Styrene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2021 - 2028

Published :

Report ID:

Pages :

Format :

Styrene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2021 - 2028

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

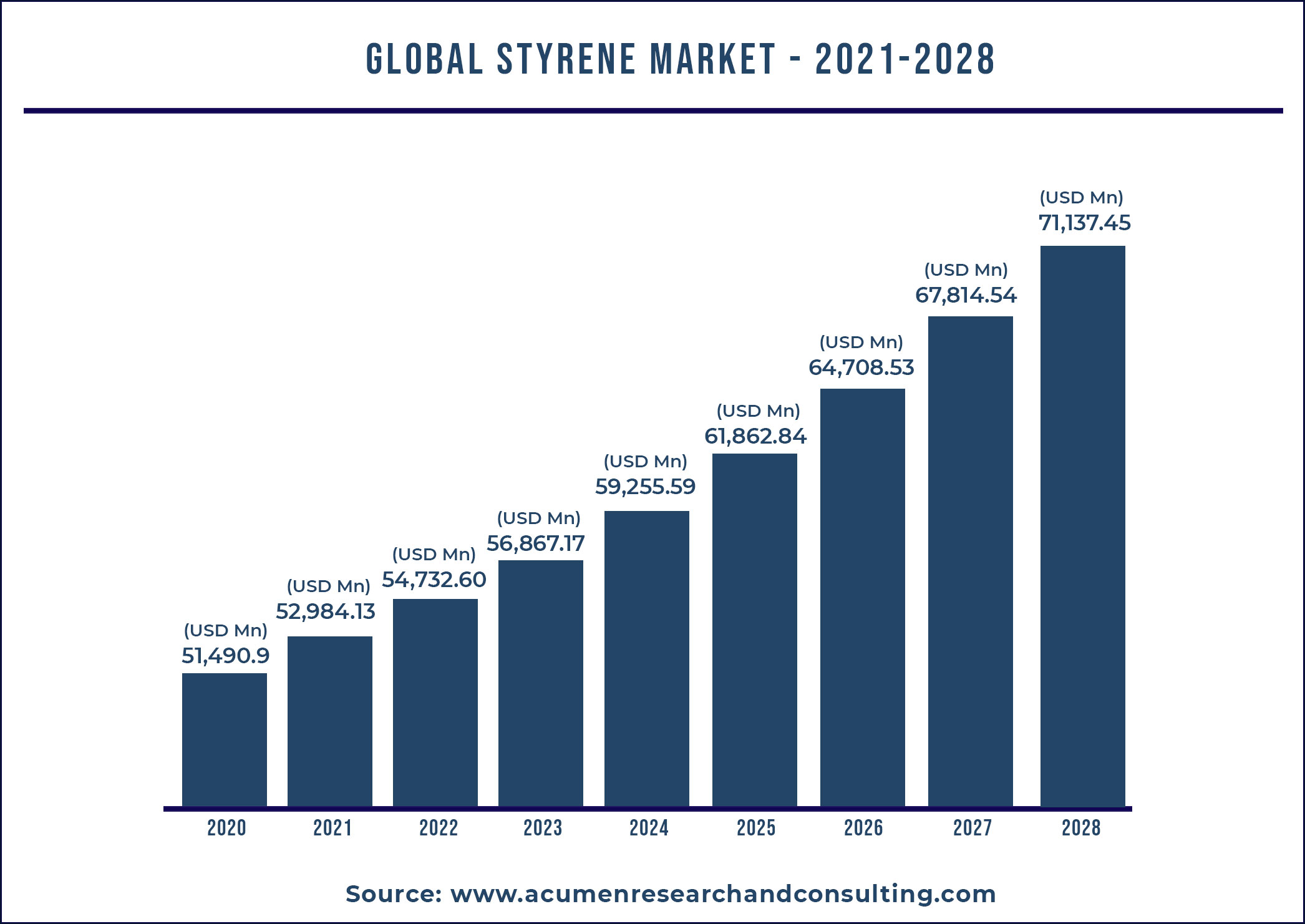

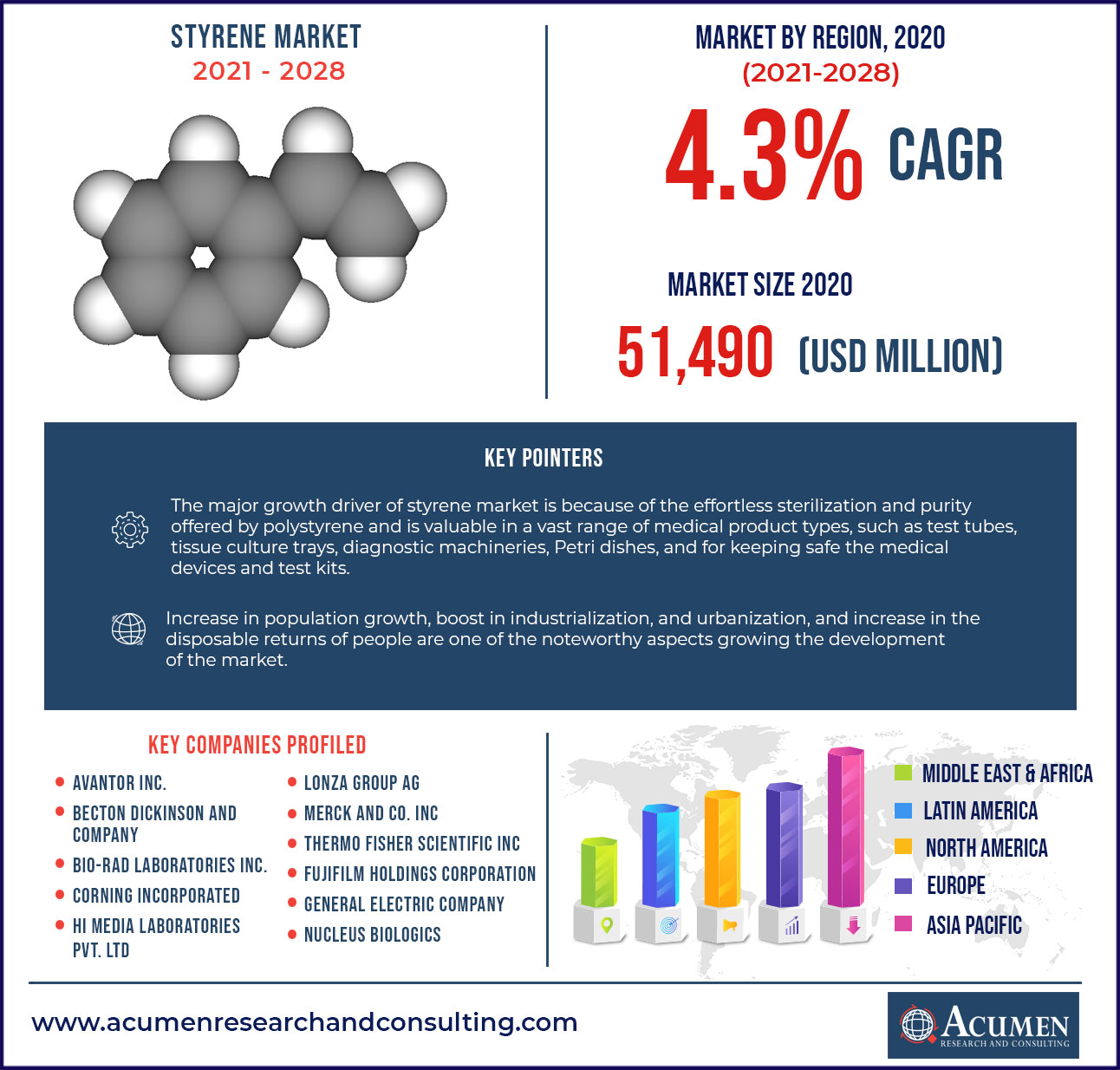

The Global Styrene Market accounted for US$51,490Mn in 2020 and is expected to grow at a considerable CAGR of 4.3% during the forecast period from 2021 to 2028.

Styrene is a natural derivative of benzene with sweet odor. It is a solvent in nature and a colorless greasy liquid, although a matured sample can be seen yellowish in color. Styrene is used to produce latex, artificial rubber, and polystyrene resins. By chemical process on styrene, it can be used to manufacture polystyrene, which is a sturdy plastic with different qualities. Styrene resins are also used to produce products such as plastic wrapping, disposable cups, and cross-linking agents in polyester resins in fiberglass, automobile interior and exterior modules, tires, extruded polystyrene (EPS) tubes and pipes, and also in assembling product types such as lighting and plumbing equipment, insulation foam, bath and shower parts, and panels along with others.

Market Growth Drivers:

- The numerous applications of styrene in plastic packaging, insulation, disposable cups and containers, etc. are presently driving the market growth.

- Acrylonitrile butadiene styrene (ABS), owing to its performance characteristics, is an important material in manufacturing of a number of medical equipment.

- ABS is largely used in 3D printing applications by OEMs. The rigidity and heat resistant capability of ABS makes it the best alternative for metals in different structural parts. It is also used automotive industry to reduce the overall vehicle weight and increase fuel efficiency.

Market Restraints

- The adverse effects of styrene on human health such as fatigue, headache, vomiting, and nausea, when worked in close proximity is restricting its usage. Also, the improper disposal practice of styrene adds to environmental effects such as global warming. As a result, governments are planning to take necessary measures to limit the usage of styrene or promote the use of substitute products, which might hinder the market growth of styrene in near term.

- Divinylbenzene is a derivative of benzene and has structure similar to that of styrene. It is easily available in the market and can partially or completely replace styrene. Thus, rising usage of divinylbenzene in the manufacturing processes of plastics, adhesives, ceramics, and specialty polymers is hindering the growth of styrene market to some extent.

- The factor known as bio-plastic which is derived for plants such as sugarcane, corn and other forms of cellulose can act as a restraint for the market growth.

Market Opportunities:

- The expanded polystyrene can be manufactured from materials which can be recycled. As a result, it is widely used in sustainable packaging products.

- Expanded styrene is largely being used for packaging purpose in e-commerce, fast moving consumer goods (FMCG), household electrical devices, and personal care sectors. This trend is expected to continue in near future which has created ample opportunities for styrene producers.

Report Coverage:

| Market | Styrene Market |

| Market Size 2020 | US $51,490 Mn |

| Market Forecast 2028 | US $71,137 Mn |

| CAGR | 4.3 % During 2021 - 2028 |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Product Type, By End-User and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ashland Inc., Royal DSM, Mitsubishi Chemicals, Nova Chemicals Corporation, Alpek SAB DE CV, The Dow Chemical Company, Bayer Material Science, LG Chem, Chevron Philips Chemical Company, IneosStyrolution Group GmbH, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Market Dynamics

Polystyrene, it is a chemically processed material from styrene, which is a hard plastic, preferred material used for electrical insulation. It is moisture resistant in nature and considered for safe packaging of the devices while transporting. Polystyrene can be recycled easily, which is the major advantage offered by this product. Polystyrene packaging offers exceptional shock absorbent capacity and guarantees the utmost safety of products. The rising requirement for different electronics devices and gadgets and fragile equipment that needs more well-organized and secure packaging materials and solutions throughout the storage process and shipping is estimated to boost market revenue growth during the forecast period. Furthermore, there is an increased dependency on online shopping as it offers ease in ordering anywhere-anytime, and discounts given by the online shopping platforms. Thus, significant increase in online shopping, specifically of electronic goods and fragile items, is subsequently resulting in the rise in demand for packaging materials and supplies.

COVID-19 pandemic, regulatory guidelines for lockdown, and social distancing restrictions imposed by governments all over the world resulted in closing of airports, ports, business and local shipping. This has significantly affected the manufacturing units and procedures worldwide and increased overload on the economy of different countries.

Market Segmentation

The global styrene market is segmented based on product type, end-user and region.

Market by Product Type

- Polystyrene

- Acrylonitrile Butadiene Styrene

- Styrene Butadiene Rubber

- Others

Polystyrene segment is estimated to hold considerable market share over the forecast period. It is the thermoplastic resin, which can be purified easily. It is used in numerous applications, some of which include wrapping electronics, for household, toys and in producing disposable products.

Market by End-user

- Packaging

- Construction

- Consumer goods

- Automotive

- Electrical and Electronics

- Others

By end-use, automotive segment is estimated to grow at rapid rateover the forecast period. The growing trend of using lightweight material to improve overall fuel efficiency of vehicle is driving the demand of styrene in automotive industry. The styrene butadiene is used for production of vehicle tires. The improved strength offered by the use of styrene butadiene in tires and other properties such as abrasion resistance and blend compatibility are the factors driving the acceptance of styrene in this segment.

Styrene Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Brazil

- Mexico

- Rest of Latin America

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Regional Insights of Styrene Market

Asia Pacific region is projected to witness significant growth in revenue share and will continue to dominate the styrene market during the forecast period. The developing countries in the region such as India and China are expected to be the major contributors to the growth of Asia Pacific region. There is also high demand of polystyrene for packaging and automotive industries in this region which also the factor that drives the market growth.

Europe region is estimated to share the second largest revenue because of the strong automotive industry in the region. Also increasing e-commerce industry, which is the key aspect for the high demand of packaging materials such as polystyrene is equally driving the demand of styrene products in the region. Usage of plastics across different end-use industries such as healthcare, food and beverages is projected to boost the growth of the market in the region.

Styrene Market Competitive Landscape

This section of the report pinpoints various key vendors of the market. Some of the prominent vendors offered in the report include Ashland Inc., Royal DSM, Mitsubishi Chemicals, Nova Chemicals Corporation, Alpek SAB DE CV, The Dow Chemical Company, Bayer Material Science, LG Chem, Chevron Philips Chemical Company, Ineos Styrolution Group GmbH, and others.

Frequently Asked Questions

How much was the estimated value of the global Styrene market in 2020?

The estimated value of global Styrene market in 2020 was accounted to be US$ 51,490Mn.

What will be the projected CAGR for global Styrene market during forecast period of 2021 to 2028?

The projected CAGR of Styrene during the analysis period of 2021 to 2028 is 4.3%.

Which are the prominent competitors operating in the market?

The prominent players of the global Styrene market involve Ashland Inc., Royal DSM, Mitsubishi Chemicals, Nova Chemicals Corporation, Alpek SAB DE CV, The Dow Chemical Company, Bayer Material Science, LG Chem, Chevron Philips Chemical Company, Ineos Styrolution Group GmbH, and others.

Which region held the dominating position in the global Styrene market?

Asia Pacific held the dominating share for Styrene during the analysis period of 2021 to 2028

Which region exhibited the fastest growing CAGR for the forecast period of 2021 to 2028?

Asia Pacific region exhibited fastest growing CAGR for Styrene during the analysis period of 2021 to 2028.

What are the current trends and dynamics in the global Styrene market?

The rapid growth in e-commerce, fast increasing consumer goods (FMCG), household electrical devices, and personal care industries are focusing on expanded polystyrene for packaging will drive the market growth.

By Product type segment, which sub-segment held the maximum share?

Based on Product type, Polystyrene segment held the maximum share for Styrene market in 2020.