Sulfuric Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Sulfuric Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

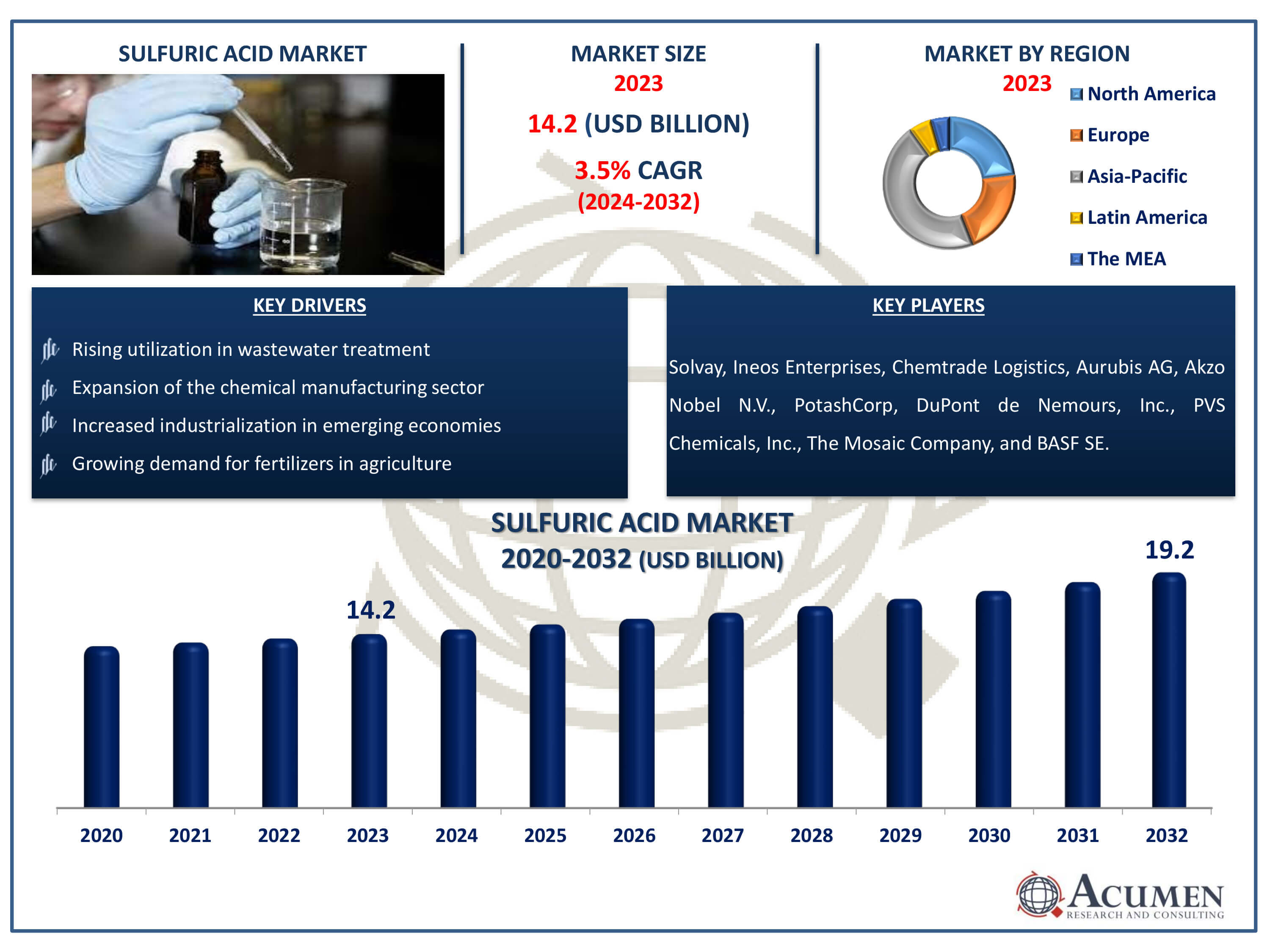

The Sulfuric Acid Market Size accounted for USD 14.2 Billion in 2023 and is estimated to achieve a market size of USD 19.2 Billion by 2032 growing at a CAGR of 3.5% from 2024 to 2032.

Sulfuric Acid Market Highlights

- Global sulfuric acid market revenue is poised to garner USD 19.2 billion by 2032 with a CAGR of 3.5% from 2024 to 2032

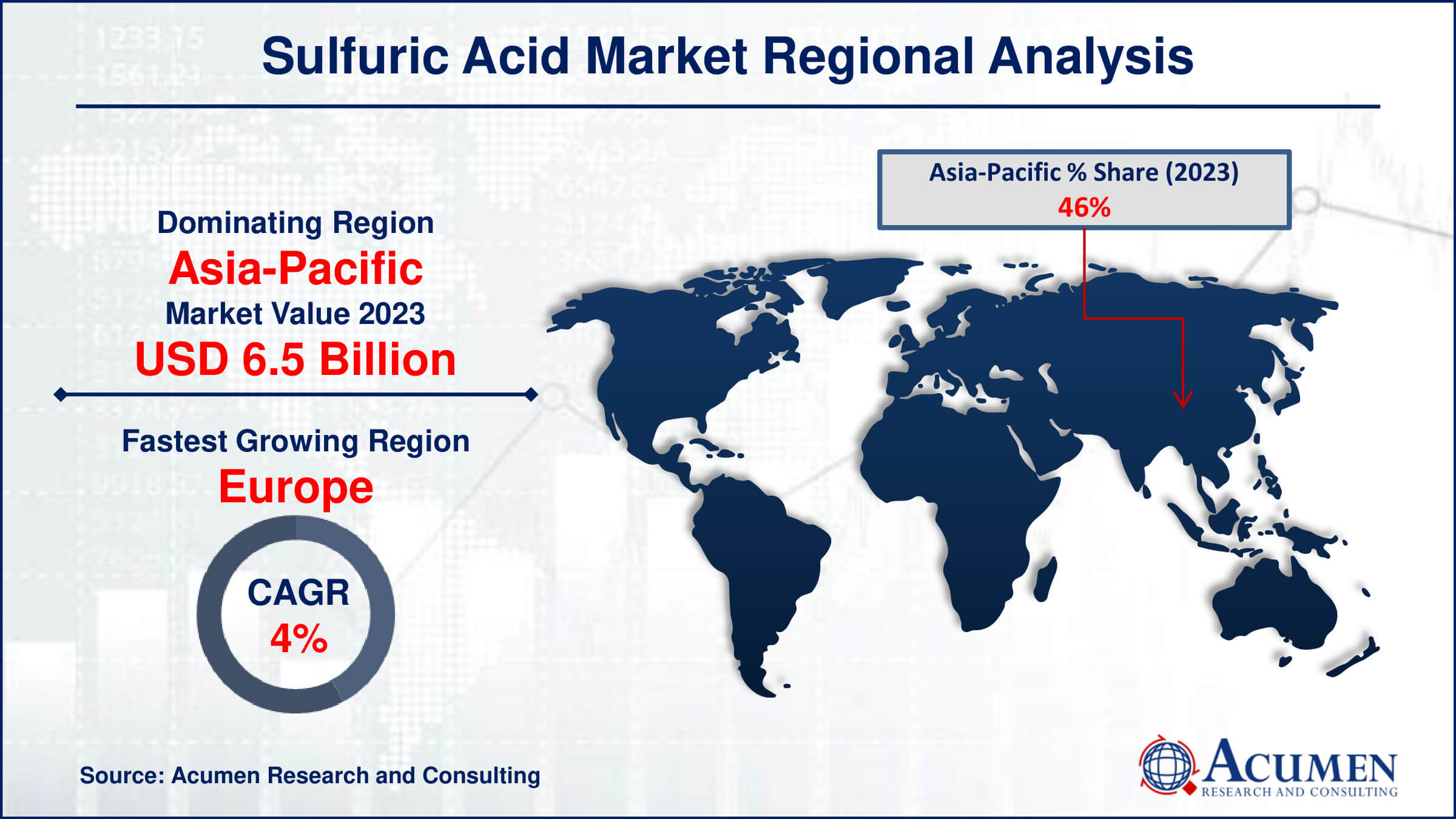

- Asia-Pacific sulfuric acid market value occupied around USD 6.5 billion in 2023

- Europe sulfuric acid market growth will record a CAGR of more than 4% from 2024 to 2032

- Among raw material type, the elemental sulfur sub-segment generated more than USD 7.5 billion revenue in 2023

- Based on application, the fertilizers sub-segment generated around 55% market share in 2023

- Expansion of sulfuric acid applications in new industries is a popular sulfuric acid market trend that fuels the industry demand

Sulfuric acid, also called oil of vitriol, is a mineral acid with the chemical formula H?SO?, comprising sulfur, oxygen, and hydrogen. It appears as a colorless, odorless, viscous liquid that is highly miscible with water. Pure sulfuric acid is not found naturally on Earth because it is hygroscopic, meaning it eagerly absorbs water vapor from the air. This acid acts as a potent oxidant with strong dehydrating properties, making concentrated sulfuric acid highly corrosive to many substances, including rocks and metals. As a critical industrial chemical, the production of sulfuric acid is a key indicator of a country’s industrial capacity. It is produced through various methods, including the contact process, the wet sulfuric acid process, and the lead chamber process. In the chemical industry, sulfuric acid is primarily used in the manufacture of fertilizers. Additionally, it plays a significant role in mineral processing, oil refining, wastewater treatment, and chemical synthesis.

Global Sulfuric Acid Market Dynamics

Market Drivers

- Growing demand for fertilizers in agriculture

- Increased industrialization in emerging economies

- Expansion of the chemical manufacturing sector

- Rising utilization in wastewater treatment

Market Restraints

- Stringent environmental regulations

- Fluctuating raw material prices

- Health hazards associated with handling sulfuric acid

Market Opportunities

- Development of sustainable production methods

- Technological advancements in manufacturing processes

- Increasing investment in research and development

Sulfuric Acid Market Report Coverage

| Market | Sulfuric Acid Market |

| Sulfuric Acid Market Size 2022 | USD 14.2 Billion |

| Sulfuric Acid Market Forecast 2032 | USD 19.2 Billion |

| Sulfuric Acid Market CAGR During 2023 - 2032 | 3.5% |

| Sulfuric Acid Market Analysis Period | 2020 - 2032 |

| Sulfuric Acid Market Base Year |

2022 |

| Sulfuric Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material Type, By Purity Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Solvay, Ineos Enterprises, Chemtrade Logistics, Aurubis AG, Akzo Nobel N.V., PotashCorp, DuPont de Nemours, Inc., PVS Chemicals, Inc., The Mosaic Company, and BASF SE. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sulfuric Acid Market Insights

Increased industrialization in emerging economies is driving the sulphuric acid industry. As nations such as China, India, and Brazil experience fast industrial growth, the demand for sulfuric acid has increased due to its use in different industrial processes. Sulfuric acid is required in the production of fertilizers, which helps to support these regions thriving agricultural sectors. It is also widely utilized in the manufacturing of chemicals, petroleum refining, and metal processing, all of which are growing rapidly in emerging countries. The construction of new infrastructure, growth in the automotive industry, and increased energy demands are all driving up demand for sulfuric acid. This industrial growth not only boosts sulfuric acid consumption, but it also drives investment in production facilities, reinforcing market demand. Overall, the industrialization trend in these developing countries drives the worldwide sulfuric acid market ahead, emphasizing its critical significance in industrial development.

Stringent environmental rules impose major constraints on the sulfuric acid market. Sulfuric acid manufacturing and use include processes that, if not effectively managed, can cause significant environmental contamination. Governments around the world, particularly in industrialized countries, have imposed stringent rules to limit sulfuric acid plant emissions and effluents. These restrictions frequently compel businesses to invest extensively in pollution control systems and meet stringent environmental standards, which can significantly raise manufacturing costs. Also, noncompliance with these standards can result in significant fines, legal action, and even shutdowns, all of which can hinder market growth. To avoid accidents and environmental contamination, sulfuric acid must be handled, stored, and transported in accordance with strict safety requirements. While these rules are critical for environmental protection and public health, they can limit the expansion of sulfuric acid manufacturing facilities and create hurdles for market participants, particularly small and medium-sized businesses that may struggle with the financial cost of compliance.

Sulfuric Acid Shortage

Sulfuric acid is a really important chemical that's used a lot in industry. It's actually the most produced chemical in the world! But right now, there's not enough of it to go around. This shortage is causing problems, especially in making fertilizers, which are super important for growing food. Fertilizer production uses most of the sulfuric acid made. If there's not enough sulfuric acid, there won't be enough fertilizer, and that's bad news for farming. But that's not all. Sulfuric acid is also crucial for making car batteries, which are needed for electric cars and other vehicles. With the shortage, carmakers might struggle to make enough batteries, adding to the problems they're already having because of the global shortage of computer chips. So, basically, the sulfuric acid shortage is making things tough for both farming and making cars.

Sulfuric Acid Market Segmentation

The worldwide market for sulfuric acid is split based on raw material type, purity type application, and geography.

Sulfuric Acid Raw Material Types

- Elemental Sulfur

- Pyrite Ore

- Base Metal Smelters

- Others

According to sulfuric acid industry analysis, in 2023, the elemental sulfur segment is projected to hold the largest market share. Elemental sulfur sources are renowned for their high acidity levels, which contribute to their effectiveness in sulfuric acid production. This segment's rapid expansion can be attributed to its efficiency and minimal environmental footprint compared to other raw materials. Furthermore, the abundant supply of elemental sulfur on the market renders it a highly cost-effective option for sulfuric acid manufacturing processes.

Sulfuric Acid Purity Types

- Standard

- Ultra-pure

The ultra-pure segment is experiencing significant growth in the market, driven by its extensive use in the electrical and electronic industries. Industries like manufacturing printed circuit boards (PCBs) and photovoltaic cells heavily rely on ultra-pure sulfuric acid. With the rapid expansion of these sectors, the demand for sulfuric acid is expected to rise steadily. Additionally, the pharmaceutical industry utilizes ultra-pure sulfuric acid in the production of certain pharmaceutical products. Given the pharmaceutical industry's swift growth, it is poised to benefit from increased market demand in the sulfuric acid industry forecast period.

Sulfuric Acid Applications

- Fertilizers

- Chemical manufacturing

- Metal Processing

- Petroleum Refining

- Textile Industry

- Automotive

- Pulp & Paper

- Others

Fertilizers are expected to be the leading application driving the global sulfuric acid market in 2023. Sulfuric acid plays a crucial role in producing phosphate fertilizers, including lime superphosphate and ammonium sulfate. As the world's population continues to grow, there's a rising demand for higher-quality food crops. To meet this demand and increase crop yield, farmers rely on chemicals such as fertilizers. Consequently, the escalating use of sulfuric acid in fertilizer production is anticipated to be a significant factor fueling the industry growth in the sulfuric acid market forecast period.

Sulfuric Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sulfuric Acid Market Regional Analysis

The Asia Pacific region, including countries like China, India, and Japan, is leading the global sulfuric acid market. This is because these countries have a high demand for sulfuric acid in industries like chemicals, fertilizers, and manufacturing. As the population in this region grows, so does the need for food, which drives up the demand for sulfuric acid in making fertilizers. In India specifically, there's a growing demand for sulfuric acid because of increased production of phosphoric acid and specialty fertilizers. Despite this, India is expected to import quite a bit of sulfuric acid in 2023, according to estimates by Argus.

In terms of sulfuric acid market analysis, in Europe, there's also expected to be a big growth in the sulfuric acid market, mainly because more sulfuric acid is needed for making fertilizers.

Sulfuric Acid Market Players

Some of the top sulfuric acid companies offered in our report includes Solvay, Ineos Enterprises, Chemtrade Logistics, Aurubis AG, Akzo Nobel N.V., PotashCorp, DuPont de Nemours, Inc., PVS Chemicals, Inc., The Mosaic Company, and BASF SE.

- In August 2021, Sumitomo Chemical made a significant decision to boost its production of high-purity chemicals for semiconductors. They plan to install new production lines at their Ehime Works in Japan and Dongwoo Fine-Chem Co., Ltd.'s Iksan Plant in South Korea. This move aims to double the capacity for high-purity sulfuric acid, catering to the growing demand in the semiconductor industry.

- In a separate development in July 2021, BASF, in collaboration with Zhejiang Jiahua Energy Chemical Industry Co. Ltd. and Zhejiang Jiafu New Material Technology Co. Ltd., announced plans to expand the production capacity of an electronic-grade sulfuric acid plant in China. These investments are aimed at more than doubling BASF's current sulfuric acid capacity in China. This expansion will enable BASF to better meet the escalating needs of the semiconductor industry in the region.

Frequently Asked Questions

How big is the sulfuric acid market?

The sulfuric acid market size was valued at USD 14.2 billion in 2023.

What is the CAGR of the global sulfuric acid market from 2024 to 2032?

The CAGR of Sulfuric Acid is 3.5% during the analysis period of 2024 to 2032.

Which are the key players in the sulfuric acid market?

The key players operating in the global market are including Solvay, Ineos Enterprises, Chemtrade Logistics, Aurubis AG, Akzo Nobel N.V., PotashCorp, DuPont de Nemours, Inc., PVS Chemicals, Inc., The Mosaic Company, and BASF SE.

Which region dominated the global sulfuric acid market share?

Asia-Pacific held the dominating position in sulfuric acid industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of sulfuric acid during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global sulfuric acid industry?

The current trends and dynamics in the sulfuric acid industry include growing demand for fertilizers in agriculture, increased industrialization in emerging economies, expansion of the chemical manufacturing sector, and rising utilization in wastewater treatment.

Which application held the maximum share in 2023?

The fertilizers application held the maximum share of the sulfuric acid industry.