Subsea Power Grid Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Subsea Power Grid Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Subsea Power Grid Systems Market Size accounted for USD 1.5 Billion in 2022 and is estimated to achieve a market size of USD 4.6 Billion by 2032 growing at a CAGR of 11.7% from 2023 to 2032.

Subsea Power Grid Systems Market Highlights

- Global subsea power grid systems market revenue is poised to garner USD 4.6 billion by 2032 with a CAGR of 11.7% from 2023 to 2032

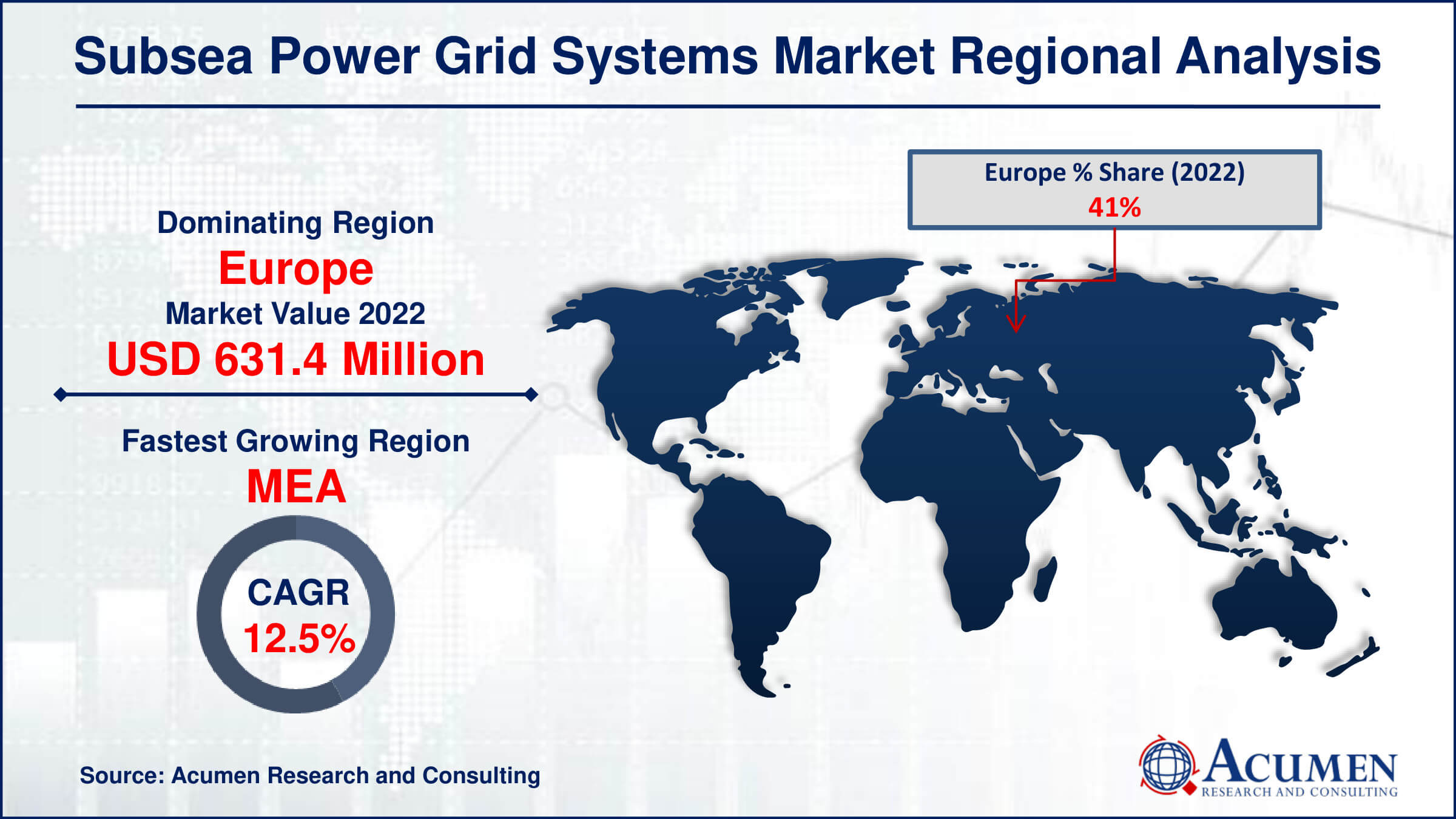

- Europe subsea power grid systems market value occupied around USD 631.4 million in 2022

- MEA subsea power grid systems market growth will record a CAGR of more than 12.5% from 2023 to 2032

- Among power supply, the wind power sub-segment generated more than USD 893.2 million revenue in 2022

- Based on component, the cables sub-segment generated around 60% market share in 2022

- Emergence of new underwater power transmission technologies is a popular subsea power grid systems market trend that fuels the industry demand

The methods of producing distributed energy vary across countries worldwide, and the demand from oil and gas companies for power systems to manage numerous equipment fuels development in the subsea power grid system market. Moreover, the market for subsea energy grid services is booming due to discoveries of oil and gas in deep and ultra-depth oceans. Furthermore, the growth of the subsea power system industry is driven by an increasing emphasis on producing electricity from renewable sources such as ocean wind, solar, and tidal power.

Global Subsea Power Grid Systems Market Dynamics

Market Drivers

- Increasing offshore oil and gas exploration activities

- Growing demand for renewable energy sources

- Technological advancements in the power sector

- Rising energy demand from developing economies

Market Restraints

- High initial investment costs

- Regulatory challenges and environmental concerns

- Limited accessibility in remote underwater locations

Market Opportunities

- Expansion of offshore wind energy projects

- Integration of energy storage solutions

- Collaboration with key players for innovation and development

Subsea Power Grid Systems Market Report Coverage

| Market | Subsea Power Grid Systems Market |

| Subsea Power Grid Systems Market Size 2022 | USD 1.5 Billion |

| Subsea Power Grid Systems Market Forecast 2032 |

USD 4.6 Billion |

| Subsea Power Grid Systems Market CAGR During 2023 - 2032 | 11.7% |

| Subsea Power Grid Systems Market Analysis Period | 2020 - 2032 |

| Subsea Power Grid Systems Market Base Year |

2022 |

| Subsea Power Grid Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Power Supply, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aker Solutions, Bandak Group, Cameron International, Dril-Quip, Expro International Group Holdings, FMC Technologies, General Electric, JDR Cable Systems (Holdings), Nexans, and Norddeutsche Seekabelwerke. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Subsea Power Grid Systems Market Insights

The rising amount of oil and gas exploration being done throughout the world is expected to result in a considerable growth in the demand for subsea power grid systems. The rivalry for subsea power grid systems is getting more intense as offshore oil and gas systems expand due to the depletion of fossil fuels and onshore oil sources. The market for subsea power systems is predicted to rise as a result of this increased competition. In addition, it is expected that the expanding global market would be fueled by the rising energy demand from different economies around the globe, especially from emerging nations.

Furthermore, technical developments in the energy and power industries are expected to spur an increase in worldwide demand. Underwater electrical grid systems are more important since reserves are running low and demand more power for compression and pumping. As a result, throughout the anticipated term, the growth of worldwide subsea power grid systems is driven by the rising demand for subsea power grid systems.

The importance of subsea power grid systems is highlighted by the growing demand for energy and the need to transition to sustainable energy alternatives. Subsea power grid systems are becoming more and more important as the world economy looks to move away from fossil fuels and towards renewable energy sources. Subsea power grid systems are becoming more and more in demand as a result of the need for dependable and efficient power distribution solutions brought on by the exploitation of new oil and gas deposits in harsh and isolated locations.

Subsea Power Grid Systems Market Segmentation

The worldwide market for subsea power grid systems is split based on component, power supply, application, and geography.

Subsea Power Grid System Market By Component

- Cables

- Variable Speed Drives

- Transformers

- Switchgears

- Others

According to subsea power grid systems industry analysis, the cables category is the largest in the market, is essential to the effective transfer of electrical power throughout subsea settings. In order to deliver electricity from power production sources to diverse subsea installations, such as offshore oil and gas platforms, renewable energy farms, and undersea infrastructure, cables are essential to subsea power grids. There are several reasons for the cables segment's dominance. First, the deployment of subsea cables to link different parts of these grids is developing in tandem with the expansion and evolution of subsea power grids to satisfy the increasing demand for energy generation and distribution in offshore settings. Furthermore, developments in cable technology, like as fiber-optic and high-voltage direct current (HVDC) cables, allow for dependable and efficient transmission across extended distances and in difficult underwater environments. Subsea cables are needed to link offshore wind and tidal energy projects to onshore power grids, and this need is further driven by the growing use of renewable energy sources. Subsea cables are also needed to power offshore platforms and equipment, which is a result of continuous investments in offshore oil and gas exploration and production.

Subsea Power Grid System Market By Power Supply

- Captive Generation

- Wind Power

- Others

The subsea power grid systems market is dominated by the wind power category, which is a major contributor to the production of electricity in offshore environments. The primary factor propelling the Wind Power segment's domination globally is the offshore wind energy projects' fast expansion. Offshore wind farms have enormous potential for producing clean, renewable power by utilising the plentiful and reliable wind resources found at sea. Offshore wind power has become an essential part of the global energy transition as governments and energy businesses prioritise decarbonisation and move towards sustainable energy sources. Offshore wind projects are becoming more feasible and appealing due to technological developments in wind turbines, such as bigger turbine capacity and creative floating offshore wind platforms. Thanks to favourable government regulations, falling costs, and technical improvements, the wind power segment has grown rapidly and is now the major power supply source in the subsea power grid systems market.

Subsea Power Grid System Market By Application

- Deep-Sea Power Supply System

- Shallow Sea Power Supply System

With a larger market share than any other section, the deep-sea power supply system category leads the market and it is expected to grow over the subsea power grid systems industry forecast period. This dominance is mostly due to the growing need in deep-sea environments where conventional power transmission techniques are either unfeasible or insufficient for dependable and efficient power supply solutions. Remote subsea facilities at considerable depths, offshore oil and gas platforms, and undersea mining activities all depend heavily on deep-sea power supply systems. High-voltage direct current (HVDC) transmission and subsea cables that can endure high pressure and hostile environmental conditions are two examples of the cutting-edge technology used in these systems. Deep-sea power supply systems are also in high demand due to the discovery and development of deep-sea energy resources, such as offshore wind farms and oil and gas deposits. The deep-sea power supply system sector is anticipated to hold onto its top spot in the subsea power grid systems market as businesses continue to expand into deeper seas. This segment will meet the increasing demands of subsea infrastructure and offshore energy production.

Subsea Power Grid Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Subsea Power Grid Systems Market Regional Analysis

In terms of subsea power grid systems market analysis, Europe is the largest regional market, with a substantial concentration of offshore oil and gas production facilities, renewable energy projects, and improvements in undersea infrastructure. The region's prominence may be ascribed to several sources, including substantial investments in offshore wind farms and subsea cable networks, as well as major offshore exploration and production activity in the North Sea, Baltic Sea, and Mediterranean Sea. Throughout addition, strict environmental laws and programs encouraging the use of renewable energy have increased demand for subsea power grid systems throughout Europe. Europe is anticipated to retain its leadership in the subsea power grid systems market due to its developed energy sector and emphasis on sustainability, which will present profitable prospects for industry participants and technical breakthroughs.

However, the subsea power grid systems market is expanding at the quickest rate in the Middle East and Africa area. The expanding discovery and production of offshore oil and gas, especially in nations like Saudi Arabia, the United Arab Emirates, and Nigeria, is responsible for the region's fast expansion. The need for subsea power grid systems in the area is also being driven by rising investments in offshore renewable energy projects, such as offshore wind and solar farms. Initiatives to diversify the energy mix and improve energy security are also anticipated to drive market expansion in the Middle East and Africa. Notwithstanding obstacles like unstable political environments and unclear regulations, the region's unrealized potential and rising energy consumption make it a crucial growth in the subsea power grid systems market forecast period.

Subsea Power Grid Systems Market Players

Some of the top subsea power grid systems companies offered in our report includes Aker Solutions, Bandak Group, Cameron International, Dril-Quip, Expro International Group Holdings, FMC Technologies, General Electric, JDR Cable Systems (Holdings), Nexans, and Norddeutsche Seekabelwerke.

Frequently Asked Questions

How big is the subsea power grid systems market?

The subsea power grid systems market size was valued at USD 1.5 billion in 2022.

What is the CAGR of the global subsea power grid systems market from 2023 to 2032?

The CAGR of subsea power grid systems is 11.7% during the analysis period of 2023 to 2032.

Which are the key players in the subsea power grid systems market?

The key players operating in the global market are including Aker Solutions, Bandak Group, Cameron International, Dril-Quip, Expro International Group Holdings, FMC Technologies, General Electric, JDR Cable Systems (Holdings), Nexans, and Norddeutsche Seekabelwerke.

Which region dominated the global subsea power grid systems market share?

Europe held the dominating position in subsea power grid systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

MEA region exhibited fastest growing CAGR for market of subsea power grid systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global subsea power grid systems industry?

The current trends and dynamics in the subsea power grid systems industry include increasing offshore oil and gas exploration activities, growing demand for renewable energy sources, technological advancements in the power sector, and rising energy demand from developing economies.

Which power supply held the maximum share in 2022?

The wind power supply held the maximum share of the subsea power grid systems industry.