick adopter of new technologies in the healthcare sector, the North America region is holding a lion’s share in the overall market in terms of revenue in 2021. The rise in bariatric surgeries, the introduction of powered staples, and the growing need for tissue and wound management are expected to fuel the demand for surgical stapling devices in this region over the forecast period.

The Europe region is the second largest market for surgical stapling devices following North America. European countries are also some of the early pioneer countries in terms of adopting technically advanced equipment and this factor is boosting the growth of surgical stapling devices and hence driving the market growth. On the other hand, the Asia-Pacific region is anticipated to register the highest CAGR growth rate over the forecast period due to the increasing expenditure by healthcare service providers on delivering improved healthcare solutions to their patients. The rapid changes in lifestyle and increasing disposable incomes resulted in an increasing diseased population and this is expected to create immense scope for growth of this market in this region. Also, the increasing number of patients is leading to increasing in surgical operations and hence expected to drive the surgical stapling devices market.

Surgical Stapling Devices Market Players

The leading players present in the surgical stapling devices market are currently undergoing rapid product innovations and focusing on untapped markets to fuel the revenue pocketing process through the sale of surgical stapling devices. Some of the top surgical stapling devices market companies offered in the professional report include Ethicon, Inc., Stryker Corporation, Covidien plc (Medtronic plc), Zimmer Holdings, Inc., Conmed Corporation, Smith & Nephew plc, Cardica, Inc., CareFusion Corporation, and Alcon Laboratories Inc.

Frequently Asked Questions

What is the size of global surgical stapling devices market in 2021?

The estimated value of global surgical stapling devices market in 2021 was accounted to be USD 5,649 Million.

What is the CAGR of global surgical stapling devices market during forecast period of 2022 to 2030?

The projected CAGR surgical stapling devices market during the analysis period of 2022 to 2030 is 8.4%.

Which are the key players operating in the market?

The prominent players of the global surgical stapling devices market are Ethicon, Inc., Stryker Corporation, Covidien plc (Medtronic plc), Zimmer Holdings, Inc., Conmed Corporation, Smith & Nephew plc, Cardica, Inc., CareFusion Corporation, and Alcon Laboratories Inc.

Which region held the dominating position in the global surgical stapling devices market?

North America held the dominating surgical stapling devices market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for surgical stapling devices market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global surgical stapling devices market?

Growing number of surgical procedures and increased demand for wound and tissue management device drives the growth of global surgical stapling devices market.

By product segment, which sub-segment held the maximum share?

Based on product, manual segment is expected to hold the maximum share of the surgical stapling devices market.