Stevia Products Market | Acumen Research and Consulting

Stevia Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

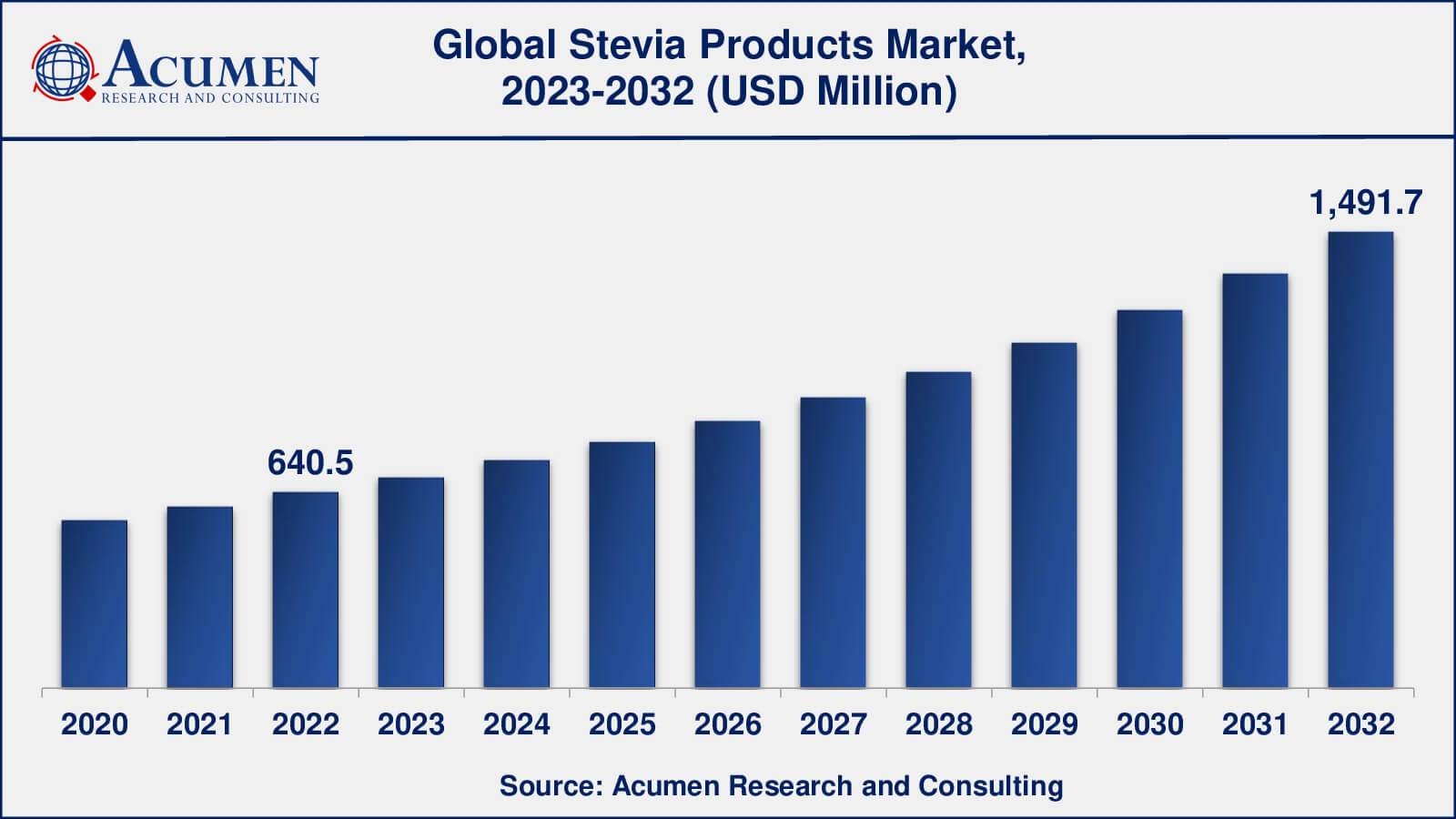

The Global Stevia Products Market Size accounted for USD 640.5 Million in 2022 and is estimated to achieve a market size of USD 1,491.7 Million by 2032 growing at a CAGR of 8.9% from 2023 to 2032.

Stevia Products Market Highlights

- Global stevia products market revenue is poised to garner USD 1,491.7 million by 2032 with a CAGR of 8.9% from 2023 to 2032

- Asia-Pacific stevia products market value occupied more than USD 294 million in 2022

- Asia-Pacific stevia products market growth will record a CAGR of around 9% from 2023 to 2032

- Among extract type, the powder sub-segment generated approx US$ 250 million revenue in 2022

- Based application, the beverages sub-segment generated around 33% share in 2022

- Innovation in product formulations is popular stevia products market trend that fuels the industry demand

Stevia is a sugar substitute and better known as a sweetener and is extracted from the leaves of the plant species Stevia rebaudiana. It is been used as a dietary supplement over years. The dynamic mixes of stevia are steviol glycosides (primarily stevioside and rebaudioside), which have up to 150 times the sweetness of sugar and are warm steady, pH-stable, and nonfermentable. The taste of stevia has a slower beginning and longer span than that of sugar, and some of its concentrates may have an astringent or licorice-like persistent flavor at high fixations. They are used as a sweetness-enhancing ingredient in various products by many food and medicine-producing companies.

Global Stevia Products Market Dynamics

Market Drivers

- Increasing demand for low-calorie sweeteners

- Growing health consciousness among consumers

- Favorable regulatory environment

- Rising prevalence of diabetes and obesity

Market Restraints

- Limited consumer awareness

- Competition from other low-calorie sweeteners

Market Opportunities

- Growing popularity of natural and plant-based ingredients

- Increasing use in a wide range of food and beverage products

Stevia Products Market Report Coverage

| Market | Stevia Products Market |

| Stevia Products Market Size 2022 | USD 130.6 Million |

| Stevia Products Market Forecast 2032 | USD 1,491.7 Million |

| Stevia Products Market CAGR During 2023 - 2032 | 8.9% |

| Stevia Products Market Analysis Period | 2020 - 2032 |

| Stevia Products Market Base Year | 2022 |

| Stevia Products Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Extract Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cargill, PureCircle, Tate & Lyle, GLG Life Tech, The Coca-Cola Company, SweetLeaf, Ingredion Inc., PepsiCo Inc., Stevia Corporation, and Evolva Holding S.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Stevia Products Market Insights

The market for stevia products has grown wisely owing to increasing health concerns such as diabetes, blood pressure, pancreas cancer, allergies, etc. The natural sweetening property of stevia is beneficial for individuals who prefer naturally sourced nourishment and drinks. The low-calorie composition of Stevia makes it an invigorating option for diabetes control or weight reduction. At present, more than 5,000 nourishment and drinks across the globe use stevia as a sweetening ingredient. Stevia sweeteners are utilized as a fixing in items such as ice cream, desserts, sauces, yogurts, pickled foods, bread, soft drinks, chewing gum, candy, seafood, prepared vegetables, etc. across Asia and South America.

Stevia is the best alternative for sugar and is cost-effective as it can be easily cultivated, with no side effects. They are likely to be preferred by consumers and vendors who are looking for alternatives to sugar. The improvisations in making stevia ready to use have resulted in bettering its taste, which is further expected to drive its acceptance among end users. There are several new products launched by stevia producers in the market, thus offering a broader view of the market's growth in the coming period.

Stevia Products Market Segmentation

The worldwide market for stevia products is split based on extract type, application, end-user, and geography.

Stevia Products Market By Extract Type

- Liquid

- Powder

- Leaf

According to the stevia products industry analysis, powdered stevia extract is the most widely used form of stevia on the market today. Powdered stevia extract made up the majority of the global stevia market in 2022, and it is expected to continue to monopolise the market during the forecast period.

Powdered stevia extract is popular due to its ease of use, versatility, and longer shelf life when compared to other forms of stevia, such as liquid and leaf. Powdered stevia extract can be easily incorporated into a variety of food and beverage products, such as baked goods, beverages, and dairy products, without affecting their texture or taste.

Stevia leaf is the most natural form of stevia and is also used in the market; however, it has a short shelf life and requires more processing to extract the sweet components. As a result, it is not as widely used in food and beverage products as powdered stevia extract. However, some customers prefer to use stevia leaf as a natural sweetener in their homemade dishes.

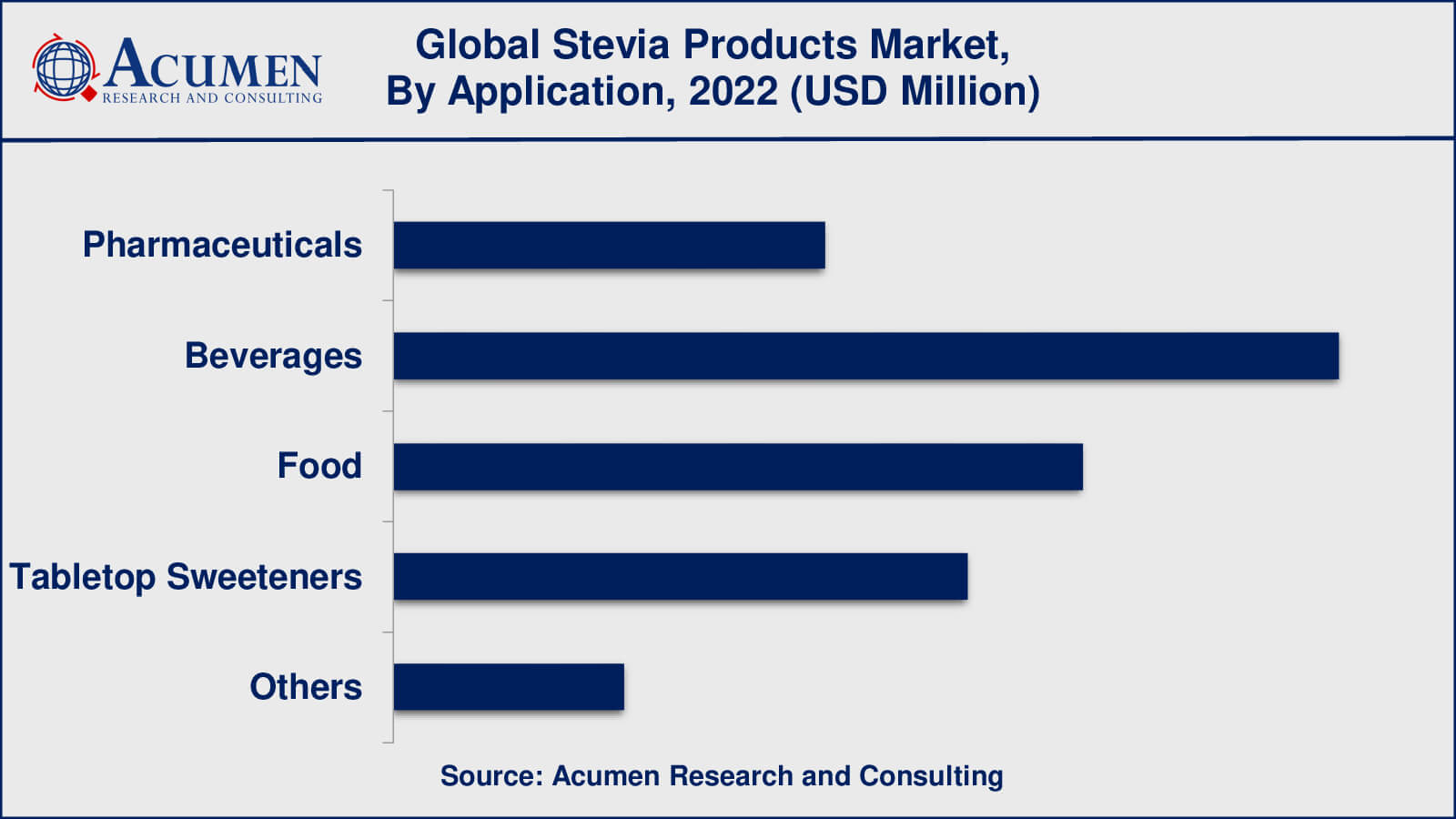

Stevia Products Market By Application

- Pharmaceuticals

- Beverages

- Food

- Tabletop Sweeteners

- Others

According to the stevia products market forecast, the the beverages sub-segment will dominate the stevia products market in terms of applications. This is due to the growing demand for low-calorie and natural sweeteners in carbonated and non-carbonated beverages such as soft drinks, sports drinks, and fruit juices. Stevia can also be found as a sweetener in tea and coffee.

Food is another important application segment of the stevia products market, with stevia being used in a variety of food products such as baked goods, confectionery, dairy products, and others. The demand for natural and low-calorie sweeteners in food products is propelling this segment's growth.

Tabletop sweeteners, which are used as a sugar substitute in coffee, tea, and other beverages, account for a sizable portion of the stevia product market. The demand for natural, low-calorie sweeteners in these applications is propelling this segment's growth.

Stevia Products Market By End-User

- Individual Users

- Professional Chefs and Bakers

- Edible Product Manufacturers

- Others

The end-user segment that dominates the stevia products market varies depending on the type of stevia product and geographic location. However, the edible product manufacturers are the biggest end-user of stevia products in general.

This is due to the fact that edible product manufacturers, such as food and beverage companies, use stevia as a natural, low-calorie sweetener in a variety of products. Carbonated and non-carbonated beverages, baked goods, dairy products, confectionery, and other items fall into this category. Stevia is used by edible product manufacturers to meet consumer demand for natural and healthier food and beverage products.

Individual users, such as health-conscious consumers who prefer natural sweeteners, account for a sizable portion of the stevia products market. These people use stevia as a tabletop sweetener as well as in their cooking and baking at home. Individual user demand for natural and low-calorie sweeteners is driving the growth of this segment.

Stevia Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Stevia Products Market Regional Analysis

North America is the largest market for stevia products, owing to rising demand among health-conscious consumers for natural and low-calorie sweeteners. The region's largest market is the United States, followed by Canada.

Europe is a significant market for stevia products, owing to rising demand for natural, low-calorie sweeteners in food and beverage products. The region's major markets include Germany, France, and the United Kingdom.

Asia-Pacific is the fastest-growing market for stevia products, owing to rising consumer demand for natural and low-calorie sweeteners in the region. The region's major markets are China, India, and Japan, with China being the largest.

Stevia Products Market Players

Some of the top stevia products companies offered in the professional report include Cargill, PureCircle, Tate & Lyle, GLG Life Tech, The Coca-Cola Company, SweetLeaf, Ingredion Inc., PepsiCo Inc., Stevia Corporation, and Evolva Holding S.A.

Frequently Asked Questions

What was the market size of the global stevia products in 2022?

The market size of stevia products was USD 1,491.7 million in 2022.

What is the CAGR of the global stevia products market from 2023 to 2032?

The CAGR of stevia products is 8.9% during the analysis period of 2023 to 2032.

Which are the key players in the stevia products market?

The key players operating in the global market are including Cargill, PureCircle, Tate & Lyle, GLG Life Tech, The Coca-Cola Company, SweetLeaf, Ingredion Inc., PepsiCo Inc., Stevia Corporation, and Evolva Holding S.A.

Which region dominated the global stevia products market share?

Asia-Pacific held the dominating position in stevia products industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of stevia products during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global stevia products industry?

The current trends and dynamics in the stevia products industry include increasing demand for low-calorie sweeteners, growing health consciousness among consumers, and favorable regulatory environment.

Which extract type held the maximum share in 2022?

The beverages extract type held the maximum share of the stevia products industry.