Structural Adhesives Market | Acumen Research and Consulting

Structural Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

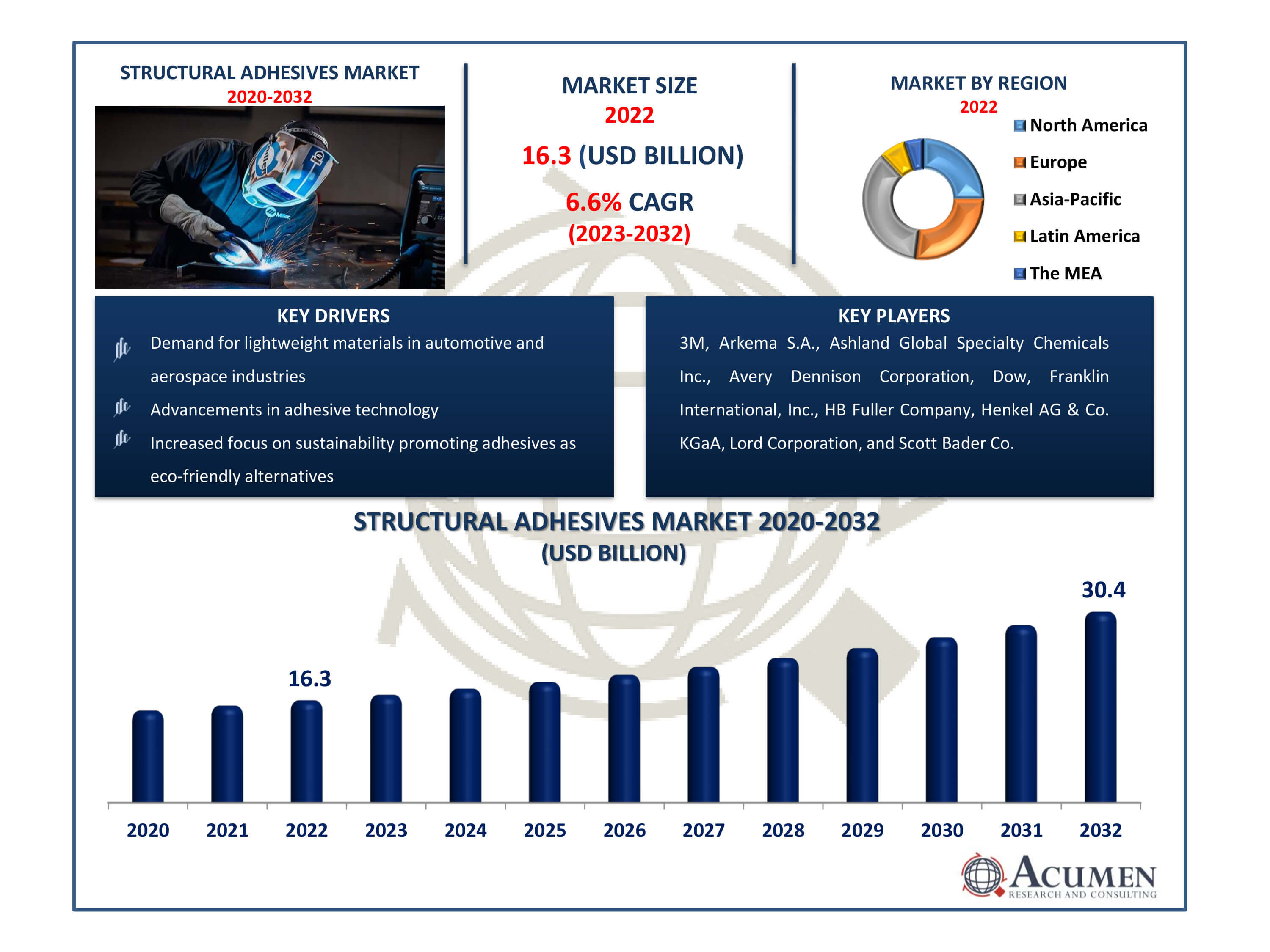

The Structural Adhesives Market Size accounted for USD 16.3 Billion in 2022 and is estimated to achieve a market size of USD 30.4 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Structural Adhesives Market Highlights

- Global structural adhesives market revenue is poised to garner USD 30.4 billion by 2032 with a CAGR of 6.6% from 2023 to 2032

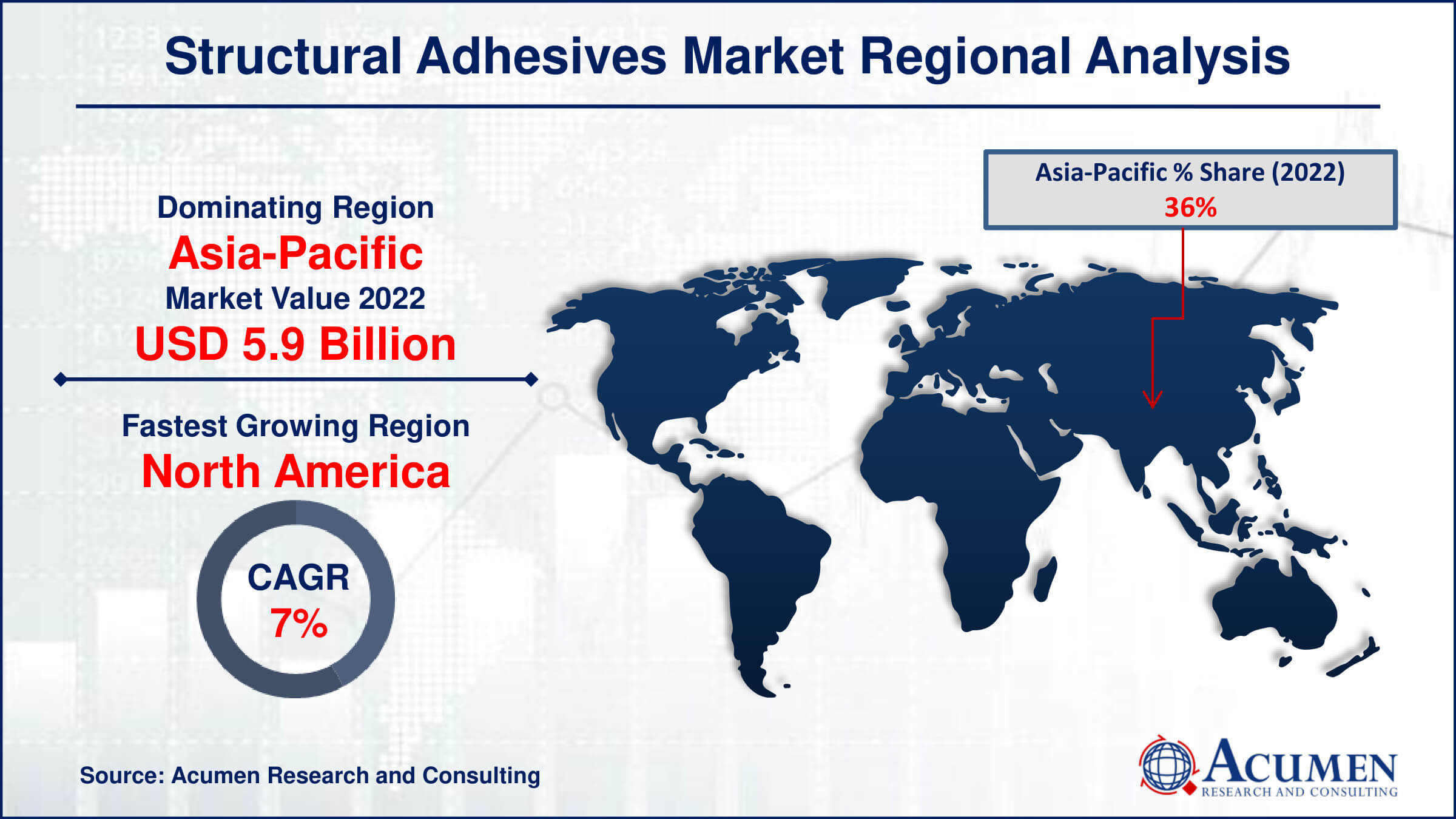

- Asia-Pacific structural adhesives market value occupied around USD 5.9 billion in 2022

- North America structural adhesives market growth will record a CAGR of more than 7% from 2023 to 2032

- Among technology, the water-based sub-segment generated over US$ 7.7 billion revenue in 2022

- Based on end-use, the building & construction sub-segment generated around 30% share in 2022

- Innovations in bio-based adhesives catering to eco-conscious markets is a popular structural adhesives market trend that fuels the industry demand

The structural adhesives market includes high-performance bonding solutions used in a variety of industries such as automotive, aerospace, and construction, providing long-lasting bonding between materials and replacing traditional joining methods such as welding or mechanical fasteners due to their increased strength and flexibility. Increased demand for structural adhesion products from the building and construction sectors and wind energy sectors worldwide drives the global market for structural adhesives. As far as demand is concerned, Asia Pacific has a dominant share of the global market in structural adhesives. A structural stick is a type of stick used to produce a load-bearing joint. It can hold two or more substrates for the whole life cycle of a product together. Also known as load bearing adhesives are structural adhesives. The adhesive types are mostly used for applications where joint strengths typically exceed 1 Mega Pascal 1 MPa, and usually are exceed 10 Mega Pascal. In constant bonding and high-strength applications, such as buses and camions, ambulance and recreational vehicles, structural sticks are widely used. They have very high peel and shear strength and are adapted to bond various materials with high strength.

Global Structural Adhesives Market Dynamics

Market Drivers

- Demand for lightweight materials in automotive and aerospace industries propelling structural adhesive use

- Advancements in adhesive technology enhancing bonding strength and versatility

- Increased focus on sustainability promoting adhesives as eco-friendly alternatives

- Growing construction activities favoring the use of structural adhesives for enhanced durability

Market Restraints

- Challenges in bonding dissimilar materials affect adhesive performance

- Regulatory complexities regarding adhesive composition and environmental impact

- Higher initial costs compared to traditional joining methods limit widespread adoption

Market Opportunities

- Expansion in electric vehicle production driving demand for adhesives in battery assembly

- Growing trend towards composites and carbon fiber materials in various industries

- Rising demand for adhesives in emerging economies construction and manufacturing sectors

Structural Adhesives Market Report Coverage

| Market | Structural Adhesives Market |

| Structural Adhesives Market Size 2022 | USD 16.3 Billion |

| Structural Adhesives Market Forecast 2032 | USD 30.4 Billion |

| Structural Adhesives Market CAGR During 2023 - 2032 | 6.6% |

| Structural Adhesives Market Analysis Period | 2020 - 2032 |

| Structural Adhesives Market Base Year |

2022 |

| Structural Adhesives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Technology, By Substrate, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M, Arkema S.A., Ashland Global Specialty Chemicals Inc., Avery Dennison Corporation, Dow, Franklin International, Inc., HB Fuller Company, Henkel AG & Co. KGaA, Lord Corporation, and Scott Bader Co. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Structural Adhesives Market Insights

The automotive industry's pursuit of lightweight, fuel-efficient vehicles to reduce carbon dioxide emissions aligns with stringent global emission regulations. Structural adhesives play a crucial role in achieving this goal by providing strength and enabling versatile surface connections. Unlike mechanical attachment methods like welding or bolting, these adhesives contribute to lighter, quieter, and safer cars. Structural adhesives evenly distribute loads, improving efficiency over mechanical fastening, which creates localized stress in combined parts. Currently, the average car utilizes approximately 15 kg of adhesives, a figure expected to rise in the coming years due to their numerous advantages. These adhesives are preferred in vehicle interiors, exteriors, and aircraft engine compartments for their ability to handle increased weight and distribute stresses across joints uniformly, maintaining structural integrity without compromising solidity.

The anticipated increase in demand for market globally during the structural adhesives market forecast period stems from these advantages and their ability to meet the evolving needs of the automotive and aerospace industries.

According to structural adhesive industry analysis the market is experiencing significant growth, propelled by increasing investments in various end-use industries in Asia-Pacific, including construction, automotive, and wind sectors. Countries like India and ASEAN are witnessing a surge in private investments, stimulated by government policies aimed at supporting domestic adhesive producers and expanding their presence abroad. These initiatives are driving market research and fostering growth in the industry.

Volatile organic compounds (VOCs) emitted during the use of structural adhesives significantly impact the environment. Many countries have established guidelines restricting VOC emissions from industrial structural adhesives. Manufacturing operations must adhere to rules governing the evaluation, recording, storage, handling, and emissions of certain substances. Non-compliance with these regulations is anticipated to result in legal obligations for future business activities.

Environmental regulations targeting residential and non-residential construction, aiming to impose heavy sanctions, are shaping the demand for structural adhesives. Rapid urbanization has escalated air pollution worldwide, adversely affecting public health. To combat this, many countries, both developed and developing, are pressured by domestic and international regulatory bodies to establish rules controlling VOC emissions and reduce pollution levels.

Various pollutants, including VOCs, particulate matter, carbon monoxide, nitrogen oxides, and sulfur dioxide, pose severe health risks globally. VOCs, especially in urban areas, are significant air pollutants. To facilitate effective air pollution control, emission standards have been established. Organizations like the Central Pollution Control Board, Ministry of Environment and Forests, Indian Standards Bureau, World Health Organization, and National Emissions Inventory (NEI) collaborate to set allowable limitations. The NEI compiles data from diverse sources, including industries, EPA models, and state agencies, to track emissions.

Structural Adhesives Market Segmentation

The worldwide market for structural adhesives is split based on type, technology, substrate, end-use, and geography.

Structural Adhesive Types

- Epoxy

- Urethane

- Acrylics

- Cyanoacrylate

- Others

The epoxy segment dominates the industry because to its varied bonding capabilities across numerous materials, strong adhesive strength, and tolerance to varying climatic conditions, and its dominance is expected to continue over the structural adhesives market forecast period. Epoxy adhesives, which are widely used in the automotive, construction, and aerospace industries, provide exceptional performance, durability, and dependability, making them a popular choice for applications requiring strong and long-lasting bonding solutions, bolstering their dominance in the segment.

Structural Adhesive Technologies

- Water-based

- Solvent-based

- Others

In terms of structural adhesives market analysis water-based technology leads the industry due to its eco-friendliness, low emissions, and compliance with severe environmental laws. Water-based adhesives help to achieve sustainability goals by emitting less VOCs and improving application safety. Their versatility, compatibility with diverse substrates, and ease of use add to their importance, appealing to industries looking for efficient and ecologically responsible adhesive solutions, resulting in their market dominance in this area.

Structural Adhesive Substrates

- Metal

- Wood

- Composite

- Plastic

- Others

The metal substrate segment dominates the structural adhesives market because to its widespread use in high-demand industries such as automotive, aerospace, and construction. Metal substrate structural adhesives provide outstanding bonding strength, endurance, and resilience to extreme environmental conditions. The dominance of this segment within the structural adhesives market is driven by the demand for dependable bonding solutions in crucial metal assemblies and components where strength and lifespan are critical.

Structural Adhesive End-Uses

- Automotive

- Aerospace

- Building & Construction

- Electrical & Electronics

- Energy

- Others

As per the structural adhesives industry analysis, the automotive sector accounts for the largest share due to its pursuit of lightweighting, enhancing vehicle performance, and adhering to stringent safety standards. Adhesives are critical in modern car design for lowering weight, increasing durability, and improving crashworthiness. With an increased emphasis on fuel efficiency and electric vehicles, structural adhesives are critical for optimising design, reinforcing joints, and assuring greater structural integrity, confirming the automotive sector's global dominance.

Structural Adhesives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Structural Adhesives Market Regional Analysis

The global structural adhesives markets are prominent in North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. In 2022, Asia Pacific led the global market in both value and volume. The region's growth in the automotive and construction industries, along with the presence of major structural adhesive manufacturers, is expected to fuel rapid expansion in the regional markets during the forecast period. Europe and North America stand as significant consumers of structural adhesives. However, EU countries are formulating new policies mandating the production of bio-based adhesives to minimize environmental impacts, imposing increasingly stringent regulations on adhesive manufacturers.

Latin America's structural adhesives market is projected to experience moderate growth over the forecast period. This growth is attributed to increasing demand for structural adhesives in the expanding automotive sector in the region in the forthcoming years.

Structural Adhesives Market Players

Some of the top structural adhesives companies offered in our report include 3M, Arkema S.A., Ashland Global Specialty Chemicals Inc., Avery Dennison Corporation, Dow, Franklin International, Inc., HB Fuller Company, Henkel AG & Co. KGaA, Lord Corporation, and Scott Bader Co.

Frequently Asked Questions

How big is the structural adhesives market?

The market size of structural adhesives was USD 16.3 billion in 2022.

What is the CAGR of the global structural adhesives market from 2023 to 2032?

The CAGR of structural adhesives is 6.6% during the analysis period of 2023 to 2032.

Which are the key players in the structural adhesives market?

The key players operating in the global market are including 3M, Arkema S.A., Ashland Global Specialty Chemicals Inc., Avery Dennison Corporation, Dow, Franklin International, Inc., HB Fuller Company, Henkel AG & Co. KGaA, Lord Corporation, and Scott Bader Co.

Which region dominated the global structural adhesives market share?

Asia-Pacific held the dominating position in structural adhesives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of structural adhesives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global structural adhesives industry?

The current trends and dynamics in the structural adhesives industry include demand for lightweight materials in automotive and aerospace industries, advancements in adhesive technology enhancing bonding strength and versatility, increased focus on sustainability promoting adhesives as eco-friendly alternatives, and growing construction activities favoring the use of structural adhesives for enhanced durability.

Which type held the maximum share in 2022?

The epoxy type held the maximum share of the structural adhesives industry.